Professional Documents

Culture Documents

Groups To DiNapoli Tax Credits 9.8.14

Groups To DiNapoli Tax Credits 9.8.14

Uploaded by

Dominic Mauro0 ratings0% found this document useful (0 votes)

228 views2 pagesA request that the Office of the State Comptroller significantly increase its scrutiny of the state’s estimated $1.7 billion in annual subsidies provided by 50 business tax credits. These business tax credits have tripled in value since 2005, and are a largely non-transparent form of state spending, which has had little independent oversight.

Original Title

Groups to DiNapoli Tax Credits 9.8.14

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA request that the Office of the State Comptroller significantly increase its scrutiny of the state’s estimated $1.7 billion in annual subsidies provided by 50 business tax credits. These business tax credits have tripled in value since 2005, and are a largely non-transparent form of state spending, which has had little independent oversight.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

228 views2 pagesGroups To DiNapoli Tax Credits 9.8.14

Groups To DiNapoli Tax Credits 9.8.14

Uploaded by

Dominic MauroA request that the Office of the State Comptroller significantly increase its scrutiny of the state’s estimated $1.7 billion in annual subsidies provided by 50 business tax credits. These business tax credits have tripled in value since 2005, and are a largely non-transparent form of state spending, which has had little independent oversight.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

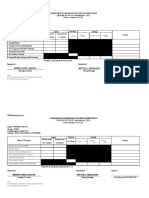

Common Cause NY Citizen Action Citizens Union Good Jobs NY

League of Women Voters of NYS New Yorkers for Fiscal Fairness

New York Public Interest Research Group Reinvent Albany

Thomas DiNapoli

Comptroller of the State of New York

110 State Street

Albany, NY 12236

September 8, 2014

Re: Increasing OSC Oversight of State Business Tax Credits

Dear Comptroller DiNapoli,

We write today to request that the Office of the State Comptroller significantly increase its

scrutiny of the states estimated $1.7 billion in annual subsidies provided by 50 business tax

credits. These business tax credits have tripled in value since 2005, and are a largely non-

transparent form of state spending, which has had little independent oversight.

We ask that your office begin by reviewing the largest credits, which amount to close to 75% of

authorized business tax subsidies: Brownfields, Film and TV Production and Empire Zones. (EZ/

QZE.) In particular, we ask that you assess whether those programs have robust, independent,

and controls and a fair and transparent process for awarding subsidies.

In their authoritative 2013 report: New York State Business Tax Credits Analysis and Evaluation,

former Comptroller Carl McCall and Peter J. Solomon repeatedly raised concerns about the lack

of transparency.

Tax incentives undermine transparency. Taxpayers and the general public

should know that a tax incentive exists, how it is imposed, and who receives

it. With few exceptions, there is limited publicly available information as to

who is getting the incentives and how much each is costing the government.

We strongly agree with the reports recommendation that The state should strengthen its

monitoring and evaluation of business tax credits. To this end, we suggest that your office

publicly recommend uniform processes and standards, including independent evaluations and

review schedules that will make credits easier for your office, the legislature, the public and the

executive branch to oversee and assess.

We look forward to working with your office on this important issue.

Thank you,

Susan Lerner

Executive Director

Common Cause NY

80 Broad St. #2703, New York, NY 10004

slernern@commoncause.org

Bob Cohen

Policy Directory

Citizen Action NY

94 Central Avenue, Albany, NY, 12206

bcohen@citizenactionny.org

Dick Dadey

Executive Director

Citizens Union

299 Broadway, New York, NY 10007

ddadey@citizensunionfoundation.org

Elizabeth Bird

Project Coordinator

Good Jobs New York

11 Park Place Suite #701,

New York, NY 10007

elizabeth@goodjobsfirst.org

Sally Robinson

President

League of Women Voters of NYS

62 Grand Street, Albany, New York, 12207

robintwins@gmail.com

Ronald Deutsch

Executive Director

New Yorkers for Fiscal Fairness

212 Great Oaks Blvd, Albany, NY 12203

rdeutschnyff@gmail.com

Blair Horner

Legislative Director

NYPIRG

107 Washington Ave., Albany, NY 12210

bhorner@nypirg.org

John Kaehny

Executive Director

Reinvent Albany

148 Lafayette Street, 12

th

Floor

New York, NY 10013

jkaehny@reinventalbany.org

If you have any questions, please contact via phone or email John Kaehny at Reinvent Albany

jkaehny@reinventalbany.org, 917-388-9087 or Blair Horner at NYPIRG, bhorner@nypirg.org,

518-439-0876, x257.

