Professional Documents

Culture Documents

Business Valuation Methods

Business Valuation Methods

Uploaded by

Raza HodaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Valuation Methods

Business Valuation Methods

Uploaded by

Raza HodaCopyright:

Available Formats

BUSINESS VALUATION METHODS

(All Valuations MUST BE based on Historical Data)

I.

Adjusted Book Value

Take the Book Value of net worth

-assets not acquired

+liabilities not assumed

+fair market value of assets acquired

+any net worth adjustments

=Adjusted Book Value

____________________________________________________________

II.

Capitalized Adjusted Earnings

First Step:

Adjust Historical Earnings

Sellers Discretionary

Cash Flow

Net Profit

+Officers salary

+Discretionary expenses

-New Owner salary

Adjusted Profit

Last

Year

50.0

+70.0

+30.0

-60.0

90.0

Second Step: Get the adjusted profits for 5 years then do a Weighted Average of the

Adjusting Earnings

Year

95

96

97

98

99

Totals

Earnings

$ 50

$ 30

$ 70

$ 60

$ 90

Weight

1

2

3

4

5

15

Adjusted

$ 50

$ 60

$ 210

$ 240

$ 450

$1,010

/15

Average

67 (rounded)

Third Step: Calculate a Discount Rate

Determine T-Bill Rate

Determine Offset Risk Rate

5.0%

12.0%

Establish rate of return based on risk

factors

Establish rate of return based on general

economy

Determine Offset Illiquidity Rate

Total the Rates

3.0%

20.0%

Fourth Step: Take the weighted average of the adjusted earnings and divide by the

discount rate.

Example:

$67/.20 = $335

___________________________________________________________________

III. Discounted Future Earnings

First Step: Adjust Historical Earnings

Net Profit

+Officers salary

+Discretionary expenses

-New Owner salary

Adjusted Profit

Last

Year

50.0

+70.0

+30.0

-60.0

90.0

Second Step: Get the adjusted profits for 5 years then do a Weighted Average of the

Adjusting Earnings

Year

95

96

97

98

99

Totals

Earnings

$ 50

$ 30

$ 70

$ 60

$ 90

Weight

1

2

3

4

5

15

Adjusted

$ 50

$ 60

$ 210

$ 240

$ 450

$1,010

/15

Average

67 (rounded)

Third Step: Determine the discount rate

Determine T-Bill Rate

Determine Offset Risk Rate

Establish rate of return based on

risk factors

Establish rate of return based on

general economy

7.0%

12.0%

Determine Offset Illiquidity Rate

Total the Rates

6.0%

25.0%

Fourth Step: Estimate growth, both real and inflationary (for this example, we are estimating a 5%

growth rate).

Fifth Step: Multiply the estimated earnings for each year by the estimated growth rate until estimated

earnings for the next ten years are determined.

Sixth Step: Multiply the adjusted, weighted earnings by the estimated growth (1 plus the growth rate) to

determine the estimated earnings for the first year.

Seventh Step: Using the net present value table, multiply the estimated earnings for each year by the

factor for the discount rate for each respective year to determine the discounted value of future earnings.

Eighth Step: Total the discounted earnings.

Ninth Step: Determine the residual value by subtracting the growth rate from the discount rate and

dividing the difference into the discounted earnings for year ten.

Tenth Step: Add the residual value to the total discounted earnings.

Year

Previous

Year

Earnings

1

2

3

4

5

6

7

8

9

10

Net Total

Residual

Total

67.0

70.4

73.9

77.6

81.5

85.6

89.9

94.4

99.1

104.1

Growth

(1+5%)

Adjusted

Earnings

1.05

1.05

1.05

1.05

1.05

1.05

1.05

1.05

1.05

1.05

70.4

73.9

77.6

81.5

85.6

89.9

94.4

99.1

104.1

109.3

Factor

(25%)

Net Present

Value

0.80000

0.64000

0.51200

0.40960

0.32768

0.26214

0.20972

0.16777

0.13422

0.10737

56.3

47.3

39.7

33.4

28.0

23.6

19.8

16.6

14.0

11.7

290.4

58.5

348.9

IV. Cash Flow Method

First Step: Identify Available cash for debt service via rule of thumb, sources/uses, or any other

acceptable method.

