Professional Documents

Culture Documents

Working Capital Management: A Project Report

Working Capital Management: A Project Report

Uploaded by

Bhawna SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Management: A Project Report

Working Capital Management: A Project Report

Uploaded by

Bhawna SinghCopyright:

Available Formats

A PROJECT REPORT

ON

WORKING CAPITAL MANAGEMENT

SAAB MARFIN MBA

Table of Contents

Summer Project Certificate

Industry Guide Declaration

Faculty Guide Declaration

Acknowledgement

Executive Summary

Objectives of the Study

Methodology of the Study

Limitations of the Study

IFFCO The Organization

10

Chapter 1

Working Capital Management

29

Data Analysis

30

Findings

58

Conclusion and Suggestions

59

Cash Management

61

Cash Management at IFFCO

62

Observations

73

Conclusion

76

Suggestions

77

Chapter 2

References

78

Appendix

A

Working Capital Management

Cash Management

108

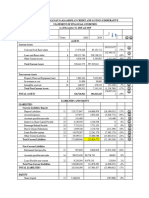

Financial Statement

112

Significant Financial Indicators

116

Provisional highlights of IFFCO performance during

2008-09

117

Value Added Statement

118

Some of the well known fertilisers used in India

119

Some Calculations

120

Working Capital Management

79

SAAB MARFIN MBA

Executive Summary

Indian Farmers Fertiliser Co-operative Limited (IFFCO) is a Multistate

Co-operative Society. It was a unique venture in which the farmers of the

country through their own Co-operative Societies created this new institution

to safeguard their interests. IFFCO manufactures Urea and NPK/ DAP

fertilizers and sells them to the co-operative societies.

The project is Working Capital Management of IFFCO. The objectives of the

project are:

To analyse the working capital and working capital management

policies at IFFCO

To analyse the cash management practices at IFFCO

The study is mainly based on the secondary data which refers to that form of

information that has already been collected and is available. The analysis of

working capital is based on ratio analysis to monitor overall trends in

working capital and to identify areas requiring closer management.

Working capital is not measurable by only current assets & current liabilities

but there are some other factors also that have an influence on the working

capital. From the analysis of the components of working capital, it was found

that the organization is utilizing its funds properly, the inventory is managed

efficiently and the organization is able to get sufficient short term financing.

It is clear that the working capital of IFFCO is in sound position. The

suggestions

can

be

made

in

the

management

of

inventory

by

implementation of JIT or Kanban and management of liquid assets including

the subsidy provided by the government.

The Cash Management System at IFFCO is very sound and efficient. It has

enabled the organization to manage its funds in a proper manner resulting

in better utilization and availability of funds in cash deficit periods. IFFCO

has a tie up with banks such as

providing IFFCO

with

facilities

IOB, HSBC Bank, ICICI Bank that are

such

as

cash

management

Working Capital Management

services,

SAAB MARFIN MBA

personalized financial MIS to enable IFFCO to accelerate the collection and

payment of funds, debit sweep option, Anywhere banking facility, etc. The

suggestion that can be given to the organization is the implementation of

RTGS (Real Time Gross Settlement) and NEFT (National Electronic Fund

Transfer) facilities which will improve the cash transfer at IFFCO.

Objectives of the Study

To analyse the Working Capital and Working Capital Management

policies at IFFCO

To understand Working Capital Management of the organization

To analyze Liquidity position of the organization

To find out the Profitability and operating efficiency of the

organization

To understand the importance of Working Capital Management

To analyze the short term financing patterns, which affect the

working capital of the organization

To study the factors

Management at IFFCO

that

affects

the

Working

Capital

To analyze the data and information of the previous years to

know the actual position of funds, investments and liabilities of

the organization

To identify some broad policy measures to improve the working

capital position of the organization

To estimate the working capital

organization in the near future

requirements

of

the

To analyse the Cash Management Practices at IFFCO

To understand the cash management process followed at the

organization

To study the factors both intrinsic and extrinsic that influences

the cash management at the organization

Working Capital Management

SAAB MARFIN MBA

To study and analyze the changes being brought about the

existing cash management system

To study the salient features, methodology and advantages of

the new cash management system being implemented at the

organization

To suggest some recommendations to the organizations for the

improvement of the cash management practices and the new

cash management MIS

Methodology of the study

The basic type of research used to prepare this report is Descriptive.

The study is mainly based on the secondary data which refers to that form of

information that has already been collected and is available. These include

some internal sources within the company and externally these sources

include books and periodicals, published reports and data of IFFCO and the

annual reports of the company. Interaction with the various employees of the

marketing accounts department has also been a major source of information.

No primary data has been used as a part of this study.

The analysis of working capital is based on ratio analysis to monitor overall

trends in working capital and to identify areas requiring closer management.

Limitations of the Study

Working Capital Management

SAAB MARFIN MBA

The following are the limitations of this summer project training:

The study is limited to five financial years i.e. from 2005-2009.

The data used in this study has been taken from the Financial

Statements & their related schedules of IFFCO Ltd., New Delhi as per

the requirement.

Some of the information that was essential for this study cannot

however be given in this report due to their confidential nature.

The scope and area of the study was limited to corporate office of

IFFCO, New Delhi only.

IFFCO The Organization

Indian Farmers Fertiliser Co-operative

Limited

(IFFCO)

was

registered

on

November 3, 1967 as a Multi-unit

Co-operative Society. It was a unique

venture in which the farmers of the

country

through

their

own

Co-operative Societies created this

new institution to safeguard their

interests.

The

numbers

of

co-operative societies associated with IFFCO have risen from 57 in 1967 to

38, 155 at present. On the enactment of the Multistate Cooperative Societies

act 1984 & 2002, the Society is deemed to be registered as a Multistate

Working Capital Management

SAAB MARFIN MBA

Cooperative Society. The byelaws of the Society provide a broad frame work

for the activities of IFFCO as a Cooperative Society.

IFFCO commissioned an Ammonia - urea complex at Kalol and the NPK/DAP

plant at Kandla both in the state of Gujarat in 1975. Another Ammonia urea complex was set up at Phulpur in the state of Uttar Pradesh in 1981.

The ammonia - urea unit at Aonla was commissioned in 1988.

In 1993, IFFCO had drawn up a major expansion programme of all the four

plants under overall aegis of IFFCO VISION 2000. The expansion projects at

Aonla, Kalol, Phulpur and Kandla have been completed on schedule. Thus all

the projects conceived as part of Vision 2000 have been realised without

time or cost overruns. All the production units of IFFCO have established a

reputation for excellence and quality.

A new growth path has been chalked out to realise newer dreams and

greater

heights

through

Vision

2010

which

is

presently

under

implementation. As part of the new vision, IFFCO has acquired fertiliser unit

at Paradeep in Orissa in September 2005. As a result of these expansion

projects and acquisition, IFFCO's annual capacity has been increased to 3.69

million tonnes of Urea and NPK/DAP equivalent to 1.71 million tonnes of

P2O5.

Mission

IFFCO's mission is "to enable Indian farmers to prosper through timely

supply of reliable, high quality agricultural inputs and services in an

environmentally sustainable manner and to undertake other activities to

improve their welfare."

Working Capital Management

SAAB MARFIN MBA

To provide to farmers high quality fertilizers in right time and in

adequate quantities with an objective to increase crop productivity.

To make plants energy efficient and continually review various

schemes to conserve energy.

Commitment to health, safety, environment and forestry development

to enrich the quality of community life.

Commitment to social responsibilities for a strong social fabric.

To institutionalise core values and create a culture of team building,

empowerment and innovation which would help in incremental growth

of employees and enable achievement of strategic objectives.

Foster a culture of trust, openness and mutual concern to make

working a stimulating and challenging experience for stake holders.

Building a value driven organisation with an improved and responsive

customer focus. A true commitment to transparency, accountability

and integrity in principle and practice.

