Professional Documents

Culture Documents

Ublbankinternshipreport 140203103141 Phpapp01

Ublbankinternshipreport 140203103141 Phpapp01

Uploaded by

Amir Imrani0 ratings0% found this document useful (0 votes)

7 views131 pagesOriginal Title

ublbankinternshipreport-140203103141-phpapp01

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views131 pagesUblbankinternshipreport 140203103141 Phpapp01

Ublbankinternshipreport 140203103141 Phpapp01

Uploaded by

Amir ImraniCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 131

((

2 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

((

3 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

((

4 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

((

5 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

PREFACE

The field of banking has always been a source of inspiration for me during my entire

academic career. To work in a bank, to acquaint with its working mechanism was always

a point of interest for me and God gave me a golden opportunity to complete my

internship at UBL, one of the leading bank in Pakistan and well known in world due to its

appearance in the international markets. I had a general idea about the banking, but

once I practically started the internship in banking field I observed much about banking,

I realized the importance and significance of commercial banking for the development

of economy. To adjust myself in such a large commercial organization was not an easy

task, but by the grace of Almighty Allah aids my internship in a befitting manner and I

learned a lot about the overall banking arena. This expanded my vision about the

banking sector, which in turn enabled me to make an appraisal of the economic

situation of our country. This report is a thorough essence of my rigorous studies which I

undergone through in a period of six weeks from 22-07-2013 to 29-08-2013 in a

commercial bank. I have exclusively studied and observed the operations/ functioning of

the bank and tried my best to abreast myself with all the dimensions of the banks. The

purpose of this report is to evaluate the performance of UBL in diversified avenues and

give concrete recommendation for further improvement. Although the bank is

functioning satisfactory, but the path to ultimate success is still full of threats and

hurdles. It was a great experience to work there and contribute handsomely in the

process of appraising its pros and cons and feeling to be a significant part of the bank. I

am thankful to all those who helped me in one-way or the other and guided me in the

preparation and compilation of this report in a presentable fashion.

((

6 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

By the Grace of Almighty, the most Merciful, the most Beneficial, I'm today submitting

my internship report, at the end of my first pragmatic experience and I'm glad to have it

with UBL, where you come first, only if you're the customer. Thirst of learning is inside

you, and whatever the environment, if you're willing to learn, you do. At UBL, I had a

new, challenging, yet a perfect environment to learn. My parents' prayers and their

teachings were always with me and hereby I will like to take this opportunity to show

my gratitude to all those who made my internship an adventurous outwit.

Here I am, from more professional and rather corporate environment of UBL Fride gate

branch. I never knew what it all going to be. As I enter the branch, despite of the most

hectic schedule, Maam Farah and Sir Zeeshan helped me so much. I'm really grateful to

both of them for clarifying my concepts and making me learn from your experience.

Whatever I learnt from you will definitely help me in my upcoming study and the

professional life ahead. Thank you so much for being so co-operative and so helpful

every time.

In the end, I will like to thank all other colleagues, Maam Maryam, Sir Ahtasham, Sir

Zubair, Sir Waqar, Sir Osama, Sir Khalid, Sir Babar, Sir Fazal, Sir Amir and all my other

fellow internees, for their unconditional support and help in making me learn in a good

environment.

TANKS TO ALL

((

7 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

DEDICATION

When the person does something, there must be an inspiration behind for doing work.

Especially I dedicate my work to my Mother from whom I have received a Great

inspiration and boost for doing this important work. In addition, I dedicate this work to

my siblings and my Teachers, they guide me and show their confidence on me and

realizes me that I am very capable of doing this work. I dedicate my work to all my

friends and colleagues who really help me to perform this work. May ALLAH bless all of

them

((

8 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

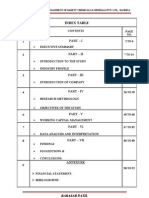

Sr. #

no

Page

numbers

1.

EXECUTIVE SUMMERY 10

2.

INTRODUCTION 11

3. Banking system 13

4. Towards islamization of economy 14

5. Advantages of banking system for economy 15

6.

UBL HISTORY 16

7. Importance of UBL 18

8. Vision and mission 20

9. Core value 21

10. Objectives of UBL 22

11. Role of UBL banking sector 23

12. Functions of UBL 24

13. Corporate level strategies 25

14. Organizational structure 26

15. Hierarchy of Organization 27

16. Branch functional chart 28

17. Board of directors 29

18. Company information 31

19.

DEPARTMENTS 32

20. Deposit department 33

21. Human resource department 45

22. Remittances department 47

23. Foreign exchange department 53

24. Collection department 56

25. Credit department of UBL 59

26. Clearance department 67

((

9 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

27.

PRODUCT AND SERVICES 74

28. Retail banking product 74

29. Corporate products 75

30. Commercial banking services 96

31. Complementary services 100

32.

FINANCIAL ANALYSIS

102

33.

SWOT ANALYSIS

117

34. Strength 118

35. Weaknesses 120

36. Opportunities 121

37. Threats 122

38.

SUGGESTIONS AND RECOMMENDATIONS

123

39.

CONCLUSION

125

40.

ANNEXURE

131

((

10 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

EXECUTIVE SUMMARY

This is an internship report regarding the introduction of UBL and their products and my learning

and understanding during my internship program.

This internship report is actually is brief discussion of functions that are performing at United

Bank Limited. UBL was established in 1959 and is one of the major commercial banks of

Pakistan. The Bank is making every effort to meet the up-coming challenges through strategic

planning and making the best use of the resources at its command. A professional team was

appointed in mid-1997 to restructure the bank and to commence rightsizing. The management

is also in the process of rationalizing the branch network, identifying, and recovering its

doubtful and classified portfolio.

It has planned to institute major improvements in customer services and internal systems to

improve efficiency. The bank is increasing resource mobilization through regular deposit

campaigns and accelerating the process of recovery of outstanding advances and non-

performing assets. UBL has assets of over Rs. 747 billion, Shareholder's Equity of over Rs. 14

billion and a solid track record of 50 years - in addition to the convenience of over 1200

branches serving you throughout the country and also at several overseas locations.

This report starts with the brief introduction of UBL along with the business sector of the bank

and banks future plans. The banks complete range products are mention. Organizations

hierarchy chart and a brief introduction of all departments in which I performed. Comments on

UBLs structures are given at the end of this section. The Ratio analysis of bank is given in last

section of report. The ratios and their formulas along with the Bar charts are performed and give

comments about the performance of BANK.

In the End I briefly evaluate the Organization according to my learning, and concluded my views

about the UBL, the last part of report tell you about some suggestions and Recommendations

for bank. As we know that DMS sent their students for internship in different organizations, so

that students can work practically and observe their respective organization under the

knowledge which they gain from MBA.

((

11 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

INTRODUCTION

Students of MBA studying courses leading to Master degree in Commerce are required

to undergo an internship program me of six month duration. This is an essential

academic requirement. The internship is followed by comprehensive report writing,

required to submit to the research and development division (R&DD) of The Islamia

University of Bahawalpur. This report is properly evaluated on the basis of its

description and analytical capabilities by internal and external examiners. I did my

internship in United Bank Limited Fride Gate Branch.

