Professional Documents

Culture Documents

Balance Sheet - Publishing Company

Balance Sheet - Publishing Company

Uploaded by

api-281323892Copyright:

Available Formats

You might also like

- Chapter # 5 - Exercise & Problems - AnswersDocument13 pagesChapter # 5 - Exercise & Problems - AnswersHumza Abbasi0% (3)

- Balance Sheet With Financial Ratios1Document1 pageBalance Sheet With Financial Ratios1api-281270178No ratings yet

- Balance Sheet With Ratios1Document1 pageBalance Sheet With Ratios1RioChristianGultomNo ratings yet

- Balance Sheet With Ratios2Document1 pageBalance Sheet With Ratios2Anonymous AHW3sHNo ratings yet

- Cost Accounting EVADocument6 pagesCost Accounting EVANikhil KasatNo ratings yet

- Contents of Balance SheetDocument8 pagesContents of Balance SheetJainBhupendraNo ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Capital & Liabilities: Sub TotalDocument5 pagesCapital & Liabilities: Sub TotalMq SzdNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- Chapter 3Document29 pagesChapter 3fentawmelaku1993No ratings yet

- (Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)Document1 page(Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)jpmonicNo ratings yet

- Basic Mortgage FinalDocument136 pagesBasic Mortgage FinalCalistoAmemebeNo ratings yet

- (Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)Document1 page(Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)Nipul BafnaNo ratings yet

- WACC Form (THAI SET STOCK)Document47 pagesWACC Form (THAI SET STOCK)Kan LertvimolkasemNo ratings yet

- Answer Scheme Group Assignment 1Document8 pagesAnswer Scheme Group Assignment 1NurulAdibahNo ratings yet

- HKAS 12 - Template For Deferred Tax Computation1Document2 pagesHKAS 12 - Template For Deferred Tax Computation1Sanath FernandoNo ratings yet

- Barwa Real Estate Balance Sheet Particulars Note NoDocument28 pagesBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Financial Status-Somany Ceramics LTD 2011-12Document15 pagesFinancial Status-Somany Ceramics LTD 2011-12Roshankumar S PimpalkarNo ratings yet

- 5ead0financial RatiosDocument3 pages5ead0financial RatiosGourav DuttaNo ratings yet

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- (TR DR) (TR CR)Document33 pages(TR DR) (TR CR)sanddyhs2uNo ratings yet

- Final Exam of PF 2012 (Infolink)Document5 pagesFinal Exam of PF 2012 (Infolink)samuel debebe100% (1)

- Financial Status Sesa Goa 2011-12Document13 pagesFinancial Status Sesa Goa 2011-12Roshankumar S PimpalkarNo ratings yet

- Cost Incurred Cost Incurred Estimated Cost of Completion Date Date Complete) Revenue Date Contract of CompletionDocument2 pagesCost Incurred Cost Incurred Estimated Cost of Completion Date Date Complete) Revenue Date Contract of CompletionArmin NiebresNo ratings yet

- Sessions 1-5Document91 pagesSessions 1-5sanNo ratings yet

- Janata Bank Limited: Profit and Loss Account For The Year 31 December 2010Document2 pagesJanata Bank Limited: Profit and Loss Account For The Year 31 December 2010S M Mazharul KarimNo ratings yet

- 2000 2001 2000 Liabilites Assets: Balance SheetDocument10 pages2000 2001 2000 Liabilites Assets: Balance SheetGuruswami PrakashNo ratings yet

- Form L-27-Unit Linked Business-3A: Part - BDocument6 pagesForm L-27-Unit Linked Business-3A: Part - BSantoshkumar YandamuriNo ratings yet

- DELL LBO Model Part 1 CompletedDocument45 pagesDELL LBO Model Part 1 CompletedascentcommerceNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- Dabur LTD: 3.1 P&L AccountDocument4 pagesDabur LTD: 3.1 P&L Account218-Harsh NarangNo ratings yet

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- System LimitedDocument11 pagesSystem LimitedNabeel AhmadNo ratings yet

