Professional Documents

Culture Documents

Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana

Uploaded by

nishtha sethiCopyright:

Available Formats

You might also like

- Schemes ModiDocument37 pagesSchemes ModiSuresh SuryaNo ratings yet

- A Short Report Sukanya Samridhi YojanaDocument4 pagesA Short Report Sukanya Samridhi YojanaNikhil DhawanNo ratings yet

- Customer's Satisfication Towards Sukanya Samriddhi Yojana (Ssy) With Special Reference To Suryapet District (T.S)Document12 pagesCustomer's Satisfication Towards Sukanya Samriddhi Yojana (Ssy) With Special Reference To Suryapet District (T.S)Pragathi Mittal100% (1)

- Financial Inclusion-A Study On Sukanya Samriddhi Yojana: V.Kameswari Harini, Prachi RampalDocument3 pagesFinancial Inclusion-A Study On Sukanya Samriddhi Yojana: V.Kameswari Harini, Prachi RampalKrishnaveni KrishnaNo ratings yet

- Salient Features of Sukanya Samriddhi YojanaDocument3 pagesSalient Features of Sukanya Samriddhi Yojanajha.sofcon5941No ratings yet

- Government Schemes For Girl ChildDocument8 pagesGovernment Schemes For Girl Childabhay chauhanNo ratings yet

- Sukanya Samriddhi Account Scheme Yojana by GovDocument22 pagesSukanya Samriddhi Account Scheme Yojana by GovvinayakraaoNo ratings yet

- Save The Girl Child Initiatives in IndiaDocument17 pagesSave The Girl Child Initiatives in IndiaAkhil ThakurNo ratings yet

- SSY Account Opening FormDocument2 pagesSSY Account Opening FormKiran JupallyNo ratings yet

- Sukanya Samriddhi YojanaDocument22 pagesSukanya Samriddhi YojanaKirti ChotwaniNo ratings yet

- Beti Bachao Beti Padhao Essay in Hindi Wiki PDFDocument2 pagesBeti Bachao Beti Padhao Essay in Hindi Wiki PDFArchana YadavNo ratings yet

- Beti Bachao-Beti PadhaoDocument14 pagesBeti Bachao-Beti Padhaojai LakhinanaNo ratings yet

- Financial Inclusion Schemes in IndiaDocument8 pagesFinancial Inclusion Schemes in IndiadheerajNo ratings yet

- Pradhan Mantri Jan Dhan YojanaDocument30 pagesPradhan Mantri Jan Dhan YojanaKirti Chotwani100% (1)

- Beti Bachao Beti PadhaoDocument20 pagesBeti Bachao Beti Padhaomohd junaid siddiquiNo ratings yet

- NPS Completed ProjectDocument53 pagesNPS Completed ProjectAkshitha KulalNo ratings yet

- Entrepreneurship Management MainDocument28 pagesEntrepreneurship Management MainSwapnil DabholkarNo ratings yet

- Impact of Covid-19 On Odisha EconomyDocument33 pagesImpact of Covid-19 On Odisha EconomySunil ShekharNo ratings yet

- Self Help Group's Muthoot Pincorp Bank SindhanurDocument61 pagesSelf Help Group's Muthoot Pincorp Bank SindhanurhasanNo ratings yet

- Manrega FinalDocument43 pagesManrega FinalShree CyberiaNo ratings yet

- Pradhanmantri Jan Dhan YojnaDocument16 pagesPradhanmantri Jan Dhan YojnaSumit Naveen SinghNo ratings yet

- Poverty Alleviation Programmes in IndiaDocument26 pagesPoverty Alleviation Programmes in IndiautkarshNo ratings yet

- A Descriptive Study On Growth of Mobile Banking & Insurance in India During Covid-19Document69 pagesA Descriptive Study On Growth of Mobile Banking & Insurance in India During Covid-19UPENDRA NISHADNo ratings yet

