Professional Documents

Culture Documents

The Concept of Venture Capital

The Concept of Venture Capital

Uploaded by

Amit Mishra0 ratings0% found this document useful (0 votes)

9 views1 pageVenture capital is a form of private equity and risk financing that includes investment in the form of both equity and debt, and is used to finance high-risk, high-potential growth companies. It provides seed funding, start-up funding, and expansion funding for companies that have demonstrated business potential but do not yet have access to public markets or traditional credit. Venture capital involves risk but also seeks medium to long-term returns through partnership with entrepreneurs by adding value through knowledge, experience, and business contacts.

Original Description:

xcacs

Original Title

ti

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentVenture capital is a form of private equity and risk financing that includes investment in the form of both equity and debt, and is used to finance high-risk, high-potential growth companies. It provides seed funding, start-up funding, and expansion funding for companies that have demonstrated business potential but do not yet have access to public markets or traditional credit. Venture capital involves risk but also seeks medium to long-term returns through partnership with entrepreneurs by adding value through knowledge, experience, and business contacts.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageThe Concept of Venture Capital

The Concept of Venture Capital

Uploaded by

Amit MishraVenture capital is a form of private equity and risk financing that includes investment in the form of both equity and debt, and is used to finance high-risk, high-potential growth companies. It provides seed funding, start-up funding, and expansion funding for companies that have demonstrated business potential but do not yet have access to public markets or traditional credit. Venture capital involves risk but also seeks medium to long-term returns through partnership with entrepreneurs by adding value through knowledge, experience, and business contacts.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 1

The venture capital investment helps for the growth of innovative entrepreneurships in

India. Venture capital has developed as a result of the need to provide non-conventional,

risky finance to new ventures based on innovative entrepreneurship. Venture capital is an

investment in the form of equity, quasi-equity and sometimes debt - straight or

conditional, made in new or untried concepts, promoted by a technically or professionally

qualified entrepreneur. Venture capital means risk capital. It refers to capital investment,

both equity and debt, which carries substantial risk and uncertainties. The risk envisaged

may be very high may be so high as to result in total loss or very less so as to result in

high gains

The concept of Venture Capital

Venture capital means many things to many people. It is in fact nearly impossible to come

across one single definition of the concept.

Jane Koloski Morris, editor of the well known industry publication, Venture Economics,

defines venture capital as 'providing seed, start-up and first stage financing' and also

'funding the expansion of companies that have already demonstrated their business

potential but do not yet have access to the public securities market or to credit

oriented institutional funding sources.

The European Venture Capital Association describes it as risk finance for

entrepreneurial growth oriented companies. It is investment for the medium or long term

return seeking to maximize medium or long term for both parties. It is a partnership with

the entrepreneur in which the investor can add value to the company because of his

knowledge, experience and contact base.

Meaning of venture capital:

Venture capital is money provided

You might also like

- Literature ReviewDocument13 pagesLiterature ReviewSukhraj Kaur Chhina100% (5)

- Lesson 19: Venture Capital - Theoretical ConceptDocument4 pagesLesson 19: Venture Capital - Theoretical ConceptAkshay SareenNo ratings yet

- Final PDocument72 pagesFinal PPriyanka balayaNo ratings yet

- Introduction To Venture Capital: I L'tiiiire (Apiial Manaf Emeni Indian ExperienceDocument13 pagesIntroduction To Venture Capital: I L'tiiiire (Apiial Manaf Emeni Indian Experienceashwin thakurNo ratings yet

- Chapter 1. Introduction of Venture CapitalDocument46 pagesChapter 1. Introduction of Venture CapitalPriyanka satamNo ratings yet

- REPORT On Venture CapitalDocument57 pagesREPORT On Venture CapitalNIKHIL SHRIVASTAVANo ratings yet

- Definition of 'Venture Capital'Document3 pagesDefinition of 'Venture Capital'Adarsh UttarkarNo ratings yet

- Venture Capital in INDIADocument83 pagesVenture Capital in INDIAnawaz100% (2)

- Venture Capital: Debt Finance Term LoanDocument4 pagesVenture Capital: Debt Finance Term LoanmansionerNo ratings yet

- Venture Capital in IndiaDocument58 pagesVenture Capital in IndiaNaandi Narvekar100% (1)