PURPOSE OF STUDY:

The purpose of the study is to work in real life situation and learn banking practice by

doing.

In this context its objectives are:

i. To analyze banking operations i.e. operational analysis, financial analysis.

ii. To develop concrete and feasible recommendations.

iii. To improve report writing skills.

SCOPE OF STUDY:

The study is confined to banking operations. An attempt, along with all its limitations, to

collect financial data and general statistics of the bank has been made. Keeping in view

the purpose of the study, which is to make an acquaintance with practical doings in the

bank, this seems a comprehensive effort.

LIMITATION OF STUDY:

It is to admit that the study attempts only those aspects, which are closely relevant to

the purpose of the study. Facts and figures, which otherwise might be equally

important, but not having a direct bearing on the conclusions arrived at this study, have

been ignored. The most important limitation from which the study suffers is the non-

((

12 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

availability of information in a manner required for analysis and the secrecy of the bank.

Another important limitation of the study is time and space constraint.

METHODOLOGY OF STUDY:

Primary and secondary data were used in compilation of report. Methodological tools

were:

i. Primary Data:

Personal Observations.

Discussion with Bank Personnel.

ii. Secondary Data:

Brochures/ Manuals of the bank.

Annual Report

State Bank Foreign Exchange Manual

Bank internship reports on UBL available in library.

Journals, newspapers and books.

Internet.

((

13 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

BANKING SYSTEM

Banking services are extremely important for both economies developed and

developing economy such as Pakistan. Banking services serve two primary purposes.

First one is, by supplying customer with the basic mediums-of-exchange (cash, current

account and credit cards). Without these familiar methods of payment, goods could only

be exchanged by barter, which is time-consuming and inefficient. Second, by accepting

money deposits from savers and then lending money to borrowers, banks encourage

flow of money to productive use and investments. Without this flow, savings would sit

idle in someones safe, it would not be available to borrow, people would not be able to

purchase cars or houses, and businesses would not be able to build the new factories.

Enabling the flow of money from savers to investors is called financial intermediation,

and it is extremely important for the growth of economy.

BANKING HISTORY

Consensus on the origination of word Bank is not yet reached at. Some authors

opinion is that this word is derived from the words Bancus or Banque, which mean a

bench and they further relate banking business inception to Jews in Lombardy. Other

authorities state that the word Bank is derived from the German word Back which

means Joint Stock fund and later on due to German occupation of Italy, this word was

Italianated into Bank. Authors quote Babylonians (few quotes Chinese) who developed

banking system as early as 2000. B.C1

BANKING IN PAKISTAN:

Banking started in Pakistan after the bold and emergent decision of formulation of SBP

on July 30, 1948. Thereafter this sector has witnessed enormous growth. In 1974 banks

were nationalized, in the hope that new era of growth could be achieved through it.

However the process is reverse since 1991, up till now MCB, ABL, and UBL have been

privatized and HBL is in the process of its privatization.

((

14 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

TOWARDS ISLAMIZATION OF ECONOMY

Interest based transactions/businesses are Haram in Islam. The GOP has shown.

Interest is to eliminate interest from its economy by developing various alternatives.

To achieve this objective various efforts are made with the following outcomes.

DEPOSITS:

S A Haq. (1998) Practice & Law of Banking in Pakistan (6

th

Ed.)

The Council of Islamic Ideology (1980). Elimination of Riba from Economy.

PLS (Modarba) Accounts

Current Accounts: (with no return paid)

LOANS:

Qarz-e-Hasana

Lending on the basis of Service charges

TRADE RELATED MODES OF FINANCES:

Bai Muajjuai; purchases of goods by banks and their sale to clients at appropriate

mark-up in prices.

Bai-Salam; purchase of goods from clients by banks and their resale to the client

at increased prices, to be paid in future.

Financing for development of property on the basis of developmental charges.

Ijara: leasing.

INVESTMENT TYPE OF MODES OF FINANCES:

Musharaka: financing on the basis of profit and loss sharing.

Modaraba: equity sharing of borrower profit and loss on basis of purchase of

modaraba certificates.

Rent sharing.

Equity participation through purchase of shares.

((

15 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

ADVANTAGES OF BANKING SYSTEM FOR ECONOMY

The deposit and loan services provided by banks benefit an economy in many ways.

First, Current account, because they act like cash, make it much easier to buy goods and

services and therefore help both consumers and businesses, who would find it in

convenient to carry or send through the mail huge amounts of cash. Second, loans

enable consumers to improve their standard of living by borrowing money to purchase

cars, houses, and other expensive consumer goods that they otherwise could not afford.

Third, loans help businesses finance plant expansion and production of new goods, and

therefore increase employment and economic growth. Finally, since banks want loans

repaid, banks choose borrowers carefully and monitor performance of a companys

managers very closely. This helps ensure that only the best projects get financed and

that companies are run efficiently. This creates a healthy, efficient economy. In addition,

since the owners (stockholders) of a company receiving a loan want

their company to be profitable and managed efficiently, bankers act as surrogate monit

ors for stockholders who cannot be present on a regular basis to watch the companys

managers.

((

16 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

UBL HISTORY

United Bank Limited was incorporated in Pakistan with the registered office in Karachi,

and the principal office situated in Islamabad. UBL has assets of over Rs. 747 billion and

a solid track record of over fifty years - in addition, the bank operates 1200 branches all

over Pakistan including 7 Islamic banking branches, and 1 branch in Karachi export

processing zone and 17 branches outside Pakistan.

The banks ordinary shares are listed on all three stock exchanges in Pakistan and its

global Depositary Receipts (GDRs) are on the list of the UK Listing Authority and the

London Stock Exchange Professional Securities Market. These GDRs are also eligible for

trading on the international Order Book System of the London Stock Exchange. Join us in

a world class journey and let us serve you better, because at UBL You come first!

November 7th 1959, Pakistan witnessed an event that would change the way we

banked forever. It was not just the inauguration of UBLs first branch at I.I. Chandigarh;

it was also the birth of the culture of service, a culture of innovation and a culture of

financial excellence!

By June 1960, shortly after six months of opening its doors to the public, UBL had

branches in:

Karachi

Dacca

Lahore

Lyallpur

Chittagong

And Narayanganj

((

17 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

In 1963, UBL became the first bank in Pakistan to have a branch overseas- on William

Street in London, United Kingdom. True to our promise of providing service and care

beyond the ordinary to our customers, UBL and You have had a history. The first saving

scheme for school going children was launched as early as 1960 or the formation of

Pakistans first Staff College of employees in 1964, UBL, through the motivation of its

staff and the trust of its customers, continued to grow at a spectacular pace. In 1967,

UBL had hit the dawn on information in terms of technology, by introducing computer

banking to Pakistan and in 1971, UBL once again paved the way by launching 3 online

branches in Karachi.

Throughout its history, UBL has kept pace with- and often exceeded the changing needs

of changing times. Keeping the tradition of innovation alive, UBL introduced Pakistans

first credit card, the UNICARD in 70s and left its mark by launching the Pak Rupees

traveler cheques in 1971. Staying true to its roots, UBL was also the first bank to have an

Islamic banking division and the first to introduce e-banking facilities at Hajj.

