Professional Documents

Culture Documents

Sa Lesson13

Sa Lesson13

Uploaded by

api-2637546160 ratings0% found this document useful (0 votes)

719 views1 pageOriginal Title

sa lesson13

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

719 views1 pageSa Lesson13

Sa Lesson13

Uploaded by

api-263754616Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Time Required: 40 minutes

STUDENT ACTIVITy: PAySTUB PUZZLES | 1

Paystub Puzzles:

Putting the Pieces Together

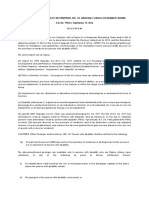

LESSoN 13: STUDENT ACTI VI Ty SHEET 1

Getting your rst paycheck can be overwhelming. There are lots of details and deductions

to consider, but knowing what to expect makes it easier. Below are four diferent paystub

samples; in all of them the employees receive their paychecks through direct deposit. Use

the rst example as a guide to understand the deductions and then determine how each

of the remaining paystubs could be revised to maximize savings.

Description Rate Hours This Period Year to Date

Regular $12.00 40 $480.00 $1,920.00

Overtime $18.00 5 $90.00 $360.00

Total $570.00 $2,280.00

Deductions This Period Year to Date

Federal Income Tax (2) $40.00 $40.00

State Income Tax (2) $10.00 $40.00

Medicare Tax (3) $5.00 $20.00

Social Security Tax (4) $20.00 $80.00

Other

Health Insurance* (5) $20.00 $80.00

Medical Flexible Spending Account*

(6)

$10.00 $40.00

Life Insurance (7) $5.00 $20.00

401(k)* (8) $20.00 $80.00

Savings Deposit (9) $30.00 $120.00

Total $160.00 $640.00

Scott K Smith

Social Security: XXX-XX-1111

Taxable Gross: $520.00

Net Pay: $410.00

Taxable Marital Status: Single

Exemptions/Allowances: (1)

Federal: 0 State: 0

Period Ending:2/01/13

Pay Date: 2/14/13

123 Company

555 Anywhere Rd

Anywhere, USA 11111

* Excluded from federal taxable wages

1. When you accept a new job, you will fll out a W-4

form on which youll determine a withholding

allowance (this is how much money will go toward

federal taxes from each paycheck). If at the end

of the year youve overpaid, youll receive a tax

refund. If youve underpaid, youll owe taxes.

2. Federal and state income taxes help pay for

services like roads, public schools and libraries.

Most but not all states have an income tax and

some cities and counties do as well.

3. Medicare taxes help pay for health care costs for

individuals over 65 and those with a disability.

4. Social security taxes help pay for retirement costs.

5. Health insurance deductions cover medical costs.

6. Flexible spending accounts (FSAs) allow you

to set aside before-tax portions of your pay for

things like childcare and medical expenses.

7. Life insurance deductions go toward a life

insurance policy.

8. A 401(k) is a retirement savings account. When

you put a certain percentage of your paycheck in

a traditional 401(k), you dont pay income tax on

that money until it is withdrawn.

9. A savings deposit deduction can be set up if you

want an after-tax portion of your paycheck to go

directly into a savings account.

You might also like

- SC 2Document2 pagesSC 2Carol Buckley0% (1)

- Income Statement TaskDocument5 pagesIncome Statement Taskiceman2167No ratings yet

- SWOT AnalysisDocument3 pagesSWOT AnalysishorrorhouseNo ratings yet

- Web Part Type IdsDocument8 pagesWeb Part Type IdsWilliam JansenNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- Cloward Piven Strategy FullDocument24 pagesCloward Piven Strategy Fullperzaklie100% (4)

- Case Digest-Labor Just CauseDocument12 pagesCase Digest-Labor Just CauseChito BarsabalNo ratings yet

- PaystubDocument7 pagesPaystubapi-299736788No ratings yet

- Fee Adjustment FormDocument2 pagesFee Adjustment FormTemple Beth SholomNo ratings yet

- Easy As 1-2 - 3: Bring Documents From Each Section Below: 1-2-3 Done!Document1 pageEasy As 1-2 - 3: Bring Documents From Each Section Below: 1-2-3 Done!suneelNo ratings yet

- Quicken Loans Decision 03-09-17Document52 pagesQuicken Loans Decision 03-09-17MLive.comNo ratings yet

- DL 32 PDFDocument3 pagesDL 32 PDFYour MommaNo ratings yet

- ADP PayrollDocument12 pagesADP PayrollIn StockNo ratings yet

- Living Wage Report 2023 With Cover PageDocument28 pagesLiving Wage Report 2023 With Cover PageCTV Calgary DigitalNo ratings yet

- Getting Paid Math 2.3.9.A1 PDFDocument3 pagesGetting Paid Math 2.3.9.A1 PDFLyndsey BridgersNo ratings yet

- Liabilities and Equity Exercises II PDFDocument27 pagesLiabilities and Equity Exercises II PDFMd Mobasshir Iqubal100% (2)

- Complete Details Payroll Salary ComDocument9 pagesComplete Details Payroll Salary ComTahmina KhanomNo ratings yet

