Professional Documents

Culture Documents

Depreciation

Depreciation

Uploaded by

api-2846142060 ratings0% found this document useful (0 votes)

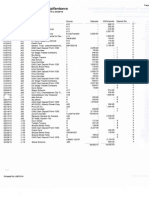

61 views1 pageThis document shows the depreciation expense calculations for machinery over 3 years (2014-2016) using the double-declining balance and straight-line depreciation methods. Under the double-declining balance method, the depreciation expense decreases each year as the book value declines. Under the straight-line method, the depreciation expense is the same each year. Key figures provided include the cost of the machinery, accumulated depreciation, book value, and depreciation expense for each year under both methods.

Original Description:

Original Title

depreciation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document shows the depreciation expense calculations for machinery over 3 years (2014-2016) using the double-declining balance and straight-line depreciation methods. Under the double-declining balance method, the depreciation expense decreases each year as the book value declines. Under the straight-line method, the depreciation expense is the same each year. Key figures provided include the cost of the machinery, accumulated depreciation, book value, and depreciation expense for each year under both methods.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

61 views1 pageDepreciation

Depreciation

Uploaded by

api-284614206This document shows the depreciation expense calculations for machinery over 3 years (2014-2016) using the double-declining balance and straight-line depreciation methods. Under the double-declining balance method, the depreciation expense decreases each year as the book value declines. Under the straight-line method, the depreciation expense is the same each year. Key figures provided include the cost of the machinery, accumulated depreciation, book value, and depreciation expense for each year under both methods.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

2014

2015

2016

1. Double-declining-balance method

Machinery

Less:

Accumulated

depreciation

Year-end book

value

Depreciation

expense for the

year

$588,000

$58,800

$588,000

=$58,800+

$105,840=

$164,640

= $588,000 $164,640=

$423,360

$105,840

$588,000

=$58,800+$105,840+

$164,640=

= $249,312

= $588,000 - $249,312 =

$338,688

$588,000

==$26,600+$53,200 +

$79,800 = = $133,000

$561,400

$588,000

=$26,600+

$53,200 = =

$79,800

$508,200

$26,600

$53,200

$53,200

=$588,000 $58,800=

$529,200

$58,800

$84,672

2. Straight-line method

Machinery

Less:

Accumulated

depreciation

Year-end book

value

Depreciation

expense for the

year

$588,000

$26,600

$455,000

1. Double-declining-balance rate = 2/ Estimated useful life = 2/10 =0.2 = 20%

Depreciation Expense for 2014 = Double-declining-balance rate * Beginning

period book value * Fraction of year = 20% *$588,000*6/12= $58,800

Depreciation Expense for 2015 = 20%*($588,000-$58,800) = $105,840

Depreciation Expense for 2016 = 20%*($588,000-$58,800 - $105,840) =

$84,672

2. Depreciation per year = (Cost Estimated residual value) / Estimated useful

life in years = ($588,000 - $56,000) / 10 = $53,200 This amount is the

depreciation amount for both 2015 and 2016 years.

Depreciation for 2014 = Depreciation per year * Fraction of year =

$53,200*(6/12) = $26,600

You might also like

- Case Study of Hola KolaDocument5 pagesCase Study of Hola KolaRuohui ChenNo ratings yet

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocument21 pagesAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Feasibility Study Excel TemplateDocument5 pagesFeasibility Study Excel TemplateARISNo ratings yet

- Task 7Document14 pagesTask 7Damaris MoralesNo ratings yet

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Budgeting Mac Horngren 14eDocument6 pagesBudgeting Mac Horngren 14eAnsuman MohapatroNo ratings yet

- Winners' Financial ModelDocument5 pagesWinners' Financial ModelARCHIT KUMARNo ratings yet

- Income Projection Statement TemplateDocument4 pagesIncome Projection Statement TemplateJune AguinaldoNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- Cost Accounting Questions Chapter 5Document7 pagesCost Accounting Questions Chapter 5Owais Khan KhattakNo ratings yet

- Accumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67Document5 pagesAccumulated Carrying Year Description Depreciation Depreciation Amount 18,666.67 18,666.67BARANGAY SIXTYNo ratings yet

- Managerial Accounting Solutions Chapter 3 PDFDocument42 pagesManagerial Accounting Solutions Chapter 3 PDFadam_garcia_81No ratings yet

- Uber CaseDocument21 pagesUber CaseScribdTranslationsNo ratings yet

- Total Costs (Actual and Estimated) $ 8,000,000.00 $ 5,600,000.00Document2 pagesTotal Costs (Actual and Estimated) $ 8,000,000.00 $ 5,600,000.00wahdah ulin nafisahNo ratings yet

- I. Sources of Fund A. EquityDocument20 pagesI. Sources of Fund A. EquityJoshell Roz RamasNo ratings yet

- Company Name Delta AirlinesDocument17 pagesCompany Name Delta AirlinesHarshit GuptaNo ratings yet

- M11 CHP 09 1 Flex Bud Variances 2011 0524Document47 pagesM11 CHP 09 1 Flex Bud Variances 2011 0524tobeh ibrahimNo ratings yet

- Feasibility Study Excel TemplateDocument9 pagesFeasibility Study Excel TemplateBeede AshebirNo ratings yet

- BudgetDocument2 pagesBudgetMitch FelsmanNo ratings yet

- Answer Test Group No.2-K27ktDocument2 pagesAnswer Test Group No.2-K27ktThư ThưNo ratings yet

- D' Mallows Income Statement For The Year Ended 2018-2022 Schedule 2018 2019Document23 pagesD' Mallows Income Statement For The Year Ended 2018-2022 Schedule 2018 2019April Loureen Dale TalhaNo ratings yet

