Professional Documents

Culture Documents

REVENUE REGULATIONS NO. 5-2003 Issued February 4, 2003 Implements The Remittance

REVENUE REGULATIONS NO. 5-2003 Issued February 4, 2003 Implements The Remittance

Uploaded by

Gedan Tan0 ratings0% found this document useful (0 votes)

7 views1 pageThe document summarizes revenue regulations regarding the remittance of shares from internal revenue taxes to provinces comprising the expanded Autonomous Region in Muslim Mindanao (ARMM). The Bureau of Internal Revenue and other collecting officers shall remit 70% of taxes collected from businesses in the region to ARMM and 30% to the National Government. The National Government will allot 30% of its share of current year tax collections in ARMM to the Regional Government for five years. Additionally, 50% of the National Government's 80% share from yearly incremental value-added tax collections in ARMM will be shared with the Regional and Local Governments.

Original Description:

From BIR

Original Title

61167rr03_05

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes revenue regulations regarding the remittance of shares from internal revenue taxes to provinces comprising the expanded Autonomous Region in Muslim Mindanao (ARMM). The Bureau of Internal Revenue and other collecting officers shall remit 70% of taxes collected from businesses in the region to ARMM and 30% to the National Government. The National Government will allot 30% of its share of current year tax collections in ARMM to the Regional Government for five years. Additionally, 50% of the National Government's 80% share from yearly incremental value-added tax collections in ARMM will be shared with the Regional and Local Governments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageREVENUE REGULATIONS NO. 5-2003 Issued February 4, 2003 Implements The Remittance

REVENUE REGULATIONS NO. 5-2003 Issued February 4, 2003 Implements The Remittance

Uploaded by

Gedan TanThe document summarizes revenue regulations regarding the remittance of shares from internal revenue taxes to provinces comprising the expanded Autonomous Region in Muslim Mindanao (ARMM). The Bureau of Internal Revenue and other collecting officers shall remit 70% of taxes collected from businesses in the region to ARMM and 30% to the National Government. The National Government will allot 30% of its share of current year tax collections in ARMM to the Regional Government for five years. Additionally, 50% of the National Government's 80% share from yearly incremental value-added tax collections in ARMM will be shared with the Regional and Local Governments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

REVENUE REGULATIONS NO.

5-2003 issued February 4, 2003 implements the remittance

of the shares/allotment from certain internal revenue taxes to the following provinces/city

comprising the expanded Autonomous Region in Muslim Mindanao (ARMM): Sulu, Tawi-Tawi,

Lanao del Sur, Maguindanao (except Cotabato City), Marawi City and Basilan Province

(excluding Isabela City).

The BIR and other Collecting Officers shall be responsible for the remittance, through the

Regional Treasurer, of the 70% share of the ARMM in the national collections from businesses

operating in the Region, as well as and the remittance of the 30% share of the National

Government (NG) to the Bureau of Treasury (BTr) through the nearest Authorized Government

Depository Bank branch, for payments made through Revenue Official Receipt (ROR) and

directly to BTr, for withholding tax payments made through Tax Remittance Advice (TRA).

The allotment to the Regional Government (RG) of the 30% remaining share of the NG

in all current year collections of internal revenue taxes within ARMM for a period of five (5)

years shall start after its inclusion in the Annual Appropriations Act.

The 50% of the 80% share of the NG from the yearly incremental revenue from VAT

collections within ARMM received by the NG shall be shared by the RG and the Local

Government Units within ARMM as follows: a) 20% for the city or municipality where such

taxes are collected; and b) 80% for the RG.

For the purpose of the Regulations, the withholding tax payments of NGAs shall be made

through the use of TRA while other internal revenue tax payments shall only be made through

the issuance of ROR by authorized Revenue Collecting Officers.

You might also like

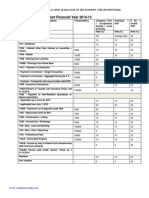

- Nepal Tax Fact 2014/15Document33 pagesNepal Tax Fact 2014/15PANUMSNo ratings yet

- Jurisdiction ReviewerDocument96 pagesJurisdiction ReviewerGedan Tan100% (1)

- Islamic Directorate of The Philippines v. CADocument2 pagesIslamic Directorate of The Philippines v. CAGedan TanNo ratings yet

- Republic of The Philippines Office of The Regional Treasury: Autonomous Region in Muslim MindanaoDocument18 pagesRepublic of The Philippines Office of The Regional Treasury: Autonomous Region in Muslim MindanaoMaryan MokamadNo ratings yet

- RMC No. 69-2023 v2Document1 pageRMC No. 69-2023 v2Jomar CorunoNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument1 pageRepublic of The Philippines Department of Finance Bureau of Internal Revenueapi-247793055No ratings yet

- TDSDocument2 pagesTDSGK TrustNo ratings yet

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- Fiscal AdministrationDocument35 pagesFiscal Administrationangeladeocampo27No ratings yet

