Professional Documents

Culture Documents

Property Tax Form Punjab

Property Tax Form Punjab

Uploaded by

bharatarora01060 ratings0% found this document useful (0 votes)

24 views7 pagesThis document is a self-assessment form for property tax returns in Punjab, India. It collects information about the property such as the municipal corporation, ward, type of property, occupier details, and area. It then has several parts that determine the tax amount due based on factors like the property area, usage, age, and whether it is occupied or vacant land. The form calculates rebates, penalties, and the net payment required according to the information provided by the occupier.

Original Description:

new form

Original Title

Property Tax form punjab

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a self-assessment form for property tax returns in Punjab, India. It collects information about the property such as the municipal corporation, ward, type of property, occupier details, and area. It then has several parts that determine the tax amount due based on factors like the property area, usage, age, and whether it is occupied or vacant land. The form calculates rebates, penalties, and the net payment required according to the information provided by the occupier.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

24 views7 pagesProperty Tax Form Punjab

Property Tax Form Punjab

Uploaded by

bharatarora0106This document is a self-assessment form for property tax returns in Punjab, India. It collects information about the property such as the municipal corporation, ward, type of property, occupier details, and area. It then has several parts that determine the tax amount due based on factors like the property area, usage, age, and whether it is occupied or vacant land. The form calculates rebates, penalties, and the net payment required according to the information provided by the occupier.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

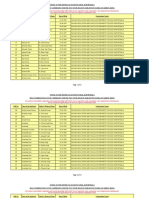

Property Tax Return , Punjab

SELF ASSESSMENT FORM

(Under Section 112-A (1) of the Punjab Municipal Corporation Act, 1976)

(Financial Year.)

Part A

(TO BE FILLED BY ALL)

1. Name of the Municipal Corporation Sahibzada Ajit Singh Nagar

2. Ward No.

3. Block / Sector /Phase No.

4. Property Identification / House No

5. Name of the Colony/ Mohalla/ Village

6. Type of property ( please indicate any

one of the following :-

Residential / Industrial / Govt.

Building/ Private Health &

Educational Institution / Commercial,

Restaurants or Hotel upto 2 Star /

Malls/ Marriage place & Resorts / 5

star Hotel and above .

7. Occupier's status

Indicate one of the following :-

Self occupied OR Rented

8. Occupier's details :

(a) Name

(b) Father 's Name

( c) Gender ( Male / Female )

(d ) Date of Birth / Age

9. Property area

( in square meters only)

1 sq. yard = 0.8361 sq mt.

1 sq. ft= 0.092903 sq . mt

----------------square meters

Part B

( TO BE FILLED FOR SELF OCCUPIED RESIDENTIAL BUILDINGS HAVING

PLOT AREA UPTO 100 SQUARE METERS/Approximate 120

sq.yds. )

10. Area of the plot under self occupied

residential building

Annual Property Tax LUMPSUM

( Amount in Rupees )

(a) If upto 50 square

meters/Approximate 60 sq.yds.,

(b) If more than 50 Square

meters/Approximate 60 sq.yds. , but

upto 100 square meters/Approximate

120 sq.yds.

Rs. 50/- (fifty ) per annum

Rs. 150 ( One Hundred and Fifty ) per

annum

Part- C

( TO BE FILLED IN CASE OF EXEMPTED CATEGORIES ONLY )

11. (a) Please indicate the relevant

exempted category from the

following :

Building and lands, exclusively

used for religious purpose,

religious rites, religious

ceremonies, cremation grounds,

burial grounds, gaushalas, stray

animal care centers, historical

and heritage buildings so

notified by the State

Government / Central

Government or UNESCO,

Charitable and philanthropic

organization exempted from

payment of the tax under the

Income Tax Act, 1961 ( Central

Act No. 43 of 1961), the

building and lands owned and

used by the Corporation and the

lands being exclusively used for

religious function or festivals.

(b) Please indicate the proof being

enclosed in support of (a)

above)

Part- D

(TO BE FILLED FOR ALL OTHERS INCLUDING VACANT LANDS)

12 Zone Number ( as determined and

published by the Zoning Committee),

in which the property mentioned

against column No. 4 is located.

13 Unit Value( as determined and

published by the Unit Valuation

Committee)

Rs._____________________

Per Square meter.