To acquire, assimilate and adopt reliable, efficient and cost effective

technologies.

Sourcing raw materials for production of phosphatic fertilisers at

economical cost by entering into Joint Ventures outside India.

To ensure growth in core and non-core sectors.

A true Cooperative Society committed for fostering cooperative movement in

the country.

IFFCO is emerging as a dynamic organisation, focussing on strategic

strengths, seizing opportunities for generating and building upon past

success, enhancing earnings to maximise the shareholders' value.

Vision

Working Capital Management

SAAB MARFIN MBA

To augment the incremental incomes of farmers by helping them to increase

their crop productivity through balanced use of energy efficient fertilizers,

maintain the environmental health and to make cooperative societies

economically & democratically strong for professionalized services to the

farming community to ensure an empowered rural India.

Vision 2010

Encouraged by the success of Vision 2000, IFFCO has charted on a new

course of action to realise a fresh set of dreams. A high powered committee

has been constituted to steer the organisation through this Road Map.

Activities being actively pursued through the strategy are:

Phosphoric Acid plant

Foray into Power Sector to set up a 500 MW power project

Ammonia Plant for supplies to Kandla Unit

IFFCO Kisan Bazar

IFFCO Bank

Multi Commodity Exchange

Acquisition of Fertilizer Plants

Nellore Fertilizer Project

Agri business

The Approach

To achieve their mission, IFFCO as a cooperative society, undertakes several

activities covering a broad spectrum of areas to promote welfare of member

cooperatives and farmers. The activities envisaged to be covered are

exhaustively defined in IFFCOs Bye-laws.

The Commitment

The thirst for ever improving the services to farmers and member

co-operatives is insatiable, commitment to quality is insurmountable and

harnessing of mother earths' bounty to drive hunger away from India in an

ecologically sustainable manner is the prime mission.

Working Capital Management

10

SAAB MARFIN MBA

Plants owned by IFFCO

Kalol Unit (Ammonia - Urea complex)

P. O. Kasturinagar, District Gandhinagar, Gujarat - 382423

Kandla Unit (NPK/DAP plant)

P. O. Kandla, Gandhidham, Kandla (Kachchh), Gujarat - 370201

Phulpur Unit (Ammonia - urea complex)

P. O. Ghiyanagar, District Allahabad, Uttar Pradesh - 212404

Aonla Unit (Ammonia - Urea unit)

P. O. IFFCO Township, Paul Pothen Nagar, Bareilly, Uttar Pradesh 243403

Paradeep Unit (NPK/DAP and Phosphoric Acid Fertiliser unit)

Village Musadia, P. O. Paradeep, District Jagatsinghpur, Orissa 754142

Production and Sales

During the year 2008-09 IFFCO produced 71.68 Lakh (7.168 million) MT

(Metric Tonnes) of fertiliser material, consisting of 40.68 lakh MT of Urea and

31.00 lakh MT NPK/DAP. It contributes 21.4% of countrys total nitrogenous

fertiliser production and 27% of total phosphatic fertiliser production in the

same period.

PRODUCTION

(in LAKH MT)

YEAR

UREA

NPK / DAP

TOTAL

2006-07

2007-08

2008-09

37.87

39.63

40.68

32.26

28.84

31

70.13

68.47

71.68

Working Capital Management

11

SAAB MARFIN MBA

SALES OF FERTILIZER MATERIAL

Material

UREA

NPK/ DAP

TOTAL

2008-09

58.69

53.89

112.58

(in Lakh MT)

2006-07

52.41

33.69

86.10

2007-08

54.29

38.95

93.24

PLANT WISE PRODUCTION

Unit

UREA

Kalol

2008-09

2007-08

Production

Capacity

Utilization

Production

Capacity

Utilization

(Lakh MT)

(percent)

(Lakh MT)

(percent)

5.60

102.80

5.45

100.00

Working Capital Management

12

SAAB MARFIN MBA

Phulpur I

Phulpur II

Aonla I

Aonla II

SUB TOTAL UREA

NPK / DAP

Kandla

Paradeep

SUB TOTAL NPK / DAP

6.63

8.40

9.87

10.18

40.68

120.30

97.20

114.10

117.80

110.30

6.30

9.24

8.76

9.89

39.63

114.30

106.90

101.30

114.40

107.40

17.94

13.06

31.00

74.30

68.00

71.40

20.18

8.66

28.84

83.50

45.10

66.50

TOTAL PRODUCTION

71.68

89.20

68.47

85.30

All India Capacity, Production and Capacity Utilization of Fertilizer

Industry

Year

2004-05

2005-06

2006-07

2007-08

2008-09

Capacity

Capacity Production Utilization

(%)

12208

11304.9

93.4

12288.4

11332.9

94.5

12290.4

11524.9

95.6

12290.4

10902.8

95.2

12290.4

10900.2

95.2

P2O5

Capacity

Production

5480.4

5459.6

5736.3

5874.6

5892.3

4038.4

4202.6

4440

3714.3

3417.3

Capacity

Utilization

(%)

75.5

78.5

78.5

64.7

58.5

Sector Wise Capacity and Production of N and P2O5

Sector

N

Capacity Production

Capacity

NP/NPKs SSP

(capacity: As on 1.11.20

(production: 2008

April-Ma

(Figures in '000 tonne nutri

P2O5

Production

Total

NP/NPK

SSP

To

Working Capital Management

13

SAAB MARFIN MBA

Public

3591.5

2973.2

386.7

Private

6030.3

4829.9

2860.1

Cooperative

3423.4

3133.1

1712.8

Total

13045.2

10900.2

4959.6

386.7

1225 4085.1

-

1712.8

1225 6184.6

s

191.7

1903.9

916.3

3011.9

191

405.4 230

-

916

405.4 341

Capacity and Investment in the Fertilizer Industry

Year / Period

2004-2005

(as on

1.11.2004)

2005-2006

(as on

1.11.2005)

2006-2007

(as on

1.11.2006)

2007-2008

(as on

1.11.2007)

2008-2009

(as on

1.11.2008)

2009-2010

(as on

1.11.2009)

Capacity During the

Period

(in '000 tonnes)

N

P2O5

62

39

Investments During the Period ( in Rs.

Crore )

Public

-

Sectors

Cooperative Private

10

Total

10

12229

-21

5427

1

7474.5

-

4231.5 14227.9

3

25933.9

3

12208

52

5428

243

7474.5

350

4231.5 14230.9

35

25936.9

385

12260

30

5671

204

7824.5

-

4231.5 14265.9

15

26321.9

15

12290

-

5875

17

7824.5

-

4231.5 14280.9

55

26336.9

55

12290

755

5892

293

7824.5

-

4231.5 14335.9

350

470

26391.9

820

13045

6185

7824.5

4581.5 14805.9

27211.9

BIO FERTILISERS

Bio-fertilisers are capable of fixing atmospheric nitrogen when suitable

crops are inoculated with them. Bio-fertilisers are low cost, effective,

Working Capital Management

14

SAAB MARFIN MBA

environmental

friendly

and

renewable

source

of

plant

nutrients

to

supplement fertilisers. Integration of chemical, organic and biological

sources of plant nutrients and their management is necessary for

maintaining soil health for sustainable agriculture. The bacterial organisms

present in the bio-fertiliser either fix atmospheric nitrogen or solubilise

insoluble forms of soil phosphate. The range of nitrogen fixed per ha/year

varies from crop to crop; it is 80 - 85 kg for cow pea, 50 - 60 kg for

groundnut, 60 - 80 kg for soybean and 50 - 55 kg for moongbean.

