Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsName of The Employee With Designation Gender General/ Women/ SR - CTZN/ Sup SR - STZN Pan No Income

Name of The Employee With Designation Gender General/ Women/ SR - CTZN/ Sup SR - STZN Pan No Income

Uploaded by

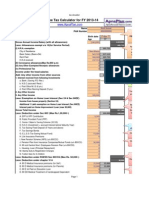

ChithambaramaniRamalingamThis document contains details of an employee's income, deductions, and tax calculations. It lists the employee's name, gender, PAN number, and gross salary income of Rs. 357696. It then lists various deductions totaling Rs. 190388 including conveyance, medical reimbursement, house loan interest, GPF contributions, and donations eligible for tax exemptions. The taxable income is calculated as Rs. 167308. As the employee is in the general/women category, the first Rs. 200000 is exempted and the tax amount is calculated as Rs. 0 since the income is below Rs. 500000 which is taxed at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- PF No.: Any Other Income Reported by The Employee (Value of Perquisites, Income From House Property Etc.)Document5 pagesPF No.: Any Other Income Reported by The Employee (Value of Perquisites, Income From House Property Etc.)neerajkumarvit09No ratings yet

- Annual Income Tax Statement For The Financial Year 2013Document4 pagesAnnual Income Tax Statement For The Financial Year 2013Manoj SankaranarayanaNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Calc Familyr PensionDocument2 pagesCalc Familyr PensionmicrostrategyhydNo ratings yet

- JSK It Returns 2011 12 AuttDocument3 pagesJSK It Returns 2011 12 AuttGobi S Gobi SNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11LordEnigma18No ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- IT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsDocument106 pagesIT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsnarayanan630% (1)

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- 36 8 8 Income Tax Return Preparation Forall Govt Employees Fy 11 12Document11 pages36 8 8 Income Tax Return Preparation Forall Govt Employees Fy 11 12chandu3060No ratings yet

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiNo ratings yet

- IT - Cal - With - Form - 16 - 2011-12Document13 pagesIT - Cal - With - Form - 16 - 2011-12seeyem2000No ratings yet

- Fill in The Data Below: 0706764 B. Sankar SinghDocument24 pagesFill in The Data Below: 0706764 B. Sankar SinghMurali Krishna VNo ratings yet

- 12.TAX 4-IT FormatDocument4 pages12.TAX 4-IT FormatRagavendra RagsNo ratings yet

- Income Statement For Year 2009 - 10: EarningsDocument4 pagesIncome Statement For Year 2009 - 10: EarningsGajanan JagtapNo ratings yet

- The Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowDocument1 pageThe Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowindianroadromeoNo ratings yet

- Pay SlipDocument1 pagePay SlipAnonymous QrLiISmpF100% (1)

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Auto CTC Salary CalculatorDocument1 pageAuto CTC Salary CalculatorSathvika SaaraNo ratings yet

- 1 Form 16 16a LatestDocument25 pages1 Form 16 16a LatestNishant GhaseNo ratings yet

- Earnings: 10 Ca (PH Allowance)Document15 pagesEarnings: 10 Ca (PH Allowance)asrahaman9No ratings yet

- CTC Break-Up PDFDocument5 pagesCTC Break-Up PDFJatinder SadhanaNo ratings yet

- Salary Breakup SheetDocument6 pagesSalary Breakup SheetSathvika SaaraNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Mar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015Document6 pagesMar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015akstrmec23No ratings yet

- 212619X Form16Document1 page212619X Form16Ajay KumarNo ratings yet

- Tax Calculation Statement: IncomeDocument4 pagesTax Calculation Statement: IncomeDrAnjani K KumarNo ratings yet

- Income Tax Proj Nov09Document530 pagesIncome Tax Proj Nov09nilesh_jain27No ratings yet

- 1604-CF FormDocument2 pages1604-CF Formjenie_rojen200423100% (2)

