Professional Documents

Culture Documents

Tirecity Classwork

Tirecity Classwork

Uploaded by

Akshay MehtaCopyright:

Available Formats

You might also like

- YouTube Profit & Loss and Balance Sheet 2005-2006Document28 pagesYouTube Profit & Loss and Balance Sheet 2005-2006titocosta100% (2)

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Taxation AnswerDocument13 pagesTaxation AnswerkannadhassNo ratings yet

- Boston BeerDocument23 pagesBoston BeerarnabpramanikNo ratings yet

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- The Year at A Glance: Profi T After Tax Growth in SalesDocument1 pageThe Year at A Glance: Profi T After Tax Growth in Salessmartchinu6No ratings yet

- Banks DIH Financial AnalysisDocument15 pagesBanks DIH Financial AnalysisRetishaLoaknauthNo ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNo ratings yet

- Balance Sheet Asat31 March 2012Document52 pagesBalance Sheet Asat31 March 2012Pravin BhojwaniNo ratings yet

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKNo ratings yet

- Book 1Document8 pagesBook 1Jerome NgNo ratings yet

- Financial ForecastingDocument22 pagesFinancial ForecastingKaustav BanerjeeNo ratings yet

- Business Analyis Report - ChaturthiDocument2 pagesBusiness Analyis Report - ChaturthiRavi Pratap Singh TomarNo ratings yet

- Analisa Eva Wacc STTPDocument11 pagesAnalisa Eva Wacc STTPAnggih Nur HamidahNo ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Analyze The Potential Profit or Loss of Your Real Estate InvestmentDocument3 pagesAnalyze The Potential Profit or Loss of Your Real Estate InvestmentiskandarmalaysiaNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocument12 pagesTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNo ratings yet

- (Pso) Pakistan State OilDocument4 pages(Pso) Pakistan State OilSalman AtherNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- InfraDocument11 pagesInfrakdoshi23No ratings yet

- Analisa Eva Wacc SsmsDocument11 pagesAnalisa Eva Wacc SsmsAnggih Nur HamidahNo ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Hampton MachineDocument7 pagesHampton MachineMurali SubramaniamNo ratings yet

- F9 Sample ReportsDocument31 pagesF9 Sample ReportsAla K ObeigNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- Tata Steel 1Document12 pagesTata Steel 1Dhwani ShahNo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- Return & Profit Analysis - PinDDDocument45 pagesReturn & Profit Analysis - PinDDPhươngAnhNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- 2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDocument8 pages2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDougNo ratings yet

- Hampton Machine Works SolutionsDocument9 pagesHampton Machine Works SolutionsPham GiangNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- SearsDocument11 pagesSearsHelplineNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- Societe de Commerce International Tameza Inc. 9251-1559 QUEBEC INCDocument31 pagesSociete de Commerce International Tameza Inc. 9251-1559 QUEBEC INCLuis Alberto Taborda SchotborgNo ratings yet

- 03 Tire City, Inc. - ExhibitsDocument2 pages03 Tire City, Inc. - ExhibitsLalit DeoNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- AT&T Vs MegafonDocument18 pagesAT&T Vs MegafonMikhay IstratiyNo ratings yet

- Bmo 8.1.13 PDFDocument7 pagesBmo 8.1.13 PDFChad Thayer VNo ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- ITC Affect On CompanyDocument10 pagesITC Affect On CompanynavpreetsinghkNo ratings yet

- Jawaban Kuis AK2Document37 pagesJawaban Kuis AK2clara_patricia_2No ratings yet

- Income Statement: Total Operating Revenue Operating ExpensesDocument11 pagesIncome Statement: Total Operating Revenue Operating ExpensesBobYuNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Managerial Finance Tutorial 7: To Be Submitted Within 3 JuneDocument7 pagesManagerial Finance Tutorial 7: To Be Submitted Within 3 JuneaskdgasNo ratings yet

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279No ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Group09 CliquepensDocument1 pageGroup09 CliquepensAkshay Mehta100% (1)

- Knapsack ProblemDocument10 pagesKnapsack ProblemAkshay MehtaNo ratings yet

- Virtual MDocument43 pagesVirtual MAkshay MehtaNo ratings yet

- Activity 6.1 Module9 Union Intersect MinusDocument2 pagesActivity 6.1 Module9 Union Intersect MinusAkshay MehtaNo ratings yet