All India Production and Dispatches of Bio

Fertilizers

Year

Production

2004-05

2005-06

2006-07

2007-08

2008-09

10479

11752.4

15871

20111.1

24455

( in tonnes)

Dispatches

10427.6

11357.6

15745

20100

24400

Prices of IFFCO's Fertilisers

(Applicable only within India)

UREA

NPK

DAP

MOP

N-46% 10-26-26 12-32-16 20:20:00 18-46-0 K-60%

M.R.P.

4830

7197

7637

6295

Local Taxes Extra, where ever applicable.

Joint Ventures of IFFCO

Indian Potash Limited (IPL)

Working Capital Management

9350

4455

15

SAAB MARFIN MBA

The Society holds an investment of Rs. 2.68 Crore (2008-09) in Indian

Potash Limited (IPL) with equity share holding of 34 per cent in the

paid up equity share capital of IPL. IPL is primarily engaged in trading

of imported Potassic and Non-Potassic Fertilisers.

Industries Chimiques Du Senegal (ICS)

The Society holds 18.54 per cent equity (2008-09) in ICS, which

manufactures Phosphoric Acid for exports and Phosphatic Fertilisers

for domestic consumption. ICS has the capacity to produce 660000 MT

of Phosphoric Acid (as P2O5) per year. The Government of Senegal and

IFFCO signed an Agreement on 16th July, 2007 and Amendment on

14th January, 2008, for the debt restructuring and recapitalisation of

ICS. Post restructuring and recapitalisation, the new Board has been

reconstituted

and

the

IFFCO

Consortium

has

taken

over

the

management control of ICS.

Indo Egyptian Fertilisers Company, SAE (IEFC)

The Society promoted a joint venture in Egypt, namely Indo Egyptian

Fertilisers Company SAE (IEFC) along with El Nasr Mining Company of

Egypt to set up a Phosphoric Acid plant with a capacity of 1500 tonnes

P2O5 per day. IEFC was incorporated in Egypt as a Joint Stock

Company on 15th November, 2005 with shareholding of IFFCO and its

affiliates at 76 percent and El Nasr Mining Co. Egypt holding 24 per

cent equity.

Oman India Fertiliser Company (OMIFCO)

Oman India Fertiliser Company (OMIFCO) is a Joint Venture Company

in Oman in which the Society has invested an amount of Rs. 329.08

Crore (2008-09) to acquire 25 percent equity in OMIFCO, which has an

installed capacity of 16.52 lakh tonne Urea and 2.5 lakh tonne surplus

Ammonia. OMIFCO commenced commercial production at its plant at

Sur (Oman) with effect from 14th July, 2005.

Working Capital Management

16

SAAB MARFIN MBA

Jordan India Fertilizer Company (JIFCO)

IFFCO and Jordan Phosphate Mines Company (JPMC), Jordan have

formed a Limited Liability Joint Venture Company, namely Jordan India

Fertilizer Company (JIFCO) on 6th March, 2008 in Amman, Jordan

under the Free Zone system to set up a phosphoric acid plant of

capacity 1500 tonnes per day P2O5 at Eshidiya in Jordan. In this

company, IFFCO holds 52 per cent equity, while JPMC holds 48 per

cent equity.

Aria Chemicals (Orissa) Limited

Aria Chemicals (Orissa) Ltd. is a joint venture between IFFCO and Aria

Chemicals Private Limited, Chennai wherein IFFCO holds 40 percent

equity in this project. This Company will set up an Aluminium Fluoride

facility at Paradeep.

Sector Diversification of IFFCO

IFFCO-TOKIO General Insurance Company Limited (ITGI)

IFFCO TOKIO General Insurance Company Limited (ITGI) was formed as

a Joint Venture Company in the year 2000 for underwriting general

insurance business in India. Out of total equity capital of Rs. 247 Crore

in ITGI, the Society and its associates hold 74 percent equity and Tokio

Marine Asia holds 26 percent.

ITGI had launched products like, Barish Bima Yojna, Mausam Bima

Yojna and Kisan Suvidha Bima Yojna to cater to the insurance

requirements of the farmers. During the year ITGI has launched

various micro insurance policies like Janta Bima Yojna, Jansuraksha

Bima Yojna, Janswasthya Bima Yojna and Mahila Suraksha Bima

Yojna to provide protection to the farmers and their families and also

poorer sections for their household goods, personal accident and

health.

IFFCO Chhattisgarh Power limited (ICPL)

Working Capital Management

17

SAAB MARFIN MBA

The Society has diversified into the Power Sector by incorporating a

Joint Venture Company namely IFFCO Chhattisgarh Power Limited

(ICPL) with Chhattisgarh State Electricity Board (CSEB) to set up a 1320

MW coal-based Mega Power Plant in District Surguja of Chhattisgarh.

The Society will hold 74 per cent equity in ICPL.

National Commodity and Derivatives Exchange Ltd. (NCDEX)

The Society holds 12 percent equity in the Paid-up Share Capital (Rs.

30 Crore) and the entire preference capital of Rs. 10 Crore in the

National Commodity and Derivative Exchange Limited (NCDEX).

NCDEX is a demutualised, on-line national level commodity exchange

providing a trading platform for futures trading in commodities in the

country and offers its market participants opportunity at price

discovery and price risk hedging. Currently, NCDEX offers contracts in

56 commodities, that is, 42 agricultural commodities, 2 bullion, 6

metals, 2 energy and 3 polymers and 1 environment (carbon credit).

National Collateral Management Services Ltd. (NCMSL)

Along with other reputed institutions, IFFCO co-promoted National

Collateral Management Services Limited (NCMSL) in the year 2004. The

Society holds 13.56 per cent of the paid up equity capital in NCMSL.

NCMSL is engaged in providing various risk management services

related to commodities like Storage and Preservation services,

Collateral Management services, Procurement services, Quality Testing

and Certification services and Information services.

Freeplay Energy India Pvt. Ltd.

During the year 2008-09, the Society made an investment of Rs. 4.83

Crore to acquire 30 percent shareholding in Freeplay Energy India Pvt.

Ltd. (FPEI), which is engaged in the field of non-conventional energy

products and devices suitable for rural India. These products are being

marketed

to

co-operative

societies

through

Societys

Working Capital Management

another

18

SAAB MARFIN MBA

subsidiary company, that is, IFFCO Kisan Sanchar Ltd. The utility of

these products has been greatly appreciated by the rural farmers.

Organizations promoted by IFFCO

IFFCO has promoted several institutions and organisations to work for the

welfare of farmers, strengthening cooperative movement, improve Indian

agriculture.

Indian Farm Forestry Development Cooperative (IFFDC)

Indian

Farm

Forestry

Development

Cooperative,

multi-state

cooperative society promoted by IFFCO, has been implementing

afforestation projects in Uttar Pradesh, Rajasthan & Madhya Pradesh.

The Society has been floated under contribution agreement signed

between IFFCO and India - Canada Environment Facility (ICEF).

Development of Primary Farm Forestry Cooperative Societies (PFFCS) is

an important activity undertaken towards afforestation of waste lands.

High participation of women is an important feature of the IFFDC.

Cooperative Rural Development Trust (CORDET)

IFFCO promoted Cooperative Rural Development Trust (CORDET) in the

year 1979 to provide education and training to farmers on various

aspects of crop production, horticulture, animal husbandry, farm

machinery etc.

IFFCO Kisan Sewa Trust (IKST)

Objective: A Relief Trust for the Welfare of the Victims of Natural

Calamities

Kisan Sewa Trust Fund was created out of contributions from:

IFFCO

Rs 100 million

Employees of IFFCO

Rs 10 million

Cooperative Societies and others

Rs 90 million

TOTAL

Rs 200 million

Working Capital Management

19

SAAB MARFIN MBA

IFFCO had always been in the forefront of activities for the rescue of

victims of natural calamities. Every year significant contributions, both

monetary as well as in kind, are made by IFFCO along with separate

contributions by the employees.

