Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsTax On GOCC's Nirc Section 27 (C) Rates of Income Tax On Domestic Corporations.

Tax On GOCC's Nirc Section 27 (C) Rates of Income Tax On Domestic Corporations.

Uploaded by

KatharosJaneGovernment-owned or controlled corporations, agencies, or instrumentalities (GOCCs) are subject to the same income tax rates as privately owned corporations engaged in similar businesses, with some exceptions. Income derived from public utilities or essential government functions is exempt from taxation. Local government units cannot impose taxes, fees or charges on the national government, its agencies, instrumentalities, or other local government units. However, local governments can set utility rates for public utilities they own and operate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You might also like

- TAX3Document1 pageTAX3Elaine Joyce GarciaNo ratings yet

- BIR Ruling 013-2004Document8 pagesBIR Ruling 013-2004RNicolo BallesterosNo ratings yet

- Prepared By: Leyla B. Malijan J19-65663Document31 pagesPrepared By: Leyla B. Malijan J19-65663leyla malijanNo ratings yet

- Taxation Reviewer 1Document110 pagesTaxation Reviewer 1bigbully23No ratings yet

- Tax Provisions PrintoutDocument4 pagesTax Provisions PrintoutjrvyeeNo ratings yet

- Exclusions Under The ConstitutionDocument4 pagesExclusions Under The ConstitutionGarri AtaydeNo ratings yet

- Bir Ruling No. 313-15Document4 pagesBir Ruling No. 313-15Stacy Lyn LiongNo ratings yet

- TAX Reviewer 2Document9 pagesTAX Reviewer 2Krystal MaciasNo ratings yet

- RR 11-18Document55 pagesRR 11-18Cuayo JuicoNo ratings yet

- Corporation: SEC. 30. Exemptions From Tax On Corporations. - The Following OrganizationsDocument4 pagesCorporation: SEC. 30. Exemptions From Tax On Corporations. - The Following OrganizationsAnonymous tIaJEFNo ratings yet

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiNo ratings yet

- Computation of Income TaxDocument6 pagesComputation of Income TaxshakiraNo ratings yet

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077No ratings yet

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- TaxLawRev1 UpdatedDocument277 pagesTaxLawRev1 UpdatedKaira TanhuecoNo ratings yet

- CREATE Salient ProvisionsDocument3 pagesCREATE Salient ProvisionsAldrin Santos AntonioNo ratings yet

- Basic Income Taxation of Corporations in PhilippinesDocument7 pagesBasic Income Taxation of Corporations in PhilippinesMae Katherine Grande Lumbria100% (1)

- Create Act: Corporate Recovery & Tax Incentives For EnterprisesDocument6 pagesCreate Act: Corporate Recovery & Tax Incentives For EnterprisesDanica RamosNo ratings yet

- COMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-33Document5 pagesCOMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-332022107419No ratings yet

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Document11 pagesRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Rolly Balagon Caballero100% (1)

- B. PAGCOR v. BIR (Non-Impairment Clause) PDFDocument14 pagesB. PAGCOR v. BIR (Non-Impairment Clause) PDFKaloi GarciaNo ratings yet

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument24 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledPam ChuaNo ratings yet

- G.R. No. 172087Document12 pagesG.R. No. 172087monica may ramosNo ratings yet

- Train Law ReportDocument29 pagesTrain Law Reportmarjorie blanco100% (1)

- PAGCOR Vs BIRDocument14 pagesPAGCOR Vs BIRGladys BantilanNo ratings yet

- DTTL Tax Unitedstateshighlights 2020Document12 pagesDTTL Tax Unitedstateshighlights 2020Росен Атанасов-ЕжкоNo ratings yet

- Pagcor V BirDocument14 pagesPagcor V BirPatricia Anne GonzalesNo ratings yet

- Report On Tanhhx 1Document28 pagesReport On Tanhhx 1Eks WaiNo ratings yet

- 186-PAGCOR v. BIR G.R. No. 172087 March 15, 2011Document13 pages186-PAGCOR v. BIR G.R. No. 172087 March 15, 2011Jopan SJNo ratings yet

- Guese - Income Tax - Project - Create - 001Document21 pagesGuese - Income Tax - Project - Create - 001Guese, Christian Nicolas ANo ratings yet

- CREATE ActDocument34 pagesCREATE ActErica Dela CruzNo ratings yet

- Digest RR 11-2018Document38 pagesDigest RR 11-2018Mo MuNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument14 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivesbce14No ratings yet