- Accountancy: Answer: Option (C)Document14 pagesAccountancy: Answer: Option (C)Ujval JyotiNo ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- San Joaquin, Iloilo Q1, 2012: Net Operating Income/ (Loss) From Current Operations (23-33)Document1 pageSan Joaquin, Iloilo Q1, 2012: Net Operating Income/ (Loss) From Current Operations (23-33)SanJoaquinIloiloNo ratings yet

- ITC Consolidated FinancialsStatement 2015 PDFDocument53 pagesITC Consolidated FinancialsStatement 2015 PDFAbhishek DuttaNo ratings yet

- Lead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital RequirementsDocument13 pagesLead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital Requirementsprateekm176123No ratings yet

- Sion Cash Flow Model 210116 - 2 Tranche NCD Tax Linked Post Internal Discussion v2Document159 pagesSion Cash Flow Model 210116 - 2 Tranche NCD Tax Linked Post Internal Discussion v2arhawnnNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Cash Flow Year 3: Actual 380,000Document60 pagesCash Flow Year 3: Actual 380,000D J Ben UzeeNo ratings yet

- Projected Cash FlowDocument5 pagesProjected Cash FlowSaif Muhammad SazinNo ratings yet

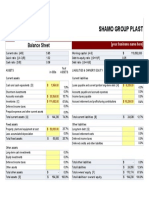

- Shamo Group Plast: Balance SheetDocument1 pageShamo Group Plast: Balance SheetEng MatanaNo ratings yet

- Solved ProblemsDocument24 pagesSolved ProblemsSammir MalhotraNo ratings yet

- NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014Document24 pagesNDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Format of Revised Schedule Vi To The Companies Act 1956 in ExcelDocument11 pagesFormat of Revised Schedule Vi To The Companies Act 1956 in Excelanshulagarwal62No ratings yet

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgNo ratings yet

- Financial Accounting & Analysis: Ratio Analysis Siddharth S. KanungoDocument48 pagesFinancial Accounting & Analysis: Ratio Analysis Siddharth S. KanungoNelson AindNo ratings yet

- Cashflowstatement IMPDocument30 pagesCashflowstatement IMPAshish SinghalNo ratings yet

- Statement of Cash Flows MCQsDocument7 pagesStatement of Cash Flows MCQsSamsung AccountNo ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Boeing: I. Market InformationDocument21 pagesBoeing: I. Market InformationMohamed Ali SalemNo ratings yet

- Assign 1 - Sem II 12-13Document8 pagesAssign 1 - Sem II 12-13Anisha ShafikhaNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

Balance Sheet - Publishing Company

Balance Sheet - Publishing Company

Uploaded by

api-281323892Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet - Publishing Company

Balance Sheet - Publishing Company

Uploaded by

api-281323892Copyright:

Available Formats

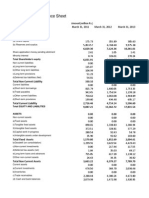

Koristka Publishing Company Balance Sheet

For the Period Ending [End Date]

Current ratio [A/B]

0.49

Working capital [A-B]

Quick ratio [(A-C)/B]

0.46

Debt-to-equity ratio [(G+H)/F]

1.18

0.02

Debt ratio [(G+H)/E]

0.53

Cash ratio [D/B]

(1,335,000,000)

Stated in 000s

ASSETS

% of ASSETS

Current assets

LIABILITIES & OWNERS' EQUITY

Current liabilities

Cash and cash equivalents [D]

50,000

0.9%

Loans payable and current portion long-term debt [H]

Short-term investments

150,000

2.6%

Accounts payable and accrued expenses

Accounts receivable [I]

Inventories [C]

1,000,000

17.5%

100,000

1.7%

Deferred income taxes

135,000

Income taxes payable

Accrued retirement and profit-sharing contributions

0.0%

$ 1,300,000

22.7%

Total current liabilities [B]

4,000,000

69.9%

Other liabilities

Long-term debt [G]

Fixed assets

Property, plant and equipment at cost

Less accumulated depreciation

Total fixed assets

2,500,000

0.0%

Prepaid expenses and other current assets

Total current assets [A]

