Professional Documents

Culture Documents

Kmpstep 03

Kmpstep 03

Uploaded by

api-200319437Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- EMS Term 2 Controlled Test 1Document15 pagesEMS Term 2 Controlled Test 1emmanuelmutemba919100% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- IWT Conscious Spending Plan 2023Document12 pagesIWT Conscious Spending Plan 2023GEO654No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IMS Proschool CFP EbookDocument140 pagesIMS Proschool CFP EbookNielesh AmbreNo ratings yet

- Brief Guide To Financial Freedom PDFDocument73 pagesBrief Guide To Financial Freedom PDFanthusiaNo ratings yet

- 2015 SALN Form - S.Y. 2020-2021Document3 pages2015 SALN Form - S.Y. 2020-2021Gladys QuiloNo ratings yet

- Bs Is Ratios - Azwan Family - SolutionDocument3 pagesBs Is Ratios - Azwan Family - SolutionNatasya ShahrulafizalNo ratings yet

- Famdev Coop Fs 2021Document6 pagesFamdev Coop Fs 2021Ma. Consolacion TambaoanNo ratings yet

- SALN FO1 Ronquillo 2023Document2 pagesSALN FO1 Ronquillo 2023Sto Niño FireStationNo ratings yet

- Tender DocumentDocument105 pagesTender DocumentSaurabh SinghNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthRodney Rubi AplanNo ratings yet

- Saln 2016 FormDocument3 pagesSaln 2016 FormJOHN100% (3)

- Accounts Report 1Document15 pagesAccounts Report 1Gaurav AnandNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableRoka Unichu CamachoNo ratings yet

- SALN Form Excel FormatDocument2 pagesSALN Form Excel Formatahim mahalasNo ratings yet

- Mr. & MRS Dahang - SalnDocument16 pagesMr. & MRS Dahang - SalnKatherine DahangNo ratings yet

- 3 Test BankDocument28 pages3 Test BankTrung Lê BáNo ratings yet

- 2023-SALN-Form-JOSEPH CRUZDocument3 pages2023-SALN-Form-JOSEPH CRUZJoseph Caballero CruzNo ratings yet

- Ems - Grade - 7 - Financial - Literacy - 2022 - Term 2 & 4 - UpdatedDocument24 pagesEms - Grade - 7 - Financial - Literacy - 2022 - Term 2 & 4 - UpdatedMIKEMPHALO100% (1)

- MM by Dexter YagerDocument110 pagesMM by Dexter Yagerrscrown100% (2)

- 2015 SALN Form PDFDocument2 pages2015 SALN Form PDFHenry JohnNo ratings yet

- 1.1.2 What Is A Profile 11 21 CompressedDocument11 pages1.1.2 What Is A Profile 11 21 CompressedGiri Raaja.RNo ratings yet

- Saln AizaDocument3 pagesSaln AizaAiza BaleñaNo ratings yet

- Ratio Analysis Heritage Foods Ltd-2Document64 pagesRatio Analysis Heritage Foods Ltd-2Varun ThatiNo ratings yet

- U1A3-Assignment: (Cells Will Expand As You Type)Document2 pagesU1A3-Assignment: (Cells Will Expand As You Type)SerenaNo ratings yet

- 2022 Saln FormDocument2 pages2022 Saln FormJohn Michael DegilloNo ratings yet

- BF Q3 StudentsDocument5 pagesBF Q3 StudentsCarmen Dana SuarezNo ratings yet

- Saln Form Blank 2015Document2 pagesSaln Form Blank 2015Daffodil BuslonNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableROM EROS GALANGNo ratings yet

- Revised As of January 2015Document4 pagesRevised As of January 2015Agustino Laoaguey MarceloNo ratings yet

- 2015 SALN FormDocument3 pages2015 SALN FormDIGITR COMPUTERSHOPNo ratings yet

Kmpstep 03

Kmpstep 03

Uploaded by

api-200319437Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kmpstep 03

Kmpstep 03

Uploaded by

api-200319437Copyright:

Available Formats

STEP

Find Out Where You Are

and What You Have

Alamin ang iyong kalagayan

at ang iyong mga pagmamay-ari.

