Professional Documents

Culture Documents

Appraisal Increases Top 15 Counties 6-10-2015

Appraisal Increases Top 15 Counties 6-10-2015

Uploaded by

MarkWigginsTXOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Appraisal Increases Top 15 Counties 6-10-2015

Appraisal Increases Top 15 Counties 6-10-2015

Uploaded by

MarkWigginsTXCopyright:

Available Formats

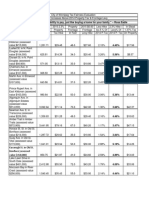

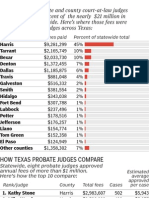

ESTIMATEDVALUEDOFADDITIONAL$10,000HOMESTEADEXEMPTIONINMOSTPOPULOUSCOUNTIESFORSTATEWIDEAVERAGEHOMEVALUEOF$151,435**

Top15Most

Populous

Countiesin

Texas

Harris

Dallas

Tarrant

Bexar

Travis

Collin

ElPaso

Hidalgo

Denton

FortBend

Montgomery

Williamson

Cameron

Nueces

Brazoria

SchoolDistrict

HoustonISD

DallasISD

FortWorthISD

SanAntonioISD

AustinISD

PlanoISD

ElPasoISD

HidalgoISD

DentonISD

FortBendISD

MontgomeryISD

RoundRockISD

BrownsvilleISD

CorpusChristiISD

AngletonISD

Percentage

increasefrom

2014taxon

2014to2015

2014

average

inMarket

2014Tax statewide homevalue

Value*of

Rate

average with$15,000

SingleFamily

homevalue homestead

Homes

exemption

withinthe

County

1.1967 $151,435

1.282085 $151,435

1.322 $151,435

1.3826 $151,435

1.222 $151,435

1.448 $151,435

1.235 $151,435

1.53 $151,435

1.54 $151,435

1.34 $151,435

1.34 $151,435

1.3375 $151,435

1.145666 $151,435

1.23735 $151,435

1.4552 $151,435

$1,633

$1,749

$1,804

$1,886

$1,667

$1,976

$1,685

$2,087

$2,101

$1,828

$1,828

$1,825

$1,563

$1,688

$1,985

9.50%

7.86%

2.45%

11.63%

15.00%

10.70%

0.19%

9.30%

12.70%

7.86%

6.00%

8.04%

0.29%

10.00%

9.50%

2015taxwith

Taxincrease

2015appraisal

2015taxwith

$15,000

2015Tax

from2014to

basedon2014

$25,000

Levy

2015ifwedo

statewideaverage homestead

homestead

Taxsavings

exemption

Increase

nothing

homevalueand

exemption

attributable

(appraisals

(appraisals

(Savings)

(appraisals

percentage

toSJR1in

increaseinmarket

increase;

increase;

over2014

increase;tax

2015

valueofsingle assumetaxrate rateremains assumetaxrate

TaxLevy

familyhomesin

remainsthe

remainsthe

afterSJR1

thesameas

thecounty

sameas2014)

sameas2014)

2014)

$165,821

$163,338

$155,145

$169,047

$174,150

$167,639

$151,723

$165,518

$170,667

$163,338

$160,521

$163,610

$151,874

$166,579

$165,821

$1,805

$1,902

$1,853

$2,130

$1,945

$2,210

$1,689

$2,303

$2,397

$1,988

$1,950

$1,988

$1,568

$1,876

$2,195

*Marketvaluemeanstheappraisedfairmarketvalue,beforetheapplicationofexemptionsorappraisalcaps.

**$151,435isthestatewideaveragehomevaluefor2014.Thesamenumberof2015isnotyetavailable.

$172

$153

$49

$244

$278

$235

$4

$215

$296

$159

$122

$163

$5

$187

$209

$1,685

$1,774

$1,721

$1,992

$1,823

$2,065

$1,565

$2,150

$2,243

$1,854

$1,816

$1,854

$1,454

$1,752

$2,049

High:

Average:

Low:

$120

$128

$132

$138

$122

$145

$124

$153

$154

$134

$134

$134

$115

$124

$146

$154

$133

$115

$52

$24

($83)

$105

$155

$90

($120)

$62

$142

$25

($12)

$29

($110)

$64

$64

Changeintax

Changeintaxrate ratenecessary

necessarytohold tohold2015tax

2015taxlevy

levyconstant

constantwith2014 with2014tax

taxlevyafterSJR1 levyifSJR1does

notpass

3.7

1.8

6.4

7.3

10.4

6.3

9.5

4.4

9.8

1.8

0.9

2.1

8.6

4.5

4.5

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

11.4

10.1

3.2

16.1

18.3

15.5

0.2

14.2

19.6

10.5

8.0

10.8

0.3

12.4

13.8

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

cents

You might also like

- Ontario Sunshine List: Municipalities and ServicesDocument538 pagesOntario Sunshine List: Municipalities and ServicesGillian GraceNo ratings yet

