Professional Documents

Culture Documents

Case Studies: F A Swu F G

Case Studies: F A Swu F G

Uploaded by

Mhmd KaramCopyright:

Available Formats

You might also like

- SWU Case StudyDocument3 pagesSWU Case StudyschoolsamNo ratings yet

- SWU Case StudyDocument3 pagesSWU Case StudyAndresNo ratings yet

- Swu FootballDocument4 pagesSwu FootballRich Kitten100% (1)

- Module 3 - Capacity Planning PDFDocument37 pagesModule 3 - Capacity Planning PDFMhmd Karam100% (1)

- ForecastingDocument35 pagesForecastingDarwin FloresNo ratings yet

- Operations Management Assignment 1.1Document2 pagesOperations Management Assignment 1.1Feleti_VaeaNo ratings yet

- Futbol, El Juego Mas DificlDocument2 pagesFutbol, El Juego Mas DificlJulio KaegiNo ratings yet

- Modeling and Forecasting The Outcomes of NBA Basketball GamesDocument25 pagesModeling and Forecasting The Outcomes of NBA Basketball Gameschompo83100% (1)

- Forecasting Report - EditedDocument12 pagesForecasting Report - Editedpeter musyimiNo ratings yet

- 1998 - Prediction and Retrospetive Analysis of Soccer Matches in A LeagueDocument23 pages1998 - Prediction and Retrospetive Analysis of Soccer Matches in A LeagueAlessandro BetoriNo ratings yet

- Statistics of Football DynamicsDocument7 pagesStatistics of Football DynamicsSF1234567890No ratings yet

- Basics of Data Interpretation: Chapter-1Document44 pagesBasics of Data Interpretation: Chapter-1Anonymous G7zeojtNNo ratings yet

- FIN213 - Tutorial 1 Solutions With ExplanationsDocument5 pagesFIN213 - Tutorial 1 Solutions With Explanationsgaming.og122No ratings yet

- Walmart in Mexico: $ Millions True SalesDocument5 pagesWalmart in Mexico: $ Millions True SalesddirringNo ratings yet

- Forecasting FundamentalsDocument44 pagesForecasting Fundamentalshimkool2000No ratings yet

- Worksheet-4 TrapalDocument7 pagesWorksheet-4 Trapaljaijaitrapal.1525No ratings yet

- NBA Attendance Empirical Paper FinalDocument22 pagesNBA Attendance Empirical Paper FinalNick HeathNo ratings yet

- Forecasting Cases Final 1Document43 pagesForecasting Cases Final 1Vipul SinghNo ratings yet

- Forecasting Fundamentals: MAN 3520 - Fall 2012 CP2 - Forecasting: Page 1 of 44Document44 pagesForecasting Fundamentals: MAN 3520 - Fall 2012 CP2 - Forecasting: Page 1 of 44Homero Xavier Vera CalderónNo ratings yet

- Reade Singleton ScorelinesDocument21 pagesReade Singleton ScorelinesStan GoyvaertsNo ratings yet

- Reggies Sofit DataDocument7 pagesReggies Sofit Dataapi-272949500No ratings yet

- Open Screenshot 2023-12-13 at 8.06.13 PM 26Document56 pagesOpen Screenshot 2023-12-13 at 8.06.13 PM 26jatinderNo ratings yet

- MaherDocument10 pagesMaherdrb7907No ratings yet

- Statistics - Seminar 3: Grouping Statistical DataDocument2 pagesStatistics - Seminar 3: Grouping Statistical DataCrina Elena AndriesNo ratings yet

- Clustering Seasonal Performances of Soccer Teams Based On Situational Score LineDocument6 pagesClustering Seasonal Performances of Soccer Teams Based On Situational Score LineAbu Vulkanik Al-JawiyNo ratings yet

- Managerial EconomicsDocument33 pagesManagerial EconomicsSalma Farooqui100% (1)