Net Profit

+ Depreciation

Last

Year

10.0

5.0

Adjusted Profit

15.0

Second Step: Choose a reasonable maturity and market interest rate for the financing requested.

Fixed Asset Purchases

Working Capital

Years

10

7

Average Maturity

Interest Rate

8.5

12%

Third Step: Reverse-compute the amount of total funds that the cash flow can support given the

maturity and interest rate chosen (using an amortization table or calculator).

Cash flow of $15,000 annually at 12% for 8.5 years is an annual debt service for the total amount of $

79,696.69 (computed on a monthly payment basis) or $77,295.78 (computed on an annual payment

basis).

Cash flow valuation establishes a range of $77,000 to $80,000.

V.

Gross Revenue Multiplier

Please use the attached table (Top 30 Business by SIC Code) and the following:

SDC or SDCF = Sellers discretionary cash flow [same as Method II, step 1]

EBIT = Earning before Interest and Taxes

EBITDA = Earning before Interest, Taxes, Depreciation and Amortization

Example:

Last Years Sales * Multiplier

Top 30 Type of Business by SIC Code

(Counted from 10/98 to 8/02)

Ranking

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

# of

SIC

Loans Code Description

1900 5812 Eating and Drinking Places

405 7231 Beauty Shops

337 7538 General Automotive Repair Shops

325 5411 Grocery Stores

260 8041 Offices and Clinics of Chiropractors

235 5999 Miscellaneous Retail Stores

231 7389 Business Services

228 8351 Child Day Care Services

175 8011 Offices and Clinics of Doctors of Medicine

165 7299 Miscellaneous Personal Services

165 5813 Drinking Places (Alcoholic Beverages)

163 5947 Gift, Novelty, and Souvenir Shops

142 7991 Physical Fitness Facilities

129 4212 Local Trucking Without Storage

127 7379 Computer Related Services

124 5531 Auto and Home Supply Stores

120 5461 Retail Bakeries

117 0781 Landscape Counseling and Planning

113 6411 Insurance Agents, Brokers, and Service

112 7999 Amusement and Recreation Services

112 5992 Florists

108 1751 Carpentry Work

105 5541 Gasoline Service Stations

105 7349 Building Cleaning and Maintenance

Services

105 8021 Offices and Clinics of Dentists

105 4213 Trucking, Except Local

103 5941 Sporting Goods Stores and Bicycle Shops

99 7215 Coin-Operated Laundries and Dry-cleaning

94 7532 Auto Body and Upholstery Repair Shops

94 5399 Miscellaneous General Merchandise Stores

92 1799 Special Trade Contractors

90 1711 Plumbing, Heating, and Air-Conditioning

88 5499 Miscellaneous Food Stores

88 2752 Commercial Printing, Lithographic

Source: The Business Reference Guide 2002 tenth edition, by Tom West, 2002.

Rule of Thumb1 or Multiplier

2X SDCF or 25 35% of annual sales

1.5X SDCF or 4X mthly sales + inventory

35% of annual sales, 1.5X SDCF

1 2X mthly sales or 11% of sales

20 70% of annual fees + FF & E

25 50% annual sales + inventory

63% of annual sales

2X SDCF or $1500 - $3000/per enrolled child

20 40% of annual fees or 1X SDC

70 75% annual sales

40 45% annual sales + inventory

4X mthly sales + inventory or 1.5X SDCF

1 years annual revenues

5X EBIT

57% of annual revenue

35% of annual sales + inventory, FF & E

4X mthly sales + inventory, FF & E

1 1.5X SDCF + FF & E

100% annual commissions

45-50% of annual sales

34% of annual sales + inventory

4 - 5X EBIT

3X EBITDA business only

50% of annual revenue or 1.5X SDCF

1 1.5X SDCF + FF & E, 50-70% Revenue

1 1.5X SDCF + FMV of fixed assets

4X mthly sales + inventory

70 100% annual sales or 2.3 2.5X SDCF

35% of annual sales or 1.75X SDCF

15 25% of annual sales + inventory

45 55% annual sales

24% of annual revenues or 1.5X SDCF

4 5X SDCF

50% of annual sales and inventory, FF & E

1 1.5X SDC

You might also like

- IAS 1 - Financial Statements FormatDocument7 pagesIAS 1 - Financial Statements FormatLegogie Moses AnoghenaNo ratings yet