- About Venture CapitalDocument8 pagesAbout Venture CapitalKishor YadavNo ratings yet

- REPORT On Venture CapitalDocument54 pagesREPORT On Venture Capitalakshay mouryaNo ratings yet

- About Venture Capital (VC)Document16 pagesAbout Venture Capital (VC)Shalini JaiswalNo ratings yet

- Banking and Insurance: "I Never Invest in Someone Who Says They'reDocument27 pagesBanking and Insurance: "I Never Invest in Someone Who Says They'remiketyagiNo ratings yet

- Venture Capital in India: Merchant Banking AssignmentDocument23 pagesVenture Capital in India: Merchant Banking AssignmentSanjay YadavNo ratings yet

- Venture CapitalDocument7 pagesVenture CapitalMeenakshiNo ratings yet

- Introduction To Venture Capital 5thDocument37 pagesIntroduction To Venture Capital 5thSaili Sarmalkar100% (1)

- Venture Capital Fund ProjectDocument29 pagesVenture Capital Fund ProjectAdii AdityaNo ratings yet

- Presented By-3. Abhishek Khandelwal 11.ashutosh Agrawal 35.prabhat Kumar Choubey 48.raunak DhuparDocument11 pagesPresented By-3. Abhishek Khandelwal 11.ashutosh Agrawal 35.prabhat Kumar Choubey 48.raunak Dhuparashu03261No ratings yet

- Venture CapitalDocument71 pagesVenture CapitalGautam KalraNo ratings yet

- Venture Capital Financing in India 2Document48 pagesVenture Capital Financing in India 2Arpit Patel0% (1)

- Alternative Investments AssignmentDocument8 pagesAlternative Investments AssignmentYashwanth YashasNo ratings yet

- 004-Gaurang Bhatt-The Concept of Venture CapitalDocument60 pages004-Gaurang Bhatt-The Concept of Venture Capitalswapshri03No ratings yet

- Venture Capital in IndiaDocument44 pagesVenture Capital in IndiaReagan SparkNo ratings yet

- Research Proposal ForDocument14 pagesResearch Proposal ForMaitri PandyaNo ratings yet

- Enture Financing: BY: M.Shamrin Sofia 18COAE049Document21 pagesEnture Financing: BY: M.Shamrin Sofia 18COAE049Sofia ShamrinNo ratings yet

- Lesson 19: Venture Capital - Theoretical ConceptDocument4 pagesLesson 19: Venture Capital - Theoretical ConceptMukundapuram PublicschoolNo ratings yet

- VC FinalDocument237 pagesVC FinalShoaib AhmedNo ratings yet

- Tushar Nivruttinath HatimDocument42 pagesTushar Nivruttinath Hatimtushar nivruttinath hatimNo ratings yet

- Venture Capital Articles PDFDocument49 pagesVenture Capital Articles PDFNarada Kumara100% (1)

- Venture CapitalDocument24 pagesVenture CapitalBipinNo ratings yet

- Investment and Securities LawDocument17 pagesInvestment and Securities Lawsantosh lakhmani0% (1)

- CCCCCCCC CC C CCCCCCC CCCCCCCCCCCCC C C: C C C CDocument4 pagesCCCCCCCC CC C CCCCCCC CCCCCCCCCCCCC C C: C C C CmandeepparmarNo ratings yet

- Venture Capital - FINDocument5 pagesVenture Capital - FINclaudiaNo ratings yet

- Concept of Venture CapitalDocument19 pagesConcept of Venture CapitalyangdolNo ratings yet

- Venture Capital (10MBA17)Document12 pagesVenture Capital (10MBA17)AshishDhavalNo ratings yet

- Financial Sevice ProjectDocument7 pagesFinancial Sevice ProjectAbdul AzeemNo ratings yet

- Submitted by Prashanth.s Rangaswamy G Punith.s MBADocument8 pagesSubmitted by Prashanth.s Rangaswamy G Punith.s MBAPrashanth Prashu SNo ratings yet

- VC 1Document29 pagesVC 1khayyumNo ratings yet

- Shri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Document21 pagesShri Chinai College of Commerce and Economics Andheri (E) ,: Submitted By: Group 9Mohit ZaveriNo ratings yet

- Chapter Six: Venture Capital 6.1. Meaning of Venture Capital InvestmentDocument15 pagesChapter Six: Venture Capital 6.1. Meaning of Venture Capital InvestmenttemedebereNo ratings yet