- Akuntansi Manajemen CPVDocument13 pagesAkuntansi Manajemen CPVVanni LimNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Case 2 - Lady M-2Document11 pagesCase 2 - Lady M-2Joanne LinNo ratings yet

- Exam 3 MBA 631 Fall 22Document4 pagesExam 3 MBA 631 Fall 22Rakesh PatelNo ratings yet

- Cocopatch ProformaDocument9 pagesCocopatch ProformaRod OrtanezNo ratings yet

- Usefulness of Financial Forecasting andDocument7 pagesUsefulness of Financial Forecasting andHambeca PHNo ratings yet

- Boston Creamery Inc: Variance AnalysisDocument9 pagesBoston Creamery Inc: Variance AnalysiswahyuNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Sample 3YR Financial ProjectionDocument22 pagesSample 3YR Financial Projectionmarjorie.maraveNo ratings yet

- Marketing Budget TemplateDocument8 pagesMarketing Budget TemplatenadamorisNo ratings yet

- Akbi 15Document9 pagesAkbi 15Ranni PrastyawatiNo ratings yet

- Colorscope 20101029 v0 1 ABDocument20 pagesColorscope 20101029 v0 1 ABirquadri0% (1)

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- Manisha Haldar - The Fashion Channel IIMT 2019 Student WorksheetDocument2 pagesManisha Haldar - The Fashion Channel IIMT 2019 Student WorksheetyyyNo ratings yet

- My GURU Mathematics Tutorial Services: Service Income Cost of ServiceDocument11 pagesMy GURU Mathematics Tutorial Services: Service Income Cost of ServiceCarmela CarinoNo ratings yet

- Colorscope 20101029 v0 1 ABDocument19 pagesColorscope 20101029 v0 1 ABrahulrao70% (1)

- Cost Residual Value Useful Life (Years) Useful Life (Units) Acceleration Rate Instructions: Enter Known VarablesDocument8 pagesCost Residual Value Useful Life (Years) Useful Life (Units) Acceleration Rate Instructions: Enter Known Varableskkatarn327No ratings yet

- Chapter 6 Answer Key (1 15)Document15 pagesChapter 6 Answer Key (1 15)Desrifta FaheraNo ratings yet

- The Fashion ChannelDocument3 pagesThe Fashion Channelglobal.ambohNo ratings yet

- PPC Forecast ModelDocument7 pagesPPC Forecast ModelOpeyemi Akinkunmi BeckleyNo ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- Hyacith Financial PlanDocument18 pagesHyacith Financial PlanERICKA GRACE DA SILVANo ratings yet

- Business Plan - Sweet Rounds 1Document17 pagesBusiness Plan - Sweet Rounds 1Felix CleofeNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- Ex1 Sensitivity AnalysisDocument21 pagesEx1 Sensitivity AnalysisP MarpaungNo ratings yet

- Financial Tables CONAIDDocument11 pagesFinancial Tables CONAIDCarl Ammiel P. LapureNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- CF Tutorial 11 - SolutionsDocument5 pagesCF Tutorial 11 - SolutionschewNo ratings yet

- XYZ Energy ROIDocument27 pagesXYZ Energy ROIWei ZhangNo ratings yet

- Final Project FMGT 80Document12 pagesFinal Project FMGT 80Alma UriasNo ratings yet

- Ch1 Solutions 1Document59 pagesCh1 Solutions 1YoungCheon JungNo ratings yet

- Financial PlanDocument28 pagesFinancial PlannabeelaraoNo ratings yet

- Color ScopeDocument12 pagesColor Scopeprincemech2004100% (2)

- HotelDocument4 pagesHotelSoumitraNo ratings yet

- BL SheetDocument3 pagesBL Sheetroselle oronganNo ratings yet

- Boston CreameryDocument11 pagesBoston CreameryNadine OwonoNo ratings yet

- Spreadsheet ModellingDocument33 pagesSpreadsheet ModellingSecond FloorNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Computer Skills: Grande Prairie, AB T8W 0K2 Cell: 587-343-3547Document1 pageComputer Skills: Grande Prairie, AB T8W 0K2 Cell: 587-343-3547api-284614206No ratings yet

- ReconciliationDocument1 pageReconciliationapi-284614206No ratings yet

- Paiboc For A Negative LetterDocument1 pagePaiboc For A Negative Letterapi-284614206No ratings yet

- VlookupDocument1 pageVlookupapi-284614206No ratings yet

- TransactionsbyvendorDocument1 pageTransactionsbyvendorapi-284614206No ratings yet

- Mail Room MemoDocument2 pagesMail Room Memoapi-284614206No ratings yet

- Balance SheetDocument1 pageBalance Sheetapi-284614206No ratings yet

- Sales by MonthDocument1 pageSales by Monthapi-284614206No ratings yet

- Ms Office Specialist Outlook 2013Document1 pageMs Office Specialist Outlook 2013api-284614206No ratings yet

- Ms Office Specialist Powerpoint 2013Document1 pageMs Office Specialist Powerpoint 2013api-284614206No ratings yet

- Gpa 4Document1 pageGpa 4api-284614206No ratings yet

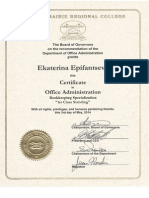

- Bookkeepign CertificateDocument1 pageBookkeepign Certificateapi-284614206No ratings yet

- Louise Mckinney ScholarshipDocument1 pageLouise Mckinney Scholarshipapi-284614206No ratings yet