Professional Documents

Culture Documents

Greece

Greece

Uploaded by

AbhishekGupta0 ratings0% found this document useful (0 votes)

16 views4 pagesEurope had long faced trade barriers until after World War 2, when countries began removing them to rebuild, giving rise to the idea of a united Europe. In 1992, 27 countries formed the European Union by signing the Maastricht Treaty. To further unite Europe and eliminate currency-related trade barriers, the Euro was adopted as the common currency in 1999. However, the global recession revealed flaws in the system as countries like Greece over-borrowed when interest rates fell under the Euro, then defaulted on payments when the recession hit.

Original Description:

Greece

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEurope had long faced trade barriers until after World War 2, when countries began removing them to rebuild, giving rise to the idea of a united Europe. In 1992, 27 countries formed the European Union by signing the Maastricht Treaty. To further unite Europe and eliminate currency-related trade barriers, the Euro was adopted as the common currency in 1999. However, the global recession revealed flaws in the system as countries like Greece over-borrowed when interest rates fell under the Euro, then defaulted on payments when the recession hit.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

0 ratings0% found this document useful (0 votes)

16 views4 pagesGreece

Greece

Uploaded by

AbhishekGuptaEurope had long faced trade barriers until after World War 2, when countries began removing them to rebuild, giving rise to the idea of a united Europe. In 1992, 27 countries formed the European Union by signing the Maastricht Treaty. To further unite Europe and eliminate currency-related trade barriers, the Euro was adopted as the common currency in 1999. However, the global recession revealed flaws in the system as countries like Greece over-borrowed when interest rates fell under the Euro, then defaulted on payments when the recession hit.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

Download as pptx, pdf, or txt

You are on page 1of 4

Divided Europe

Europe had always been a

continent of trade barriers,

tariffs and different

currencies

After the World War II, in

order to rebuild Europe,

different European countries

began removing trade

barriers

This gave birth to the idea of

a united Europe and thus 27

countries signed the

Maastricht Treaty on 7

th

Feb

1992 to form the European

Union

Adoption of the Euro

But the problem of

different currencies was

still hampering trade

High exchange fees were a

major barrier and resulted

in high operating margins

for businesses across the

continent

Thus, in order to eliminate

these deterrents the Euro

was adopted as the common

currency on Jan 1, 1999

Start of the Crisis - Monetary

Policy vs Fiscal Policy

Monetary policy governs how much money is there and

what would be the borrowing or lending rates

Fiscal policy governs how much a government collects in

taxes and how much it spends. A government can spend

only as much as it earns in taxes, the rest it has to borrow.

This is known as Deficit Spending

With the adoption of the Euro, the member countries

shunned their individual monetary policies

The European Central Bank was established which

governed a single monetary policy for all the member

countries. But, the members continued with their

individual fiscal policies

Start of the Crisis The

Borrowing Spree

Greece, which could earlier borrow at rates as high

as 18%, was now able to secure loans at only 3%

This was possible because of the common Euro

credit card.

Banks perceived that even if Greece defaults, the

larger economies like Germany and France would

pay up the debt

In 2008, hit by the worldwide recession, Greece

began defaulting on its payments

You might also like

- Credit Union ArrivalsDocument30 pagesCredit Union ArrivalsAbhishekGuptaNo ratings yet

- The Impact of European Currency PDFDocument14 pagesThe Impact of European Currency PDFLileth Anne Panghulan ViduyaNo ratings yet

- OverviewoftheEurozoneCrisis PPTDocument31 pagesOverviewoftheEurozoneCrisis PPTCaleb ReisNo ratings yet

- Lecture 10 - International Finance by Krugman 11th EditionDocument20 pagesLecture 10 - International Finance by Krugman 11th EditionWuZiFankoalaNo ratings yet

- 7 Europoean Union Studies TE 2020Document57 pages7 Europoean Union Studies TE 2020Gamer HDNo ratings yet

- Eurocrisis & Double Dip RecessionDocument53 pagesEurocrisis & Double Dip RecessionAkash RawatNo ratings yet

- European Debt Crisis FinalDocument45 pagesEuropean Debt Crisis FinalJagadish NavaleNo ratings yet

- Ems, Emu and EuroDocument16 pagesEms, Emu and EuroKapil DhingraNo ratings yet

- Euro CrisisDocument30 pagesEuro CrisisMaryam MostafaNo ratings yet

- Kitsing IBPP Slides EU 141123Document80 pagesKitsing IBPP Slides EU 141123mayank AgrawalNo ratings yet