- Project Report of Financial Institution - 2019 PDFDocument91 pagesProject Report of Financial Institution - 2019 PDFBhakti GoswamiNo ratings yet

- Jan Dhan YojnaDocument55 pagesJan Dhan YojnaManasi BhosleNo ratings yet

- Impact of Stand Up India Scheme For Women EntrepreunersDocument5 pagesImpact of Stand Up India Scheme For Women EntrepreunerscsydheepanNo ratings yet

- Sukanya Samriddhi Yojana - SBI Corporate WebsiteDocument2 pagesSukanya Samriddhi Yojana - SBI Corporate WebsitesritraderNo ratings yet

- Make in India, Startup IndiaDocument24 pagesMake in India, Startup IndiaCharu LataNo ratings yet

- The BirthDocument51 pagesThe BirthSantosh BarikNo ratings yet

- Economics Project Sem2Document41 pagesEconomics Project Sem2madhuri50% (2)

- Ashutosh Eco11Document27 pagesAshutosh Eco11ashish664No ratings yet

- Reliance Life Insurance (Customer Buying Behaviour Towards IDocument87 pagesReliance Life Insurance (Customer Buying Behaviour Towards Inikkita18sharmaNo ratings yet

- Covid 19 Blow On Indian Banks ParalyzedDocument24 pagesCovid 19 Blow On Indian Banks Paralyzedtanu kapoorNo ratings yet

- MNREGADocument129 pagesMNREGASulthan JoseNo ratings yet

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624No ratings yet

- Kisan Credit Card SchemeDocument14 pagesKisan Credit Card Schemekabhibhi100% (1)

- A Study On Awareness and Challenges Faced by Small Business Units in Filing GSTDocument39 pagesA Study On Awareness and Challenges Faced by Small Business Units in Filing GSTDIVYA BHARATHI S 18MBA175100% (1)

- Introduction of Kissan Credit Card SchemeDocument4 pagesIntroduction of Kissan Credit Card SchemeRomen BuragohainNo ratings yet

- KudumbashreeDocument12 pagesKudumbashreeamarsxcran100% (1)

- Pradhan Mantri Atal Pension Yojana (APY)Document108 pagesPradhan Mantri Atal Pension Yojana (APY)Jitendra Suraaj TripathiNo ratings yet

- Sources of Rural CreditDocument9 pagesSources of Rural CreditMAYANK SINHANo ratings yet

- Presentation On Money & BankingDocument15 pagesPresentation On Money & BankingRahul VyasNo ratings yet

- Sukanya Samriddhi Yojana - CalculatorDocument4 pagesSukanya Samriddhi Yojana - CalculatorIndiran100% (1)

- Mgnrega's Impact On Income and Employment in Seaweeds Cultivating HouseholdsDocument8 pagesMgnrega's Impact On Income and Employment in Seaweeds Cultivating HouseholdsSiva KumarNo ratings yet

- Make in IndiaDocument6 pagesMake in Indiasridharvchinni_21769No ratings yet

- Swot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesDocument4 pagesSwot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesAnooja SajeevNo ratings yet

- Canara BankDocument7 pagesCanara BankPriyankaKulkarni100% (1)

- Impact of E-Commerce in Indian Economy PDFDocument13 pagesImpact of E-Commerce in Indian Economy PDFJayagokul SaravananNo ratings yet

- Star CompanyDocument15 pagesStar CompanyCandsz JcaNo ratings yet

- Sukanya Samriddhi Yojana PDFDocument3 pagesSukanya Samriddhi Yojana PDFDakshita DubeyNo ratings yet

- BRICS 9 NewDocument24 pagesBRICS 9 NewAYUSHI SHARMANo ratings yet

- Brand Image of Icici Prudential Life InsuranceDocument40 pagesBrand Image of Icici Prudential Life InsuranceShehbaz KhannaNo ratings yet

- A Study On Women Empowerment Through Micro Finance With Reference To Thiruvallur DistrictDocument16 pagesA Study On Women Empowerment Through Micro Finance With Reference To Thiruvallur DistrictReeta DeviNo ratings yet