- Mozambique Tax Guide 2015 16Document13 pagesMozambique Tax Guide 2015 16Diva DessaiNo ratings yet

- TDS Chart FY 2010-11 & FY 2011-12Document1 pageTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- TDS PresentationDocument16 pagesTDS Presentationgamers SatisfactionNo ratings yet

- Makati OrdinanceDocument2 pagesMakati OrdinanceCHARLOTTE GALLEGONo ratings yet

- Gazette 34 of 04 June 2010 - Mafube FS 205Document20 pagesGazette 34 of 04 June 2010 - Mafube FS 205Thandi85No ratings yet

- SubjectDocument2 pagesSubjectapi-247793055No ratings yet

- Ammendments Made by Finance Bill 2068 in All ActsDocument14 pagesAmmendments Made by Finance Bill 2068 in All ActsNiraj ShresthaNo ratings yet

- Synopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.Document33 pagesSynopsis of Budget For Fy 2068-69 Prepared by G. K. Agrawal & Co.knmodiNo ratings yet

- Flow ChartDocument2 pagesFlow ChartKristal JuditNo ratings yet

- Kawasaki Davao Business TaxDocument9 pagesKawasaki Davao Business TaxcharmainejalaNo ratings yet

- Government of Andhra PradeshDocument4 pagesGovernment of Andhra PradeshBalu Mahendra Susarla0% (1)

- Notice To The Taxpayers: Change of Value Added Tax Rate Income TaxDocument1 pageNotice To The Taxpayers: Change of Value Added Tax Rate Income Taxamicoindustries984No ratings yet

- Additional Notes For TaxDocument3 pagesAdditional Notes For TaxPhia CustodioNo ratings yet

- RR 1 - 1998Document3 pagesRR 1 - 1998Lady Ann CayananNo ratings yet

- Assignment TaxDocument12 pagesAssignment TaxRusna Ahmad100% (2)

- By Rowena Altura: Volume 9 No.12Document6 pagesBy Rowena Altura: Volume 9 No.12arnelmapzNo ratings yet

- The Effect of Fiscal Decentralization To Gross Domestic Regional Product of District / City in South Sumatra ProvinceDocument22 pagesThe Effect of Fiscal Decentralization To Gross Domestic Regional Product of District / City in South Sumatra ProvinceRahmat Pasaribu OfficialNo ratings yet

- Canvas Activity 2Document10 pagesCanvas Activity 2Micol VillaflorNo ratings yet

- Amendments - For A.Y. 2011-12Document49 pagesAmendments - For A.Y. 2011-12Arun BansalNo ratings yet

- Chapter12 PRADocument6 pagesChapter12 PRAFakhar QureshiNo ratings yet

- The PEZA IssueDocument29 pagesThe PEZA IssueArne TanNo ratings yet

- Tds Automation FunctionalityDocument3 pagesTds Automation FunctionalitySurya GudipatiNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 69-2010 Issued On August 13, 2010 Prescribes TheDocument1 pageREVENUE MEMORANDUM ORDER NO. 69-2010 Issued On August 13, 2010 Prescribes TheAlexis Ailex Villamor Jr.No ratings yet

- Ps Limitation 2022 Local Budget Circular No 145 Dated March 2 2022Document14 pagesPs Limitation 2022 Local Budget Circular No 145 Dated March 2 2022kessejunsan16No ratings yet

- Taxation SlideDocument26 pagesTaxation SlidePei Jia WahNo ratings yet

- Giroplan-Iit Ob2220230612045901bv4Document2 pagesGiroplan-Iit Ob2220230612045901bv4GeminiCrescentNo ratings yet

- LGU Sources of IncomeDocument5 pagesLGU Sources of Incomeuasfinance01No ratings yet

- RR 12-2007 PDFDocument7 pagesRR 12-2007 PDFnaldsdomingoNo ratings yet

- Coa C2015-004Document3 pagesCoa C2015-004Robelle RizonNo ratings yet

- Giroplan-Iit Ob2420240314101533wmnDocument2 pagesGiroplan-Iit Ob2420240314101533wmnnhxg7rxpmvNo ratings yet

- Rwanda - Individual SummaryDocument6 pagesRwanda - Individual SummaryKasendereNo ratings yet

- CREATE Salient ProvisionsDocument3 pagesCREATE Salient ProvisionsAldrin Santos AntonioNo ratings yet

- Tds SALARY FOR A.Y. 2011-12Document59 pagesTds SALARY FOR A.Y. 2011-12Pragnesh ShahNo ratings yet

- Local Government PFM ManualDocument199 pagesLocal Government PFM ManualAndy WynneNo ratings yet

- Chap 3Document59 pagesChap 3V HasagalNo ratings yet

- Nepal TaxationDocument19 pagesNepal TaxationVijay AgrahariNo ratings yet

- Exemption From Withholding Tax On CompensationDocument2 pagesExemption From Withholding Tax On CompensationrjNo ratings yet