When you are in a mall and you want to go to a restaurant or a

shop you look at the mall directory. The maps in the mall directory have a dot or drawing that says YOU ARE HERE. This little

sign lets you know where you are and helps you plan the fastest

way to get to the restaurant or shop you are looking for. Kung wala ang sign na to medyo mahihirapan ka. Kahit na alam mo na

ang eksaktong lokasyon ng gusto mong puntahan, matatagalan

bago mo ito marating kung hindi mo alam kung nasaan ka sa loob

41

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

ng mall. Baka hilo ka na sa kakaikot at kakalakad hindi mo pa ito

makita. The same thing can happen when you are going after your

goals. If you dont know where you are now, it will be harder for

you to achieve your objectives.

The third step in our wealth building program is to learn about

your present financial condition. Being aware of your current situation will allow you to develop a better plan of action to accomplish your goals. Kapag alam mo kung ano ang meron ka sa

ngayon, malalaman mo rin kung ano pa ang kailangan mong gawin para maabot ang iyong mga pangarap.

There are three things you need to know to determine your present

financial situation: assets, liabilities and net worth. You probably

dont hear or read about these financial terms often but these are

just fancy names for things you are already familiar with:

- assets are things that you own (mga ari-arian)

- liabilities are things that you owe (mga utang)

- net worth is the real measure of wealth & easily computed

Government employees, public officials and companies are required by law to submit a statement of assets and liabilities (SAL)

every year. Kahit hindi ka taong gobyerno ugaliing gumawa ng

personal SAL para malaman mo ang iyong pinansyal na katayuan.

But it doesnt have to be as complex and as detailed as those prepared by accountants. Since it is for your own use, a simple list

will do; forget about the rules followed by accountants.

Whenever you prepare your list of assets and liabilities always

write the date so that it will be easy for you to compare lists made

at different times and see if your financial condition is improving

42

Step 3 Find Out Where You Are and What You Have

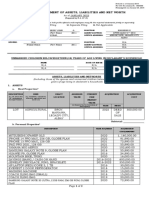

or getting worse. Refer to the sample list of assets and liabilities

below as you continue to read this chapter.

SAMPLE LIST OF ASSETS & LIABILITIES

As of December 31, 2007

ASSETS (Mga Ari-arian)

1. Properties

Bahay at lupa

Kotse

Furniture & appliances

Alahas

Damit, sapatos at iba pa

P

P

P

P

P

800,000.00

350,000.00

120,000.00

30,000.00

50,000.00

P

P

P

P

10,000.00

20,000.00

30,000.00

90,000.00

2. Savings & investments

Cash

Deposito sa bangko

Mutual funds

Pension Plan

TOTAL ASSETS

P 1,500,000.00

LIABILITIES (Mga Utang)

Utang sa bahay

Utang sa kotse

Utang sa credit card

Salary loan

TOTAL LIABILITIES

NET WORTH

P

P

P

P

500,000.00

150,000.00

30,000.00

35,000.00

715,000.00

785,000.00

43

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

YOUR ASSETS

Listing your assets is like counting your blessings. Kung ngayon

mo lang gagawin ito, malamang mabibigla ka pag nalaman mo na

marami din pala ang iyong pag-aari at mga biyayang natanggap;

mas marami kaysa akala mo. Get a pen and paper now; start counting and feel blessed.

Each item in your list of assets should have an estimated value, so

include only the items that you can convert to money. Ibig sabihin, hindi mo dapat isama sa listahan ang ibang assets mo gaya

ng kapogihan o kagandahan o ganda ng boses, dahil hindi natin

alam ang katumbas na halaga nito. List your assets under two

groups: properties and savings & investments.

1. Properties

Your list of properties will include all your real estate properties (your house, condos, apartments, residential lots, farm

lots, etc.), cars & other motor vehicles, appliances, furniture,

electronic equipment, jewelry, clothes and accessories. Include any collection you have like artwork, antiques, ornamental plants, books, magazines, ceramics, comics, toys, CDs

and videos (hindi pirated). Look around the house and add to

your list anything you see that can be converted to cash.

