Professional Documents

Culture Documents

Blue Cross Select Bronze

Blue Cross Select Bronze

Uploaded by

api-285960909Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blue Cross Select Bronze

Blue Cross Select Bronze

Uploaded by

api-285960909Copyright:

Available Formats

Blue Cross Select Bronze

An individual HMO health plan from Blue Care Network of Michigan.

You may choose from a select network of quality primary care doctors with complete access to specialists and hospitals within

BCNs entire HMO network. Your primary care doctor will coordinate your care and refer you to specialists when necessary.

Other than eligible emergency services and accidental injuries, care outside the network is not covered. Use our Find a Doctor

tool at bcbsm.com/find-a-doctor to see if your doctor is in the Select HMO network.

Benefits

In-network

Annual deductible

Individual plan (one member)

$5,950 per individual plan per calendar year.

Medical and drug expenses are combined to meet the integrated deductible.

Family plan (two or more members)

$11,900 per family plan per calendar year.

Medical and drug expenses are combined to meet the integrated deductible.

Note: If your plan is a family plan, the entire family deductible must be met before BCN pays for

covered services. The family deductible may be met by one or more family members.

Coinsurance

40% after deductible for most services

50% after deductible for bariatric, temporomandibular joint, infertility,

prosthetics and orthotics and durable medical equipment services

Annual coinsurance maximum

Individual plan (one member)

$400 per individual plan per calendar year

Family plan (two or more members)

$800 per family plan per calendar year

Note: If your plan is a family plan, all copays and coinsurance paid by the members on your family

plan will apply to the family coinsurance and copay maximum. The entire family coinsurance and

copay maximum must be met before BCN pays for covered services at 100% of the approved

amount. The family coinsurance and copay maximum may be met by one or more family members.

Out-of-pocket maximum

Individual plan (one member)

The integrated deductible, coinsurance and copays $6,350 per member

for all medical and drug expenses accumulate to

Family plan (two or more members)

the out-of-pocket maximum.

$12,700 per family

Note: If your plan is a family plan, the entire family out-of-pocket maximum must be met before

BCN pays for covered services at 100% of the approved amount. The family out-of-pocket

maximum may be met by one or more family members.

Find other important information about Blues benefits and membership

at bcbsm.com/importantinfo.

Call a health plan advisor at 1-877-469-2583 if you have any questions.

Blue Cross Select Bronze

Benefits

In-network

Preventive care

Preventive medical, prescription drugs and

immunizations include: health maintenance

exam, select laboratory services, gynecologic

exam, pap smear screening, mammogram

screening, select female contraceptives, female

voluntary sterilization and other adult and

childhood preventive services and immunizations

as recommended by the U.S. Preventive Services

Task Force, Advisory Committee on Immunization

Practices, Health Resources and Services

Administration or other sources as recognized by

BCN that are in compliance with the provisions of

the Patient Protection and Affordable Care Act.

Covered 100% with no deductible, copay or coinsurance

Screening colonoscopy

Covered 100% with no deductible, copay or coinsurance.

Routine colonoscopy must be billed as preventive to be covered at 100%.

Pediatric services

Well baby and child

Covered 100% with no deductible, copay or coinsurance

Pediatric dental

Stand alone plan available for purchase

Pediatric vision

Covered 100%, one vision exam per pediatric member per calendar year

Covered 100%, standard lenses and frames or contact lenses

Frequency limits apply

Ambulatory services

Physician office visits, presurgical consultations $30 copay per primary care visit and $50 copay per specialist office visit after

and office consultations

deductible. Diagnostic and laboratory services are subject to plans deductible

and coinsurance.

Urgent care physicians office

$30 copay per primary care visit and $50 copay per specialist office visit after

deductible. Diagnostic and laboratory services are subject to plans deductible

and coinsurance.

Laboratory and diagnostic services

Laboratory tests and pathology

Covered 60% after deductible

Diagnostic tests and X-rays (including

electrocardiogram, chest X-ray)

Covered 60% after deductible

Imaging services: CT scans, MRIs, PET, etc.

