Professional Documents

Culture Documents

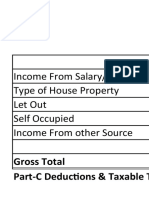

Other 80 C Deductions: 11. Total Income or Taxable Income (8-10)

Other 80 C Deductions: 11. Total Income or Taxable Income (8-10)

Uploaded by

Anandraojs JsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Other 80 C Deductions: 11. Total Income or Taxable Income (8-10)

Other 80 C Deductions: 11. Total Income or Taxable Income (8-10)

Uploaded by

Anandraojs JsCopyright:

Available Formats

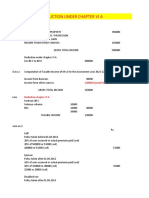

Housing loan repayment of principal portion

Other 80 C deductions

(ii) Section 80CCC

(iii )

Total amount u/s 80C, 80CCC and 80 CCD is Rs. 156776, Admissible amount is

150000

(B).RAJIV GANDHI EQUITY SAVINGS SCHEME (RGESS)(80CCG) 50% of

investment

Other sections (e.g. 80E, 80G etc.) under Chapter VI-A

Qualifying Amount

Deductible Amount

Mediclame 80 D

Handicaped dependent medical treatment 80 DD

Treatment of chronic diseases 80 DDB

Education Loan Interest repayment 80 E

Interst on housing loan 80EE (For loans taken during and after 2013-14)

Donation to special funds 80 G

Deduction for handicaped employees 80 U

10. Aggregate of deductible amout

150,000

( Rs.404195 Rounded to Ten)

11. Total Income or Taxable income (8-10)

404,200

12. Income Tax

15,420

13. Less Rebate 87A (10% of point 11, maximum of Rs. 2000) available if Point 13 is <500001

2,000

14. Tax after 87A rebate

13,420

15. Education cess @ 3% of income tax

403

16. Total Tax Payable including cess

13,823

17. Less: Relief under section 89 (attach details)

18. Tax payable/ refundable

[Rounded value to ten is Rs 13820]

13,823

Verification

I, ................. ,son/daughter of ............ working in the capacity of ............... do hereby certify that

a sum of Rs. 13820

Thirteen Thousand Eight Hundred Twenty Rupees Only

has been deducted and deposited to the credit of the Central Government. I further certify that the information given above

is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other

available records

MUKKATTUKKARA

26/03/2015

http://babuvadukkumchery.blogspot.in

Signature of .................

You might also like

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Amma Income TaxDocument5 pagesAmma Income Taxraghuraman1511No ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Tax Saving OptionDocument2 pagesTax Saving OptionAlias DNo ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Principles of Taxation - DeductionsDocument7 pagesPrinciples of Taxation - Deductions20047 BHAVANDEEP SINGHNo ratings yet

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsNo ratings yet

- DeductionsDocument81 pagesDeductionshitesh1601kukrejaNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- FormDocument4 pagesFormUtkarsh GurjarNo ratings yet

- VRS NotesDocument82 pagesVRS NotesrisingiocmNo ratings yet

- Income Tax Declaration Form For Financial Year 2021-2022Document1 pageIncome Tax Declaration Form For Financial Year 2021-2022Siddharth DasNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument8 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaGeetanjali BarejaNo ratings yet

- Income Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaDocument7 pagesIncome Tax Calculator For F.Y 2020 21 A.Y 2021 22 ArthikDishaSARAVANAN PNo ratings yet

- Deductions From Gross Total Income: HapterDocument20 pagesDeductions From Gross Total Income: HapterJAWED MOHAMMADNo ratings yet

- Income Tax Divyastra CH 13 Deductions From GTI RDocument22 pagesIncome Tax Divyastra CH 13 Deductions From GTI RN AparnaNo ratings yet

- Ajppm3616g Partb 2022-23Document3 pagesAjppm3616g Partb 2022-23niel doriftoNo ratings yet

