Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

51 viewsHanshaw V Life Ins Co North Amer

Hanshaw V Life Ins Co North Amer

Uploaded by

Howard FriedmanDistrict court ERISA decision on church plan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNo ratings yet

- Nebosh Unit - IA Questions Answers Matrix PDFDocument89 pagesNebosh Unit - IA Questions Answers Matrix PDFCiske Berrington89% (9)

- County of Ventura V Godspeak Calvary ChapelDocument30 pagesCounty of Ventura V Godspeak Calvary ChapelHoward FriedmanNo ratings yet

- Middleton V United Church of ChristDocument23 pagesMiddleton V United Church of ChristHoward FriedmanNo ratings yet

- Ohio HB 272Document4 pagesOhio HB 272Howard FriedmanNo ratings yet

- NY State Camp RulingDocument43 pagesNY State Camp RulingmordyNo ratings yet

- Adam Community Center V City of TroyDocument19 pagesAdam Community Center V City of TroyHoward FriedmanNo ratings yet

- Solid Rock Baptist Church V MurphyDocument37 pagesSolid Rock Baptist Church V MurphyHoward FriedmanNo ratings yet

- Comment LTR On IRS Notice 2020-36Document14 pagesComment LTR On IRS Notice 2020-36Howard FriedmanNo ratings yet

- Whitsitt V NewsomDocument7 pagesWhitsitt V NewsomHoward FriedmanNo ratings yet

- Kelly V North CarolinaComplaintDocument39 pagesKelly V North CarolinaComplaintHoward FriedmanNo ratings yet

- New Harvest Christian V SalinasDocument19 pagesNew Harvest Christian V SalinasHoward FriedmanNo ratings yet

- Murphy V LamontDocument34 pagesMurphy V LamontHoward FriedmanNo ratings yet

- Amer College Obstetricians V FDADocument80 pagesAmer College Obstetricians V FDAHoward FriedmanNo ratings yet

- An Act: Be It Enacted by The General Assembly of The State of OhioDocument35 pagesAn Act: Be It Enacted by The General Assembly of The State of OhioMatt ThomasNo ratings yet

- Antietam Battlefield KOA V HoganDocument32 pagesAntietam Battlefield KOA V HoganHoward Friedman0% (1)

- Gish V NewsomDocument9 pagesGish V NewsomHoward FriedmanNo ratings yet

- Boydston V Mercy HospitalDocument14 pagesBoydston V Mercy HospitalHoward FriedmanNo ratings yet

- Bethany College (NLRB)Document20 pagesBethany College (NLRB)Howard FriedmanNo ratings yet

- Shurtleff V BostonDocument14 pagesShurtleff V BostonHoward FriedmanNo ratings yet

- Kennedy V Bremerton School DistrictDocument31 pagesKennedy V Bremerton School DistrictHoward FriedmanNo ratings yet

- 2019 Annual Law and Religion NewsletterDocument22 pages2019 Annual Law and Religion NewsletterHoward FriedmanNo ratings yet

- GB V Crossroads AcademyDocument6 pagesGB V Crossroads AcademyHoward FriedmanNo ratings yet

- Order Adopting Report and RecommendationsDocument3 pagesOrder Adopting Report and RecommendationsBasseemNo ratings yet

- 2019-01-14 P.R. Dioceses Petition - FINALDocument299 pages2019-01-14 P.R. Dioceses Petition - FINALHoward FriedmanNo ratings yet

- Law & Religion Bib 18Document21 pagesLaw & Religion Bib 18Howard FriedmanNo ratings yet

- IBank Vs Sps BrionesDocument4 pagesIBank Vs Sps BrionesRed HoodNo ratings yet

- Insurance Amendment Act 2015Document9 pagesInsurance Amendment Act 2015Anonymous yoWp5Yi5No ratings yet

- Shipment Number 46386099336Document1 pageShipment Number 46386099336Hassan ANo ratings yet

- H.H. Hollero Construction v. GSISDocument1 pageH.H. Hollero Construction v. GSISkenn TenorioNo ratings yet

- United States v. McNinch, 356 U.S. 595 (1958)Document7 pagesUnited States v. McNinch, 356 U.S. 595 (1958)Scribd Government DocsNo ratings yet

- Ecf Doc 1 8198028Document67 pagesEcf Doc 1 8198028asdfdsafdsaNo ratings yet

- Stakeholders in ShippingDocument4 pagesStakeholders in Shippingnandini_mba4870No ratings yet

- SapphireReserveCard V0000039 BGC10582 Eng PDFDocument56 pagesSapphireReserveCard V0000039 BGC10582 Eng PDFamir.workNo ratings yet

- 04 Great Pacific Life vs. CADocument1 page04 Great Pacific Life vs. CABasil MaguigadNo ratings yet

- Lecture 5 Risk AnalysisDocument70 pagesLecture 5 Risk AnalysisAdrian BagayanNo ratings yet

- 2015 Winter Handouts PDFDocument304 pages2015 Winter Handouts PDFMOHAN KUMARNo ratings yet

- 394 - RFQ Document - Thermo Vapour Re Compressor - R0 PDFDocument471 pages394 - RFQ Document - Thermo Vapour Re Compressor - R0 PDFnaziakhan1No ratings yet

- HDFC Personal LoanDocument3 pagesHDFC Personal LoanmohammadtaufeequeNo ratings yet

