Professional Documents

Culture Documents

Exam in Financial Theory (October 26, 2011)

Exam in Financial Theory (October 26, 2011)

Uploaded by

tsunkangCopyright:

Available Formats

You might also like

- BFC5935 - Sample Exam PDFDocument5 pagesBFC5935 - Sample Exam PDFXue XuNo ratings yet

- Soa Exam Ifm: Study ManualDocument44 pagesSoa Exam Ifm: Study ManualHang Pham100% (1)

- Cima p1 MockDocument5 pagesCima p1 MockPriya NairNo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- MS 224.SCM(IL-I) Question CMA January-2023 Exam.Document3 pagesMS 224.SCM(IL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- MGMT2110 Final Exam Sample 2015 (Riki)Document10 pagesMGMT2110 Final Exam Sample 2015 (Riki)MarcoNo ratings yet

- MS 224.MSCMIL I Question CMA January 2022 ExaminationDocument3 pagesMS 224.MSCMIL I Question CMA January 2022 ExaminationMd. Showkat IslamNo ratings yet

- May/June 2022 Exam Paper Question-By-Question Analysis See Below, Examples of How To Approach The QuestionsDocument11 pagesMay/June 2022 Exam Paper Question-By-Question Analysis See Below, Examples of How To Approach The QuestionsBo DlaminiNo ratings yet

- 4ec1-01-Pef-20220825 Examiners Report June22Document44 pages4ec1-01-Pef-20220825 Examiners Report June22Shibraj DebNo ratings yet

- TEST Exam M3 VT2024Document6 pagesTEST Exam M3 VT2024aleema anjumNo ratings yet

- Becc 103 Asst 2021-22 EngDocument3 pagesBecc 103 Asst 2021-22 Engcode tubeNo ratings yet

- Becc 103 Asst 2021-22 EngDocument3 pagesBecc 103 Asst 2021-22 Engcode tubeNo ratings yet

- Ecf3900 Final Exam Paper 2014 Sem2Document3 pagesEcf3900 Final Exam Paper 2014 Sem2Joshua OhNo ratings yet

- MS224.MSCMIL I Question CMA May 2022 ExaminationDocument3 pagesMS224.MSCMIL I Question CMA May 2022 Examinationmahir5109No ratings yet

- Exam AFE: Morning SessionDocument14 pagesExam AFE: Morning SessionSalamaAlAmryNo ratings yet

- BCOC-137 Assignment 2021-22 (English)Document4 pagesBCOC-137 Assignment 2021-22 (English)mohit vermaNo ratings yet

- Baech Becc 106 Asst 2021-22 EngDocument3 pagesBaech Becc 106 Asst 2021-22 Engcode tubeNo ratings yet

- TA112.BQAF - .L Question CMA September 2022 Exam.Document9 pagesTA112.BQAF - .L Question CMA September 2022 Exam.Mohammed Javed UddinNo ratings yet

- BFC5935 - SAMPLE EXAM Solutions PDFDocument10 pagesBFC5935 - SAMPLE EXAM Solutions PDFXue Xu0% (1)

- Edu 2017 04 Cfesdm Exam AmDocument16 pagesEdu 2017 04 Cfesdm Exam AmJRVVNo ratings yet

- BECC-108 2021-22 EnglishDocument5 pagesBECC-108 2021-22 EnglishSoumya Prasad NayakNo ratings yet

- Econ 261: Principles of Finance Quiz 2-40 Marks: InstructionsDocument2 pagesEcon 261: Principles of Finance Quiz 2-40 Marks: InstructionsRehan HasanNo ratings yet

- Econimic InnovationDocument42 pagesEconimic InnovationRahima atifNo ratings yet

- 4ec1 02r Pef 20220825Document39 pages4ec1 02r Pef 20220825Kuok Hei LeungNo ratings yet

- Dec-22 QP9-set-2-PGDMM-L&SCM-Strategic-Management-Dec-2022Document2 pagesDec-22 QP9-set-2-PGDMM-L&SCM-Strategic-Management-Dec-2022Rahul MenariaNo ratings yet

- 4ec1-02-Pef-20220825 Examiners Report June22Document42 pages4ec1-02-Pef-20220825 Examiners Report June22Shibraj DebNo ratings yet

