Professional Documents

Culture Documents

Gold Daily 27th Aug 2014

Gold Daily 27th Aug 2014

Uploaded by

Chandan GargCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gold Daily 27th Aug 2014

Gold Daily 27th Aug 2014

Uploaded by

Chandan GargCopyright:

Available Formats

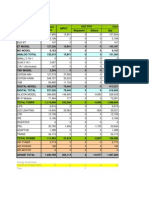

GOLD OUTRIGHT REPORT

8/27/2014

Price

CONTRACT

COMEX Gold Dec'14

COMEX Silver Sept`14

OPEN

HIGH

LOW

CLOSE

PCT CHANGE

VOLUME

1277.40

1291.90

1275.70

1285.20

0.61%

99244.00

19.33

19.66

19.31

19.39

0.32%

25012.00

OI

362471.00

166342.00

Gold

Support

Resistance

Camarilla Levels

H4

H3

L3

L4

ETF Changes

Gold

Silver

Gold SPDR

Silver Ishares

1287.43

19.45

1286.17

19.43

25627335

-0.37%

379012

Unch

1283.64

19.38

1282.37

19.36

Silver

Support

Resistance

1280**

1278***

1275.5*

1272**

1267***

1265**

1285**

1289**

1291.1***

1296*

1299.8***

1304.5*

19.39*

19.335***

19.28*

19.255***

19.22*

19.20**

19.445*

19.48**

19.58***

19.62*

19.655**

19.68***

1263.2.***

1307.1*

19.175***

19.71*

Key data to watch out For the Week

COMEX Gold Daily Chart

1450.00

US GDP (QoQ)

US Intial Jobless claims

Pending home sales

Eurozone CPI

Chicago PMI

1350.00

Key data for the Day: GfK German consumer climate

1250.00

Technical View On Gold

1150.00

View: Bearish to sideways

Technically Gold remains bearish by failing to break above the key resistance level 1292 levels which is 38.2%

retracement mark of the entire fall from 1321.8 to 1273.4 Levels. Expect the momentum to remain bearish.

On a move lower, Gold is expected to test 1267 levels with intermediate support near 1274 levels

To Summarize, Gold is expected to remain bearish to sideways and Test of lower levels towards 1267 is on cards as

long as it trades below 1292 levels.

Fundamental Key Themes

Ceasefire agreement reached between Israel and the Palestiniana.

Fall in Gold ETF's to Continue

Ukraine - Russia tensions to continue.

Equity Markets remain strong close to record Highs.

Apr

Jun

Jul

Aug

COMEX Silver Daily Chart

25.00

21.00

17.00

Apr

Copyright 2013 Futures First. All Rights Reserved.

May

May

Jun

Jul

Aug

Key Indicators

Open Interest

ETF Holdings

550000k

400k

150k

545000k

130k

540000k

380k

110k

360k

70k

50k

Jul 01

Jul 16

Gold Open Interest

Jul 31

Aug 15

Silver Open Interest

48400k

48200k

535000k

48000k

2050

2.7

2000

2.6

1950

2.5

1900

2.4

1850

2.3

1800

Jun/14

Jul/14

525000k

Jun 17

47800k

47600k

Jul 01

Aug/14

Copyright 2013 Futures First. All Rights Reserved.

1750

Apr/14

May/14

Jul 15

Silver ETF holdings

S&P 500 Futures

2.8

May/14

530000k

Source: Reuters

US 10 year Yield

2.2

Apr/14

48600k

90k

340k

320k

Jun 16

48800k

170k

420k

Jun/14

Jul/14

Jul 29

Aug 12

Gold SPDR Holdings

Source : Reuters

CRB Commodity Index

Aug/14

315

310

305

300

295

290

285

280

275

270

Apr/14

May/14

Jun/14

Jul/14

Aug/14

You might also like

- Scotland's Top 500 CompaniesDocument10 pagesScotland's Top 500 CompaniesPatrick McPartlin62% (13)

- 20 KL Tank Dip ChartDocument3 pages20 KL Tank Dip Chart0050115366% (71)

- Skiathos ApproachDocument5 pagesSkiathos ApproachBen HestonNo ratings yet

- ZWWWDocument9 pagesZWWWqlxiao100% (1)

- Dictionary of Chemical FormulasDocument44 pagesDictionary of Chemical Formulashendrayana1555100% (1)

- BJV Ltfe MilasDocument31 pagesBJV Ltfe MilasMehmet KaraNo ratings yet

- KT 15Document1 pageKT 15Wage KarsanaNo ratings yet

- QLV đầu tư vàngDocument18 pagesQLV đầu tư vàngSơnNamNo ratings yet

- SKBO Charts (Dragged)Document1 pageSKBO Charts (Dragged)Mike AguirreNo ratings yet

- FD CheatsheetDocument11 pagesFD CheatsheetHarleen KaurNo ratings yet

- Raghunandan Money: S Support, R Resistance, ATP Average Trade PriceDocument2 pagesRaghunandan Money: S Support, R Resistance, ATP Average Trade PriceshailendraresearchNo ratings yet

- MCX Margin File - FTC: SL No Trading Symbol Total Qty Price IntradayDocument1 pageMCX Margin File - FTC: SL No Trading Symbol Total Qty Price Intradayrajsi3797No ratings yet

- Terrain Clearances by Span ReportDocument158 pagesTerrain Clearances by Span ReportPragyan Thokar TamangNo ratings yet

