Professional Documents

Culture Documents

Financail Statement Excercise

Financail Statement Excercise

Uploaded by

Nhan Thien NhuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financail Statement Excercise

Financail Statement Excercise

Uploaded by

Nhan Thien NhuCopyright:

Available Formats

FSA

Project 1

The balance sheet of DCC Corp., as of the end of Quarter 2, is provided below.

BS

Assets Liab. & Owners Equity

Cash $11,300 Accounts payable $500

A/R $1,000

Inventory Long-term debt $8,000

parts $600 Common Stock $4,000

finished goods $6,000 ($2 par value)

Paid-in-surplus $5,000

Retained Earnings $1,400

Total Assets $18,900 Liab. & Owners Equity $18,900

During Quarter 3:

DCC purchased $3000 worth of parts, $2000 with cash, the remainder to be paid in Quarter 4.

Sold 6 computers, each for $600.

4 were sold for cash, 2 were sold on credit with payment to be received in Quarter 4.

The gross margin was 32%

Interest expense = 100 (paid in Quarter 3)

All SG&A expenses were paid in Quarter 3

The pre-tax margin was 23%

The tax rate is 30% and Quarter 3 taxes will be paid in Quarter 4

The dividend payout ratio is 35% (paid immediately)

200 new shares of common stock were issued and sold for $1000 in Quarter 3

Purchase the warehouse DCC is located in for $20,000 on the first day of Quarter 3

You pay $10,000 down & finance the rest with long-term debt

You depreciate the warehouse over 40 years. Monthly depreciation expense is $40.

1, Create journal entries for Quarter 3 transactions, and the Quarter 3 ending balance sheet.

(Hint: you will need to create the income statement.)

2. Create a STATEMENT OF CASH FLOW for Quarter 3.

You might also like

- Case 2 Equity Valuation and AnalysisDocument4 pagesCase 2 Equity Valuation and AnalysisTauseefAhmadNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cash Flow Exercises Set 1Document3 pagesCash Flow Exercises Set 1chiong0% (1)

- NFP AssDocument9 pagesNFP AssAbdii Dhufeera100% (2)

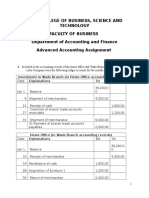

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- Exercises For Final PDFDocument11 pagesExercises For Final PDFThanh HằngNo ratings yet

- Kuis UTS Genap Lab AKM II DoskoDocument4 pagesKuis UTS Genap Lab AKM II DoskoYokka FebriolaNo ratings yet

- Credit Sales AR and Equity Chapters QuestionsDocument4 pagesCredit Sales AR and Equity Chapters QuestionsSakhawat HossainNo ratings yet

- SheDocument12 pagesSheMark Anthony Tibule80% (5)

- Financial Accounting Atc 1Document3 pagesFinancial Accounting Atc 1hshing02No ratings yet

- Corporate Action ProcessingDocument37 pagesCorporate Action ProcessingSheetal LaddhaNo ratings yet

- A03 Principles of Accounting IIDocument40 pagesA03 Principles of Accounting IIG JhaNo ratings yet

- A03 Principles of Accounting IIDocument40 pagesA03 Principles of Accounting IIG JhaNo ratings yet

- ACC 3003-Revision For Test 1Document7 pagesACC 3003-Revision For Test 1falnuaimi001No ratings yet

- Workout QuestionsDocument5 pagesWorkout Questionssam100% (1)

- Review Session 6 TEXTDocument6 pagesReview Session 6 TEXTAliBerradaNo ratings yet

- IF2 - Project 1 PDFDocument6 pagesIF2 - Project 1 PDFBillNo ratings yet

- Kuis AK 2Document4 pagesKuis AK 2Jhon F SinagaNo ratings yet

- Cash Flow Statements Questions PDFDocument51 pagesCash Flow Statements Questions PDFRaj AgrawalNo ratings yet

- CA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelDocument18 pagesCA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelMan Ish K DasNo ratings yet

- Financial Accounting ProjectDocument9 pagesFinancial Accounting ProjectL.a. LadoresNo ratings yet

- HKALE PACCT Question Book 2001 Paper 1Document15 pagesHKALE PACCT Question Book 2001 Paper 1Elien ZosNo ratings yet