In the 1990s the government of Pakistan decided to change the face of banking by

creating a blueprint to privatize UBL. At this point, financial experts were called on

board to set the bank back on course, and with implementation of relevant changes, the

government privatized the bank in the year 2002 Best way and Al Ayaan collaborated,

forming the cornerstone for the UBL of tomorrow. Today, UBL opens its eyes to a new

vision every day, a vision of resurgent excellence and renewed commitment to our

customers. 52 years into our glorious history UBL is now part of one of the worlds

largest financial services groups.

((

18 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

IMPORTANT ABOUT UBL

United Bank Limited was incorporated in Pakistan with the registered office in Karachi,

and the principal office situated in Islamabad. UBL has assets of over Rs. 747 billion and

a solid track record of over fifty years - in addition, the bank operates 1200 branches all

over Pakistan including 7 Islamic banking branches, and 1 branch in Karachi export

processing zone and 17 branches outside Pakistan.

The banks ordinary shares are listed on all three stock exchanges in Pakistan and its

global Depositary Receipts (GDRs) are on the list of the UK Listing Authority and the

London Stock Exchange Professional Securities Market. These GDRs are also eligible for

trading on the international Order Book System of the London Stock Exchange.

NUMBER OF BRANCHS:

UBL has a large network of branches, which extends to the remotest areas of the

country. In December 1983, there were 1623 branches whereas in 1974 it had only 1238

branches and in October 2003 these figures show total number of 1007 branches UBL

has been very active in increasing its overseas branches network. The first foreign

branches were established in London in 1963. Now UBL has branches in Bahrain, Qatar,

Saudi Arabia, United Arab Emirates, Yemen Arab Republic, UK Switzerland, Egypt, Oman

and The United States. These branches are playing a significant role in channeling home

remittances and foreign trade of Pakistan.

COMPUTERIZATION OF UBL:

UBL has taken leading start in the introduction of computers in (1966-1968) in

important cities. Its three computers centers Rawalpindi, Lahore and Karachi are

equipped with the modern mainframe computers of various capacities. Every branch

((

19 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

has been decorated with microcomputers. The use of computers has enabled the bank

to save time and efforts raise efficiency and deliver the goods speedily to its customers.

This has also allowed the bank to maintain its leadership within the industry.

UBL - ON LINE SYSTEM

Themes of this service is Access anytime, anywhere, any device which symbolizes

comfort, convince and connectivity. UB-Online a web based service that can be accessed

through multiple media link like, (1) PC via internet (2) Mobile phone with WAP or free

SMS) (3) Personal Digital (4) assistants and (5) Plain telephone; following are some of

the exciting features:

Accounts statement & electronic data interchange

Graphical analysis

Alerts service /facility, search facility and activity long

The banks as another computer-based system known as UIBANK

Which is a well-develop on-line branch-banking package. The system automatically

prepares various report, central bank returns, and statement of accounts for customers.

((

20 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

UBL vision and

mission

To be a world class bank dedicated to

excellence, and to surpass the highest

expectations of our customers and all other

stakeholders

Set the highest industry standard for quality, across all

areas of operation, on a sustained basis

Optimize people, processes and technology to deliver

the best possible financial solution to our customers

Become the most sought after investment

Be recognized as the employer of choice

((

21 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

CORE VALUES

*Honesty and

integrity

*Commitment

and

dedication

*Fairness and

meritocracy

*Teamwork

and

collaborative

spirit

*Humility and

mutual

respect

*Caring and

socially

responsible

((

22 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

OBJECTIVES OF UBL:

The united bank limited sets its goal annually does revision of them and takes monthly

feedback.

To provide

the on line

facility in

every branch

of bank.

To achieve

the goals

which are in

profit terms?

Make best

efforts to win

the trust and

confidence of

its customers.

To make it

leading bank

in banking

sector.

To adopt

modern

banking

techniques.

Operations

proficiently

assigned by

the

government.

Efficient in

providing

evening time

facilities.

To get all the

branches

computerize

d.

Boost the

financial

sector all over

the world

particularly in

Pakistan.

((

23 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

ROLE OF UBL BANKING SECTOR:

The impressive growth and development, which UBL achieve, present it undoubtedly

the most dynamic and progressive. In a very shorter period of time it became one of the

leading banks overtaking several other older and its competitor banks. The major

contributions the bank has made are enlisted below:

ROLE

Promotion of

sports

Record setting

performance

and

commitment to

serve the

customers

Personalized

service and

dynamic

approach

ROLE

Human

resource

development

Diaries and

calendars

received prizes

too

Professional

management

Modern

banking policy

ROLE

Credit cards

(unicard-1970)

Travelers

Cheques

(Humarah-

1971)

Small loans (or)

micro credits

Utility bills

collection

((

24 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

FUNCTIONS OF UBL

UBL is a commercial bank, which transacts the business of banking in accordance with

the provisions of BCO, 1962. Section 7 of the Act authorizes banks to engage in the

prescribed form of business. In the light of this section

UBLs functions can be categorized as under:

F

u

nc

ti

o

ns

Agency services

General Utility Services

Underwriting of loans raised by Government or public

bodies and trading by corporations etc.

Acting as executer, trustee or attorneys for the customer.

Providing safe custody and facilities to keep jewelry,

documents or securities.

Providing specialized services to customers, and

Hajj-related services.

Collecting cheques & bills exchange from its customers

Issuing of travelers chafes to give credit facilities to travel.

Issuing of letter of credit to facilitate imports and export.

Accepting bills of exchange on behalf of customers..

Collecting interest due, divided pensions and other sums

to customers.

Transfer of money from place to place.

Acting as executor, trustee or attorneys for the customer.

Purchasing shares for the customers.

Undertaking foreign exchange business.

((

25 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

CORPORATE LEVEL STRATEGIES

Corporate strategy is the direction an organization takes with the objective of achieving business

success in the long term.

BUSINESS LEVEL STRATEGIES:

It means the tactics to beat the competition.

The main focus is building relationships and being known by the way they do

business. Management recognizes that a banking relationship requires

compatibility, communication, and cooperation and that each customer

deserves nothing less than full attention and available resources to meet their

financial objectives.

Core value and corporate culture is based on the belief that superior

personalized service is the most important product. Bank is in the process of

getting to know customers by name and understand their business and personal

financial needs.

DEPARTMENTAL/FUNCTIONAL LEVEL STRATEGIES:

Operational methods used to implement the tactics.

To establish sound relationship with top industrial groups and various

multinationals.

To launch the innovative products as which cater to the needs of different

segments of the markets?

Bank main focus is to provide the extensive training to employees in process,

products, marketing and selling skills introduced.

To implement a performance appraisal process to provide motivation and a

merit oriented culture in the bank.