- TA112.BQAF - .L Question CMA May 2022 ExaminationDocument8 pagesTA112.BQAF - .L Question CMA May 2022 ExaminationMohammed Javed UddinNo ratings yet

- QUARET 1 FBS LHT 4 Assess Personal Competencies and Skills 2Document4 pagesQUARET 1 FBS LHT 4 Assess Personal Competencies and Skills 2LORNA NELLASNo ratings yet

- P2 May 2011 PEGDocument15 pagesP2 May 2011 PEGkarlr9No ratings yet

- Marking Scheme Computer Science 083Document26 pagesMarking Scheme Computer Science 083Arohan BuddyNo ratings yet

- Ans Cs 2023Document37 pagesAns Cs 2023itsbeckynottaylor.1989No ratings yet

- 3rd Trimester Paper 2022Document9 pages3rd Trimester Paper 2022vaibhavrs22.pumbaNo ratings yet

- 3.EF232.FIMIL II Question CMA September 2022 Exam.Document8 pages3.EF232.FIMIL II Question CMA September 2022 Exam.nobiNo ratings yet

- hhw 12Document1 pagehhw 12pariisthebest17No ratings yet

- Mba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDocument9 pagesMba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDeep Narayan RamNo ratings yet

- BEA 242 Introduction To Econometrics Group Assignment (Updated On 10 May 2012: The Change in Highlighted)Document4 pagesBEA 242 Introduction To Econometrics Group Assignment (Updated On 10 May 2012: The Change in Highlighted)Reza Riantono SukarnoNo ratings yet

- Diploma in Foundation Studiesprogrammes Semester 2, 2019-20 End of Termassessment Question and Answer BookletDocument9 pagesDiploma in Foundation Studiesprogrammes Semester 2, 2019-20 End of Termassessment Question and Answer BookletAsad Ali Re OfficerNo ratings yet

- Internal Assignment Questions P.G. Diploma in Business Management Annual Examinations 2021Document8 pagesInternal Assignment Questions P.G. Diploma in Business Management Annual Examinations 2021Harsha VardhanNo ratings yet

- Mefa PDFDocument4 pagesMefa PDFpadmajasivaNo ratings yet

- Actex IFM Manual Fall 2019 SampleDocument35 pagesActex IFM Manual Fall 2019 SampleBrian NgNo ratings yet

- Bachelor'S of Arts (Economics Honours) Programme (Baech) : BECC-101Document6 pagesBachelor'S of Arts (Economics Honours) Programme (Baech) : BECC-101code tubeNo ratings yet

- TA112 .BQAF - .L Question CMA January 2022 Examination PDFDocument7 pagesTA112 .BQAF - .L Question CMA January 2022 Examination PDFMohammed Javed UddinNo ratings yet

- 29712mtp Ipcc sr2 May2013 p7 BDocument2 pages29712mtp Ipcc sr2 May2013 p7 Bguptafamily1992No ratings yet

- School of Business Management: SVKM'S NmimsDocument2 pagesSchool of Business Management: SVKM'S NmimsHarsh GandhiNo ratings yet

- ChicagoGSB Math Models SyllabusDocument8 pagesChicagoGSB Math Models SyllabusNuggets MusicNo ratings yet

- Aqa Econ1 W MS Jan 12Document20 pagesAqa Econ1 W MS Jan 12sexysexy21No ratings yet

- Y12 Eco QPDocument17 pagesY12 Eco QPRainald Avish chandNo ratings yet

- Faculty Department: University ExaminationsDocument4 pagesFaculty Department: University Examinationskuazikua hondjeraNo ratings yet

- CM231.MAC (IL-II) Question CMA May-2023 Exam.Document7 pagesCM231.MAC (IL-II) Question CMA May-2023 Exam.Md FahadNo ratings yet

- IandF CT8 201609 ExaminersReportDocument17 pagesIandF CT8 201609 ExaminersReportAnonymous k7TK4e4No ratings yet

- Aqa Econ1 W MS Jun 12Document19 pagesAqa Econ1 W MS Jun 12sexysexy21No ratings yet

- Edu 2015 10 Cfesdm Exam PMDocument13 pagesEdu 2015 10 Cfesdm Exam PMAyeshaAttiyaAliNo ratings yet

