Professional Documents

Culture Documents

Short-Term Solvency Ratios:: 27. The Dupont Identity Is

Short-Term Solvency Ratios:: 27. The Dupont Identity Is

Uploaded by

Jansen0 ratings0% found this document useful (0 votes)

4 views1 pageThis document contains calculations of various financial ratios for short-term solvency, asset utilization, long-term solvency, profitability, and shareholder value for the years 2010 and 2011. Key metrics include a current ratio of 1.44 in 2010 and 1.40 in 2011, total asset turnover of 0.95 times, profit margin of 11.93%, return on equity of 18.91%, earnings per share of $1.46, and price-to-earnings ratio of 29.47 times.

Original Description:

good

Original Title

Jawaban Asis 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains calculations of various financial ratios for short-term solvency, asset utilization, long-term solvency, profitability, and shareholder value for the years 2010 and 2011. Key metrics include a current ratio of 1.44 in 2010 and 1.40 in 2011, total asset turnover of 0.95 times, profit margin of 11.93%, return on equity of 18.91%, earnings per share of $1.46, and price-to-earnings ratio of 29.47 times.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageShort-Term Solvency Ratios:: 27. The Dupont Identity Is

Short-Term Solvency Ratios:: 27. The Dupont Identity Is

Uploaded by

JansenThis document contains calculations of various financial ratios for short-term solvency, asset utilization, long-term solvency, profitability, and shareholder value for the years 2010 and 2011. Key metrics include a current ratio of 1.44 in 2010 and 1.40 in 2011, total asset turnover of 0.95 times, profit margin of 11.93%, return on equity of 18.91%, earnings per share of $1.46, and price-to-earnings ratio of 29.47 times.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

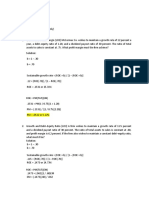

Short-term solvency ratios:

Current ratio = Current assets / Current liabilities

Current ratio 2010 = $56,260 / $38,963 = 1.44 times

Current ratio 2011 = $60,550 / $43,235 = 1.40 times

Quick ratio = (Current assets Inventory) / Current liabilities

Quick ratio 2010 = ($56,260 23,084) / $38,963 = 0.85 times

Quick ratio 2011 = ($60,550 24,650) / $43,235 = 0.83 times

Cash ratio = Cash / Current liabilities

Cash ratio 2010 = $21,860 / $38,963 = 0.56 times

Cash ratio 2011 = $22,050 / $43,235 = 0.51 times

Asset utilization ratios:

Total asset turnover = Sales / Total assets

Total asset turnover = $305,830 / $321,075 = 0.95 times

Inventory turnover = Cost of goods sold / Inventory

Inventory turnover = $210,935 / $24,650 = 8.56 times

Receivables turnover = Sales / Accounts receivable

Receivables turnover = $305,830 / $13,850 = 22.08 times

Long-term solvency ratios:

Total debt ratio = (Total assets Total equity) / Total assets

Total debt ratio 2010 = ($290,328 176,365) / $290,328 = 0.39

Total debt ratio 2011 = ($321,075 192,840) / $321,075 = 0.40

Debt-equity ratio = Total debt / Total equity

Debt-equity ratio 2010 = ($38,963 + 75,000) / $176,365 = 0.65

Debt-equity ratio 2011 = ($43,235 + 85,000) / $192,840 = 0.66

Equity multiplier = 1 + D/E

Equity multiplier 2010 = 1 + 0.65 = 1.65

Equity multiplier 2011 = 1 + 0.66 = 1.66

Times interest earned = EBIT / Interest

Times interest earned = $68,045 / $11,930 = 5.70 times

Cash coverage ratio = (EBIT + Depreciation) / Interest

Cash coverage ratio = ($68,045 + 26,850) / $11,930 = 7.95 times

Profitability ratios:

Profit margin = Net income / Sales

Profit margin = $36,475 / $305,830 = 0.1193 or 11.93%

Return on assets = Net income / Total assets

Return on assets = $36,475 / $321,075 = 0.1136 or 11.36%

Return on equity = Net income / Total equity

Return on equity = $36,475 / $192,840 = 0.1891 or 18.91%

27. The DuPont identity is:

ROE = (PM)(TAT)(EM)

ROE = (0.1193)(0.95)(1.66) = 0.1891 or 18.91%

Earnings per share = Net income / Shares

Earnings per share = $36,475 / 25,000 = $1.46 per share

P/E ratio = Shares price / Earnings per share

P/E ratio = $43 / $1.46 = 29.47 times

Dividends per share = Dividends / Shares

Dividends per share = $20,000 / 25,000 = $0.80 per share

Book value per share = Total equity / Shares

Book value per share = $192,840 / 25,000 shares = $7.71 per share

Market-to-book ratio = Share price / Book value per share

Market-to-book ratio = $43 / $7.71 = 5.57 times

PEG ratio = P/E ratio / Growth rate

PEG ratio = 29.47 / 9 = 3.27 times

You might also like

- Corporate Finance - Solution For Chapter 3Document11 pagesCorporate Finance - Solution For Chapter 3Vân Anh Đỗ LêNo ratings yet

- FIN Assignment 1Document8 pagesFIN Assignment 1Arpita Mouli MustafiNo ratings yet

- Financial Numericals RatiosDocument27 pagesFinancial Numericals Ratiosanks0909100% (2)

- FM AssignmentDocument4 pagesFM AssignmentDuren JayaNo ratings yet

- Case 1-5 - Campbell SoupDocument2 pagesCase 1-5 - Campbell SoupNazira OmarNo ratings yet

- Corporate Finance Chapter 4Document15 pagesCorporate Finance Chapter 4Razan EidNo ratings yet

- CH 3Document4 pagesCH 3mervin coquillaNo ratings yet

- Home Work 2Document5 pagesHome Work 2Shoaib MahmoodNo ratings yet

- Fin Stat MtsDocument26 pagesFin Stat MtsHazman MatNo ratings yet

- Navana CNG Ratio AnalysisDocument6 pagesNavana CNG Ratio AnalysisMohammad AnisNo ratings yet

- Chapter 3 Problems AnswersDocument11 pagesChapter 3 Problems AnswersOyunboldEnkhzayaNo ratings yet

- FM AssignmentDocument7 pagesFM Assignmentkartika tamara maharaniNo ratings yet

- To Compute the-WPS OfficeDocument7 pagesTo Compute the-WPS Officetirunehdefaru1No ratings yet

- PENGURUSAN KEWANgaDocument3 pagesPENGURUSAN KEWANgaMuhamad DaudNo ratings yet

- CH 04Document50 pagesCH 04Akbar LodhiNo ratings yet

- Math Solution Ratio AnalysisDocument4 pagesMath Solution Ratio Analysisraju710@gmail.comNo ratings yet

- CH03答案Document11 pagesCH03答案zmm45x7sjtNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- I. Ratio Analysis Calculations (2010-11) Liquidity Position: A) Current RatioDocument6 pagesI. Ratio Analysis Calculations (2010-11) Liquidity Position: A) Current RatioManuj KapoorNo ratings yet

- Ratios Analysis of Rafhan Maize PVTDocument6 pagesRatios Analysis of Rafhan Maize PVTImtiaz AhmadNo ratings yet

- Question 5 - Practice Test 2 - DaoDuyPhuocDocument1 pageQuestion 5 - Practice Test 2 - DaoDuyPhuocduyphuoc04No ratings yet

- Module 5 Homework Answer KeyDocument7 pagesModule 5 Homework Answer KeyMrinmay kunduNo ratings yet

- 19286711Document8 pages19286711suruth242100% (1)

- Ratio Analysis and Example PDFDocument9 pagesRatio Analysis and Example PDFthexplorer008No ratings yet

- 08 10 2021 - Nguyen Thanh NhiDocument3 pages08 10 2021 - Nguyen Thanh NhiNhi NguyenNo ratings yet