- Forecasting Fundamentals: MAN 3520 - Spring 2012 CP2 - Forecasting: Page 1 of 44Document44 pagesForecasting Fundamentals: MAN 3520 - Spring 2012 CP2 - Forecasting: Page 1 of 44Abinash PalanisamyNo ratings yet

- HandoutDocument15 pagesHandoutDairymple MendeNo ratings yet

- Time Series Analysis by Salah UddinDocument12 pagesTime Series Analysis by Salah UddinNazim Uddin MahmudNo ratings yet

- BFF3121 Lecture 5 Assignment 3 Benchmarks Student WorkDocument3 pagesBFF3121 Lecture 5 Assignment 3 Benchmarks Student WorkAshton LeeNo ratings yet

- Scatter Plots and Line of Best Fit Line of BestDocument2 pagesScatter Plots and Line of Best Fit Line of Bestapi-16254560No ratings yet

- 7 2YieldCurveDocument6 pages7 2YieldCurverranjan27No ratings yet

- Basics StatisticsDocument11 pagesBasics StatisticsrssarmaNo ratings yet

- Forecasting Methods - An Overview of Models and Techniques: David A. Dickey, N. C. State U., Raleigh, N. CDocument17 pagesForecasting Methods - An Overview of Models and Techniques: David A. Dickey, N. C. State U., Raleigh, N. CAkshay SharmaNo ratings yet

- BTRM WP15 - SOFR OIS Curve Construction - Dec 2020Document23 pagesBTRM WP15 - SOFR OIS Curve Construction - Dec 2020MypatNo ratings yet

- Industrial Engineering: Sales and Demand ForecastingDocument47 pagesIndustrial Engineering: Sales and Demand ForecastingKAMAL PATINo ratings yet

- DATA4100 VisualizationDocument9 pagesDATA4100 VisualizationjdncwefdfnNo ratings yet

- Assignment For Quantitative AnalysisDocument3 pagesAssignment For Quantitative AnalysisPhat Minh Huynh0% (1)

- Week 3 Forecasting With IndicesDocument5 pagesWeek 3 Forecasting With IndicesarianzaeemiNo ratings yet

- ACM - Vol, Correlation, Unified Risk Theory - 092010Document8 pagesACM - Vol, Correlation, Unified Risk Theory - 092010ThorHollisNo ratings yet

- Forecasting Using An Additive Model (From Last Week) Additive Model A T S RDocument10 pagesForecasting Using An Additive Model (From Last Week) Additive Model A T S RsansagithNo ratings yet

- RugbyDocument19 pagesRugbyswapbjspnNo ratings yet

- Predicting Soccer League Games Using Multinomial Logistic ModelsDocument9 pagesPredicting Soccer League Games Using Multinomial Logistic ModelsRobert AbuyaNo ratings yet

- Methodist KL 2013 M2 (Q)Document4 pagesMethodist KL 2013 M2 (Q)STPMmaths0% (1)

- Intraday Time Analysis FINALDocument6 pagesIntraday Time Analysis FINALTradingSystemNo ratings yet

- Tutorial 1 (Week 2)Document5 pagesTutorial 1 (Week 2)sdfklmjsdlklskfjdNo ratings yet

- Instructions For ECON1102 Chart Book - 2014 Session 1Document7 pagesInstructions For ECON1102 Chart Book - 2014 Session 1christine_liu0110No ratings yet

- Attendence in Past Games: PeriodDocument2 pagesAttendence in Past Games: PeriodAllison HolderNo ratings yet

- Prediction and Retrospective AnDocument25 pagesPrediction and Retrospective AnfabianggNo ratings yet

- Components of The Game Result in A Football LeagueDocument18 pagesComponents of The Game Result in A Football LeagueLuis Alberto FuentesNo ratings yet

- ECON1203 HW Solution Week03Document10 pagesECON1203 HW Solution Week03Bad BoyNo ratings yet

