Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsThe GRC Value Proposition

The GRC Value Proposition

Uploaded by

vinayakraaoValue proposition

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

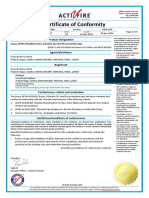

- NACE MR0175 Certified User Carbon Steel (CS) Certification - AMPPDocument3 pagesNACE MR0175 Certified User Carbon Steel (CS) Certification - AMPPvinayakraaoNo ratings yet

- Afp3206 Apr 24Document3 pagesAfp3206 Apr 24vinayakraaoNo ratings yet

- Afp2977 Apr 24Document3 pagesAfp2977 Apr 24vinayakraaoNo ratings yet

- Lic Cards Rewards CatalogueDocument2 pagesLic Cards Rewards CataloguevinayakraaoNo ratings yet

- Duties and Responsibilities of A Director of A Private Limited Company - IpleadersDocument5 pagesDuties and Responsibilities of A Director of A Private Limited Company - IpleadersvinayakraaoNo ratings yet

- EN 10219 (Valid Till 31-03-2026)Document2 pagesEN 10219 (Valid Till 31-03-2026)vinayakraaoNo ratings yet

- KOP To NGP ScheduleDocument1 pageKOP To NGP SchedulevinayakraaoNo ratings yet

- As 4680-2006Document7 pagesAs 4680-2006vinayakraaoNo ratings yet

- Metro Trading (Dona)Document5 pagesMetro Trading (Dona)vinayakraaoNo ratings yet

- Sukanya Samriddhi Account Scheme Yojana by GovDocument22 pagesSukanya Samriddhi Account Scheme Yojana by GovvinayakraaoNo ratings yet

- Surya Roshni Annual Report 2012-13Document80 pagesSurya Roshni Annual Report 2012-13vinayakraaoNo ratings yet

- Pictorial Standards ISO 8501 1Document2 pagesPictorial Standards ISO 8501 1vinayakraaoNo ratings yet

- 5S Sab KucchaDocument89 pages5S Sab KucchavinayakraaoNo ratings yet

The GRC Value Proposition

The GRC Value Proposition

Uploaded by

vinayakraao0 ratings0% found this document useful (0 votes)

3 views4 pagesValue proposition

Original Title

The GRC Value Proposition[1]

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentValue proposition

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views4 pagesThe GRC Value Proposition

The GRC Value Proposition

Uploaded by

vinayakraaoValue proposition

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

february 6, 2013

Risk News & Resources

The GRC Value Proposition

By Brenda Boultwood

When it comes to governance, risk

and compliance (GRC), many organizations are at a crossroads. On the

one hand, they understand the importance of implementing effective

GRC processes and systems to deal

with a growing range of risks and

regulations. But on the other hand,

they are under tremendous pressure

to cut costs.

In 2012, KPMG reported that

the annual cost of GRC consumes

more than 6% of organizations

annual revenues. Almost two-thirds

of respondents considered GRC

convergence a cost, rather than an

investment, and only 31% said that

they were effective at quantifying the

benefits of these activities. Eightynine percent say that the cost had

increased over the past two years,

while 84% expected it to grow further in the next two years.

How then does one build an

internal business case for GRC that

can justify the corresponding costs?

Is there any tangible value (in terms

of dollars and cents) in establishing

a GRC program? Can better risk

and compliance management lead to

actual profits, and how can GRC be

leveraged to not only protect, but

create, value?

The challenge lies in the sheer

complexity of the concept. Take,

for instance, the C part of GRC

compliance. Every year, organizations across industries are hit

with thousands of new regulatory

announcements that impact business

operations and strategy. It can extremely time-consuming, costly and

exhausting to not only keep track of

these new regulatory requirements

but to analyze them and to implement new compliance processes.

There are also multiple internal

compliance requirements to deal

with in areas such as HR, product

quality and health and safety. Addressing these various obligations

both internal and external has

become a multimillion dollar challenge at many organizations. And

thats just the compliance bit. Risk

management and governance can be

equally complex.

