Professional Documents

Culture Documents

Stock Valuation Report Satyaprakashji and Value Picks

Stock Valuation Report Satyaprakashji and Value Picks

Uploaded by

stalloycorpOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Valuation Report Satyaprakashji and Value Picks

Stock Valuation Report Satyaprakashji and Value Picks

Uploaded by

stalloycorpCopyright:

Available Formats

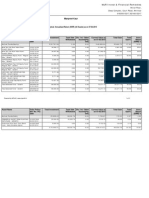

Valuation Report

Page 1 of 2

Your company name

Satya Prakash-60196

Thu 22, Jan 2015

Scheme Wise - Valuation Report As on Date : 22-01-2015

Satya Prakash-60196

Your Relationship Handler

Address

Badhwar Park

Name

Your company name

City

Mumbai

Off-Address

12, Mahavir, 37-A, B.G Kher Marg, Near Jain Temple, Malbar Hill

Phone

91-22022914951

City

MUMBAI

Mobile

9820329605

Pincode

400006

Phone

02223697020

Mobile

9819053112

pkhandwala@rediffmail.com

Sr

No

Investor

Folio No

Date

Sub Type

Amount

(Rs.)

Div.

Reinv.

(Rs.)

NAV

(Rs.)

No Of

Unit

NAV

Date

Trn

Days

Current

NAV

(Rs.)

Current

Value

(Rs.)

Div R Div P

(Rs.) (Rs.)

Total

(Rs.)

Annualized

Return

(%)

Abs.

Return

(%)

Birla Sun Life Frontline Equity Fund - Gr

1 Satya Prakash

2 Satya Prakash

*1016650430

*1016650430

29-09-14

03-11-14

Gen. Purpose

Gen. Purpose

25,000

5,000

145.3000

152.4700

172.058 21-01

32.793 21-01

114

79

165.1800

165.1800

28,421

5,417

28,421

5,417

43.81

38.51

13.68

8.34

3 Satya Prakash

4 Satya Prakash

*1016650430

*1016650430

21-11-14

01-12-14

Gen. Purpose

Gen. Purpose

25,000

5,000

158.3900

159.1500

157.838 21-01

31.417 21-01

61

51

165.1800

165.1800

26,072

5,189

26,072

5,189

25.65

27.12

4.29

3.79

5 Satya Prakash

*1016650430

01-01-15

Gen. Purpose

5,000

157.3300

31.780 21-01

20

165.1800

65,000

152.6228

Sub Total

425.886

5,249

5,249

91.06

4.99

70,348

70,348

38.09

8.23

Overall Return : 38.09% | Weighted Avg. Abs. Return : 8.23% | Gain / (Loss) : Rs. 5,347.95

BNP Paribas Midcap Fund - Gr

6 Satya Prakash

7 Satya Prakash

*900000429727

*900000429727

29-09-14

28-10-14

Gen. Purpose

Gen. Purpose

25,000

5,000

20.4080

20.6010

1,225.010 21-01

242.707 21-01

114

85

23.5710

23.5710

28,875

5,721

28,875

5,721

49.62

61.91

15.50

14.42

8 Satya Prakash

9 Satya Prakash

*900000429727

*900000429727

28-11-14

29-12-14

Gen. Purpose

Gen. Purpose

5,000

5,000

21.8700

21.9450

228.624 21-01

227.842 21-01

54

23

23.5710

23.5710

5,389

5,370

5,389

5,370

52.57

117.58

7.78

7.41

40,000

20.7880

45,355

45,355

53.40

13.39

Sub Total

1,924.183

Overall Return : 53.40% | Weighted Avg. Abs. Return : 13.39% | Gain / (Loss) : Rs. 5,354.91

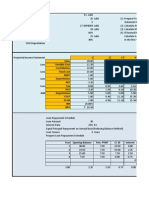

DSP BlackRock Micro Cap Fund - Gr

10 Satya Prakash

*3066750/06

15-01-15

Gen. Purpose

Sub Total

25,000

37.5980

664.929 21-01

25,000

37.5980

664.929

38.0400

25,294

25,294

71.52

1.18

25,294

25,294

71.52

1.18

Overall Return : 71.52% | Weighted Avg. Abs. Return : 1.18% | Gain / (Loss) : Rs. 293.90