- Chapter 15 in ClassDocument4 pagesChapter 15 in ClassTati AnaNo ratings yet

- CH 2Document4 pagesCH 2ايهاب غزالةNo ratings yet

- Que 01 12Document13 pagesQue 01 12Cosovliu RamonaNo ratings yet

- HKALE PACCT Question Book 2002 Paper 2Document10 pagesHKALE PACCT Question Book 2002 Paper 2Elien ZosNo ratings yet

- Chapter 5-Master Budgeting Offline Quiz-1 PDFDocument2 pagesChapter 5-Master Budgeting Offline Quiz-1 PDFMARY ALODIA BEN YBARZABALNo ratings yet

- Chegg India Pvt. Ltd. MNE Test Paper - Accountancy: Answer Any 5 QuestionsDocument7 pagesChegg India Pvt. Ltd. MNE Test Paper - Accountancy: Answer Any 5 QuestionsJoel Christian MascariñaNo ratings yet

- Level 3 ABC 2021Document54 pagesLevel 3 ABC 2021Ami KayNo ratings yet

- F06 MT1 Exam Review SolsDocument9 pagesF06 MT1 Exam Review SolsTerra ThorneNo ratings yet

- Advance AccDocument8 pagesAdvance AccjayaNo ratings yet

- Shareholder's Equity: ReviewDocument12 pagesShareholder's Equity: ReviewG7 HexagonNo ratings yet

- QuizDocument5 pagesQuizhappystoneNo ratings yet

- Week 2 Quiz Federal TaxDocument4 pagesWeek 2 Quiz Federal TaxLatosha James-ChisholmNo ratings yet

- Acca ExercisesDocument10 pagesAcca ExercisesAmir AmirliNo ratings yet

- Accounting AnswersDocument5 pagesAccounting AnswersallhomeworktutorsNo ratings yet

- Q 1 3Document9 pagesQ 1 3Ahasanul AlamNo ratings yet

- 13 Single Entry and Incomplete Records - Additional ExercisesDocument5 pages13 Single Entry and Incomplete Records - Additional ExercisesMei Mei Chan100% (2)

- Isc Specimen Question Paper Accounts 2014Document9 pagesIsc Specimen Question Paper Accounts 2014BIKASH166No ratings yet

- Disposal of Non-Current AssetsDocument3 pagesDisposal of Non-Current AssetsTawanda Tatenda Herbert100% (1)

- CashDocument4 pagesCashiceman2167No ratings yet

- Subscription (450 1000) 450000 Profit On Sale of Events Ticket 310000 Profit On Investments 200000 Total Income 960000Document2 pagesSubscription (450 1000) 450000 Profit On Sale of Events Ticket 310000 Profit On Investments 200000 Total Income 960000Alina RahimNo ratings yet

- TH TH TH TH TH RD TH ND TH TH TH THDocument2 pagesTH TH TH TH TH RD TH ND TH TH TH THselina fraserNo ratings yet

- Adjusting Entries Exercises - SPRING 2017Document3 pagesAdjusting Entries Exercises - SPRING 2017Lydia LeeNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Hayes Company BudgetDocument2 pagesHayes Company BudgetRosemarie Mae DezaNo ratings yet

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- Exercise For Mid TestDocument11 pagesExercise For Mid TestNadia NathaniaNo ratings yet

- Revision Questions - Final Exam - 4Document13 pagesRevision Questions - Final Exam - 4Vivian WongNo ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- baitap-sinhvien-IAS 21Document12 pagesbaitap-sinhvien-IAS 21tonight752No ratings yet

- ACC 3003 - Final Exam RevisionDocument19 pagesACC 3003 - Final Exam Revisionfalnuaimi001100% (1)

- K 18Document15 pagesK 18Sx nNo ratings yet

- Soal LatihanDocument15 pagesSoal LatihanRafi FarrasNo ratings yet

- Accounting Case StudyDocument1 pageAccounting Case StudyAhmad ZakariaNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Bai Tap UNIT 9 Tieng Anh 10Document6 pagesBai Tap UNIT 9 Tieng Anh 10kitty2911No ratings yet

- Tong Hop Bai Tap Tanh 10 CA Namco Dap AnDocument121 pagesTong Hop Bai Tap Tanh 10 CA Namco Dap AnNhan Thien NhuNo ratings yet