- 4ec1 01Document7 pages4ec1 01CanioNo ratings yet

- GED102 Week 2 WGNDocument6 pagesGED102 Week 2 WGNJennylyn CortelNo ratings yet

- TA 223.ICTIL I Question CMA January 2022Document4 pagesTA 223.ICTIL I Question CMA January 2022Riad FaisalNo ratings yet

- Answering Paper 2 Questions: Economics For The IB DiplomaDocument9 pagesAnswering Paper 2 Questions: Economics For The IB Diploma정우창No ratings yet

- 2018 Sample MATH M1 Level5 EDocument25 pages2018 Sample MATH M1 Level5 EKelvin LauNo ratings yet

- Exam IA 27032012 - Example For BBDocument6 pagesExam IA 27032012 - Example For BBJerry K FloaterNo ratings yet

- Security Analysis and Portfolio ManagementDocument2 pagesSecurity Analysis and Portfolio ManagementSidharth MIshra100% (1)

Exam in Financial Theory (October 26, 2011)

Exam in Financial Theory (October 26, 2011)

Uploaded by

tsunkangOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam in Financial Theory (October 26, 2011)

Exam in Financial Theory (October 26, 2011)

Uploaded by

tsunkangCopyright:

Available Formats

1

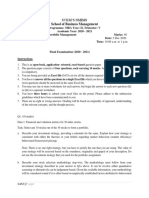

UPPSALA UNIVERSITY EXAM NUMBER: __________

Department of Economics

Mikael Bask (070-949 83 97)

You must identify yourself at the examination with a photo ID card.

Otherwise the exam will not be corrected.

EXAM IN D/FINANCIAL THEORY

MASTER/FINANCIAL THEORY

October 26, 2011 (Wednesday)

The exam consists of 5 problems, totaling 28 points. To get the grade G (pass), at least 14 points are

needed, and to get the grade VG (pass with distinction), at least 21 points are needed. The answers to

the problems should be in English and you are allowed to use a dictionary.

Read through all the questions before you begin answering them and start answering each question on

a new page. The writing time is 5 hours. Write your examination number in the indicated spaces!

GOOD LUCK!!

2

EXAM NUMBER: __________

1. (2+1+4+1+1=9 points)

The variance of the return on the risky portfolio P with N securities is given by

2

=

Assume that equal amounts are invested in each security in portfolio P.

(i) Derive expressions for portfolio Ps systematic and non-systematic risks.

(ii) Interpret your findings in (i).

Assume hereafter that the single-index model holds for the individual securities in portfolio P.

(iii) Derive expressions for portfolio Ps systematic and non-systematic risks.

(iv) Why is Beta a measure of a securitys non-diversifiable risk?

(v) Give at least two reasons why the single-index model may be useful in portfolio management.

2. (5 points)

Discuss carefully the following concepts: market efficiency and market rationality.

3. (4+1+2=7 points)

(i) The first-order conditions for the investors portfolio optimization problem are

Derive the CAPM from these conditions. Clearly state the assumptions you make in the derivation.

(ii) Assume that short selling of securities is not allowed.

Does this affect the CAPM? Motivate your answer.

(iii) Formulate in words the portfolio optimization problem that results in the first-order conditions in (i).

3

EXAM NUMBER: __________

4. (2+1+2=5 points)

(i) Present one of the safety first methods that we discussed in the course.

(ii) What is the common characteristic for all safety first methods?

(iii) What is Value-at-Risk?

5. (2 points)

What is the separation theorem in portfolio management?

You might also like

- BFC5935 - Sample Exam PDFDocument5 pagesBFC5935 - Sample Exam PDFXue XuNo ratings yet

- Soa Exam Ifm: Study ManualDocument44 pagesSoa Exam Ifm: Study ManualHang Pham100% (1)

- Cima p1 MockDocument5 pagesCima p1 MockPriya NairNo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- MS 224.SCM(IL-I) Question CMA January-2023 Exam.Document3 pagesMS 224.SCM(IL-I) Question CMA January-2023 Exam.Shawn MehdiNo ratings yet

- MGMT2110 Final Exam Sample 2015 (Riki)Document10 pagesMGMT2110 Final Exam Sample 2015 (Riki)MarcoNo ratings yet

- MS 224.MSCMIL I Question CMA January 2022 ExaminationDocument3 pagesMS 224.MSCMIL I Question CMA January 2022 ExaminationMd. Showkat IslamNo ratings yet