Franklin India High Growth Companies Fund - Gr

11 Satya Prakash

*1206420000571838

15-01-15

Gen. Purpose

Sub Total

25,000

29.2429

854.908 21-01

25,000

29.2429

854.908

29.8624

25,530

25,530

128.87

2.12

25,530

25,530

128.87

2.12

27,698

5,217

5,190

27,698

5,217

5,190

34.56

21.98

32.95

10.79

4.34

3.79

Overall Return : 128.87% | Weighted Avg. Abs. Return : 2.12% | Gain / (Loss) : Rs. 529.62

HDFC Equity Fund - Gr.

12 Satya Prakash

13 Satya Prakash

14 Satya Prakash

*9503582/76

*9503582/76

*9503582/76

29-09-14

10-11-14

10-12-14

Gen. Purpose

Gen. Purpose

Gen. Purpose

15 Satya Prakash

*9503582/76

12-01-15

Gen. Purpose

Sub Total

25,000

5,000

5,000

441.4900

468.8110

471.2710

56.626 21-01

10.665 21-01

10.610 21-01

114

72

42

489.1410

489.1410

489.1410

5,000

472.3230

10.586 21-01

489.1410

40,000

452.0424

88.487

5,178

5,178

144.41

3.56

43,283

43,283

34.58

8.21

Overall Return : 34.58% | Weighted Avg. Abs. Return : 8.21% | Gain / (Loss) : Rs. 3,282.74

HDFC Mid Cap Opportunities Fund - Gr

16 Satya Prakash

*9503582/76

29-09-14

Gen. Purpose

25,000

31.7160

788.246 21-01

114

37.1980

29,321

29,321

55.34

17.28

17 Satya Prakash

18 Satya Prakash

19 Satya Prakash

*9503582/76

*9503582/76

*9503582/76

27-10-14

21-11-14

25-11-14

Gen. Purpose

Gen. Purpose

Gen. Purpose

5,000

25,000

5,000

32.1340

34.7640

34.5240

155.598 21-01

719.135 21-01

144.827 21-01

86

61

57

37.1980

37.1980

37.1980

5,788

26,750

5,387

5,788

26,750

5,387

66.88

41.89

49.60

15.76

7.00

7.75

20 Satya Prakash

21 Satya Prakash

*9503582/76

*9503582/76

26-12-14

15-01-15

Gen. Purpose

Gen. Purpose

5,000

25,000

35.2200

36.8710

141.965 21-01

678.040 21-01

26

6

37.1980

37.1980

5,281

25,222

5,281

25,222

78.84

53.95

5.62

0.89

90,000

34.2491

97,749

97,749

52.67

8.61

Sub Total

2,627.811

Overall Return : 52.67% | Weighted Avg. Abs. Return : 8.61% | Gain / (Loss) : Rs. 7,749.28

ICICI Prudential Tax Plan - Regular Div

22 Satya Prakash

23 Satya Prakash

24 Satya Prakash

*6911581/74

*6911581/74

*6911581/74

25-08-14

25-09-14

27-10-14

Tax Plan

Tax Plan

Tax Plan

5,000

5,000

5,000

24.8700

25.1800

25.6500

201.045 21-01

198.570 21-01

194.932 21-01

149

118

86

25.8700

25.8700

25.8700

5,201

5,137

5,043

402

397

390

5,603

5,534

5,433

29.55

33.05

36.73

12.06

10.68

8.65

25 Satya Prakash

26 Satya Prakash

*6911581/74

*6911581/74

25-11-14

26-12-14

Tax Plan

Tax Plan

5,000

5,000

25.0300

24.4500

199.760 21-01

204.499 21-01

57

26

25.8700

25.8700

5,168

5,290

5,168

5,290

21.49

81.53

3.36

5.81

25,000

25.0299

998.806

25,839

1,189

27,028

33.96

8.11

Sub Total

Overall Return : 33.96% | Weighted Avg. Abs. Return : 8.11% | Gain / (Loss) : Rs. 2,028.22