- 08 - PGBPDocument42 pages08 - PGBPMujtaba ZaidiNo ratings yet

- Contract FinalDocument19 pagesContract Finalabhishek singhNo ratings yet

- INS200Document4 pagesINS200Miszz Bella Natallya'zNo ratings yet

- Mold Components 5-19-17Document400 pagesMold Components 5-19-17KodhansNo ratings yet

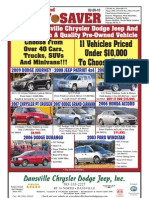

- Penny Saver: 11 Vehicles Priced Under $10,000 To Choose From!!!Document48 pagesPenny Saver: 11 Vehicles Priced Under $10,000 To Choose From!!!Dansville Wayland PennySaverNo ratings yet

- Chapter 5 Case DigestDocument4 pagesChapter 5 Case DigestAudreyNo ratings yet

- E Series CatalystDocument1 pageE Series CatalystEmiZNo ratings yet

- Cruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFDocument7 pagesCruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFdrattyNo ratings yet

- Spartan Gym FEASIBDocument36 pagesSpartan Gym FEASIBJomer VictoriaNo ratings yet

- Eric Hang Actuarial ResumeDocument1 pageEric Hang Actuarial Resumeapi-339253387No ratings yet

- Credit Transactions Surety Allied Banking v. YujuicoDocument3 pagesCredit Transactions Surety Allied Banking v. YujuicoJanella Montemayor-RomeroNo ratings yet

- Dr. Bhimrao Ambedkar University, Agra: Seth Padam Chand Jain Institute of Commerce, Business Management & EconimicsDocument18 pagesDr. Bhimrao Ambedkar University, Agra: Seth Padam Chand Jain Institute of Commerce, Business Management & EconimicsashuNo ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- Banking & Insurance IMP QuestionsDocument2 pagesBanking & Insurance IMP QuestionsAkshay InamdarNo ratings yet

- PGBP NotesDocument24 pagesPGBP NotesYogesh Aggarwal100% (2)

Hanshaw V Life Ins Co North Amer

Hanshaw V Life Ins Co North Amer

Uploaded by

Howard Friedman0 ratings0% found this document useful (0 votes)

51 views14 pagesDistrict court ERISA decision on church plan

Original Title

Hanshaw v Life Ins Co North Amer

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDistrict court ERISA decision on church plan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

51 views14 pagesHanshaw V Life Ins Co North Amer

Hanshaw V Life Ins Co North Amer

Uploaded by

Howard FriedmanDistrict court ERISA decision on church plan

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

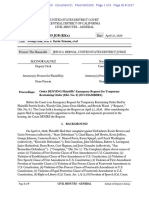

UNITED STATES DISTRICT COURT

WESTERN DISTRICT OF KENTUCKY

LOUISVILLE DIVISION

CIVIL ACTION NO: 3:14-CV-00216-JHM

PAMELA HANSHAW PLAINTIFF

V.

LIFE INSURANCE COMPANY OF NORTH AMERICA DEFENDANT

MEMORANDUM OPINION AND ORDER

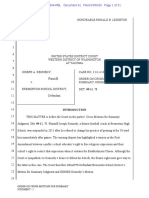

This matter is before the Court on Plaintiffs Motion to Remand [DN 7] the present

action to the J efferson Circuit Court. Fully briefed, this matter is ripe for decision. For the

following reasons, the Plaintiffs motion is DENIED.

I. BACKGROUND

Plaintiff, Pamela Hanshaw, was employed by St. Claire Medical Center, Inc.

1

(St.

Claire), a non-profit hospital. St. Claire established and funded a group long-term disability

(LTD) insurance policy for its eligible employees. The LTD policy was issued and

underwritten by Defendant, Life Insurance Company of North America (LINA). (Compl. [DN

1-2] 9.) Plaintiff, who was an eligible participant in the policy, submitted a claim to LINA for

the monthly disability income benefit, after allegedly becoming disabled. (Id. 11.) Defendant

denied Plaintiffs claim. (Id. 12.)

On February 5, 2014, Plaintiff filed this action in J efferson Circuit Court against

Defendant, alleging claims for breach of contract; breach of the duty of good faith and fair

dealing; violation of Kentucky Unfair Claims Settlement Practices Act, KRS 304.12230

(UCSPA); violation of Kentucky Consumer Protection Act, KRS 367.170; negligence per se

1

St. Claire is also referred to as St. Claire Regional Medical Center in various documents, including the LTD

insurance policy with LINA. St. Claire Regional Medical Center is an assumed name of St. Claire Medical Center,

Inc., which is the name of the business entity on record with the Kentucky Secretary of State. (Amended Articles of

Incorporation of St. Claire Medical Center, Inc. [DN 16-1] 1.)

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 1 of 14 PageID #: 121

2

for using opinions of medical personnel who are not licensed in Kentucky in violation of KRS

311.560; unjust enrichment; and failure to timely pay the claim in violation of KRS 304.12235.

(Compl. [DN 1-2] 2551.)