$200 copay after deductible, then covered 60%

Prior authorization required

Allergy testing and therapy in a physicians office Covered 60% after deductible

Maternity and newborn care

Maternity benefit

$500 copay after deductible, then covered 60%

Prenatal visits

Covered 100% with no deductible, copay or coinsurance.

Diagnostic and laboratory services are subject to plans deductible and

coinsurance.

Postnatal visits

$30 copay per visit after deductible. Diagnostic and laboratory services are

subject to plans deductible and coinsurance.

Blue Cross Select Bronze

Benefits

In-network

Emergency services

Emergency room

$250 copay after deductible, then covered 60%. Copay waived if admitted.

Ambulance services

Covered 60% after deductible

Urgent care visits

$40 copay after deductible. Diagnostic and laboratory services are subject to

plans deductible and coinsurance.

Urgent care center or outpatient location

Hospitalization and other services

Inpatient hospital care, long-term acute care

hospital (semiprivate room)

$500 copay after deductible, then covered 60%

Physician surgical services

Covered 60% after deductible

Home health care

Covered 60% after deductible

Hospice care

Covered 100% after deductible

Skilled nursing facility

$500 copay after deductible, then covered 60%

Limited to a maximum of 45 days per member

per calendar year

Chemotherapy

Covered 60% after deductible

Organ transplant Bone marrow, kidney,

cornea and skin

Covered 60% after deductible

BCN-designated facilities only

Specified organ transplant

Covered 60% after deductible

BCN-designated facilities only

Sleep studies including testing and surgeries

Covered 60% after deductible

Bariatric surgery once per lifetime

Covered 50% after deductible

Male voluntary sterilization

Covered 60% after deductible

Artificial insemination

Not covered

Rehabilitative and habilitative services and devices

Outpatient physical and occupational therapy

Covered 60% after deductible

Limited to a combined maximum of 30 visits per member per calendar year

Chiropractic spinal manipulation and

osteopathic manipulative therapy

Covered 60% after deductible

Speech therapy

Covered 60% after deductible

Limited to a combined maximum of 30 visits per member per calendar year

Limited to a maximum of 30 visits per member per calendar year

Cardiac and pulmonary rehabilitation

Covered 60% after deductible

Limited to a combined maximum of 30 visits per member per calendar year

Specified autism spectrum disorder

applied behavioral analysis

Covered 60% after deductible. Services must be preauthorized by BCN.

Prosthetic and orthotic appliances

Covered 50% after deductible

BCN-approved suppliers only

Durable medical equipment

Covered 50% after deductible

BCN-approved suppliers only

Diabetes supplies and outpatient diabetes

self-management training

Covered 60% after deductible

Blue Cross Select Bronze

Benefits

In-network

Mental health and substance abuse

Inpatient and residential mental health

$500 copay after deductible, then covered 60%

Outpatient mental health

Covered 60% after deductible

Inpatient and residential substance abuse

$500 copay after deductible, then covered 60%

Outpatient substance abuse

Covered 60% after deductible

Prescription drugs

Prescription drugs 1 to 30 days

Tier 1a Preferred generic: $4 copay after integrated deductible

(retail network pharmacy

and mail-order provider)

Tier 1b Nonpreferred generic: $20 copay after integrated deductible

Tier 2 Preferred brand: 25% coinsurance after integrated deductible,

$40 minimum and $100 maximum copay

Tier 3 Nonpreferred brand: 50% coinsurance after integrated deductible,

$80 minimum and $100 maximum copay

Tier 4 Preferred specialty: 20% coinsurance after integrated deductible,

no minimum and $200 maximum copay

Tier 5 Nonpreferred specialty: 25% coinsurance after integrated

deductible, no minimum and $300 maximum copay

Prescription drugs 31 to 60 days

Tier 1a Preferred generic: $12 copay after integrated deductible

Note: Specialty drugs (Tier 4 and 5) are limited

to a 30-day supply.