- Solutions of RDBMSDocument64 pagesSolutions of RDBMSAkshay MehtaNo ratings yet

- RDBMS 6Document1 pageRDBMS 6Akshay MehtaNo ratings yet

- Computer Network2.4Document22 pagesComputer Network2.4Akshay MehtaNo ratings yet

- Computer Network2.3Document15 pagesComputer Network2.3Akshay MehtaNo ratings yet

- Computer Network2.5Document21 pagesComputer Network2.5Akshay MehtaNo ratings yet

- Introduction To Data WarehousingDocument38 pagesIntroduction To Data WarehousingAkshay MehtaNo ratings yet

- CLR ExplainedDocument883 pagesCLR ExplainedAkshay MehtaNo ratings yet

Tirecity Classwork

Tirecity Classwork

Uploaded by

Akshay MehtaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tirecity Classwork

Tirecity Classwork

Uploaded by

Akshay MehtaCopyright:

Available Formats

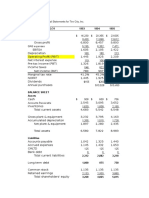

For years ending 12/31

INCOME STATEMENT

Net sales

Cost of sales

Gross profit

1993

GAS expenses

Depreciation

EBIT

Net interest expense

Pre-tax income

Income taxes

Net income

Dividends

Addition to Retained earnings

16230 $

9430

6800

5195

160

1,445

Marginal tax rate

1994

1995

20355 $ 23,505

11898

13,612

8457

9,893

7,471

6352

180

213

1,925

2,209

119.0

106.0

94.0

1,326

1,819

2,115

546

822

925

997

200

797

1,190

240

950

780

155 $

625

41.2%

45.2%

43.7%

BALANCE SHEET

Assets

Cash

Accounts Receivable

Inventories

Total current assets

Accounts payable

Accrued expenses

NOWC

Gross plant & equipment

Accumulated depreciaiton

Net plant & equipment

Total net OC

508 $

609

2,545

3,095

706

3,652

1,630

1,838

2,190

4,683

1,042

5,542

1,325

6,548

1,440

1,145

2,496

1,432

2,785

1,653

3,455

3,232

3,795

4,163

1,335

1,515

1,728

1,897

2,280

2,435

4,393

5,065

5,890

125

125

125

1,000

875

750

1,125

1,135

1,000

1,135

875

1,135

2,133

2,930

3,880

3,268

4,065

5,015

4,393

5,065

5,890

617

391

169

Operating capital

CMLTD

Bank debt

Long term debt

Total debt capital

Common stock

Retained earnings

Total shareholders' equity

Operating capital

difference amount

Net debt

1997

1996F

$ 28,206.0 $

$ 16,415.89 $

$ 11,790.11 $

$ 8,941.30 $

213

$ 2,635.81 $

101.3495

$ 2,534.46 $

$ 1,115.16 $

$ 1,419.30 $

$

283.86 $

$ 1,135.44 $

44.0%

$

$

$

$

$

$

$

$

$

$

846.18

4,371.93

1625

6,843.11

1,776.98

1,985.70

3,080.43

6163

1,941

4,222

7,302.43

125

401.99

625

1151.99

1135

5,015.44

6,150.44

7,302.43

(0.00)

306

33,847.2

19,665.22

14,181.98

10,682.18

333

3,166.84

119.3585

3,047.48

1,340.89

1,706.59

341.32

1,365.27

44.0%

$

$

$

$

$

$

$

$

$

$

1,015.42

5,212.47

3,147.79

9,375.67

2,132.37

2,379.46

4,863.84

6563

2,274

4,289

9,152.88

125

1012.17

500

1637.17

1135

6,380.71

7,515.71

9,152.88

(0.00)

622

Retained Earnings: EBIT Interest Payments Taxes on

Here Tax rate = 44% of PBT

Dividend Payments = 20% of PAT

Interest Payments = Average (Opening LT Debt + Ending

Rate

Here Op LT Debt = 750; Ending LT Debt = 625; Expected

Hence Retained Earnings for the year: [EBIT-0.5(875+7

Payout Ratio]