- CFfinalDocument4 pagesCFfinalAngela ArleneNo ratings yet

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesDocument6 pagesAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesStanly OrtizNo ratings yet

- St. Anne'S Girls High School. Halasuru, Bangalore-560 008 Calculation of Income Tax For The Year 2015-16 Assessment Year 2016-17Document2 pagesSt. Anne'S Girls High School. Halasuru, Bangalore-560 008 Calculation of Income Tax For The Year 2015-16 Assessment Year 2016-17Rama KurubaNo ratings yet

- Income Tax Calculator For MaleDocument19 pagesIncome Tax Calculator For MaleAlok SaxenaNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- IT Calculator, Mohandas 2013Document36 pagesIT Calculator, Mohandas 2013DEEPTHISAINo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- It FormDocument13 pagesIt FormMani Vannan JNo ratings yet

- Income Tax (Master)Document1 pageIncome Tax (Master)nareshjangra397No ratings yet

- 12ba KishanDocument11 pages12ba KishanChaitanya SwaroopNo ratings yet

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Tax SimulationDocument1 pageTax SimulationSupriadi DaudNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxDocument16 pagesIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- Classification of Taxes PPT DomsDocument37 pagesClassification of Taxes PPT DomsBabasab Patil (Karrisatte)No ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Particulars of Salary: If You Are A Handicapped Employee, Yes/NoDocument13 pagesParticulars of Salary: If You Are A Handicapped Employee, Yes/NoMushtaq AhmadNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkDocument2 pagesT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkDocument2 pagesT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Project Registration FormDocument1 pageT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Project Registration FormChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Important DatesDocument1 pageT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Important DatesChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Zeroth ReviewDocument1 pageT.J.S. Engineering College: Zeroth ReviewChithambaramaniRamalingamNo ratings yet

- Project Title: Guide Name, DesignationDocument3 pagesProject Title: Guide Name, DesignationChithambaramaniRamalingamNo ratings yet

- S.No Register Number Name Mark (10) : Internal Examiner External ExaminerDocument3 pagesS.No Register Number Name Mark (10) : Internal Examiner External ExaminerChithambaramaniRamalingamNo ratings yet

- Final Yr NamelistDocument4 pagesFinal Yr NamelistChithambaramaniRamalingamNo ratings yet

- FINALYEARPROJECTBATCHDocument4 pagesFINALYEARPROJECTBATCHChithambaramaniRamalingamNo ratings yet

- Roll No Name Attendance MCQ (15) Record MarkDocument4 pagesRoll No Name Attendance MCQ (15) Record MarkChithambaramaniRamalingamNo ratings yet

- Comparison of Open-Source PAAS Architectural Compo PDFDocument10 pagesComparison of Open-Source PAAS Architectural Compo PDFChithambaramaniRamalingamNo ratings yet

- Random Experiment Numbers: Internal Examiner External ExaminerDocument2 pagesRandom Experiment Numbers: Internal Examiner External ExaminerChithambaramaniRamalingamNo ratings yet

- List of Questions: 1: Internal Examiner External ExaminerDocument3 pagesList of Questions: 1: Internal Examiner External ExaminerChithambaramaniRamalingamNo ratings yet

- Semantic Web Ontology For Automated Web Services Discovery in Soa SystemDocument2 pagesSemantic Web Ontology For Automated Web Services Discovery in Soa SystemChithambaramaniRamalingamNo ratings yet

- Contact DetailsDocument1 pageContact DetailsChithambaramaniRamalingamNo ratings yet

- Rajalakshmi Engineering College, Thandalam - 602105 Subject Code / NameDocument5 pagesRajalakshmi Engineering College, Thandalam - 602105 Subject Code / NameChithambaramaniRamalingamNo ratings yet

Name of The Employee With Designation Gender General/ Women/ SR - CTZN/ Sup SR - STZN Pan No Income

Name of The Employee With Designation Gender General/ Women/ SR - CTZN/ Sup SR - STZN Pan No Income

Uploaded by

ChithambaramaniRamalingam0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document contains details of an employee's income, deductions, and tax calculations. It lists the employee's name, gender, PAN number, and gross salary income of Rs. 357696. It then lists various deductions totaling Rs. 190388 including conveyance, medical reimbursement, house loan interest, GPF contributions, and donations eligible for tax exemptions. The taxable income is calculated as Rs. 167308. As the employee is in the general/women category, the first Rs. 200000 is exempted and the tax amount is calculated as Rs. 0 since the income is below Rs. 500000 which is taxed at 10%.

