Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

26 viewsStrategic Management Notes

Strategic Management Notes

Uploaded by

CamilleDetailed and outlined notes on Strategic management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Table of ContentsDocument1 pageTable of ContentsCamille100% (4)

- Restaurant Business PlanDocument34 pagesRestaurant Business Planmohe80% (10)

- 8 Free Things To Do in HKDocument6 pages8 Free Things To Do in HKCamilleNo ratings yet

- 11 Sights You Need To Seein Cape Town South AfricaDocument2 pages11 Sights You Need To Seein Cape Town South AfricaCamilleNo ratings yet

- Spanish DessertsDocument50 pagesSpanish DessertsCamilleNo ratings yet

- Key External Factors Opportunities: External Factor Evaluation (EFE) MatrixDocument11 pagesKey External Factors Opportunities: External Factor Evaluation (EFE) MatrixCamilleNo ratings yet

- Offers Unique "Starbucks Experience" To Customers: Strengths WeaknessesDocument1 pageOffers Unique "Starbucks Experience" To Customers: Strengths WeaknessesCamilleNo ratings yet

- University of The Philippines Cebu Management DivisionDocument37 pagesUniversity of The Philippines Cebu Management DivisionCamilleNo ratings yet

- PfizerDocument10 pagesPfizerCamilleNo ratings yet

- Indolence of The FilipinosDocument17 pagesIndolence of The FilipinosCamilleNo ratings yet

- Avocado and Tuna Tapas: IngredientsDocument15 pagesAvocado and Tuna Tapas: IngredientsCamilleNo ratings yet

- Spanish Crock Pot Slow CookerDocument50 pagesSpanish Crock Pot Slow CookerCamilleNo ratings yet

- Spanish DessertsDocument51 pagesSpanish DessertsCamilleNo ratings yet

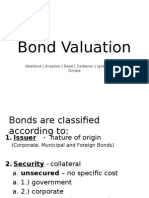

- Bond Valuation: Abellana - Arzadon - Base - Calderon - Igot - Nollora - OmelaDocument17 pagesBond Valuation: Abellana - Arzadon - Base - Calderon - Igot - Nollora - OmelaCamilleNo ratings yet

- The Nature of An External AuditDocument5 pagesThe Nature of An External AuditCamille100% (1)

- Spanish CasserolesDocument50 pagesSpanish CasserolesCamilleNo ratings yet

- 時間 jikan - Time 午前 gozen - A.M. (morning) 午後 gogo - P.M. (afternoon)Document4 pages時間 jikan - Time 午前 gozen - A.M. (morning) 午後 gogo - P.M. (afternoon)CamilleNo ratings yet

- Chapter 10: Training ProgramsDocument78 pagesChapter 10: Training ProgramsCamille100% (1)

- Hotels and ResortsDocument47 pagesHotels and ResortsCamilleNo ratings yet

Strategic Management Notes

Strategic Management Notes

Uploaded by

Camille0 ratings0% found this document useful (0 votes)

26 views2 pagesDetailed and outlined notes on Strategic management

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDetailed and outlined notes on Strategic management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views2 pagesStrategic Management Notes

Strategic Management Notes

Uploaded by

CamilleDetailed and outlined notes on Strategic management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Grace period - 1 to 2 years; do not pay the PRINCIPAL but pay INTEREST

Interest payment for the first two years ()

How income taxes are computed:

o Income tax payable

Point of reference EBIT

Unallowable percentage

Interest income treasury bills, bonds, account deposits

Only 67% is subjected to taxes

Income tax cash and non-cash

How dividends are computed?

Categories of Cash flows

o Operations/Operating Activities started with EBIT

o Investments and Financing

Supplier receivable good for 30 days

Minimum cash requirement percentage that would serve as buffer for future

purposes

DCF basis for NPV and IRR

o Cash Budgeting Analysis

PIRR, Equity IRR, NPV, Payback Period

Capital Budgeting

o Decision-making process with respect to investments in fixed assets

o Involves incremental cash flows with investment proposals and

evaluation those proposed investments

o Critical Elements

o Free Cashflow cash flow in excess of that required to fund all projects

that have positive NPVs when discounted at the relevant cost of capital

Cost of capital cost of borrowing (interest)

Debt (interest expense) and equity (opportunity cost)

Payments, investments have already been taken care of

o IRR what rate of return does this project earn?

Discount rate that equates the present value of the projects

cash

Required Rate of Return

Based on shareholders required rate of return /board

policy

Based on industry standards

Based on other indices/metrics (interest rate if you

borrow)

o NPV equal to the

o Payback Period number of years needed to recover the initial cash

outlay

o Expectation is that youd go beyond the horizon, match with the life of

the corporation (50 years)

o Terminal Value considers the cash flows beyond 30 years and bring it

to the present 30 year

Using a multiplier 7 (Rule of Thumb)

o Hurdle Rate could also be the required rate of return

Why four levels?

NPVs are positive given the different levels

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Table of ContentsDocument1 pageTable of ContentsCamille100% (4)

- Restaurant Business PlanDocument34 pagesRestaurant Business Planmohe80% (10)

- 8 Free Things To Do in HKDocument6 pages8 Free Things To Do in HKCamilleNo ratings yet

- 11 Sights You Need To Seein Cape Town South AfricaDocument2 pages11 Sights You Need To Seein Cape Town South AfricaCamilleNo ratings yet

- Spanish DessertsDocument50 pagesSpanish DessertsCamilleNo ratings yet

- Key External Factors Opportunities: External Factor Evaluation (EFE) MatrixDocument11 pagesKey External Factors Opportunities: External Factor Evaluation (EFE) MatrixCamilleNo ratings yet

- Offers Unique "Starbucks Experience" To Customers: Strengths WeaknessesDocument1 pageOffers Unique "Starbucks Experience" To Customers: Strengths WeaknessesCamilleNo ratings yet

- University of The Philippines Cebu Management DivisionDocument37 pagesUniversity of The Philippines Cebu Management DivisionCamilleNo ratings yet

- PfizerDocument10 pagesPfizerCamilleNo ratings yet

- Indolence of The FilipinosDocument17 pagesIndolence of The FilipinosCamilleNo ratings yet

- Avocado and Tuna Tapas: IngredientsDocument15 pagesAvocado and Tuna Tapas: IngredientsCamilleNo ratings yet

- Spanish Crock Pot Slow CookerDocument50 pagesSpanish Crock Pot Slow CookerCamilleNo ratings yet

- Spanish DessertsDocument51 pagesSpanish DessertsCamilleNo ratings yet

- Bond Valuation: Abellana - Arzadon - Base - Calderon - Igot - Nollora - OmelaDocument17 pagesBond Valuation: Abellana - Arzadon - Base - Calderon - Igot - Nollora - OmelaCamilleNo ratings yet

- The Nature of An External AuditDocument5 pagesThe Nature of An External AuditCamille100% (1)

- Spanish CasserolesDocument50 pagesSpanish CasserolesCamilleNo ratings yet

- 時間 jikan - Time 午前 gozen - A.M. (morning) 午後 gogo - P.M. (afternoon)Document4 pages時間 jikan - Time 午前 gozen - A.M. (morning) 午後 gogo - P.M. (afternoon)CamilleNo ratings yet

- Chapter 10: Training ProgramsDocument78 pagesChapter 10: Training ProgramsCamille100% (1)

- Hotels and ResortsDocument47 pagesHotels and ResortsCamilleNo ratings yet