0.0%

$ 4,000,000

69.9%

2,635,000

525,000

Accrued retirement costs

Deferred income taxes

Deferred credits and other liabilities

Other assets

Long-term cash investments

400,000

Equity investments

7.0%

0.0%

Deferred income taxes

0.0%

Other assets

25,000

0.4%

Total other assets

425,000

7.4%

Total assets [E]

$ 5,725,000

100.0%

Total other liabilities

525,000

Total liabilities

3,160,000

Total owners' equity [F]

2,565,000

Total liabilities + owners' equity

5,725,000

(1,335,000,000)

% of ASSETS

43.7%

2.4%

0.0%

0.0%

46.0%

9.2%

0.0%

0.0%

0.0%

9.2%

55.2%

44.8%

100.0%

You might also like

- Chapter # 5 - Exercise & Problems - AnswersDocument13 pagesChapter # 5 - Exercise & Problems - AnswersHumza Abbasi0% (3)

- Balance Sheet With Financial Ratios1Document1 pageBalance Sheet With Financial Ratios1api-281270178No ratings yet

- Balance Sheet With Ratios1Document1 pageBalance Sheet With Ratios1RioChristianGultomNo ratings yet

- Balance Sheet With Ratios2Document1 pageBalance Sheet With Ratios2Anonymous AHW3sHNo ratings yet

- Cost Accounting EVADocument6 pagesCost Accounting EVANikhil KasatNo ratings yet

- Contents of Balance SheetDocument8 pagesContents of Balance SheetJainBhupendraNo ratings yet

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Capital & Liabilities: Sub TotalDocument5 pagesCapital & Liabilities: Sub TotalMq SzdNo ratings yet

- InvestmentsDocument15 pagesInvestmentsDevesh KumarNo ratings yet

- Financial Analysis of Islami Bank BangladeshDocument5 pagesFinancial Analysis of Islami Bank BangladeshMahmudul Hasan RabbyNo ratings yet

- Chapter 3Document29 pagesChapter 3fentawmelaku1993No ratings yet

- (Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)Document1 page(Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)jpmonicNo ratings yet

- Basic Mortgage FinalDocument136 pagesBasic Mortgage FinalCalistoAmemebeNo ratings yet

- (Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)Document1 page(Enter Company Name) EBITDA & Financial Leverage Analysis (Enter Date)Nipul BafnaNo ratings yet

- WACC Form (THAI SET STOCK)Document47 pagesWACC Form (THAI SET STOCK)Kan LertvimolkasemNo ratings yet

- Answer Scheme Group Assignment 1Document8 pagesAnswer Scheme Group Assignment 1NurulAdibahNo ratings yet

- HKAS 12 - Template For Deferred Tax Computation1Document2 pagesHKAS 12 - Template For Deferred Tax Computation1Sanath FernandoNo ratings yet

- Barwa Real Estate Balance Sheet Particulars Note NoDocument28 pagesBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarNo ratings yet

- DLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)Document18 pagesDLF LTD Ratio Analyses (ALL Figures in Rs Crores) (Realty)AkshithKapoorNo ratings yet

- Financial Status-Somany Ceramics LTD 2011-12Document15 pagesFinancial Status-Somany Ceramics LTD 2011-12Roshankumar S PimpalkarNo ratings yet

- 5ead0financial RatiosDocument3 pages5ead0financial RatiosGourav DuttaNo ratings yet

- Group 4 Symphony FinalDocument10 pagesGroup 4 Symphony FinalSachin RajgorNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- (TR DR) (TR CR)Document33 pages(TR DR) (TR CR)sanddyhs2uNo ratings yet

- Final Exam of PF 2012 (Infolink)Document5 pagesFinal Exam of PF 2012 (Infolink)samuel debebe100% (1)

- Financial Status Sesa Goa 2011-12Document13 pagesFinancial Status Sesa Goa 2011-12Roshankumar S PimpalkarNo ratings yet

