Professional Documents

Culture Documents

Lte Top 12 Challenges PDF

Lte Top 12 Challenges PDF

Uploaded by

yhamil010 ratings0% found this document useful (0 votes)

14 views7 pagesOriginal Title

Lte-Top-12-Challenges.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views7 pagesLte Top 12 Challenges PDF

Lte Top 12 Challenges PDF

Uploaded by

yhamil01Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

LTE Top 12 Challenges

By Manish Singh, Vice President of Product Line Management

Without a doubt, mobile broadband is todays growth engine for the telecom industry. The emerging picture is

clear: consumers want mobile broadband, and they want it now. This is indeed phenomenal growth so far, but

lets put this in perspective of what is still to come: according to industry organization GSMA, there are ~4.3B

wireless users in the world, of which 80 percent are voice-only GSM users, while only 9 percent are 3G

WCDMA and HSPA users (i.e., voice +data users). Thus the growth opportunity for mobile broadband (data)

is at least 3B subscribers and theres a good chance that many, if not most, of them can be captured in the

next 5-10 years.

To keep up with this surging demand, networks operators around the world are looking to roll out 4G networks

and Long Term Evolution (LTE) is the global front runner. Yet as the excitement for LTE begins to build,

scratching beneath the surface reveals many nontrivial challenges that still need to be overcome for

successful network deployment and more importantly, for broad consumer adoption. In this series of articles

we explore the top 12 challenges that need to be addressed for LTE success.

1. Spectrum Harmonization: One of the key benefits of GSM networks has been seamless roaming across

countries and continents, largely because of harmonized spectrum spanning large parts of the world. LTE

infrastructure is being designed to operate in different spectrum bands of different sizes, however, ranging

from 1.25MHz to 20MHz. [For LTE max potential data rates, 20MHz FDD contiguous spectrum is

required.] To truly support seamless global roaming, harmonized spectrum will be needed otherwise the

burden is shifted to terminals (e.g., handsets or mobile devices) to support multiple frequency bands,

which adds time, expense, complexity and inefficiency to the equation.

Today, LTE-land is far from achieving harmonized spectrum. The three main emerging options for LTE

spectrum allocation are:

Digital Dividend: In the U.S., the 700MHz band has already been auctioned and Verizon plans to

deploy LTE in it with a single 10MHz carrier. Currently in Europe there is a strong push to free up

common 800MHz bandwidth across all countries; however, this remains an open and somewhat

contentious issue with the regulators.

2.6GHz: Spectrum in 2.6GHz is available in large parts of the world and can serve as harmonized

spectrum. However, there are a couple of important attributes to the 2.6GHz frequency band. First,

relatively poor propagation characteristics will significantly impact indoor coverage, an issue already

quite visible in the 3G HSPA networks deployed in the 2.1GHz band. Second, poor propagation

characteristics also translate into smaller cell radius hence the need for more cells, which adds

expense and complexity. Lastly and most importantly, frequency has a direct impact on network costs,

as both OpEx and CapEx increase significantly with higher frequency.

2G / 3G Spectrum Re-farming: There are a few spectrum re-farming options available, such as at

2.1GHz (for 5MHz carriers) or the GSM 900MHz band (for 5MHz or less carriers). [Note: One related

topic is GSM sunset; this is discussed further down in the article.] NTT DoCoMo in particular has

shared its plan for using one of its UMTS carriers for LTE initially.

There are no clear answers for LTE spectrum allocation and harmonization; this complex issue needs to

be addressed by the industry in strong collaboration with regulators otherwise seamless roaming across

LTE networks will remain just a vision.

2. Voice over LTE: One of the touted benefits of LTE is the converged Evolved Packet Core (EPC), which is

a true All-IP core and hence should carry all types of traffic voice, video and data. However, most of the

2

MC00244

standardization work has focused on the data aspects of LTE and voice has been somewhat neglected.

Different operators are giving different priority to this issue; in fact, some of the early adopters are looking

at data-only services for their initial LTE network rollouts.