- Seattle Property Tax BreakdownDocument13 pagesSeattle Property Tax BreakdownWestSeattleBlog0% (1)

- De Guzman Roy Relo Guide-EmailDocument27 pagesDe Guzman Roy Relo Guide-Emailapi-244003819No ratings yet

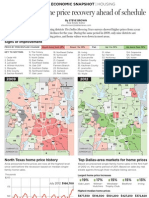

- 0709BUS EconsnapshotDocument1 page0709BUS EconsnapshotThe Dallas Morning NewsNo ratings yet

- Home Guide Weekly 1-30Document9 pagesHome Guide Weekly 1-30EP Trail GazetteNo ratings yet

- 1415975259ps Pgs 111714 PDFDocument15 pages1415975259ps Pgs 111714 PDFCoolerAdsNo ratings yet

- Colorado Childcare Prices and Affordability BriefDocument3 pagesColorado Childcare Prices and Affordability BrieferthwurmNo ratings yet

- 7 Derryfield Ave, Burlington MA, 01803 - HomesDocument6 pages7 Derryfield Ave, Burlington MA, 01803 - Homesashes_xNo ratings yet

- TX Ag Exemption HandoutDocument2 pagesTX Ag Exemption HandoutAngelaNo ratings yet

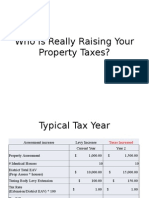

- Who Is Really Raising Your Property TaxesDocument6 pagesWho Is Really Raising Your Property TaxesLennie JarrattNo ratings yet

- 2015 Tax Fairness EvaluationDocument2 pages2015 Tax Fairness EvaluationTessa VanderhartNo ratings yet

- EmployeeDocument27 pagesEmployeePravin LandgeNo ratings yet

- Bhs PDFDocument14 pagesBhs PDFAnonymous Feglbx5No ratings yet

- Karli R. RussellDocument3 pagesKarli R. Russellapi-510992536No ratings yet

- Media Kit: We Can Print Anything! Get Your Free Quote Today!Document4 pagesMedia Kit: We Can Print Anything! Get Your Free Quote Today!joe9783No ratings yet

- Sunshine List: Municipalities 2012Document418 pagesSunshine List: Municipalities 2012TDPNEWSNo ratings yet

- MichiganDocument1 pageMichigantressanavaltaNo ratings yet

- 1004 County LineDocument12 pages1004 County LineMineral Wells Index/Weatherford DemocratNo ratings yet

- Market MetricsDocument3 pagesMarket MetricsMichael KozlowskiNo ratings yet

- Rapport de CertifyDocument3 pagesRapport de CertifyL'Usine NouvelleNo ratings yet

- IndependentDocument20 pagesIndependentindy-bcNo ratings yet

- Manisha Bewtra Race and Housing in Arlington MA 070720Document21 pagesManisha Bewtra Race and Housing in Arlington MA 070720Manisha G. Bewtra, AICPNo ratings yet

- 2011 Ladonia ProfileDocument5 pages2011 Ladonia ProfileTCOG Community & Economic DevelopmentNo ratings yet

- 0820 Econ SnapshotDocument1 page0820 Econ SnapshotThe Dallas Morning NewsNo ratings yet

- Game of LifeDocument12 pagesGame of Lifeapi-695109449No ratings yet

- Principal Achievement Award WinnersDocument8 pagesPrincipal Achievement Award WinnersAlex ParkerNo ratings yet

- Lesson 14-Budget Planning WorksheetDocument6 pagesLesson 14-Budget Planning Worksheetapi-253889154No ratings yet

- RelocationDocument1 pageRelocationapi-242819906No ratings yet

- 1323184381binder1Document36 pages1323184381binder1CoolerAdsNo ratings yet

- All of Us at Wish You A Happy and Healthy Holiday Season!Document24 pagesAll of Us at Wish You A Happy and Healthy Holiday Season!todaysshopperNo ratings yet

- CLA Cattle Market Report October 21, 2015Document1 pageCLA Cattle Market Report October 21, 2015Clovis Livestock AuctionNo ratings yet

- Germantown Express News 07/12/14Document20 pagesGermantown Express News 07/12/14Hometown Publications - Express NewsNo ratings yet

- 0621 County LineDocument12 pages0621 County LineMineral Wells Index/Weatherford DemocratNo ratings yet