On March 4, 2014, Defendant removed this action from the J efferson Circuit Court to this

Court alleging both diversity jurisdiction and federal question jurisdiction. Defendant contends

removal is proper because Plaintiffs claims are governed by the Employee Retirement Income

Security Act of 1974, 29 U.S.C. 1001 et seq. (ERISA). (Def.s Notice Removal [DN 1]

3, 7.) Defendant maintains that while Plaintiffs Complaint did not expressly reference ERISA,

the cause of action asserted in the Complaint clearly involves an ERISA plan and is subject to,

and preempted by, ERISA, and is therefore properly removable.

On March 13, 2014, Plaintiff filed this Motion to Remand [DN 7] the case to J efferson

Circuit Court arguing that this Court lacks subject matter jurisdiction. Plaintiff alleges that

Defendants Notice of Removal is defective, and maintains that the Complaint alleges only state

law claims and makes no mention of ERISA. Further, Plaintiff contends that the facts as stated

in the Complaint do not provide a basis for complete preemption under ERISA, and cannot

therefore form the basis of subject matter jurisdiction for removal. Additionally, Plaintiff moves

to remand on the ground that her claims are exempt from ERISA because the plan at issue is a

church plan that is exempted from ERISAs coverage pursuant to 29 U.S.C. 1003(b)(2),

1002(33). In response to the diversity jurisdiction basis for removal, Plaintiff asserts that

Defendant has failed to demonstrate that the amount-in-controversy exceeds $75,000.

II. STANDARD OF REVIEW

Removal to federal court from state court is proper for any civil action brought in a State

court of which the district courts of the United States have original jurisdiction. 28 U.S.C.

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 2 of 14 PageID #: 122

3

1441(a). One category of cases of which district courts have original jurisdiction is federal

question cases: cases arising under the Constitution, laws, or treaties of the United States. 28

U.S.C. 1331. Ordinarily, determining whether a particular case arises under federal law turns

on the well-pleaded complaint rule[,] i.e., whether a federal question necessarily appears in the

plaintiffs statement of [her] own claim. Aetna Health Inc. v. Davila, 542 U.S. 200, 207 (2004)

(internal quotation marks omitted). Thus, the existence of a federal defense normally does not

create federal-question jurisdiction, id., and a defendant may not [generally] remove a case to

federal court unless the plaintiffs complaint establishes that the case arises under federal law,

id. (quoting Franchise Tax Bd. of State of Cal. v. Constr. Laborers Vacation Trust for S. Cal.,

463 U.S. 1, 10 (1983)) (internal quotation marks omitted).

2

However, complete preemption is an exception to the well-pleaded complaint rule:

when a federal statute wholly displaces the state-law cause of action through complete pre-

emption, the state claim can be removed. Davila, 542 U.S. at 207 (quoting Beneficial Natl

Bank v. Anderson, 539 U.S. 1, 8 (2003)). Removal is permitted in this context because [w]hen

the federal statute completely pre-empts the state-law cause of action, a claim which comes

within the scope of that cause of action, even if pleaded in terms of state law, is in reality based

on federal law. Beneficial Natl Bank, 539 U.S. at 8. In Metropolitan Life Insurance Co. v.

Taylor, 481 U.S. 58 (1987), the Supreme Court held that the complete preemption exception to

the well-pleaded complaint rule applies to claims within the scope of ERISA 502(a)(1)(B), 29

U.S.C. 1132(a)(1)(B). Metro. Life Ins., 481 U.S. at 6667.

ERISA 502(a)(1)(B) provides:

2

This is the case with ERISAs express preemption clause, 514(a), 29 U.S.C. 1144(a), which preempts any and

all State laws insofar as they may now or hereafter relate to any employee benefit plan described in section 1003(a)

of this title and not exempt under section 1003(b). 29 U.S.C. 1144(a). That a state-law claim is preempted

under 1144(a) is no basis to remove the case from state court to federal. Gardner v. Heartland Indus. Partners,

LP, 715 F.3d 609, 612 (6th Cir. 2013).

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 3 of 14 PageID #: 123

4

A civil action may be brought(1) by a participant or beneficiary . . . (B) to

recover benefits due to him under the terms of his plan, to enforce his rights under

the terms of the plan, or to clarify his rights to future benefits under the terms of

the plan.

29 U.S.C. 1132(a)(1)(B). Therefore, in order to be subject to complete preemption, and

properly removable to federal court, the state law claim must be brought by a participant or

beneficiary to recover benefits due to him under the terms of his plan, to enforce his rights

under the terms of the plan, or to clarify his rights to future benefits under the terms of the plan,

as provided in 1132(a)(1)(B). See Barrow v. Aleris Intern, No. 1:07-CV-110-J HM, 2007 WL

3342306, at *2 (W.D. Ky. Nov. 7, 2007).

III. DISCUSSION

Plaintiff filed this Motion to Remand [DN 7] the case to state court arguing that this

Court lacks subject matter jurisdiction. Plaintiff alleges that the removal notice is defective

because Defendant failed to provide sufficient factual support for its allegation that ERISA

governs Plaintiffs claims. Further, Plaintiff maintains that the Complaint alleges only state law

claims against Defendant and that Defendant failed to prove Plaintiffs claims are subject to

complete preemption so as to avoid the well-pleaded complaint rule. Additionally, Plaintiff

contends that even if the LTD plan constituted an ERISA plan, it is exempt from ERISA as a

church plan, and as a result, the case should be remanded to state court.

