Professional Documents

Culture Documents

BetterInvesting Weekly Stock Screen 12-1-14

BetterInvesting Weekly Stock Screen 12-1-14

Uploaded by

BetterInvestingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BetterInvesting Weekly Stock Screen 12-1-14

BetterInvesting Weekly Stock Screen 12-1-14

Uploaded by

BetterInvestingCopyright:

Available Formats

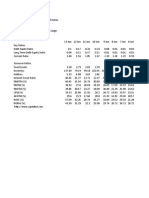

Company Name

BlackRock

Cummins

Copa Holdings SA

Fastenal

Flowers Foods

Healthcare Services Group

j2 Global

Coca-Cola Femsa SAB de CV

Lorillard

Microsoft

MSC Industrial Direct Co

Nu Skin Enterprises

Oritani Financial Corp

Raven Industries

Sunoco Logistics Partners LP

Syngenta AG

T. Rowe Price Group

WPP PLC

Symbol

BLK

CMI

CPA

FAST

FLO

HCSG

JCOM

KOF

LO

MSFT

MSM

NUS

ORIT

RAVN

SXL

SYT

TROW

WPPGY

WEEK OF DECEMBER 1, 2014

Hist 10Yr Hist 10 Yr Rev R2 EPS R2 Cur Div

Rev Gr

EPS Gr

10 Yr 10 Yr Yield

Industry

Asset Management

33.1%

23.7%

0.87

0.93

2.2%

Diversified Industrials

7.8%

17.5%

0.79

0.71

2.1%

Airlines

20.5%

21.0%

0.95

0.93

3.5%

Industrial Distribution

10.3%

13.6%

0.91

0.86

2.2%

Packaged Foods

9.3%

15.0%

0.97

0.90

2.7%

Business Services

11.7%

10.9%

0.98

0.92

2.3%

Software - Infrastructure

15.9%

15.4%

0.95

0.92

2.0%

Beverages - Soft Drinks

12.9%

13.5%

0.99

0.82

2.1%

Tobacco

9.5%

11.0%

0.96

0.98

3.9%

Software - Infrastructure

8.4%

10.2%

0.96

0.85

2.6%

Industrial Distribution

9.5%

9.5%

0.89

0.73

2.0%

Household & Personal Products

10.6%

24.3%

0.79

0.73

3.3%

Banks - Regional - US

17.7%

35.8%

0.95

0.80

4.8%

Diversified Industrials

10.2%

11.4%

0.93

0.87

2.3%

Oil & Gas Midstream

15.9%

20.6%

0.81

0.93

3.0%

Agricultural Inputs

8.5%

16.7%

0.95

0.86

3.4%

Asset Management

10.2%

11.4%

0.90

0.81

2.1%

Advertising Agencies

8.2%

8.4%

0.92

0.74

2.8%

Screen Notes

MyStockProspector screen on Dec. 3

10-year annual sales, EPS growth of at least 7%

10-year annual sales, EPS growth R2 of 0.70 and higher

Annual dividend growth exceeding 10%

10-year annual dividend growth R2 of 0.80 and above

Current dividend yield of at least 2%

Analysts' projected 5-year annual EPS growth of 7% and higher

Dividend Proj 5 Yr

Div Gr R2 10 Yr EPS Gr

24.0%

0.96

11.0%

27.4%

0.97

7.9%

48.2%

0.82

19.6%

25.7%

0.98

16.1%

19.0%

0.93

8.0%

25.1%

0.90

18.0%

55.2%

0.85

10.0%

31.3%

0.94

17.2%

25.8%

0.85

8.4%

14.3%

0.98

9.3%

11.7%

0.97

14.0%

12.9%

0.85

11.2%

22.7%

0.98

12.0%

16.8%

0.98

10.0%

12.0%

0.99

10.2%

23.9%

0.97

9.0%

15.7%

0.96

9.8%

14.0%

0.93

8.9%

You might also like

- BetterInvesting Weekly Stock Screen 7-28-14Document1 pageBetterInvesting Weekly Stock Screen 7-28-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-12-15Document1 pageBetterInvesting Weekly Stock Screen 1-12-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 12-9-13Document1 pageBetterInvesting Weekly Stock Screen 12-9-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-23-15Document1 pageBetterInvesting Weekly Stock Screen 11-23-15BetterInvestingNo ratings yet

- BetterInvestng Weekly Stock Screen 1-2-17Document1 pageBetterInvestng Weekly Stock Screen 1-2-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-29-15Document1 pageBetterInvesting Weekly Stock Screen 6-29-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-25-13Document1 pageBetterInvesting Weekly Stock Screen 11-25-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-22-16Document1 pageBetterInvesting Weekly Stock Screen 8-22-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-28-16Document1 pageBetterInvesting Weekly Stock Screen 3-28-16BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 10-24-16Document1 pageBetterInvesting Weekly Stock Screen 10-24-16BetterInvestingNo ratings yet

- BetterInvesting Weekly - Stock Screen - 3-5-12Document1 pageBetterInvesting Weekly - Stock Screen - 3-5-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-24-14Document1 pageBetterInvesting Weekly Stock Screen 2-24-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-22-17Document1 pageBetterInvesting Weekly Stock Screen 5-22-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 12-16-13Document1 pageBetterInvesting Weekly Stock Screen 12-16-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-27-17Document1 pageBetterInvesting Weekly Stock Screen 2-27-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-25-17Document1 pageBetterInvesting Weekly Stock Screen 9-25-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-26-17Document1 pageBetterInvesting Weekly Stock Screen 6-26-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-13Document1 pageBetterInvesting Weekly Stock Screen 6-3-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-7-17Document1 pageBetterInvesting Weekly Stock Screen 8-7-17BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-30-12Document1 pageBetterInvesting Weekly Stock Screen 4-30-12BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-25-16Document1 pageBetterInvesting Weekly Stock Screen 7-25-16BetterInvestingNo ratings yet