- CA/CL 1,361,646/1,140,285 1.19 Times: Current RatioDocument3 pagesCA/CL 1,361,646/1,140,285 1.19 Times: Current RatioNhi NguyenNo ratings yet

- Managerial Finance For Ratio AnalysisDocument7 pagesManagerial Finance For Ratio AnalysisShahzadraeesNo ratings yet

- Fin Stat MtsDocument27 pagesFin Stat MtsJurcelinho Axel IwangouNo ratings yet

- Chapter 10Document5 pagesChapter 10Usman KhalidNo ratings yet

- Chap4 (1-15)Document8 pagesChap4 (1-15)Jahanzaib JavaidNo ratings yet

- Profitibilty RatioDocument50 pagesProfitibilty RatioAshish NayanNo ratings yet

- FM Assignmen HamzeDocument41 pagesFM Assignmen HamzeKhadar MaxamedNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- CFIN 3rd Edition by Besley Brigham ISBN Solution ManualDocument6 pagesCFIN 3rd Edition by Besley Brigham ISBN Solution Manualrussell100% (30)

- CH 05Document50 pagesCH 05Gaurav KarkiNo ratings yet

- Financial Statements and RatiosDocument27 pagesFinancial Statements and RatiosIoana MariucaNo ratings yet

- Finman - Fs AnalysisDocument5 pagesFinman - Fs AnalysisnettenolascoNo ratings yet

- FM Activity PoDocument11 pagesFM Activity Pojeraldtomas12No ratings yet

- 04 Evaluating Operating and Financial Performance PDFDocument31 pages04 Evaluating Operating and Financial Performance PDFMiguel Gonzalez LondoñoNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-6Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-6Pramod VasudevNo ratings yet

- Sheet1: Workings 2013 2012 Liquidity RatiosDocument1 pageSheet1: Workings 2013 2012 Liquidity RatiosAbhishek SuranaNo ratings yet

- Assignment 44Document14 pagesAssignment 44Khadar MaxamedNo ratings yet

- Chapter 2Document3 pagesChapter 2Ikramul HaqueNo ratings yet

- CH03Document4 pagesCH03wahib aumioNo ratings yet

- CF MathDocument5 pagesCF MathArafat HossainNo ratings yet

- Financial Management Chapter 5Document4 pagesFinancial Management Chapter 5Rida AbbasNo ratings yet

- 05fin221 spr08 Feb14Document11 pages05fin221 spr08 Feb14Sharath KumarNo ratings yet

- 0976 Module 10 RossFCF9ce SM Ch10 FINALDocument21 pages0976 Module 10 RossFCF9ce SM Ch10 FINALYuk SimNo ratings yet

- Class+8+ Chapter+8 +Practice+Questions+ ANSWERSDocument4 pagesClass+8+ Chapter+8 +Practice+Questions+ ANSWERSMar JoNo ratings yet

- Ventura, Mary Mickaella R Chapter4 - p.112-118Document8 pagesVentura, Mary Mickaella R Chapter4 - p.112-118Mary VenturaNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosAlexa Isobel TicarNo ratings yet

- Financial Ratios ListDocument1 pageFinancial Ratios Listbibekmishra8107No ratings yet

- Practice Numericals Solutions-1Document7 pagesPractice Numericals Solutions-1Daniyal ZafarNo ratings yet

- Assignment 3 SolutionDocument7 pagesAssignment 3 SolutionAaryaAustNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Total Assets Turnover Ratio Sales Total Assets 1.5 Sales $400,000 Sales 1.5 × $400,000 $600,000Document2 pagesTotal Assets Turnover Ratio Sales Total Assets 1.5 Sales $400,000 Sales 1.5 × $400,000 $600,000nomunomu96No ratings yet

- Chapter 11 Short Exercise SolutionsDocument14 pagesChapter 11 Short Exercise Solutionsbaseballjunker4No ratings yet

- Financial LeverageDocument14 pagesFinancial Leverages_marnhyNo ratings yet

- Fsa Solved ProblemsDocument27 pagesFsa Solved ProblemsKumarVelivela100% (1)