Professional Documents

Culture Documents

Manila Standard Today - Business Daily Stocks Review (February 25, 2015)

Manila Standard Today - Business Daily Stocks Review (February 25, 2015)

Uploaded by

Manila Standard TodayOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Manila Standard Today - Business Daily Stocks Review (February 25, 2015)

Manila Standard Today - Business Daily Stocks Review (February 25, 2015)

Uploaded by

Manila Standard TodayCopyright:

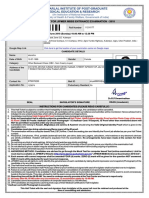

MST Business Daily Stocks Review

Wednesday, February 25, 2015

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

2.7

75.3

99.4

105.2

63

2.3

4.2

19.6

31.6

2.95

1.01

92.9

1.65

30.5

75

99

140

392

59

146.8

130

2.8

1.55

63.5

67.5

82.5

50

1.9

1.1

14.5

23.2

1.75

0.175

69.35

1.2

20.45

58

76

119

276

41.5

105.1

116

2.25

AG Finance

4.09

Asia United Bank

69.8

Banco de Oro Unibank Inc. 114.00

Bank of PI

98.75

China Bank

47.15

BDO Leasing & Fin. INc. 2.27

Bright Kindle Resources 2.64

COL Financial

16.3

Eastwest Bank

26.5

I-Remit Inc.

1.80

MEDCO Holdings

0.540

Metrobank

94.7

Natl. Reinsurance Corp. 0.94

PB Bank

18.52

Phil Bank of Comm

32.15

Phil. National Bank

83.00

Phil. Savings Bank

95.30

PSE Inc.