Part-E

( TO BE FILLED FOR VACANT LANDS ONLY)

14 Vacant plot area ( in square meters)

15 Usage Factor

16 Occupancy Factor

17 Total Unit Value

( Unit value X Usage Factor X

Occupancy Factor)

18 Annual Unit Value

( 5% OR 15% Or 20% of Total Unit

Value )

19 Payable Annual Property Tax

( Annual Unit Value X Area of the

vacant land X 0.25 % [ 25/100x 100])

Rs.---------------------

Part F

( TO BE FILLED IN ALL OTHER CASES)

20. Factors(Please circle the relevant factor in each Block below)

Block A Usage Factor (UF)

1. Residential Building 1

2. Govt. Institution including Educational and Health

institution

1.5

3. Private institution including Hospital, Nursing Homes,

Educational and Industry

2

4. Commercials units, Restaurants including Hotels upto two

star

4

5 Malls including Hotels with three & four stars and

Marriage Palaces and Resorts

5

6. Five Star Hotel & Above 10

Block B- Type Factor (TF)

1. House Constructed upon the Land whose owner is the

same

1

2. Other Excepting ( 1 above e.g. Multistoried group

Housing Building etc.

0.75

Block C- Structural Factor ( SF)

1. Pucca ( cemented bricks walled and load bearing roof) 1

2. Semi Pucca ( cemented bricks walled or non cemented

bricks walled with non load bearing roof

0.75

3 Kuccha ( Non cemented or non brick walled and non

load bearing roof

0.50

Block D- Occupancy Factor ( OF)

1. Self Occupied 1

2. Others excepting ( a) 2

Block E- Age Factor of the Building to be Taken From the date of the completion

Certificate (AF)

1. Built during last ten year 1

2. Built between last ten year to twenty years 0.9

3. Built between last twenty years to thirty years 0.8

4. Built between last thirty years to forty years 0.7

5. Built between last forty years to fifty years 0.6

6. Built more than fifty years back 0.5

21

A- Plot Area ( in square meters only ):

Built up Area Vacant Area Total Area

B- Details of Built up area (BUA) in Square meters only

(i.e . total constructed floor area on all the floors of the building)

Basement -

Ground floor -

First floor -

Second floor -

Third floor -

Fourth floor -

Fifth floor -

( and so on) -

-----------------------------

Total Built up area -

----------------------------

C- In case the built- up area is used for multiple purposes ( like Restaurant on

ground floor , residence on one floor , institution on other floor, etc.) , break

up of built up area (BUA ) usage be indicated below:-

Usage Area ( in sq. area meters only

Residential Building

Govt.Institution including Educational and Health

institution

Private institution including Hospital , Nursing Homes,

Educational and Industry

Commercial units, Restaurants including Hotels upto

two star

Malls, 3 & 4 Star Hotels, Marriage palaces & Resorts

Five Star Hotel & above

Total

22 Total Unit Value (TUV)

(Unit Value (Sr. No. 13) X Factor

(Sr. No . 20).ie UV X UF X TF X SF X OF X AF)

Rs.

23 Annual Unit Value (AUV)

In case of residential 5% of TUV( Sr. No.22)

In case of Malls and

Hotels with five stars

and above

20 % of TUV

For others 15% of TUV

Rs.

24) CALCULATION OF TAX PAYBLE

(a) If Built up area (BUA) is 25% or more of the

area of the plot , then Tax on Built up Area

(BUA) only is to be calculated as under :-

(AUV X BUA X 1 %)

Rs---------------

(b) If Built up area (BUA) is less than 25% of the

area of plot , then Tax on Built up area and

vacant land area is to be calculated as under:-

( i) [ AUV X BUA X 1 %]

(ii) [ AUV X VA X 0.25% ]

Rs.-------------------

Rs.-------------------

Total Rs.

Part G

( TO BE FILLED IN ALL CASES)

25. Total Annual Tax payable

(Sr. No. 10, 19, or 24)

Rs.______________

26. Remission, If any , being claimed under section 141 of the

Punjab Municipal Corporation Act 1976 on account of

unoccupied building , authenticated proof being enclosed

should be indicated and the amount of calculation of

remission amount to be indicated in this column.

Rs._______________

(proof being enclosed

----------------------)

27 Amount of Rebate

( If payment is being made before 30

th

June of the

financial year , then 10% rebate on the tax calculated can

be claimed)

Rs.

28 Penalty

( @ 25 % of the amount yet to be paid , if payment is

being made after 30

th

September)

Rs

29 Interest amount

( @ 15% per annum on the amount yet to be paid for the

delayed period beyond 30

th

September)

Rs.

30 Net payment being made

[ 25-26-27+ 28+29]

Rs.

I undertake that the information given by me in the above form is correct and true

and I shall be responsible if the same is found to be incorrect.