- May/June 2022 Exam Paper Question-By-Question Analysis See Below, Examples of How To Approach The QuestionsDocument11 pagesMay/June 2022 Exam Paper Question-By-Question Analysis See Below, Examples of How To Approach The QuestionsBo DlaminiNo ratings yet

- 4ec1-01-Pef-20220825 Examiners Report June22Document44 pages4ec1-01-Pef-20220825 Examiners Report June22Shibraj DebNo ratings yet

- TEST Exam M3 VT2024Document6 pagesTEST Exam M3 VT2024aleema anjumNo ratings yet

- Becc 103 Asst 2021-22 EngDocument3 pagesBecc 103 Asst 2021-22 Engcode tubeNo ratings yet

- Becc 103 Asst 2021-22 EngDocument3 pagesBecc 103 Asst 2021-22 Engcode tubeNo ratings yet

- Ecf3900 Final Exam Paper 2014 Sem2Document3 pagesEcf3900 Final Exam Paper 2014 Sem2Joshua OhNo ratings yet

- MS224.MSCMIL I Question CMA May 2022 ExaminationDocument3 pagesMS224.MSCMIL I Question CMA May 2022 Examinationmahir5109No ratings yet

- Exam AFE: Morning SessionDocument14 pagesExam AFE: Morning SessionSalamaAlAmryNo ratings yet

- BCOC-137 Assignment 2021-22 (English)Document4 pagesBCOC-137 Assignment 2021-22 (English)mohit vermaNo ratings yet

- Baech Becc 106 Asst 2021-22 EngDocument3 pagesBaech Becc 106 Asst 2021-22 Engcode tubeNo ratings yet

- TA112.BQAF - .L Question CMA September 2022 Exam.Document9 pagesTA112.BQAF - .L Question CMA September 2022 Exam.Mohammed Javed UddinNo ratings yet

- BFC5935 - SAMPLE EXAM Solutions PDFDocument10 pagesBFC5935 - SAMPLE EXAM Solutions PDFXue Xu0% (1)

- Edu 2017 04 Cfesdm Exam AmDocument16 pagesEdu 2017 04 Cfesdm Exam AmJRVVNo ratings yet

- BECC-108 2021-22 EnglishDocument5 pagesBECC-108 2021-22 EnglishSoumya Prasad NayakNo ratings yet

- Econ 261: Principles of Finance Quiz 2-40 Marks: InstructionsDocument2 pagesEcon 261: Principles of Finance Quiz 2-40 Marks: InstructionsRehan HasanNo ratings yet

- Econimic InnovationDocument42 pagesEconimic InnovationRahima atifNo ratings yet

- 4ec1 02r Pef 20220825Document39 pages4ec1 02r Pef 20220825Kuok Hei LeungNo ratings yet

- Dec-22 QP9-set-2-PGDMM-L&SCM-Strategic-Management-Dec-2022Document2 pagesDec-22 QP9-set-2-PGDMM-L&SCM-Strategic-Management-Dec-2022Rahul MenariaNo ratings yet

- 4ec1-02-Pef-20220825 Examiners Report June22Document42 pages4ec1-02-Pef-20220825 Examiners Report June22Shibraj DebNo ratings yet

- TA112.BQAF - .L Question CMA May 2022 ExaminationDocument8 pagesTA112.BQAF - .L Question CMA May 2022 ExaminationMohammed Javed UddinNo ratings yet

- QUARET 1 FBS LHT 4 Assess Personal Competencies and Skills 2Document4 pagesQUARET 1 FBS LHT 4 Assess Personal Competencies and Skills 2LORNA NELLASNo ratings yet

- P2 May 2011 PEGDocument15 pagesP2 May 2011 PEGkarlr9No ratings yet

- Marking Scheme Computer Science 083Document26 pagesMarking Scheme Computer Science 083Arohan BuddyNo ratings yet

- Ans Cs 2023Document37 pagesAns Cs 2023itsbeckynottaylor.1989No ratings yet

- 3rd Trimester Paper 2022Document9 pages3rd Trimester Paper 2022vaibhavrs22.pumbaNo ratings yet

- 3.EF232.FIMIL II Question CMA September 2022 Exam.Document8 pages3.EF232.FIMIL II Question CMA September 2022 Exam.nobiNo ratings yet