Defendant disagrees, contending that it specifically alleged facts establishing that

Plaintiffs claims are governed under ERISA. Further, Defendant argues that the LTD policy is

an ERISA employee welfare benefit plan. Defendant maintains that because Plaintiffs

Complaint asserts claims seeking to recover benefits under that plan, Plaintiffs claims are

completely preempted by ERISA. Furthermore, Defendant maintains that the LTD policy is not

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 4 of 14 PageID #: 124

5

a church plan. Defendant contends that it properly removed Plaintiffs claims to federal court,

and therefore, Plaintiffs Motion to Remand should be denied.

In determining whether removal of Plaintiffs claims to federal court is proper, the Court

must determine as an initial matter whether Defendants Notice of Removal was sufficient to

establish grounds for removal. The Court must then determine whether the LTD insurance

policy is an ERISA plan, and if so, whether ERISA completely preempts Plaintiffs state law

claims. Lastly, the Court must determine whether the LTD policy is a church plan exempt from

ERISA.

A. Notice of Removal

Plaintiff argues that Defendants Notice of Removal is defective because it lacks factual

allegations and instead alleges in conclusory terms the basis for federal jurisdiction. See, e.g.,

Thomas v. Burlington Indus., Inc., 763 F. Supp. 1570, 1576 (S.D. Fla. 1991); Bryant v. Blue

Cross & Blue Shield of Ala., 751 F. Supp. 968, 969 (N.D. Ala. 1990) (state law claim against

insurer not subject to removal where insurer made only bare-bones contention in notice of

removal that action will be governed by the provisions of [ERISA]). However, the Notice of

Removal in this case is distinguishable from the Thomas and Bryant notices of removal because

it contains allegations of fact that the LTD plan is an employee welfare benefit plan, which are

governed by ERISA. (Def.s Notice Removal [DN 1] 3, 7.) Thus, Defendants Notice of

Removal in this case contains more than a bare-bones contention that the action is governed by

ERISA and is sufficient to establish grounds for removal.

Moreover, the removal statute requires that a notice of removal merely contain a short

and plain statement of the grounds for removal. 28 U.S.C. 1446(a). This statute has been

interpreted to mean that the same liberal rules testing the sufficiency of a pleading should also

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 5 of 14 PageID #: 125

6

apply to evaluating the sufficiency of a defendants notice of removal. See, e.g., Charter Sch. of

Pine Grove, Inc. v. St. Helena Parish Sch. Bd., 417 F.3d 444, 447 (5th Cir. 2005); White v.

Humana Health Plan, Inc., No. 06 C 5546, 2007 WL 1297130, at *1 (N.D. Ill. May 2, 2007)

(citing 14C Charles Alan Wright, Arthur R. Miller & Edward H. Cooper, Federal Practice and

Procedure 3733 (3d ed. 2006)) (The court need only be provided with the facts from which

removal jurisdiction can be determined.). Thus, Plaintiffs argument that the Notice of

Removal is defective fails.

B. ERISA Plan

Congress enacted ERISA to protect . . . the interests of participants in employee benefit

plans and their beneficiaries by setting out substantive regulatory requirements for employee

benefit plans and providing for appropriate remedies, sanctions, and ready access to the Federal

courts. 29 U.S.C. 1001(b). The purpose of ERISA is to provide a uniform regulatory regime

over employee benefit plans. Aetna Health Inc. v. Davila, 542 U.S. 200, 208 (2004). Thus,

ERISA comprehensively regulates life, health, disability, and pension benefits provided by

employers to employees pursuant to employee benefit plans. ERISA defines an employee

benefit plan as an employee welfare benefit plan or an employee pension benefit plan or a plan

which is both. 29 U.S.C. 1002(3). Plaintiff contends that ERISA does not preempt her state

law claims because St. Claires LTD policy does not constitute an employee welfare benefit

plan as defined by ERISA. An employee welfare benefit plan is any plan, fund, or program .

. . established or maintained by an employer . . . for the purpose of providing for its participants

or their beneficiaries, through the purchase of insurance or otherwise, (A) . . . benefits in the

event of sickness, accident, disability, death or unemployment. 29 U.S.C. 1002(1).

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 6 of 14 PageID #: 126

7

The existence of an ERISA plan is a question of fact, to be answered in light of all the

surrounding circumstances and facts from the point of view of a reasonable person. Thompson

v. Am. Home Assurance Co., 95 F.3d 429, 434 (6th Cir. 1996). The Sixth Circuit has articulated

the following three-part test for determining whether an ERISA benefits plan exists:

First, the court must apply the so-called safe harbor regulations established by

the Department of Labor to determine whether the program was exempt from

ERISA. Second, the court must look to see if there was a plan by inquiring

whether from the surrounding circumstances a reasonable person [could]

ascertain the intended benefits, the class of beneficiaries, the source of financing,

and procedures for receiving benefits. Finally, the court must ask whether the

employer established or maintained the plan with the intent of providing

benefits to its employees.

Thompson, 95 F.3d at 43435 (citations omitted).

A review of LINAs Group Long Term Disability Policy [DN 16-4] reflects that the

policy satisfies the minimum requirements for establishing an ERISA plan.