- Venture Capital FundsDocument95 pagesVenture Capital FundsEsha ShahNo ratings yet

- Venture Capital": Prepared byDocument13 pagesVenture Capital": Prepared byRatnesh SinghNo ratings yet

- Venture Capital Funding - FSDocument14 pagesVenture Capital Funding - FSashaya_j_007No ratings yet

- This Paper Proposes To Outline The Concept and Origin of Venture CapitalDocument7 pagesThis Paper Proposes To Outline The Concept and Origin of Venture CapitalparamsnNo ratings yet

- Venture Capital and Entrepreneurial FinanceDocument15 pagesVenture Capital and Entrepreneurial FinanceArun KumarNo ratings yet

- ESHP ProjectDocument7 pagesESHP ProjectSurag SushilNo ratings yet

- Blackbook Project On Venture CapitalDocument83 pagesBlackbook Project On Venture CapitalPriyanka balayaNo ratings yet

- Venturecapitalppt 121214040042 Phpapp01 PDFDocument13 pagesVenturecapitalppt 121214040042 Phpapp01 PDFNadsNo ratings yet

- Venture Capital in India 2017 ProjectDocument80 pagesVenture Capital in India 2017 Projectakki_655150% (2)

- Venture Capital in IndaiDocument66 pagesVenture Capital in IndaiTahir HussainNo ratings yet

- Session 15, 16 VCDocument35 pagesSession 15, 16 VCdakshaangelNo ratings yet

- Unit 6 Venture CapitalDocument39 pagesUnit 6 Venture CapitalNtinginya Iddi rajabuNo ratings yet

- The Origin of Venture CapitalDocument26 pagesThe Origin of Venture CapitalTejal GuptaNo ratings yet

- Startup VC - Guide: Everything Entrepreneurs Need to Know about Venture Capital and Startup FundraisingFrom EverandStartup VC - Guide: Everything Entrepreneurs Need to Know about Venture Capital and Startup FundraisingNo ratings yet

- Demystifying Venture Capital: How It Works and How to Get ItFrom EverandDemystifying Venture Capital: How It Works and How to Get ItNo ratings yet

- Summary of Rich Dad’s Guide to Investing by Robert Kiyosaki: by Robert Kiyosaki - What the Rich Invest In, That the Poor and Middle Class Do Not! - A Comprehensive SummaryFrom EverandSummary of Rich Dad’s Guide to Investing by Robert Kiyosaki: by Robert Kiyosaki - What the Rich Invest In, That the Poor and Middle Class Do Not! - A Comprehensive SummaryNo ratings yet

- Tactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionFrom EverandTactical Objective: Strategic Maneuvers, Decoding the Art of Military PrecisionNo ratings yet

- A Critical Analysis: Related PapersDocument13 pagesA Critical Analysis: Related PapersAmit MishraNo ratings yet

- Analysis of Financial Performance of Mining CompanyDocument18 pagesAnalysis of Financial Performance of Mining CompanyAmit MishraNo ratings yet

- Cat Study PlanDocument1 pageCat Study PlanAmit MishraNo ratings yet

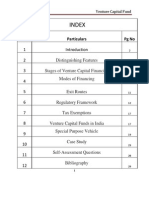

- Table of ContentDocument3 pagesTable of ContentAmit MishraNo ratings yet

- Assignment 3Document10 pagesAssignment 3Amit MishraNo ratings yet

- Analysis of Forex MarketDocument78 pagesAnalysis of Forex MarketAmit MishraNo ratings yet

- E GovernanceDocument83 pagesE GovernanceAmit Mishra100% (3)

- India As An Cultural DestinationDocument10 pagesIndia As An Cultural DestinationAmit Mishra0% (1)

- Project Guidelines P.G.diploma LevelDocument12 pagesProject Guidelines P.G.diploma LevelAmit MishraNo ratings yet

- PunjabDocument441 pagesPunjabAmit Mishra100% (1)

- Rural Development and Panchayat Raj (CGS.2) DepartmentDocument2 pagesRural Development and Panchayat Raj (CGS.2) DepartmentAmit MishraNo ratings yet

- CRT - How To Prepare A ResumeDocument2 pagesCRT - How To Prepare A ResumeAmit MishraNo ratings yet