=[3166.80 0.5(625+750+x)*0.1]*0.56*0.8

=1387.9264 0.0224 x

Total Net Operating Capital on Assets side and Liability s

Total Net Operating Capital on Assets side : Net Op WC +

= 4863.84+4289=

Total Net Op Capital on Liabilities side: LT debt + Curren

+ Common Equity + Retained Earnings

Here LT Debt outstanding at the end of the year = 625

CMLT Debt = 125

Common Equity = 1135

Retained Earnings at the end of the year = Retained Ear

during 1996

= 3880 + 1144.44 -0.0224 x

Solving for x (Exp Bank Loan) => 7302.43 = 625+125+

7302.43 -6909.44 = (1-0.0224) x

x= 392.99 / 0.9776 = 401.99 ; Assuming no fresh

will approach bank for a loan of 402k in 1996.

rnings: EBIT Interest Payments Taxes on EBT Dividend payments

e = 44% of PBT

yments = 20% of PAT

ments = Average (Opening LT Debt + Ending LT Debt + Loan Taken during the year) * Int

Debt = 750; Ending LT Debt = 625; Expected Loan from Bank =x; Int Rate = 10%

ned Earnings for the year: [EBIT-0.5(875+750+x)*0.10]*[1-TaxRate]*[1-Dividend

o]

80 0.5(625+750+x)*0.1]*0.56*0.8

0.0224 x

erating Capital on Assets side and Liability side should match.

erating Capital on Assets side : Net Op WC + Net Plant & Equip

4+4289=

Capital on Liabilities side: LT debt + Current Maturities of LT Debt + Exp Bank Loan (x)

Equity + Retained Earnings

t outstanding at the end of the year = 625

= 125

uity = 1135

rnings at the end of the year = Retained Earnings at the end of 1995 and Additions

144.44 -0.0224 x

x (Exp Bank Loan) => 7302.43 = 625+125+x+1135+3880+1144.44-0.0224x

09.44 = (1-0.0224) x

99 / 0.9776 = 401.99 ; Assuming no fresh issue of equity or long term debt, Mr Martin

h bank for a loan of 402k in 1996.

You might also like

- YouTube Profit & Loss and Balance Sheet 2005-2006Document28 pagesYouTube Profit & Loss and Balance Sheet 2005-2006titocosta100% (2)

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- Taxation AnswerDocument13 pagesTaxation AnswerkannadhassNo ratings yet

- Boston BeerDocument23 pagesBoston BeerarnabpramanikNo ratings yet

- Real Estate Investment AnalysisDocument1 pageReal Estate Investment AnalysisJoelleCabasaNo ratings yet

- The Year at A Glance: Profi T After Tax Growth in SalesDocument1 pageThe Year at A Glance: Profi T After Tax Growth in Salessmartchinu6No ratings yet

- Banks DIH Financial AnalysisDocument15 pagesBanks DIH Financial AnalysisRetishaLoaknauthNo ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Total Application of Funds Fixed Assets Fixed AssetsDocument14 pagesTotal Application of Funds Fixed Assets Fixed AssetsSam TyagiNo ratings yet

- Balance Sheet Asat31 March 2012Document52 pagesBalance Sheet Asat31 March 2012Pravin BhojwaniNo ratings yet

- Financial PlanningDocument26 pagesFinancial PlanningKevinVdKNo ratings yet

- Book 1Document8 pagesBook 1Jerome NgNo ratings yet

- Financial ForecastingDocument22 pagesFinancial ForecastingKaustav BanerjeeNo ratings yet

- Business Analyis Report - ChaturthiDocument2 pagesBusiness Analyis Report - ChaturthiRavi Pratap Singh TomarNo ratings yet

- Analisa Eva Wacc STTPDocument11 pagesAnalisa Eva Wacc STTPAnggih Nur HamidahNo ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Analyze The Potential Profit or Loss of Your Real Estate InvestmentDocument3 pagesAnalyze The Potential Profit or Loss of Your Real Estate InvestmentiskandarmalaysiaNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Taxation: MD Mashiur Rahaman Robin KPMG-RRHDocument12 pagesTaxation: MD Mashiur Rahaman Robin KPMG-RRHZidan ZaifNo ratings yet

