Professional Documents

Culture Documents

Profitability Ratios: Liquidity and Solvency Ratios

Profitability Ratios: Liquidity and Solvency Ratios

Uploaded by

Jagannath PadhiCopyright:

Available Formats

You might also like

- Common Size Statement nestle-FRDocument4 pagesCommon Size Statement nestle-FRIvan Tan28100% (1)

- Investment Valuation RatiosDocument3 pagesInvestment Valuation RatiosHIMANSHU RAWATNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIDocument8 pagesEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanNo ratings yet

- NestleDocument4 pagesNestleNikita GulguleNo ratings yet

- Comparison of Ratio Between Two Consequent Years of One Company Comparison of Ratio Between Two Companies For The Same Year ConclusionDocument14 pagesComparison of Ratio Between Two Consequent Years of One Company Comparison of Ratio Between Two Companies For The Same Year Conclusion2771683No ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Balance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsDocument16 pagesBalance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsPRIYA GNAESWARANNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Zodiac - Financial Accounting: Hunar-Grade XiibDocument14 pagesZodiac - Financial Accounting: Hunar-Grade XiibHUNAR LODHA Suchitra AcademyNo ratings yet

- FM Assignment - Prashant KhombhadiaDocument3 pagesFM Assignment - Prashant Khombhadiavicky54321inNo ratings yet

- Key Financial Ratios of Bajaj AutoDocument6 pagesKey Financial Ratios of Bajaj Autohitman3886No ratings yet

- Balance Sheet of Reliance IndustriesDocument7 pagesBalance Sheet of Reliance IndustriesSatyajeet ChauhanNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- DR Reddy RatiosDocument6 pagesDR Reddy RatiosRezwan KhanNo ratings yet

- Moneycontrol PDFDocument6 pagesMoneycontrol PDFMANIVISHVARJOON BOOMINATHANNo ratings yet

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- Excel Brittaniya 2Document3 pagesExcel Brittaniya 2Adnan LakdawalaNo ratings yet

- FINANCIAL ANALYSIS of ONGCDocument13 pagesFINANCIAL ANALYSIS of ONGCdipshi92No ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet

- Welcome To The Presentation SessionDocument32 pagesWelcome To The Presentation SessionMoinul IslamNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Year 2007 Liquidity Ratios: Current Assets Current LiabilitiesDocument5 pagesYear 2007 Liquidity Ratios: Current Assets Current Liabilitiesckin_1609No ratings yet

- Ratios From NetDocument4 pagesRatios From NetAnushka RajaniNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Name: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialDocument8 pagesName: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialAkash MehtaNo ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- 1.inroduction: Working Capital Management Refers To A Company's ManagerialDocument7 pages1.inroduction: Working Capital Management Refers To A Company's Managerialmaa digitalxeroxNo ratings yet

- SRK Institute of Technology Enikepadu Accountancy Project TitlesDocument4 pagesSRK Institute of Technology Enikepadu Accountancy Project TitlesRavi KiranNo ratings yet

- Asian Paints-Money Control - FFSDocument10 pagesAsian Paints-Money Control - FFSKeshav Singh RathoreNo ratings yet

- Ratios Micro TilDocument1 pageRatios Micro TilVeronica BaileyNo ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Finanacial Ratios of HPCLDocument10 pagesFinanacial Ratios of HPCLriyaNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Bayerische Motoren Werke Aktiengesellschaft (BMW - DE) : Total Operating Costs Profit or Loss of OperationDocument23 pagesBayerische Motoren Werke Aktiengesellschaft (BMW - DE) : Total Operating Costs Profit or Loss of Operationkoneabdoulaye842No ratings yet

- Punjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public SectorDocument7 pagesPunjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public Sectorsheph_157No ratings yet

- Key Financial RatiosDocument140 pagesKey Financial RatiosBharat565No ratings yet

- 02C) Financial Ratios - ExamplesDocument21 pages02C) Financial Ratios - ExamplesMuhammad AtherNo ratings yet

- Notes: AssetsDocument13 pagesNotes: AssetsChaitanya BhujadeNo ratings yet

- Axis RatioDocument5 pagesAxis RatiopradipsinhNo ratings yet

- Balance Sheet of Reliance IndustriesDocument10 pagesBalance Sheet of Reliance IndustriesSatyajeet ChauhanNo ratings yet

- BF AssignmentDocument13 pagesBF AssignmentMomina waseemNo ratings yet

- Consolidated P & LDocument16 pagesConsolidated P & Lpunksta182No ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Nestle ST RatioDocument2 pagesNestle ST Rationeha.talele22.stNo ratings yet

- Balance Sheet Basics: AssetsDocument8 pagesBalance Sheet Basics: AssetsManish KumarNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Spreadsheet FMDocument11 pagesSpreadsheet FMrssardarNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosNguyễn Như NgọcNo ratings yet

- Operational & Financial RatiosDocument3 pagesOperational & Financial RatiosAnonymous HAkNRaNo ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Ratios AnalysisDocument8 pagesRatios AnalysisNoor SalmanNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Encl.: As AboveDocument7 pagesEncl.: As AboveJagannath PadhiNo ratings yet