The amount you indicate for each property in your list, whether fully paid or not, should reflect the present value of the item

and not the original price when you bought it. Ang halaga ng

mga ari-arian ay nagbabago, merong tumataas ang halaga

habang tumatagal gaya ng house & lot at meron namang mga

44

Step 3 Find Out Where You Are and What You Have

bagay na bumababa ang halaga gaya ng kotse, appliances at

yung bag na binili mo nung huling nag-midnight sale.

Always use the present market value, which is the amount

you will get if you sell the property. Halimbawa, kung nabili

mo ang iyong kotse noong 2001 sa halagang P500,000 pero

P100,000 na lang ang halaga nito ngayon, P100,000 ang isusulat mo sa listahan. Ganun din sa bahay at lupa; kung

P600,000 mo ito nabili noon pero tumaas na ang halaga nito

sa P1 million, ang ilalagay mo na amount ay P1 million.

To know the value of your properties ask people who know

the latest prices; real estate agents, car dealers, pawnshops and

dealers of second hand furniture and appliances. You can also

check out the classified ads of newspapers and magazines to

have an idea of the present market value of your properties. If

you cant find any information regarding prices just make a

good guesstimate.

2. Savings & investments

The second group in your list of assets will include all the

money you have as well as your investments. The money can

be in cash or in bank deposit accounts. Investments can include pre-need (pension, educational & memorial) and insurance plans, placements in mutual funds, securities and stocks

(you will learn more about these in Step 10). Kung ikaw ay

may negosyo o kasosyo ka sa isang negosyo isama mo sa listahan ang halaga nito. Kung may mga taong umutang sa yo

at sa tingin mo mababayaran ka pa, isama mo rin at magdasal ka na sana magkakatotoo ang iniisip mo na mabayaran.

45

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

The value of your cash and bank deposits is easy to determine;

you just count and look at your passbook, certificate of time

deposit or the ATM receipt.

For mutual funds and stocks you can get the latest value per

share by reading the business section of newspapers, surfing

the internet or calling your agent. To compute the total amount

of your investment, just multiply the value per share by the

number of shares you own. Kung ayaw mong magcompute,

hintayin mo na lang yung statement na pinapadala ng mutual

fund company or stock broker; nakalagay na dun yung total.

For pre-need plans do not use the total amount you have already paid or the total value of the plan because you will not

get this amount if you decide to terminate before the maturity

date. Instead, use the cash value or pre-termination value that

is indicated in the terms and conditions of your plan. The cash

value varies depending on how long the plan has been active

and increases as you get nearer to the maturity date.

YOUR LIABILITIES

Now that youve counted your blessings, its time for you to get a

headache. Maglilista ka na ng mga utang mo. Liabilities include:

46

housing loan & other real property loans

car loan

credit card dues

salary loan

payments for items bought on installment

money borrowed from family & friends

other payment obligations (example, overdue rent)

Step 3 Find Out Where You Are and What You Have

Do not include in your list, premium payments for pre-need or insurance plans because these are not considered as liabilities. Hindi

ka magkakautang kung hindi mo ito mabayaran. Baka may makuha ka pa nga na cash value pag ayaw mo nang ituloy yung plan.

Exclude also from the list, payments for rent (except those that are

overdue) and tuition fees because these are expenses not liabilities.

Huwag mo rin isama sa listahan ang utang na loob pero sana

suklian mo balang araw ang pinagkakautangan mo nito.

Its easy to determine the value of most loans. For credit card

dues, the total balance is clearly indicated in the monthly billing

statement. For salary loans, appliance installment plans and other

short-term loans you can just add the remaining monthly payments.

However, for long-term loans, like a 25-year housing loan, do not

use the total of the remaining monthly amortization because you

will end up with a very big amount.

Halimbawa, kung ikaw ay nag-apply ng P500,000 housing loan na

may interest na 12% at babayaran sa loob ng 25 taon, ang buwanang hulog mo ay mahigit P5,300 o P63,600 sa isang taon. Kung

ito ang gagamitin mo, lalabas na may utang kang P1,590,000

(P63,600 x 25 taon)! Di ba dapat P500T lang ang utang mo?

Kung bigla kang nanalo sa lotto kinabukasan at binayaran ng buo

ang loan, ang P500,000 na principal ang babayaran mo (plus

konting fee siguro) hindi yung P1.59 million.