351

RCBC `A

46.95

Security Bank

159

Union Bank

70.45

Vantage Equities

3.13

FINANCIAL

4.1

4

69.8

67.85

114.00 113.00

99.20

97.70

47.2

47.05

2.27

2.27

2.65

2.64

16.3

16.06

26.5

25.45

1.79

1.78

0.580

0.540

95.65

94.75

0.96

0.96

18.88

18.48

32.10

32.05

83.05

82.80

95.60

95.00

351

344

47

46.9

161.8

159.5

70.45

70.20

3.13

3.04

INDUSTRIAL

45.05

44.65

1.92

1.8

1.14

1.11

2

1.99

8.2

8.14

18.88

18.6

21.1

20.5

57.5

57

1.77

1.75

13.2

13.06

19.180 18.76

11.00

10.88

8.80

8.72

10.74

10.66

20.4

17.1

29.25

28.95

103.2

102.1

15.00

14.32

0.4850 0.4700

14.80

14.52

6.84

6.68

220.40 215.40

10.56

10.24

40.10

38.10

2.78

2.72

59.00

52.00

32.4

32

31

29.6

8.040

8.030

282.60 279.80

4.58

4.52

10.50

10.30

10.66

10.56

3.89

3.83

2.65

2.58

5.69

5.66

6.57

6.57

204.8

204

1.9

1.76

0.213

0.173

1.56

1.52

2.30

2.26

218.00 212

4.72

4.48

0.74

0.71

22.85

20.85

1.58

1.56

HOLDING FIRMS

0.480

0.480

58.00

57.70

25.00

24.45

1.45

1.41

7.14

7.10

1.75

1.75

2.78

2.53

2.8

2.66

742.5

735

9.75

9.52

15.72

15.46

4.55

4.50

0.435

0.360

1209

1190

6.34

6.20

67.60

66.65

8.8

8.7

0.71

0.69

15.24

15.12

0.61

0.6

5.16

5.09

5.25

5.25

0.0440 0.0420

1.350

1.330

0.710

0.710

78.65

77.50

2.80

2.80

920.00 917.00

1.20

1.18

0.97

0.96

107.00 106.00

0.5500 0.4900

0.2800 0.2480

0.335

0.330

PROPERTY

10.040 9.900

1.10

1.05

1.350

1.350

0.265

0.255

37.70

37.10

4.45

4.33

5.05

4.96

0.97

0.94

1.01

1.01

Net Foreign

Change Volume

Trade/Buying

4.09

69.5

114.00

97.95

47.05

2.27

2.64

16.06

25.6

1.78

0.550

95.15

0.96

18.88

32.05

82.80

95.60

351

46.9

160.4

70.20

3.09

0.00

-0.43

0.00

-0.81

-0.21

0.00

0.00

-1.47

-3.40

-1.11

1.85

0.48

2.13

1.94

-0.31

-0.24

0.31

0.00

-0.11

0.88

-0.35

-1.28

531,400

21110

790,880

671,520

24,700

10,000

105,000

7,800

1,460,100

11,000

3,034,000

1,014,130

90,000

160,700

2,500

4,840,586

2,120

23,380

207,800

2,160,260

24,770

45,000

44.8

1.9

1.12

1.99

8.14

18.88

20.5

57

1.77

13.06

18.960

10.92

8.79

10.68

18.88

29

102.5

14.32

0.4850

14.70

6.74

216.80

10.5

38.10

2.72

52.00

32.15

29.7

8.040

281.40

4.58

10.30

10.66

3.84

2.63

5.67

6.57

204.8

1.78

0.178

1.53

2.27

214.6

4.72

0.71

22.85

1.57

-0.22

-1.04

-0.88

-0.50

-0.61

0.53

-2.38

0.00

-1.12

0.31

1.07

0.74

1.03

-0.19

-1.15

0.00

-0.10

-1.24

1.04

-1.34

-0.44

-1.28

2.34

-4.99

-0.73

-11.86

-0.16

-4.04

0.00

-0.21

0.22

-0.77

-1.30

-1.29

1.15

-0.53

-0.45

0.00

-3.26

-12.32

-2.55

-0.44

-1.56

4.89

-1.39

-8.60

-0.63

3,250,300 48,640,600.00

123,000

119,000

642,000

2,200

82,500

253,300.00

526,700

210,000.00

164,540

-144,392.00

115,000

28,500

-37,798.00

3,907,600 -5,247,642.00

2,247,500 3,123,060.00

26,127,800 27,247,976.00

67,000

-63,960.00

468,900

-218,870.00

3,685,200 6,021,215.00

389,620

-8,938,216.00

2,700

-24,404.00

210,000

9,400.00

6,900

1,049,300 20,160.00

1,489,840 -127,843,338.00

3,470,800 13,533,334.00

1,000

71,000

6,430

739,400

-14,808,415.00

1,151,800 9,767,780.00

197,500

194,640

-6,614,652.00

2,206,720

2,718,900 -10,416,472.00

75,100

-683,306.00

1,631,000 634,070.00

1,606,000 611,580.00

1,487,400 120,648.00

500

1,000

-47,088.00

606,000

151,740,000 39,450.00

31,000

344,000

3,427,570 -183,977,214.00

4,937,000 22,553,130.00

743,000

500

372,000

-15,600.00

0.480

58.00

24.65

1.41

7.10

1.75

2.73

2.74

738

9.66

15.54

4.55

0.390

1198

6.34

67.05

8.79

0.71

15.16

0.61

5.14

5.25

0.0430

1.330

0.710

78.00