Reliance Small Cap Fund - Div

27 Satya Prakash

28 Satya Prakash

29 Satya Prakash

*488143227427

*488143227427

*488143227427

18-08-14

15-09-14

16-10-14

Gen. Purpose

Gen. Purpose

Gen. Purpose

5,000

5,000

5,000

17.7652

20.5886

19.8189

281.449 21-01

242.853 21-01

252.284 21-01

156

128

97

23.2682

23.2682

23.2682

6,549

5,651

5,870

6,549

5,651

5,870

72.48

37.11

65.49

30.98

13.01

17.40

30 Satya Prakash

*488143227427

17-11-14

Gen. Purpose

5,000

21.2275

235.544 21-01

65

23.2682

5,481

5,481

53.98

9.61

https://www.njindiaonline.in/njcdesk/valuation_report_1.php?vari=0000000000000000000... 1/22/2015

Valuation Report

Sr

No

Investor

Page 2 of 2

Gen. Purpose

Div.

Reinv.

(Rs.)

5,000

-

Gen. Purpose

5,000

30,000

20.5231

Folio No

Date

Sub Type

31 Satya Prakash

*488143227427

15-12-14

32 Satya Prakash

*488143227427

15-01-15

Sub Total

Amount

(Rs.)

NAV

Date

Trn

Days

21.4035

233.607 21-01

37

Current

NAV

(Rs.)

23.2682

23.1449

216.030 21-01

23.2682

NAV

(Rs.)

No Of

Unit

1,461.767

Current

Div R Div P

Value

(Rs.) (Rs.)

(Rs.)

5,436

-

Annualized

Abs.

Return

Return

(%)

(%)

5,436

85.94

8.71

Total

(Rs.)

5,027

5,027

32.41

0.53

34,013

34,013

59.90

13.38

Overall Return : 59.90% | Weighted Avg. Abs. Return : 13.38% | Gain / (Loss) : Rs. 4,012.68

Reliance Small Cap Fund - Gr

33 Satya Prakash

*488145149791

21-11-14

Gen. Purpose

Sub Total

25,000

23.1957

1,077.786 21-01

25,000

23.1957

1,077.786

61

25.4423

27,421

27,421

57.95

9.69

27,421

27,421

57.95

9.69

Overall Return : 57.95% | Weighted Avg. Abs. Return : 9.69% | Gain / (Loss) : Rs. 2,421.35

SBI Pharma Fund - Rgular Plan - Gr

34 Satya Prakash

*14138940

21-11-14

SECTOR

25,000

117.1814

213.344 21-01

61

122.0278

26,034

26,034

24.75

4.14

35 Satya Prakash

*14138940

15-01-15

SECTOR

25,000

118.4572

211.047 21-01

122.0278

25,754

25,754

183.37

3.01

50,000

117.8158

424.391

51,788

51,788

38.95

3.58

0 1,189

4,47,808

46.51

7.91

Sub Total

Overall Return : 38.95% | Weighted Avg. Abs. Return : 3.58% | Gain / (Loss) : Rs. 1,787.51

Grand Total

4,15,000

10,548.954

4,46,619

Overall Portfolio's Return : 46.51% | Overall Portfolio's Weighted Avg.Abs. Return : 7.91% | Overall Portfolio's Gain / (Loss) : Rs. 32,808.17

Current Value of your Total Investment is Rs. 4,46,619/-

INVESTMENT

VALUATION

Note:

1) Folio No. with * symbol indicate Destatementised Folios.

2) Highlighted with

are NJ Trading Account Transactions.

3) Annualized Return is calculated on an Absolute basis for < 1 Year And on XIRR basis for >= 1 Year.

4) While calculating TENURE for investment, Amendment made in Union Budget 2014-15 to classify Long Term/Short Term for debt fund is not taken in above report. It is under processing and required changes will be

incorporated soon.