- Yuan He PDFDocument15 pagesYuan He PDFPeper12345No ratings yet

- SOM 306 ProjectDocument5 pagesSOM 306 ProjectHarsh HirparaNo ratings yet

- Chapter # 11 (The Basic Seven-B7-Tools of Quality)Document54 pagesChapter # 11 (The Basic Seven-B7-Tools of Quality)Ali Ahmed100% (1)

- Descriptive StatisticsDocument18 pagesDescriptive StatisticsDiana HrabNo ratings yet

- Assignment 1 QuestionsDocument3 pagesAssignment 1 QuestionsLATIKA 21No ratings yet

- Ben Ulmer, Matt Fernandez, Predicting Soccer Results in The English Premier LeagueDocument5 pagesBen Ulmer, Matt Fernandez, Predicting Soccer Results in The English Premier LeagueCosmin GeorgeNo ratings yet

- EXCEL FormulaeDocument223 pagesEXCEL FormulaeMazter HukomNo ratings yet

- Math Ia Draft 2Document12 pagesMath Ia Draft 2futg266No ratings yet

- Sports Metric Forecasting: Guides to Beating the Spreads in Major League Baseball, Basketball, and Football GamesFrom EverandSports Metric Forecasting: Guides to Beating the Spreads in Major League Baseball, Basketball, and Football GamesNo ratings yet

- Finance 210 Engag 2Document8 pagesFinance 210 Engag 2Mhmd KaramNo ratings yet

- Chapter 2Document12 pagesChapter 2Mhmd KaramNo ratings yet

- كويز اسواق ماليةDocument5 pagesكويز اسواق ماليةMhmd KaramNo ratings yet

- Chapterr 3 ModifiedDocument43 pagesChapterr 3 ModifiedMhmd KaramNo ratings yet

- Islamic Finance Week 4 SectionDocument8 pagesIslamic Finance Week 4 SectionMhmd KaramNo ratings yet

- Chapter 3 SummarizedDocument30 pagesChapter 3 SummarizedMhmd KaramNo ratings yet

- Introduction To Managerial Accounting Short Case Study (10 Marks)Document2 pagesIntroduction To Managerial Accounting Short Case Study (10 Marks)Mhmd KaramNo ratings yet

- Case Study-Short SolutionDocument6 pagesCase Study-Short SolutionMhmd KaramNo ratings yet

- Assignment 1 (ECN 511)Document4 pagesAssignment 1 (ECN 511)Mhmd KaramNo ratings yet

- HW EconDocument2 pagesHW EconMhmd KaramNo ratings yet

- Topic 9 - Influence of Monetary and Fiscal Policy On Aggregate DemandDocument30 pagesTopic 9 - Influence of Monetary and Fiscal Policy On Aggregate DemandMhmd KaramNo ratings yet

- Taking Risks and Making Profits Within The Dynamic Business EnvironmentDocument46 pagesTaking Risks and Making Profits Within The Dynamic Business EnvironmentMhmd KaramNo ratings yet

- Case Study - GCC Economic Outlook PDFDocument18 pagesCase Study - GCC Economic Outlook PDFMhmd KaramNo ratings yet

- CH 18 Short Term Financial Plan QuestionsDocument6 pagesCH 18 Short Term Financial Plan QuestionsMhmd KaramNo ratings yet

- Module 2 - Lect 5 - Forecasting PDFDocument36 pagesModule 2 - Lect 5 - Forecasting PDFMhmd KaramNo ratings yet

- CH 19 Cash and Liquidity Management Appendix Class WorkDocument4 pagesCH 19 Cash and Liquidity Management Appendix Class WorkMhmd KaramNo ratings yet

- Module 4 - Decision Theory PDFDocument41 pagesModule 4 - Decision Theory PDFMhmd Karam100% (1)

- Data-11 - 27 - 2020-7 - 38 AMDocument1 pageData-11 - 27 - 2020-7 - 38 AMMhmd KaramNo ratings yet