((

26 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

ORGANIZATIONAL STRUCTURE

President

President Secretariat

Division Division Division

RHQ RHQ

Hub Branch Hub branch

Spoke branch Spoke branch

((

27 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Hierarchy of Organization

Officer Grade I

Non Clarical Staff Clerical Staff Officer Grade II Officer III

VP

EVP

SEVP

Managing Directots

Executive Committee

Board of Directors

Deputy Chaiman

Chairman

((

28 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

BRANCH FUNCTIONAL CHART:

Area manager

Sir Ahtasham

Operational manager

Sir Zubair

Credit department (Sir Amir)

Computer department (Sir

Osama)

Account opening (Sir Khalid & Sir Babar)

Bills and remittance (Mam

Farah)

Legal department

Cash department (Sir Tymoor)

Foreign currency (Sir Fazal)

Clearing (Sir Zeeshan)

Finance (Mam Mariym)

Audit department

Employees working

((

29 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

BOARD OF DIRECTORS

His Highness Sheikh Nahayan Mabarak Al Nahayan (Chairman)

The Chairman of the Board, Sheikh Nahayan Mabarak Al-Nahayans life and career have

been characterized by creativity, innovation, and dedicated public service. In his role as

the Minister of Higher Education and Scientific Research.

Sir Mohammed Anwar Pervez, OBE, HPk (Deputy Chairman)

Sir Mohammed Anwar Pervez, OBE HPk is Deputy Chairman of Board of Directors of

United Bank Limited. He is also Chairman of Bestway Northern Limited in UK.

Mr. Atif R. Bokhari (President & CEO)

Mr. Atif R. Bokhari, currently President & CEO, United bBank Limited (UBL).

Mr. Omar Ziad Jaafar Al Askari (Director)

Omar Ziad Al Askari is the Chairman and Chief Executive Officer of United Technical

Services. He is a Certified Public Accountant.

Mr. Zameer Mohammed Choudrey (Director)

Mr. Zameer Mohammed Choudrey has been a Member of the Board of Directors of

United Bank Limited. He is Chairman of the Board Audit Committee. He is also a Director

of UBL Insurers Limited.

((

30 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Mr. Seerat Asghar (Director)

Mr. Seerat Asghar has been appointed as Director of United Bank Limited by the

Government of Pakistan with effect from 30th March, 2010. He is also a member of

Human Resources Committee of the Bank.

Mr. Rana Assad Amin (Director)

Rana Assad Amin has been appointed as a Director of United Bank Limited by the

Government of Pakistan pursuant to Section 183 of the Compainies Ordinance, 1984.

Mr. Amin Uddin(Director)

Mr. Amin Uddin has been appointed as member of Board of Directors of United Bank

Limited.He is a member of Board Audit Committee of UBL and insurance limited.

Mr. Arshad Ahmad Mir (Director)

Mr. Arshad Ahmad Mir, appointed as member of Board of Directors 26 October 2009

SUBSIDIARIES

1. Switzerland united national bank limited.

2. United Bank AG (Zurich)

3. United National Bank Limited

4. UBL fund managers limited

5. United executors and Trustees Company limited

ASSOCIATES

UBL Insurers Limited

Oman United Exchange Company LLC

((

31 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

COMPANYINFORMATION

Registered Office:

13th Floor, UBL Building, Jinnah Avenue,

Blue

Area,Islamabad.

Head Office

State Life Building No.1, I.I. Chundrigar

Road, Karachi 74000, Pakistan.

Share Registrar

M/s. THK Associates (Pvt.) Limited

Ground Floor, State Life Building No. 3,

Dr. Ziauddin Ahmed Road,

Karachi Pakistan

UAN No. 021- 111-000-322

Fax No. 021- 35655595

Company Registration

No.

0001026

National Tax Number

0801164-8

Auditors

(M/s. KPMG Taseer Hadi & Co) and

(M/s. BDO Ebrahim & Co)

Chartered

Accountants

Chief Financial Officer

Mr. Rayomond Kotwal

Company Secretary & Chief Legal

Counsel

Mr. Aqeel Ahmed Nasir

Legal Advisors

M/s. Mehmood Abdul Ghani & Co

(Advocate)

Contacts

UAN : 111-825-111

Contact Center: 111-825-888

Website: www.ubldirect.com

Email: customer.services@ubl.com.pk

((

32 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

DEPARTMENTS

Departments

Deposit department

Human resource department

Departments

Remittance department

Foreign exchange department

Collection department

Departments

Credit department

Clearance department

((

33 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

DEPOSITE DEPARTEMNT

As per the definition of Banking under see 5(b) of BCO 1992 one of the main functions

of a bank is to accept deposit. Deposits are the backbone of any bank; other functions of

the bank primarily depend upon the type and size of deposits. Function perfumed by

cash and deposit department in UBL Fride gate Branch.

Fried gate branch accepts deposits under the following three accounts.

i. Current account

ii. PLS saving account

iii. Terms Deposits

TYPES OF ACCOUNT:

UBL BASIC BANKING ACCOUNT:

In this type of account minimum of two withdrawals and deposits are allowed per

month and free of charges. If customer do more transactions above the mentioned

limited then the flat fee is charged as per rates are prevailing according to bank policy.

This account is free from Levy charges in case of not meeting minimum balance

requirements.

A. INDIVIDUAL ACCOUNT

In this account a single customer operates the account. The banker will run the account

according to the rules, but if the customer gives special instructions the Bank will have

to follow it.

B. JOINT ACCOUNT:

In this type of account two or more than two persons will open the account. The

account will be operated by one account holder in case of (either of the survival). If the

instructions are not given, all the account holders will have to sign the check.

((

34 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

NATURE OF ACCOUNTS IN UBL

A) CURRENT ACCOUNT:

These are non-profitable demand accounts. The account can be opened with minimum

amount of rupees 1000/-. These accounts are usually maintained for business purpose.

Due to enormous competition UBL has introduced daily profit current account for

corporate clients called (UNISEVER) minimum balance required is Rs. 100,000/-. If

minimum balance requirement is not met, bank is authorized to recover predetermined

charges.

UBL Business Partner Account (Current Account):

UBL offers our regular customers unlimited deposits and unlimited withdrawals and

minimum credit limit of 10000/-. If reduced the amount from this said limit, the 50

rupees per month should be deducted from the account unless these are charges are

exempted in any case. The Business Partner Account offers the net banking services plus

UBL WALLET and PREMIUM CARD and other existing products.

UBL Business Partner Plus: (current Account):

UBL offers unlimited Withdrawals and deposits. With the exemption of service charges,

while maintaining the minimum balance of 25000/-. The ATM and other charges are

free according to this UBL Business Partner Plus (current Account).

B) PLS SAVING ACCOUNT

These accounts were intended with the aim of encouraging thrift among people. These

accounts can be opened either in Pakistani rupees or in few major currencies of the

world. Bank offers (4%- 6%) return on these accounts. The basic feature is the profit and

loss sharing as according to non-interest based banking system. These accounts can be

((

35 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

opened in the name of; individuals, joint names, trust accounts, charitable

organizations.

Unlike current accounts, Zakat is applicable on local currency saving accounts. Minors

accounts can be opened on the condition that their guardians shall operate these

accounts.