Tier 1b Nonpreferred generic: $60 copay after integrated deductible

(mail order only)

Tier 2 Preferred brand: 25% coinsurance after integrated deductible,

$120 minimum and $300 maximum copay

Tier 3 Nonpreferred brand: 50% coinsurance after integrated deductible,

$240 minimum and $300 maximum copay

Tier 4 Preferred specialty: Not covered

Tier 5 Nonpreferred specialty: Not covered

Prescription drugs 61 to 83 days

Tier 1a Preferred generic: $12 copay after integrated deductible

Note: Specialty drugs (Tier 4 and 5) are limited

to a 30-day supply.

Tier 1b Nonpreferred generic: $60 copay after integrated deductible

(mail order only)

Tier 2 Preferred brand: 25% coinsurance after integrated deductible, $120

minimum and $300 maximum copay

Tier 3 Nonpreferred brand: 50% coinsurance after integrated deductible,

$240 minimum and $300 maximum copay

Tier 4 Preferred specialty: Not covered

Tier 5 Nonpreferred specialty: Not covered

Blue Cross Select Bronze

Benefits

In-network

Prescription drugs continued

Prescription drugs 84 to 90 days

Tier 1a Preferred generic: $12 copay after integrated deductible

Note: Specialty drugs (Tier 4 and 5) are limited

to a 30-day supply.

Tier 1b Nonpreferred generic: $60 copay after integrated deductible

(90-day retail network pharmacy

or mail-order provider)

Tier 2 Preferred brand: 25% coinsurance after integrated deductible,

$120 minimum and $300 maximum copay

Tier 3 Nonpreferred brand: 50% coinsurance after integrated deductible,

$240 minimum and $300 maximum copay

Tier 4 Preferred specialty: Not covered

Tier 5 Nonpreferred specialty: Not covered

Note

To be eligible for coverage, the following services require approval before they are provided: inpatient acute care, rehabilitation services, some

radiology services (CT, CTA, MRI, MRA, MRS, QCT bone densitometry, nuclear cardiology, PET and PET/CT fusion, diagnostic CT colonography,

CT abdomen and pelvis), sleep studies, mental health and substance abuse, skilled nursing facilities, self- and physician-administered specialty

drugs, applied behavioral analysis and human organ transplant services.

Pricing information for various procedures by in-network providers can be obtained by calling the Customer Service number listed on the back of

your BCN ID card and providing the procedure code. Your provider can also provide this information upon request.

Exclusions and limitations: Conditions covered by workers compensation or similar law; services or supplies not specifically listed as covered under your

benefit plan; services received before your effective date or after coverage ends; services you wouldnt have to pay for if you did not have this coverage; services

or supplies that are not medically necessary; physical exams for insurance, employment, sports or school; any amounts in excess of BCNs approved amount;

cosmetic surgery, admissions and hospitalizations; services for gender reassignment or for the treatment of gender identity disorder including hormonal therapy;

dental care, dental implants or treatment to the teeth except as specifically stated in your benefit plan; hearing aids; infertility-related drugs; private duty nursing;

telephone, fax machine or any other type of electronic consultation; educational services, except as specifically provided or arranged by BCN or specifically stated in

your benefit plan; care or treatment furnished in a nonparticipating hospital, except as specifically stated in your benefit plan; personal comfort items; custodial care;

services or supplies supplied to any person not covered under your benefit plan; services while confined in a hospital or other facility owned or operated by state or

federal government, unless required by law; voluntary abortions or vasectomy reversals; RK, PRK or Lasik; services provided by a professional provider to a family

member; services provided by any person who ordinarily resides in the covered persons home or who is a family member; any drug, medicine or device that is not

approved by the Food and Drug Administration, unless required by law; vitamins, dietary products and any other nonprescription supplements except as specifically

stated in your benefit plan; dental services, except for dental injury; appliances, supplies or services as a result of war or any act of war, whether declared or not;

communication or travel time, lodging or transportation, except as stated in your benefit plan; foot care services, except as stated in your benefit plan; health clubs

or health spas, aerobic and strength conditioning, work-hardening programs and related material and products for these programs; hair prosthesis, hair transplants

or implants; experimental treatments, except as stated in your benefit plan; and alternative medicines or therapies.