Always use the balance of the principal for long-term loans so

that you will have a more accurate value for the loan. You can see

this balance in the statements provided by the lender. Kung wala

sa statement, itanong mo na lang sa hiniraman mo, makikita nila

ito sa computer.

47

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

YOUR NET WORTH

Among the three items you need to know to figure out your current

financial situation, the easiest to determine is net worth. But this is

the most significant. It is computed by subtracting the total value

of your liabilities from the total value of your assets.

Net Worth = Total Assets Total Liabilities

Net worth is the true measure of your wealth. This is what will

be left if all your assets are sold to pay off all your liabilities. Even

if you have assets worth P10 million you can still have a very

small net worth (and in effect not truly wealthy) if your liabilities

are huge. Talo ka pa ng isang tao na kahit konti lang ang mga ariarian wala namang malalaking utang.

Kung si company president ay may total assets na P10M at liabilities na P9.5 million, ang net worth niya ay P500,000. Samantala,

si Mang Pandoy na isang regular na empleyado ng kumpanya, ay

may ari-arian na nagkakahalaga lang ng P900,000 pero ang utang

nya ay P50,000 lang. Ang net worth ni Mang Pandoy ay P850,000

at lumalabas na mas mayaman pa siya kaysa presidente.

Take note that net worth can be zero, which happens if the total

value of your assets is the same as the total value of your liabilities.

It can also be negative. Ang ibig sabihin ng negative net worth

ay sobra ang pagkabaon mo sa utang. Kahit na ibenta mo pa lahat ang mga ari-arian mo kulang pa itong pambayad sa iyong mga

utang. This is the kind of debt that will be very difficult to erase.

A huge debt that your children and grandchildren may inherit.

48

Step 3 Find Out Where You Are and What You Have

If you want to be truly wealthy, find ways to increase your net

worth. This can be done by accumulating more assets while keeping your liabilities under control. Choose assets that will bring in

more assets like rental properties (mga paupahan) or your own

business and accumulate assets that will likely increase in value

like mutual funds and stocks. To achieve true wealth do more of

the things that will bring money into your pocket (assets) and reduce or stop doing things that will take money out of your pocket

(liabilities).

Your list of assets and liabilities should be updated regularly, at

least once a year. But I recommend that you do it every three to

six months. The advantage of updating your list frequently is that

you are able to see whatever little progress you're making. Makakita ka lang ng kahit konting pagtaas ng iyong net worth ay siguradong gaganahan ka na ituloy ang pag-iipon at pagpapalago ng

iyong mga naipundar. It will also boost your self-confidence because you know you are doing the right things and going in the

right direction.

YOUR INNER ASSETS

There are other valuable assets you possess that will not appear in

your list but are vital to achieving financial success. These inner

assets come from within you and include your:

Skills

Talents

Knowledge

Strengths

Experience

Positive Traits

People can take away your material assets. They can burn down

your house, steal your car, steal your money, bring your business

49

Kaya Mo, Pinoy! 12 STEPS TO BUILD WEALTH ON ANY INCOME

down, etc. But nobody can take away your inner assets. Hawak

mo ang mga ito habangbuhay. Ito ang matitira mong yaman kapag

lahat ng materyal na pag-aari ay nawala sa yo.

Suriing mabuti ang iyong sarili para malaman mo kung saan ka

mahusay at magaling (hindi tinamaan ng magaling). Knowing

where youre good at will help you choose the right job or business

where you have a greater chance of succeeding. Magaling ka bang

kumanta, sumayaw o umarte? Pwede kang magtagumpay sa larangan ng entertainment. Mahilig ka bang makipag-ugnayan sa

ibat-ibang tao at tumulong sa kapwa? Maari kang pumasok bilang public servant. Kung magaling ka sa pagpinta pwede kang

maging sikat na pintor. If you know what you can do well, you

will know where you can excel.

Many successful people used their natural talent and skills to get to

the top and as a result achieved financial freedom. Si Pacman na

ang galing sa pakikipagsuntukan ay naging daan para umangat ng

husto ang buhay ng kaniyang pamilya at mga kamag-anak. Si

Dolphy na nag-eextra lang dati pero naging hari ng komedya at

ilang dekada nang namamayagpag sa pelikula at telebisyon. Si

Leah Salonga na nakapagtanghal na sa ibat-ibang sulok ng mundo dahil sa husay sa pagkanta. Ikaw din, gamitin mo ang iyong

angking husay at galing para maabot ang iyong mga pangarap at

maging daan para guminhawa ang iyong buhay.