IFFCO Kisan Sanchar Limited (IKSL)

IFFCO Kisan Sanchar Limited was incorporated in April, 2007 with the

objective to use the information technology to empower farmers in

rural areas and to strengthen the cooperative network in the country.

The highlight of IKSLs services in the rural telecom domain continues

to be Valued Added Services (VAS) extended to the subscribers. Five

free voice messages of immediate relevance to people living in rural

areas, a Help Line with experts to provide information inputs to the

farmers and several other innovative activities for subscribers

constitute a major source of knowledge transfer.

An ambitious project 'ICT Initiatives for Farmers and Cooperatives' is

launched to promote e-culture in rural India. IFFCO obsessively nurtures its

relations with farmers and undertakes a large number of agricultural

extension activities for their benefit every year.

At IFFCO, the thirst for ever improving the services to farmers and member

co-operatives is insatiable, commitment to quality is insurmountable and

harnessing of mother earths' bounty to drive hunger away from India in an

ecologically

sustainable

manner

is

the

prime

mission.

All that IFFCO cherishes in exchange is an everlasting smile on the face of

Indian Farmer who forms the moving spirit behind this mission.

IFFCO, to day, is a leading player in India's fertiliser industry and is making

substantial contribution to the efforts of Indian Government to increase food

grain production in the country.

IFFCO is also behind several other companies with the sole intention of

benefitting

farmers.

The distribution of IFFCO's fertiliser is undertaken through over 38155

Working Capital Management

20

SAAB MARFIN MBA

co-operative societies. The entire activities of Distribution, Sales and

Promotion are co-ordinated by Marketing Central Office (MKCO) at New Delhi

assisted by the Marketing offices in the field.

In addition, essential agro-inputs for crop production are made available to

the farmers through a chain of 158 Farmers Service Centre (FSC).

Subsidiaries of IFFCO

Kisan International Trading FZE (KIT)

Kisan International Trading FZE (KIT) was set up as a wholly owned

subsidiary of the Society in Dubai in April 2005. KIT has become a

leading international trading organisation, which handles the import

and export of various fertilisers and fertiliser Raw Materials and

Intermediates.

IFFCO Kisan Bazar Ltd.

IFFCO Kisan Bazar Ltd. (IKBL) was incorporated on 26th February, 2004

as

IFFCOs

wholly

owned

subsidiary

company

for

inter-alia

undertaking business in agri-inputs and consumer goods for the

benefit of farmers/cooperatives.

Business and Financial Review of Subsidiaries and Associates

Even in the year of global economic meltdown, the business portfolio has

been steadily growing in tandem with the high growth aspirations. The

organization have stepped up investments in related businesses through

various Joint Ventures and Associate Companies in order to strengthen

themselves further by looking at new opportunities that are unfolding and

create value addition in the core fertiliser sector.

On 31st March 2009, the total investments were Rs. 914 Crore in

comparison to Rs.770.57 Crore on 31st March 2008 as per the following

break-up:

(Rs. In Crore)

As

on

31st

March

2009

Working Capital Management

2008

21

SAAB MARFIN MBA

Investment in Jt. Ventures/Subsidiaries

888.27

750.13

Investment in Business Associates

25.73

20.44

Total

914.00

770.57

Financial Performance

As per its tradition, the Society has again exhibited an impressive financial

performance in all its major parameters, namely, Revenue Growth and

Resource Utilisation, testifying to the robustness of its Corporate Strategy of

creating multiple drivers of growth in spite of constraints in the availability

of raw materials, the Global Economic Meltdown and inordinate delays in

receipt of large subsidy amounts from the Government of India. This was

possible due to higher production, sales volume and improvement in

operating efficiencies.

The Society achieved the highest ever sales turnover of Rs 32,933 Crore.

This represents an increase of 170 per cent over the previous year. While,

the sales volume of fertiliser material increased by 20 per cent to 112.58

lakh MT fertiliser during 2008-09, as against 93.24 lakh MT in the previous

year, the major increase in the sales turnover was on account of substantial

increase in the commodity prices. The performance is even more satisfying

when viewed in the light of the challenging business environment of the

fertiliser industry.

Sources and Uses of Funds

The Cash Flow from Operating, Investing and Financing activities as reflected

in the Cash Flow Statement is summarised in the following table:

(Rs. In Crore)

2008-09

Cash provided by operating activities

1560

1072

Cash Used in Investing activities

(6578)

(970)

Working Capital Management

2007-08

22

SAAB MARFIN MBA

Cash provided by financing activities

4844

(190)

Decrease in cash and cash equivalents

(174)

(88)

Corporate Governance

The

Society

has

consistently

followed

transparent,

democratic

and

professional practices in Corporate Governance since its inception. We have

carved out a strong Cooperative Identity and are making sincere efforts to

uphold the Cooperative Values by cherishing Cooperative Principles. The

Societys endeavour has been to achieve the highest levels of transparency,

accountability and full disclosure to its shareholders in a bid to uphold the

spirit of Cooperative Principles and Cooperative Values by following the

charter as lay down by International Cooperative Alliance (ICA). The activities

of the Society have been conducted within the provisions of the Multi State

Cooperative Societies Act/Rules and IFFCO Bye-laws. A separate detailed

report on Corporate Governance is given along with the Annual Report.

Financial Ratings

The Societys excellent credit ratings with bankers and rating agencies allows

access to short term funds including foreign currency borrowings at

competitive rates. Ratings assigned by different Rating Agencies to the

Society were as under:

CRISIL Ratings

Rating for Governance and Value Creation (GVC) Practices of

IFFCO

CRISIL has, assigned a GVC Level 2 rating to IFFCO. This rating

indicates that the capability of the Society with respect to wealth

creation for all its stakeholders, while adopting sound corporate

governance practices, is high.

Rating for the Rs. 100 crore Commercial Paper Programme of

IFFCO

CRISIL has assigned a P1+ (pronounced P One Plus) rating to

IFFCOs Rs.100 Crore Commercial Paper Programme. This rating

Working Capital Management

23

SAAB MARFIN MBA

indicates that the degree of safety with regard to timely payment of

interest and principal on the instrument is Very Strong.

Rating for the Rs. 400 crore Bonds Programme of IFFCO

CRISIL has assigned the rating on IFFCOs Long Term Borrowing

Programme to AA/Stable. The rating indicates high degree of

safety with regard to timely payment of interest and principal on

the instrument.

FITCH Ratings

Rating for the Rs. 100 crore Commercial Paper Programmes of

IFFCO

FITCH Ratings has assigned a National Short Term Rating of F1+

(Ind)to IFFCOs Rs. 100 crore Commercial Paper Programme. This

rating indicates that the degree of safety with regard to timely

payment of interest and principal on the instrument is Very Strong.

Rating

for

Long

Term

Borrowing

Programme

of

IFFCO

FITCH Ratings assigned National Long - Term Rating of AA+ (Ind)

to the Long Term Debt Programme of IFFCO. The outlook on the

Long Term Rating is Stable. This rating indicates high degree of

safety with regard to timely payment of interest and principal on

the instrument.

CARE Ratings

PR 1+ (P One Plus) rating to IFFCOs Working Capital facilities/Short

Term Loans having tenure of up to one year.

CARE AA (Double A) rating to External Commercial Borrowings and

other existing long term borrowings having tenure of over one year.

Working Capital Management

24

SAAB MARFIN MBA

Value Added

Value Added is the wealth which an enterprise has been able to create

through the collective effort of capital, management and employees. In

economic terms, value added is the market price of the output of an

enterprise less the price of the goods and services acquired by transfer.

Value Added can provide a useful measure in gauging performance and

activity of the company.