5) This Report is Strictly Private and confidential only for clients of NJ India Invest .The Information given above is correct and to the best of our knowledge. For any discrepancy on the same contact the nearest Office of NJ

India Invest.

| Anti Money Laundering | Terms of use | Disclaimer | Privacy Policy |

https://www.njindiaonline.in/njcdesk/valuation_report_1.php?vari=0000000000000000000... 1/22/2015

You might also like

- Financial Analysis ToolDocument50 pagesFinancial Analysis ToolContessa PetriniNo ratings yet

- Cpi Sells Computer Peripherals at December 31 2011 Cpi S InventoryDocument1 pageCpi Sells Computer Peripherals at December 31 2011 Cpi S Inventorytrilocksp SinghNo ratings yet

- Delaware Corporation Manual 2004Document49 pagesDelaware Corporation Manual 2004documentseeker100% (1)

- Raji BF Statement of HoldingDocument23 pagesRaji BF Statement of HoldingBild Andhra PradeshNo ratings yet

- Manpreet Kaur: MJR Invest & Financial RemediesDocument2 pagesManpreet Kaur: MJR Invest & Financial Remediesmaakabhawan26No ratings yet

- P ('t':'3', 'I':'1920491675') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Document1 pageP ('t':'3', 'I':'1920491675') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Zulham MurtadhaNo ratings yet

- Reliance Equity Opportunities FundDocument1 pageReliance Equity Opportunities FundSandeep BorseNo ratings yet

- Wyeth - Q4FY12 Result Update - Centrum 22052012Document4 pagesWyeth - Q4FY12 Result Update - Centrum 22052012SwamiNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- HUL Stand Alone StatementsDocument50 pagesHUL Stand Alone StatementsdilipthosarNo ratings yet

- Fund Sbi Mutual Fund Scheme Sbi Pharma Fund (G)Document31 pagesFund Sbi Mutual Fund Scheme Sbi Pharma Fund (G)Zahid HassanNo ratings yet

- Data Analysis and InterpretationDocument50 pagesData Analysis and InterpretationAnonymous MhCdtwxQINo ratings yet

- Balwinder Kaur: MJR Invest & Financial RemediesDocument2 pagesBalwinder Kaur: MJR Invest & Financial Remediesmaakabhawan26No ratings yet

- ValueResearchFundcard HDFCTaxsaverFund 2014jul23Document4 pagesValueResearchFundcard HDFCTaxsaverFund 2014jul23thakkarpsNo ratings yet

- QUA07401 SalarySlipwithTaxDetailsDocument1 pageQUA07401 SalarySlipwithTaxDetailssumitNo ratings yet

- Asset Management 2011-12Document25 pagesAsset Management 2011-12RabekanadarNo ratings yet

- ICICI ReportDocument10 pagesICICI ReportCoding playgroundNo ratings yet

- Daily Equity Report 6 February 2015Document4 pagesDaily Equity Report 6 February 2015NehaSharmaNo ratings yet

- QUA04354 SalarySlipwithTaxDetailsmarchDocument1 pageQUA04354 SalarySlipwithTaxDetailsmarchrajanNo ratings yet

- SIP Returns All Equity Funds of HDFCDocument1 pageSIP Returns All Equity Funds of HDFCNirav PatelNo ratings yet

- DWSAlphaEquityFund 2014jul07Document4 pagesDWSAlphaEquityFund 2014jul07Yogi173No ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Session 16 - FA&ADocument21 pagesSession 16 - FA&AYASH BATRANo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Fundamental Analysis of Sun PharmaDocument13 pagesFundamental Analysis of Sun PharmaManvi JainNo ratings yet

- Bajaj Auto Apr 2023Document10 pagesBajaj Auto Apr 2023dhruv.bhandari.0301No ratings yet

- CSDCVDVDVDFVDocument12 pagesCSDCVDVDVDFVlakshita1234No ratings yet

- Sbi Analyst PPT Fy16Document49 pagesSbi Analyst PPT Fy16tamirisaarNo ratings yet

- SSS Income StatementDocument16 pagesSSS Income StatementAriel DimalantaNo ratings yet

- QUA06706 - SalarySlipwithTaxDetails March PDFDocument1 pageQUA06706 - SalarySlipwithTaxDetails March PDFmrugeshkateNo ratings yet