This document is intended to be an easytoread summary. It is not a contract. Additional limitations and exclusions may apply to covered services.

A complete description of benefits is contained in the applicable Blue Care Network certificate and riders. In the event of a conflict between this

document and the applicable certificate and riders, the certificate and riders will rule. Payment amounts are based on the BCNapproved amount,

less any applicable deductible, copay and/or coinsurance amounts required by the plan. This coverage is provided pursuant to a contract entered

into in the state of Michigan and shall be construed under the jurisdiction and according to the laws of the state of Michigan.

CF 13378 AUG 14

Blue Care Network is a nonprofit corporation and independent licensee of the Blue Cross and Blue Shield Association.

R030120

You might also like

- Corporate Classic PDFDocument4 pagesCorporate Classic PDFironhide404No ratings yet

- Housecalls 101: Policy and Procedure Manual for Medical Home VisitsFrom EverandHousecalls 101: Policy and Procedure Manual for Medical Home VisitsNo ratings yet

- Atlas and Classification of ElectroencephalographyDocument1 pageAtlas and Classification of Electroencephalographyadinda.larastitiNo ratings yet

- Oxf Fre Access Ppo1b Ny f1Document1 pageOxf Fre Access Ppo1b Ny f1Function0No ratings yet

- Bornstein (2005) The Dependent PatientDocument8 pagesBornstein (2005) The Dependent PatientYasunori Nishikawa0% (1)

- Surgery Essence Pritesh Singh 6th EditionDocument7 pagesSurgery Essence Pritesh Singh 6th EditionShubhamPareek100% (2)

- Basic Training For: Barangay Health Workers Barangay Nutrition ScholarDocument16 pagesBasic Training For: Barangay Health Workers Barangay Nutrition ScholarMario Hipolito100% (5)

- Blue-Cross-Premier-Platinum-Extra-Dental-Vision CareerDocument8 pagesBlue-Cross-Premier-Platinum-Extra-Dental-Vision Careerapi-248930594No ratings yet

- Advantage Blue: Summary of BenefitsDocument4 pagesAdvantage Blue: Summary of BenefitsDeeDee JonesNo ratings yet

- 2012 Blue Advantage Benefit TableDocument3 pages2012 Blue Advantage Benefit Tableapi-41207808No ratings yet

- I A Bluechoice Ppo - Large Group (51+ Employees) Plan 4511Sx Benefit SummaryDocument3 pagesI A Bluechoice Ppo - Large Group (51+ Employees) Plan 4511Sx Benefit SummaryDave EmersonNo ratings yet

- Kaiser Permanente: KP CA Silver 2000/45: This Is Only A SummaryDocument8 pagesKaiser Permanente: KP CA Silver 2000/45: This Is Only A SummaryKelly HoffmanNo ratings yet

- Benefit Summary: Your BenefitsDocument14 pagesBenefit Summary: Your BenefitsmadhusoftechNo ratings yet

- Insurance Benefit SummaryDocument4 pagesInsurance Benefit SummaryRose Mary Read BallNo ratings yet

- 2012 Hsa Benefit TableDocument3 pages2012 Hsa Benefit Tableapi-41207808No ratings yet

- Kaiser Permanente: Good Health Is No SecretDocument6 pagesKaiser Permanente: Good Health Is No SecretThomas Dominic CazneauNo ratings yet

- Bcbs HDHPPremierDocument2 pagesBcbs HDHPPremierTerry BybeeNo ratings yet

- Northeastern University Student Health Plan: Blue Care Elect Preferred (PPO)Document4 pagesNortheastern University Student Health Plan: Blue Care Elect Preferred (PPO)agdayemNo ratings yet