- Impact of GST On Indian Economy PaperDocument10 pagesImpact of GST On Indian Economy PaperKetan YadavNo ratings yet

- Education System in IndiaDocument21 pagesEducation System in IndiaZeeshan Shaukat0% (1)

- Full Paper PDFDocument10 pagesFull Paper PDFSuhasini DurveNo ratings yet

- An Assignment On Small Industries Development Bank of India (SIDBI)Document13 pagesAn Assignment On Small Industries Development Bank of India (SIDBI)Pooja Gujarathi50% (2)

- A Study On Swachh Bharat Abhiyan and Management LessonsDocument2 pagesA Study On Swachh Bharat Abhiyan and Management LessonsarcherselevatorsNo ratings yet

- Post Office - 1Document1 pagePost Office - 1idspdhuleNo ratings yet

Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana

Uploaded by

nishtha sethiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana

Uploaded by

nishtha sethiCopyright:

Available Formats

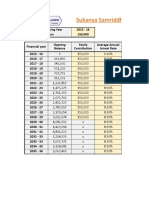

Sukanya Samriddhi Yojana Tax-Free Small Savings Scheme

for a Girl Child

by SH IV KU KRE JA on MARCH 3, 2015

in IN VE ST MEN TS

This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial

planning firm, Ojas Capital in Delhi/NCR. He can be reached at skukreja@investitude.co.in

Beti Bachao, Beti Padhao is the mantra with which Prime Minister Narendra Modi

launchedSukanya Samriddhi Yojana on January 22nd this year. Later on, the government

issued a notification to allow 80C exemption equal to the amount invested in the scheme up to

Rs. 1,50,000, which is also the maximum amount one can invest in this scheme in a financial

year.

Now, the Finance Minister in his budget speech has proposed to make the interest component as

well as the maturity proceeds as tax-free. I think this proposal has made this scheme to be the

best small savings scheme available to the Indian investors. Yes, even better than our golden

scheme of Public Provident FUND (PPF). So, what is this scheme all about? Lets check.

Sukanya Samriddhi Yojana is a small savings scheme which can be opened by the parents or a

legal guardian of a girl child in any post office or authorised branches of some of the commercial

banks. The girl child is called the Account Holder and the guardian is called the Depositor in

this scheme.

Before I compare this scheme with PPF, let us first check the important features of this scheme.

Salient Features of Sukanya Samriddhi Yojana

Who can open this account? - Parents or a legal guardian of a girl child who is 10 years of

age or younger than that, can open this account in the name of the child. For initial operations of

the scheme, one year grace period has been provided to make it 11 years of age. With this one

year grace period in age, which is valid up to December 1, 2015, you can get this account opened

for a girl child who is born between December 2, 2003 and December 1, 2004.

9.1% Tax-Free Rate of Interest - This scheme has been flagged off with a 9.1% rate of

interest, higher than that of PPF which stands at 8.7%. But, this rate is not fixed at 9.1% for the

You might also like

- Schemes ModiDocument37 pagesSchemes ModiSuresh SuryaNo ratings yet

- A Short Report Sukanya Samridhi YojanaDocument4 pagesA Short Report Sukanya Samridhi YojanaNikhil DhawanNo ratings yet

- Customer's Satisfication Towards Sukanya Samriddhi Yojana (Ssy) With Special Reference To Suryapet District (T.S)Document12 pagesCustomer's Satisfication Towards Sukanya Samriddhi Yojana (Ssy) With Special Reference To Suryapet District (T.S)Pragathi Mittal100% (1)

- Financial Inclusion-A Study On Sukanya Samriddhi Yojana: V.Kameswari Harini, Prachi RampalDocument3 pagesFinancial Inclusion-A Study On Sukanya Samriddhi Yojana: V.Kameswari Harini, Prachi RampalKrishnaveni KrishnaNo ratings yet