2.80

917.50

1.20

0.97

107.00

0.5100

0.2650

0.335

0.00

0.09

-0.20

-2.76

-0.28

6.71

7.91

9.16

-0.47

-0.62

-0.89

1.11

11.43

0.00

0.00

-0.74

1.62

1.43

-0.13

0.00

0.00

3.75

-4.44

0.00

-1.39

0.13

2.94

-0.05

-1.64

1.04

0.85

2.00

6.85

0.00

40,000

1,199,600 46,163,331.00

2,323,900 -13,628,670.00

140,000

81,400

10,000

2,287,000

278,000

194,730

33,241,880.00

2,714,500 2,714,433.00

17,922,300 101,356,664.00

27,000

31,590,000 77,000.00

126,513,120

100,500

-3,792.00

1,663,620 33,765,128.00

9,544,900 3,096,834.00

378,000

1,944,700 -858,774.00

57,000

-27,600.00

172,376,247

500

7,600,000 -43,000.00

16,000

900,000

106,950

-993,702.00

3,000

201,190

-15,241,870.00

74,000

80,000

3,540

40,695,000 1,089,840.00

15,420,000 124,000.00

110,000

10.020

1.10

1.350

0.255

37.65

4.35

5.03

0.95

1.01

1.21

1.85

0.00

-7.27

1.76

-1.58

-0.40

-1.04

3.06

816,300

1,090,000

51,000

420,000

15,770,700

3,945,000

105,000

5,289,000

1,000

-22294.5

22,164,147.00

10,750,660.00

235,250.00

32,280.00

10,683,655.00

-16,800.00

9,427,412.50

52 Weeks Previous

High Low STOCKS

Close

High Low

Close

0.201

0.98

1.09

0.370

2.25

1.77

1.6

4.88

0.180

0.470

0.74

4.45

24.8

2.06

3.6

19.62

1.02

6.66

1.96

6.5

0.068

0.47

0.87

0.175

1.22

1.18

1.19

2.75

0.070

0.325

0.4

2.5

18.72

1.45

2.9

14.1

0.58

3.05

0.87

4.37

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

0.138

0.460

0.920

0.215

1.69

1.66

1.40

5.34

0.133

0.3750

0.5000

6

27.70

1.77

3.18

20.00

0.91

7.25

1.080

7.240

Net Foreign

Change Volume

Trade/Buying

0.138

0.147

0.138

0.460

0.455

0.460

0.920

0.910

0.920

0.240

0.210

0.219

1.70

1.67

1.67

1.71

1.64

1.66

1.41

1.38

1.39

5.34

5.33

5.4

0.137

0.124

0.126

0.3750 0.3550

0.3550

0.5000 0.5000

0.5000

6

5.89

5.89

28.35

28.00

28.10

1.78

1.77

1.78

3.20

3.18

3.20

20.40

19.98

20.20

0.93

0.89

0.93

7.25

7.25

7.25

1.090

1.050

1.080

7.240

7.110

7.160

SERVICES

3.25

1.55 2GO Group

5.65

6.3

5.67

6.05

43.7

27

ABS-CBN

61.6

66

61.6

65.05

1.43

0.92 Acesite Hotel

1.08

1.08

1.08

1.08

1.09

0.59 APC Group, Inc.

0.690

0.700

0.690

0.700

12.46

10

Asian Terminals Inc.

12.5

12.5

12.5

12.5

14

8.28 Bloomberry

11.76

11.74

11.06

11.14

0.1640 0.0960 Boulevard Holdings

0.1100

0.1100 0.1090

0.1090

4.05

2.97 Calata Corp.

4.39

4.35

4.26

4.33

71

44.8 Cebu Air Inc. (5J)

90.1

90.5

89.75

89.85

12.3

10.14 Centro Esc. Univ.

10.28

10.6

10.32

10.38

3.28

1.99 Discovery World

1.7

1.7

1.7

1.7

9

4

DFNN Inc.

6.38

6.36

6.10

6.10

4

2.58 Easy Call Common

2.81

2.80

2.80

2.80

1700

1080 FEUI

1090

1085

1085

1085

2008

1580 Globe Telecom

1910

1930

1910

1928

9.04

7.12 GMA Network Inc.

6.22

6.35

6.25

6.28

2.02

1.2

Harbor Star

1.52

1.61

1.56

1.57

118.9

94.4 I.C.T.S.I.

112

113.7

112.1

113.7

0.017

0.012 IP E-Game Ventures Inc. 0.015

0.016

0.014

0.015

0.0653 0.026 Island Info

0.275

0.285

0.260

0.280

2.2800 1.560 ISM Communications

1.3300

1.3600 1.3300

1.3600

6.99

1.95 Jackstones

3.9

4.49

3.2

3.2

9.67

5.82 Leisure & Resorts

9.70

9.90

9.68

9.82

2.2

1.1

Lorenzo Shipping

1.36

1.48

1.4

1.4

4.32

1.9

Macroasia Corp.

2.25

2.25

2.18

2.20

1.97

0.485 Manila Bulletin

0.700

0.710

0.700

0.700

14.46

10.14 Melco Crown

10.4

10.6

10.3

10.3

0.62

0.35 MG Holdings

0.370

0.400

0.375

0.385

1.040

0.36 NOW Corp.

0.510

0.510

0.510

0.510

22.8

14.54 Pacific Online Sys. Corp. 17.88

18.7

18

18.7

6.6

5.2

PAL Holdings Inc.

4.67

4.80

4.68

4.68

107

81

Phil. Seven Corp.