- hhw 12Document1 pagehhw 12pariisthebest17No ratings yet

- Mba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDocument9 pagesMba Programme (3 Year) Ii Year Assignment Question Papers 2010-2011 201: Human Resource ManagementDeep Narayan RamNo ratings yet

- BEA 242 Introduction To Econometrics Group Assignment (Updated On 10 May 2012: The Change in Highlighted)Document4 pagesBEA 242 Introduction To Econometrics Group Assignment (Updated On 10 May 2012: The Change in Highlighted)Reza Riantono SukarnoNo ratings yet

- Diploma in Foundation Studiesprogrammes Semester 2, 2019-20 End of Termassessment Question and Answer BookletDocument9 pagesDiploma in Foundation Studiesprogrammes Semester 2, 2019-20 End of Termassessment Question and Answer BookletAsad Ali Re OfficerNo ratings yet

- Internal Assignment Questions P.G. Diploma in Business Management Annual Examinations 2021Document8 pagesInternal Assignment Questions P.G. Diploma in Business Management Annual Examinations 2021Harsha VardhanNo ratings yet

- Mefa PDFDocument4 pagesMefa PDFpadmajasivaNo ratings yet

- Actex IFM Manual Fall 2019 SampleDocument35 pagesActex IFM Manual Fall 2019 SampleBrian NgNo ratings yet

- Bachelor'S of Arts (Economics Honours) Programme (Baech) : BECC-101Document6 pagesBachelor'S of Arts (Economics Honours) Programme (Baech) : BECC-101code tubeNo ratings yet

- TA112 .BQAF - .L Question CMA January 2022 Examination PDFDocument7 pagesTA112 .BQAF - .L Question CMA January 2022 Examination PDFMohammed Javed UddinNo ratings yet

- 29712mtp Ipcc sr2 May2013 p7 BDocument2 pages29712mtp Ipcc sr2 May2013 p7 Bguptafamily1992No ratings yet

- School of Business Management: SVKM'S NmimsDocument2 pagesSchool of Business Management: SVKM'S NmimsHarsh GandhiNo ratings yet

- ChicagoGSB Math Models SyllabusDocument8 pagesChicagoGSB Math Models SyllabusNuggets MusicNo ratings yet

- Aqa Econ1 W MS Jan 12Document20 pagesAqa Econ1 W MS Jan 12sexysexy21No ratings yet

- Y12 Eco QPDocument17 pagesY12 Eco QPRainald Avish chandNo ratings yet

- Faculty Department: University ExaminationsDocument4 pagesFaculty Department: University Examinationskuazikua hondjeraNo ratings yet

- CM231.MAC (IL-II) Question CMA May-2023 Exam.Document7 pagesCM231.MAC (IL-II) Question CMA May-2023 Exam.Md FahadNo ratings yet

- IandF CT8 201609 ExaminersReportDocument17 pagesIandF CT8 201609 ExaminersReportAnonymous k7TK4e4No ratings yet

- Aqa Econ1 W MS Jun 12Document19 pagesAqa Econ1 W MS Jun 12sexysexy21No ratings yet

- Edu 2015 10 Cfesdm Exam PMDocument13 pagesEdu 2015 10 Cfesdm Exam PMAyeshaAttiyaAliNo ratings yet

- 4ec1 01Document7 pages4ec1 01CanioNo ratings yet

- GED102 Week 2 WGNDocument6 pagesGED102 Week 2 WGNJennylyn CortelNo ratings yet

- TA 223.ICTIL I Question CMA January 2022Document4 pagesTA 223.ICTIL I Question CMA January 2022Riad FaisalNo ratings yet

- Answering Paper 2 Questions: Economics For The IB DiplomaDocument9 pagesAnswering Paper 2 Questions: Economics For The IB Diploma정우창No ratings yet

- 2018 Sample MATH M1 Level5 EDocument25 pages2018 Sample MATH M1 Level5 EKelvin LauNo ratings yet

- Exam IA 27032012 - Example For BBDocument6 pagesExam IA 27032012 - Example For BBJerry K FloaterNo ratings yet

- Security Analysis and Portfolio ManagementDocument2 pagesSecurity Analysis and Portfolio ManagementSidharth MIshra100% (1)