- Robin SharmaDocument8 pagesRobin SharmaJagannath Padhi0% (3)

- Linear Programming Problems - FormulationDocument55 pagesLinear Programming Problems - FormulationJagannath Padhi100% (1)

- Fiscal Policy: Presented byDocument40 pagesFiscal Policy: Presented byJagannath PadhiNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of PaymentsJagannath PadhiNo ratings yet

Profitability Ratios: Liquidity and Solvency Ratios

Profitability Ratios: Liquidity and Solvency Ratios

Uploaded by

Jagannath PadhiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitability Ratios: Liquidity and Solvency Ratios

Profitability Ratios: Liquidity and Solvency Ratios

Uploaded by

Jagannath PadhiCopyright:

Available Formats

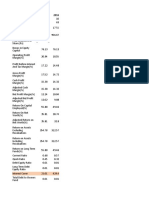

Investment Valuation Ratios

Mar '14

Face Value 2.00

Dividend Per Share 8.00

Operating Profit Per Share (Rs) 36.93

Net Operating Profit Per Share (Rs) 157.15

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin{%)

96.47

23.50

Profit Before Interest And Tax Margin{%) 20.73

Gross Profit Margin{%) 21.60

Cash Profit Margin(%) 20.12

Adjusted Cash Margin(%) 20.12

Net Profit Margin(%) 18.29

Adjusted Net Profit Margin(%) 18.29

Return On Capital Employed(%) 29.47

Return On Net Worth(%) 25.16

Adjusted Return on Net Worth(%) 25.16

Return on Assets Excluding Revaluations 119.03

Return on Assets Including Revaluations 119.03

Return on Long Term Funds(%)

Liquidity And Solvency

Ratios Current Ratio

32.87

1.98

Quick Ratio 2.53

Debt Equity Ratio 0.15

Long Term Debt Equity Ratio 0.03

Debt Coverage Ratios

Interest Cover 26.64

Total Debt to Owners Fund 0.15

Financial Charges Coverage Ratio 28.61

Financial Charges Coverage Ratio Post

Tax

22.68

Management Efficiency Ratios

Inventory Turnover Ratio 169.76

Debtors Turnover Ratio 4.55

Investments Turnover Ratio 169.76

Fixed Assets Turnover Ratio 4.46

Total Assets Turnover Ratio 1.16

Asset Turnover Ratio 1.25

Cash Flow Indicator Ratios

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital 127.39

Profit & Loss Account Ratios

Material Cost Composition

6.57

Imported Composition of Raw Materials

Consumed

68.97

Selling Distribution Cost Composition

Expenses as Composition of Total Sales 88.93

Dividend Payout Ratio Net Profit

26.71

Dividend Payout Ratio Cash Profit 24.29

Earning Retention Ratio 73.29

Cash Earning Retention Ratio 75.71

AdjustedCash Flow Times 0.56

Mar '14

Earnings Per Share 29.95

Book Value 119.03

You might also like

- Common Size Statement nestle-FRDocument4 pagesCommon Size Statement nestle-FRIvan Tan28100% (1)

- Investment Valuation RatiosDocument3 pagesInvestment Valuation RatiosHIMANSHU RAWATNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- Equity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIDocument8 pagesEquity Share Data HDFC Bank Mar-20 SBI Mar-19 HDFC Bank/ SBIAkshaya LakshminarasimhanNo ratings yet

- NestleDocument4 pagesNestleNikita GulguleNo ratings yet

- Comparison of Ratio Between Two Consequent Years of One Company Comparison of Ratio Between Two Companies For The Same Year ConclusionDocument14 pagesComparison of Ratio Between Two Consequent Years of One Company Comparison of Ratio Between Two Companies For The Same Year Conclusion2771683No ratings yet

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- Previous Years : L&T Finance Holding SDocument6 pagesPrevious Years : L&T Finance Holding Srahul gargNo ratings yet

- Balance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsDocument16 pagesBalance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsPRIYA GNAESWARANNo ratings yet

- Financial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Document19 pagesFinancial Analysis of Apollo Hospitals: Presented By: Imran Mohammad Rather 2010MBE09Vishal GuptaNo ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Zodiac - Financial Accounting: Hunar-Grade XiibDocument14 pagesZodiac - Financial Accounting: Hunar-Grade XiibHUNAR LODHA Suchitra AcademyNo ratings yet

- FM Assignment - Prashant KhombhadiaDocument3 pagesFM Assignment - Prashant Khombhadiavicky54321inNo ratings yet

- Key Financial Ratios of Bajaj AutoDocument6 pagesKey Financial Ratios of Bajaj Autohitman3886No ratings yet

- Balance Sheet of Reliance IndustriesDocument7 pagesBalance Sheet of Reliance IndustriesSatyajeet ChauhanNo ratings yet

- Investment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15Document4 pagesInvestment Valuation Ratios Years Mar-19 Mar-18 Mar-17 Mar-16 Mar-15honey08priya1No ratings yet

- DR Reddy RatiosDocument6 pagesDR Reddy RatiosRezwan KhanNo ratings yet

- Moneycontrol PDFDocument6 pagesMoneycontrol PDFMANIVISHVARJOON BOOMINATHANNo ratings yet