Place Signature of the assessee /

Occupier of the property

Dated

Property Tax Return , Punjab

SELF ASSESSMENT FORM

(Under Section 112-A (1) of the Punjab Municipal Corporation Act, 1976)

(Financial Year.)

Part A

(TO BE FILLED BY ALL)

1. Name of the Municipal Corporation Sahibzada Ajit Singh Nagar

2. Ward No.

3. Block / Sector /Phase No.

4. Property Identification / House No

5. Name of the Colony/ Mohalla/ Village

6. Type of property ( please indicate any

one of the following :-

Residential / Industrial / Govt.

Building/ Private Health &

Educational Institution / Commercial,

Restaurants or Hotel upto 2 Star /

Malls/ Marriage place & Resorts / 5

star Hotel and above .

7. Occupier's status

Indicate one of the following :-

Self occupied OR Rented

8. Occupier's details :

(a) Name

(b) Father 's Name

( c) Gender ( Male / Female )

(d ) Date of Birth / Age

9. Property area

( in square meters only)

1 sq. yard = 0.8361 sq mt.

1 sq. ft= 0.092903 sq . mt

----------------square meters

Part B

( TO BE FILLED FOR SELF OCCUPIED RESIDENTIAL BUILDINGS HAVING

PLOT AREA UPTO 100 SQUARE METERS/Approximate 120 sq.yds. )

10. Area of the plot under self occupied

residential building

Annual Property Tax LUMPSUM

( Amount in Rupees )

(a) If upto 50 square

meters/Approximate 60 sq.yds.,

(b) If more than 50 Square

meters/Approximate 60 sq.yds. , but

upto 100 square meters/Approximate

120 sq.yds.

Part- C

( TO BE FILLED IN ALL CASES)

11. Total Annual Tax payable

(Sr. No. 10 )

Rs.______________

12. Remission, If any , being claimed under section 141 of the

Punjab Municipal Corporation Act 1976 on account of

unoccupied building , authenticated proof being enclosed

should be indicated and the amount of calculation of

remission amount to be indicated in this column.

Rs._______________

(proof being enclosed

----------------------)

13. Amount of Rebate , If applicable as per rules

( If payment is being made before 30

th

June of the

financial year , then 10% rebate on the tax calculated can

be claimed)

Rs.

14. Penalty

( @ 25 % of the amount yet to be paid , if payment is

being made after 30

th

September)

Rs

15. Interest amount

( @ 15% per annum on the amount yet to be paid for the

delayed period beyond 30

th

September)

Rs.

16. Net payment being made

[ 11-12-13+14+15]

Rs.

I undertake that the information given by me in the above form is correct and true

and I shall be responsible if the same is found to be incorrect.

Place Signature of the assessee /

Occupier of the property

Dated

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Secured Party MASTER FILEDocument4 pagesSecured Party MASTER FILEbyron94% (101)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coco Chanel BiographyDocument15 pagesCoco Chanel Biographybharatarora0106No ratings yet

- Extrajudicial Settlement of Estate SampleDocument2 pagesExtrajudicial Settlement of Estate Sampleyano_08100% (2)

- SKM 36722082218360Document2 pagesSKM 36722082218360bharatarora0106No ratings yet

- Immune System PDFDocument6 pagesImmune System PDFbharatarora0106No ratings yet

- 1 PDFsam SKM 36722082218360Document1 page1 PDFsam SKM 36722082218360bharatarora0106No ratings yet

- 2 PDFsam SKM 36722082218360Document1 page2 PDFsam SKM 36722082218360bharatarora0106No ratings yet

- 365 Steps To Self Confidence - 59f464d11723ddf6fce419ea PDFDocument8 pages365 Steps To Self Confidence - 59f464d11723ddf6fce419ea PDFbharatarora0106No ratings yet

- Chemistry Notes For Class 12 Chapter 6 General Principles and Processes of Isolation of Elements PDFDocument14 pagesChemistry Notes For Class 12 Chapter 6 General Principles and Processes of Isolation of Elements PDFbharatarora0106No ratings yet

- Admit CardDocument74 pagesAdmit Cardbharatarora0106No ratings yet

- Epson M 2140 ManualDocument130 pagesEpson M 2140 Manualbharatarora0106No ratings yet

- RoleDocument44 pagesRolebharatarora0106No ratings yet

- College Migration FormDocument2 pagesCollege Migration Formbharatarora0106No ratings yet

- KGTraditionalFractions2MAP PDFDocument2 pagesKGTraditionalFractions2MAP PDFbharatarora0106No ratings yet