- CV - Rishi Doshi - 2019Document2 pagesCV - Rishi Doshi - 2019Rishi DoshiNo ratings yet

- Getting Paid MathDocument3 pagesGetting Paid MathDawson BanksNo ratings yet

- SPHS IB Advocate - Spring 2011Document8 pagesSPHS IB Advocate - Spring 2011SPHS IB Advocate EditorsNo ratings yet

- Overview of Non-Life Insurance Sector: October 17, 2019Document19 pagesOverview of Non-Life Insurance Sector: October 17, 2019Sadia AfrinNo ratings yet

- Business Management Module 1Document30 pagesBusiness Management Module 1Ashenafi Belete AlemayehuNo ratings yet

- Cheat Sheets - Profit and LossDocument4 pagesCheat Sheets - Profit and LossMeghna ChoudharyNo ratings yet

- Final Module (ENTREP)Document13 pagesFinal Module (ENTREP)cyrelle rose jumentoNo ratings yet

- Planning: The Basic Function of ManagementDocument18 pagesPlanning: The Basic Function of ManagementClaire Evann Villena EboraNo ratings yet

- Asia Metroolitan University Taman Kemachaya, Batu 9, 43200 CHERAS SelangorDocument7 pagesAsia Metroolitan University Taman Kemachaya, Batu 9, 43200 CHERAS SelangorMehedi TanvirNo ratings yet

- PracticeDocument1 pagePracticeorjuanNo ratings yet

- Draft: Vehicle PropulsionDocument14 pagesDraft: Vehicle PropulsionHusain KanchwalaNo ratings yet

- Exam Candidate HandbookDocument32 pagesExam Candidate HandbooknikhilkhemkaNo ratings yet

- 9088ce Pay-StubDocument1 page9088ce Pay-Stubapi-255272420No ratings yet

- Homework Menu Ks2Document6 pagesHomework Menu Ks2jitqsxyodNo ratings yet

- Britany Morris: Talx Home Work Number HomeDocument3 pagesBritany Morris: Talx Home Work Number HomeBRITTAY2No ratings yet

- Payroll Manager Accountant in Austin TX Resume Katherine PottsDocument3 pagesPayroll Manager Accountant in Austin TX Resume Katherine PottsKatherinePottsNo ratings yet

- User Manual - Import Payroll DataDocument8 pagesUser Manual - Import Payroll Dataharry.anjh3613No ratings yet

- DBA SIA Module BookletDocument12 pagesDBA SIA Module Booklethassan_401651634No ratings yet

- Excel PayrollBook Instruction PDFDocument25 pagesExcel PayrollBook Instruction PDFangelito alarasNo ratings yet

- Chapter 4 - Requirement Modeling (CS31)Document45 pagesChapter 4 - Requirement Modeling (CS31)Vienna Corrine Q. AbucejoNo ratings yet

- Accounts Receivable Resume SampleDocument8 pagesAccounts Receivable Resume Samplezehlobifg67% (3)

- IB Exam Paper Gr. 11 HLDocument28 pagesIB Exam Paper Gr. 11 HLadambayNo ratings yet

- F1 Maths PDFDocument84 pagesF1 Maths PDFFook Long WongNo ratings yet

- Payroll Manager or Payroll DirectorDocument4 pagesPayroll Manager or Payroll Directorapi-78120304No ratings yet

- PAYROLLDocument6 pagesPAYROLLDinesh Kumar GuptaNo ratings yet

- Sample Reports For OfficeDocument9 pagesSample Reports For OfficeAdnan DiampuanNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- IELTS Mock Test 3Document6 pagesIELTS Mock Test 3K44 Luật Thương mại Quốc TếNo ratings yet

- FPA Worksheet BalanceSheetDocument1 pageFPA Worksheet BalanceSheetMandar BahadarpurkarNo ratings yet

- Final JudgmentDocument31 pagesFinal JudgmentLisa VaasNo ratings yet

- B MBA I To IV Semesters Syllabus 2015-16Document258 pagesB MBA I To IV Semesters Syllabus 2015-16bcamaresh8054No ratings yet

- IFWG Working PaperDocument58 pagesIFWG Working PaperBusinessTech100% (5)

- ResourceProxy PDFDocument3 pagesResourceProxy PDFGuerline PhilistinNo ratings yet

- T1, T1c, T2, T3, T4 LinesDocument4 pagesT1, T1c, T2, T3, T4 LinesdhawanrishNo ratings yet

- Pdfmergerfreecom Ms Excel 2007 Formulas With Examples PDF in Hindi WordpresscomcompressDocument4 pagesPdfmergerfreecom Ms Excel 2007 Formulas With Examples PDF in Hindi WordpresscomcompressRitesh NimjeNo ratings yet

- Payroll: Company Financial Salaries Wages DeductionsDocument5 pagesPayroll: Company Financial Salaries Wages DeductionsKavitaNo ratings yet

- Litton FinancialStatementDocument1 pageLitton FinancialStatementZhen WuNo ratings yet

- IBIS World Payroll-Bookkeeping Services US 2016 PDFDocument33 pagesIBIS World Payroll-Bookkeeping Services US 2016 PDFSandra DeeNo ratings yet

