Professional Documents

Culture Documents

QUA06702 SalarySlipwithTaxDetails

QUA06702 SalarySlipwithTaxDetails

Uploaded by

ZubairsaeedCopyright:

Available Formats

You might also like

- Salary Sheet (Jestha) - Amar ThakurDocument1 pageSalary Sheet (Jestha) - Amar ThakurAmar ThakurNo ratings yet

- Pay Slip NewDocument1 pagePay Slip NewSukadev Sahu0% (2)

- Dell International Services India PVT LTDDocument1 pageDell International Services India PVT LTDpankaj_kolekar33333No ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipPrayagNo ratings yet

- Quatrro Global Services Private LimitedDocument1 pageQuatrro Global Services Private LimitedZubairsaeedNo ratings yet

- QUA06596 SalarySlip Feb withTaxDetails PDFDocument1 pageQUA06596 SalarySlip Feb withTaxDetails PDFVijay KumarNo ratings yet

- QUA06708 SalarySlipwithTaxDetailsAugustDocument1 pageQUA06708 SalarySlipwithTaxDetailsAugustsonu mackNo ratings yet

- Payslip AprDocument1 pagePayslip Aprabhijitj0555100% (1)

- Payslip 11860967 AugDocument1 pagePayslip 11860967 Augshreya arunNo ratings yet

- India AUG 2016Document1 pageIndia AUG 2016thirumaljrNo ratings yet

- Larsen & Toubro Limited: K.Jeyakumar - 134435 JUL, 2012Document2 pagesLarsen & Toubro Limited: K.Jeyakumar - 134435 JUL, 2012Nidharshan Selvaraj RNo ratings yet

- Jpqr9l104xgdt5lvxacedw IV GP PyslpDocument1 pageJpqr9l104xgdt5lvxacedw IV GP PyslpAsim JavedNo ratings yet

- PayslipDocument1 pagePayslipBodhisatwa BhattacharyaNo ratings yet

- Payslip For The Month of JUN-2011Document1 pagePayslip For The Month of JUN-2011Binay K SrivastawaNo ratings yet

- Ixfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Document1 pageIxfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Anonymous NoxtOPCWNo ratings yet

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- Pay Slip 201117614Document2 pagesPay Slip 201117614Jeetendra Kumar Chaudhury86% (7)

- SalaryDocument1 pageSalaryUrmil ShahNo ratings yet

- Comviva Technologies Limited: Pay Slip For The Month of April 2012Document1 pageComviva Technologies Limited: Pay Slip For The Month of April 2012Prabhakar KumarNo ratings yet

- Pay Slip For May 2013: Empno Gaurav Kumar 155281 NameDocument1 pagePay Slip For May 2013: Empno Gaurav Kumar 155281 NameashukundanNo ratings yet

- Fuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 DaysDocument1 pageFuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 Daysanup_nairNo ratings yet

- Salary SlipsDocument6 pagesSalary SlipsIMSaMiNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Model SlipDocument1 pageModel SlipNithiyanantham BcomcaNo ratings yet

- SalarySlipwithTaxDetails JUNEDocument2 pagesSalarySlipwithTaxDetails JUNEParveen SainiNo ratings yet

- February 2023 Salary Slip E000052897Document1 pageFebruary 2023 Salary Slip E000052897rajvNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- Udipta Energy & Equipment Pvt. LTDDocument3 pagesUdipta Energy & Equipment Pvt. LTDParesh NayakNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- Anuja Tejinkar3Document1 pageAnuja Tejinkar3javed9890No ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- Payslip MarDocument1 pagePayslip MarMaheshKandguleNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- Pay SlipDocument1 pagePay SlipVISHESH JAISWALNo ratings yet

- Recoveries Earnings: Amount AmountDocument3 pagesRecoveries Earnings: Amount AmountVadamalai AdhimoolamNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Schneider Electric India Pvt. LTDDocument1 pageSchneider Electric India Pvt. LTDArasu RajaNo ratings yet

- M/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00Document1 pageM/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00AnilNo ratings yet

- Kelly PayslipDocument1 pageKelly PayslipadtyshkhrNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Oct 08Document1 pageOct 08api-19460822No ratings yet