- Euro Debt CrisisDocument2 pagesEuro Debt CrisisJona CaberteNo ratings yet

- Euro Euro: System SystemDocument57 pagesEuro Euro: System SystemKripansh GroverNo ratings yet

- Eurozone Crisis FinalDocument38 pagesEurozone Crisis FinalCharu PundirNo ratings yet

- Lesson 2 HistoryDocument13 pagesLesson 2 Historyrorita.canaleuniparthenope.itNo ratings yet

- Httpslearn Eu Central 1 Prod Fleet01 Xythos - Content.blackboardcdn - Com610a68551efab32185376x Blackboard S3 Bucket Learn EuDocument48 pagesHttpslearn Eu Central 1 Prod Fleet01 Xythos - Content.blackboardcdn - Com610a68551efab32185376x Blackboard S3 Bucket Learn EuValerie RogatskinaNo ratings yet

- Euro CurrencyDocument53 pagesEuro CurrencyShruti Kalantri0% (1)

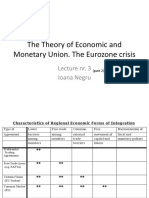

- The Theory of Economic and Monetary Union. The Eurozone CrisisDocument40 pagesThe Theory of Economic and Monetary Union. The Eurozone CrisisSalamander1212No ratings yet

- Euro CrisisDocument13 pagesEuro CrisisCeasar CoolNo ratings yet

- The European Monetary System, The Maastricht Treaty, Birth of The Euro and Its FutureDocument41 pagesThe European Monetary System, The Maastricht Treaty, Birth of The Euro and Its FutureSharon NunesNo ratings yet

- Final MusamDocument118 pagesFinal MusamMuzna AhmedNo ratings yet

- Introduction of Euro As Common CurrencyDocument53 pagesIntroduction of Euro As Common Currencysuhaspatel84No ratings yet

- Debt Crisis of Greece: Lessons For Stable EconomyDocument11 pagesDebt Crisis of Greece: Lessons For Stable EconomyShubham ThakurNo ratings yet

- Has The Euro Crisis EndedDocument38 pagesHas The Euro Crisis EndedVarun ReddyNo ratings yet

- European Monetary SystemDocument2 pagesEuropean Monetary SystemMelissa Muñoz100% (1)

- Euro Zone Crisis: Div ADocument73 pagesEuro Zone Crisis: Div AYogesh Rana100% (1)

- EU euro індивідуальнаDocument2 pagesEU euro індивідуальнаНаталія ХоменкоNo ratings yet

- What Is The 'European Monetary System - EMS'Document5 pagesWhat Is The 'European Monetary System - EMS'Swathi JampalaNo ratings yet

- The European UnionDocument13 pagesThe European Unionapi-347529927No ratings yet

- Will Euro Survive ??: Presented byDocument18 pagesWill Euro Survive ??: Presented bySoumyadip MistryNo ratings yet

- (Uploaded) Topic 8 Slides (16!6!2021)Document38 pages(Uploaded) Topic 8 Slides (16!6!2021)Wong Tze YauNo ratings yet

- The Single European Currency: Key IssuesDocument20 pagesThe Single European Currency: Key Issuespravo20No ratings yet

- Optimum Currency Areas and The European Experience: Slides Prepared by Thomas BishopDocument51 pagesOptimum Currency Areas and The European Experience: Slides Prepared by Thomas BishopTariqul IslamNo ratings yet

- By:-Niharika, Surbhi & YogeshDocument32 pagesBy:-Niharika, Surbhi & YogeshNiharika Satyadev JaiswalNo ratings yet

- Bài đọc 8 Từ bài đọc sau, hãy rút ra những cột mốc chính hình thành liên minh tiền tệ Châu Âu. Cấp độ hội nhập sâu (centralization - tập trung hóa) được thể hiện ở những chi tiết nào?Document15 pagesBài đọc 8 Từ bài đọc sau, hãy rút ra những cột mốc chính hình thành liên minh tiền tệ Châu Âu. Cấp độ hội nhập sâu (centralization - tập trung hóa) được thể hiện ở những chi tiết nào?Khánh NhưNo ratings yet