- Cost Incurred Cost Incurred Estimated Cost of Completion Date Date Complete) Revenue Date Contract of CompletionDocument2 pagesCost Incurred Cost Incurred Estimated Cost of Completion Date Date Complete) Revenue Date Contract of CompletionArmin NiebresNo ratings yet

- Sessions 1-5Document91 pagesSessions 1-5sanNo ratings yet

- Janata Bank Limited: Profit and Loss Account For The Year 31 December 2010Document2 pagesJanata Bank Limited: Profit and Loss Account For The Year 31 December 2010S M Mazharul KarimNo ratings yet

- 2000 2001 2000 Liabilites Assets: Balance SheetDocument10 pages2000 2001 2000 Liabilites Assets: Balance SheetGuruswami PrakashNo ratings yet

- Form L-27-Unit Linked Business-3A: Part - BDocument6 pagesForm L-27-Unit Linked Business-3A: Part - BSantoshkumar YandamuriNo ratings yet

- DELL LBO Model Part 1 CompletedDocument45 pagesDELL LBO Model Part 1 CompletedascentcommerceNo ratings yet

- Boeing: I. Market InformationDocument20 pagesBoeing: I. Market InformationJames ParkNo ratings yet

- Dabur LTD: 3.1 P&L AccountDocument4 pagesDabur LTD: 3.1 P&L Account218-Harsh NarangNo ratings yet

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- System LimitedDocument11 pagesSystem LimitedNabeel AhmadNo ratings yet

- Accountancy: Answer: Option (C)Document14 pagesAccountancy: Answer: Option (C)Ujval JyotiNo ratings yet

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document26 pagesChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- San Joaquin, Iloilo Q1, 2012: Net Operating Income/ (Loss) From Current Operations (23-33)Document1 pageSan Joaquin, Iloilo Q1, 2012: Net Operating Income/ (Loss) From Current Operations (23-33)SanJoaquinIloiloNo ratings yet

- ITC Consolidated FinancialsStatement 2015 PDFDocument53 pagesITC Consolidated FinancialsStatement 2015 PDFAbhishek DuttaNo ratings yet

- Lead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital RequirementsDocument13 pagesLead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital Requirementsprateekm176123No ratings yet

- Sion Cash Flow Model 210116 - 2 Tranche NCD Tax Linked Post Internal Discussion v2Document159 pagesSion Cash Flow Model 210116 - 2 Tranche NCD Tax Linked Post Internal Discussion v2arhawnnNo ratings yet

- Afm PDFDocument5 pagesAfm PDFBhavani Singh RathoreNo ratings yet

- Cash Flow Year 3: Actual 380,000Document60 pagesCash Flow Year 3: Actual 380,000D J Ben UzeeNo ratings yet

- Projected Cash FlowDocument5 pagesProjected Cash FlowSaif Muhammad SazinNo ratings yet

- Shamo Group Plast: Balance SheetDocument1 pageShamo Group Plast: Balance SheetEng MatanaNo ratings yet

- Solved ProblemsDocument24 pagesSolved ProblemsSammir MalhotraNo ratings yet

- NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014Document24 pagesNDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Format of Revised Schedule Vi To The Companies Act 1956 in ExcelDocument11 pagesFormat of Revised Schedule Vi To The Companies Act 1956 in Excelanshulagarwal62No ratings yet

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgNo ratings yet

- Financial Accounting & Analysis: Ratio Analysis Siddharth S. KanungoDocument48 pagesFinancial Accounting & Analysis: Ratio Analysis Siddharth S. KanungoNelson AindNo ratings yet

- Cashflowstatement IMPDocument30 pagesCashflowstatement IMPAshish SinghalNo ratings yet

- Statement of Cash Flows MCQsDocument7 pagesStatement of Cash Flows MCQsSamsung AccountNo ratings yet

- BDP Financial Final PartDocument14 pagesBDP Financial Final PartDeepak G.C.No ratings yet

- Boeing: I. Market InformationDocument21 pagesBoeing: I. Market InformationMohamed Ali SalemNo ratings yet

- Assign 1 - Sem II 12-13Document8 pagesAssign 1 - Sem II 12-13Anisha ShafikhaNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)