- PPO Option 1: UPMC Health Plan: This Is Only A SummaryDocument7 pagesPPO Option 1: UPMC Health Plan: This Is Only A SummaryraamonikNo ratings yet

- A Healthy You Is Important.: Your Benefits Can Help You Achieve ItDocument6 pagesA Healthy You Is Important.: Your Benefits Can Help You Achieve ItJimNo ratings yet

- University of Missouri Kansas City International SBC 500499912071900371 FINAL 2Document7 pagesUniversity of Missouri Kansas City International SBC 500499912071900371 FINAL 2maheshm_erpNo ratings yet

- Open Access Plus: Connecticut General Life Insurance Co.: This Is Only A SummaryDocument20 pagesOpen Access Plus: Connecticut General Life Insurance Co.: This Is Only A Summaryswapnil343No ratings yet

- HSA Choice Plus Plan AIQM/02V: Important Questions Answers Why This MattersDocument8 pagesHSA Choice Plus Plan AIQM/02V: Important Questions Answers Why This MattersAnonymous PWVeGM5n9gNo ratings yet

- Ma Choice 3D 5DDocument13 pagesMa Choice 3D 5DAutomotive Wholesalers Association of New EnglandNo ratings yet

- Bluechoice Silver: This Is Only A SummaryDocument10 pagesBluechoice Silver: This Is Only A SummaryGopinath RamakrishnanNo ratings yet

- KP Dcgold020dentalpeddental IvlDocument8 pagesKP Dcgold020dentalpeddental IvlKhamed TabetNo ratings yet

- Ma Risk 3S 5SDocument14 pagesMa Risk 3S 5SAutomotive Wholesalers Association of New EnglandNo ratings yet

- Standard & Basic Option Service Benefit Plan Summary: Previous NextDocument19 pagesStandard & Basic Option Service Benefit Plan Summary: Previous NextmpersiNo ratings yet

- CardinalCarebrochure2010 2011Document6 pagesCardinalCarebrochure2010 2011l_darknessNo ratings yet

- Employee Benefits-Wellness Guide 2023-24Document30 pagesEmployee Benefits-Wellness Guide 2023-24shanzeh2609No ratings yet

- Individual Plan Comparison Chart: Participating Provider Coverage ShownDocument1 pageIndividual Plan Comparison Chart: Participating Provider Coverage Shownakula_rupeshNo ratings yet

- Uhc Hsa 2000-80 1 17Document22 pagesUhc Hsa 2000-80 1 17api-252555369No ratings yet

- TransAmerica Cancer PlanDocument10 pagesTransAmerica Cancer PlanpreparebenefitsNo ratings yet

- Aetna 2014Document1 pageAetna 2014Vignesh EswaranNo ratings yet

- AWANE: Massachusetts PPO 2000: This Is Only A SummaryDocument13 pagesAWANE: Massachusetts PPO 2000: This Is Only A SummaryAutomotive Wholesalers Association of New EnglandNo ratings yet

- Anthem Classic PPO 250-20-20Document4 pagesAnthem Classic PPO 250-20-20PhilippNo ratings yet

- Bs Wellbeing OneDocument4 pagesBs Wellbeing OneShrenik MehtaNo ratings yet

- BCBSIL Multistate Premier 2 SummaryDocument10 pagesBCBSIL Multistate Premier 2 SummaryMark MaNo ratings yet

- Plan 1 Gkfa SummaryDocument11 pagesPlan 1 Gkfa Summaryapi-247823065No ratings yet

- BCBS LA 2020IndividualSolutions PDFDocument28 pagesBCBS LA 2020IndividualSolutions PDFger80No ratings yet

- Benefit Highlights: AARP Medicare Advantage Choice (PPO)Document3 pagesBenefit Highlights: AARP Medicare Advantage Choice (PPO)EstherNo ratings yet