- Salary SlipDocument1 pageSalary Slipkiran pawarNo ratings yet

- Payslip Jul 2023Document1 pagePayslip Jul 2023Kartika RaguvanshiNo ratings yet

- Salary Slip SepDocument1 pageSalary Slip SepKhwaja ShaikhNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- Yogesh August PayslipDocument1 pageYogesh August Payslipशिवभक्त बाळासाहेब मोरेNo ratings yet

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Salary SlipDocument3 pagesSalary Slipsagerofgyan0% (1)

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- November 2016Document1 pageNovember 2016vasssssssSNo ratings yet

- Tata Projects Limited: Salary Slip For The Month of June - 2021Document1 pageTata Projects Limited: Salary Slip For The Month of June - 2021prishaprajapati01No ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- March 2022Document1 pageMarch 2022Urmila UjgareNo ratings yet

- India Payslip May 2021Document1 pageIndia Payslip May 2021Talla KaseeswarNo ratings yet

- QUA06708 SalarySlipwithTaxDetailsDocument1 pageQUA06708 SalarySlipwithTaxDetailssonu mackNo ratings yet

- QUA06708 SalarySlipwithTaxDetails FebDocument1 pageQUA06708 SalarySlipwithTaxDetails Febsonu mackNo ratings yet

- QUA06673 Feb-2015Document1 pageQUA06673 Feb-2015AmitNo ratings yet

- QUA06708 SalarySlipwithTaxDetails AprilDocument1 pageQUA06708 SalarySlipwithTaxDetails Aprilsonu mackNo ratings yet

- Use Case - Practice ExampleDocument2 pagesUse Case - Practice ExampleArafat Rahman Talukder100% (2)

- Labor Relations Process 11Th Edition Holley Test Bank Full Chapter PDFDocument35 pagesLabor Relations Process 11Th Edition Holley Test Bank Full Chapter PDFNancyWardDDSrods100% (12)

- Chap 12-Pages-16-24,29-47Document28 pagesChap 12-Pages-16-24,29-47RITZ BROWNNo ratings yet

- 01.09.22 - 66130005113501R - Home Depot - CarwashDocument2 pages01.09.22 - 66130005113501R - Home Depot - CarwashjleonardomendozaNo ratings yet

- MERC 113 Guide (Answer) To Problem Solving Ex and Formative TestDocument15 pagesMERC 113 Guide (Answer) To Problem Solving Ex and Formative TestqemsabaterNo ratings yet

- Market TrendsDocument13 pagesMarket TrendsChinmay ThoratNo ratings yet

- Life Certificate LICIDocument2 pagesLife Certificate LICIChatterjee KushalNo ratings yet

- President's Budget Nominee Withdraws Amid Opposition: Biden Limited by Judges Leery of Rule by RegulationDocument34 pagesPresident's Budget Nominee Withdraws Amid Opposition: Biden Limited by Judges Leery of Rule by RegulationyurijapNo ratings yet

- Flux Charger Sales Pitch, FAQ PDFDocument4 pagesFlux Charger Sales Pitch, FAQ PDFAmy Bersalona-DimapilisNo ratings yet

- Your Paddle - Com Order #43570095Document2 pagesYour Paddle - Com Order #43570095Bénedicte Shabani ZeïtunaNo ratings yet

- Carbon Markets Pathways To Promote Sustainable AgricultureDocument33 pagesCarbon Markets Pathways To Promote Sustainable AgricultureKaustav SoodNo ratings yet

- Entrep Task Performance MidtermDocument3 pagesEntrep Task Performance MidtermCyra GarciaNo ratings yet

- Senior Audit Associate: Isla Lipana & Co., The Philippine Member Firm of The PWC Global NetworkDocument5 pagesSenior Audit Associate: Isla Lipana & Co., The Philippine Member Firm of The PWC Global NetworkJerome MontoyaNo ratings yet

- ALD - BECSA - HSE - 002 Contractor Engagement - V1.2Document38 pagesALD - BECSA - HSE - 002 Contractor Engagement - V1.2JoachimNo ratings yet

- AMCTender DocumentDocument135 pagesAMCTender DocumentsdattaNo ratings yet

- Cloud Resource Management and SchedulingDocument39 pagesCloud Resource Management and SchedulingSubhadip Das SarmaNo ratings yet