- Chapter One, Two and Three Research MethodologyDocument97 pagesChapter One, Two and Three Research MethodologyMhmd KaramNo ratings yet

- HW Econ 1Document4 pagesHW Econ 1Mhmd KaramNo ratings yet

- Name: ID:: Groups Count Sum Averag e Varianc eDocument2 pagesName: ID:: Groups Count Sum Averag e Varianc eMhmd KaramNo ratings yet

Case Studies: F A Swu F G

Case Studies: F A Swu F G

Uploaded by

Mhmd KaramOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case Studies: F A Swu F G

Case Studies: F A Swu F G

Uploaded by

Mhmd KaramCopyright:

Available Formats

.

CASE STUDIES

FORECASTING ATTENDANCE AT SWU FOOTBALL GAMES

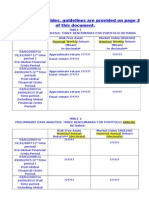

1. Because we are interested in annual attendance and there are six years of data, we find the

average attendance in each year shown in the table below. A graph of this indicates a linear

trend in the data. Using Trend Analysis in the forecasting module of QM for Windows we find

the equation:

Y = 31,660 + 2,305.714X

Where Y is attendance and X is the time period (X = 1 for 2005, 2 for 2006, etc.).

For this model, r2 = 0.98 which indicates this model is very accurate.

Attendance in 2011 is projected to be

Y = 31,660 + 2,305.714(7) = 47,800

Attendance in 2012 is projected to be

Y = 31,660 + 2,305.714(8) = 50,105

At this rate, the stadium, with a capacity of 54,000, will be maxed out (filled to capacity) in

2014.

Year

2005

2006

2007

2008

2009

2010

Attendance

34840

35380

38520

40500

43320

45820

2. Based upon the projected attendance and tickets prices of $20 in 2011 and $21 (a 5%

increase) in 2012, the projected revenues are:

47,800(20) = $956,000 in 2010 and

50,105(21) = $1,052,205 in 2012.

3. The school might consider another expansion of the stadium, or raise the ticket prices more

than 5% per year. Another possibility is to raise the prices of the best seats while leaving the

end zone prices more reasonable.

51

FORECASTING MONTHLY SALES

1.

The scatter plot of the data shows a definite seasonal pattern with higher sales in the winter

months and lower sales in the summer and fall months. There is a slight upward trend as

evidenced by the fact that for each month, the sales increased from the first year to the second,

and again form the second year to the third.

52

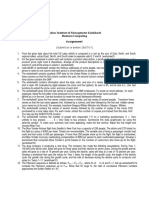

2. A trend line based on the raw data is found to be:

Y = 330.889 1.162X

The slope of the trend line is negative which would indicate that sales are declining over time.

However, as previously noted, sales are increasing. The high seasonal index in January and

February causes the trend line on the unadjusted data to appear to have a negative slope.

3. There is a definite seasonal pattern and a definite trend in the data. Using the decomposition

method in QM for Windows, the trend equation (based on the deseasonalized data) is

Y = 294.069 + 0.859X

The table below gives the seasonal indices, the unadjusted forecasts found using the trend line,

and the final (adjusted) forecasts for the next year.

Month

January

February

March

April

May

June

July

August

September

October

November

December

Unadjusted forecast

325.852

326.711

327.57

328.429

329.288

330.147

331.006

331.865

332.724

333.583

334.442

335.301

Seasonal index

1.447

1.393

1.379

1.074

1.039

0.797

0.813

0.720

0.667

0.747

0.891

1.033

Adjusted forecast

471.5

455.1

451.7

352.7

342.1

263.1

269.1

238.9

221.9

249.2

298.0

346.4

53

You might also like

- SWU Case StudyDocument3 pagesSWU Case StudyschoolsamNo ratings yet

- SWU Case StudyDocument3 pagesSWU Case StudyAndresNo ratings yet

- Swu FootballDocument4 pagesSwu FootballRich Kitten100% (1)