Clearly, the full OpEx and CapEx benefits of a converged EPC can only be realized when all traffic types

are carried over a single, unified core. The issue of standardization of voice over LTE gets even more

complicated when we bring into the mix the interlocking of LTE with different types of legacy networks

including GSM, HSPA, CDMA2000, WiMAX and WiFi.

Some of the primary options under consideration for carrying voice over LTE are:

Circuit Switch Fallback (CS Fallback): This is an attractive option that enables operators to leverage

their legacy GSM / UMTS / HSPA networks for carrying voice traffic. With CS Fallback, while making

or receiving a voice call the LTE terminal suspends the data connection with the LTE network and sets

up the voice connection via the legacy network. CS Fallback completely offloads the voice traffic to

legacy 2G / 3G networks, which of course requires operators to maintain their legacy CS core network.

CS Fallback is an attractive short-to-mid-term option as it enables operators to further leverage their

existing legacy infrastructure but, in the long term, other options will be more appealing to fully reap

the benefits for the converged EPC.

IMS-based VoIP: The IP Multimedia Subsystem (IMS) option supports Voice over IP (VoIP) over LTE

networks directly. In addition, this option leverages Single Radio Voice Call Continuity (SRVCC) to

address coverage gaps in LTE networks. While the initial voice call is established over the LTE

network, if the user goes out of the LTE coverage area then the call is handed off to the legacy CS

core network via support from the IMS core. This option does provide an interesting rollout strategy to

operators that have a strong IMS core as it allows them to transition to VoIP from the start while

leveraging existing legacy assets for voice continuity outside of LTE coverage areas.

Voice over LTE via Generic Access (VoLGA): An initiative led by T-Mobile, VoLGA essentially extends

the application of 3GPPs GAN standards to carry voice over LTE networks. This approach has strong

appeal to network operators who have already deployed Unlicensed Mobile Access (UMA) solutions

and can leverage them to enable voice delivery over LTE. The VoLGA architecture introduces a new

network element called VANC (VoLGA Access Network Controller) that enables interlocking between

the LTE network and the legacy CS core network.

At this time it is only fair to say that there are multiple options under consideration for supporting voice

over LTE networks, and the industry is a long way from reaching consensus on a standardized approach.

3. Small or Large Cells: Historically, 2G and 3G networks were built with the philosophy of build it and they

will come, and the good news is that consumers have adopted these technologies although for 3G there

was nearly a four-year delay in adoption uptake. With femtocells, operators now have a new tool in their kit

as they consider deployment options namely an inside-out rollout strategy for delivering LTE data rates

in the indoor environment (e.g., home, caf, airport, etc.), while leveraging their UMTS/HSPA networks for

macro coverage.

With LTE femtocells, operators can deliver dedicated capacity to consumers in their homes and offices,

and as LTE adoption increases over time there will be a tipping point when the LTE macro network

deployment business case becomes solid and should thus proceed. In other words, the inside-out rollout

strategy eliminates Return on Investment (ROI) risks. Another aspect that needs to be considered is the

bundling of femtocells with devices (e.g., providing a home base station with every new netbook or smart

phone purchase). These devices generate huge amounts of data traffic and this traffic can easily be

offloaded from the macro-cellular network, thereby significantly lowering the price/bit of delivery.

The small or large cell issue is also tied to spectrum, and for LTE, network operators can consider

dedicated carriers for macrocells vs. femtocells. For example, the 2.6GHz band might not be suitable for

3

MC00244

macrocells, but it is very well suited for femtocells. Femtocells greatly increase frequency re-use in the

indoor environment and are the cheapest capacity augmentation solution available today. It remains to be

seen how operators will deploy LTE networks, but it is certain that the 4G network will no longer be a

homogenous macro-only network; femtocells will definitely be part of the picture.