3

With respect to the

second inquiry, a reasonable person could ascertain the following: (1) LTD insurance was the

intended benefit of the plan; (2) that the beneficiaries were the eligible employees of St. Claire as

an incident of their employment; (3) the source of financing was premiums paid by St. Claire;

and (4) the procedure to apply for and collect benefits was to submit a claim to LINA subject to

specific conditions precedent to eligibility. [DN 16-4.] Additionally, the group policy shows

that St. Claire established the LTD plan for the purpose of providing disability benefits to a

clearly defined group of employees. [DN 16-4.]

For these reasons, the Court concludes that the LTD policy is an employee benefit plan

governed by ERISA. 29 U.S.C. 1002(3).

3

It appears prong one is not contested by the parties because neither side briefed it.

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 7 of 14 PageID #: 127

8

C. Complete Preemption

Having determined that the LTD plan is an ERISA plan, the Court must determine

whether ERISA completely preempts Plaintiffs state law claims. As discussed, a claim that is

within the scope of 1132(a)(1)(B) is completely preempted and thus removable to federal

court. See Metro. Life Ins., 481 U.S. at 6667; Davila, 542 U.S. at 20910. In the Sixth Circuit,

a claim is within the scope of 1132(a)(1)(B) if the two requirements of the Davila test are met:

(1) the plaintiff complains about the denial of benefits to which he is entitled only because of

the terms of an ERISA-regulated employee benefit plan; and (2) the plaintiff does not allege the

violation of any legal duty (state or federal) independent of ERISA or the plan terms[.]

Gardner v. Heartland Indus. Partners, LP, 715 F.3d 609, 613 (6th Cir. 2013) (quoting Davila, 542

U.S. at 210).

4

In her Motion to Remand, Plaintiff failed to specifically address whether her claims fell

within the scope of 1132(a)(1)(B)s civil enforcement provision. The Supreme Court stated

that to make that determination, the court must examine the plaintiffs complaint, the statute on

which the state law claims are based, and the various plan documents. Davila, 542 U.S. at 211.

Upon review of the instant Complaint, the relevant state laws, and the LTD policy [DN 16-4],

this Court determines that Plaintiffs state law claims amount to a claim for benefits under an

ERISA plan and are completely preempted by ERISA.

First, Plaintiff complains about the denial of benefits to which [s]he is entitled only

because of the terms of an ERISA-regulated employee benefit plan. Gardner, 715 F.3d at 613

(quoting Davila, 542 U.S. at 210). Plaintiff alleges that LINA provides LTD benefits under her

4

In other words, if an individual, at some point in time, could have brought his claim under ERISA 502(a)(1)(B),

[29 U.S.C. 1132(a)(1)(b),] and where there is no other independent legal duty that is implicated by a defendants

actions, then the individuals cause of action is completely pre-empted by ERISA 502(a)(1)(B)[, 29 U.S.C.

1132(a)(1)(B)]. Davila, 542 U.S. at 210.

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 8 of 14 PageID #: 128

9

employers LTD plan. She alleges that she became disabled and, in accordance with the LTD

insurance policy, submitted a claim for monthly disability income benefits, which was denied by

LINA. The action complained of is LINAs denial of Plaintiffs claim for monthly disability

income benefits. Further, the only relationship LINA had with Plaintiff was its administration of

Plaintiffs employers benefit plan. It is clear, then, that Plaintiff complains only about denial of

coverage promised under the terms of an ERISA-regulated employee benefit plan. Upon denial

of those benefits, Plaintiff could have sought a remedy through a 1132(a)(1)(B) action. Thus,

the first prong is met.

Second, Plaintiff does not claim any violation of a legal duty independent of those

imposed by ERISA or the ERISA plans terms. Plaintiffs state law contract claims plainly

cannot arise independently of ERISA or the plan terms because Defendants duties under the

contractthe ERISA-regulated LTD policyare premised on the terms of that contract.

Plaintiff specifically alleges that [b]y denying Plaintiffs monthly disability income benefits and

by not complying with the terms of the insurance policy, Defendant breached the parties

contractual agreement. (Compl. [DN 1-2] 28 (emphasis added).) Thus, Defendants contract

duties under state law derive from the plan terms.

Plaintiffs various tort causes of action also are not independent of ERISA or the plan

terms. Whether a duty is independent of an ERISA plan, for purposes of the Davila rule, does

not depend merely on whether the duty nominally arises from a source other than the plans

terms. Gardner, 715 F.3d at 613. Therefore, it makes no difference that Plaintiff only asserts

state law claims and expressly disavows any federal causes of action, (Pl.s Mot. Remand [DN

7] 56). What matters is whether LINAs duty and potential liability under state law derives

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 9 of 14 PageID #: 129

10

from the particular rights and obligations established by the [ERISA] benefit plan[]. Davila,

542 U.S. at 213.

Defendants purported duties under the various state laws could arise in this instance only

because of Defendants administrative review of Plaintiffs claim for benefits under an ERISA

plan. See, e.g., Hogan v. J acobson, No. 3:12-CV-00820, 2014 WL 9784864, at *3 (W.D. Ky.

Mar. 12, 2014). Interpretation of the terms of Plaintiffs benefit plan forms an essential part of

her claims, and liability would exist here only because of [Defendant]s administration of [the]

ERISA-regulated benefit plan[]. Id. Defendants duty and potential liability under state law in

this case, then, derives from the particular rights and obligations established by the benefit plan.

Therefore, Plaintiffs state law tort causes of action are not entirely independent of the federally

regulated contract itself.