- Salient Features of Sukanya Samriddhi YojanaDocument3 pagesSalient Features of Sukanya Samriddhi Yojanajha.sofcon5941No ratings yet

- Government Schemes For Girl ChildDocument8 pagesGovernment Schemes For Girl Childabhay chauhanNo ratings yet

- Sukanya Samriddhi Account Scheme Yojana by GovDocument22 pagesSukanya Samriddhi Account Scheme Yojana by GovvinayakraaoNo ratings yet

- Save The Girl Child Initiatives in IndiaDocument17 pagesSave The Girl Child Initiatives in IndiaAkhil ThakurNo ratings yet

- SSY Account Opening FormDocument2 pagesSSY Account Opening FormKiran JupallyNo ratings yet

- Sukanya Samriddhi YojanaDocument22 pagesSukanya Samriddhi YojanaKirti ChotwaniNo ratings yet

- Beti Bachao Beti Padhao Essay in Hindi Wiki PDFDocument2 pagesBeti Bachao Beti Padhao Essay in Hindi Wiki PDFArchana YadavNo ratings yet

- Beti Bachao-Beti PadhaoDocument14 pagesBeti Bachao-Beti Padhaojai LakhinanaNo ratings yet

- Financial Inclusion Schemes in IndiaDocument8 pagesFinancial Inclusion Schemes in IndiadheerajNo ratings yet

- Pradhan Mantri Jan Dhan YojanaDocument30 pagesPradhan Mantri Jan Dhan YojanaKirti Chotwani100% (1)

- Beti Bachao Beti PadhaoDocument20 pagesBeti Bachao Beti Padhaomohd junaid siddiquiNo ratings yet

- NPS Completed ProjectDocument53 pagesNPS Completed ProjectAkshitha KulalNo ratings yet

- Entrepreneurship Management MainDocument28 pagesEntrepreneurship Management MainSwapnil DabholkarNo ratings yet

- Impact of Covid-19 On Odisha EconomyDocument33 pagesImpact of Covid-19 On Odisha EconomySunil ShekharNo ratings yet

- Self Help Group's Muthoot Pincorp Bank SindhanurDocument61 pagesSelf Help Group's Muthoot Pincorp Bank SindhanurhasanNo ratings yet

- Manrega FinalDocument43 pagesManrega FinalShree CyberiaNo ratings yet

- Pradhanmantri Jan Dhan YojnaDocument16 pagesPradhanmantri Jan Dhan YojnaSumit Naveen SinghNo ratings yet

- Poverty Alleviation Programmes in IndiaDocument26 pagesPoverty Alleviation Programmes in IndiautkarshNo ratings yet

- A Descriptive Study On Growth of Mobile Banking & Insurance in India During Covid-19Document69 pagesA Descriptive Study On Growth of Mobile Banking & Insurance in India During Covid-19UPENDRA NISHADNo ratings yet

- Project Report of Financial Institution - 2019 PDFDocument91 pagesProject Report of Financial Institution - 2019 PDFBhakti GoswamiNo ratings yet

- Jan Dhan YojnaDocument55 pagesJan Dhan YojnaManasi BhosleNo ratings yet

- Impact of Stand Up India Scheme For Women EntrepreunersDocument5 pagesImpact of Stand Up India Scheme For Women EntrepreunerscsydheepanNo ratings yet

- Sukanya Samriddhi Yojana - SBI Corporate WebsiteDocument2 pagesSukanya Samriddhi Yojana - SBI Corporate WebsitesritraderNo ratings yet

- Make in India, Startup IndiaDocument24 pagesMake in India, Startup IndiaCharu LataNo ratings yet

- The BirthDocument51 pagesThe BirthSantosh BarikNo ratings yet

- Economics Project Sem2Document41 pagesEconomics Project Sem2madhuri50% (2)