Original Description:

rec

Original Title

New Microsoft Office Excel Worksheet (1)

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains details of an employee's income, deductions, and tax calculations. It lists the employee's name, gender, PAN number, and gross salary income of Rs. 357696. It then lists various deductions totaling Rs. 190388 including conveyance, medical reimbursement, house loan interest, GPF contributions, and donations eligible for tax exemptions. The taxable income is calculated as Rs. 167308. As the employee is in the general/women category, the first Rs. 200000 is exempted and the tax amount is calculated as Rs. 0 since the income is below Rs. 500000 which is taxed at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views2 pagesName of The Employee With Designation Gender General/ Women/ SR - CTZN/ Sup SR - STZN Pan No Income

Name of The Employee With Designation Gender General/ Women/ SR - CTZN/ Sup SR - STZN Pan No Income

Uploaded by

ChithambaramaniRamalingamThis document contains details of an employee's income, deductions, and tax calculations. It lists the employee's name, gender, PAN number, and gross salary income of Rs. 357696. It then lists various deductions totaling Rs. 190388 including conveyance, medical reimbursement, house loan interest, GPF contributions, and donations eligible for tax exemptions. The taxable income is calculated as Rs. 167308. As the employee is in the general/women category, the first Rs. 200000 is exempted and the tax amount is calculated as Rs. 0 since the income is below Rs. 500000 which is taxed at 10%.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 2

Name of the employee with Designation

Gender General/ Women/ Sr.Ctzn/ Sup Sr.Stzn

PAN No

INCOME

Gross Only Salary Income

Other Income if any (Bank Int + NSC Int etc)

Income From One House Property(If Loss Put minus signe)

Total

DEDUCTIONS

Conveyance ( Max Rs. 9600/- P.A.)

Medical Reimbursment Allown (Max Rs.15000/- P.A)

Proff. Tax (P.TAX)[U/s 16(iii)

House Building Loan Interest (U/s 16(ii) (Max Rs.150000/-)

Total of U/s 10 &16

G.P.F.

GISL/ G.I.S. E.S.I.

P.L.I.

LIC

Tution Fees

N.S.C.

House Building Loan Principal

P.P.F.

Stamp Duty/ Registration Fees

House Building Loan Principal

Fixed Deposite (above 5 Years)

Equity Link Savings Bond

TOTAL OF 80 C

R.Chithambaramani AP

General

BBVPC2602R

357696

357696

9600

15000

2180

26780

28100

96508

( Max.Rs. 1,00,000/-)

80 E (Interest paid for Education Loan)

80G (Donation to the Charitable Fund)

80GG (House Rent Paid

[ who have not get House Rent]

80 GGA (Donation for Rural Development or Scientific

80GGC

( Any Contribute to Political Party )

80U (Exemption for Ph.Handcpd employee, Max Rs. 50,000/-)

80 DD (Medical treatment for self or dependent family

member)[Max.Rs. 50,000/- handcpd or mentaly disordered

80D (Medical Insurance Paid including C.G. Health Scheme,

Max Rs. 15,000/-)

80DDB (only for particular desease) (Medical treatmet for sever

decease for self or dependent)