Figure: Allocation of Value Added

Significant Accounting Policies

1. Basis of Preparation of Financial Statements

The Financial Statements are prepared on accrual basis of accounting

under the historical cost convention in accordance with the generally

accepted accounting principles in India, the Accounting Standards

issued by the Institute of Chartered Accountants of India and the

relevant provisions of Multi State Co-operative Societies Act, 2002.

2. Use of Estimates

The preparation of financial statements, in conformity with the

generally accepted accounting principles, require estimates and

assumptions to be made that affect the reported amount of assets and

Working Capital Management

25

SAAB MARFIN MBA

liabilities as of the date of the financial statements and the reported

amount of revenues and expenses during the reporting period.

Difference between the actual results and estimates are recognized in

the period in which the results materialise.

3. Fixed Assets

(i).

Fixed Assets are stated at historical cost less accumulated

depreciation. Cost comprises of the purchase price and any

attributable cost of bringing the asset to its working condition

for its intended use.

(ii).

Assets retired from active use and held for disposal are shown

separately under Fixed Assets at lower of net book value and

estimated realisable value.

4. Expenditure incurred during Construction Period

In respect of new/major expansion of units, the indirect expenditure

incurred

during

construction

period

up

to

the

date

of

the

commencement of commercial production, which is attributable to the

construction of the project, is capitalised on proportionate basis.

5. Intangible Assets

An intangible asset is recognised where it is probable that the future

economic benefits attributable to the asset will flow to the Society and

the cost of the asset can be measured reliably. Such assets are stated

at cost less accumulated amortisation.

6. Impairment of Assets

At each balance sheet date an assessment is made whether any

indication exists that an asset has been impaired. If any such

indication exists, an impairment loss i.e. the amount by which the

carrying amount of an asset exceeds its recoverable amount, is

provided in the books of account.

7. Investments

i) Long Term Investments are carried at cost. Provision for diminution

in the value of such investments is made to recognise a decline,

other than temporary, in the value of the investments.

Working Capital Management

26

SAAB MARFIN MBA

ii) Current Investments are valued at lower of cost and fair value

determined on an individual investment basis.

8. Depreciation / Amortisation

(a) Depreciation on Fixed Assets is provided on Straight Line

Method as follows:

(i) In respect of assets acquired up to 31st March, 1990 at the

rates prescribed under Income tax Act, 1961 and rules

framed there under.

(ii) In respect of assets acquired after 31st March,1990 at the

rates based on schedule XIV to the Companies Act,1956

except for fixed assets taken over at Paradeep Unit which

are depreciated based on useful life of such assets.

(b) Assets are depreciated to the extent of 95% of the original

cost except assets individually costing up to Rs.5000/- which

are fully depreciated in the year of acquisition.

(c) Railway wagons under "Own Your Wagon Scheme" are

depreciated over a period of ten years.

(d) Machinery Spares which can be used only in connection with

an item of Plant & Machinery and its use is expected to be

irregular, are fully depreciated over the remaining useful life

of the related asset.

(e) Premium paid for acquisition of leasehold land, other than

those acquired under perpetual lease basis, is amortised over

the period of lease.

(f) Leasehold Buildings are fully depreciated over the period of

lease in case period of lease is less than the useful life

derived from the rates as per Schedule- XIV of Companies

Act.

(g) Additions to assets are depreciated for the full year

irrespective of the date of addition and no depreciation is

provided on assets sold/ discarded during the year. However,

in the case of capitalisation of project, depreciation is

Working Capital Management

27

SAAB MARFIN MBA

provided

on

pro-rata

basis

from

the

date

of

commencement of commercial production.

(h) Intangible assets are amortised over their estimated useful

lives but not exceeding ten years when the asset is available

for use.

9. Provisions, Contingent Liabilities and Contingent Assets

(a) Provisions are recognised for liabilities that can be measured by

using a substantial degree of estimation, if:

i) The Company has a present obligation as a result of a past event;

ii) A probable outflow of resources embodying economic benefits

is expected to

settle the obligation; and

iii) The amount of the obligation can be reliably estimated.

(b) Contingent liability is disclosed in case of :

i) Present obligation arising from a past event when it is not

probable that an outflow of resources embodying economic

benefits will be required to settle the obligation.

ii) Possible

obligation,

unless

the

probability

of

outflow

in

settlement is remote.

(c) Reimbursement expected in respect of expenditure required to

settle a provision is recognised only when it is virtually certain that

the reimbursement will be received.

(d) Contingent assets are neither recognised nor disclosed in the

financial statements.

10.

Operating Leases

Assets acquired on leases wherein a significant portion of the risks

and rewards of ownership are retained by the lessors are classified as

operating leases. Lease rentals paid for such leases are recognised as

an expense on straight line basis over the term of lease.

11.

Prior Period Income / Expenditure

Income/Expenditure items relating to prior period(s) not exceeding

Rs.2,00,000/- each is treated as Income/ Expenditure for the current

year.

Working Capital Management

28

SAAB MARFIN MBA

12.

Pre-Paid Expenses

Expenditure up to Rs.50000/- in each case except Insurance Premium

is accounted for in the year in which the same is incurred.

Working Capital Management

29

SAAB MARFIN MBA

CHAPTER 1

Working Capital

Management

Working Capital Management

30

SAAB MARFIN MBA

Data Analysis

Operating Cycles

1. Days Inventory Outstanding (DIO)

Days Inventory

Outstanding (DIO)

Average Inventory

Cost of Goods sold (COGS) / 365

(in Rs. Crores)

Year

Average

Inventory

COGS

DIO (number of

days)

2004-05

2005-06

2006-07

2007-08

2008-09

976.03

1225.57

1901.79

1930.52

1654.23

6809.48

9166.48

9578.09

11336.77

31496.75

52.317

48.801

72.473

62.155

19.170

Analysis

The smaller the number of days of inventory outstanding, the more efficient

a company is. IFFCO day inventory outstanding is around 19 days for the

year 2008-09 which is very good. Inventory is held for less time and less

money is tied up in inventory. Instead, money is freed up for things like

research and development, marketing or even share buybacks and dividend

payments.

Working Capital Management

31

SAAB MARFIN MBA

The DIO had always been showing a decreasing trend apart from the period

of 2006-07 in which inventory was build up due to the purchase of Paradeep

plant.

2. Days Sales Outstanding

Days Sales

Outstanding

(DSO)

Average Accounts Receivable

=

Net Sales / 365

Year

Avg. A/c

Receivables

(in crores)

Net Sales

(in Crores)

DSO (number of

days)

2004-05

2005-06

2006-07

2007-08

2008-09

397.025

399.495

418.04

387.72

410.495

7396.87

9942.93

10330.11

12162.82

32933.30

19.591

14.665

14.771

11.635

4.550

Analysis

Days Sales Outstanding (DSO) looks at the number of days needed to collect

on sales and involves Accounts Receivables. While cash-only sales have a

DSO of zero, people do use credit extended by the company, so this number

is going to be positive.

Most of sales of IFFCO are on cash basis and sales to large institutions

only are on credit basis. The DSO for the year 2008-09 is 4.550, which is

Working Capital Management

32

SAAB MARFIN MBA

very good for the company. The DSO is showing a decreasing trend

meaning that the days to collect on sales are decreasing every year.

3. Days Payable Outstanding

Days Payable

Outstanding (DPO)

Average Accounts Payable

Cost of Goods sold (COGS) / 365

(in Rs. Crores)

Year

Average

Accounts Payable

COGS

DPO (number of

days)

2004-05

2005-06

2006-07

2007-08

2008-09

728.425

934.165

913.425

833.87

1664.225

6809.48

9166.48

9578.09

11336.77

31496.75

39.045

37.198

34.809

26.847

19.286

Analysis

This involves the company's payment of its own bills or Accounts Payables. If

this can be maximized, the company holds onto cash longer, maximizing its

investment potential.