C) TERM DEPOSITS:

Term deposits are also called fixed deposits. These can be withdrawn after a specified

period of time. Interest is paid to the depositor on all fixed or term deposits. The rate of

return varies with the duration for which the amount is kept with bank

There are two types of term deposits.

i. STDRS Special Term Deposit Receipt (local currency):

Special Term Deposit Receipts are issued for different periods of maturity ranging from

one month to 5 years, having attractive returns. There is no limit on denominations.

ii. NTDRs Notice Term Deposit Receipt (local currency):

These are term deposit with special features that these can be withdrawn any time but

after giving a predetermined and pre agreed early notice.

REQUIREMENT FOR OPENING OF ACCOUNT:

To open an account in UBL the customer will have to fill an account opening form in

front of bank officer. He has to sign in all required places in front of the officer.

Documents Required in Account Opening:

i. N.I.C Copy.

ii. Account opening form (provided by bank)

iii. Two photograph (in case of illiterate person)

iv. Specimen Signature card (Provided By Bank)

v. Cheque Requisition Form

vi. Introduction of Account.

((

36 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

PROCEDURE FOR ACCOUNT OPENING:

Penning down information and keying it into the system does seem a simple and tedious

job but it is not. My initial five days at customer service department was the liveliest

experience of my internship. Though physically I was there just to assist the account

opening officer, but it turned out to be much more for me. That is when I first actually

imitated as a presenter of UBL to customers, when to many people, I'm their hope.

UBL offers a variety of options for anyone; to everyone. You are an investor, regular

businessman, middle man, salaried person or a house wife; UBL serve you in every way

it can through its commendable and reliable services, because at UBL, YOU come first.

Working at Customer Service Department, I did counter with different types of

customer and opened their accounts under the supervision of the officer. When you

have the sole responsibility to open the accounts, it's always very important to

understand the needs of your customer. Understanding the psyche of customer is very

important. Until and unless you're completely satisfied that the customer has genuine

reason and need to open the account, don't do so.

ACCOUNT OPENING FORM:

In all the documentation within the bank, clearness and tidiness are the major features.

Over writing and cutting should always be avoided as it may lead to any

misinterpretation. Account Opening Form is the most important documentation when a

customer walks in for commercial banking and wants to develop a relationship with us.

In AOF, all the necessary information should be completely scrutinized before the

customer walks back. Now lets look at some of the salient requirements of AOF and

their importance.

((

37 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

CURRENCY AND TYPE OF ACCOUNT

It offers you all the eight different types of accounts mentioned before. First understand

why the customer is here and what type of account suits him a lot. Scale down all the

options suiting his investment or requirement and help him choose what is best for him.

Outline all the salient features of that particular account to him and make him tick the

best box.

Mark the currency box if the customer wishes to deposit in currency, in case, other than

PKR.

NATURE OF ACCOUNT

Understand and choose the desired nature of account.

INDIVIDUAL ACCOUNT (SINGLE/JOINT)

Determines if the account is personal or joint. Once again understand your customer

here. Illiterate and gullible customers should better opt for joint account for their own

security.

PARTICULARS OF ACCOUNT

First of all the title of account is entered by which it will be called off. Following is the

Key/Secret Word of six characters which is mostly preferred to be mothers name

because its simple unforgettable. Key word is used to verify the customer on phone or

while other subsequent inquiries. Next comes the mailing address; where the bank

should mail anything it has to. Next is the permanent address of the customer, which

should be copied from the CNIC of the customer. E-mail address is mandatory for Net

banking and e-statement facility whereas Mobile number for mobile banking. Lastly, it is

your choice to hold your statements for collection or mail it to you.

Here make sure mandatory fields are entered and any valid contact number must be

provided.

((

38 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

PERSONAL INFORMATION

Following portion summarizes social with standing of a person. Applicants name,

Fathers or husbands name, gender, marital status, Date of birth, nationality, country of

residence and identification source and its number should be enter. Make sure the

source of identification is not expired. Enter NTN if available. Know the occupation of

the applicant and check the respected box.

In case there is more than one account applicant, fill in all the above mentioned

information for other applicant as well.

*Its a good practice to ask for the original identification source of the customer and pen

down the number and expiry date directly from it.

NEXT OF KIN

In case if the account holder is somehow not contacted, this portion provides

information of the person who should be contacted instead. Persons name,

relationship, address and Telephone number should be provided.

BUSINESS ACCOUNT

Determines that the party has its own entity under which the account will be

supervised. Match the respected category and check the box. The customer is marked

as a walk in, marketed or referred customer. Name of parent and other companies are

entered. Geographical area of activity is mentioned. How the business earns is

mentioned to know the business type. Then similarly mode of transaction, ultimate

beneficiary, initial deposit and approximate maximum value of transaction per month is

recorded.

*Finally after fulfilling all the necessary requirements, the officer here by recommends

to open the account of the customer.

((

39 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

PARTICULARS OF ACCOUNT

Here the information about the business is filled in. Title of account, company/business

name, and nature of business, office/mailing address, head office /registered address,

office email and NTN are mandatory information required for business account. CNIC is

required in case of sole proprietor ship and information of few persons are required

who can be contacted in case of companies. Here we need to know that who will be

operating the company accounts.

ADDITIONAL INFORMATION

Existing relationship with UBL

In case if the customer already has some relationship with UBL, it should be mentioned

here. This is just in case to formally know and cross check the customers provided

information.

Existing relationship with other banks

This is to know what relationship the customer has with other banks, if any.

UBL Wallet ATM/Debit Card

Here first define your customer what ATM card is, what are its features and what is

the difference between its different options. Enter the name of the customer in

Name on card field. Then is the option of supplementary ATM card. A customer can

issue up to 9 supplementary cards. If supplementary card is required, a UBL Wallet VISA

card requisition form is filled in which details about supplementary card holders is

penned.

Zakat Deduction (only on PLS A/C)

PLS account holders can directly pay Zakat from their accounts, if they are willing to.

((

40 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Other UBL Products

Account holders can opt for UBL Netbanking, UBL Orion, Credit card, Personal loan, Car

Financing, Mortgage and Business Finance.

Operating Instructions

This identifies the signing authority of the account. It can be operated singly, either or

survivor, jointly, mandate or by any other in special cases.

Statement of Accounts

This specifies how early the account statement is required. It can be daily, weekly,

monthly, quarterly or semi annually. Customers can choose Mail or e Statement or both.

Special Instructions

Special instructions, if any, are registered here. It usually certifies further theoperating

instructions of the account.

Account referred by

Detail of person referring the customer is entered here.

Terms and Conditions

These terms and conditions outline the policy of bank about its accounts regulations.

Abidance by state bank laws and banks policy is compulsory and customers signature

at the end of the statement is his abidance by the law

Indemnity and Undertaking

Here the customer agree by the bank policies and agree to its terms. Applicant signs the

undertaking and officially agrees to be a part of UBL.

((

41 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

*As an account opening officer, you must enclose all the signatures and should verify

them. Every cutting on the AOF should be verified by customer's signature, and officer

should verify the customer's signature.

