Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

40 viewsAleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

Uploaded by

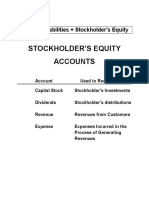

Cooper89This document contains the homework questions and exercises assigned to Aleshia Cooper for her Accounts 305 class. It includes journal entries recording bond issuances with discounts and premiums, stock warrant issuances, debt conversions to equity, and calculations of weighted average shares outstanding for earnings per share. The exercises cover accounting for bonds payable, stock warrants, debt conversions, and earnings per share calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- CH16HW TrierweilerDocument5 pagesCH16HW TrierweilerMax Trierweiler100% (1)

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- FinMan 11e TM Ch04Document15 pagesFinMan 11e TM Ch04Cooper89No ratings yet

- Kearns V. Robinhood ComplaintDocument30 pagesKearns V. Robinhood ComplaintWill PorterNo ratings yet

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- AC550 Week Four AssigmentDocument8 pagesAC550 Week Four Assigmentsweetpr22No ratings yet

- Solutions Chapter 16Document7 pagesSolutions Chapter 16Kakin WanNo ratings yet

- CH03Document4 pagesCH03wahib aumioNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (13)

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- H.W Chapter 17Document11 pagesH.W Chapter 17Cooper89No ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Bond Price 100,000Document22 pagesBond Price 100,000HAMMADHRNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Acc 550 Week 4 HomeworkDocument7 pagesAcc 550 Week 4 Homeworkjoannapsmith33No ratings yet

- Review Questions For Test #2 ACC210Document8 pagesReview Questions For Test #2 ACC210AaaNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- S.No. Account Title and Explanation Debit ($) Credit ($)Document1 pageS.No. Account Title and Explanation Debit ($) Credit ($)Ekta Saraswat VigNo ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- CH 06 TutoriaDocument31 pagesCH 06 TutoriaSana Khan100% (1)

- Problems Chapter 13 (7,8,10)Document7 pagesProblems Chapter 13 (7,8,10)NUR SYAHIRAH BINTI SUFIANNo ratings yet

- Working Capital Manageme NT: Weekend Assignment: 3Document10 pagesWorking Capital Manageme NT: Weekend Assignment: 3Ankit KhandelwalNo ratings yet

- Cheat SheetDocument9 pagesCheat SheetKhushi RaiNo ratings yet

- Ôn Tập FA1 RecoveredDocument16 pagesÔn Tập FA1 RecoveredHiếu Hoàng MinhNo ratings yet

- (GR1) TCDN - Case 3Document19 pages(GR1) TCDN - Case 3Thắng Vũ Nguyễn ĐứcNo ratings yet

- Assignment 2 - Final PeriodDocument3 pagesAssignment 2 - Final PeriodJoelyn FajiculayNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Particulars Parent Share Noncontrolling Share Entire Value: Income StatementDocument2 pagesParticulars Parent Share Noncontrolling Share Entire Value: Income StatementEkta Saraswat VigNo ratings yet

- Dewa Satria Rachman Lubis - 11 - 4-17Document15 pagesDewa Satria Rachman Lubis - 11 - 4-17DewaSatriaNo ratings yet

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Document6 pagesHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryNo ratings yet

- 109 2 PDFDocument3 pages109 2 PDF112205013No ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- Chữa Đề Thi Chap 7 8 9Document14 pagesChữa Đề Thi Chap 7 8 9Đàm Ngọc Giang NamNo ratings yet

- Power Notes: Bonds Payable and Investments in BondsDocument38 pagesPower Notes: Bonds Payable and Investments in BondsiVONo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Problems FinalDocument2 pagesProblems FinalMhay Teofilo Bal-adNo ratings yet

- Accounting Final ExamDocument40 pagesAccounting Final ExamdvNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- ACC1701 Revision Session SlidesDocument38 pagesACC1701 Revision Session SlidesshermaineNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For Corporations Prob 4Document3 pagesSol. Man. - Chapter 15 - Accounting For Corporations Prob 4ruth san joseNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- CH 5 Answers To Homework AssignmentsDocument13 pagesCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocument9 pagesManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNo ratings yet

