Professional Documents

Culture Documents

Challan No. / Itns 280: Tax Applicable (Tick One) Assessment Year

Challan No. / Itns 280: Tax Applicable (Tick One) Assessment Year

Uploaded by

anaga1982Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challan No. / Itns 280: Tax Applicable (Tick One) Assessment Year

Challan No. / Itns 280: Tax Applicable (Tick One) Assessment Year

Uploaded by

anaga1982Copyright:

Available Formats

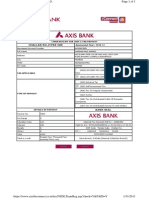

Single Copy (to be sent to the ZAO)

Tax Applicable (Tick One)

Challan No. /

ITNS

280

Assessment Year

(0020) Income Tax On Companies (Corporation Tax)

(0021) Income Tax (Other Than Companies)

Permanent Account Number

Full Name

Complete Address with City

& State

Tel. No.

Pin Code

Type of Payment (Tick One)

Advance Tax (100)

Surtax (102)

Self Assessment Tax (300)

Tax on Distributed Profits of Domestic Companies (106)

Tax on Regular Assessment (400)

Tax on Distributed Income to Unit Holders (107)

Details of Payments

Amount (in Rs. Only)

FOR USE IN RECEIVING BANK

Income Tax

Debit to A/c / Cheque Credited on

Surcharge

Education Cess

DD

MM

YY

Interest

SPACE FOR BANK SEAL

Penalty

Others

Total

Total in Words

Crore

Lacs

Thousands

Hundreds

Tens

Paid in Cash / Debit to A/c / Cheque No. :

Units

Dated :

Drawn on :

(Name of the Bank and Branch)

Rs.

Date

Signature of person making payment

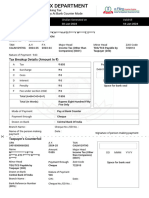

Taxpayer's Counterfoil

PAN

Received from

(To be filled up by tax payer)

Cash/ Debit to A/c /Cheque No. :

SPACE FOR BANK SEAL

for Rs. :

Rs.(in words):

Drawn on :

(Name of the Bank and Branch)

On account of Income Tax on

Other than Companies

Tax

(To be filled up by person making the payment)

Type of Payment :

for the Assessment Year

Companies

Date

Rs.

visit www.challan.in

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- TDS TDSChallan280Document1 pageTDS TDSChallan280sikander1990No ratings yet

- Challan 280Document1 pageChallan 280Mohit MehtaNo ratings yet

- CHALLAN 280 For 2013-14Document1 pageCHALLAN 280 For 2013-14mohanktvmNo ratings yet

- Challan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDocument2 pagesChallan NO./ ITNS 280: Crores Hundreds Tens Thousands Units LacsDharmeshNo ratings yet

- Challan No. ITNS 281 : Assessment YearDocument1 pageChallan No. ITNS 281 : Assessment YearTpm UmasankarNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Saravana KumarNo ratings yet

- RSD3Document1 pageRSD3Thaneshwar MishraNo ratings yet

- Challan NO./ ITNS 280Document2 pagesChallan NO./ ITNS 280amritaasraaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- 27180Document1 page27180nupursingh604No ratings yet

- Challan No Itns 280 PDFDocument2 pagesChallan No Itns 280 PDFArvind Rathod50% (4)

- Challan 280-3Document1 pageChallan 280-3KamalNo ratings yet

- Challan 280Document1 pageChallan 280purepuneetNo ratings yet

- ChallanDocument1 pageChallanRAVINDERNo ratings yet

- Challan 280Document2 pagesChallan 280ravibhartia1978No ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Challan NO./ ITNS 280: A D G P M 4 8 2 8 BDocument1 pageChallan NO./ ITNS 280: A D G P M 4 8 2 8 BKarur KumarNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- VP Goyalt Tds ChallanDocument1 pageVP Goyalt Tds Challanverma619No ratings yet

- Challanitns 280Document2 pagesChallanitns 280VENKATALAKSHMINo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- Anita SahgalDocument3 pagesAnita SahgalNaveen AsthanaNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- T.D.S. / Tcs Tax Challan: DD MM YyDocument1 pageT.D.S. / Tcs Tax Challan: DD MM Yyar8ku9sh0aNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Challan 280Document6 pagesChallan 280Narendra PrajapatiNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Axis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280Document1 pageAxis Bank Axis Bank Axis Bank Axis Bank: Challan No./Itns 280bha_goNo ratings yet

- Sureshbhai (Challan)Document1 pageSureshbhai (Challan)Ketan DhameliyaNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Challan AxisDocument3 pagesChallan AxisSumit Darak50% (2)

- Challan F.Y 2012-13Document1 pageChallan F.Y 2012-13amit22505No ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Excel 04Document3 pagesExcel 04Pawan UdyogNo ratings yet

- TDS-ChallanFormatDocument1 pageTDS-ChallanFormatAnand_Gupta_6499No ratings yet

- Income Tax Proforma PakistanDocument16 pagesIncome Tax Proforma PakistanInayat UllahNo ratings yet

- ChallanFormDocument1 pageChallanFormbghosh00112233No ratings yet

- CBDT E-Payment Request Form - Annexure III NEW PDFDocument2 pagesCBDT E-Payment Request Form - Annexure III NEW PDFAnonymous EZ6ZDmG0ss76% (79)

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- Raigad Telecom District: Account SummaryDocument3 pagesRaigad Telecom District: Account SummaryAviraj KharadeNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- CA. Pavan GoyalDocument15 pagesCA. Pavan Goyalshruti2024No ratings yet

- Application For Admission For The 2009-2010 Academic Year 2013-2014Document2 pagesApplication For Admission For The 2009-2010 Academic Year 2013-2014anaga1982No ratings yet

- (See Rule 12 (2) ) : (At The Time ofDocument2 pages(See Rule 12 (2) ) : (At The Time ofanaga1982No ratings yet

- Re Advertisement 5-13Document27 pagesRe Advertisement 5-13anaga1982No ratings yet

- SNAP 2010 Question Paper and Ans KeyDocument19 pagesSNAP 2010 Question Paper and Ans Keyanaga1982No ratings yet