Professional Documents

Culture Documents

Tax Calander 07052014-1

Tax Calander 07052014-1

Uploaded by

VinayakComputerRaverOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Calander 07052014-1

Tax Calander 07052014-1

Uploaded by

VinayakComputerRaverCopyright:

Available Formats

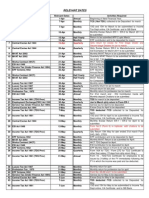

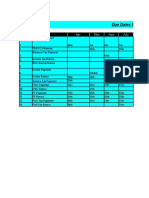

Tax Calendar for filing of Return

And payment of taxes under

(MVAT ACT)

1. MONTHLY

Sr.

Month

No.

1

April

2

May

3

June

4

July

5

August

6

September

2. QUARTERLY

Sr.

No.

1

2

3

4

5

3. SIX MONTHLY

Sr.

No.

1

2

3

Due Date

21st May

21st June

21st July

21st August

21st September

21st October

Sr.

No.

7

8

9

10

11

12

Month

Due Date.

October

November

December

January

February

March

21st November

21st December

21st January

21st February

21st March

21st April

Month

Due Date

April to June

July to September

October to December

January to March (For dealers

liable to file F-704)

January to March (For dealers not

liable to file F-704)

21st July

21st October

21st January

21st April

30th June

(Due date for tax

payment is

21st April)

Month

Due Date

April to September

October to March (For dealers

liable to file F-704)

October to March (For dealers not

liable to file F-704)

30th October

30th April

30th June

(Due date for tax

payment is

30th April)

NOTE:

1. As per Trade Circular 16T of 2008 issued by Honble CST the

concession of additional 10 days are given for uploading e-return.

However, this concession is available subject to the payment of tax as per

return is made on or before prescribed due date.

2. Therefore, the dealer fulfilling this condition may upload e-return within

additional 10 days.

4. AUDIT REPORT

Sr.

No.

1

Month

Due Date

Audit Report u/s 61

15th January

Month

Due Date

E ANNEXURE (With the

last Return of the

Financial Year)

30th June

5. E ANNEXURE

Sr.

No.

1

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- BIR RDO 113 Taxpayers' Compliance Guide 2019Document4 pagesBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- Tax Calendar 191212 PDFDocument1 pageTax Calendar 191212 PDFAnonymous WxU8OqNo ratings yet

- 2020 Kempal Bir Loa DocsDocument5 pages2020 Kempal Bir Loa DocsPajarillo Kathy AnnNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Statutory Compliances - GeneralDocument25 pagesStatutory Compliances - GeneralajaydhageNo ratings yet

- Accounts Payable Year End Procedures 0809Document5 pagesAccounts Payable Year End Procedures 0809Aman Khan Badal KhanNo ratings yet

- Work ScheduleDocument12 pagesWork ScheduleDonesh VarshneyNo ratings yet

- Financial Calendar 2011-12Document3 pagesFinancial Calendar 2011-12Delma SebastianNo ratings yet

- Statutory Due Date For F y 15 16Document1 pageStatutory Due Date For F y 15 16rajdeeppawarNo ratings yet

- Financial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerDocument16 pagesFinancial Accounti ng1: Transactions For The Month of January of A Small Finishing RetailerYassin ElsafiNo ratings yet

- 12 Compliance ChartDocument19 pages12 Compliance CharttabrezullakhanNo ratings yet

- Bookkeeping (Second Part)Document38 pagesBookkeeping (Second Part)Thuzar Lwin100% (3)

- TCS - in Income TaxDocument8 pagesTCS - in Income TaxrpsinghsikarwarNo ratings yet

- TotalDocument2 pagesTotalaskviNo ratings yet

- Tax CalendarDocument1 pageTax CalendarSwati Puneet AgarwalNo ratings yet

- 1604-Cf 2013 Global EcoDocument1 page1604-Cf 2013 Global Ecostringwinds101No ratings yet

- 2020 Kempal Bir Loa DocsDocument5 pages2020 Kempal Bir Loa DocsPajarillo Kathy AnnNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

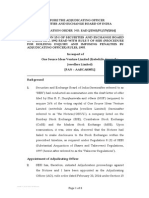

- Adjudication Order Against One Source Ideas Venture LimitedDocument8 pagesAdjudication Order Against One Source Ideas Venture LimitedShyam SunderNo ratings yet

- Accruals and PrepaymentsDocument2 pagesAccruals and PrepaymentsPriya NairNo ratings yet

- Application For Seeking Information Under The Right To Information Act, 2005Document3 pagesApplication For Seeking Information Under The Right To Information Act, 2005Hrishikesh KodmurNo ratings yet

- Itba/ast/f/142 (1) /2022 23/1047096297Document4 pagesItba/ast/f/142 (1) /2022 23/1047096297Rakesh DangiNo ratings yet

- 1st Memo AuditDocument4 pages1st Memo AuditPaul SamuelNo ratings yet

- Stock Sold.: Unit 3 Accounting - AOS 1 Name: - SAC 2 - Practice SACDocument10 pagesStock Sold.: Unit 3 Accounting - AOS 1 Name: - SAC 2 - Practice SACGulleds IbrahimNo ratings yet