Its therefore understandable that

many organizations look at GRC

almost as a burden. The truth is that

GRC can not only help mitigate

risks and ensure compliance, but also

drive business value and profitability.

Now lets examine a quartet ways

in which GRC contributes to the

bottom line:

viewing the insurance policies, an organization could try leveraging loss

event data from risk management

processes to determine if they need

to continue paying the same kind of

premiums.

If the loss event data shows that

the total annual property losses

accrued by the organization are less

than the annual insurance premium, the organization could consider

canceling the whole insurance policy,

and opt for self-insurance instead.

Alternatively, the organization

could opt for higher deductibles to

reduce premiums. At a minimum, the

organization must have a data-driven

and risk-based dialog about what type

of insurance makes the most sense.

An organization could also leverage a risk-based approach to property insurance. This would involve

assessing the risk of damages to

physical property, and then determining if that risk is worth insuring

in comparison to other business

risks. If the risk priority is low, the

organization can again cancel the

property insurance policy or reduce

the premium amount, and thereby

save significant costs.

This kind of risk prioritization is an integral part of an

effective enterprise risk management (ERM) program. It tells the

organization which risks need

more resources and attention than

others. Overall, an ERM program

can help reduce insurance premiums significantly.

PRINTED COPY FOR

PERSONAL READING ONLY.

1. Cost Savings

While GRC is most often viewed

NOT FOR DISTRIBUTION.

as an expense, it can also be a

The Case for GRC

Governance, risk management and

compliance are not new concepts.

However, implementing them in

an integrated model aligned with

business processes and strategic objectives is still something with which

many organizations are struggling.

cost-saver. Take, for instance, the

area of property insurance. The premiums can be a significant expense

for any organization. But while re-

Lets look at another example:

Director and Officers Liability

(D&O) insurance, which, as the

name suggests, protects the directors and officers of an organization

against the losses suffered from business-related lawsuits. A robust ERM

program with well-thought-out and

well-implemented controls can help

keep D&O liabilities in check, and

thereby limit the associated premiums. The mere existence of such a

program, backed by strong data, can

be a basis for insurance companies

to reduce umbrella-type insurance

premiums.

A good place to start would be in

the area of control testing. In most

organizations, a single control is tested multiple times by multiple groups.

For instance, to comply with SOX

Section 404, an information security

control might be tested not only by

the Finance department, but also the

IT department, the internal audit

department and external auditors.

Intuitively, many organizations

know this overlap exists, but politics

and scarce data prevent them from

getting a clear picture of the duplication. In addition to diluting accountability, this duplication in testing

simply wastes costs and effort.

grated and streamlined approach

to GRC can help. It brings together, standardizes and systematizes

all risk, control, compliance, and

governance processes. It also helps

eliminate redundancies by ensuring

that only one group is appointed to

perform each activity. Thus, in the

previous example, only the internal

audit group would be responsible

for testing the information security

control to comply with SOX Section

404. This allows the other groups to

devote their time and effort to more

value-added activities, or to other

control testing requirements.

PRINTED COPY FOR PERSONAL READING ONLY.

NOT FOR DISTRIBUTION.

Thats one way to save costs

Clearly, GRC can be a signifi-

cant cost saver. At the same, GRC

processes and systems will cost the

organization. How then does one

optimize GRC costs?

Why should so many groups test

the same control when just one

group can? This is where an inte-

through integrated GRC. Another is

by replacing multiple siloed technology systems (e.g., the audit management system and the supply chain

compliance management system)

with a common GRC framework that

extends across the enterprise. This

helps organizations do away with

political silos and their inefficiencies

and extra costs, and instead manage

their processes, systems and people

more collaboratively.

2. Enhanced Profitability and

Capital Allocation

Regulatory requirements such as

Basel III obligate banks and financial

services organizations to set aside

sufficient capital to act as a buffer against operational risk events.