- Assigned Problems FinmarDocument8 pagesAssigned Problems FinmarTABUADA, Jenny Rose V.No ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- POA MCQ SolutionsDocument141 pagesPOA MCQ SolutionssyrasgamingttNo ratings yet

- Tutorial Equity Part 1Document2 pagesTutorial Equity Part 1LAVINNYA NAIR A P PARBAKARANNo ratings yet

- AccountingDocument5 pagesAccountingyousaf haroonNo ratings yet

- Intermediate Accounting: Week 3 Assignment Student Name: Nidal Charafeddine Professor: Sheila Woods Devry University July-2016Document9 pagesIntermediate Accounting: Week 3 Assignment Student Name: Nidal Charafeddine Professor: Sheila Woods Devry University July-2016nidal charaf eddineNo ratings yet

- CH 18 ADocument9 pagesCH 18 AAlex YaoNo ratings yet

- 10 Non-Current AssetsDocument25 pages10 Non-Current AssetsDayaan ANo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tax Case CompiledDocument14 pagesTax Case CompiledCooper89No ratings yet

- Balance Sheet: Current Assets Current LiabilitiesDocument3 pagesBalance Sheet: Current Assets Current LiabilitiesCooper89No ratings yet

- FinMan 11e TM Ch02Document14 pagesFinMan 11e TM Ch02Cooper89No ratings yet

- FinMan 11e TM Ch01Document21 pagesFinMan 11e TM Ch01Cooper89No ratings yet

- Chapter 4 - Completing The Accounting CycleDocument142 pagesChapter 4 - Completing The Accounting CycleCooper89100% (3)

- CH 05 P3 BDocument4 pagesCH 05 P3 BCooper89No ratings yet

- Á Ï° ° а CH 04Document31 pagesÁ Ï° ° а CH 04Cooper89No ratings yet

- Achivmt Test Answ2Document18 pagesAchivmt Test Answ2Cooper89No ratings yet

- Chapter 12Document15 pagesChapter 12Cooper89No ratings yet

- Case Problem Chapter 3 63Document3 pagesCase Problem Chapter 3 63Cooper89No ratings yet

- A. Cooper 1: Account Debit CreditDocument4 pagesA. Cooper 1: Account Debit CreditCooper89No ratings yet

- H.W Chapter 21Document7 pagesH.W Chapter 21Cooper89No ratings yet

- ACCA 305 Extra Credit AssignmentDocument18 pagesACCA 305 Extra Credit AssignmentCooper89No ratings yet

- Date Account Debit Credit: A. Cooper 1Document3 pagesDate Account Debit Credit: A. Cooper 1Cooper89No ratings yet

- H.W Chapter 17 ProblemDocument4 pagesH.W Chapter 17 ProblemCooper89No ratings yet

- Aleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Document5 pagesAleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Cooper89No ratings yet

- H.W Chapter 17Document11 pagesH.W Chapter 17Cooper89No ratings yet

- Private Equity Fund OperationsDocument2 pagesPrivate Equity Fund OperationsIndependent Evaluation at Asian Development BankNo ratings yet

- IFRS9 AnalysisDocument27 pagesIFRS9 AnalysisOana CraciunNo ratings yet

- The Millionaire Next DoorDocument6 pagesThe Millionaire Next Doorapi-240941683No ratings yet

- 04 - Advantages and Disadvantages of CreditDocument2 pages04 - Advantages and Disadvantages of CreditAbid Naeem50% (2)

- Case Studies On Corporate GovernanceDocument10 pagesCase Studies On Corporate Governanceibscdc100% (2)

- Republic of The Philippines Court of Appeals Quezon: TAX CityDocument27 pagesRepublic of The Philippines Court of Appeals Quezon: TAX CitydoookaNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- Notification No. FEMA 20/2000-RB Dated 3rd May 2000Document10 pagesNotification No. FEMA 20/2000-RB Dated 3rd May 2000nalluriimpNo ratings yet