- Submission GST-03 Return For Final Taxable PeriodzzzDocument1 pageSubmission GST-03 Return For Final Taxable PeriodzzzKhairi HarunNo ratings yet

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableDocument1 pageTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavNo ratings yet

- Supply of Documents On PriorityDocument15 pagesSupply of Documents On PriorityManoj Kumar TanwarNo ratings yet

- Overall PerformanceDocument15 pagesOverall PerformanceCommotrendz teamNo ratings yet

- Checklist: Statutory Compliances by Employers For Statutory Deposits, Returns & InformationDocument25 pagesChecklist: Statutory Compliances by Employers For Statutory Deposits, Returns & Informationप्रदीप मिश्रNo ratings yet

- 07 - p.10 - ENGLDocument1 page07 - p.10 - ENGLcefuneslpezNo ratings yet

- Trash - CPDocument74 pagesTrash - CPgroup3 cgstauditNo ratings yet

- Engagement Letter - Acctg Services - ANGEL VDocument2 pagesEngagement Letter - Acctg Services - ANGEL ValdrinlogrosaNo ratings yet

- Service Tax Payment Dates1Document1 pageService Tax Payment Dates1B Sreekanth ChowdaryNo ratings yet

- Rmo 69-2010Document4 pagesRmo 69-2010Sammy AsanNo ratings yet

- ObservationDocument1 pageObservationFaila JabeenNo ratings yet

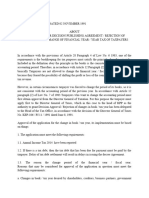

- Se 14 Tahun 1991Document3 pagesSe 14 Tahun 1991MADENo ratings yet

- Tax Collector Correspondence4005106Document2 pagesTax Collector Correspondence4005106Mohammed AbdullahNo ratings yet

- Notice 138Document13 pagesNotice 138Farhan AliNo ratings yet

- opt/scribd/conversion/tmp/scratch 2442/77378071Document1 pageopt/scribd/conversion/tmp/scratch 2442/77378071Manish TanawalaNo ratings yet

- Reg. - Regular Delay in PaymentsDocument5 pagesReg. - Regular Delay in PaymentsNiranjan NotaniNo ratings yet

- Commission OF Internal REVENUE, Petitioner, Trading CO., INC., RespondentDocument12 pagesCommission OF Internal REVENUE, Petitioner, Trading CO., INC., RespondentXIANo ratings yet

- Drop ParasDocument20 pagesDrop ParasSubhas MishraNo ratings yet

- Accounts PGDMDocument48 pagesAccounts PGDMMeghali BarmanNo ratings yet

- SCN - 1975 - 76 - To - 2013 - 14 - Upto - JuneDocument6 pagesSCN - 1975 - 76 - To - 2013 - 14 - Upto - JuneRAJESH ANDENo ratings yet

- April'2010 To June'2010Document1 pageApril'2010 To June'2010tarunbhattacharyaNo ratings yet

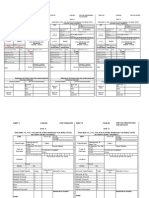

- MTR 6 PT Excel FormatDocument5 pagesMTR 6 PT Excel FormatJOYSON NOEL DSOUZANo ratings yet

- For Information To All Consumers - DT 27.08.2013 Detailed Status On Fuel Surcharge Adjustment (FSA) So Far LeviedDocument1 pageFor Information To All Consumers - DT 27.08.2013 Detailed Status On Fuel Surcharge Adjustment (FSA) So Far Leviedcontest118579No ratings yet

- 216-2001 (PLG) Settlement of Overdue NCL in Simple InterestDocument4 pages216-2001 (PLG) Settlement of Overdue NCL in Simple InterestArun JerardNo ratings yet

- 80G FormatDocument23 pages80G FormatPadmanabha NarayanNo ratings yet

- Tax Forms and DeadlinesDocument2 pagesTax Forms and DeadlinesJustine LouiseNo ratings yet

- Due Dates For Taxes Payment: S.No Particular Apr May June JulyDocument3 pagesDue Dates For Taxes Payment: S.No Particular Apr May June JulyharshilraichuraNo ratings yet

- تقرير فحص ضريبيDocument3 pagesتقرير فحص ضريبيSmart Certified Translation ServicesNo ratings yet

- Year End 20172018Document7 pagesYear End 20172018Manoj N BhosaleNo ratings yet

- Annexes Including TransmittalDocument17 pagesAnnexes Including TransmittalMeanne Waga SalazarNo ratings yet

- Commercial Taxes-Tamil NaduDocument40 pagesCommercial Taxes-Tamil NaduharidasskNo ratings yet

- Anukret On Tax Incentive in Securities Sector EnglishDocument4 pagesAnukret On Tax Incentive in Securities Sector EnglishChou ChantraNo ratings yet

- The Latest Breach of The Law by The AvnDocument3 pagesThe Latest Breach of The Law by The Avnd-fbuser-31847459No ratings yet

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocument9 pagesIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelNo ratings yet

- BUDGETINGDocument2 pagesBUDGETINGGARUIS MELINo ratings yet