- Phân Tích Báo Cáo Tài Chính Công Ty Amvi BiotechDocument19 pagesPhân Tích Báo Cáo Tài Chính Công Ty Amvi BiotechNhan Thien Nhu100% (1)

- Exercise of Project Financial Appraisal The Hydrolyzed Protein Factory Construction Project 1. Overview of The ProjectDocument3 pagesExercise of Project Financial Appraisal The Hydrolyzed Protein Factory Construction Project 1. Overview of The ProjectNhan Thien NhuNo ratings yet

- A. Total Quality ManagementDocument11 pagesA. Total Quality ManagementNhan Thien NhuNo ratings yet

- Name: Trần Ngọc Tuyển Class: 38k16 - clc Macroeconomics Assignment 2Document2 pagesName: Trần Ngọc Tuyển Class: 38k16 - clc Macroeconomics Assignment 2Nhan Thien NhuNo ratings yet

- 5forces ModelDocument4 pages5forces ModelIgnited MindsNo ratings yet

- Third Week - Dsadfor PrintingDocument14 pagesThird Week - Dsadfor Printingyukiro rineva0% (2)

- BINUS University: Academic Career: Class ProgramDocument3 pagesBINUS University: Academic Career: Class ProgramJohan fetoNo ratings yet

- Assignment On Private Company Vs Public Company in eDocument5 pagesAssignment On Private Company Vs Public Company in eSaravanagsNo ratings yet

- ACI Practice TestDocument33 pagesACI Practice TestAbdulqadir UmarNo ratings yet

- Blai - PrelimDocument7 pagesBlai - PrelimSydney Miles MahinayNo ratings yet

- A Project Report ON Portfolio Management and Risk AnalysisDocument62 pagesA Project Report ON Portfolio Management and Risk AnalysisRakesh SharmaNo ratings yet

- Chapter 3 Quiz ExcelDocument8 pagesChapter 3 Quiz ExcelJasmine GuliamNo ratings yet

- Mutual Fund Selection ProcessDocument11 pagesMutual Fund Selection ProcessspeedenquiryNo ratings yet

- Case Study #6 - Hamilton Park VIII v1.0Document3 pagesCase Study #6 - Hamilton Park VIII v1.0Hari JNo ratings yet

- Derecognition of Financial InstrumentsDocument3 pagesDerecognition of Financial InstrumentsMinh TuệNo ratings yet

- Economic Value Added in ComDocument7 pagesEconomic Value Added in Comhareshsoni21No ratings yet

- Takafulink Flexi v2.0 31122014Document4 pagesTakafulink Flexi v2.0 31122014amnasufiyaNo ratings yet

- Lease Financing: Lessor LesseeDocument12 pagesLease Financing: Lessor Lesseealialim.No ratings yet

- Factsheet Al Amal) June 2010Document1 pageFactsheet Al Amal) June 2010sureniimbNo ratings yet

- RICS On Valuation of Development LandDocument26 pagesRICS On Valuation of Development LandKartik LadNo ratings yet

- Virtual 9k ChallengeDocument101 pagesVirtual 9k ChallengeGab ByNo ratings yet

- BerkadiaDocument6 pagesBerkadiaadapananiNo ratings yet

- Chapter 25 - The Money Supply and The Federal Reserve SystemDocument3 pagesChapter 25 - The Money Supply and The Federal Reserve SystemRudyanto SihotangNo ratings yet

- FSA 8e Ch05 SMDocument39 pagesFSA 8e Ch05 SMnufusNo ratings yet

- 3-Computing Gross ProfitDocument5 pages3-Computing Gross ProfitAquisha MicuboNo ratings yet

- BFMDocument17 pagesBFMsaurabhasdfNo ratings yet

- Financial Asset Valuation IntroductionDocument7 pagesFinancial Asset Valuation IntroductionGiga Kutkhashvili100% (1)

- CASH AND CASH EQUIVALENTS TheoDocument1 pageCASH AND CASH EQUIVALENTS Theovenice cambryNo ratings yet

- FY20 PresentationDocument49 pagesFY20 PresentationTrilok BavishiNo ratings yet

- (Sip) SoneyDocument66 pages(Sip) SoneySami ZamaNo ratings yet

- Our Strategy LHN Ar16Document44 pagesOur Strategy LHN Ar16Bilal El YoussoufiNo ratings yet

- CVDPDocument6 pagesCVDPNahidul IslamNo ratings yet