- Consolidated FS Subsequent To Date of Purchase TypeDocument158 pagesConsolidated FS Subsequent To Date of Purchase TypeSassy OcampoNo ratings yet

- GWI Oct17 (4) CompressedDocument68 pagesGWI Oct17 (4) CompressedMahesh KothiyalNo ratings yet

- Capital BudgetingDocument192 pagesCapital BudgetingMatt Hytr100% (2)

- Rob Parson at Morgan Stanley 2Document5 pagesRob Parson at Morgan Stanley 2Embuhmas BroNo ratings yet

- Ceasa WP3822Document89 pagesCeasa WP3822Poe TryNo ratings yet

- E39042b6 PDFDocument199 pagesE39042b6 PDFGilbert PariyoNo ratings yet

- CIIA Reference LiteratureDocument6 pagesCIIA Reference LiteratureJorgeqNo ratings yet

- TaxRev Case University PhysiciansDocument15 pagesTaxRev Case University Physiciansj guevarraNo ratings yet

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Document3 pagesSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Nikky Bless LeonarNo ratings yet

- AKKU Annual Report 2018Document148 pagesAKKU Annual Report 2018TyasNo ratings yet

- The Allocation of Catastrophe RiskDocument12 pagesThe Allocation of Catastrophe RiskAlex PutuhenaNo ratings yet

- Startup Roadmap 3Document6 pagesStartup Roadmap 3Souvik Paul100% (1)

- Appropriation, Allotment, Obligation and Disbursements: What Are Common Types of Appropriation?Document5 pagesAppropriation, Allotment, Obligation and Disbursements: What Are Common Types of Appropriation?Niña Kristine AlinsonorinNo ratings yet

- Chapter 8: Leverage and CVP Analysis: 2001 Dec 2bDocument4 pagesChapter 8: Leverage and CVP Analysis: 2001 Dec 2bShubham ParabNo ratings yet

- 83-B Equitable PCI v. DNGDocument4 pages83-B Equitable PCI v. DNGKarla BeeNo ratings yet

- Introduction To DerivativesDocument19 pagesIntroduction To DerivativesAditya SrivastavaNo ratings yet

- Aritcle of Incorporation CodedDocument8 pagesAritcle of Incorporation CodedmmmnnyskrtNo ratings yet

- Sbi Mutual FundDocument78 pagesSbi Mutual Fundsshane kumar33% (3)

- Are Non - Performing Assets Gloomy or Greedy From Indian Perspective?Document9 pagesAre Non - Performing Assets Gloomy or Greedy From Indian Perspective?Mohit JainNo ratings yet

- Partnership MyDocument13 pagesPartnership MyHoneylyne PlazaNo ratings yet

Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

Uploaded by

Cooper890 ratings0% found this document useful (0 votes)

40 views7 pagesThis document contains the homework questions and exercises assigned to Aleshia Cooper for her Accounts 305 class. It includes journal entries recording bond issuances with discounts and premiums, stock warrant issuances, debt conversions to equity, and calculations of weighted average shares outstanding for earnings per share. The exercises cover accounting for bonds payable, stock warrants, debt conversions, and earnings per share calculations.

Original Description:

Original Title

H.w Chapter 16

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the homework questions and exercises assigned to Aleshia Cooper for her Accounts 305 class. It includes journal entries recording bond issuances with discounts and premiums, stock warrant issuances, debt conversions to equity, and calculations of weighted average shares outstanding for earnings per share. The exercises cover accounting for bonds payable, stock warrants, debt conversions, and earnings per share calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

40 views7 pagesAleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

Aleshia Cooper Thursday, 28 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 16-1, 2, 3, 7, 8, 16, and 19 Exercise 16-1

Uploaded by

Cooper89This document contains the homework questions and exercises assigned to Aleshia Cooper for her Accounts 305 class. It includes journal entries recording bond issuances with discounts and premiums, stock warrant issuances, debt conversions to equity, and calculations of weighted average shares outstanding for earnings per share. The exercises cover accounting for bonds payable, stock warrants, debt conversions, and earnings per share calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