TOTAL OF VI A

124608

24000

15000

39000

TOTAL EXEMPTION

190388

TAXABLE IMCOME

167308

GENERAL & WOMEN

EXEMPTED UPTO 200000 NIL

200001-500000 10%

500001 - 1000000 20%

ABOVE 1000000 30%

EDU CHESS 3%

TAX AMOUNT

NIL

SENIOR CITIZEN

EXEMPTED UPTO 250000 NIL

250001-500000 10%

500001 - 1000000 20%

ABOVE 1000000 30%

EDU CHESS 3%

TAX AMOUNT

You might also like

- PF No.: Any Other Income Reported by The Employee (Value of Perquisites, Income From House Property Etc.)Document5 pagesPF No.: Any Other Income Reported by The Employee (Value of Perquisites, Income From House Property Etc.)neerajkumarvit09No ratings yet

- Annual Income Tax Statement For The Financial Year 2013Document4 pagesAnnual Income Tax Statement For The Financial Year 2013Manoj SankaranarayanaNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Calc Familyr PensionDocument2 pagesCalc Familyr PensionmicrostrategyhydNo ratings yet

- JSK It Returns 2011 12 AuttDocument3 pagesJSK It Returns 2011 12 AuttGobi S Gobi SNo ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11LordEnigma18No ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- IT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsDocument106 pagesIT-Statement&Relief Calculator-FY-16-17 (Ubuntu) - 2.odsnarayanan630% (1)

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- 36 8 8 Income Tax Return Preparation Forall Govt Employees Fy 11 12Document11 pages36 8 8 Income Tax Return Preparation Forall Govt Employees Fy 11 12chandu3060No ratings yet

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiNo ratings yet

- IT - Cal - With - Form - 16 - 2011-12Document13 pagesIT - Cal - With - Form - 16 - 2011-12seeyem2000No ratings yet

- Fill in The Data Below: 0706764 B. Sankar SinghDocument24 pagesFill in The Data Below: 0706764 B. Sankar SinghMurali Krishna VNo ratings yet

- 12.TAX 4-IT FormatDocument4 pages12.TAX 4-IT FormatRagavendra RagsNo ratings yet

- Income Statement For Year 2009 - 10: EarningsDocument4 pagesIncome Statement For Year 2009 - 10: EarningsGajanan JagtapNo ratings yet

- The Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowDocument1 pageThe Details of Income (Other Than Salary) and The Saving For The Purpose Mentioned Above May Kindly Be Considered As Detailed BelowindianroadromeoNo ratings yet

- Pay SlipDocument1 pagePay SlipAnonymous QrLiISmpF100% (1)

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaNo ratings yet

- Auto CTC Salary CalculatorDocument1 pageAuto CTC Salary CalculatorSathvika SaaraNo ratings yet

- 1 Form 16 16a LatestDocument25 pages1 Form 16 16a LatestNishant GhaseNo ratings yet

- Earnings: 10 Ca (PH Allowance)Document15 pagesEarnings: 10 Ca (PH Allowance)asrahaman9No ratings yet

- CTC Break-Up PDFDocument5 pagesCTC Break-Up PDFJatinder SadhanaNo ratings yet

- Salary Breakup SheetDocument6 pagesSalary Breakup SheetSathvika SaaraNo ratings yet

- T K ArumugamDocument7 pagesT K ArumugamThangamNo ratings yet

- Mar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015Document6 pagesMar - 2015 April - 2015 May - 2015 June - 2015: July - 2015 Aug - 2015 DA Arr. Sept - 2015 Oct - 2015 Nov - 2015 Da Arr. Dec - 2015akstrmec23No ratings yet

- 212619X Form16Document1 page212619X Form16Ajay KumarNo ratings yet

- Tax Calculation Statement: IncomeDocument4 pagesTax Calculation Statement: IncomeDrAnjani K KumarNo ratings yet

- Income Tax Proj Nov09Document530 pagesIncome Tax Proj Nov09nilesh_jain27No ratings yet

- 1604-CF FormDocument2 pages1604-CF Formjenie_rojen200423100% (2)