96.50

96.50

96.10

96.10

11.3

4.39 Philweb.Com Inc.

12.72

12.78

12.72

12.78

3486

2572 PLDT Common

3164.00

3200.00 3160.00

3200.00

2.01

0.26 Premium Leisure

1.710

1.700

1.670

1.670

0.710

0.250 PremiereHorizon

0.600

0.630

0.580

0.620

48.5

32.2 Puregold

40.35

40.55

39.20

39.90

74

48

Robinsons RTL

85.85

85.85

83.70

83.85

SSI Group

10.36

10.48

10.16

10.16

0.87

0.59 STI Holdings

0.69

0.71

0.70

0.70

2.95

1.68 Transpacific Broadcast 2.01

2.02

2.02

2.02

11.46

7.78 Travellers

7

7.03

6.95

7

0.435

0.305 Waterfront Phils.

0.385

0.390

0.365

0.365

MINING & OIL

0.0086 0.0028 Abra Mining

0.0056

0.0055 0.0052

0.0053

5.45

1.72 Apex `A

2.90

2.91

2.90

2.91

17.24

11.48 Atlas Cons. `A

9.76

9.82

9.75

9.81

25

9.43 Atok-Big Wedge `A

11.90

11.90

11.00

11.90

0.325

0.225 Basic Energy Corp.

0.270

0.265

0.265

0.265

12.8

6.2

Benguet Corp `A

7.5200

7.75

7.11

7.7500

12.7

6

Benguet Corp `B

7.0100

7.07

7.07

7.0700

1.2

0.5

Century Peak Metals Hldgs 1

1.03

1

1.03

1.73

0.76 Coal Asia

0.9

0.9

0.89

0.9

10.98

4.93 Dizon

7.52

8.05

7.52

7.52

Ferronickel

2.64

2.72

2.65

2.66

0.46

0.385 Geograce Res. Phil. Inc. 0.350

0.350

0.345

0.350

0.455

0.3000 Lepanto `A

0.260

0.265

0.255

0.255

0.730

0.2950 Lepanto `B

0.265

0.265

0.255

0.255

0.024

0.012 Manila Mining `A

0.0150

0.0160 0.0140

0.0150

0.026

0.014 Manila Mining `B

0.0160

0.0160 0.0150

0.0160

8.2

1.960 Marcventures Hldgs., Inc. 5.79

5.9

5.7

5.78

48.85

14.22 Nickelasia

27.6

29.3

27.6

29

3.35

1.47 Nihao Mineral Resources 3.05

3.18

3.05

3.15

1.030

0.220 Omico

0.7400

0.7600 0.7300

0.7400

3.06

1.24 Oriental Peninsula Res. 2.300

2.350

2.290

2.290

0.021

0.016 Oriental Pet. `A

0.0140

0.0130 0.0130

0.0130

0.023

0.017 Oriental Pet. `B

0.0140

0.0140 0.0140

0.0140

7.67

4.02 Petroenergy Res. Corp. 5.86

5.87

5.71

5.87

12.88

7.8

Philex `A

8.21

8.3

8.1

8.13

10.42

6.5

PhilexPetroleum

4.9

4.85

4.78

4.8

0.042

0.031 Philodrill Corp. `A

0.016

0.016

0.015

0.016

420

123 Semirara Corp.

155.00

156.80 153.40

154.00

9

4.3

TA Petroleum

3.82

3.8

3.8

3.8

0.016

0.0087 United Paragon

0.0120

0.0120 0.0110

0.0120

PREFERRED

44.1

26.3 ABS-CBN Holdings Corp. 63.8

68.95

63.8

67

Ayala Corp. Pref `B1

505

505

505

505

116

102 First Gen G

108

110

109.9

110

9.04

6.76 GMA Holdings Inc.

6.01

6.09

6.01

6.09

9.67

5.82 Leisure and Resort

1.03

1.03

1.03

1.03

MWIDE PREF

108.7

106

106

106

PCOR-Preferred A