- Module 3 - Capacity Planning PDFDocument37 pagesModule 3 - Capacity Planning PDFMhmd Karam100% (1)

- ForecastingDocument35 pagesForecastingDarwin FloresNo ratings yet

- Operations Management Assignment 1.1Document2 pagesOperations Management Assignment 1.1Feleti_VaeaNo ratings yet

- Futbol, El Juego Mas DificlDocument2 pagesFutbol, El Juego Mas DificlJulio KaegiNo ratings yet

- Modeling and Forecasting The Outcomes of NBA Basketball GamesDocument25 pagesModeling and Forecasting The Outcomes of NBA Basketball Gameschompo83100% (1)

- Forecasting Report - EditedDocument12 pagesForecasting Report - Editedpeter musyimiNo ratings yet

- 1998 - Prediction and Retrospetive Analysis of Soccer Matches in A LeagueDocument23 pages1998 - Prediction and Retrospetive Analysis of Soccer Matches in A LeagueAlessandro BetoriNo ratings yet

- Statistics of Football DynamicsDocument7 pagesStatistics of Football DynamicsSF1234567890No ratings yet

- Basics of Data Interpretation: Chapter-1Document44 pagesBasics of Data Interpretation: Chapter-1Anonymous G7zeojtNNo ratings yet

- FIN213 - Tutorial 1 Solutions With ExplanationsDocument5 pagesFIN213 - Tutorial 1 Solutions With Explanationsgaming.og122No ratings yet

- Walmart in Mexico: $ Millions True SalesDocument5 pagesWalmart in Mexico: $ Millions True SalesddirringNo ratings yet

- Forecasting FundamentalsDocument44 pagesForecasting Fundamentalshimkool2000No ratings yet

- Worksheet-4 TrapalDocument7 pagesWorksheet-4 Trapaljaijaitrapal.1525No ratings yet

- NBA Attendance Empirical Paper FinalDocument22 pagesNBA Attendance Empirical Paper FinalNick HeathNo ratings yet

- Forecasting Cases Final 1Document43 pagesForecasting Cases Final 1Vipul SinghNo ratings yet

- Forecasting Fundamentals: MAN 3520 - Fall 2012 CP2 - Forecasting: Page 1 of 44Document44 pagesForecasting Fundamentals: MAN 3520 - Fall 2012 CP2 - Forecasting: Page 1 of 44Homero Xavier Vera CalderónNo ratings yet

- Reade Singleton ScorelinesDocument21 pagesReade Singleton ScorelinesStan GoyvaertsNo ratings yet

- Reggies Sofit DataDocument7 pagesReggies Sofit Dataapi-272949500No ratings yet

- Open Screenshot 2023-12-13 at 8.06.13 PM 26Document56 pagesOpen Screenshot 2023-12-13 at 8.06.13 PM 26jatinderNo ratings yet

- MaherDocument10 pagesMaherdrb7907No ratings yet

- Statistics - Seminar 3: Grouping Statistical DataDocument2 pagesStatistics - Seminar 3: Grouping Statistical DataCrina Elena AndriesNo ratings yet

- Clustering Seasonal Performances of Soccer Teams Based On Situational Score LineDocument6 pagesClustering Seasonal Performances of Soccer Teams Based On Situational Score LineAbu Vulkanik Al-JawiyNo ratings yet

- Managerial EconomicsDocument33 pagesManagerial EconomicsSalma Farooqui100% (1)

- Forecasting Fundamentals: MAN 3520 - Spring 2012 CP2 - Forecasting: Page 1 of 44Document44 pagesForecasting Fundamentals: MAN 3520 - Spring 2012 CP2 - Forecasting: Page 1 of 44Abinash PalanisamyNo ratings yet

- HandoutDocument15 pagesHandoutDairymple MendeNo ratings yet

- Time Series Analysis by Salah UddinDocument12 pagesTime Series Analysis by Salah UddinNazim Uddin MahmudNo ratings yet