Aleshia Cooper

Thursday, 28 January, 2014

Accounts 305 -01

Mr. Terrance Richards

Homework Questions: E: 16-1, 2, 3, 7, 8, 16, And 19

Exercise 16-1

DATE ACCOUNT Debit Credit

Cash ($20,000,000 0.99) 19,800,000

Discount on Bonds Payable 200,000

Bonds Payable 20,000,000

DATE ACCOUNT Debit Credit

Unamortized Bond Issue Costs 70,000

Cash 70,000

DATE ACCOUNT Debit Credit

Cash ($10,000,000 0.98) 9,800,000

Discount on Bonds Payable 600,000

Bonds Payable 10,000,000

Paid-in CapitalStock Warrants 400,000

DATE ACCOUNT Debit Credit

Value of bonds plus warrants ($10,000,000

0.98)

$9,800,000

Value of warrants ($4.00 100,000 shares)

400,000

Value of bonds

$9,400,000

DATE ACCOUNT Debit Credit

Debt Conversion Expense 75,000

Bonds Payable 10,000,000

Discount on Bonds Payable 55,000

Common Stock 1,000,000

Paid-in Capital in Excess of Par* 8,945,000

Cash 75,000

Exercise 16-2

DATE ACCOUNT Debit Credit

Cash ($10,000,000 0.98) 9,800,000

Discount on Bonds Payable 600,000

Bonds Payable 10,000,000

Paid-in CapitalStock Warrants 400,000

DATE ACCOUNT Debit Credit

Debt Conversion Expense 75,000

Bonds Payable 10,000,000

Discount on Bonds Payable 55,000

Common Stock 1,000,000

Paid-in Capital in Excess of Par* 8,945,000

Cash 75,000

Exercise 16-3

DATE ACCOUNT Debit Credit

Cash ($10,000,000 0.98)

500,000

Discount on Bonds Payable

7,500

Bonds Payable

500,000

Paid-in CapitalStock Warrants

7,500

Exercise 16-7

Value of bonds without warrants

X Issue price = Value assigned to bonds

Value of bonds without warrants +

Value of warrants

Value of warrants

X Issue price = Value assigned to warrants

Value of bonds without warrants +

Value of warrants

$136,000

X $152,000 = $129,200 Value assigned to bonds

$136,000 + $24,000

$24,000

X $152,000 = 22,800

$152,000

Value assigned to warrants

Total

$136,000 + $24,000

DATE ACCOUNT Debit Credit

Cash ($10,000,000 0.98) 9,800,000

Discount on Bonds Payable 600,000

Bonds Payable 10,000,000

Paid-in CapitalStock Warrants 400,000

DATE ACCOUNT Debit Credit

Cash ($10,000,000 0.98)

152,000

Discount on Bonds Payable

18,000

Bonds Payable 10,000,000

Exercise 16-8

SANDS COMPANY

Journal Entry

September 1, 2014

DATE ACCOUNT Debit Credit

Cash ($9.00 20,000 shares) 180,000

Paid-in CapitalStock Options ($4.00

20,000)

80,000

Common Stock ($5.00 par value 20,000

shares)

100,000

Paid-in Capital in Excess of Par 160,000

Schedule 1

24,000

Bond Interest ExpenseSchedule 2

90,000

Schedule 1

Premium on Bonds Payable and Value of Stock Warrants

Sales price (4,000 X $1,040) $4,160,000

Less: Face value of bonds 4,000,000

160,000

Deduct value assigned to stock warrants

(4,000 X 2 = 8,000; 8,000 X $3) 24,000

Premium on bonds payable $ 136,000

Schedule 2

Accrued Bond Interest to Date of Sale

Face value of bonds $4,000,000

Interest rate X 9%

Annual interest $ 360,000

Accrued interest for 3 months ($360,000 X 3/12) $ 90,000

Exercise 16-16

Event

Dates

Outstanding

Shares

Outstanding

Restatement

Fraction

of Year

Weighted

Shares

Beginning balance Jan. 1Feb. 1 480,000 1.1 X 3.0 1/12 132,000

Issued shares Feb. 1Mar. 1 600,000 1.1 X 3.0 1/12 165,000

Stock dividend Mar. 1May 1 660,000 3.0 2/12 330,000

Reacquired shares May 1June 1 560,000 3.0 1/12 140,000

Stock split June 1Oct. 1 1,680,000 4/12 560,000

Reissued shares Oct. 1Dec. 31 1,740,000 3/12 435,000

Weighted-average number of shares outstanding 1,762,000

(b) Earnings Per Share =

$3,456,000 (Net Income)