- DR Ali FinalDocument3 pagesDR Ali FinalbuxartaxNo ratings yet

- Income Tax Planner FY 2020-21Document12 pagesIncome Tax Planner FY 2020-21RedNo ratings yet

- Taxation CLass Test 1Document6 pagesTaxation CLass Test 1ap.quatrroNo ratings yet

- Tax Computation-TemplateDocument70 pagesTax Computation-TemplatePadma SachithanandhamNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)

- Form 16 - TCS Part BDocument4 pagesForm 16 - TCS Part BSai SekharNo ratings yet

- On Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMDocument11 pagesOn Deductions Under Section 80C To 80U (Unit - 4) Bcom 6 SEMMudasir LoneNo ratings yet

- 15.deductions From Gross Total IncomeDocument5 pages15.deductions From Gross Total IncomeDEV BHARGAVANo ratings yet

- ITForm16 33204617654Document2 pagesITForm16 33204617654smhathrasjunctionNo ratings yet

- Salary On IncomeDocument22 pagesSalary On IncomeManjunathNo ratings yet

- 4 Chapter VI-ADocument11 pages4 Chapter VI-AVENKATESWARLUMCOMNo ratings yet

- Personal Income Tax Under The New Regime and Old RegimeDocument4 pagesPersonal Income Tax Under The New Regime and Old RegimeAiswarya BNo ratings yet

- AssignmentDocument5 pagesAssignmentSuyash PrakashNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- Particulars of Tax CreditDocument2 pagesParticulars of Tax CreditMd Roni HasanNo ratings yet

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDocument3 pagesIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNo ratings yet

- 031508996Document2 pages031508996Lokesh KumarNo ratings yet

- Deduction From Gross Total Income (Section-80C To 80U)Document5 pagesDeduction From Gross Total Income (Section-80C To 80U)Siddhartha Singhal057No ratings yet

- 7705 Form16-B-201819-461 PDFDocument1 page7705 Form16-B-201819-461 PDFAnonymous vlaen0sHNo ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Deductions Available Under Chapter VI of Income TaxDocument4 pagesDeductions Available Under Chapter VI of Income TaxDeepanjali NigamNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- IT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteDocument13 pagesIT Deductions Allowed Under Chapter VI-A Sec 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB Etc - APTEACHERS WebsiteKIMS IECNo ratings yet

- Tax Chapter 8 Deduct From Gross IncomeDocument14 pagesTax Chapter 8 Deduct From Gross Incomemacklyn220% (1)

- DeductionsDocument7 pagesDeductionsAnurag BishtNo ratings yet

- StatementDocument2 pagesStatementabinand29No ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- Form16Document10 pagesForm16anon-263698No ratings yet

- Deductions Dec 21Document26 pagesDeductions Dec 21snowbell 95No ratings yet

- 7523 Form16-B-201819-353Document1 page7523 Form16-B-201819-353Anonymous vlaen0sHNo ratings yet

- 18609cp7 PCC Compsuggans TaxationDocument6 pages18609cp7 PCC Compsuggans TaxationDeepal DhamejaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Anatomy: Key PointsDocument2 pagesAnatomy: Key PointsAnandraojs JsNo ratings yet

- Anatomy: Key PointsDocument4 pagesAnatomy: Key PointsAnandraojs JsNo ratings yet

- Anatomy: Key PointsDocument2 pagesAnatomy: Key PointsAnandraojs JsNo ratings yet

- Fees and Charges For Debit CardDocument2 pagesFees and Charges For Debit CardAnandraojs JsNo ratings yet

- Manual Of: SurgeryDocument3 pagesManual Of: SurgeryAnandraojs JsNo ratings yet

- Clinical PearlsdDocument3 pagesClinical PearlsdAnandraojs JsNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- Toppers: of Med ThrissurDocument3 pagesToppers: of Med ThrissurAnandraojs JsNo ratings yet