FOR BANK USE ONLY

Special Category of Account

If the account is of minor, UBL staff, Illiterate, Blind or Registered Alien, it should be

checked respectively. Passport size Photographs are required in this case and customer

can only make the transaction personally. Make sure signatures are not too simple or

shaky. If so, again passport size photographs may be required and transactions can only

be made personally for customer's own security.

Service Charges

This is the minimum balance penalty which is applicable to all except students,

mustahiqueen of zakat and government employees' salary or pension purpose accounts

Know You Customer

Here's an assessment that the account opening officer do in order to understand some

aspects of the new customer relationship.

Individual Account

The customer is marked as walk in, marketed or a referral; he/she is a public figure or

not. Moreover what will be the customer's sources of funds? What would be the usual

mode of transaction and what would be the intentions of account with UBL. Who will be

the ultimate beneficiary and what the approximate value of transaction per month is.

((

42 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

DOCUMENTATION TO BE OBTAINED

Individuals

Photocopy of CNIC/Alien Registration No./ passport

Photocopy of service card/employment card/student card

Sole Proprietorship

As above and NTN/Sales Tax Registration Certificate

Application to open account on sole proprietorship letter head

Rubber stamp of sole proprietorship is to be affixed on AOF and SSC.

Partnership

Photocopy of CNIC of all partners

Application to open account on partnership letter head signed by all

partners

Attested copy of Partnership deed

Copy of Registration certificate with Registrar of Firms

Authority letter in favor of person is responsible to operate the account.

Rubber stamp of partnership is to be affixed on AOF and SSC.

Joint Stock Companies

Certified copies of Resolution of BoDs for opening of account and

certifying the person responsible to operate it

Memorandum and Article of Association

Certificate of Incorporation and Commencement of business

CNIC of all the directors

NTN/Sales Tax Registration Certificate

Rubber stamp of Company to be affixed on all documentation

((

43 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Clubs, Societies and Associations

Certified copies of:

Certificate of registration

By-Laws/Rules and Regulations

Resolution of governing body to open an account, certifying the person

responsible to operate it.

NTN/Sales Tax Registration Certificate

Rubber stamp of Company to be affixed on all documentation

Agent Accounts

Certified copy of 'Power of Attorney'

Photocopy of CNIC

Trust Accounts

Photocopy of Certificate of Registration

Photocopy of CNIC of all trusties

Certified copy of instrument of trust

Executors and Administrators

Photocopy of CNIC of Executor/Administrator

Certified copy of Letter of Administration or Probate

SPECIMEN SIGNATURE CARD (SSC)

Whenever a customer visits us to make a transaction, we cannot all the time verify his

signature by AOF. For this purpose SSC is signed and then scanned into the system. So

whenever the signature requires verification, it can be done through systems next to

((

44 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

employees. SSC comprises of Branch code, A/C No., date, customer's name, special

instructions and two signatures.

CHEQUE BOOK REQUISITION FORM

At the opening of account, this form is filled, identifying the account number, number of

leaves and whether to hold cheque book for collection or to mail it.

LETTER OF THANKS

A letter of thanks is dispatched to the mailing address of the new account holder and its

copy is attached to the AOF. Actually this letter of thanks is for the confirmation of this

fact that customer actually lives at the mentioned address.

ATM BALANCING PROCEDURE

The balancing of ATM maintained in those branches maintaining the UNIBANK 2000

system. The branches which are converted to SYMBOLS have no need of process of ATM

balancing. The cashier put cash in the cassettes of ATM Machine in early morning. Then

the Role of previous days off line and online transactions is given to RBO. The RBO check

the role, and mark those transactions, which have icons of withdrawals and approved

together, put offline transactions in the system and updated.

The online transactions are checked through the list and role provided from the ATM

Machine. The Cash remaining in the ATM machine balanced daily. The figures are

matched that how much cash is uploaded in the ATM machine, and how much

remaining in the ATM.

((

45 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

HUMAN RESOURCE DEPARTMENT:

The most important asset of UBL is its people. To maximize its work force investment,

the Aim of the Human Resource department is to enhance the UBL as the best place to

work.

In the area of Human resources their goal is to maximize the return on the banks

annual $4 billion investment in personnel expense by improving efficiency of HR

operations and the Effectiveness of all UBLs. For this purpose and to follow the

instructions regarding HR the department of HR plays an important role.

The main functions of this department are to:

Assess the need of employees where, ever required.

Provide equity opportunities for all the applicants.

Select the most appropriate person for the job.

For the purpose of selection conduct interviews, tests etc.

Provides training opportunities to the employee both on the job and outside job.

Motive the employee through the programs adopted by the head office.

Evaluate the performance of the employees with the help of their immediate

boss.

Recommend reward and promotion for the employees.

Objectives of the Human Resource Department

To accomplish the organization goals and support its strategies HR dept. has the

following objectives.

To establish employee recruitment and selection system for hiring the best

possible employees consistent with the organization needs.

To maximize the potential of each employee in order to attain the organization

goals and insure individual career growth and personal dignity.

((

46 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

To retain the employees whose performance helps the organization realize its

goals and release those, whose performance is unsatisfactory?

To ensure organizational compliance with state and federal laws those are

applicable to HR management function.

Recruitment and selection

Human Resource is the most important assets of the organization. It is with the people

that quality performance really begins and ends. Recruitment represents first contact

that a company has with potential employees. A well-managed and well-planned

recruitment effort results in quality applicants.

UBL has very well planned and well-managed recruitment process .UBL recruitment

process begins with the determination of current and anticipated (short-long term)

personnel needs. After it the requirement of the job are determined by combining the

job specifications. They first try to recruit people internally. If the applicants are not

available internally then they go for external recruitment.

Performance Appraisal

Performance appraisal is the process of assessing qualitative and quantitative aspects of

an Employees job performance. The UBL performance appraisal process answers the

following questions:

How well am I doing?

How can I do better?

How well are our employee doing individually and collectively?

The appraisal program of the bank has different methods and different categories of

employees. For clerical staff, they are using job description method. For managers they

use performance planning and coaching evaluation (PPC & E) programs. It is similar

concepts like management by objective.

((

47 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

REMITTANCES DEPARTEMNT:

Current business trends demand fast movement from one geo-graphic end to another.

Latest technology and telecom data transmission has made it possible to make such

transactions with in minutes. UBL Fride Gate Branch Remittances Department performs

following functions.

Meanings of Remittances:

Remittance is transfer of funds from one place to another or from one person to

another.

A Remittance is an important service provided by banks to customers as well as non-

customers. Since it is not a free service it is a source of income for the bank.

Parties involve in remittances:

Four parties involved in remittance:-

Remitter

Remittee

Issuing Bank

Paying Bank

Remitter:

One who initiates, or requests for a remittance. The remitter comes to the issuing or

originating branch, asks for a remittance to be made, and deposits the money to be

remitted. The bank charges him a commission for this service. He may or may not be the

branchs customer.

((

48 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Remittee:

A Remittee is also called the beneficiary, or the payee. The person in whose name the

remittance is made. A remittee is also the one who receive the payment.

Issuing Bank:

The bank that sends the remittance through demand drafts, telegraphic transfers, or

Mail Transfers is known as issuing bank.