4. Backhaul: Network operators face two challenges when it comes to LTE backhaul:

Adding raw capacity

Realizing full mesh backhaul

Because wireless networks are spectrum limited, typically the bottleneck so far has been on the air

interface. LTE will shift the capacity bottleneck from the air interface to the backhaul link between base

stations and the core network. This challenge is across the board, from macrocells to femtocells. For

macrocells, a large part of the current backhaul infrastructure is comprised of bundled T1/E1s, but these

will not suffice for 100Mbps+data rates. Similarly, for femtocells the current IP broadband infrastructure is

mainly comprised of DSL and cable modem links, but these are insufficient for carrying 100Mbps+data

rates.

LTEs flat network architecture eliminates the Radio Network Controller / Base Station Controller

(RNC/BSC)-like aggregation node in the Radio Access Network (RAN), which is both good and bad. While

this simplifies the network architecture and reduces latency (on paper, anyway), in the real world it creates

a completely new challenge: how to realize a full mesh backhaul between eNodeBs. Remember, in LTE

networks the eNodeB needs to communicate with peer eNodeBs in order to support handoff functions

both control plane and data plane.

Operators will need to make significant investments in their backhaul infrastructure as they deploy LTE.

Eventually, in order to comprehensively address the backhaul challenge, operators will use a full range of

technologies including microwave, fiber/Ethernet, CATV Ethernet and potentially WiMAX. Whether

operators deploy their own backhaul solutions or continue to lease backhaul for LTE remains to be seen. It

will also be interesting to see what role pure backhaul leasing providers will play in LTE networks.

5. Self Organizing Networks (SON): Self Organizing Networks today represent a noble goal that operators

and vendors alike are striving to pursue. The core principle is to completely eliminate the need for

cumbersome radio network planning: as new cell sites are added in the network, neighboring cells

dynamically learn about the changes in the neighboring radio environment, recalibrate their configurations,

and adjust accordingly to minimize interference and update neighboring cell lists for handoff support. The

eventual goal is to have zero touch installation.

Presumably SON will enable quick network rollouts and upgrades and should greatly reduce the OpEx

typically associated with planning and managing radio networks, and the architects of the Next Generation

Mobile Network (NGMN) clearly mandated SON as a key requirement for 4G networks. Different RAN

vendors claim to have solutions for SON, but these are still far from meeting the noble goal of zero touch.

Most of these solutions today are Operations, Administration, Maintenance & Provisioning (OAM&P)-

centric and address only a subset of complete SON requirements. Current solutions can potentially

address certain aspects of SON, but there are many corner cases where these solutions break and thus

SON will remain a research and innovation area for the next few years. Eventually the industry needs

standardized SON specifications so that solutions from different vendors can co-exist simultaneously in

the RAN but we are still a few years away from realizing this.

6. Security: Secure delivery of traffic over LTE networks requires dealing with a range of issues:

Securing the air interface to avoid eavesdropping, sniffing, theft

Securing the all-IP core network (i.e., the EPC)

Securing the all-IP devices

4

MC00244

3GPP has chosen Snow3G as the stream cipher for encryption algorithms UAE2 and UIA2; the cipher

works on 32-bit words and supports both 128- and 256-bit keys. Because this is the 3GPP standard, LTE

gear needs to support Snow3G and the challenge is that current generation chipsets do not provide on-

chip accelerators for Snow3G. As a result, Network Equipment Providers (NEPs) have to find alternative

solutions, including FPGA-based acceleration to meet line rate performance requirements. Continuous

Computings FlexPacket ATCA-PP50 packet processing blade is a rare example of a solution that

incorporates a mezzanine for Snow3G acceleration.

Being all-IP, the EPC is susceptible to all kind of security attacks just like any traditional IP network such

as a Local Area Network (LAN). EPC gear needs to support a large number of IPsec terminations for

securing data and control plane communications. In addition, the EPC needs to be protected from

Distributed Denial of Service (DDoS) attacks and thus comprehensive Intrusion Prevention and Detection

Systems (IPS/IDS) need to be deployed.

Like it or not, LTE devices will be prone to all kinds of attack and the iPhones recent SMS-related

memory corruption issue highlights the kind of challenge that next-generation devices and networks face.

Quick fixes, quick rollouts and quick updates will be essential to stay ahead of (or at least keep pace with)

evolving IP-based threats. Network operators will need to put in place virus-scanning solutions in the EPC.