- Tax Law ReviewDocument8 pagesTax Law ReviewIon FashNo ratings yet

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- Pagcor VS Bir, GR No. 172087Document13 pagesPagcor VS Bir, GR No. 172087RAINE BARANDANo ratings yet

- RR No. 11-2018Document47 pagesRR No. 11-2018Micah Adduru - Robles100% (1)

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholNo ratings yet

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholNo ratings yet

- Week 10 Part 3 Exclusions From The Gross IncomeDocument19 pagesWeek 10 Part 3 Exclusions From The Gross IncomeArellano Rhovic R.No ratings yet

- Pagcor V Bir GR 172087Document16 pagesPagcor V Bir GR 172087LalaLanibaNo ratings yet

- Preferential TaxationDocument8 pagesPreferential TaxationMary Jane PabroaNo ratings yet

- LECT 1 IncomeDocument4 pagesLECT 1 IncomeFredalyn Joy VelaqueNo ratings yet

- RR No. 11-2018Document90 pagesRR No. 11-2018Leticia TaclasNo ratings yet

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- Non - Resident Foreign Corporations Subject To Special Tax RatesDocument3 pagesNon - Resident Foreign Corporations Subject To Special Tax RatesMeghan Kaye LiwenNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- The Obligations of Government Agencies, Bureaus and Instrumentalities As Withholding AgentsDocument3 pagesThe Obligations of Government Agencies, Bureaus and Instrumentalities As Withholding AgentssuzetteNo ratings yet

- Ra 9337Document23 pagesRa 9337cheska_abigail950No ratings yet

- Business Policy - Chap 1Document22 pagesBusiness Policy - Chap 1Niña BotardoNo ratings yet

- Goods Sold' Shall Include The Invoice Cost of TheDocument9 pagesGoods Sold' Shall Include The Invoice Cost of TheChaze CerdenaNo ratings yet

- Section 6. Section 27 of The National Internal Revenue Code of 1997, As Amended, Is Hereby FurtherDocument3 pagesSection 6. Section 27 of The National Internal Revenue Code of 1997, As Amended, Is Hereby FurtherthisisnotmyofficialeaddNo ratings yet

- Corporation TaxationDocument7 pagesCorporation TaxationslncrochetNo ratings yet

- Taxation Midterm ReviewerDocument5 pagesTaxation Midterm ReviewerMaria RochelleNo ratings yet

- Chapter 1 TaxDocument17 pagesChapter 1 TaxSiddharth VaswaniNo ratings yet

- Let's Talk Tax: Regular Corporate Income TaxDocument3 pagesLet's Talk Tax: Regular Corporate Income TaxEldren CelloNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- INTERNAL. This Information Is Accessible To ADB Management and Staff. It May Be Shared Outside ADB With Appropriate PermissionDocument25 pagesINTERNAL. This Information Is Accessible To ADB Management and Staff. It May Be Shared Outside ADB With Appropriate PermissionKatharosJaneNo ratings yet

- Agrarian Reform Law Aug 17 2015Document81 pagesAgrarian Reform Law Aug 17 2015KatharosJaneNo ratings yet

- Irr - Ra 9262Document74 pagesIrr - Ra 9262KatharosJaneNo ratings yet

- Confederation For Unity Et. Al. vs. Commissioner BIR GR NO. 213446Document38 pagesConfederation For Unity Et. Al. vs. Commissioner BIR GR NO. 213446KatharosJaneNo ratings yet

- Anti Competition LawDocument18 pagesAnti Competition LawKatharosJaneNo ratings yet

- Ce Laws, Contracts, Specifications and ProfessionalDocument31 pagesCe Laws, Contracts, Specifications and ProfessionalKatharosJane100% (1)

- Digest Evidence Assigned CasesDocument11 pagesDigest Evidence Assigned CasesKatharosJaneNo ratings yet

- The Right of Existence and Self DefenseDocument3 pagesThe Right of Existence and Self DefenseKatharosJane100% (2)

- Credit Transaction CasesDocument5 pagesCredit Transaction CasesKatharosJane0% (1)

- Assignment No. 2 - Constitutional Law IIDocument10 pagesAssignment No. 2 - Constitutional Law IIKatharosJaneNo ratings yet

- Fringe Benefits What Is Fringe Benefit?Document9 pagesFringe Benefits What Is Fringe Benefit?KatharosJaneNo ratings yet

- 2031rr15 02Document8 pages2031rr15 02KatharosJaneNo ratings yet

Tax On GOCC's Nirc Section 27 (C) Rates of Income Tax On Domestic Corporations.