Hence, Plaintiff brings suit only to rectify a wrongful denial of benefits promised under

an ERISA-regulated plan, and does not attempt to remedy any violation of a legal duty

independent of ERISA. The Court concludes that Plaintiff states causes of action that fall

within the scope of 1132(a)(1)(B), Metropolitan Life, 481 U.S. at 66, and are therefore

completely preempted by ERISA and removable to federal district court.

D. ERISA Church Plan Exemption

Having determined that the LTD plan is an employee benefits plan under ERISA and that

Plaintiffs claims are completely preempted by 1132(a)(1)(B), the Court must determine

whether the LTD plan is nevertheless exempt from ERISA as a church plan. If the LTD plan

is a church plan, this Court lacks subject matter jurisdiction and the Motion to Remand must be

granted.

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 10 of 14 PageID #: 130

11

Congress specifically exempted certain employee benefit plans from coverage under

ERISA. See 29 U.S.C. 1003(b)(1)(5). Pursuant to 1003(b)(2), ERISA does not apply to an

employee benefit plan that is a church plan as defined in 1002(33). 29 U.S.C. 1003(b)(2).

5

When ERISA originally exempted church plans from its requirements, it provided that [t]he

term church plan means . . . a plan established and maintained for its employees by a church or

by a convention or association of churches. 29 U.S.C. 1002(33)(A) (1976). The statute

permitted a church plan to also cover the employees of church agencies (such as hospitals and

schools), but that provision was to sunset in 1982. 29 U.S.C. 1002(33)(C) (1976). In 1980,

Congress amended ERISA to eliminate the 1982 deadline and to include other clarifications. See

Multiemployer Pension Plan Amendments Act of 1980, Pub. L. No. 96-364, 407(a), 94 Stat.

1208. The relevant statutory section, 29 U.S.C. 1002(33), now provides in pertinent part:

(A) The term church plan means a plan established and maintained . . .

for its employees (or their beneficiaries) by a church or by a convention or

association of churches which is exempt from tax under section 501 of Title 26.

****

(C) For purposes of this paragraph

(i) A plan established and maintained for its employees (or their

beneficiaries) by a church or by a convention or association of churches

includes a plan maintained by an organization, whether a civil law

corporation or otherwise, the principal purpose or function of which is the

administration or funding of a plan or program for the provision of

retirement benefits or welfare benefits, or both, for the employees of a

church or a convention or association of churches, if such organization is

controlled by or associated with a church or a convention or association of

churches.

(ii) The term employee of a church or a convention or association

of churches includes

5

The provisions of this subchapter shall not apply to any employee benefit plan if . . . such plan is a church plan (as

defined in section 1002(33) of this title) with respect to which no election has been made under section 410(d) of

Title 26. 29 U.S.C. 1003(b)(2). Defendant made no argument that an election had been made under I.R.C.

410(d).

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 11 of 14 PageID #: 131

12

(I) a duly ordained, commissioned, or licensed minister of

a church in the exercise of his ministry, regardless of the source of

his compensation;

(II) an employee of an organization, whether a civil law

corporation or otherwise, which is exempt from tax under section

501 of Title 26 and which is controlled by or associated with a

church or a convention or association of churches; and

(III) an individual described in clause (v).

(iii) A church or a convention or association of churches which is

exempt from tax under section 501 of Title 26 shall be deemed the

employer of any individual included as an employee under clause (ii).

(iv) An organization, whether a civil law corporation or otherwise,

is associated with a church or a convention or association of churches if it

shares common religious bonds and convictions with that church or

convention or association of churches.

(v) If an employee who is included in a church plan separates

from the service of a church or a convention or association of churches or

an organization, whether a civil law corporation or otherwise, which is

exempt from tax under section 501 of Title 26 and which is controlled by

or associated with a church or a convention or association of churches, the

church plan shall not fail to meet the requirements of this paragraph

merely because the plan

(I) retains the employee's accrued benefit or account for

the payment of benefits to the employee or his beneficiaries

pursuant to the terms of the plan; or

(II) receives contributions on the employee's behalf after

the employee's separation from such service, but only for a period

of 5 years after such separation, unless the employee is disabled

(within the meaning of the disability provisions of the church plan

or, if there are no such provisions in the church plan, within the

meaning of section 72(m)(7) of Title 26) at the time of such

separation from service.

29 U.S.C. 1002(33).

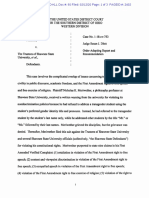

The Parties dispute the proper interpretation of 1002(33) and whether the LTD plan

meets the definition of a church plan. Plaintiffs interpretation, based primarily on subsection C,

is that a church plan is a plan that is (1) established by a church or (2) established by an

organization that is controlled by or associated with a church. (Pl.s Reply Supp. Mot. Remand

[DN 18] 3 (quoting Overall v. Ascension, --- F. Supp. 2d ---, No. 1311396, 2014 WL 2448492,

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 12 of 14 PageID #: 132

13

at *15 (E.D. Mich. May 13, 2014)).) Plaintiff contends that the LTD plan is a church plan

exempted from ERISA because St. Claire is a church owned entity, (Pl.s Mot. Remand [DN

7] 4), and a fully controlled and sponsored subsidiary of the Sisters of Notre Dame, (Pl.s

Reply Supp. Mot. Remand [DN 18] 3), concluding that [a]s a result of its church status, St.