= $1.96

1,762,000 (Weighted-average Number

Shares Outstanding)

(c) Earnings Per Share =

$3,456,000 $900,000

= $1.45

1,762,000

Exercise 16-19

Dates

Outstanding

Shares

Outstanding

Fraction

of Year

Weighted

Shares

January 1April 1 7,500,000 3/12 1,875,000

April 1December 31 8,500,000 9/12 6,375,000

Weighted-average number of shares outstanding 8,250,000

You might also like

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- CH16HW TrierweilerDocument5 pagesCH16HW TrierweilerMax Trierweiler100% (1)

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- FinMan 11e TM Ch04Document15 pagesFinMan 11e TM Ch04Cooper89No ratings yet

- Kearns V. Robinhood ComplaintDocument30 pagesKearns V. Robinhood ComplaintWill PorterNo ratings yet

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- AC550 Week Four AssigmentDocument8 pagesAC550 Week Four Assigmentsweetpr22No ratings yet

- Solutions Chapter 16Document7 pagesSolutions Chapter 16Kakin WanNo ratings yet

- CH03Document4 pagesCH03wahib aumioNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (13)

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- H.W Chapter 17Document11 pagesH.W Chapter 17Cooper89No ratings yet

- Chapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Document6 pagesChapter 9 - Annand, D. (2018) :: Concept Self-Check: 1 To 6Minh HuyyNo ratings yet

- Bond Price 100,000Document22 pagesBond Price 100,000HAMMADHRNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Acc 550 Week 4 HomeworkDocument7 pagesAcc 550 Week 4 Homeworkjoannapsmith33No ratings yet

- Review Questions For Test #2 ACC210Document8 pagesReview Questions For Test #2 ACC210AaaNo ratings yet

- Ias 32Document3 pagesIas 32Yến Hoàng HảiNo ratings yet

- S.No. Account Title and Explanation Debit ($) Credit ($)Document1 pageS.No. Account Title and Explanation Debit ($) Credit ($)Ekta Saraswat VigNo ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- CH 06 TutoriaDocument31 pagesCH 06 TutoriaSana Khan100% (1)

- Problems Chapter 13 (7,8,10)Document7 pagesProblems Chapter 13 (7,8,10)NUR SYAHIRAH BINTI SUFIANNo ratings yet

- Working Capital Manageme NT: Weekend Assignment: 3Document10 pagesWorking Capital Manageme NT: Weekend Assignment: 3Ankit KhandelwalNo ratings yet

- Cheat SheetDocument9 pagesCheat SheetKhushi RaiNo ratings yet

- Ôn Tập FA1 RecoveredDocument16 pagesÔn Tập FA1 RecoveredHiếu Hoàng MinhNo ratings yet

- (GR1) TCDN - Case 3Document19 pages(GR1) TCDN - Case 3Thắng Vũ Nguyễn ĐứcNo ratings yet

- Assignment 2 - Final PeriodDocument3 pagesAssignment 2 - Final PeriodJoelyn FajiculayNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Particulars Parent Share Noncontrolling Share Entire Value: Income StatementDocument2 pagesParticulars Parent Share Noncontrolling Share Entire Value: Income StatementEkta Saraswat VigNo ratings yet

- Dewa Satria Rachman Lubis - 11 - 4-17Document15 pagesDewa Satria Rachman Lubis - 11 - 4-17DewaSatriaNo ratings yet

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Document6 pagesHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryNo ratings yet

- 109 2 PDFDocument3 pages109 2 PDF112205013No ratings yet

- FM FinalDocument7 pagesFM FinalStoryKingNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- Chữa Đề Thi Chap 7 8 9Document14 pagesChữa Đề Thi Chap 7 8 9Đàm Ngọc Giang NamNo ratings yet