- Uhc Aawa24lp0123163 000 H1278028000 SB 21082023 030634 2024 SF20230921Document15 pagesUhc Aawa24lp0123163 000 H1278028000 SB 21082023 030634 2024 SF20230921kevin.mccreaNo ratings yet

- 2020-1769-4 Summary BrochureDocument9 pages2020-1769-4 Summary Brochurekalli Nagarjun ReddyNo ratings yet

- NH Ind 7a No CTDocument15 pagesNH Ind 7a No CTAutomotive Wholesalers Association of New EnglandNo ratings yet

- Blue Shield - Platinum Full Ppo 150 12 15Document5 pagesBlue Shield - Platinum Full Ppo 150 12 15api-252555369No ratings yet

- JACAM Benefit OverviewDocument7 pagesJACAM Benefit OverviewStephenDohertyNo ratings yet

- UHC Description of BenefitsDocument9 pagesUHC Description of BenefitsSebastián GuevaraNo ratings yet

- Benefit Highlights: Health Plan Is Through BCBSNC Health AdvocateDocument4 pagesBenefit Highlights: Health Plan Is Through BCBSNC Health AdvocateMaríaMadridNo ratings yet

- AARP UHC 2024 Benefit Highlights LA 004P FocusDocument4 pagesAARP UHC 2024 Benefit Highlights LA 004P FocusAlaa ZaidNo ratings yet

- Medical Deductibles: High Deductible Health Plan (HDHP)Document3 pagesMedical Deductibles: High Deductible Health Plan (HDHP)Sergio ArtinanoNo ratings yet

- UnitedHealthcare Gold Compass 1500 PDFDocument8 pagesUnitedHealthcare Gold Compass 1500 PDFAnonymous iM0X5WNo ratings yet

- 2012 Comparison of PlansDocument2 pages2012 Comparison of Plansapi-41207808No ratings yet

- A Life Med Regular Brochure Full 201401Document20 pagesA Life Med Regular Brochure Full 201401Loges Waran MohanNo ratings yet

- This Is Only A Summary.: Premier PlanDocument8 pagesThis Is Only A Summary.: Premier Planmandeep2610No ratings yet

- Plan Comparison 2013Document6 pagesPlan Comparison 2013Amnika JagarnathNo ratings yet

- 2011 Essential Key FactsDocument2 pages2011 Essential Key Factsdebaser420No ratings yet

- United Healthcare UHC Premier 1500 CEFP GoldDocument14 pagesUnited Healthcare UHC Premier 1500 CEFP GoldSteveNo ratings yet

- 2014 Sanel 2000 HmoDocument13 pages2014 Sanel 2000 HmoAutomotive Wholesalers Association of New EnglandNo ratings yet

- Management Science Associates SpdsDocument64 pagesManagement Science Associates SpdsAshwinNo ratings yet

- Aetna Y0001 H5521 380 PR25 SB24 M 2024 SF20240425Document23 pagesAetna Y0001 H5521 380 PR25 SB24 M 2024 SF20240425kevin.mccreaNo ratings yet

- Gold 500/90: ( ) For Prior Authorization in Network (You Pay) Out-of-Network (You Pay)Document2 pagesGold 500/90: ( ) For Prior Authorization in Network (You Pay) Out-of-Network (You Pay)rcdasariNo ratings yet

- Early Cancer Detection in Primary Care: Are You Aware of New Blood-Based Multi-Cancer Screening ToolsFrom EverandEarly Cancer Detection in Primary Care: Are You Aware of New Blood-Based Multi-Cancer Screening ToolsNo ratings yet

- Budget Spreadsheet - Education or Work ForceDocument2 pagesBudget Spreadsheet - Education or Work Forceapi-285960909No ratings yet

- Home Buying-1Document6 pagesHome Buying-1api-285960909No ratings yet

- Credit Card 3Document8 pagesCredit Card 3api-285960909No ratings yet

- Car ProjectDocument11 pagesCar Projectapi-285960909No ratings yet

- Citibank InformationDocument4 pagesCitibank Informationapi-285960909No ratings yet