- Monthly 25 Stocks For October 2014Document10 pagesMonthly 25 Stocks For October 2014Stephen CastellanoNo ratings yet

- BetterInvesting Weekly Stock Screen 091012Document6 pagesBetterInvesting Weekly Stock Screen 091012BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-28-14Document1 pageBetterInvesting Weekly Stock Screen 4-28-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-19Document1 pageBetterInvesting Weekly Stock Screen 1-23-19BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 9-16-13Document3 pagesBetterInvesting Weekly Stock Screen 9-16-13BetterInvestingNo ratings yet

- 8990 Initiation Cimb Format PDFDocument33 pages8990 Initiation Cimb Format PDFrtfirefly168No ratings yet

- BetterInvesting Weekly Stock Screen 9-7-15Document1 pageBetterInvesting Weekly Stock Screen 9-7-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-13Document1 pageBetterInvesting Weekly Stock Screen 4-15-13BetterInvestingNo ratings yet

- 2012 Inc.5000 Companies Located in Massachusetts.: Rank Company Name 3-YEAR % Growth Revenue (Millions) StateDocument4 pages2012 Inc.5000 Companies Located in Massachusetts.: Rank Company Name 3-YEAR % Growth Revenue (Millions) StateWilliam HarrisNo ratings yet

- BetterInvesting Weekly Stock Screen 5-7-18Document1 pageBetterInvesting Weekly Stock Screen 5-7-18BetterInvestingNo ratings yet

- Barings To Miami Pension PlanDocument25 pagesBarings To Miami Pension Planturnbj75No ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-16Document1 pageBetterInvesting Weekly Stock Screen 5-16-16BetterInvestingNo ratings yet

- Daily Trade Journal - 05.03.2014Document6 pagesDaily Trade Journal - 05.03.2014Randora LkNo ratings yet

- ValuEngine Weekly Newsletter February 17, 2012Document10 pagesValuEngine Weekly Newsletter February 17, 2012ValuEngine.comNo ratings yet

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDocument6 pagesUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkNo ratings yet

- BetterInvesting Weekly Stock Screen 2-16-15Document1 pageBetterInvesting Weekly Stock Screen 2-16-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-1-13Document1 pageBetterInvesting Weekly Stock Screen 4-1-13BetterInvestingNo ratings yet

- PWC WaccDocument5 pagesPWC WaccChin-Han YuNo ratings yet

- BetterInvesting Weekly Stock Screen 3-3-14Document1 pageBetterInvesting Weekly Stock Screen 3-3-14BetterInvestingNo ratings yet

- ValuEngine Weekly Newsletter July 23, 2010Document15 pagesValuEngine Weekly Newsletter July 23, 2010ValuEngine.comNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-17Document1 pageBetterInvesting Weekly Stock Screen 1-23-17BetterInvestingNo ratings yet

- Infosys Financial RatiosDocument2 pagesInfosys Financial RatiosvaasurastogiNo ratings yet

- Mstar Anss 14 01Document1 pageMstar Anss 14 01derek_2010No ratings yet

- ValuEngine Weekly Newsletter March 30, 2010Document15 pagesValuEngine Weekly Newsletter March 30, 2010ValuEngine.comNo ratings yet

- BetterInvesting Weekly Stock Screen 9-28-15Document1 pageBetterInvesting Weekly Stock Screen 9-28-15BetterInvestingNo ratings yet

- ValuEngine Weekly December 10, 2010Document9 pagesValuEngine Weekly December 10, 2010ValuEngine.comNo ratings yet

- Top SCM SoftwaresDocument6 pagesTop SCM SoftwaresSachin PanpatilNo ratings yet

- BetterInvesting Weekly Stock Screen 11-30-15Document1 pageBetterInvesting Weekly Stock Screen 11-30-15BetterInvestingNo ratings yet

- Corporate Presentation: February, 2011Document21 pagesCorporate Presentation: February, 2011FibriaRINo ratings yet

- BetterInvesting Weekly Stock Screen 12-3-12Document1 pageBetterInvesting Weekly Stock Screen 12-3-12BetterInvestingNo ratings yet

- HCL Technologies LTD Industry:Computers - Software - LargeDocument2 pagesHCL Technologies LTD Industry:Computers - Software - LargevaasurastogiNo ratings yet

- Idea Cellular LTD: Key Financial IndicatorsDocument4 pagesIdea Cellular LTD: Key Financial IndicatorsGanesh DeshiNo ratings yet

- Software Transparency: Supply Chain Security in an Era of a Software-Driven SocietyFrom EverandSoftware Transparency: Supply Chain Security in an Era of a Software-Driven SocietyNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-28-19Document1 pageBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-7-19Document1 pageBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-2-19Document1 pageBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-19Document1 pageBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-2-19Document1 pageBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-19Document1 pageBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-1-19Document1 pageBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-16-18Document1 pageBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-5-19Document1 pageBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-19Document1 pageBetterInvesting Weekly Stock Screen 1-23-19BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 6-10-19Document1 pageBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-9-19Document1 pageBetterInvesting Weekly Stock Screen 4-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-22-19Document1 pageBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-25-19Document1 pageBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-11-19Document1 pageBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingNo ratings yet

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- Financial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrDocument2 pagesFinancial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrBetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-19-18Document1 pageBetterInvesting Weekly Stock Screen 11-19-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-5-18Document1 pageBetterInvesting Weekly Stock Screen 11-5-18BetterInvestingNo ratings yet