Paying Bank:

Paying Bank also knows as the drawee bank and the bank on which the instrument is

drawn. It has to make the payment (usually located in a different city or country).

Kind of remittances:

Transfer within the branch

Transfer from one branch to another

Transfer from one bank to another bank in the same city

Transfers from one bank to another bank in the different cities.

CASH OVER THE COUNTER

The COC is used for the encashment of the Foreign Remittances. The amounts which are

transferred to UBL from different countries are enchased through that procedure. The

following details are required from the customer, the Original CNIC with Copy. The

supervisor asked the customer from where the remittance received and who send.

The payment is only given to those persons who provide the name of sender and

receiver along with the original CNIC.

((

49 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

1: DEMAND DRAFT (D.D)

D.D is issue by branch of the bank drawn on other branch of the same bank.

PROCEDURE FOR D.D:

Purchaser is asked to fill in an application form duly singed by applicant. Three things

should be maintained in the form.

Name of Payee

Place of payment

Amount of D.D

Commission is charged on D.D as bank income. The applicant is asked to deposit the

cash specified on the application form to the teller. After depositing cash the

remittances in charge prepare a D.D. That is singed by two officers must having power

of attorney. Bank also provides this facility to public who do not have account in UBL.

They will have to submit a N.I.C copy along with D.D application form.

DEMAND DRAFT RATES

DDs are always a secure way of paying remittances in other cities. Both account holders

and walk in customers can avail the facility of DDs.

Charges for DDs are:

Up to Rs. 100,000/- 0.10%, Min Rs. 100 for A/C holders

0.20%, Min Rs. 200 for Non A/C holders

Over Rs. 100,000/- 0.05%, Min Rs. 150 for A/C holders

0.15%, Min Rs. 250 for Non A/.C holders

Issuance of duplicate DD Rs. 150 for A/C holders

Rs. 250 for Non A/.C holders

When DDs are issued, head office accounts are debited and remitters account is

credited, on presentation, head office account is credited and beneficiary's account is

debited.

((

50 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

2. TELEGRAPHIC TRANSFER (T.T)

Transfer of funds to another branch of the same bank with the help of test numbers. If

the test number agrees the bank make payment to the party.

PROCEDURE FOR T.T

The procedure for T.T is same as D.D. But in D.D it is given on a printed-paper and singed

by two officers but, in T.T, only test number is given to the customer.

3. MAIL TRANSFER (MT)

When the money is not required immediately, the remittances can also be made by MT.

Here the selling officer of the bank sends instructions in writing by mail to the paying

bank for the payment of a specified amount of money. The payment under transfer is

made by debiting the buyers account at the sending office and crediting it the

recipients account at the paying bank. UBL takes mail charges from the applicant where

no excise duty is charged.

4. PAY ORDERS

Pay order is banker cheque issued favoring a named beneficiary. Application for the PO

stamped and the customers account balance is checked or cash received for the

amount PO and other charges. Pay Order leaf is typed and crossed if required and

signed by two authorized persons. Thereafter it is delivered to the customer. PO can be

cancelled at original purchasers request in writing and surrender the instrument, which

then marked canceled along with other documents and prior entries.

RUPEE TRAVELER CHEQUES:

UBL has launched R.T.C Brand named Hamrah in November 1996. These are issued to

applicants with varied denominations without excise duty and commission. When issued

HO account is credited and on encashment the same account is debited. RTCs lost cases

are communicated to HO and client is either repaid or new RTCs are issued to him/her.

((

51 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

SECURITY DEPOSIT RECEIPTS (SDR)

Security deposit Receipts are your safe way of making payments. Not only its free of

cost for A/C holders, it also offers you the best liquidity solution as the cash

continues to be with you until and unless your deal gets final and you pay off. In case of

cancellation, it's also free of cost for A/C holders and their amount is returned to their

normal account balance.

*for non A/C holders, Rs. 250 is charged. Duplicate fee is Rs. 250 (flat)

PAY ORDER RATES

POs are another safe way of paying your remittances within the city. They are payable at

any branch and then are forwarded for clearing. There charges are

Issuance of PO Rs. 75 for A/C holders

Rs. 250 for Non A/C holders

Cancellation of PO Rs. 75 for A/C holders

Rs. 250 for Non A/.C holders

Issuance of duplicate PO Rs. 150 for A/C holders

Rs. 300 for Non A/.C holders

In case of PO, remitter account is credited and PO A/C of branch is debited. At

presentation, Beneficiary is debited and PO A/C of branch is credited.

UNI REMOTE:

Uni Remote is the online facility of depositing cash to any account in UBL. With on-line

banking, you are connected to the complete network of UBL all over Pakistan. Uni

Remote charges are Rs. 200 for cash withdrawal and Rs.100 for cash deposit.

This is a new tool for the transfer of money. This is a step towards the online banking

taken by UBL. This tool transfers money from one branch of UBL to other through

((

52 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

electronic transfer. The customer will have to fill the deposit slip. On the slip he will

write the name and account number of the person to whom the money will transfer, the

name of the branch is also written. The amount is deposited with teller and the receipt

is shown to remittance in chraged. One I.D copy is also attached with slip. The

remittances in charge will transfer if by using device (computer) through online service.

The fund transfer is must be supervised by another authorized officer. Every time for

this is five minutes.

Major Withdrawals

The withdrawals made by the customer in previous day, over one million are noted

here, in the sheet, after completing signatures of supervisors and manager. It is filed.

Daily customer transactions

In this sheet all the daily customer transactions are noted, after signing it is also filed.

Subsidiary Ledger:

It is also Called 110. It is also completed daily.

Daily Over Rides;

It is completed daily also.

The operational Works at start of the day:

The checking of opening of cash, How the cash counter is opened , how the cash is put

into the counter, the opened cash , is recorded in the registers, the CSOM make sure

that the cashier will not take unsorted cash. The cameras and metal detector and other

electronic instruments are working properly.

Ending the Day:

In end of the day the QUIEMATRIC which is token a machine, we check its time and it

makes all the day. The cash is closed at what limit, and how much sorted and unsorted

cash left in the locker, noted in the relevant Registers.

((

53 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

FOREIGN EXCHANGE DEPARTMENT

The main functions of foreign exchange department are:

To open the letter of credit (LC) facilitates imports and export.

This department also deals with foreign currency accounts.

This department deals with inward & outward remittances.

This department also performs some general functions relating to foreign

exchange e.g. private travel exchange quotas, business travel quotas etc.

This department also deals in foreign currency accounts.

Procedure to open an Account in Foreign Currency

There are two types of foreign currency account:

For Residents

Pakistani resident can open the account in foreign currency and following documents

are required.

Photo copy of ID card

Foreign exchange

The remaining process is same as in the case of local currency account.

For Non Residents

Following documents are required:

Photo copy of passport

Photo copy of Visa

Further process is same

Closing of the Account

The same procedure can be used to close this account as in case of local account.

((

54 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Advantages of Foreign Currency Account

No withholding tax

No compulsory deduction of Zakat

No wealth tax is taken

No question about source

Credit card and loan facilities are available

The depositor can get 75% of the loan of their deposits as a loan at low rate.