- Layoff Consequences H 1bsDocument2 pagesLayoff Consequences H 1bsnithincb20001No ratings yet

- Resume Accountant CanadaDocument4 pagesResume Accountant Canadacprdxeajd100% (2)

- Payroll Voucher GuideDocument32 pagesPayroll Voucher GuideVerry NoviandiNo ratings yet

- Datasheet PDFDocument4 pagesDatasheet PDFpkkothariNo ratings yet

- Book For System AnalysisDocument38 pagesBook For System AnalysisAlex YouNo ratings yet

- Financial Accounting For ICWADocument944 pagesFinancial Accounting For ICWAAmit Kumar100% (2)

- Ais 2 AssignmentDocument18 pagesAis 2 AssignmentPui YanNo ratings yet

- Making MoneyDocument8 pagesMaking MoneyYunike TrifenaNo ratings yet

- Vizconde Vs CADocument2 pagesVizconde Vs CAStephanie Valentine100% (2)

- Courts Gagging The MediaDocument17 pagesCourts Gagging The MediaAbhishekNo ratings yet

- UNODOC CatalogueDocument15 pagesUNODOC CataloguealexandremagachoNo ratings yet

- Litex V EduvalaDocument5 pagesLitex V EduvalajonbelzaNo ratings yet

- Cbse Political Science Term MCQS) - Arihant Prakashan (2022) 46Document1 pageCbse Political Science Term MCQS) - Arihant Prakashan (2022) 46Ibadul BariNo ratings yet

- Serg Products Vs PCI LeasingDocument3 pagesSerg Products Vs PCI LeasingErika Angela Galceran100% (2)

- LESSON-1-Types-of-Govt-How-Govt-is-Formed (Part 4)Document22 pagesLESSON-1-Types-of-Govt-How-Govt-is-Formed (Part 4)Dee Cyree RusiaNo ratings yet

- Annex-D SwornDocument3 pagesAnnex-D SwornVicky Tamo-oNo ratings yet

- Indigineous Title Disputes - What They Meant For The 2006 ElectionsDocument11 pagesIndigineous Title Disputes - What They Meant For The 2006 ElectionsManoa Nagatalevu TupouNo ratings yet

- Foreclosure Case Wins Misc 48 PagesDocument46 pagesForeclosure Case Wins Misc 48 Pagestraderash1020100% (4)

- PDCP V IAC Case DigestDocument1 pagePDCP V IAC Case DigestPj PalajeNo ratings yet

- Anirudh Pandurangi Ix-A: Amity International School, Saket, New DelhiDocument11 pagesAnirudh Pandurangi Ix-A: Amity International School, Saket, New DelhiaNo ratings yet

- Contract For Website DesignDocument4 pagesContract For Website DesignarshinnefNo ratings yet

- Memorail Vanraj Sept 2019 V4Document23 pagesMemorail Vanraj Sept 2019 V4Santosh Chavan BhosariNo ratings yet

- Central Azucarera de Tarlac vs. Central Azucarera de Tarlac Labor Union GR 188949Document2 pagesCentral Azucarera de Tarlac vs. Central Azucarera de Tarlac Labor Union GR 188949Andrea Gatchalian100% (2)

- Doctrine of Ancillary JurisdictionDocument2 pagesDoctrine of Ancillary JurisdictionRLO1No ratings yet

- Lse 12ca eDocument8 pagesLse 12ca eIoio92No ratings yet

- List of Candidates in Jefferson CountyDocument10 pagesList of Candidates in Jefferson CountyNewzjunkyNo ratings yet

- Depenalisasi Sebagai Kebijakan Hukum Pidana Terhadap Pecandu NarkotikaDocument5 pagesDepenalisasi Sebagai Kebijakan Hukum Pidana Terhadap Pecandu NarkotikaShera MaharaniNo ratings yet

- 19 Patula vs. PeopleDocument2 pages19 Patula vs. PeopleNivNo ratings yet

- Drugstores Association of The Philippines, Inc. vs. National Council On Disability AffairsDocument9 pagesDrugstores Association of The Philippines, Inc. vs. National Council On Disability AffairsJea ulangkaya100% (1)

- KAS Kadana Test 02Document48 pagesKAS Kadana Test 02malgeram13No ratings yet

- Civil Procedure (Malaysia) - Table of Contents PDFDocument14 pagesCivil Procedure (Malaysia) - Table of Contents PDFmakhsmyNo ratings yet

- IRMO - ERRF2011 (1) (AutoRecovered)Document2 pagesIRMO - ERRF2011 (1) (AutoRecovered)PhanieNo ratings yet

- Doctrine of Qualified Political AgencyDocument68 pagesDoctrine of Qualified Political AgencyJam Charmaine M. BelenNo ratings yet

- Bill Drafting Manual Kentucky General AssemblyDocument205 pagesBill Drafting Manual Kentucky General AssemblyTayyib ShahNo ratings yet

- Answer Key Cbse Sample Papers For Class 8 FA 3Document3 pagesAnswer Key Cbse Sample Papers For Class 8 FA 3Himanshu PailuNo ratings yet