50

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- EMS Term 2 Controlled Test 1Document15 pagesEMS Term 2 Controlled Test 1emmanuelmutemba919100% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- IWT Conscious Spending Plan 2023Document12 pagesIWT Conscious Spending Plan 2023GEO654No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IMS Proschool CFP EbookDocument140 pagesIMS Proschool CFP EbookNielesh AmbreNo ratings yet

- Brief Guide To Financial Freedom PDFDocument73 pagesBrief Guide To Financial Freedom PDFanthusiaNo ratings yet

- 2015 SALN Form - S.Y. 2020-2021Document3 pages2015 SALN Form - S.Y. 2020-2021Gladys QuiloNo ratings yet

- Bs Is Ratios - Azwan Family - SolutionDocument3 pagesBs Is Ratios - Azwan Family - SolutionNatasya ShahrulafizalNo ratings yet

- Famdev Coop Fs 2021Document6 pagesFamdev Coop Fs 2021Ma. Consolacion TambaoanNo ratings yet

- SALN FO1 Ronquillo 2023Document2 pagesSALN FO1 Ronquillo 2023Sto Niño FireStationNo ratings yet

- Tender DocumentDocument105 pagesTender DocumentSaurabh SinghNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthRodney Rubi AplanNo ratings yet

- Saln 2016 FormDocument3 pagesSaln 2016 FormJOHN100% (3)

- Accounts Report 1Document15 pagesAccounts Report 1Gaurav AnandNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableRoka Unichu CamachoNo ratings yet

- SALN Form Excel FormatDocument2 pagesSALN Form Excel Formatahim mahalasNo ratings yet

- Mr. & MRS Dahang - SalnDocument16 pagesMr. & MRS Dahang - SalnKatherine DahangNo ratings yet

- 3 Test BankDocument28 pages3 Test BankTrung Lê BáNo ratings yet

- 2023-SALN-Form-JOSEPH CRUZDocument3 pages2023-SALN-Form-JOSEPH CRUZJoseph Caballero CruzNo ratings yet

- Ems - Grade - 7 - Financial - Literacy - 2022 - Term 2 & 4 - UpdatedDocument24 pagesEms - Grade - 7 - Financial - Literacy - 2022 - Term 2 & 4 - UpdatedMIKEMPHALO100% (1)

- MM by Dexter YagerDocument110 pagesMM by Dexter Yagerrscrown100% (2)

- 2015 SALN Form PDFDocument2 pages2015 SALN Form PDFHenry JohnNo ratings yet

- 1.1.2 What Is A Profile 11 21 CompressedDocument11 pages1.1.2 What Is A Profile 11 21 CompressedGiri Raaja.RNo ratings yet

- Saln AizaDocument3 pagesSaln AizaAiza BaleñaNo ratings yet

- Ratio Analysis Heritage Foods Ltd-2Document64 pagesRatio Analysis Heritage Foods Ltd-2Varun ThatiNo ratings yet

- U1A3-Assignment: (Cells Will Expand As You Type)Document2 pagesU1A3-Assignment: (Cells Will Expand As You Type)SerenaNo ratings yet

- 2022 Saln FormDocument2 pages2022 Saln FormJohn Michael DegilloNo ratings yet

- BF Q3 StudentsDocument5 pagesBF Q3 StudentsCarmen Dana SuarezNo ratings yet

- Saln Form Blank 2015Document2 pagesSaln Form Blank 2015Daffodil BuslonNo ratings yet

- Sworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableDocument2 pagesSworn Statement of Assets, Liabilities and Net Worth: Joint Filing Separate Filing Not ApplicableROM EROS GALANGNo ratings yet

- Revised As of January 2015Document4 pagesRevised As of January 2015Agustino Laoaguey MarceloNo ratings yet

- 2015 SALN FormDocument3 pages2015 SALN FormDIGITR COMPUTERSHOPNo ratings yet