- Amapr 2011 RepoDocument3 pagesAmapr 2011 RepoSubhamoy007No ratings yet

- QUA04047 Mar15Document1 pageQUA04047 Mar15Mehtab saifiNo ratings yet

- EMSCFIN-FARDocument37 pagesEMSCFIN-FARPuwanachandran KaniegahNo ratings yet

- One From Everyone NEWDocument14 pagesOne From Everyone NEWPratik KathuriaNo ratings yet

- Quarterly Acc 3rd 2011 12Document10 pagesQuarterly Acc 3rd 2011 12Asif Al AminNo ratings yet

- Suggested Solution FAR450 - JUNE 2012 Solution 1ADocument8 pagesSuggested Solution FAR450 - JUNE 2012 Solution 1APablo EkskobaNo ratings yet

- QUA06706 SalarySlipwithTax MaiDocument1 pageQUA06706 SalarySlipwithTax MaimrugeshkateNo ratings yet

- Quarter Financial Year Ended 31st March 2014Document31 pagesQuarter Financial Year Ended 31st March 2014Rahul PatelNo ratings yet

- Aali - Icmd 2010 (A01) PDFDocument2 pagesAali - Icmd 2010 (A01) PDFArdheson Aviv AryaNo ratings yet

- Value Research: FundcardDocument4 pagesValue Research: FundcardYogi173No ratings yet

- QUA06194 SalarySlipwithTaxDetails21 PDFDocument1 pageQUA06194 SalarySlipwithTaxDetails21 PDFUtsabNo ratings yet

- Third Quarter March 31 2014Document18 pagesThird Quarter March 31 2014major144No ratings yet

- Axis Factsheet February 2015Document20 pagesAxis Factsheet February 2015Sumit GuptaNo ratings yet

- ANNEXURESDocument6 pagesANNEXURESneymarjr.facebooklockedNo ratings yet

- Financial Analysis of Perpetual Help Community Cooperative (PHCCI)Document17 pagesFinancial Analysis of Perpetual Help Community Cooperative (PHCCI)Jasmine Lilang ColladoNo ratings yet

- Factsheet: Har Zimmedari Ke Peechhe Planning Hoti HaiDocument16 pagesFactsheet: Har Zimmedari Ke Peechhe Planning Hoti Haisrgupta99No ratings yet

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNo ratings yet

- Square Textiles Limited: Balance Sheet As of 31st March, 2010Document4 pagesSquare Textiles Limited: Balance Sheet As of 31st March, 2010SUBMERINNo ratings yet

- Financial ModellingDocument13 pagesFinancial ModellingPrashant Dhage100% (2)

- RL Reco Fund Tracker 181214Document5 pagesRL Reco Fund Tracker 181214techkasambaNo ratings yet

- Comprehensive ReportDocument1 pageComprehensive ReportAnkit SharmaNo ratings yet

- Finman Chapter 5 EditedDocument4 pagesFinman Chapter 5 EditedCarlo BalinoNo ratings yet

- HDFC Bank AnnualReport 2012 13Document180 pagesHDFC Bank AnnualReport 2012 13Rohan BahriNo ratings yet

- Progress at A Glance Table 2007-08Document1 pageProgress at A Glance Table 2007-08Sunil ShawNo ratings yet

- CompanyDocument19 pagesCompanyMark GrayNo ratings yet

- Systematic Investment PlanDocument23 pagesSystematic Investment PlanHarsha PursnaniNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- SPL - 3rd QTR BL-PNL-DEC 2018-2019 (Full)Document17 pagesSPL - 3rd QTR BL-PNL-DEC 2018-2019 (Full)MedulNo ratings yet

- Balance SheetDocument6 pagesBalance SheetMohammad Abid MiahNo ratings yet

- 3075Final File For UploadDocument5 pages3075Final File For UploadKalyani PranjalNo ratings yet

- Blue Dart Express LTD.: CompanyDocument5 pagesBlue Dart Express LTD.: CompanygirishrajsNo ratings yet

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014From EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014No ratings yet

- AssignmentDocument3 pagesAssignmentHaziel LadananNo ratings yet

- FINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsDocument11 pagesFINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsAmie Jane Miranda100% (1)

- 3 Corporate Finance PRACTICE PROBLEMS AND SOLUTIONS 2021Document10 pages3 Corporate Finance PRACTICE PROBLEMS AND SOLUTIONS 2021Mbongeni ShongweNo ratings yet