1026

1026

1012

1012

77.3

74.2 SMC Preferred A

75.05

76

75.4

75.55

81.85

75

SMC Preferred C

81.5

81.6

81

81.5

1.34

1

Swift Pref

1.8

1.8

1.8

1.8

WARRANTS & BONDS

2.42

0.0010 LR Warrant

4.340

4.440

4.280

4.340

SME

10.96

2.4

Double Dragon

7.72

7.72

7.66

7.66

Xurpas

11.02

11.36

10.78

10.8

EXCHANGE TRADED FUNDS

119.6

94

First Metro ETF

126.3

126.6

126.5

126.5

0.00

0.00

0.00

1.86

-1.18

0.00

-0.71

1.12

-5.26

-5.33

0.00

-1.83

1.44

0.56

0.63

1.00

2.20

0.00

0.00

-1.10

0

1,640,000

1,203,000

13,090,000

452,000

37,524,000

230,000

44,734,600

19,140,000

1,640,000

75,000

124,400

1,688,300

1,901,980

84,000

16,653,300

1,425,000

1,100

495,000

6,229,200

4,009,210.00

7.08

5.60

0.00

1.45

0.00

-5.27

-0.91

-1.37

-0.28

0.97

0.00

-4.39

-0.36

-0.46

0.94

0.96

3.29

1.52

0.00

1.82

2.26

-17.95

1.24

2.94

-2.22

0.00

-0.96

4.05

0.00

4.59

0.21

-0.41

0.47

1.14

-2.34

3.33

-1.12

-2.33

-1.93

1.45

0.50

0.00

-5.19

1,184,000

515,820

70,000

248,000

1,260,000

24,253,400

8,700,000

1,104,000

195,570

136,918

38,000

70,300

4,000

10

96,375

34,700

1,013,000

648,660

53,600,000

80,280,000

357,000

10,784,000

78,700

205,000

81,000

1,278,000

3,390,300

9,050,000

416,000

175,000

57,000

950

500,900

114,005

9,365,000

20,137,000

9,735,300

1,118,990

4,360,200

479,000

10,000

1,202,600

2,400,000

1,508,680.00

-5.36

0.34

0.51

0.00

-1.85

3.06

0.86

3.00

0.00

0.00

0.76

0.00

-1.92

-3.77

0.00

0.00

-0.17

5.07

3.28

0.00

-0.43

-7.14

0.00

0.17

-0.97

-2.04

0.00

-0.65

-0.52

0.00

2,004,000,000

29,000

24,500

39,205.00

500

1,960,000

1,600

10,000

-70,700.00

904,000

30.00

270,000

60,800

12,303,000 960,200.00

50,000

43,830,000

3,350,000

630,000,000

4,200,000

1,183,500

9,067,100 129,862,605.00

1,593,000 15,600.00

1,570,000

376,000

-62,100.00

33,200,000

11,700,000

14,200

868,600

-24,500.00

101,000

134,700,000 -76,500.00

617,290

-34,675,554.00

1,000

17,700,000

5.02

0.00

1.85

1.33

0.00

-2.48

-1.36

0.67

0.00

0.00

725,910

10,100

17,990

11,040,400

51,000

10,500

570

51,000

71,400

1,000

0.00

89,000

-0.78

-2.00

271,800

4,110,500

0.16

19,320

-20,790.00

89,420.00

-15,493,850.00

794.00

128,800.00

-1,500.00

69,544.00

43,160,315.00

MST

42.6

31.75 Aboitiz Power Corp.

44.9

6.1

2.51 Agrinurture Inc.

1.92

1.66

0.88 Alliance Tuna Intl Inc.

1.13

2.3

1.25 Alsons Cons.

2

17.98

9.58 Asiabest Group

8.19

17.2

14.6 Century Food