Tax On GOCC's Nirc Section 27 (C) Rates of Income Tax On Domestic Corporations.

Uploaded by

KatharosJane0 ratings0% found this document useful (0 votes)

14 views1 pageGovernment-owned or controlled corporations, agencies, or instrumentalities (GOCCs) are subject to the same income tax rates as privately owned corporations engaged in similar businesses, with some exceptions. Income derived from public utilities or essential government functions is exempt from taxation. Local government units cannot impose taxes, fees or charges on the national government, its agencies, instrumentalities, or other local government units. However, local governments can set utility rates for public utilities they own and operate.

Original Description:

Pertinent provisions on NIRC for GOccs

Original Title

Tax on GOCCs

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGovernment-owned or controlled corporations, agencies, or instrumentalities (GOCCs) are subject to the same income tax rates as privately owned corporations engaged in similar businesses, with some exceptions. Income derived from public utilities or essential government functions is exempt from taxation. Local government units cannot impose taxes, fees or charges on the national government, its agencies, instrumentalities, or other local government units. However, local governments can set utility rates for public utilities they own and operate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views1 pageTax On GOCC's Nirc Section 27 (C) Rates of Income Tax On Domestic Corporations.

Tax On GOCC's Nirc Section 27 (C) Rates of Income Tax On Domestic Corporations.

Uploaded by

KatharosJaneGovernment-owned or controlled corporations, agencies, or instrumentalities (GOCCs) are subject to the same income tax rates as privately owned corporations engaged in similar businesses, with some exceptions. Income derived from public utilities or essential government functions is exempt from taxation. Local government units cannot impose taxes, fees or charges on the national government, its agencies, instrumentalities, or other local government units. However, local governments can set utility rates for public utilities they own and operate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 1

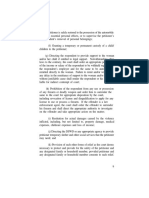

Tax on GOCCs

NIRC

Section 27 (C)

Rates of Income

Corporations. -

tax

on

Domestic

(C) Government-owned or ControlledCorporations, Agencies or Instrumentalities.

The provisions of existing special or general

laws to the contrary notwithstanding, all

corporations, agencies, or instrumentalities

owned or controlled by the Government,

except the Government Service Insurance

System (GSIS), the Social Security System

(SSS), the Philippine Health Insurance

Corporation (PHIC), the Philippine Charity

Sweepstakes Office (PCSO) and the

Philippine

Amusement

and

Gaming

Corporation (PAGCOR), shall pay such rate

of tax upon their taxable income as are

imposed by this Section upon corporations

or associations engaged in s similar

business, industry, or activity.

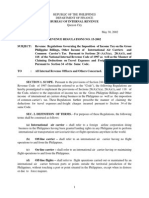

NIRC

Section 32 (B)(7)(b)

Gross Income.

(B) Exclusions from Gross Income.

The following items shall not be included in

gross income and shall be exempt from

taxation under this title:

(7) Miscellaneous Items.

(b) Income Derived by the Government or

its Political Subdivisions.

Income derived from any public utility or

from the exercise of any essential

governmental function accruing to the

Government of the Philippines or to any

political subdivision thereof.

Local Government Code

Section 133 (o)

Common Limitations on the Taxing Powers

of Local Government Units.

Unless otherwise provided herein, the

exercise of the taxing powers of provinces,

cities, municipalities, and barangays shall

not extend to the levy of the following:

(o) Taxes, fees or charges of any kind on

the National Government, its agencies and

instrumentalities, and local government

units.

Local Government Code

Section 154

Public Utility Charges.

Local government units may fix the rates for

the operation of public utilities owned,

operated and maintained by them within

their jurisdiction.