- FAR MODULE 3 The Accounting EquationDocument3 pagesFAR MODULE 3 The Accounting EquationKatherine MagpantayNo ratings yet

- Gap Analysis Model AssignmentDocument10 pagesGap Analysis Model Assignmentsamia suktaNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- List of Mines in Bhubaneswar Region.Document241 pagesList of Mines in Bhubaneswar Region.Harekrishna Nag100% (1)

- Niken Hervina (C1C019009) - PEREKONOMIAN INDONESIA - JURNAL 2Document200 pagesNiken Hervina (C1C019009) - PEREKONOMIAN INDONESIA - JURNAL 2Niken HervinaNo ratings yet

- 90 Day Year BlueprintDocument15 pages90 Day Year BlueprintKen maz100% (1)

- Brand Identity and Strategies of Couverture & The GarbstoreDocument6 pagesBrand Identity and Strategies of Couverture & The GarbstorefakhrulNo ratings yet

- Facebook Groups: Guide To Effectively Using FB Groups For Fast ResultsDocument9 pagesFacebook Groups: Guide To Effectively Using FB Groups For Fast ResultsinGrill MediaNo ratings yet

- Tugas Inggris M Edi SuryaDocument9 pagesTugas Inggris M Edi SuryaAstaghfirullahNo ratings yet

- WELD-Electrical Characteristics of An Arc (With Diagram) - MetallurgyDocument4 pagesWELD-Electrical Characteristics of An Arc (With Diagram) - MetallurgypeterNo ratings yet

- Myanmar Health Assistant Association Vacancy Announcement (VA - 103/2021 MHAA-HR)Document3 pagesMyanmar Health Assistant Association Vacancy Announcement (VA - 103/2021 MHAA-HR)Win Moe KyawNo ratings yet

- Storage Facility Closure Plan (Template)Document2 pagesStorage Facility Closure Plan (Template)paolo sangalangNo ratings yet

- TYPES OF ADVERTISING CLassification of AdvertisingDocument127 pagesTYPES OF ADVERTISING CLassification of AdvertisingTejaswi PundhirNo ratings yet

- Warranties Liabilities Patents Bids and InsuranceDocument39 pagesWarranties Liabilities Patents Bids and InsuranceIVAN JOHN BITONNo ratings yet

QUA06702 SalarySlipwithTaxDetails

QUA06702 SalarySlipwithTaxDetails

Uploaded by

ZubairsaeedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

QUA06702 SalarySlipwithTaxDetails

QUA06702 SalarySlipwithTaxDetails

Uploaded by

ZubairsaeedCopyright:

Available Formats

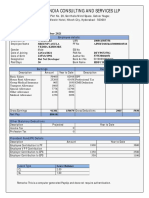

QUATRRO GLOBAL SERVICES PRIVATE LIMITED

Basement, 24, C- Block, Community Centre, Janak Puri, DELHI 110058

NEW DELHI

Pay Slip for the month of February 2015

All amounts in INR

Emp Code :QUA06702

Emp Name :SYED ZUBAIR

Department:Technical Solutions Group

Designation:SOLUTION ENGINEER

Grade

:1A

DOB

:06 May 1989

Location

:GURGAON

Bank/MICR :110234004

Bank A/c No.:100031275401 (INDUSIND BANK LTD)

Cost Center :QBPO

PAN

:BMOPA9333F

DOJ:03 Nov 2014 Payable Days:28.00 PF No.

:HR/GGN/29073/6617

ESI No.

:

Earnings

Deductions

Description

Rate

Monthly

Arrear

Total

Description

Amount

BASIC

11500.00

11500.00

0.00

11500.00 PF

1380.00

HRA

3585.00

3585.00

0.00

3585.00 ELWF

10.00

CONV

800.00

800.00

0.00

800.00

CCA

750.00

750.00

0.00

750.00

CBPB(Bonus)

2500.00

2500.00

0.00

2500.00

MED ALL

600.00

600.00

0.00

600.00

GROSS EARNINGS

19735.00 19735.00

0.00 19735.00

GROSS DEDUCTIONS

1390.00

Net Pay : 18345.00 (EIGHTEEN THOUSAND THREE HUNDRED FORTY FIVE ONLY)