- BFF3121 Lecture 5 Assignment 3 Benchmarks Student WorkDocument3 pagesBFF3121 Lecture 5 Assignment 3 Benchmarks Student WorkAshton LeeNo ratings yet

- Scatter Plots and Line of Best Fit Line of BestDocument2 pagesScatter Plots and Line of Best Fit Line of Bestapi-16254560No ratings yet

- 7 2YieldCurveDocument6 pages7 2YieldCurverranjan27No ratings yet

- Basics StatisticsDocument11 pagesBasics StatisticsrssarmaNo ratings yet

- Forecasting Methods - An Overview of Models and Techniques: David A. Dickey, N. C. State U., Raleigh, N. CDocument17 pagesForecasting Methods - An Overview of Models and Techniques: David A. Dickey, N. C. State U., Raleigh, N. CAkshay SharmaNo ratings yet

- BTRM WP15 - SOFR OIS Curve Construction - Dec 2020Document23 pagesBTRM WP15 - SOFR OIS Curve Construction - Dec 2020MypatNo ratings yet

- Industrial Engineering: Sales and Demand ForecastingDocument47 pagesIndustrial Engineering: Sales and Demand ForecastingKAMAL PATINo ratings yet

- DATA4100 VisualizationDocument9 pagesDATA4100 VisualizationjdncwefdfnNo ratings yet

- Assignment For Quantitative AnalysisDocument3 pagesAssignment For Quantitative AnalysisPhat Minh Huynh0% (1)

- Week 3 Forecasting With IndicesDocument5 pagesWeek 3 Forecasting With IndicesarianzaeemiNo ratings yet

- ACM - Vol, Correlation, Unified Risk Theory - 092010Document8 pagesACM - Vol, Correlation, Unified Risk Theory - 092010ThorHollisNo ratings yet

- Forecasting Using An Additive Model (From Last Week) Additive Model A T S RDocument10 pagesForecasting Using An Additive Model (From Last Week) Additive Model A T S RsansagithNo ratings yet

- RugbyDocument19 pagesRugbyswapbjspnNo ratings yet

- Predicting Soccer League Games Using Multinomial Logistic ModelsDocument9 pagesPredicting Soccer League Games Using Multinomial Logistic ModelsRobert AbuyaNo ratings yet

- Methodist KL 2013 M2 (Q)Document4 pagesMethodist KL 2013 M2 (Q)STPMmaths0% (1)

- Intraday Time Analysis FINALDocument6 pagesIntraday Time Analysis FINALTradingSystemNo ratings yet

- Tutorial 1 (Week 2)Document5 pagesTutorial 1 (Week 2)sdfklmjsdlklskfjdNo ratings yet

- Instructions For ECON1102 Chart Book - 2014 Session 1Document7 pagesInstructions For ECON1102 Chart Book - 2014 Session 1christine_liu0110No ratings yet

- Attendence in Past Games: PeriodDocument2 pagesAttendence in Past Games: PeriodAllison HolderNo ratings yet

- Prediction and Retrospective AnDocument25 pagesPrediction and Retrospective AnfabianggNo ratings yet

- Components of The Game Result in A Football LeagueDocument18 pagesComponents of The Game Result in A Football LeagueLuis Alberto FuentesNo ratings yet

- ECON1203 HW Solution Week03Document10 pagesECON1203 HW Solution Week03Bad BoyNo ratings yet

- Yuan He PDFDocument15 pagesYuan He PDFPeper12345No ratings yet

- SOM 306 ProjectDocument5 pagesSOM 306 ProjectHarsh HirparaNo ratings yet

- Chapter # 11 (The Basic Seven-B7-Tools of Quality)Document54 pagesChapter # 11 (The Basic Seven-B7-Tools of Quality)Ali Ahmed100% (1)

- Descriptive StatisticsDocument18 pagesDescriptive StatisticsDiana HrabNo ratings yet