In addition, service providers will need to plan how to update subscribers devices in case a security attack

is unleashed that requires defensive vaccine downloads. In essence, traditional enterprise security

solutions will now need to find their way into the EPC as LTE networks are deployed; the issue is that

these solutions need to be scaled to meet core network demands and performance requirements and

need to be hardened to meet carrier-grade equipment requirements.

7. Devices and Terminals: As operators get ready for LTE trials, some of the key questions are: When will

the devices and terminals be ready and what will they be like? It is not yet clear whether operators will

roll out LTE services with data-centric devices such as data cards, dongles and netbooks or whether

we will see fully-featured LTE smart phones that support voice, data, video and all the other services. Most

observers anticipate that data cards and dongles will be available earlier, followed by smart phones, but

then again it is possible that we might have another big surprise from Apple!

LTE devices need to support Multiple Input Multiple Output (MIMO) in order to deliver high data rates but

this directly increases a devices complexity. One of the interesting things to watch will be whether the

initial devices will support only 2x2 MIMO or whether some vendors will launch devices supporting 4x4

MIMO from the start. This choice is directly related to battery life, and while data cards and dongles might

get enough juice from their hosting laptops and netbooks, smart phone designers have critical design

challenges in front of them in terms of balancing battery life with MIMO support.

Yet another key issue with devices and terminals is the frequency bands that they will support a factor

which is directly related to spectrum harmonization and has significant impact on device complexity and

costs.

Lastly, how much legacy support will be embedded in these devices? It is clear that LTE networks will not

have nationwide coverage for a long while, and to support full mobility will these devices support both 2G

and 3G fallback mechanisms? This question is directly related to an operators LTE network rollout

strategy and ties to choices the operator makes on how to support voice over LTE.

8. Traffic Management: As indicated at the top of this article, growing mobile broadband adoption is what is

driving the need for LTE network rollouts. According to AT&T Wireless, one 3G iPhone user typically

generates as much data traffic as 30 basic feature phone users. LTE greatly improves spectral efficiency

(by 4X) and will be deployed in larger 20MHz bands for maximum bandwidth potential, but eventually

these gains in data rates will be dwarfed by the faster rate at which overall data traffic is growing. Factor in

netbooks, USB cards and dongles and the growing data traffic problem will only become bigger as Internet

video and large peer-to-peer (P2P) file transfers migrate to LTE networks. Given this reality, traffic

management will be essential. Deep Packet Inspection (DPI) gear is today being deployed in 3G networks

5

MC00244

as bump-in-the-wire solutions, but for LTE networks such DPI capabilities may be pre-integrated into

Serving Gateways and Packet Data Network (PDN) Gateways.

Network operators have to make huge investments as they roll out their LTE networks, and yet the biggest

threat they face is that eventually they will be reduced to being mere bit pipe providers. Over time network

intelligence has migrated from the core (remember the Advanced Intelligent Network, AIN?) to the edge

and access portions, and now very much to devices (i.e., consider the app store phenomenon). DPI

technology enables operators to convert their bit pipes to smart pipes by empowering them to deliver

tiered service level agreements (SLAs) to consumers and tiered bandwidth allocation to content providers.

DPI also opens up the opportunity for new revenue-generating opportunities such as targeted advertising

because with DPI, operators can greatly improve the relevance of their ads.

Growing data traffic is also creating demand for Internet traffic offloading gear. Essentially what mobile

operators are looking for is the ability to offload Internet traffic at the edge of their networks and not be

required to carry that traffic to (and through) their core networks. In LTE, there is not yet consensus on

where the best point is to offload Internet traffic because there are no aggregation functions in the RAN.

Will this require new bump-in-the-wire gear to be deployed for LTE? [And yes, Internet traffic offloading

and traffic management do not mix well if done improperly.]

9. Flat Rate Plans: Introduction of flat-rate, all-you-can-eat data plans were, if not the most important, a very

critical factor for precipitating widespread mobile broadband adoption. At the same time, the introduction of

these plans has set consumers expectations and now they expect more bandwidth for less money.