You might also like

- TAX3Document1 pageTAX3Elaine Joyce GarciaNo ratings yet

- BIR Ruling 013-2004Document8 pagesBIR Ruling 013-2004RNicolo BallesterosNo ratings yet

- Prepared By: Leyla B. Malijan J19-65663Document31 pagesPrepared By: Leyla B. Malijan J19-65663leyla malijanNo ratings yet

- Taxation Reviewer 1Document110 pagesTaxation Reviewer 1bigbully23No ratings yet

- Tax Provisions PrintoutDocument4 pagesTax Provisions PrintoutjrvyeeNo ratings yet

- Exclusions Under The ConstitutionDocument4 pagesExclusions Under The ConstitutionGarri AtaydeNo ratings yet

- Bir Ruling No. 313-15Document4 pagesBir Ruling No. 313-15Stacy Lyn LiongNo ratings yet

- TAX Reviewer 2Document9 pagesTAX Reviewer 2Krystal MaciasNo ratings yet

- RR 11-18Document55 pagesRR 11-18Cuayo JuicoNo ratings yet

- Corporation: SEC. 30. Exemptions From Tax On Corporations. - The Following OrganizationsDocument4 pagesCorporation: SEC. 30. Exemptions From Tax On Corporations. - The Following OrganizationsAnonymous tIaJEFNo ratings yet

- In Come Tax TableDocument9 pagesIn Come Tax TablejorjirubiNo ratings yet

- Computation of Income TaxDocument6 pagesComputation of Income TaxshakiraNo ratings yet

- Annex B: Income Tax Tables: Table 1 Tax Rates For IndividualsDocument9 pagesAnnex B: Income Tax Tables: Table 1 Tax Rates For Individualshaze_toledo5077No ratings yet

- Tax On Corporation MaterialsDocument18 pagesTax On Corporation Materialsjdy managbanagNo ratings yet

- TaxLawRev1 UpdatedDocument277 pagesTaxLawRev1 UpdatedKaira TanhuecoNo ratings yet

- CREATE Salient ProvisionsDocument3 pagesCREATE Salient ProvisionsAldrin Santos AntonioNo ratings yet

- Basic Income Taxation of Corporations in PhilippinesDocument7 pagesBasic Income Taxation of Corporations in PhilippinesMae Katherine Grande Lumbria100% (1)

- Create Act: Corporate Recovery & Tax Incentives For EnterprisesDocument6 pagesCreate Act: Corporate Recovery & Tax Incentives For EnterprisesDanica RamosNo ratings yet

- COMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-33Document5 pagesCOMPUTATION OF GROSS INCOME As Per Tax Code Sec. 32-332022107419No ratings yet

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Document11 pagesRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create)Rolly Balagon Caballero100% (1)

- B. PAGCOR v. BIR (Non-Impairment Clause) PDFDocument14 pagesB. PAGCOR v. BIR (Non-Impairment Clause) PDFKaloi GarciaNo ratings yet

- Be It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledDocument24 pagesBe It Enacted by The Senate and The House of Representatives of The Philippines in Congress AssembledPam ChuaNo ratings yet

- G.R. No. 172087Document12 pagesG.R. No. 172087monica may ramosNo ratings yet

- Train Law ReportDocument29 pagesTrain Law Reportmarjorie blanco100% (1)

- PAGCOR Vs BIRDocument14 pagesPAGCOR Vs BIRGladys BantilanNo ratings yet

- DTTL Tax Unitedstateshighlights 2020Document12 pagesDTTL Tax Unitedstateshighlights 2020Росен Атанасов-ЕжкоNo ratings yet

- Pagcor V BirDocument14 pagesPagcor V BirPatricia Anne GonzalesNo ratings yet

- Report On Tanhhx 1Document28 pagesReport On Tanhhx 1Eks WaiNo ratings yet

- 186-PAGCOR v. BIR G.R. No. 172087 March 15, 2011Document13 pages186-PAGCOR v. BIR G.R. No. 172087 March 15, 2011Jopan SJNo ratings yet

- Guese - Income Tax - Project - Create - 001Document21 pagesGuese - Income Tax - Project - Create - 001Guese, Christian Nicolas ANo ratings yet

- CREATE ActDocument34 pagesCREATE ActErica Dela CruzNo ratings yet

- Digest RR 11-2018Document38 pagesDigest RR 11-2018Mo MuNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument14 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL Exclusivesbce14No ratings yet

- Tax Law ReviewDocument8 pagesTax Law ReviewIon FashNo ratings yet

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- Pagcor VS Bir, GR No. 172087Document13 pagesPagcor VS Bir, GR No. 172087RAINE BARANDANo ratings yet

- RR No. 11-2018Document47 pagesRR No. 11-2018Micah Adduru - Robles100% (1)