- European Monetary SystemDocument3 pagesEuropean Monetary SystemDavid Andrés Robalino ChicaNo ratings yet

- Case Study On The EUDocument21 pagesCase Study On The EUaxeem1No ratings yet

- European UnionDocument31 pagesEuropean Unionapi-285187009No ratings yet

- Chapter 9Document41 pagesChapter 9Quang Nguyễn ThếNo ratings yet

- Chap 029Document36 pagesChap 029ana shohibulNo ratings yet

- Course Name: Professors' Name: University Name: City, State: DateDocument6 pagesCourse Name: Professors' Name: University Name: City, State: DateDavid Fluky FlukyNo ratings yet

- EuroDocument17 pagesEuroShreyas DalviNo ratings yet

- The Changing World ContextDocument15 pagesThe Changing World Contextjayvee OrfanoNo ratings yet

- Prepared By: Akanksha Jain Ambika Gupta Prateek Gupta Syed MustansirDocument20 pagesPrepared By: Akanksha Jain Ambika Gupta Prateek Gupta Syed MustansirakankshajnNo ratings yet

- The Euro Crisis & Future of European IntegrationDocument22 pagesThe Euro Crisis & Future of European IntegrationDavidNo ratings yet

- Road To The EuroDocument31 pagesRoad To The EuronishithathiNo ratings yet

- Prepared By: Akanksha Jain Ambika Gupta Prateek GuptaDocument19 pagesPrepared By: Akanksha Jain Ambika Gupta Prateek GuptaakankshajnNo ratings yet

- Eurozone Group 4Document36 pagesEurozone Group 4NhiHoangNo ratings yet

- EEC - The Concept and The Challenge: Crisis of The EurozoneDocument20 pagesEEC - The Concept and The Challenge: Crisis of The EurozoneAli Abdullah KhanNo ratings yet

- Inter Finance Banking Report FinalDocument13 pagesInter Finance Banking Report FinalEvan NoorNo ratings yet

- Chapter 6Document79 pagesChapter 6yehunNo ratings yet

- Euro-Zone and The European Debt Crises: A Study On Impact of European Debt Crisis On The European EconomyDocument45 pagesEuro-Zone and The European Debt Crises: A Study On Impact of European Debt Crisis On The European EconomyRavi ChavdaNo ratings yet

- European Banking SystemDocument5 pagesEuropean Banking SystemRidhima PangotraNo ratings yet

- Delegation of The European Union To The US Washington, DCDocument37 pagesDelegation of The European Union To The US Washington, DCVivekanand IasNo ratings yet

- SailashreeChakraborty 13600921093 FM405Document10 pagesSailashreeChakraborty 13600921093 FM405Sailashree ChakrabortyNo ratings yet

- Euro CrisisDocument36 pagesEuro CrisisAshwini KrishnaNo ratings yet

- European Union: Presented By:-Mansi Hardik Mendhiratta Gaurav Deepanshu Garg Chandan Maheshwari Manish Mansi GuptaDocument49 pagesEuropean Union: Presented By:-Mansi Hardik Mendhiratta Gaurav Deepanshu Garg Chandan Maheshwari Manish Mansi Guptadeep gargNo ratings yet

- The 1975 Referendum on Europe - Volume 1: Reflections of the ParticipantsFrom EverandThe 1975 Referendum on Europe - Volume 1: Reflections of the ParticipantsNo ratings yet

- Strategy Project - Burger KingDocument12 pagesStrategy Project - Burger KingAbhishekGupta50% (2)

- Forecasting Airport Passenger ArrivalDocument6 pagesForecasting Airport Passenger ArrivalAbhishekGuptaNo ratings yet

- Weekly Newsletter - Group 1Document3 pagesWeekly Newsletter - Group 1AbhishekGuptaNo ratings yet

- Movie Analysis: Spy Game: ThemeDocument1 pageMovie Analysis: Spy Game: ThemeAbhishekGuptaNo ratings yet

- Common Currency in AsiaDocument8 pagesCommon Currency in AsiaAbhishekGuptaNo ratings yet

- Business Communication Project: Communication Personified - Adolf Hitler (Group 7) List of ReferencesDocument1 pageBusiness Communication Project: Communication Personified - Adolf Hitler (Group 7) List of ReferencesAbhishekGuptaNo ratings yet

- ColloquiumDocument6 pagesColloquiumAbhishekGuptaNo ratings yet