- Ashutosh Eco11Document27 pagesAshutosh Eco11ashish664No ratings yet

- Reliance Life Insurance (Customer Buying Behaviour Towards IDocument87 pagesReliance Life Insurance (Customer Buying Behaviour Towards Inikkita18sharmaNo ratings yet

- Covid 19 Blow On Indian Banks ParalyzedDocument24 pagesCovid 19 Blow On Indian Banks Paralyzedtanu kapoorNo ratings yet

- MNREGADocument129 pagesMNREGASulthan JoseNo ratings yet

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624No ratings yet

- Kisan Credit Card SchemeDocument14 pagesKisan Credit Card Schemekabhibhi100% (1)

- A Study On Awareness and Challenges Faced by Small Business Units in Filing GSTDocument39 pagesA Study On Awareness and Challenges Faced by Small Business Units in Filing GSTDIVYA BHARATHI S 18MBA175100% (1)

- Introduction of Kissan Credit Card SchemeDocument4 pagesIntroduction of Kissan Credit Card SchemeRomen BuragohainNo ratings yet

- KudumbashreeDocument12 pagesKudumbashreeamarsxcran100% (1)

- Pradhan Mantri Atal Pension Yojana (APY)Document108 pagesPradhan Mantri Atal Pension Yojana (APY)Jitendra Suraaj TripathiNo ratings yet

- Sources of Rural CreditDocument9 pagesSources of Rural CreditMAYANK SINHANo ratings yet

- Presentation On Money & BankingDocument15 pagesPresentation On Money & BankingRahul VyasNo ratings yet

- Sukanya Samriddhi Yojana - CalculatorDocument4 pagesSukanya Samriddhi Yojana - CalculatorIndiran100% (1)

- Mgnrega's Impact On Income and Employment in Seaweeds Cultivating HouseholdsDocument8 pagesMgnrega's Impact On Income and Employment in Seaweeds Cultivating HouseholdsSiva KumarNo ratings yet

- Make in IndiaDocument6 pagesMake in Indiasridharvchinni_21769No ratings yet

- Swot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesDocument4 pagesSwot Analysis of Asset Classes: Asset Strength Weakness Oppotunity Threat EquitiesAnooja SajeevNo ratings yet

- Canara BankDocument7 pagesCanara BankPriyankaKulkarni100% (1)

- Impact of E-Commerce in Indian Economy PDFDocument13 pagesImpact of E-Commerce in Indian Economy PDFJayagokul SaravananNo ratings yet

- Star CompanyDocument15 pagesStar CompanyCandsz JcaNo ratings yet

- Sukanya Samriddhi Yojana PDFDocument3 pagesSukanya Samriddhi Yojana PDFDakshita DubeyNo ratings yet

- BRICS 9 NewDocument24 pagesBRICS 9 NewAYUSHI SHARMANo ratings yet

- Brand Image of Icici Prudential Life InsuranceDocument40 pagesBrand Image of Icici Prudential Life InsuranceShehbaz KhannaNo ratings yet

- A Study On Women Empowerment Through Micro Finance With Reference To Thiruvallur DistrictDocument16 pagesA Study On Women Empowerment Through Micro Finance With Reference To Thiruvallur DistrictReeta DeviNo ratings yet

- Impact of GST On Indian Economy PaperDocument10 pagesImpact of GST On Indian Economy PaperKetan YadavNo ratings yet

- Education System in IndiaDocument21 pagesEducation System in IndiaZeeshan Shaukat0% (1)

- Full Paper PDFDocument10 pagesFull Paper PDFSuhasini DurveNo ratings yet

- An Assignment On Small Industries Development Bank of India (SIDBI)Document13 pagesAn Assignment On Small Industries Development Bank of India (SIDBI)Pooja Gujarathi50% (2)

- A Study On Swachh Bharat Abhiyan and Management LessonsDocument2 pagesA Study On Swachh Bharat Abhiyan and Management LessonsarcherselevatorsNo ratings yet

- Post Office - 1Document1 pagePost Office - 1idspdhuleNo ratings yet