- (Pso) Pakistan State OilDocument4 pages(Pso) Pakistan State OilSalman AtherNo ratings yet

- Chapter 03 PenDocument27 pagesChapter 03 PenJeffreyDavidNo ratings yet

- InfraDocument11 pagesInfrakdoshi23No ratings yet

- Analisa Eva Wacc SsmsDocument11 pagesAnalisa Eva Wacc SsmsAnggih Nur HamidahNo ratings yet

- Start Date End Date Template VersionDocument52 pagesStart Date End Date Template VersionshobuzfeniNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Hampton MachineDocument7 pagesHampton MachineMurali SubramaniamNo ratings yet

- F9 Sample ReportsDocument31 pagesF9 Sample ReportsAla K ObeigNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- Tata Steel 1Document12 pagesTata Steel 1Dhwani ShahNo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- Return & Profit Analysis - PinDDDocument45 pagesReturn & Profit Analysis - PinDDPhươngAnhNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- 2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDocument8 pages2021 Budget Plan Executive Summary: City of Akron, Ohio Dan Horrigan, MayorDougNo ratings yet

- Hampton Machine Works SolutionsDocument9 pagesHampton Machine Works SolutionsPham GiangNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- SearsDocument11 pagesSearsHelplineNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- Hindustan Unilever LTD.: Trend AnalysisDocument7 pagesHindustan Unilever LTD.: Trend AnalysisAnkitaBansalNo ratings yet

- Societe de Commerce International Tameza Inc. 9251-1559 QUEBEC INCDocument31 pagesSociete de Commerce International Tameza Inc. 9251-1559 QUEBEC INCLuis Alberto Taborda SchotborgNo ratings yet

- 03 Tire City, Inc. - ExhibitsDocument2 pages03 Tire City, Inc. - ExhibitsLalit DeoNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- AT&T Vs MegafonDocument18 pagesAT&T Vs MegafonMikhay IstratiyNo ratings yet

- Bmo 8.1.13 PDFDocument7 pagesBmo 8.1.13 PDFChad Thayer VNo ratings yet

- Tire City SpreadsheetDocument7 pagesTire City Spreadsheetp23ayushsNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Ashok LeylandDocument1,832 pagesAshok Leylandjadhavshankar100% (1)

- ITC Affect On CompanyDocument10 pagesITC Affect On CompanynavpreetsinghkNo ratings yet

- Jawaban Kuis AK2Document37 pagesJawaban Kuis AK2clara_patricia_2No ratings yet

- Income Statement: Total Operating Revenue Operating ExpensesDocument11 pagesIncome Statement: Total Operating Revenue Operating ExpensesBobYuNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Managerial Finance Tutorial 7: To Be Submitted Within 3 JuneDocument7 pagesManagerial Finance Tutorial 7: To Be Submitted Within 3 JuneaskdgasNo ratings yet

- Problems 1-30: Input Boxes in TanDocument24 pagesProblems 1-30: Input Boxes in TanSultan_Alali_9279No ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Group09 CliquepensDocument1 pageGroup09 CliquepensAkshay Mehta100% (1)

- Knapsack ProblemDocument10 pagesKnapsack ProblemAkshay MehtaNo ratings yet

- Virtual MDocument43 pagesVirtual MAkshay MehtaNo ratings yet

- Activity 6.1 Module9 Union Intersect MinusDocument2 pagesActivity 6.1 Module9 Union Intersect MinusAkshay MehtaNo ratings yet

- Solutions of RDBMSDocument64 pagesSolutions of RDBMSAkshay MehtaNo ratings yet

- RDBMS 6Document1 pageRDBMS 6Akshay MehtaNo ratings yet

- Computer Network2.4Document22 pagesComputer Network2.4Akshay MehtaNo ratings yet

- Computer Network2.3Document15 pagesComputer Network2.3Akshay MehtaNo ratings yet

- Computer Network2.5Document21 pagesComputer Network2.5Akshay MehtaNo ratings yet

- Introduction To Data WarehousingDocument38 pagesIntroduction To Data WarehousingAkshay MehtaNo ratings yet

- CLR ExplainedDocument883 pagesCLR ExplainedAkshay MehtaNo ratings yet