18.78

15.8

9.82 Cirtek Holdings (Chips) 21

56.8

21.5 Concepcion

57

4.57

0.82 Da Vinci Capital

1.79

39.5

17.3 Del Monte

13.02

14

5.98 DNL Industries Inc.

18.760

12.98

9.05 Emperador

10.84

8.15

4.25 Energy Devt. Corp. (EDC) 8.70

12.34

8.68 EEI

10.70

17

8.61 Federal Res. Inv. Group 19.1

27.1

12.2 First Gen Corp.

29

90.5

48.9 First Holdings A

102.6

27

16

Ginebra San Miguel Inc. 14.50

0.014

0.0097 Greenergy

0.4800

15.74

12.8 Holcim Philippines Inc. 14.90

9.4

2.05 Integ. Micro-Electronics 6.77

199.8

150.8 Jollibee Foods Corp.

219.60

10.98

8.55 Lafarge Rep

10.26

79

48.5 Liberty Flour

40.10

5.2

2.8

LMG Chemicals

2.74

45.45

16

Macay Holdings

59.00

30

20.35 Manila Water Co. Inc.

32.2

90

12

Maxs Group

30.95

14.7

10.1 Megawide

8.040

317

246 Mla. Elect. Co `A

282.00

5.37

4

Pepsi-Cola Products Phil. 4.57

14.48

11.56 Petron Corporation

10.38

14.5

9.94 Phinma Corporation

10.80

7.03

4.33 Phoenix Petroleum Phils. 3.89

Phoenix Semiconductor 2.60

6.68

4.88 RFM Corporation

5.70

8.1

2.28 Roxas Holdings

6.6

275

210 San MiguelPure Foods `B 204.8

2.25

1.7

Splash Corporation

1.84

0.191

0.102 Swift Foods, Inc.

0.203

2.5

1.6

TKC Steel Corp.

1.57

2.68

1.37 Trans-Asia Oil

2.28

188.6

111.3 Universal Robina

218

5.5

1.58 Victorias Milling

4.5

1.3

0.550 Vitarich Corp.

0.72

26

9.01 Vivant Corp.

25.00

2.17

1.33 Vulcan Indl.

1.58

0.7

61.6

31.85

2.16

7.39

2.7

3.29

2.05

747

11.34

84

5.34

0.23

1060

7.1

59.8

6.55

0.9

19.9

0.75

5.4

5.35

0.0550

2.31

0.84

88

3.5

866

2.2

1.39

156

0.285

0.245

0.510

0.46

45.75

21.95

1.6

6.3

1.550

1.8

1.04

508

7.470

47.25

4

0.144

706

5.3

36.7

3.95

0.58

12.96

0.580

4.06

4.5

0.027

1.23

0.355

54.5

1.5

680

1.04

0.85

58.05

0.158

0.150

0.295

Abacus Cons. `A

0.480

Aboitiz Equity

57.95

Alliance Global Inc.

24.70

Anglo Holdings A

1.45

Anscor `A

7.12

Asia Amalgamated A

1.64

ATN Holdings A

2.53

ATN Holdings B

2.51

Ayala Corp `A

741.5

Cosco Capital

9.72

DMCI Holdings

15.68

Filinvest Dev. Corp.

4.50

Forum Pacific

0.350

GT Capital

1198

House of Inv.

6.34

JG Summit Holdings

67.55

Lopez Holdings Corp.

8.65

Lodestar Invt. Holdg.Corp. 0.7

LT Group

15.18

Mabuhay Holdings `A

0.61

Metro Pacific Inv. Corp. 5.14

Minerales Industrias Corp. 5.06

Pacifica `A

0.0450

Prime Media Hldg

1.330

Prime Orion

0.720

San Miguel Corp `A

77.90

Seafront `A

2.72

SM Investments Inc.

918.00

Solid Group Inc.

1.22

South China Res. Inc.