- Power Notes: Bonds Payable and Investments in BondsDocument38 pagesPower Notes: Bonds Payable and Investments in BondsiVONo ratings yet

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Problems FinalDocument2 pagesProblems FinalMhay Teofilo Bal-adNo ratings yet

- Accounting Final ExamDocument40 pagesAccounting Final ExamdvNo ratings yet

- Mid Semester Assignment: Course Code: FIN - 254 Section: 08Document8 pagesMid Semester Assignment: Course Code: FIN - 254 Section: 08Fahim Faisal 1620560630No ratings yet

- Answers To Week 1 HomeworkDocument6 pagesAnswers To Week 1 Homeworkmzvette234No ratings yet

- ACC1701 Revision Session SlidesDocument38 pagesACC1701 Revision Session SlidesshermaineNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For Corporations Prob 4Document3 pagesSol. Man. - Chapter 15 - Accounting For Corporations Prob 4ruth san joseNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- CH 5 Answers To Homework AssignmentsDocument13 pagesCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocument9 pagesManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNo ratings yet

- Assigned Problems FinmarDocument8 pagesAssigned Problems FinmarTABUADA, Jenny Rose V.No ratings yet

- Particulars Amount Amount Rs. (DR.) Rs. (DR.)Document14 pagesParticulars Amount Amount Rs. (DR.) Rs. (DR.)Alka DwivediNo ratings yet

- POA MCQ SolutionsDocument141 pagesPOA MCQ SolutionssyrasgamingttNo ratings yet

- Tutorial Equity Part 1Document2 pagesTutorial Equity Part 1LAVINNYA NAIR A P PARBAKARANNo ratings yet

- AccountingDocument5 pagesAccountingyousaf haroonNo ratings yet

- Intermediate Accounting: Week 3 Assignment Student Name: Nidal Charafeddine Professor: Sheila Woods Devry University July-2016Document9 pagesIntermediate Accounting: Week 3 Assignment Student Name: Nidal Charafeddine Professor: Sheila Woods Devry University July-2016nidal charaf eddineNo ratings yet

- CH 18 ADocument9 pagesCH 18 AAlex YaoNo ratings yet

- 10 Non-Current AssetsDocument25 pages10 Non-Current AssetsDayaan ANo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tax Case CompiledDocument14 pagesTax Case CompiledCooper89No ratings yet

- Balance Sheet: Current Assets Current LiabilitiesDocument3 pagesBalance Sheet: Current Assets Current LiabilitiesCooper89No ratings yet

- FinMan 11e TM Ch02Document14 pagesFinMan 11e TM Ch02Cooper89No ratings yet

- FinMan 11e TM Ch01Document21 pagesFinMan 11e TM Ch01Cooper89No ratings yet

- Chapter 4 - Completing The Accounting CycleDocument142 pagesChapter 4 - Completing The Accounting CycleCooper89100% (3)

- CH 05 P3 BDocument4 pagesCH 05 P3 BCooper89No ratings yet

- Á Ï° ° а CH 04Document31 pagesÁ Ï° ° а CH 04Cooper89No ratings yet

- Achivmt Test Answ2Document18 pagesAchivmt Test Answ2Cooper89No ratings yet

- Chapter 12Document15 pagesChapter 12Cooper89No ratings yet

- Case Problem Chapter 3 63Document3 pagesCase Problem Chapter 3 63Cooper89No ratings yet

- A. Cooper 1: Account Debit CreditDocument4 pagesA. Cooper 1: Account Debit CreditCooper89No ratings yet

- H.W Chapter 21Document7 pagesH.W Chapter 21Cooper89No ratings yet

- ACCA 305 Extra Credit AssignmentDocument18 pagesACCA 305 Extra Credit AssignmentCooper89No ratings yet

- Date Account Debit Credit: A. Cooper 1Document3 pagesDate Account Debit Credit: A. Cooper 1Cooper89No ratings yet

- H.W Chapter 17 ProblemDocument4 pagesH.W Chapter 17 ProblemCooper89No ratings yet

- Aleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Document5 pagesAleshia Cooper Thursday, 23 January, 2014 Accounts 305 - 01 Mr. Terrance Richards Homework Questions: E: 15-1, 15-2, 15-3, and 15-5Cooper89No ratings yet

- H.W Chapter 17Document11 pagesH.W Chapter 17Cooper89No ratings yet

- Private Equity Fund OperationsDocument2 pagesPrivate Equity Fund OperationsIndependent Evaluation at Asian Development BankNo ratings yet

- IFRS9 AnalysisDocument27 pagesIFRS9 AnalysisOana CraciunNo ratings yet

- The Millionaire Next DoorDocument6 pagesThe Millionaire Next Doorapi-240941683No ratings yet

- 04 - Advantages and Disadvantages of CreditDocument2 pages04 - Advantages and Disadvantages of CreditAbid Naeem50% (2)

- Case Studies On Corporate GovernanceDocument10 pagesCase Studies On Corporate Governanceibscdc100% (2)

- Republic of The Philippines Court of Appeals Quezon: TAX CityDocument27 pagesRepublic of The Philippines Court of Appeals Quezon: TAX CitydoookaNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- Notification No. FEMA 20/2000-RB Dated 3rd May 2000Document10 pagesNotification No. FEMA 20/2000-RB Dated 3rd May 2000nalluriimpNo ratings yet

- Consolidated FS Subsequent To Date of Purchase TypeDocument158 pagesConsolidated FS Subsequent To Date of Purchase TypeSassy OcampoNo ratings yet

- GWI Oct17 (4) CompressedDocument68 pagesGWI Oct17 (4) CompressedMahesh KothiyalNo ratings yet

- Capital BudgetingDocument192 pagesCapital BudgetingMatt Hytr100% (2)

- Rob Parson at Morgan Stanley 2Document5 pagesRob Parson at Morgan Stanley 2Embuhmas BroNo ratings yet

- Ceasa WP3822Document89 pagesCeasa WP3822Poe TryNo ratings yet

- E39042b6 PDFDocument199 pagesE39042b6 PDFGilbert PariyoNo ratings yet

- CIIA Reference LiteratureDocument6 pagesCIIA Reference LiteratureJorgeqNo ratings yet

- TaxRev Case University PhysiciansDocument15 pagesTaxRev Case University Physiciansj guevarraNo ratings yet

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Document3 pagesSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Nikky Bless LeonarNo ratings yet

- AKKU Annual Report 2018Document148 pagesAKKU Annual Report 2018TyasNo ratings yet

- The Allocation of Catastrophe RiskDocument12 pagesThe Allocation of Catastrophe RiskAlex PutuhenaNo ratings yet

- Startup Roadmap 3Document6 pagesStartup Roadmap 3Souvik Paul100% (1)

- Appropriation, Allotment, Obligation and Disbursements: What Are Common Types of Appropriation?Document5 pagesAppropriation, Allotment, Obligation and Disbursements: What Are Common Types of Appropriation?Niña Kristine AlinsonorinNo ratings yet

- Chapter 8: Leverage and CVP Analysis: 2001 Dec 2bDocument4 pagesChapter 8: Leverage and CVP Analysis: 2001 Dec 2bShubham ParabNo ratings yet

- 83-B Equitable PCI v. DNGDocument4 pages83-B Equitable PCI v. DNGKarla BeeNo ratings yet

- Introduction To DerivativesDocument19 pagesIntroduction To DerivativesAditya SrivastavaNo ratings yet

- Aritcle of Incorporation CodedDocument8 pagesAritcle of Incorporation CodedmmmnnyskrtNo ratings yet

- Sbi Mutual FundDocument78 pagesSbi Mutual Fundsshane kumar33% (3)

- Are Non - Performing Assets Gloomy or Greedy From Indian Perspective?Document9 pagesAre Non - Performing Assets Gloomy or Greedy From Indian Perspective?Mohit JainNo ratings yet

- Partnership MyDocument13 pagesPartnership MyHoneylyne PlazaNo ratings yet