- Staad Pro ModelDocument5 pagesStaad Pro Modelmuhammad LutfhiNo ratings yet

- Elements Arranged in Terms of Atomic NumberDocument10 pagesElements Arranged in Terms of Atomic NumbergopuvenkatNo ratings yet

- Historic London Gold RatesDocument6 pagesHistoric London Gold RatesshivajidullaNo ratings yet

- Cat II Ils DME RWY 35R LTBADocument1 pageCat II Ils DME RWY 35R LTBABoeingman737No ratings yet

- Daily ReportDocument4 pagesDaily ReportCommotrendz teamNo ratings yet

- Position Size - No of SharesDocument28 pagesPosition Size - No of SharesSuraj KSNo ratings yet

- 5 R Fu WMvbgy LHU9 GCQGDocument1 page5 R Fu WMvbgy LHU9 GCQGShalini AriyarathneNo ratings yet

- Assesment Math Term 2Document5 pagesAssesment Math Term 2h2zrqmc9tqNo ratings yet

- Type of Marker Chainage in MtrsDocument4 pagesType of Marker Chainage in MtrssebincherianNo ratings yet

- Equity - Daily Calls SheetDocument239 pagesEquity - Daily Calls SheetAmit ThreemteamNo ratings yet

- Daily Report 05.01Document4 pagesDaily Report 05.01commotrendzteam2152No ratings yet

- Espiritu Wilson S. Laboratory 1Document48 pagesEspiritu Wilson S. Laboratory 1Pajarillaga Franz Erick QuintoNo ratings yet

- VFS Data LBCDocument3 pagesVFS Data LBCSALMAN SOHAIBNo ratings yet

- Take Off Special One Engine Failure Procedure: Eskisehir, TurkeyDocument9 pagesTake Off Special One Engine Failure Procedure: Eskisehir, TurkeyYigit Omer CiftciNo ratings yet

- PCS 04 Agustus 2012 SabtuDocument185 pagesPCS 04 Agustus 2012 SabtuRezka Badiaraja100% (1)

- KHD KHD: Ltcp/Adf Adiyaman, TurkeyDocument5 pagesKHD KHD: Ltcp/Adf Adiyaman, TurkeyYigit Omer CiftciNo ratings yet

- Sr. No. Name Location STD Facility Landline No./ Extension NoDocument5 pagesSr. No. Name Location STD Facility Landline No./ Extension NoanuprajaNo ratings yet

- Thermistor Resistance TableDocument1 pageThermistor Resistance TablePin KisNo ratings yet

- Daily Support and Resistance For MCX & Intl Spot Commodities Based On Previous CloseDocument1 pageDaily Support and Resistance For MCX & Intl Spot Commodities Based On Previous CloseParesh ShahNo ratings yet

- REPORT Part2Document2 pagesREPORT Part2arghyaNo ratings yet

- Technical LevelsDocument1 pageTechnical LevelsAftab Ahmed SiddiqueNo ratings yet

- Daily Gold Price Feb 2012Document2 pagesDaily Gold Price Feb 2012malaysianmineralsNo ratings yet

- CCS CablesDocument4 pagesCCS CablesbijviljoenNo ratings yet

- Timber DesignDocument7 pagesTimber DesignJohn loyd hernandezNo ratings yet

- Pivot LVLS PDFDocument1 pagePivot LVLS PDFLalit Kumar SoniNo ratings yet

- June 17, 2019: CurrenciesDocument2 pagesJune 17, 2019: CurrencieswinNo ratings yet

- LOADDocument8 pagesLOADSudha JNo ratings yet

- PSEI StocksDocument3 pagesPSEI StocksGeb VenceNo ratings yet

- Design Note - STAAD FILEDocument5 pagesDesign Note - STAAD FILEvaibhav dahiwalkarNo ratings yet

- Specific HeatDocument1 pageSpecific HeatPonchoi PintacasiNo ratings yet

- Axial NP B05 SpecificationDocument2 pagesAxial NP B05 Specificationsivasakti chp2No ratings yet

- Quick Calculator: Item InformationDocument204 pagesQuick Calculator: Item InformationtoxicwindNo ratings yet

- ACSR ConductorDocument2 pagesACSR ConductorRelief_EngineerNo ratings yet

- Daily Commodity Market Outlook Views & Report As ofDocument9 pagesDaily Commodity Market Outlook Views & Report As ofPrabhu G UmadiNo ratings yet

- Airport Diagram: VAR 5.9 WDocument1 pageAirport Diagram: VAR 5.9 WCristian CasasNo ratings yet

- Suppoer Building ModelDocument5 pagesSuppoer Building Modelselvakumar sNo ratings yet

- TRN InformationDocument19 pagesTRN InformationdhrubaNo ratings yet

- Metal (Commodity) Report 21 November 2011 by Mansukh Investment and Trading SolutionDocument2 pagesMetal (Commodity) Report 21 November 2011 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Earrings Stock - NamitaDocument3 pagesEarrings Stock - NamitaKrishna PriyaNo ratings yet

- Dictionary of Chemical FormulasDocument69 pagesDictionary of Chemical FormulaslkNo ratings yet

- 5 DecDocument24 pages5 DecMuhammad Afiq AzmanNo ratings yet

- How To Calculate PPVDocument84 pagesHow To Calculate PPVArya PradityaNo ratings yet

- KTherm Global Quick Guide Nov18 10Document1 pageKTherm Global Quick Guide Nov18 10Steven TrigoNo ratings yet

- Dac Feb. 2012Document6 pagesDac Feb. 2012jeanpidr02No ratings yet

- DosDocument4 pagesDosVikashNo ratings yet