Sources: New York State Tax Reform and Fairness Commission 2013

http://www.pjsolomon.com/news/media/2013-11-13-Tax_Incentive_Study_Final.pdf.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- List of Contractors (In Alphabetical Order)Document3 pagesList of Contractors (In Alphabetical Order)Rajnish MishraNo ratings yet

- Jadwal PenerbanganDocument5 pagesJadwal PenerbanganM Fajrur RahmanNo ratings yet

- HWK - 6Document3 pagesHWK - 6Karen Nicole Lopez0% (1)

- TSF External Apr 2022 Junior Engineer TSF ENGDocument2 pagesTSF External Apr 2022 Junior Engineer TSF ENGMuhammad DandyNo ratings yet

- CEO Job DescriptionDocument5 pagesCEO Job DescriptionHumayun Rashid KhanNo ratings yet

- HHDReceipt 185826Document6 pagesHHDReceipt 185826Bala KrishnanNo ratings yet

- (Students) Cost Accounting ExercisesDocument7 pages(Students) Cost Accounting Exercisescuishan makNo ratings yet

- Oracle Apps P2P Cycle With Technical InfoDocument5 pagesOracle Apps P2P Cycle With Technical InfoVCJyothiNo ratings yet

- Petty CashDocument10 pagesPetty CashAzhar LatiefNo ratings yet

- PJ095 GT SL0001Document1 pagePJ095 GT SL0001EdwinNo ratings yet

- Brgy. Rizal Estanzuela BFDP - Monitoring - Form ADocument4 pagesBrgy. Rizal Estanzuela BFDP - Monitoring - Form AVillanueva YuriNo ratings yet

- Analyzing The External Environment of The Firm: Chapter TwoDocument37 pagesAnalyzing The External Environment of The Firm: Chapter TwoshuvoertizaNo ratings yet

- 2.7 - Hunt, Geoffrey - Gramsci, Civil Society and Bureaucracy (En)Document15 pages2.7 - Hunt, Geoffrey - Gramsci, Civil Society and Bureaucracy (En)Johann Vessant RoigNo ratings yet

- John Schuler's ResumeDocument1 pageJohn Schuler's ResumeJohn SchulerNo ratings yet

- Wall Partition (Civil Works)Document1 pageWall Partition (Civil Works)alvin calusaNo ratings yet

- Challenges To Industrial Organization and ManagementDocument22 pagesChallenges To Industrial Organization and ManagementEdCarlo De Guia RamisNo ratings yet

- Tax Remedies and Administrative Matters in Local TaxationDocument2 pagesTax Remedies and Administrative Matters in Local TaxationAiken Alagban LadinesNo ratings yet

- Tiruchendurmurugan - Hrce.tn - Gov.in Ticketing Reports e Acknowledgement View - PHP Transid 20240131103116000190Document2 pagesTiruchendurmurugan - Hrce.tn - Gov.in Ticketing Reports e Acknowledgement View - PHP Transid 20240131103116000190vadivoo.1967No ratings yet

- Feldman-Mahalanobis ModelDocument3 pagesFeldman-Mahalanobis ModelPankaj PatilNo ratings yet

- Les Contrats Chinois en RDCDocument27 pagesLes Contrats Chinois en RDCANDRE DIKANo ratings yet

- Analysis of Present Scenario of Handloom Weaving Industry in Bangladesh PDFDocument14 pagesAnalysis of Present Scenario of Handloom Weaving Industry in Bangladesh PDFsabetaliNo ratings yet

- Payment System Issues and ChallengesDocument14 pagesPayment System Issues and Challengesray_alokNo ratings yet

- Basic Banking MCQsDocument8 pagesBasic Banking MCQsShashank Majhee100% (1)

- ΕΠΙΘΕΩΡΗΣΗ ΝΑΥΤΙΛΙΑΚΩΝ ΜΕΤΑΦΟΡΩΝ 2008 ΤΩΝ ΗΝΩΜΕΝΩΝ ΕΘΝΩΝDocument200 pagesΕΠΙΘΕΩΡΗΣΗ ΝΑΥΤΙΛΙΑΚΩΝ ΜΕΤΑΦΟΡΩΝ 2008 ΤΩΝ ΗΝΩΜΕΝΩΝ ΕΘΝΩΝPeter NousiosNo ratings yet

- Mid 2018 2019 512a 93eaafe3a2Document419 pagesMid 2018 2019 512a 93eaafe3a2J&A Partners JANNo ratings yet

- 11 ECO 08 Introduction To Index NumberDocument4 pages11 ECO 08 Introduction To Index NumberFebin Kurian FrancisNo ratings yet

- Crete: Jump To Navigation Jump To SearchDocument24 pagesCrete: Jump To Navigation Jump To SearchLittle SpidermanNo ratings yet

- Rural and Urban SchoolDocument99 pagesRural and Urban SchoolKoh FenqiNo ratings yet

- Strategic Choice - Traditional ApproachDocument50 pagesStrategic Choice - Traditional Approacharab1108100% (1)

- BPI Vs CIR, 473 SCRA 205, Oct. 17, 2005Document8 pagesBPI Vs CIR, 473 SCRA 205, Oct. 17, 2005katentom-1No ratings yet