- Spokane Social Data - American Community SurveyDocument5 pagesSpokane Social Data - American Community SurveySpokane City CouncilNo ratings yet

- Northlake FlyerDocument3 pagesNorthlake FlyernathanreddinNo ratings yet

- Moorestown - 1217 PDFDocument40 pagesMoorestown - 1217 PDFelauwitNo ratings yet

- The-Goddard-School - 8 18 21Document10 pagesThe-Goddard-School - 8 18 21marianarocamora.unoiNo ratings yet

- Rates SheetDocument2 pagesRates Sheetapi-252412877No ratings yet

- 1469184753ps-pgs072516 PDFDocument12 pages1469184753ps-pgs072516 PDFCoolerAdsNo ratings yet

- Brown Harris Stevens First Half 2016 Hamptons Market ReportDocument12 pagesBrown Harris Stevens First Half 2016 Hamptons Market ReportAnonymous Feglbx5No ratings yet

- Illinois District Card: Stark County CUSD 100 Wyoming, ILLINOISDocument21 pagesIllinois District Card: Stark County CUSD 100 Wyoming, ILLINOISttalbot6801No ratings yet

- Cash Incentives FlyerDocument1 pageCash Incentives FlyerSteve Mun GroupNo ratings yet

- Clean Campaign #1Document2 pagesClean Campaign #1Jessica LunaNo ratings yet

- Family Budget (Monthly) 1Document11 pagesFamily Budget (Monthly) 1Fred Alma20% (10)

- Windsor Sunshine List 2013Document13 pagesWindsor Sunshine List 2013windsorcityblog1No ratings yet

- Illinois School Card: Stark County Junior High School Toulon, ILLINOIS Grades: Stark County CUSD 100Document12 pagesIllinois School Card: Stark County Junior High School Toulon, ILLINOIS Grades: Stark County CUSD 100ttalbot6801No ratings yet

- 1445246503ps-pgs101915 PDFDocument12 pages1445246503ps-pgs101915 PDFCoolerAdsNo ratings yet

- 0503 County LineDocument12 pages0503 County LineMineral Wells Index/Weatherford DemocratNo ratings yet

- 1454682693ps pgs020816 PDFDocument12 pages1454682693ps pgs020816 PDFCoolerAdsNo ratings yet

- 17 Hillsdale Ave, Burlington MA, 01803 - HomesDocument6 pages17 Hillsdale Ave, Burlington MA, 01803 - Homesashes_xNo ratings yet

- Probate 1022 CDocument1 pageProbate 1022 CDana ThompsonNo ratings yet

- Northwestern Vermont Towns Ranked by Median IncomeDocument1 pageNorthwestern Vermont Towns Ranked by Median IncomeCloverWhithamNo ratings yet

- Market History Bucks SingleFamilyDocument10 pagesMarket History Bucks SingleFamilyDavid SlaughterNo ratings yet

- Appraisal Notices For Tax Year 2019Document2 pagesAppraisal Notices For Tax Year 2019Anonymous Pb39klJNo ratings yet

- Passport Magazine Advertising RatesDocument2 pagesPassport Magazine Advertising RatesjrcNo ratings yet

- Gonzales EMS Named Best Rural Provider: Atkinson Named New Cub Scout LeaderDocument1 pageGonzales EMS Named Best Rural Provider: Atkinson Named New Cub Scout LeaderNikki MaxwellNo ratings yet

- West Virginia University - Main Campus Student Expense Budget 2011-12Document2 pagesWest Virginia University - Main Campus Student Expense Budget 2011-12Bridgette PerdueNo ratings yet

- April 2015 The Address PDFDocument24 pagesApril 2015 The Address PDFGCMediaNo ratings yet

- Made From Scratch: The Legendary Success Story of Texas RoadhouseFrom EverandMade From Scratch: The Legendary Success Story of Texas RoadhouseRating: 5 out of 5 stars5/5 (1)

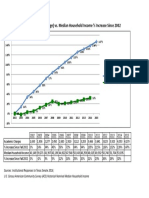

- Tti PRC Htranstnc 083016Document27 pagesTti PRC Htranstnc 083016MarkWigginsTXNo ratings yet

- Academic Charges Vs MHIDocument1 pageAcademic Charges Vs MHIMarkWigginsTXNo ratings yet

- TxDOT HB 2612Document27 pagesTxDOT HB 2612BrandonFormbyNo ratings yet

- Academic Charges Vs CPIDocument1 pageAcademic Charges Vs CPIMarkWigginsTXNo ratings yet

- Pd-1067-15 Perry Concur AlcalaDocument9 pagesPd-1067-15 Perry Concur AlcalaMarkWigginsTXNo ratings yet