Working Capital Management

33

SAAB MARFIN MBA

The DPO of IFFCO is around 19 days for the year 2008-09. It is also

observed that DPO is decreasing every year. From the data provided, it is

found out that IFFCO had sufficient funds to make payments of its own bills

and make investments in various activities.

4. Gross Operating Cycle

Gross Operating

cycle (GOC)

DIO +

DSO

Year

DIO

DSO

2004-05

2005-06

2006-07

2007-08

2008-09

52.317

48.801

72.473

62.155

19.170

19.591

14.665

14.771

11.635

4.550

(in Days)

GOC

71.908

63.466

87.244

73.791

23.720

Analysis

Gross operating cycle is a tool which measures the total number of days

from the day the purchases are made or the stock arrives to the day all the

Working Capital Management

34

SAAB MARFIN MBA

collections are made. Cash is said to be blocked till the collections have been

collected. So the sooner the cash is received from the consumers the better

is for the company as they get cash for further production.

IFFCO gross operating cycle is around 24 days. This is very good for the

company as a fast turnover rate of these assets is what creates real liquidity

and is a positive indication of the quality and the efficient management of

inventory and receivables.

5. Cash Conversion Cycle (CCC)

Cash

Conversion

Cycle (CCC)

DIO +

DPO

DSO

Year

DIO

DSO

DPO

2004-05

2005-06

2006-07

2007-08

2008-09

52.317

48.801

72.473

62.155

19.170

19.591

14.665

14.771

11.635

4.550

39.045

37.198

34.809

26.847

19.286

Working Capital Management

(in Days)

CCC

32.863

26.269

52.435

46.943

4.434

35

SAAB MARFIN MBA

Analysis

The cash conversion cycle (CCC) measures how fast a company can convert

cash on hand into even more cash on hand. The CCC does this by following

the cash as it is first converted into inventory and accounts payable (AP),

through sales and accounts receivable (AR), and then back into cash.

IFFCO CCC is of around 4.4 days in the year 2008-09. This means that the

company is able to generate the cash within this period after making it

payments of its own bills. Since it is very low, it is good for the company.

Ratios related to Inventory Management

1. Inventory Turnover Ratio

Inventory

Turnover

Ratio

Cost of Goods sold

(COGS)

Average Inventory

(in Rs. Crores)

Year

COGS

Average

Inventory

Inventory

Turnover Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

6809.48

9166.48

9578.09

11336.77

31496.75

976.03

1225.57

1901.79

1930.52

1654.23

6.977

7.479

5.036

5.872

19.040

Working Capital Management

36

SAAB MARFIN MBA

Analysis

The inventory turnover ratio at IFFCO is 19.040 in 2008-09. It means that

that the company is turning its inventory of finished goods into sales 19.040

times in a year and is in good position. There had been a decrease in the

inventory turnover ratio from 7.479 in 2005-06 to 5.036 in 2006-07. During

this period, there was a large amount of inventory in the company because

of the purchase of the Paradeep production plant. During all other period,

the turnover is always increasing.

2. Inventory to Working Capital Ratio

Inventory to

Working

Capital Ratio

Inventory

Working Capital

X 100

Year

Inventory

(in Crores)

Working Capital

(in Crores)

Inventory to

Working Capital

Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

931.50

1519.64

2283.94

1577.10

1731.36

1499.14

3387.39

4880.05

4404.17

4490.10

62.136

44.862

46.802

35.809

38.559

Working Capital Management

37

SAAB MARFIN MBA

Analysis

The Inventory to Working Capital Ratio measures how well the company is

able to generate cash using working capital at its current inventory level. An

increasing inventory to working capital ratio is generally a negative sign,

showing the company may be having operational problems. If a company has

too much working capital invested in inventory, they may have difficulty

having enough working capital to make payments on short term liabilities

and accounts payable.

Inventory to working capital ratio for IFFCO has been decreasing consistently

with increasing very marginally in the year 2006-07 and in 2008-09.

3. Inventory to Current Assets Ratio

Inventory to

Current

Assets Ratio

Inventory

Current Assets

X 100

Year

Inventory

(in Crores)

Current Assets

(in Crores)

Inventory to

Current Assets

Ratio

2004-05

2005-06

2006-07

2007-08

931.50

1519.64

2283.94

1577.10

2603.98

4748.98

6081.28

5775.74

35.772

31.999

37.557

27.306

Working Capital Management

38

SAAB MARFIN MBA

2008-09

1731.36

7672.99

22.564

Analysis

The Inventory to Current Assets Ratio measures that how much percentage

of current assets is formed by the inventories. An increasing inventory to

current assets ratio is a negative sign. It means that more & more percentage

of current assets is being constituted by the inventories. This indicates poor

operational efficiency of the organization. Also it shows that the funds

invested in current assets to meet obligations on a short notice are actually

illiquid to some extent and it may be difficult to convert them into cash

immediately. Normally, less than 50 % of current assets are treated as

average position of inventory.

IFFCO has shown a decrease in this ratio over the past years, which

indicates a GOOD inventory position for IFFCO and, the ratio was never been

above 38%.

4. Inventory to Sales Ratio

Inventory to

Sales Ratio

Inventory

Sales

X 100

Year

Inventory

(in Crores)

Sales

(in Crores)

Inventory to Sales

Ratio

2004-05

931.50

7396.87

12.593

Working Capital Management

39

SAAB MARFIN MBA

2005-06

2006-07

2007-08

2008-09

1519.64

2283.94

1577.10

1731.36

9942.93

10330.11

12162.82

32933.30

15.284

22.110

12.967

5.257

Analysis

The Inventory to Sales Ratio measures the percentage of inventory the

company currently has on hand to support the current amount of sales. An

increasing Inventory to Sales ratio is generally a negative sign, showing the

company may be having trouble keeping inventory down and/or Net Sales

have slowed, and can sometimes indicate larger financial problems the

company may be facing.

As per the data of IFFCO, this ratio had increased initially till the year

2006-07 but is falling down consistently after that time, which is a POSITIVE

sign indicating good movement of inventory.

Ratios related to Receivable Management

1. Debtors turnover ratio

Debtor

Turnover

Ratio

Net Sales

Average Accounts

Receivable

Working Capital Management

40

SAAB MARFIN MBA

Year

Net Sales

(in Crores)

Avg. A/c

Receivables (in

Crores)

Debtor Turnover

Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

7396.87

9942.93

10330.11

12162.82

32933.30

397.03

399.50

418.04

387.72

410.50

18.631

24.888

24.711

31.370

80.227

Analysis

This ratio is also known as Accounts Receivable Turnover Ratio and

measures the number of times Accounts Receivables were collected during

the year. This is also a measure of how well the company collects sales on

credit from its customers.

IFFCO have a high and increasing Accounts Receivable Turnover which is

a Positive Sign. The company is able to turnover its debtors 80.227 times in

a year.

2. Average collection period

Average

Collection

Period

360

Debtor Turnover

Ratio

Working Capital Management

41

SAAB MARFIN MBA

Year

Sales

(in Crores)

2004-05

2005-06

2006-07

2007-08

2008-09

7396.87

9942.93

10330.11

12162.82

32933.30

Average

Debtors

(in Crores)

397.03

399.50

418.04

387.72

410.50

Debtor

Turnover

Ratio

18.631

24.888

24.711

31.370

80.227

Average

Collection

Period

19.323

14.465

14.569

11.476

4.487

Analysis

The Average Collection Period represents the average number of days for

which a firm takes to collect accounts receivables. It measures the quantity

of debtors.

The Average Collection Period for IFFCO was around 4.5 days in 2008-09.

This is extremely good considering the fact that IFFCO is a fertilizer company,

and functions as a cooperative. The maximum collection period during this

five year period is around 17 days in the year 2005-06 and is decreasing

since then.