- Summary, K EUR: Variable Production Cost Per Unit, EURDocument130 pagesSummary, K EUR: Variable Production Cost Per Unit, EURPhan Thanh TùngNo ratings yet

- Reva - PresentationDocument18 pagesReva - PresentationMuhammadSaadKhanNo ratings yet

- Answers Unit 1Document6 pagesAnswers Unit 1perseverancesdaNo ratings yet

- CML 102 Foundations of Accounting (Notes)Document170 pagesCML 102 Foundations of Accounting (Notes)Wesley100% (2)

- Financial Accounting IvDocument10 pagesFinancial Accounting Ivprajaktashete372No ratings yet

- Chapter 7 Handout Solution - Accounting 405-1Document5 pagesChapter 7 Handout Solution - Accounting 405-1Bridget ElizabethNo ratings yet

- GFRS IndexDocument26 pagesGFRS Indexayush jainNo ratings yet

- Mutual FundsDocument4 pagesMutual FundsAlpa JoshiNo ratings yet

- متطلبات القياس و الافصاح المحاسبي عن رأس المال الفكري و أثره على القوائم المالية لمنظمات الأعمالDocument24 pagesمتطلبات القياس و الافصاح المحاسبي عن رأس المال الفكري و أثره على القوائم المالية لمنظمات الأعمالNour MezianeNo ratings yet

- Understanding Deposit InsuranceDocument2 pagesUnderstanding Deposit InsuranceDesiree MarianoNo ratings yet

- 6c969acbc8 3d1699e994 PDFDocument503 pages6c969acbc8 3d1699e994 PDFHp BarulagiNo ratings yet

- Carpentier Charlotte Master Thesis How To Value Brands CorrectlyDocument88 pagesCarpentier Charlotte Master Thesis How To Value Brands CorrectlyAnish ShahNo ratings yet

- Mutual Funds: Learning OutcomesDocument47 pagesMutual Funds: Learning OutcomesPravesh PangeniNo ratings yet

- 4100.05.A. Overview of Partnership RulesDocument11 pages4100.05.A. Overview of Partnership Rulesgerarde moretNo ratings yet

- Dino Miranda 2022Document7 pagesDino Miranda 2022Sander D. PeraNo ratings yet

- Accounting GovernmentDocument21 pagesAccounting GovernmentJolianne SalvadoOfcNo ratings yet

- Chapter 15 PDFDocument29 pagesChapter 15 PDFKimNo ratings yet

- Teaching Tool 17 - Portfolio Attribution Example 6-Nov-07 Personal Finance: Another Perspective PurposeDocument2 pagesTeaching Tool 17 - Portfolio Attribution Example 6-Nov-07 Personal Finance: Another Perspective PurposeShobhit GoyalNo ratings yet

- v1nChuHABHUWjH4tt5dcaP PDFDocument416 pagesv1nChuHABHUWjH4tt5dcaP PDFashaduzzamanNo ratings yet

- IM ACCO 20033 Financial Accounting and Reporting Part 1Document95 pagesIM ACCO 20033 Financial Accounting and Reporting Part 1Montales, Julius Cesar D.No ratings yet

- Corporate Finance IndividualDocument3 pagesCorporate Finance Individualarry widodoNo ratings yet

- GE Hca15 PPT ch01Document205 pagesGE Hca15 PPT ch01jeanneta oliviaNo ratings yet

- Ref No: APSEZL/SECT/2022-23/82 December 23, 2022: BSE Limited National Stock Exchange of India LimitedDocument2 pagesRef No: APSEZL/SECT/2022-23/82 December 23, 2022: BSE Limited National Stock Exchange of India Limitedvirupakshudu kodiyalaNo ratings yet

- Tata Technologies Limited: Corporate Identity Number: U72200PN1994PLC013313Document436 pagesTata Technologies Limited: Corporate Identity Number: U72200PN1994PLC013313RoshanNo ratings yet

- Case CASE 4-1 4-1 PC PC Depot DepotDocument7 pagesCase CASE 4-1 4-1 PC PC Depot DepotJourast LadzuardyNo ratings yet