But this kind of capital allocation

isnt limited to banks and financial

services institutions (BFSIs). Most

organizations across industries strive

to optimize capital allocation across

business units in a way that is beneficial to stakeholders. But how can one

determine those areas of the business

that need more capital, and those

that dont?

Risk assessments and loss event

data play a key role here by providing an accurate picture of expected

and unexpected losses. Based on this

loss data, as well as the probability

and impact of risks, executives can

confidently decide whether a particular part of the business is taking

too many risks (in which case, capital

can be taken away) or too little risks

(in which case, more capital can be

allocated). Taking capital away from

a business cancels its ability to take

risk; conversely, allocating more

capital to the business encourages

risk-taking.

Lets go a step further. When

organizations perform risk-control

assessments, they will be able to

determine whether or not there are

sufficient controls to mitigate a risk.

In some cases, they might find that

there are too few controls; in others,

there may be so many controls that

the residual risk is low in relation

to the organizations risk appetite.

In such cases, controls can be eliminated, and the associated spending

reduced. Moreover, in these areas,

organizations can afford to take more

risks and seize more opportunities.

On the flip side, if there are too

few controls or if the control effectiveness score is low, organizations

need to invest in enhancing them.

This is where a centralized approach

to GRC helps, by enabling enterprise-level tracking of the estimates

identified to enhance or fix controls

associated with the areas of greatest

risk. This, in turn, allows organizations to accurately plan and optimize

their resources accordingly.

3. Greater Transparency

The average organization today is a

complex organism with multiple people, hierarchies, business lines, suppliers/vendors and global operations.

The greater the complexity, the more

difficult is it to ensure risk transparency. But the more the risk transparency, the more value the organization

holds in the eyes of investors. Greater

risk transparency also allows management to make smarter and more

informed strategic decisions.

That said, it is still a struggle for

many organizations to gain a complete and integrated view of their

enterprise risks. It doesnt help that

each department or business line has

their own risk management processes,

systems and language that are separate and different from those of other

departments in the organization.

GRC is about fostering greater

risk collaboration, harmonization

and standardization across the complete enterprise including suppliers, vendors and business partners.

Visionary organizations are leading

the way by establishing a common

vocabulary of risks and controls

across the business. Some are leveraging enterprise risk heat maps that

highlight areas of concern across

qualitative and quantitative risk factors. Many are trying to adopt more

advanced risk analytics.

provide complete visibility into how

risks are linked to each business process, and how these business processes in turn are linked to strategic objectives. Organizations that are able

to create this mapping, and leverage

risk-based inputs in strategic decision-making are better positioned to

decide, for instance, whether or not

it to make a new acquisition or to

expand into a new geography or to

grow a new line of the business.

4. Improved Resiliency

Too often, business groups performing various GRC activities tend

to operate in silos with little or no

collaboration or sharing of information. Any data related to risks, controls or audit data is usually managed

and stored in multiple spreadsheets

or in different systems.

This approach not only creates

silos and inefficiency, but also makes

it difficult to locate data easily. The

challenge is compounded if employees responsible for certain data (e.g.,

internal audit) leave the organization

or move to a different role. If the organization then needs to access data

on priority, they might have to rely

on someones memory of where that

data was stored.

With an integrated GRC system, data management becomes

much more organized, efficient and

convenient. All risk or compliance

related data can be stored in a single,

centralized, enterprise-level framework, making it easy and quick to

find something. Organizations can

consequently become more resilient

to staffing changes and attrition.

Parting Thoughts

Over the last decade, many organizations have had to invest in GRC

to comply with various regulations.

But have they realized all the benefits that GRC has had to offer? Have

they been able to look at GRC not

merely as a way to avoid non-compliance penalties, but as a valuable

tool to drive revenue and increase

their competitive advantage?

PRINTED COPY FOR PERSONAL READING ONLY.

NOT FOR DISTRIBUTION.