- Lecture Notes #1 FuchsDocument5 pagesLecture Notes #1 Fuchsbharatarora0106No ratings yet

- Ethics and Values: Rigo C. ReasDocument55 pagesEthics and Values: Rigo C. ReasJustine Sherwin ViloriaNo ratings yet

- Summons Under CPCDocument30 pagesSummons Under CPCTawhidur Rahman Murad89% (9)

- C.A. Foundation Final Accounts For Sole Proprietorship QuestionsDocument2 pagesC.A. Foundation Final Accounts For Sole Proprietorship Questionsgpgaming1693No ratings yet

- Affidavit of Loss Receipts - GalindoDocument6 pagesAffidavit of Loss Receipts - GalindoRMV LawOfficeNo ratings yet

- Exam Year Adv No: PSC-1-RT (4) B-1/2020 Advertisement Name Payment Status: Exempted Application Id IP AddressDocument3 pagesExam Year Adv No: PSC-1-RT (4) B-1/2020 Advertisement Name Payment Status: Exempted Application Id IP AddressNAVEEN CHUNCHURENo ratings yet

- NYULawReview Volume 95 Issue 4 BallDocument39 pagesNYULawReview Volume 95 Issue 4 BallJoe EskenaziNo ratings yet

- Career Executive Service Board Vs CSCDocument2 pagesCareer Executive Service Board Vs CSCxeileen08100% (1)

- Calacala v. RepublicDocument2 pagesCalacala v. RepublicJDR JDRNo ratings yet

- HPTADocument3 pagesHPTAYashafei Wynona Edu-antiporda CalvanNo ratings yet

- Talento vs. Escalada, Jr. 556 SCRA 491Document12 pagesTalento vs. Escalada, Jr. 556 SCRA 491KidMonkey2299No ratings yet

- Worker's Liens Act 1893.575.authDocument15 pagesWorker's Liens Act 1893.575.authBenjamin Laughton-GoughNo ratings yet

- COC-and-other-requirements (HERRERA, CLARK JERZON M.)Document5 pagesCOC-and-other-requirements (HERRERA, CLARK JERZON M.)Kyle FaderangaNo ratings yet

- Form 66Document2 pagesForm 66skgupta2711No ratings yet

- Angel RPG - Investigator's CasebookDocument183 pagesAngel RPG - Investigator's CasebookDavidHavok60% (5)

- Business Ethics and Social Responsibilities - Module 1Document11 pagesBusiness Ethics and Social Responsibilities - Module 1Ayessa mae CaagoyNo ratings yet

- Week 18 Lecture - Law Enforcement OperationsDocument3 pagesWeek 18 Lecture - Law Enforcement OperationsKenn BuenoNo ratings yet

- 3D1819 PALE Notes and Reviewer IDocument13 pages3D1819 PALE Notes and Reviewer IPatricia RodriguezNo ratings yet

- Biolife Medical PVT LTD: D 31, Site Iv, Kasna, Greater Noida 201 306, U. P., IndiaDocument1 pageBiolife Medical PVT LTD: D 31, Site Iv, Kasna, Greater Noida 201 306, U. P., IndianishthaNo ratings yet

- Student Handbook AY2021-22 (26 Aug)Document28 pagesStudent Handbook AY2021-22 (26 Aug)Oscar RomainvilleNo ratings yet

- Matrix/Canopy Motion To DismissDocument3 pagesMatrix/Canopy Motion To DismissJohn ArchibaldNo ratings yet

- Presentation 1Document11 pagesPresentation 1Sanket BhedeNo ratings yet

- Abad-Gamo Legal Writing As A Study ToolDocument5 pagesAbad-Gamo Legal Writing As A Study ToolAlexis Louisse Gonzales100% (2)

- Complaint Against Driver and Fiat-ChryslerDocument5 pagesComplaint Against Driver and Fiat-ChryslerMichelle SolomonNo ratings yet

- Lick 08 TabDocument4 pagesLick 08 TabarijitNo ratings yet

- Contract Project Communication of Acceptance Via TelephoneDocument23 pagesContract Project Communication of Acceptance Via TelephoneAniket SachanNo ratings yet

- ,3333. Crossing of ChequesDocument13 pages,3333. Crossing of ChequesRishabh jainNo ratings yet

- FORCESDocument73 pagesFORCESMaria BhaijiNo ratings yet

- PHIMCO V PILA (2010) : Strike PicketingDocument3 pagesPHIMCO V PILA (2010) : Strike PicketingClarisse-joan Bumanglag Garma100% (1)