- Assignment 1 QuestionsDocument3 pagesAssignment 1 QuestionsLATIKA 21No ratings yet

- Ben Ulmer, Matt Fernandez, Predicting Soccer Results in The English Premier LeagueDocument5 pagesBen Ulmer, Matt Fernandez, Predicting Soccer Results in The English Premier LeagueCosmin GeorgeNo ratings yet

- EXCEL FormulaeDocument223 pagesEXCEL FormulaeMazter HukomNo ratings yet

- Math Ia Draft 2Document12 pagesMath Ia Draft 2futg266No ratings yet

- Sports Metric Forecasting: Guides to Beating the Spreads in Major League Baseball, Basketball, and Football GamesFrom EverandSports Metric Forecasting: Guides to Beating the Spreads in Major League Baseball, Basketball, and Football GamesNo ratings yet

- Finance 210 Engag 2Document8 pagesFinance 210 Engag 2Mhmd KaramNo ratings yet

- Chapter 2Document12 pagesChapter 2Mhmd KaramNo ratings yet

- كويز اسواق ماليةDocument5 pagesكويز اسواق ماليةMhmd KaramNo ratings yet

- Chapterr 3 ModifiedDocument43 pagesChapterr 3 ModifiedMhmd KaramNo ratings yet

- Islamic Finance Week 4 SectionDocument8 pagesIslamic Finance Week 4 SectionMhmd KaramNo ratings yet

- Chapter 3 SummarizedDocument30 pagesChapter 3 SummarizedMhmd KaramNo ratings yet

- Introduction To Managerial Accounting Short Case Study (10 Marks)Document2 pagesIntroduction To Managerial Accounting Short Case Study (10 Marks)Mhmd KaramNo ratings yet

- Case Study-Short SolutionDocument6 pagesCase Study-Short SolutionMhmd KaramNo ratings yet

- Assignment 1 (ECN 511)Document4 pagesAssignment 1 (ECN 511)Mhmd KaramNo ratings yet

- HW EconDocument2 pagesHW EconMhmd KaramNo ratings yet

- Topic 9 - Influence of Monetary and Fiscal Policy On Aggregate DemandDocument30 pagesTopic 9 - Influence of Monetary and Fiscal Policy On Aggregate DemandMhmd KaramNo ratings yet

- Taking Risks and Making Profits Within The Dynamic Business EnvironmentDocument46 pagesTaking Risks and Making Profits Within The Dynamic Business EnvironmentMhmd KaramNo ratings yet

- Case Study - GCC Economic Outlook PDFDocument18 pagesCase Study - GCC Economic Outlook PDFMhmd KaramNo ratings yet

- CH 18 Short Term Financial Plan QuestionsDocument6 pagesCH 18 Short Term Financial Plan QuestionsMhmd KaramNo ratings yet

- Module 2 - Lect 5 - Forecasting PDFDocument36 pagesModule 2 - Lect 5 - Forecasting PDFMhmd KaramNo ratings yet

- CH 19 Cash and Liquidity Management Appendix Class WorkDocument4 pagesCH 19 Cash and Liquidity Management Appendix Class WorkMhmd KaramNo ratings yet

- Module 4 - Decision Theory PDFDocument41 pagesModule 4 - Decision Theory PDFMhmd Karam100% (1)

- Data-11 - 27 - 2020-7 - 38 AMDocument1 pageData-11 - 27 - 2020-7 - 38 AMMhmd KaramNo ratings yet

- Chapter One, Two and Three Research MethodologyDocument97 pagesChapter One, Two and Three Research MethodologyMhmd KaramNo ratings yet

- HW Econ 1Document4 pagesHW Econ 1Mhmd KaramNo ratings yet

- Name: ID:: Groups Count Sum Averag e Varianc eDocument2 pagesName: ID:: Groups Count Sum Averag e Varianc eMhmd KaramNo ratings yet