- IT CircularDocument65 pagesIT Circularnavdeepsingh.india8849100% (2)

- TRA Taxes at Glance - 2016-17Document22 pagesTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- Ax Reminder: When To Apply 10% or 15% EWT For Professional FeesDocument2 pagesAx Reminder: When To Apply 10% or 15% EWT For Professional FeesRegs AccexNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- Giroplan-Iit Ob2120230302164542r50Document2 pagesGiroplan-Iit Ob2120230302164542r50江宗朋No ratings yet

- Finance Circular 2023Document6 pagesFinance Circular 2023registrarsecNo ratings yet

- Income Tax Deduction From SalariesDocument112 pagesIncome Tax Deduction From SalarieskumarNo ratings yet

- Sanggunian Provincial, City and Municipal Treasurers and AllDocument4 pagesSanggunian Provincial, City and Municipal Treasurers and AllCarlos RabagoNo ratings yet

- By Shoba Kanakraj: Mstu, ChennaiDocument20 pagesBy Shoba Kanakraj: Mstu, ChennaiVasanthNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- A Comparative Analysis on Tax Administration in Asia and the PacificFrom EverandA Comparative Analysis on Tax Administration in Asia and the PacificNo ratings yet

- Continuation of Jurisdiction Page 1Document1 pageContinuation of Jurisdiction Page 1Gedan TanNo ratings yet

- MotionDocument1 pageMotionGedan TanNo ratings yet

- GR No. l-11600Document22 pagesGR No. l-11600Gedan TanNo ratings yet

- Laws Govern The Insurance Policy: P.D. No. 612Document1 pageLaws Govern The Insurance Policy: P.D. No. 612Gedan TanNo ratings yet

- Copi, Irving M. and Cohen, Carl (2014) - Introduction To Logic. Pearson Education LimitedDocument1 pageCopi, Irving M. and Cohen, Carl (2014) - Introduction To Logic. Pearson Education LimitedGedan TanNo ratings yet

- Case Title Page No. Aspects of Due Process Police PowerDocument2 pagesCase Title Page No. Aspects of Due Process Police PowerGedan TanNo ratings yet

- Legal Ethics.....Document87 pagesLegal Ethics.....Gedan TanNo ratings yet

- No. of Shares Name of Issuing Company Stock Certificate No. Par Value Book Value Selling PriceDocument2 pagesNo. of Shares Name of Issuing Company Stock Certificate No. Par Value Book Value Selling PriceGedan TanNo ratings yet

- Labor Cases - Illegal DismissalDocument117 pagesLabor Cases - Illegal DismissalGedan TanNo ratings yet

- Odyssey Park v. CADocument3 pagesOdyssey Park v. CAGedan TanNo ratings yet

- Heirs of Luis Bacus Vs Court of Appeals, Spouses Faustino Duray and Victoriana DurayDocument2 pagesHeirs of Luis Bacus Vs Court of Appeals, Spouses Faustino Duray and Victoriana DurayGedan TanNo ratings yet

- The Heirs of Pedro Escanlar Et Al v. CA 281 Scra 176 (1997)Document3 pagesThe Heirs of Pedro Escanlar Et Al v. CA 281 Scra 176 (1997)Gedan TanNo ratings yet

- Supreme Court: Statement of The CaseDocument10 pagesSupreme Court: Statement of The CaseGedan TanNo ratings yet

- G.R. No. 185829 April 25, 2012Document25 pagesG.R. No. 185829 April 25, 2012Gedan TanNo ratings yet

- Jasmin Soler vs. Court of AppealsDocument3 pagesJasmin Soler vs. Court of AppealsGedan TanNo ratings yet

- 44.bank of BPI v. PinedaDocument9 pages44.bank of BPI v. PinedaGedan TanNo ratings yet

- 47.rosenlor Development v. Paterno InquingDocument15 pages47.rosenlor Development v. Paterno InquingGedan TanNo ratings yet

- 46.rillo v. CADocument5 pages46.rillo v. CAGedan TanNo ratings yet

- Maria Cristina v. CADocument5 pagesMaria Cristina v. CAGedan TanNo ratings yet

- Supreme Court: Tipon & Fernandez For Petitioners. Andres B. Plan For RespondentsDocument5 pagesSupreme Court: Tipon & Fernandez For Petitioners. Andres B. Plan For RespondentsGedan TanNo ratings yet

- Jasmin Soler, Petitioner, vs. Court of Appeals, Commercial BANK OF MANILA, and NIDA LOPEZ, Respondents. DecisionDocument5 pagesJasmin Soler, Petitioner, vs. Court of Appeals, Commercial BANK OF MANILA, and NIDA LOPEZ, Respondents. DecisionGedan TanNo ratings yet