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholNo ratings yet

- Chapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Document19 pagesChapter Iv - Tax On Corporations SEC. 27. Rates of Income Tax On Domestic Corporations.Anita Solano BoholNo ratings yet

- Week 10 Part 3 Exclusions From The Gross IncomeDocument19 pagesWeek 10 Part 3 Exclusions From The Gross IncomeArellano Rhovic R.No ratings yet

- Pagcor V Bir GR 172087Document16 pagesPagcor V Bir GR 172087LalaLanibaNo ratings yet

- Preferential TaxationDocument8 pagesPreferential TaxationMary Jane PabroaNo ratings yet

- LECT 1 IncomeDocument4 pagesLECT 1 IncomeFredalyn Joy VelaqueNo ratings yet

- RR No. 11-2018Document90 pagesRR No. 11-2018Leticia TaclasNo ratings yet

- Preferential Taxation - Magumpara, AliahDocument8 pagesPreferential Taxation - Magumpara, AliahAliah MagumparaNo ratings yet

- Non - Resident Foreign Corporations Subject To Special Tax RatesDocument3 pagesNon - Resident Foreign Corporations Subject To Special Tax RatesMeghan Kaye LiwenNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- The Obligations of Government Agencies, Bureaus and Instrumentalities As Withholding AgentsDocument3 pagesThe Obligations of Government Agencies, Bureaus and Instrumentalities As Withholding AgentssuzetteNo ratings yet

- Ra 9337Document23 pagesRa 9337cheska_abigail950No ratings yet

- Business Policy - Chap 1Document22 pagesBusiness Policy - Chap 1Niña BotardoNo ratings yet

- Goods Sold' Shall Include The Invoice Cost of TheDocument9 pagesGoods Sold' Shall Include The Invoice Cost of TheChaze CerdenaNo ratings yet

- Section 6. Section 27 of The National Internal Revenue Code of 1997, As Amended, Is Hereby FurtherDocument3 pagesSection 6. Section 27 of The National Internal Revenue Code of 1997, As Amended, Is Hereby FurtherthisisnotmyofficialeaddNo ratings yet

- Corporation TaxationDocument7 pagesCorporation TaxationslncrochetNo ratings yet

- Taxation Midterm ReviewerDocument5 pagesTaxation Midterm ReviewerMaria RochelleNo ratings yet

- Chapter 1 TaxDocument17 pagesChapter 1 TaxSiddharth VaswaniNo ratings yet

- Let's Talk Tax: Regular Corporate Income TaxDocument3 pagesLet's Talk Tax: Regular Corporate Income TaxEldren CelloNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- INTERNAL. This Information Is Accessible To ADB Management and Staff. It May Be Shared Outside ADB With Appropriate PermissionDocument25 pagesINTERNAL. This Information Is Accessible To ADB Management and Staff. It May Be Shared Outside ADB With Appropriate PermissionKatharosJaneNo ratings yet

- Agrarian Reform Law Aug 17 2015Document81 pagesAgrarian Reform Law Aug 17 2015KatharosJaneNo ratings yet

- Irr - Ra 9262Document74 pagesIrr - Ra 9262KatharosJaneNo ratings yet

- Confederation For Unity Et. Al. vs. Commissioner BIR GR NO. 213446Document38 pagesConfederation For Unity Et. Al. vs. Commissioner BIR GR NO. 213446KatharosJaneNo ratings yet

- Anti Competition LawDocument18 pagesAnti Competition LawKatharosJaneNo ratings yet

- Ce Laws, Contracts, Specifications and ProfessionalDocument31 pagesCe Laws, Contracts, Specifications and ProfessionalKatharosJane100% (1)

- Digest Evidence Assigned CasesDocument11 pagesDigest Evidence Assigned CasesKatharosJaneNo ratings yet

- The Right of Existence and Self DefenseDocument3 pagesThe Right of Existence and Self DefenseKatharosJane100% (2)

- Credit Transaction CasesDocument5 pagesCredit Transaction CasesKatharosJane0% (1)

- Assignment No. 2 - Constitutional Law IIDocument10 pagesAssignment No. 2 - Constitutional Law IIKatharosJaneNo ratings yet

- Fringe Benefits What Is Fringe Benefit?Document9 pagesFringe Benefits What Is Fringe Benefit?KatharosJaneNo ratings yet

- 2031rr15 02Document8 pages2031rr15 02KatharosJaneNo ratings yet