- CFfinalDocument4 pagesCFfinalAngela ArleneNo ratings yet

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesDocument6 pagesAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesStanly OrtizNo ratings yet

- St. Anne'S Girls High School. Halasuru, Bangalore-560 008 Calculation of Income Tax For The Year 2015-16 Assessment Year 2016-17Document2 pagesSt. Anne'S Girls High School. Halasuru, Bangalore-560 008 Calculation of Income Tax For The Year 2015-16 Assessment Year 2016-17Rama KurubaNo ratings yet

- Income Tax Calculator For MaleDocument19 pagesIncome Tax Calculator For MaleAlok SaxenaNo ratings yet

- Form 16Document4 pagesForm 16neel721507No ratings yet

- IT Calculator, Mohandas 2013Document36 pagesIT Calculator, Mohandas 2013DEEPTHISAINo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- It FormDocument13 pagesIt FormMani Vannan JNo ratings yet

- Income Tax (Master)Document1 pageIncome Tax (Master)nareshjangra397No ratings yet

- 12ba KishanDocument11 pages12ba KishanChaitanya SwaroopNo ratings yet

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Tax SimulationDocument1 pageTax SimulationSupriadi DaudNo ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxDocument16 pagesIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- Classification of Taxes PPT DomsDocument37 pagesClassification of Taxes PPT DomsBabasab Patil (Karrisatte)No ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Particulars of Salary: If You Are A Handicapped Employee, Yes/NoDocument13 pagesParticulars of Salary: If You Are A Handicapped Employee, Yes/NoMushtaq AhmadNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkDocument2 pagesT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkDocument2 pagesT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project WorkChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Project Registration FormDocument1 pageT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Project Registration FormChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Important DatesDocument1 pageT.J.S. Engineering College: Department of Computer Science and Engineering CS8811-Project Work Important DatesChithambaramaniRamalingamNo ratings yet

- T.J.S. Engineering College: Zeroth ReviewDocument1 pageT.J.S. Engineering College: Zeroth ReviewChithambaramaniRamalingamNo ratings yet

- Project Title: Guide Name, DesignationDocument3 pagesProject Title: Guide Name, DesignationChithambaramaniRamalingamNo ratings yet

- S.No Register Number Name Mark (10) : Internal Examiner External ExaminerDocument3 pagesS.No Register Number Name Mark (10) : Internal Examiner External ExaminerChithambaramaniRamalingamNo ratings yet

- Final Yr NamelistDocument4 pagesFinal Yr NamelistChithambaramaniRamalingamNo ratings yet

- FINALYEARPROJECTBATCHDocument4 pagesFINALYEARPROJECTBATCHChithambaramaniRamalingamNo ratings yet

- Roll No Name Attendance MCQ (15) Record MarkDocument4 pagesRoll No Name Attendance MCQ (15) Record MarkChithambaramaniRamalingamNo ratings yet

- Comparison of Open-Source PAAS Architectural Compo PDFDocument10 pagesComparison of Open-Source PAAS Architectural Compo PDFChithambaramaniRamalingamNo ratings yet

- Random Experiment Numbers: Internal Examiner External ExaminerDocument2 pagesRandom Experiment Numbers: Internal Examiner External ExaminerChithambaramaniRamalingamNo ratings yet

- List of Questions: 1: Internal Examiner External ExaminerDocument3 pagesList of Questions: 1: Internal Examiner External ExaminerChithambaramaniRamalingamNo ratings yet

- Semantic Web Ontology For Automated Web Services Discovery in Soa SystemDocument2 pagesSemantic Web Ontology For Automated Web Services Discovery in Soa SystemChithambaramaniRamalingamNo ratings yet

- Contact DetailsDocument1 pageContact DetailsChithambaramaniRamalingamNo ratings yet

- Rajalakshmi Engineering College, Thandalam - 602105 Subject Code / NameDocument5 pagesRajalakshmi Engineering College, Thandalam - 602105 Subject Code / NameChithambaramaniRamalingamNo ratings yet