No permission of any authority

It saves from devaluation

Foreign Remittances

To transfer money abroad and to bring the funds in country remittances are used. It is of

three types.

Foreign Currency Demand Draft

The sender can make the foreign currency payment by purchasing a bank draft from

branch. Then it is dispatched to receiver. He can claim it from responding branch.

Requirements:

The debtor must be foreign account holder of UBL.

He must mention the name of foreign bank.

The Govt. must allow the purpose of remittance.

Foreign Mail Transfer:

The UBL issues the order for the payment to the responding branch by mail. After

receiving the letter the responding branch can make the payment.

((

55 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Foreign Telegraphic Transfer:

The branch manager sends a telegraphic message to the responding branch to make the

payment to the ultimate client.

Letter of Credit:

LC is a written undertaking by a bank given to the seller, at the request and on the

instruction of the buyer to pay at sight or at a determinable future date up to a stated

amount within a prescribed time limit and against stipulated document.

Parties involved in LC are;

Buyer (Applicant)

Seller (Beneficiary)

Bank (Issuing Bank)

Condition for Operating LC:

Importers have to fulfill the following conditions before submission of credit

application.

Importer must be Pakistani

Party should be the a/c holder of that bank where he will open LC

LC should be established within 60 days from the date of issue of license.

Merchandise can be shipped within 12 months from the date of issue of import

license.

Insurance amount should be covered locally.

((

56 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

COLLECTION DEPARTMENT

Collection department also plays an important role in the operations of trade finance of

UBL. This facility is also provided to the exporters. The difference between letter of

Credit and Collection is that letter of credit when accepted is become the liability of

bank while collection is not the liability of the bank but upon the performance of the

exporter and the importer. It is not a conditional under taking by the bank. Collection

is the handling by bank of documents, in accordance with instructions received, in order

to:

Obtain payment and /or acceptance, or

Deliver documents against payment and /or against acceptance, or

Deliver documents on other terms and conditions.

For the purpose of collection department, there are two types of documents:

1. Financial documents: -means bill of exchange, promissory notes, cheque, or

other similar instruments used for obtaining the payment of money.

2. Commercial Documents: - means invoices, transport documents, documents of

title, or other similar documents whatsoever, no being financial documents.

3.

There are two types of Collection:

1. Clean collection, and

2. Documentary collection.

Both these collection, methods are performed by the collection department.

((

57 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

1. Clean collection:

Collection of financial documents not accompanied with commercial & transport

documents are called clean collection e.g. collection of Cheque demand draft, dividend

bill of exchange promissory note etc.

2. Documentary Collection:

Documentary collection is the collection of:

Financial documents accompanied by commercial documents ;

Commercial documents not accompanied by financial documents;

Documentary collection is also an instrument available to the Exporters.

Method of payment:

The payment from the importer through yet presenting bank may be received one of

the following ways;

Payment without Delay:

Amounts collected (less charges and /or disbursements and /or expenses where

applicable) must be made available without delay to the exporter, in accordance with

the terms and conditions of the collection instructions.

Payment by Acceptance:

If the payment is by acceptance then the bank will accept the draft and made the

payment when it will be received from the importer. When the payment is received it is

credited to the account of the exporter and the account of the bank is debited.

((

58 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

Outward bills for collection

Meaning of OBC:

When an instrument is drawn on a bank, which is located outside the city, its proceeds

can be collected through a mechanism called Outward Bills for Collection (OBC).

Features:

Remunerative

Transfer of funds between cities

Collecting Bank work as an agent

Collecting Bank is the holder in due course

For OBC party must be the account holder of UBL.

Inward Bills for Collection:

If any other bank sends a cheque of United Bank Limited, it is Inward Bill for Collection.

UBL remits money after checking the balance of the customer account.

The process of collection starts when the cheques of Bank UBL are received from other

banks. Then these cheques are sent to the Head Office Karachi, which sends the

cheques to SBP for clearing and get the confirmation of cheque and credit advice. Main

activity of clearing is performed by Head Office, which contacts other banks through

SBP.

((

59 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

CREDIT DEPARTMENT OF UBL

Credit extension is the principal function of a bank, through which pace of activity is

accelerated in the various sectors of economy. Also the indicators, which mainly reflect

the high quality of banks management, are its prudent financing decisions, proper

control of finance and prompt recovery. In this regard the credit policy of a bank play a

very important role as it provides the overall framework, responsibilities, and

authorities and facilitates of decision-making. Credit department performance is subject

to a defined policy on credit control exercised by the SBP. SBP affect credit decisions

through the weapons of bank rate, open market operations, variable reserve

requirements, selective credit restrictions and prudential regulations.

UBL CREDIT POLICY:

Credits operations are undertaken in accordance to banks credit policy. The policy

strictly are prohibits violation of SBP/Local central banks rules and suggest financing of

self-liquidating, cash flow supported and well collateralized transactions, which equate

the principle of lending (safety, liquidity, dispersal, remunerations and suitability).

FACILITIES OFFERED BY UBL FRIDE GATE BRANCH

Running Finance (for one year)

Demand Finance (3to 5 years)

PROCEDURE FOR FINANCING FROM UBL

When a party comes for financing, banker will ask the following questions.

1 PURPOSE:

In this the party mentions the purpose; they want to apply for the finances. No lending

is done without purpose.

((

60 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

2 BUSINESSES

The party must have some specific running business i.e. general merchandise,

construction business etc.

The second question arises of the cash flow that how much flow is generated by the

party from the current business.

3 SECURITIES:

The bank will secure itself against the lending. There can be two type of security.

Commercial

Residential

The bank prefers commercial security. Relationship Manager (RM) is mainly responsible

for the relationship between the banks and party. He acts like a bridge between the

two.

In the first instance, the party would prepare the following property documents.

AKS Shajarah

Naqsha Tasveeri

Approved Building Plan

Tresh fard

Intaqal Naqal

The party is asked to contact any valuator on the panel of UBL. ICM&L and Tajak Builder

are on the panel of UBL Fride Gate Branch. The valuator will visit the site and set market

value and FSV of the said property. He prepares report of at least three pages. These

documents sent for one page legal opinion to any layer on the panel of UBL. Having

clear legal opinion (RM) is start preparing credit Approval 30(CA). The documents are

singed by the RM & AM and then forwarded to UBL RHQ in Peshawar. Here SRM

examines the CA if he found some exception he will send it back to the respective Rm.

((

61 | Internship Report The Islamia University Of Bahawalpur

Internee: Mudasra Amjad

RM rectifies the acceptation and sends it back to SRM. SRM studied and pass it to credit

officer. He has three hours of time to study the CA and if found correct then he pass it to

another credit officer. After his examination the CA is passed on to the credit risk

manager. He checks the CA and after signing it sent to CAD. He forwards the CA to SCO.

Whose office is at UBL RUCO at Lahore, after his signature the C.A is sent back to RCAD.

RCAD make a check less list and asked the RM to contact the party to complete the said

documents they are.

Letter of continuity

Personal Guarantee

Letter of hypothecation of stock

D.P Note

Mortgage Deed

NIC of executants and witness

Stock report

Insurance policy

Party profile