The decoupling between traffic growth and revenue growth is the single biggest challenge that network

operators face today. To understand the magnitude of the challenge, lets again look at some numbers:

AT&T claims that each iPhone typically drives 30X more traffic than regular feature phones. A close look

at AT&Ts data pricing plan suggests that iPhone users are not paying even 3X more Average Revenue

Per User (ARPU) compared to other feature phone users -- yet they are driving 30X more traffic. To

address these challenges, operators need to look at aggressively lowering the price per bit. Frankly,

lowering the price/bit is what is forcing operators to look at network rollout strategies that incorporate

femtocells and Internet traffic offloading.

Service providers also need to figure out new ways to generate additional revenue. Offering tiered SLAs to

consumers is one approach, but in the bigger scheme of things operators need to start looking at how to

generate revenue from the other end of the pipe: content providers. At the end of the day, a carriers

wireless network is spectrum-limited and can only carry so much traffic. Offering Internet highways

instead of best-effort bandwidth to content providers with guaranteed reserved bandwidths is the way to

go, and presumably content providers would be willing to pay for this. Operators need to tear a page from

the air travel playbook and, in a similar sense, charge different tariffs to business-class passengers than

coach-class passengers. Ensuring that content providers get what they pay for is essential for operators to

effectively monetize their LTE networks otherwise we will see reduced investments in infrastructure and

collectively everyone will suffer with degraded quality of experience (QoE).

10. Intellectual Property Rights: IPR battles and associated royalty payments were a significant impediment

in 3G rollouts. Patent battles between Nokia and Qualcomm, which started in 2005 and finally ended in

2007 with Nokia paying $20M to Qualcomm, epitomize the challenge. Network operators caught in the

crossfire have to re-plan their rollout strategies, make adjustments and face delays in making their

networks operational. 3G handset manufacturers didnt go unscathed, either, facing endless negotiations

with multiple parties on royalty payments.

Every new technology comes loaded with patents, but what really matters are patents that are classified

as essential patents -- those that are absolutely necessary for that technology. So the key question is

who owns essential patents for LTE? Can operators and handset manufacturers go to a single

organization and negotiate associated royalties, or are we again going to witness complex, lengthy, multi-

party patent negotiations?

6

MC00244

To streamline the LTE IPR costs, seven key players Ericsson, NEC, NextWave Wireless, Nokia, Nokia

Siemens and Sony Ericsson collectively agreed to create a framework that limits patent royalties to a

single digit percentage of handset sales price -- and not to exceed $10 for LTE modems in netbooks. So is

this issue really behind us? Not really, because missing from the agreement are key eco-system players

like Qualcomm, Broadcom, Texas Instruments, Huawei, etc., who own parts of LTEs essential patents.

So while a noble attempt, so far the LTE IPR framework has fallen short. In addition, the United States

Patent and Trademark Office (USPTO) is being flooded with patent applications for SON from large

players and innovators alike. So we should all brace for another round of significant patent battles which

can potentially delay LTE network rollouts.

11. Interoperability: A vibrant and robust ecosystem is essential for wide deployment and adoption of LTE.

To achieve deployment flexibility and lower operation costs, network operators need a strong infrastructure

and device supplier base. At the heart of this lies the interoperability issue: ensuring operators can mix and

match equipment from different suppliers in their networks.

While GSM and 3G were both standards-based technologies, the reality is that interfaces like A-bis or Iub

were never really standard. Robust interoperability between LTE Base Stations (called eNodeBs) and the

EPC on the S1 interface is essential and seems reasonably achievable by the industry. However, the X2

interface between eNodeBs still has several moving parts in 3GPP that need to be nailed down. If not

done quickly, the industry might have a repeat of open interfaces with proprietary implementations like with

A-bis and Iub. This would limit operators ability to mix and match different eNodeB providers gear in their

RAN.