- E-CUBE 15 CatalogDocument7 pagesE-CUBE 15 CatalogMohsin LatifNo ratings yet

- Tumor Marker/Penanda Tumor: Dr. Andriani Tri Susilowati, M.SC, SPPKDocument19 pagesTumor Marker/Penanda Tumor: Dr. Andriani Tri Susilowati, M.SC, SPPKFahrum BurhanNo ratings yet

- DiseasesDocument231 pagesDiseasesAbedDabaja100% (1)

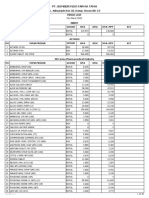

- Price List###Document35 pagesPrice List###Balai Pengobatan AdventNo ratings yet

- Medical TerminologyDocument154 pagesMedical TerminologySamuel Obeng100% (3)

- Pulmonary Function Tests ScribdDocument34 pagesPulmonary Function Tests ScribdNamita JadhaoNo ratings yet

- Pathophysiology of Acute Renal FailureDocument2 pagesPathophysiology of Acute Renal Failureminangsung minangnengNo ratings yet

- Medical Waste Disposal BrochureDocument3 pagesMedical Waste Disposal BrochureRachael HernandezNo ratings yet

- Medical Devices Act - M 3 en PDFDocument42 pagesMedical Devices Act - M 3 en PDFDewa GedeNo ratings yet

- Evidence Based Practice: Dr. Richa Singh Professor Dept. of Obs. & Gynae. S. N. Medical College, AgraDocument28 pagesEvidence Based Practice: Dr. Richa Singh Professor Dept. of Obs. & Gynae. S. N. Medical College, Agraricha singhNo ratings yet

- PGDHHM AssignmentsDocument5 pagesPGDHHM AssignmentsKuldeep BajajNo ratings yet

- MidtermDocument15 pagesMidtermapi-400034813No ratings yet

- Power Point Consumer Health EducationDocument81 pagesPower Point Consumer Health EducationAlbert Ian CasugaNo ratings yet

- Part Has Arathi 2020Document2 pagesPart Has Arathi 2020Sathyla Lander SelomNo ratings yet

- Intro To First Aid and Basic Life SupportDocument31 pagesIntro To First Aid and Basic Life SupportLance BaraquielNo ratings yet

- Intra Operative Phase (Skills Lab) : Performing Surgical Skin Preparation and DrapingDocument12 pagesIntra Operative Phase (Skills Lab) : Performing Surgical Skin Preparation and DrapingZerimar Dela CruzNo ratings yet

- 114 Ophthalmology MCQsDocument18 pages114 Ophthalmology MCQsSyed Ali Haider0% (1)

- Explanation and Consent: Intravenous CannulationDocument3 pagesExplanation and Consent: Intravenous CannulationAyu IsmaNo ratings yet

- WEEK 10 CU 10 - Evidenced Base Practice in Health Education NewDocument5 pagesWEEK 10 CU 10 - Evidenced Base Practice in Health Education Newarmanuel1390antNo ratings yet

- Jointly Team: SMLE GroupDocument22 pagesJointly Team: SMLE GroupAkpevwe EmefeNo ratings yet

- Home Health Registered NurseDocument2 pagesHome Health Registered NurseLiwliwa LiwliwNo ratings yet

- Implant Book PDFDocument56 pagesImplant Book PDFayman67% (3)

- CME: Tendo-Achilles Injury and Its ManagementDocument39 pagesCME: Tendo-Achilles Injury and Its ManagementDr. Mohammad Nazrul IslamNo ratings yet

- Running Head: Iturralde V. Hilo Medical Center Usa: Case Study 1Document11 pagesRunning Head: Iturralde V. Hilo Medical Center Usa: Case Study 1HugsNo ratings yet

- Scrotal Swelling FadhlyDocument52 pagesScrotal Swelling FadhlyfadhlyNo ratings yet

- Info GraphicsDocument1 pageInfo GraphicsMay Ann RosalesNo ratings yet