At the end of the day, GRC

processes and systems can and must

Those are questions that each

organization might find useful to ask

as they develop their risk and compliance plans for the new year. No

doubt, investing in GRC is not inexpensive. But the rewards gained from

effective GRC processes and systems

far outweigh the investments made.

The key is to make GRC an integral

part of organizational culture, where

it percolates down into everyday

business processes and decision-making at every level.

Technology also plays a significant

role by simplifying GRC processes,

optimizing resources, streamlining and automating workflows and

enabling real-time monitoring and

reporting. When technology is coupled with people and processes under

the common umbrella of GRC,

organizations are well- positioned to

distinguish between risks and opportunities successfully as well as

to optimize costs, improve financial

and operational stability and gain

the trust of regulators, stakeholders,

investors and customers.

Brenda Boultwood is the vice president of industry solutions at MetricStream. She is responsible for a portfolio

of key industry verticals, including

energy and utilities, federal agencies,

strategic banking and financial services. She has had a rich career in risk

management, and has held several key

operating roles at some of the largest

global organizations.

Most recently, prior to joining MetricStream, she served as senior vice president

and chief risk officer at Constellation

Energy. Prior to that, she served as global

head of strategy, Alternative Investment

Services, at J.P. Morgan Chase, where

she developed the strategy for the companys hedge fund services, private equity

fund services, leveraged loan services and

global derivative services. During her

tenure at J.P. Morgan Chase, Brenda

also served as global head of strategic risk

management for its Treasury Services

group. Earlier in her career, at Bank One

Corporation, she worked as the head of

corporate market risk management and

counterparty credit, and head of corporate

operational risk management, before

advancing to head of global risk management for the companys Global Treasury

Services group. She has also been a board

member of the Global Association of Risk

Professionals (GARP), and currently

serves on the board of the Committee of

Chief Risk Officers (CCRO).

PRINTED COPY FOR PERSONAL READING ONLY.

NOT FOR DISTRIBUTION.

(#78166) Reprinted with permission from the February 6, 2013 issue of GARP. Copyright 2013 Global Association of Risk Professionals.

For more information about reprints from GARP, please visit PARS International Corp. at www.magreprints.com.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NACE MR0175 Certified User Carbon Steel (CS) Certification - AMPPDocument3 pagesNACE MR0175 Certified User Carbon Steel (CS) Certification - AMPPvinayakraaoNo ratings yet

- Afp3206 Apr 24Document3 pagesAfp3206 Apr 24vinayakraaoNo ratings yet

- Afp2977 Apr 24Document3 pagesAfp2977 Apr 24vinayakraaoNo ratings yet

- Lic Cards Rewards CatalogueDocument2 pagesLic Cards Rewards CataloguevinayakraaoNo ratings yet

- Duties and Responsibilities of A Director of A Private Limited Company - IpleadersDocument5 pagesDuties and Responsibilities of A Director of A Private Limited Company - IpleadersvinayakraaoNo ratings yet

- EN 10219 (Valid Till 31-03-2026)Document2 pagesEN 10219 (Valid Till 31-03-2026)vinayakraaoNo ratings yet

- KOP To NGP ScheduleDocument1 pageKOP To NGP SchedulevinayakraaoNo ratings yet

- As 4680-2006Document7 pagesAs 4680-2006vinayakraaoNo ratings yet

- Metro Trading (Dona)Document5 pagesMetro Trading (Dona)vinayakraaoNo ratings yet

- Sukanya Samriddhi Account Scheme Yojana by GovDocument22 pagesSukanya Samriddhi Account Scheme Yojana by GovvinayakraaoNo ratings yet

- Surya Roshni Annual Report 2012-13Document80 pagesSurya Roshni Annual Report 2012-13vinayakraaoNo ratings yet

- Pictorial Standards ISO 8501 1Document2 pagesPictorial Standards ISO 8501 1vinayakraaoNo ratings yet

- 5S Sab KucchaDocument89 pages5S Sab KucchavinayakraaoNo ratings yet