3. Debtors to current assets ratio

Debtors to

Debtors

X 100

Working Capital Management

42

SAAB MARFIN MBA

Current

Assets Ratio

Current Assets

Year

Debtors

(in Crores)

Current Assets

(in Crores)

Debtors to Current

Assets Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

324.59

474.40

361.68

413.76

407.23

2603.98

4748.98

6081.28

5775.74

7672.99

12.465

9.990

5.947

7.164

5.307

Analysis

Debtors to Current Assets Ratio indicates the position of debtors in total

current assets. This ratio is calculated by debtors with current assets. If

debtors are average or less than average, it indicates proper realization of

debtors. On the other hand, if debtors are very heavy in respect of other

current assets, it indicates poor recovery of the company.

As Per the table, the Debtors to Current Assets Ratio for IFFCO decreased

from 2004-05 to 2006-07 and then increased in the year 2007-08 and then

decreasing onwards. The decrease is a healthy sign showing proper

realization of debts in 2008-09.

Working Capital Management

43

SAAB MARFIN MBA

4. Debtors to working capital ratio

Debtors to

Working

Capital Ratio

Debtors

Working Capital

X 100

Year

Debtors

(in Crores)

Working Capital

(in Crores)

Debtors to

Working Capital

Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

324.59

474.40

361.68

413.76

407.23

1499.14

3387.39

4880.05

4404.17

4490.10

21.652

14.005

7.411

9.395

9.070

Analysis

Working capital is directly related with the position of debtors. If debtors are

lower as compared to Working Capital, then it indicates proper and smooth

utilization of working capital. But on the other hand, the amount of debtor is

very large in that condition, Working capital blocked and operational

efficiency is directly affected.

From the data, it can be seen that this ratio for IFFCO has been decreasing

which is good for the company. There was a increment in the year 2007-08

due to increase in the debtors but again it continued to decrease.

Working Capital Management

44

SAAB MARFIN MBA

5. Debt to Equity Ratio

Debt to

Equity Ratio

Debt

Total Equity

Year

Debt

(in Crores)

Equity

(in Crores)

Debt to Equity

Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

647.09

5035.39

6486.12

6775.64

12802.78

3301.15

3555.38

3641.84

3688.66

3958.87

0.196

1.416

1.781

1.837

3.234

Analysis

The ratio shows the extent to which debt financing has been used in the

business. A high ratio means that claims of creditors are greater than those

of owners. A high level of debt introduces inflexibility in the firms

operations due to the increasing interference and pressure from creditors. A

low debt-equity ratio implies a greater claim of owners than capital.

At IFFCO, this ratio is increasing every year. It means that increase in debt

of the company is more than the increase in the equity. In the year 2008-09,

it increased to 3.234 from 1.837 in the year 2007-08 because of the major

increase in the short term loans from the banks.

Working Capital Management

45

SAAB MARFIN MBA

Ratios Related to Cash Management

1. Working capital ratio or current ratio

Current Ratio

=

Current Assets

Current Liabilities

Year

Current Assets

(in Crores)

Current

Liabilities

(in Crores)

Current Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

2603.98

4748.98

6081.28

5775.74

7672.99

1104.84

1361.58

1201.23

1371.57

3182.89

2.357

3.488

5.063

4.211

2.411

Analysis

Working Capital Ratio is used to analyze the short term solvency of the

company. Usually a ratio of 2:1 is considered to be the best current ratio.

Higher the ratio, greater is the ability of the firm to meet its short term

obligations.

Working Capital Management

46

SAAB MARFIN MBA

Current Ratio at IFFCO is always greater than 2 in all five years for which

data has been analyzed indicating that IFFCO never really face a major

problem in meeting its short-term liabilities.

2. Liquid ratio or Acid-test ratio or Quick ratio

Quick Ratio

=

Current Assets - Inventories

Current Liabilities

Year

Current

Assets

(in

Crores)

Inventories

(in Crores)

2004-05

2005-06

2006-07

2007-08

2008-09

2603.98

4748.98

6081.28

5775.74

7672.99

931.50

1519.64

2283.94

1577.10

1731.36

Quick

Assets

(in

Crores)

1672.48

3229.34

3797.34

4198.64

5941.63

Current

Liabilities

(in Crores)

Quick Ratio

1104.84

1361.58

1201.23

1371.57

3182.89

1.514

2.372

3.161

3.061

1.867

Analysis

Working Capital Management

47

SAAB MARFIN MBA

Position of Liquid ratio is very good. The Quick Ratio of 1:1 is considered

to be satisfactory. This is so because if the quick assets are equal to the

current liabilities then the company may be able to meet its entire

short-term obligations pretty conveniently.

The quick ratio of the company is above 1 for all the five years. The quick

ratio was 3.161 and 3.061 during the year 2006-07 and 2007-08

respectively. This is due to large amount of inventory at IFFCO during that

period. However, the reason for this is the purchase of Paradeep production

plant during that period.

3. Cash to current assets ratio

Cash to

Current

Asset Ratio

Cash

=

X 100

Current Assets

Year

Cash

(in Crores)

Current Assets

(in Crores)

Cash to Current

Asset Ratio (%)

2004-05

2005-06

2006-07

2007-08

2008-09

199.10

98.22

330.84

243.32

69.63

2603.98

4748.98

6081.28

5775.74

7672.99

7.646

2.068

5.440

4.213

0.907

Working Capital Management

48

SAAB MARFIN MBA

Analysis

The Cash to Current Assets Ratio indicates what percentage of current assets

is comprised of cash at hand and cash at bank.

Upon analyzing the data of the past 5 years for IFFCO it was observed that

the cash balances formed only a very small percentage of the current assets.

In the last 5 years, the highest was 7.65% in the year 2004-05 after which it

is decreasing. The ratio had variations in this period an in the year 2008-09,

it was 0.91%. This is a POSITIVE SIGN as it shows effective utilization of the

funds of the organization and there is not much of idle cash with the

organization.

4. Sales to current assets ratio

Sales to

Current Asset

Ratio

Sales

Current Assets

Year

Sales

(in Crores)

Current Assets

(in Crores)

Sales to Current

Asset Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

7396.87

9942.93

10330.11

12162.82

32933.30

2603.98

4748.98

6081.28

5775.74

7672.99

2.841

2.094

1.699

2.106

4.292

Working Capital Management

49

SAAB MARFIN MBA

Analysis

The Sales to Current Assets Ratio basically measures how well a company is

making use of its assets in generating sales. An increasing sale to current

assets ratio is a POSITIVE SIGN as it indicates that the company has a healthy

production scenario because of which most of inventory is being converted

into sales for the company.

IFFCO has shown a decrease in its sales to current assets ratio from

2004-05 to 2006-07 after which it is constantly increasing which implies

that the company is doing well and inventory is not being held up at any

stage in the production process.

5. Working capital turnover ratio

Working Capital = Current Assets - Current Liabilities

Working

Capital

Turnover

Ratio

Year

Sales

=

Sales

(in Crores)

Average Working Capital

Working Capital

(in Crores)

Working Capital

Turnover Ratio

Working Capital Management

50

SAAB MARFIN MBA

2004-05

2005-06

2006-07

2007-08

2008-09

7396.87

9942.93

10330.11

12162.82

32933.30

1580.36

2443.27

4133.72

4642.11

4447.14

4.680

4.070

2.499

2.620

7.406

Analysis

IFFCO has a high working capital turnover ratio.

A high or increasing Working Capital Turnover is usually a Positive Sign,

showing the company is better able to generate sales from its Working

Capital. The company has been able to gain more Net Sales with the smaller

amount of Working Capital in 2008-09 as compared to that in 2007-08. The

working capital turnover had been decreasing from 4.860 in the year

2004-05 to 2.499 in 2006-07 but it increasing since then to 7.406 in the

year 2008-09.