Significant churn in 3GPP specifications is another threat to LTE interoperability. While specifications

always evolve over time, the nature of changes in the LTE specifications at this stage is still significant. As

an example, the March 2009 version of 3GPP specifications saw significant updates to various protocols

and procedures and this remains a threat unless addressed swiftly by the standards body. Specifically for

LTE, the standardization effort is complex when we bring into the mix the issue of interworking with

existing legacy technologies including GSM, WCDMA, CDMA2000, WiMAX and others.

Each of these issues poses a threat to achieving interoperability on a mass scale. On the good news side,

the industry has launched the LTE/SAE Trial Initiative, called LSTI, which is driving collaboration between

infrastructure and device vendors to achieve interoperability based on a common set of features.

12. Two, Three, Four: Most operators currently have both 2G and 3G networks in service. As 4G LTE

networks are rolled out, should these carriers then manage and operate three simultaneous networks

2G, 3G and 4G? In the near term the answer is obvious: operators will continue to keep their 2G and 3G

networks going. For the mid- and long term, though, LTE once again brings the topic of GSM sunset to the

forefront or maybe 3G sunset.

Operators currently enjoy significant roaming revenues from their GSM networks [recall that 80 percent of

worldwide wireless users are still on GSM technology]. Parting from this high margin revenue stream is not

going to be easy. The issue also ties to spectrum re-farming, and spectrum is expensive. Switching off

GSM networks would enable operators to re-farm that spectrum, but there are many strict regulations

around this spectrum in different countries including complete nationwide coverage requirements.

Alternatively, operators might consider keeping their 2G networks going for awhile and switch off their 3G

networks first, migrating those 3G users to LTE. There are no clear answers yet, but what is very clear is

that operating three simultaneous networks is not a long term option.

One thing is certain: there are definitely interesting times ahead. Mobile broadband adoption has taken off; it is

here, it is now, and it is (thankfully!) not going away. The exa-flood is coming moving from terabytes to

petabytes to exabytes and operators need to start preparing their networks to handle massive data traffic

growth. And while LTE is by far the leading technology of choice for 4G wireless deployment, as with any new

technology there are significant challenges that remain to be addressed.

7

MC00244

The opportunity is large and the demand is strong, and with these foundations in place it is only a matter of

time before innovators find solutions to address the challenges. Continuous Computing is doing its part by

productizing leading edge technologies such as 40G ATCA platforms for fast pipes, LTE femtocells for cheap

pipes, and DPI solutions for smart pipes. Please contact us if you would like to discuss any of the above

challenges in more detail.

About Continuous Computing

Continuous Computing

is the global source of integrated platform solutions that enable network equipment

providers to overcome the mobile broadband capacity challenge quickly and cost effectively. Leveraging more

than 20 years of telecom innovation, the company empowers customers to increase return on investment by

focusing internal resources on differentiation for 3G, Long Term Evolution (LTE), Femtocell and Deep Packet

Inspection (DPI) applications. Expertise and responsiveness set the company apart: only Continuous

Computing combines best-in-class ATCA platforms with world-famous Trillium

protocol software to create

highly-optimized, field-proven wireless and packet processing network infrastructure. www.ccpu.com

Continuous Computing is an active member of 3GPP, CP-TA, eNsemble Multi-Core Alliance, ETSI, Femto

Forum, Intel Embedded Alliance, Multicore Packet Processing Forum, NI Alliance, PICMG and the SCOPE

Alliance.

Continuous Computing, the Continuous Computing logo and Trillium are trademarks or registered trademarks

of Continuous Computing Corporation. Other names and brands may be claimed as the property of others.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Network Management System by Man I SubramanianDocument4 pagesNetwork Management System by Man I SubramanianRadhika Sethu0% (1)

- Globalization in EducationDocument19 pagesGlobalization in EducationWawa WadzirNo ratings yet

- All Types GPRS Call FlowDocument17 pagesAll Types GPRS Call FlowChandan KumarNo ratings yet

- 10 Steps To Effective ListeningDocument3 pages10 Steps To Effective ListeningGladiola DelimNo ratings yet

- Umts BasicsDocument156 pagesUmts BasicsNitin GuptaNo ratings yet

- Optimization of 5G Accessibility in Non StandaloneDocument6 pagesOptimization of 5G Accessibility in Non StandaloneHernan BatiNo ratings yet