Claire falls within the church plan exception of ERISA, (id.) Thus, Plaintiff contends that

because St. Claire is allegedly an entity controlled by or associated with the Catholic Church,

its LTD plan qualifies as church plan.

Defendants interpretation is that only a church or a convention or association of

churcheswhich St. Claire is not

6

may establish and maintain a church plan. (Def.s Resp. to

Pl.s Mot. Remand [DN 16] 45 (citing 29 U.S.C. 1002(33)(A); Rollins v. Dignity Heath, --- F.

Supp. 2d ---, No. C131450, 2013 WL 6512682, at *45 (N.D. Cal. Dec. 12, 2013)).) However,

the Court need not decide which interpretation is correct because even accepting Plaintiffs

interpretation of 1002(33) that a church plan need not be established by a church, the LTD plan

still does not qualify as a church plan. Plaintiffs argument disregards the limiting language of

subsection C(i) that to maintain a church plan, an organization must not only be associated with

the church,

7

but it must have as its principal purpose or function . . . the administration or

funding of a [benefits] plan or program. 29 U.S.C. 1002(33)(C)(i).

8

St. Claire Medical

6

Plaintiff mentions St. Claires church status as the reason why St. Claire falls within the church plan exception

of ERISA. (Pl.s Reply Supp. Mot. Remand [DN 18] 3.) However, there is no credible argument made that St.

Claire Medical Center, Inc. is itself a church. St. Claires primary purpose is to provide healthcare. While St. Claire

is likely a church agency as referenced in the legislative history, St. Claire is not itself a church.

7

Although the parties dispute whether St. Claire is controlled by or associated with the Catholic Church, this issue is

not dispositive.

8

(C) For purposes of this paragraph--

(i) A plan established and maintained for its employees (or their beneficiaries) by a

church or by a convention or association of churches includes a plan maintained by an

organization, whether a civil law corporation or otherwise, the principal purpose or

function of which is the administration or funding of a plan or program for the provision

of retirement benefits or welfare benefits, or both, for the employees of a church or a

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 13 of 14 PageID #: 133

14

Center is a healthcare organization; its principal purpose is the provision of healthcare, not the

administration of a benefits plan.

9

Therefore, the Court finds that St. Claires long-term disability benefits plan is not a

church plan under ERISA, and is, therefore, governed by ERISA. Accordingly, this Court has

subject matter jurisdiction to decide the matter.

10

IV. CONCLUSION

For the reasons set forth above, IT IS HEREBY ORDERED that Plaintiffs Motion to

Remand [DN 7] the case to J efferson Circuit Court is DENIED.

cc: counsel of record

convention or association of churches, if such organization is controlled by or associated

with a church or a convention or association of churches.

29 U.S.C. 1002(33)(C)(i).

9

According to its Articles of Incorporation, the specific purposes of St. Claire are to carry out the Roman Catholic

Apostolate of care for the sick, by providing quality physician services for the benefit of the community through the

operation, support and management of a hospital and a medical and health center, or institution. (Amended

Articles of Incorporation of St. Claire Medical Center, Inc. [DN 16-1] 12.)

10

Because the Court concludes that there is federal question jurisdiction, it need not address the issue of diversity

jurisdiction.

October 22, 2014

Case 3:14-cv-00216-JHM-JDM Document 19 Filed 10/24/14 Page 14 of 14 PageID #: 134

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IPCC - FAST TRACK MATERIAL - 35e PDFDocument69 pagesIPCC - FAST TRACK MATERIAL - 35e PDFKunalKumarNo ratings yet

- Nebosh Unit - IA Questions Answers Matrix PDFDocument89 pagesNebosh Unit - IA Questions Answers Matrix PDFCiske Berrington89% (9)

- County of Ventura V Godspeak Calvary ChapelDocument30 pagesCounty of Ventura V Godspeak Calvary ChapelHoward FriedmanNo ratings yet

- Middleton V United Church of ChristDocument23 pagesMiddleton V United Church of ChristHoward FriedmanNo ratings yet

- Ohio HB 272Document4 pagesOhio HB 272Howard FriedmanNo ratings yet

- NY State Camp RulingDocument43 pagesNY State Camp RulingmordyNo ratings yet

- Adam Community Center V City of TroyDocument19 pagesAdam Community Center V City of TroyHoward FriedmanNo ratings yet

- Solid Rock Baptist Church V MurphyDocument37 pagesSolid Rock Baptist Church V MurphyHoward FriedmanNo ratings yet

- Comment LTR On IRS Notice 2020-36Document14 pagesComment LTR On IRS Notice 2020-36Howard FriedmanNo ratings yet

- Whitsitt V NewsomDocument7 pagesWhitsitt V NewsomHoward FriedmanNo ratings yet

- Kelly V North CarolinaComplaintDocument39 pagesKelly V North CarolinaComplaintHoward FriedmanNo ratings yet

- New Harvest Christian V SalinasDocument19 pagesNew Harvest Christian V SalinasHoward FriedmanNo ratings yet

- Murphy V LamontDocument34 pagesMurphy V LamontHoward FriedmanNo ratings yet

- Amer College Obstetricians V FDADocument80 pagesAmer College Obstetricians V FDAHoward FriedmanNo ratings yet