0.96

Top Frontier

106.10

Unioil Res. & Hldgs

0.5000

Wellex Industries

0.2480

Zeus Holdings

0.335

9.03

1.99

2.07

0.375

35.3

6.15

6.1

2

1.5

5.51

0.99

1

0.185

23.7

4.41

5

1.22

0.97

8990 HLDG

A. Brown Co., Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

Cityland Dev. `A

Trading Summary

FINANCIAL

INDUSTRIAL

HOLDING FIRMS

PROPERTY

SERVICES

MINING & OIL

GRAND TOTAL

SHARES

10,705,801

221,444,287

186,074,769

204,766,295

261,421,172

2,913,992,591

3,802,806,535

9.900

1.08

1.350

0.275

37.00

4.42

5.05

0.96

0.98

1,968,130.00

1,277,310.00

54,447,633.00

-35,125.00

3,104,450.00

2,039,484.00

15,291,890.00

-46,428.00

1,384,970.00

T op G ainers

VALUE

743,367,381.96

2,124,093,243.915

10,489,411,660.6455

1,446,086,454.22

1,932,766,365.435

448,249,478.758

17,233,632,835.9355

STOCKS

FINANCIAL

1,788.81 (down) 1.85

INDUSTRIAL

12,817.68 (down) 63.97

HOLDING FIRMS

6,891.75 (down) 14.96

PROPERTY

3,124.84 (up) 34.81

SERVICES

2,243.26 (up) 12.57

MINING & OIL

16,167.25 (up) 75.73

PSEI

7,844.06 (up) 9.20

All Shares Index

4,546.02 (down) 1.23

Gainers: 77; Losers: 97; Unchanged: 45; Total: 219

202,758,165.00

24,920.00

7.25

54,000.00

-31,105,131.00

-50,513,422.00

-32,700.00

101,455.00

-1,700.00

115,741,425.00

-48,000.00

-8,565,643.00

169,400.00

959,020.00

222,450.00

1,440.00

16,613,746.00

1,533,150.00

45,000.00

91,379.00

4,312,080.00

112,743,760.00

1,231,550.00

-141,807,460.00

-7,089,776.50

10,321,166.00

7,100.00

5,792,450.00

4,659,573.00

-109,900.00

-233,856.00

51,500.00

101,300.00

423,080.00

-8,059,336.00

T op L osers

Close

(P)

Change

(%)

STOCKS

Close

(P)

Change

(%)

Forum Pacific

0.390

11.43

Jackstones

3.2

-17.95

ATN Holdings B

2.74

9.16

Swift Foods, Inc.

0.178

-12.32

ATN Holdings A

2.73

7.91

Macay Holdings

52.00

-11.86

2GO Group'

6.05

7.08

Vivant Corp.

22.85

-8.60

Wellex Industries

0.2650

6.85

Arthaland Corp.

0.255

-7.27

Asia Amalgamated A

1.75

6.71

Oriental Pet. `A'

0.0130

-7.14

ABS-CBN

65.05

5.60

Abra Mining

0.0053

-5.36

Nickelasia

29

5.07

Phil. Estates Corp.

0.3550

-5.33

ABS-CBN Holdings Corp.

67

5.02

Bloomberry

11.14

-5.27

Victorias Milling

4.72

4.89

MRC Allied Ind.

0.126

-5.26

You might also like

- Customer Service Module Lesson PlanDocument10 pagesCustomer Service Module Lesson PlanDavinia Botía Corral100% (3)

- Pre-Lab: 1Dph BBBBBBBBBBBBBBBBBBBBBBBBBB ,' BBBBBBBBBBBBBB /de 6Hfwlrq BBBBBBBDocument2 pagesPre-Lab: 1Dph BBBBBBBBBBBBBBBBBBBBBBBBBB ,' BBBBBBBBBBBBBB /de 6Hfwlrq BBBBBBBAhnafHabibKhanNo ratings yet

- Arc Flash Protection Goggle W/ Nose Shield. ATPV 12 Calories. Product DetailsDocument1 pageArc Flash Protection Goggle W/ Nose Shield. ATPV 12 Calories. Product DetailsFabiánArcos100% (1)

- BSE Design Guides (HKU)Document2 pagesBSE Design Guides (HKU)李梓誠0% (1)

- Normal DistributionDocument43 pagesNormal Distributionkrystel basaNo ratings yet

- Team Effectiveness Diagnostic-LAL1Document5 pagesTeam Effectiveness Diagnostic-LAL1MacNo ratings yet

- American Girl Presentaton Team-6Document9 pagesAmerican Girl Presentaton Team-6Ashish Kaushal RanjanNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 26, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 23, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 24, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 10, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 12, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (August 12, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 20, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 10, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (April 10, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 25, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 25, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 9, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (January 9, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 24, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (June 24, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 6, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (February 6, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 13, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 13, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 1, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 17, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 17, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (June 23, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (June 23, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 8, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 8, 2014)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (August 5, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (August 5, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (July 10, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (July 10, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (April 1, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (April 1, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (March 18, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (March 18, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (January 8, 2015)Document1 pageManila Standard Today - Business Daily Stocks Review (January 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 15, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 15, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Document1 pageManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNo ratings yet

- Business Sustainability in Asia: Compliance, Performance, and Integrated Reporting and AssuranceFrom EverandBusiness Sustainability in Asia: Compliance, Performance, and Integrated Reporting and AssuranceNo ratings yet

- The Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsFrom EverandThe Mechanics of Securitization: A Practical Guide to Structuring and Closing Asset-Backed Security TransactionsNo ratings yet