- Investment Banking Chapter 1Document27 pagesInvestment Banking Chapter 1ravindergudikandulaNo ratings yet

- Auditors LiabilityDocument36 pagesAuditors LiabilityVaibhav BanjanNo ratings yet

- Test and Exam Qs Topic 2 - Solutions - v2 PDFDocument20 pagesTest and Exam Qs Topic 2 - Solutions - v2 PDFCindy YinNo ratings yet

- Financial Accounting (7th Edition) P4-2ADocument4 pagesFinancial Accounting (7th Edition) P4-2AMarsha MaeNo ratings yet

- Software Product Development A Complete Guide - 2020 EditionFrom EverandSoftware Product Development A Complete Guide - 2020 EditionNo ratings yet

- 2 Income Statement FormatDocument3 pages2 Income Statement Formatapi-299265916No ratings yet

- Goods and Service TaxDocument7 pagesGoods and Service TaxNitheesh BNo ratings yet

- Statement of Cash FlowsDocument7 pagesStatement of Cash FlowsFarahin SyedNo ratings yet

- Business Accounting FinalDocument12 pagesBusiness Accounting FinalNikesh Munankarmi100% (1)

- Accounting Revision - TRADING AND PROFIT AND LOSS ACCOUNT PDFDocument7 pagesAccounting Revision - TRADING AND PROFIT AND LOSS ACCOUNT PDFshevon mhlangaNo ratings yet

- Projected Balance SheetDocument1 pageProjected Balance Sheetr.jeyashankar9550100% (1)

- Chapter - 1Document35 pagesChapter - 1Samia ElsayedNo ratings yet

- Accounting For Non Profit Making Organisations PDFDocument23 pagesAccounting For Non Profit Making Organisations PDFrain06021992No ratings yet

- Ca Inter FM Icai Past Year Q Ca Namir AroraDocument193 pagesCa Inter FM Icai Past Year Q Ca Namir AroraPankaj MeenaNo ratings yet

- Chapter 2 Corporate TaxDocument50 pagesChapter 2 Corporate TaxNgNo ratings yet

- Acc 414 International AccountingDocument177 pagesAcc 414 International AccountingEmmanuel AbolajiNo ratings yet

- Question # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in PakistanDocument14 pagesQuestion # 1 (A) Critically Examine The Difference Between Various Forms of Organization Exists in Pakistanayub_balticNo ratings yet

- Financial StatementsDocument21 pagesFinancial StatementsSunil KumarNo ratings yet

- Tax Benefits To Ssi SectorDocument13 pagesTax Benefits To Ssi SectorHarshVardhan AryaNo ratings yet

- Cash Budget - Cash Budgeting:: Definition and ExplanationDocument5 pagesCash Budget - Cash Budgeting:: Definition and ExplanationPrajay KhNo ratings yet

- Group 3 - Lending Club Case Study Solutions FinalDocument2 pagesGroup 3 - Lending Club Case Study Solutions FinalArpita GuptaNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationUmairHussain4943100% (7)

- P1: Describe The Main Job Roles and Functions in An Organization. Functional AreaDocument8 pagesP1: Describe The Main Job Roles and Functions in An Organization. Functional AreaSanjida ShahriarNo ratings yet

- An Iso 9001: 2000 Certified International B-SchoolDocument4 pagesAn Iso 9001: 2000 Certified International B-SchoolKunal BadhwarNo ratings yet