- Finance Tata Chemicals LTDDocument5 pagesFinance Tata Chemicals LTDzombeeeeNo ratings yet

- Excel Brittaniya 2Document3 pagesExcel Brittaniya 2Adnan LakdawalaNo ratings yet

- FINANCIAL ANALYSIS of ONGCDocument13 pagesFINANCIAL ANALYSIS of ONGCdipshi92No ratings yet

- Marico RatiosDocument8 pagesMarico RatiosAmarnath DixitNo ratings yet

- Welcome To The Presentation SessionDocument32 pagesWelcome To The Presentation SessionMoinul IslamNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Year 2007 Liquidity Ratios: Current Assets Current LiabilitiesDocument5 pagesYear 2007 Liquidity Ratios: Current Assets Current Liabilitiesckin_1609No ratings yet

- Ratios From NetDocument4 pagesRatios From NetAnushka RajaniNo ratings yet

- Key Financial Ratios of Shree CementsDocument2 pagesKey Financial Ratios of Shree CementsTrollNo ratings yet

- Name: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialDocument8 pagesName: Mausam Surelia BATCH: BBA 2016-2019 Subject: FinancialAkash MehtaNo ratings yet

- Key Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Document6 pagesKey Financial Ratios of Bharat Heavy Electricals - in Rs. Cr.Virangad SinghNo ratings yet

- 1.inroduction: Working Capital Management Refers To A Company's ManagerialDocument7 pages1.inroduction: Working Capital Management Refers To A Company's Managerialmaa digitalxeroxNo ratings yet

- SRK Institute of Technology Enikepadu Accountancy Project TitlesDocument4 pagesSRK Institute of Technology Enikepadu Accountancy Project TitlesRavi KiranNo ratings yet

- Asian Paints-Money Control - FFSDocument10 pagesAsian Paints-Money Control - FFSKeshav Singh RathoreNo ratings yet

- Ratios Micro TilDocument1 pageRatios Micro TilVeronica BaileyNo ratings yet

- Eps N LevrageDocument7 pagesEps N LevrageShailesh SuranaNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Finanacial Ratios of HPCLDocument10 pagesFinanacial Ratios of HPCLriyaNo ratings yet

- Ratios FinancialDocument16 pagesRatios Financialgaurav sahuNo ratings yet

- Ratios FinDocument16 pagesRatios Fingaurav sahuNo ratings yet

- Ratios FinDocument30 pagesRatios Fingaurav sahuNo ratings yet

- Bayerische Motoren Werke Aktiengesellschaft (BMW - DE) : Total Operating Costs Profit or Loss of OperationDocument23 pagesBayerische Motoren Werke Aktiengesellschaft (BMW - DE) : Total Operating Costs Profit or Loss of Operationkoneabdoulaye842No ratings yet

- Punjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public SectorDocument7 pagesPunjab National Bank: BSE: 532461 - NSE: PNB - ISIN: INE160A01014 - Banks - Public Sectorsheph_157No ratings yet

- Key Financial RatiosDocument140 pagesKey Financial RatiosBharat565No ratings yet

- 02C) Financial Ratios - ExamplesDocument21 pages02C) Financial Ratios - ExamplesMuhammad AtherNo ratings yet

- Notes: AssetsDocument13 pagesNotes: AssetsChaitanya BhujadeNo ratings yet

- Axis RatioDocument5 pagesAxis RatiopradipsinhNo ratings yet

- Balance Sheet of Reliance IndustriesDocument10 pagesBalance Sheet of Reliance IndustriesSatyajeet ChauhanNo ratings yet

- BF AssignmentDocument13 pagesBF AssignmentMomina waseemNo ratings yet

- Consolidated P & LDocument16 pagesConsolidated P & Lpunksta182No ratings yet

- Project of Tata MotorsDocument7 pagesProject of Tata MotorsRaj KiranNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Nestle ST RatioDocument2 pagesNestle ST Rationeha.talele22.stNo ratings yet

- Balance Sheet Basics: AssetsDocument8 pagesBalance Sheet Basics: AssetsManish KumarNo ratings yet

- Key Financial Ratios of NTPC: - in Rs. Cr.Document3 pagesKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNo ratings yet

- Spreadsheet FMDocument11 pagesSpreadsheet FMrssardarNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosNguyễn Như NgọcNo ratings yet

- Operational & Financial RatiosDocument3 pagesOperational & Financial RatiosAnonymous HAkNRaNo ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Ratios AnalysisDocument8 pagesRatios AnalysisNoor SalmanNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Encl.: As AboveDocument7 pagesEncl.: As AboveJagannath PadhiNo ratings yet

- Robin SharmaDocument8 pagesRobin SharmaJagannath Padhi0% (3)

- Linear Programming Problems - FormulationDocument55 pagesLinear Programming Problems - FormulationJagannath Padhi100% (1)

- Fiscal Policy: Presented byDocument40 pagesFiscal Policy: Presented byJagannath PadhiNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of PaymentsJagannath PadhiNo ratings yet