6. Sales to working capital ratio

Working Capital = Current Assets - Current Liabilities

Sales to

Working

Capital Ratio

Sales

=

Average Working Capital

Working Capital Management

51

SAAB MARFIN MBA

Year

Sales

(in Crores)

Working Capital

(in Crores)

Sales to Working

Capital Ratio

2004-05

2005-06

2006-07

2007-08

2008-09

7396.87

9942.93

10330.11

12162.82

32933.30

1580.36

2443.27

4133.72

4642.11

4447.14

4.680

4.070

2.499

2.620

7.406

Analysis

The Sales to Working Capital ratio measures how well the company's working

capital is being used to generate sales. Working Capital represents the

major items typically closely tied to sales, and each item will directly affect

this ratio. Increasing Sales to Working Capital ratio is usually a positive sign,

indicating the company is more able to use its working capital to generate

sales.

The sales to working capital ratio has been increasing from 2007-08 for

IFFCO which is good as it implies that the company is generating more &

more sales and is able to utilize its working capital more efficiently with the

passing years. The decrease of the ratio in the previous years was due to the

increase in inventory holding which was required for the Paradeep production plant.

Profitability Ratios

1. Return on Assets

Return on Assets

Profit After Tax

Working Capital Management

52

SAAB MARFIN MBA

(ROA)

Average Total Assets

Year

Profit After

Tax

(in

Crores)

Average Total

Assets

(in crores)

ROA

2004-05

2005-06

2006-07

2007-08

2008-09

319.64

341.35

175.02

257.59

360.01

4449.22

6709.33

9855.58

10830.24

14151.13

0.072

0.051

0.018

0.024

0.025

Analysis

ROA is an indicator of how profitable a company is relative to its total

assets. The ROA figure gives investors an idea of how effectively the

company is converting the money it has to invest into net income. The

higher the ROA number, the better, because the company is earning more

money on less investment.

At IFFCO, the ROA is increasing from the year 2006-07 which is good for

the company. Earlier it was decreasing as there was increase in the assets

due to purchase of the production plants.

2. Return on Equity

Return on

Equity (ROE)

Profit After Tax

Average Equity

Working Capital Management

53

SAAB MARFIN MBA

Year

Profit After Tax

(in Crores)

Average Equity

(in crores)

ROE

2004-05

2005-06

2006-07

2007-08

2008-09

319.64

341.35

175.02

257.59

360.01

3205.37

3428.27

3598.61

3665.25

3823.77

0.100

0.100

0.049

0.070

0.094

Analysis

Return on Equity measures the rate of return on the ownership interest of

the common stock owners. It measures a firm's efficiency at generating

profits from every unit of shareholders' equity. ROE shows how well a

company uses investment funds to generate earnings growth.

From the data, IFFCO ROE had always been good. There was a decrease in

the year 2006-07 due to the purchase of Paradeep plant which increased the

purchases of the organization.

Working Capital Management

54

SAAB MARFIN MBA

3. Return on Capital Employed

Return on

Capital

Employed

(ROCE)

Profit Before Tax

=

Average Capital Employed

Year

Profit Before Tax

(in Crores)

Average Capital

Employed

(in crores)

ROCE

2004-05

2005-06

2006-07

2007-08

2008-09

470.92

481.90

251.25

380.52

441.95

4449.22

6709.33

9855.58

10830.24

14151.13

0.1058

0.0718

0.0255

0.0351

0.0312

Analysis

ROCE is used to prove the value the business gains from its assets and

liabilities. It basically can be used to show how much a business is gaining

for its assets, or how much it is losing for its liabilities. At IFFCO, ROCE had

shown variable changes. This is due to the variable increments in the

capital employed (majorly the loan funds) as compared to the profit before

tax.

Working Capital Management

55

SAAB MARFIN MBA

4. Net Profit Margin

Net Profit

Margin

Profit After Tax

Sales

Year

Profit After Tax

(in Crores)

Sales

(in Crores)

Net Profit Margin

2004-05

2005-06

2006-07

2007-08

2008-09

319.64

341.35

175.02

257.59

360.01

7396.87

9942.93

10330.11

12162.82

32933.30

0.043

0.034

0.017

0.021

0.011

Analysis

Net profit margin ratio establishes a relationship between net profit and

sales and indicates managements efficiency in manufacturing, administering

and selling the products. This ratio is the overall measure of the firms ability

to turn each rupee sales into net profit.

From the data, IFFCO have a variable net profit margin. The sales turnover

depend upon the element of subsidy which is decided by the government

from time - to - time depending on the condition of international market.

During the year 2008-09, the component of subsidy increased tremendously

due to high international fertilizer price. Looking at the turnover of 2008-09,

Working Capital Management

56

SAAB MARFIN MBA

the subsidy amounted to Rs. 25545.60 crores vis--vis to subsidy amounted

to Rs. 6194.35 crores for the year 2007-08.

Loans and Advances to Current Assets

Loans and

Advances to

Current Assets

Ratio

Loans and

Advances

Current Assets

Year

Loans and

Advances

(in

Crores)

Current Assets

(in Crores)

2004-05

2005-06

2006-07

2007-08

2008-09

1148.77

2656.70

3104.82

3541.56

5464.77

2603.98

4748.98

6081.28

5775.74

7672.99

X 100

Loans and

Advances to

Current Assets

Ratio

44.116

55.943

51.055

61.318

71.221

Analysis

As per the data, it can be clearly said that the position of the Loans &

Advances with respect to current assets is increasing every year (a marginal

decrease in the year 2006-07) which is very Good for IFFCO. The ratio was

around 44.116% in 2004-05 which had increased to 71.221% in 2008-09.

Working Capital Management

57

SAAB MARFIN MBA

Loans and Advances to Working Capital

Loans and

Advances to

Working Capital

Ratio

Loans and

Advances

X 100

Working Capital

Year

Loans and

Advances

(in

Crores)

Working Capital

(in Crores)

2004-05

2005-06

2006-07

2007-08

2008-09

1148.77

2656.70

3104.82

3541.56

5464.77

1499.14

3387.39

4880.05

4404.17

4490.10

Loans and

Advances to

Working Capital

Ratio (%)

76.629

78.429

63.623

80.414

121.707

Analysis

Working Capital Management

58

SAAB MARFIN MBA

This ratio shows how significant Loans & Advances Are to Working Capital

and that Loans & Advances plays an important role in working capital

management of IFFCO. This ratio shows that the company has more cash in

hand and can utilize these funds as per the company requirement.

At IFFCO, this ratio has always been increasing which is good for the

organization. This means that company is having enough cash and utilizing

it effectively.

Working Capital Position

Working Capital

=

Current Assets - Current

Liabilities

Year

Current Assets

(in Crores)

Current

Liabilities

(in Crores)

Working Capital

(in Crores)

2004-05

2005-06

2006-07

2007-08

2008-09

2603.98

4748.98

6081.28

5775.74

7672.99

1104.84

1361.58

1201.23

1371.57

3182.89

1499.14

3387.40

4880.05

4404.17

4490.10

Analysis

Working Capital Management

59

SAAB MARFIN MBA

Working Capital Position indicates changes in Current Assets and Current

Liabilities over the study period and also during a particular year. Working

capital position shows operational efficiency & proper utilization of short

term resources in an organization.

The trend of working capital with respect to Current Assets and Current

Liabilities for IFFCO is increasing. This shows a GOOD GROWTH of the

company. The Working Capital is managed properly & efficiently by the

organization. However, there was decrease in the year 2007-08 due to

decrease in the level of inventory.

Comparison with some competitors in the Industry

IFFCO

Coromandel National

International Fertilizers

Fertilizers

and

Chambal

Chemicals Fertilizers

Travancore

Net Worth

3958.87

1127.14

1470.70

647.94

1234.35

Sales Turnover

32933.30 9374.98

5127.10

706.89

4595.53

Net Profit

360.01

496.38