- Strategic Position and Action EvaluationDocument3 pagesStrategic Position and Action EvaluationhusinorainNo ratings yet

- Financial Ratios of Keppel Corp 2008-1Document3 pagesFinancial Ratios of Keppel Corp 2008-1Kon Yikun KellyNo ratings yet

- Acca f7 Int Revision Mock Questions - Version 2 Final 7th NovDocument10 pagesAcca f7 Int Revision Mock Questions - Version 2 Final 7th NovsunilmourNo ratings yet

- Final Accounts With Out AdjustmentsDocument2 pagesFinal Accounts With Out AdjustmentsMurari NayuduNo ratings yet

- Amoun Company Analysis and Credit RatingDocument9 pagesAmoun Company Analysis and Credit RatingHesham TabarNo ratings yet

- Quantitative TechniquesDocument11 pagesQuantitative TechniquessanjayifmNo ratings yet

- Buyingahouse 1Document4 pagesBuyingahouse 1api-251852099100% (1)

- The Guide To Find A Job in The Financial SectorDocument88 pagesThe Guide To Find A Job in The Financial SectorCaroline BaillezNo ratings yet

- Financial Accounting and Reporting 02Document6 pagesFinancial Accounting and Reporting 02Nuah SilvestreNo ratings yet

- AutoCount Accounting User Manual (Reduse) PDFDocument243 pagesAutoCount Accounting User Manual (Reduse) PDFindartoimams100% (1)

- Financial StatementDocument11 pagesFinancial StatementGurneet Singh7113No ratings yet

- The Handbook of Financial Modeling: Printed BookDocument1 pageThe Handbook of Financial Modeling: Printed BookThanh NguyenNo ratings yet

- Couresot LineDocument2 pagesCouresot LineSeifu BekeleNo ratings yet

- Topic 8, Mutural Funds AnswersDocument2 pagesTopic 8, Mutural Funds AnswersTan KaihuiNo ratings yet

- 00 02 GST Advance - Info PDFDocument118 pages00 02 GST Advance - Info PDFKen ChiaNo ratings yet

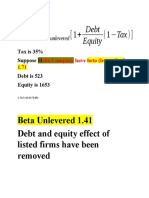

- Beta Levered and UnleveredDocument3 pagesBeta Levered and UnleveredNouman MujahidNo ratings yet

- MICROFINANCEDocument2 pagesMICROFINANCEYkeOluyomi OlojoNo ratings yet

- Trading AccountDocument3 pagesTrading AccountRirin GhariniNo ratings yet

- Ias 20 - Gov't GrantDocument19 pagesIas 20 - Gov't GrantGail Bermudez100% (1)

- Capital AllowancesDocument32 pagesCapital AllowancesMakoni CharityNo ratings yet

- Debtor Collection PeriodDocument7 pagesDebtor Collection PeriodSakshi GoelNo ratings yet

- Management AccountingDocument36 pagesManagement Accountingmunish70sharma2390% (10)

- Dell Business DescriptionDocument18 pagesDell Business DescriptionBigmen AndyNo ratings yet

- IAS 16 and 40 PDFDocument11 pagesIAS 16 and 40 PDFWaqas Younas BandukdaNo ratings yet

- Sol 3 CH 6Document46 pagesSol 3 CH 6Aditya KrishnaNo ratings yet

- Valuation of Goodwill and SharesDocument15 pagesValuation of Goodwill and SharesJuhi PunmiyaNo ratings yet

- Foreign Exchange Market NotesDocument49 pagesForeign Exchange Market Notesderekleung1992No ratings yet

- The Cost of Trade CreditDocument4 pagesThe Cost of Trade CreditWawex DavisNo ratings yet

- Chapter 5 ExerciseDocument7 pagesChapter 5 ExerciseJoe DicksonNo ratings yet

- Cash FlowDocument3 pagesCash FlowTubagus Donny SyafardanNo ratings yet

- Foreign Trade Policy (2015-2020)Document17 pagesForeign Trade Policy (2015-2020)Neha RawalNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)