- An Act: Be It Enacted by The General Assembly of The State of OhioDocument35 pagesAn Act: Be It Enacted by The General Assembly of The State of OhioMatt ThomasNo ratings yet

- Antietam Battlefield KOA V HoganDocument32 pagesAntietam Battlefield KOA V HoganHoward Friedman0% (1)

- Gish V NewsomDocument9 pagesGish V NewsomHoward FriedmanNo ratings yet

- Boydston V Mercy HospitalDocument14 pagesBoydston V Mercy HospitalHoward FriedmanNo ratings yet

- Bethany College (NLRB)Document20 pagesBethany College (NLRB)Howard FriedmanNo ratings yet

- Shurtleff V BostonDocument14 pagesShurtleff V BostonHoward FriedmanNo ratings yet

- Kennedy V Bremerton School DistrictDocument31 pagesKennedy V Bremerton School DistrictHoward FriedmanNo ratings yet

- 2019 Annual Law and Religion NewsletterDocument22 pages2019 Annual Law and Religion NewsletterHoward FriedmanNo ratings yet

- GB V Crossroads AcademyDocument6 pagesGB V Crossroads AcademyHoward FriedmanNo ratings yet

- Order Adopting Report and RecommendationsDocument3 pagesOrder Adopting Report and RecommendationsBasseemNo ratings yet

- 2019-01-14 P.R. Dioceses Petition - FINALDocument299 pages2019-01-14 P.R. Dioceses Petition - FINALHoward FriedmanNo ratings yet

- Law & Religion Bib 18Document21 pagesLaw & Religion Bib 18Howard FriedmanNo ratings yet

- IBank Vs Sps BrionesDocument4 pagesIBank Vs Sps BrionesRed HoodNo ratings yet

- Insurance Amendment Act 2015Document9 pagesInsurance Amendment Act 2015Anonymous yoWp5Yi5No ratings yet

- Shipment Number 46386099336Document1 pageShipment Number 46386099336Hassan ANo ratings yet

- H.H. Hollero Construction v. GSISDocument1 pageH.H. Hollero Construction v. GSISkenn TenorioNo ratings yet

- United States v. McNinch, 356 U.S. 595 (1958)Document7 pagesUnited States v. McNinch, 356 U.S. 595 (1958)Scribd Government DocsNo ratings yet

- Ecf Doc 1 8198028Document67 pagesEcf Doc 1 8198028asdfdsafdsaNo ratings yet

- Stakeholders in ShippingDocument4 pagesStakeholders in Shippingnandini_mba4870No ratings yet

- SapphireReserveCard V0000039 BGC10582 Eng PDFDocument56 pagesSapphireReserveCard V0000039 BGC10582 Eng PDFamir.workNo ratings yet

- 04 Great Pacific Life vs. CADocument1 page04 Great Pacific Life vs. CABasil MaguigadNo ratings yet

- Lecture 5 Risk AnalysisDocument70 pagesLecture 5 Risk AnalysisAdrian BagayanNo ratings yet

- 2015 Winter Handouts PDFDocument304 pages2015 Winter Handouts PDFMOHAN KUMARNo ratings yet

- 394 - RFQ Document - Thermo Vapour Re Compressor - R0 PDFDocument471 pages394 - RFQ Document - Thermo Vapour Re Compressor - R0 PDFnaziakhan1No ratings yet

- HDFC Personal LoanDocument3 pagesHDFC Personal LoanmohammadtaufeequeNo ratings yet

- 08 - PGBPDocument42 pages08 - PGBPMujtaba ZaidiNo ratings yet

- Contract FinalDocument19 pagesContract Finalabhishek singhNo ratings yet

- INS200Document4 pagesINS200Miszz Bella Natallya'zNo ratings yet

- Mold Components 5-19-17Document400 pagesMold Components 5-19-17KodhansNo ratings yet

- Penny Saver: 11 Vehicles Priced Under $10,000 To Choose From!!!Document48 pagesPenny Saver: 11 Vehicles Priced Under $10,000 To Choose From!!!Dansville Wayland PennySaverNo ratings yet

- Chapter 5 Case DigestDocument4 pagesChapter 5 Case DigestAudreyNo ratings yet

- E Series CatalystDocument1 pageE Series CatalystEmiZNo ratings yet

- Cruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFDocument7 pagesCruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFdrattyNo ratings yet

- Spartan Gym FEASIBDocument36 pagesSpartan Gym FEASIBJomer VictoriaNo ratings yet

- Eric Hang Actuarial ResumeDocument1 pageEric Hang Actuarial Resumeapi-339253387No ratings yet

- Credit Transactions Surety Allied Banking v. YujuicoDocument3 pagesCredit Transactions Surety Allied Banking v. YujuicoJanella Montemayor-RomeroNo ratings yet

- Dr. Bhimrao Ambedkar University, Agra: Seth Padam Chand Jain Institute of Commerce, Business Management & EconimicsDocument18 pagesDr. Bhimrao Ambedkar University, Agra: Seth Padam Chand Jain Institute of Commerce, Business Management & EconimicsashuNo ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- Banking & Insurance IMP QuestionsDocument2 pagesBanking & Insurance IMP QuestionsAkshay InamdarNo ratings yet

- PGBP NotesDocument24 pagesPGBP NotesYogesh Aggarwal100% (2)