- The Standard - Business Daily Stocks Review (June 8, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 2, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 3, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (June 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 6, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 26, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 25, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 18, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 4, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 7, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 20, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 11, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 5, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 30, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (May 13, 2015)Document1 pageThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Document1 pageManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 28, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 24, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNo ratings yet

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Document1 pageManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 23, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 22, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 29, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 17, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Weekly Stocks Review (April 19, 2015)Document1 pageThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayNo ratings yet

- The Standard - Business Daily Stocks Review (April 16, 2015)Document1 pageThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayNo ratings yet

- CandidateHallTicket PDFDocument1 pageCandidateHallTicket PDFAditya YadavNo ratings yet

- แผน Unit 5 Vocabulary Collocation ล่าสุดDocument19 pagesแผน Unit 5 Vocabulary Collocation ล่าสุดThapanat Boon-yingNo ratings yet

- Hindoh MF2000 MF3000 MF4000 N610 N410 Series Security Target Lite V1.0Document75 pagesHindoh MF2000 MF3000 MF4000 N610 N410 Series Security Target Lite V1.0Dawood AhmedNo ratings yet

- Wartung Assyst Plus 204 enDocument32 pagesWartung Assyst Plus 204 enKent Wai100% (1)

- Industrial Safety and Health Management 6th Edition Asfahl Test BankDocument9 pagesIndustrial Safety and Health Management 6th Edition Asfahl Test Bankfelicityto1jbn100% (27)

- 2B3.1. Robbery, FSG 2B3.1Document4 pages2B3.1. Robbery, FSG 2B3.1RichardNo ratings yet

- Drainage Systems in ApartmentsDocument16 pagesDrainage Systems in ApartmentsAarthi RNo ratings yet

- Japan, US Struggle To Find Crashed Jet and Its 'Secrets': Tokyo (AFP)Document2 pagesJapan, US Struggle To Find Crashed Jet and Its 'Secrets': Tokyo (AFP)Annastasya ParestiNo ratings yet

- 2 Classes and Objects2018-10-23 14 - 17 - 43Document71 pages2 Classes and Objects2018-10-23 14 - 17 - 43RiyaNo ratings yet

- Midrex 2017 DFM1stQtrPrintFinalDocument13 pagesMidrex 2017 DFM1stQtrPrintFinalMohamed ShabanNo ratings yet

- CMD Message: Deepak Kumar Hota Chairman & Managing Director BemlDocument1 pageCMD Message: Deepak Kumar Hota Chairman & Managing Director BemlMadhurya KrishnaNo ratings yet

- By Rick Conlow: 7 Lessons For Team MasteryDocument37 pagesBy Rick Conlow: 7 Lessons For Team MasteryYemi AdetayoNo ratings yet

- Reaction Paper Human BehaviorDocument1 pageReaction Paper Human BehaviorEsteve DagdagNo ratings yet

- Solar Dryer IFRJDocument18 pagesSolar Dryer IFRJdzaki ramadhanNo ratings yet

- Recommended Books For RBI Grade B Exam With Bonus Online MaterialDocument15 pagesRecommended Books For RBI Grade B Exam With Bonus Online MaterialrahulNo ratings yet

- Recereum WhitePaperDocument23 pagesRecereum WhitePaperLord VNo ratings yet

- Sonic Drive inDocument1 pageSonic Drive inWXYZ-TV Channel 7 DetroitNo ratings yet

- NTSE Odisha Merit ListDocument8 pagesNTSE Odisha Merit ListShrutija SwainNo ratings yet

- Vinyl Acetate Monomer VAM BrochureDocument2 pagesVinyl Acetate Monomer VAM BrochureMuslim Nasir100% (1)

- JP Programme Officer PAK-OxfamNDocument2 pagesJP Programme Officer PAK-OxfamNxtremist2001No ratings yet

- Fall Background PowerPoint Template by SlideWinDocument29 pagesFall Background PowerPoint Template by SlideWinHoàng Thùy DươngNo ratings yet

- FAB Analyst and Investor Day BiosDocument17 pagesFAB Analyst and Investor Day BioskhuramrajpootNo ratings yet

- Cargills Annual Report 2013 PDFDocument100 pagesCargills Annual Report 2013 PDFArunallNo ratings yet