- Actual Name of AE Koetting - Task Force Arrests Roommates On Drug ChargesDocument6 pagesActual Name of AE Koetting - Task Force Arrests Roommates On Drug ChargesThomas AlbinNo ratings yet

- Formula of Tenses Aktif and PasiveDocument2 pagesFormula of Tenses Aktif and PasiveGilang andrianNo ratings yet

- Online Shopping Website: Electronics and Communication EngineeringDocument10 pagesOnline Shopping Website: Electronics and Communication EngineeringRohit RanaNo ratings yet

- 1775 Features of Spoken Language QuizDocument3 pages1775 Features of Spoken Language QuizIoanna Jane AndreopoulouNo ratings yet

- Integrated Skills ApproachesDocument19 pagesIntegrated Skills ApproachesValeria CapetilloNo ratings yet

- 16 Tenses PDFDocument37 pages16 Tenses PDFFatih100% (1)

- The Pulse of News in Social Media: Forecasting Popularity: Roja Bandari Sitaram Asur Bernardo A. HubermanDocument8 pagesThe Pulse of News in Social Media: Forecasting Popularity: Roja Bandari Sitaram Asur Bernardo A. HubermanJeremy LangNo ratings yet

- JavascriptDocument110 pagesJavascriptRodrigo-55539740% (1)

- Aligning Assessment To Competency Objectives & TLM DR HraishDocument9 pagesAligning Assessment To Competency Objectives & TLM DR HraishHarish Agarwal100% (2)

- Leech Principios de Pragmática NotasDocument2 pagesLeech Principios de Pragmática Notasgermen_02No ratings yet

- Bruns Resume 2021Document1 pageBruns Resume 2021api-540779061No ratings yet

- The Effects of Brand Image On Customer SatisfactioDocument20 pagesThe Effects of Brand Image On Customer Satisfactioana yulistia kusumaNo ratings yet

- Aaliyah Callender - DocumentDocument55 pagesAaliyah Callender - DocumentAlana LewisNo ratings yet

- Lesson Plan in English 10 Quarter I Topic: Winning Over Individual Challenges: Appreciation of The Song "Roar" Learning CompetencyDocument6 pagesLesson Plan in English 10 Quarter I Topic: Winning Over Individual Challenges: Appreciation of The Song "Roar" Learning CompetencyMyra Mosuela BolinasNo ratings yet

- The Benefits of Social Media For BusinessDocument2 pagesThe Benefits of Social Media For BusinessBeannieNo ratings yet

- Traditional FolkDocument5 pagesTraditional FolkGourab LenkaNo ratings yet

- Tài Liệu Livestream: Choose the correct answer for the following questionsDocument2 pagesTài Liệu Livestream: Choose the correct answer for the following questionsĐạt Nguyễn ThànhNo ratings yet

- Dương Đình KhươnggDocument22 pagesDương Đình KhươnggKhươngg DươnggNo ratings yet

- RPH 2019 KSSR Tahun 6 Bahasa InggerisDocument98 pagesRPH 2019 KSSR Tahun 6 Bahasa InggerisHasnulhadi Bin IbrahimNo ratings yet

- Social Studies 6th 2017Document30 pagesSocial Studies 6th 2017api-267803318No ratings yet

- Godawari College: Project Work ReportDocument19 pagesGodawari College: Project Work ReportTECH S100% (1)

- 01 Training Activity MatrixDocument14 pages01 Training Activity MatrixRAMIL DE LA TORRENo ratings yet

- Silabus Discourse Analysis-SdtDocument4 pagesSilabus Discourse Analysis-SdtAnas Putra100% (1)

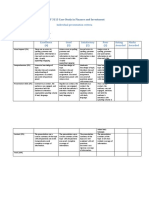

- BBMF 3113 Case Study in Finance and Investment: Individual Presentation CriteriaDocument3 pagesBBMF 3113 Case Study in Finance and Investment: Individual Presentation Criteriajesvan wongNo ratings yet