Income Tax Worksheet for the Period April 2014 - March 2015

Description

BASIC

HRA

CONV

CCA

CBPB(Bonus)

MED ALL

Gross

46000.00

14340.00

3200.00

3000.00

7500.00

2400.00

Exempt

Taxable

0.00 46000.00

0.00 14340.00

3200.00

0.00

0.00

3000.00

0.00

7500.00

0.00

2400.00

Gross

76440.00

3200.00 73240.00

Deductions

Previous Employer Taxable Income

0.00

Previous Employer Professional Tax

0.00

Professional Tax

0.00

Under Chapter VI-A

5520.00

Any Other Income

0.00

Taxable Income

67720.00

Total Tax

0.00

Tax Rebate u/s 87a

0.00

Surcharge

0.00

Tax Due

0.00

Educational Cess

0.00

Net Tax

0.00

Tax Deducted (Previous Employer)

0.00

Tax Deducted on Perq.

0.00

Tax Deducted on Any Other Income.

0.00

Tax Deducted Till Date

0.00

Tax to be Deducted

0.00

Tax/Month

0.00

Tax on Non-Recurring Earnings

0.00

Tax Deduction for this month

0.00

Deduction Under Chapter VI-A

Investments u/s 80C

Provident Fund

5520.00

Taxable HRA Calculation(Non-Metro)

Rent Paid

0.00

From

03/11/2014

To

31/03/2015

1. Actual HRA

14340.00

2. 40% or 50% of Basic

18400.00

3. Rent > 10% Basic

0.00

Least of above is exempt

0.00

Taxable HRA

14340.00

Total Investments u/s 80C

5520.00

U/S 80C

5520.00 TDS Deducted Monthly

Total Ded Under Chapter VI-A5520.00 Month

December-2014

January-2015

February-2015

Tax Deducted on Perq.

Total

Total Any Other Income

0.00

Personal Note: This is a system generated payslip, does not require any signature.

Amount

0.00

0.00

0.00

0.00

0.00

You might also like

- Salary Sheet (Jestha) - Amar ThakurDocument1 pageSalary Sheet (Jestha) - Amar ThakurAmar ThakurNo ratings yet

- Pay Slip NewDocument1 pagePay Slip NewSukadev Sahu0% (2)

- Dell International Services India PVT LTDDocument1 pageDell International Services India PVT LTDpankaj_kolekar33333No ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipPrayagNo ratings yet

- Quatrro Global Services Private LimitedDocument1 pageQuatrro Global Services Private LimitedZubairsaeedNo ratings yet

- QUA06596 SalarySlip Feb withTaxDetails PDFDocument1 pageQUA06596 SalarySlip Feb withTaxDetails PDFVijay KumarNo ratings yet

- QUA06708 SalarySlipwithTaxDetailsAugustDocument1 pageQUA06708 SalarySlipwithTaxDetailsAugustsonu mackNo ratings yet

- Payslip AprDocument1 pagePayslip Aprabhijitj0555100% (1)

- Payslip 11860967 AugDocument1 pagePayslip 11860967 Augshreya arunNo ratings yet

- India AUG 2016Document1 pageIndia AUG 2016thirumaljrNo ratings yet

- Larsen & Toubro Limited: K.Jeyakumar - 134435 JUL, 2012Document2 pagesLarsen & Toubro Limited: K.Jeyakumar - 134435 JUL, 2012Nidharshan Selvaraj RNo ratings yet

- Jpqr9l104xgdt5lvxacedw IV GP PyslpDocument1 pageJpqr9l104xgdt5lvxacedw IV GP PyslpAsim JavedNo ratings yet

- PayslipDocument1 pagePayslipBodhisatwa BhattacharyaNo ratings yet

- Payslip For The Month of JUN-2011Document1 pagePayslip For The Month of JUN-2011Binay K SrivastawaNo ratings yet

- Ixfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Document1 pageIxfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Anonymous NoxtOPCWNo ratings yet

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- Pay Slip 201117614Document2 pagesPay Slip 201117614Jeetendra Kumar Chaudhury86% (7)

- SalaryDocument1 pageSalaryUrmil ShahNo ratings yet

- Comviva Technologies Limited: Pay Slip For The Month of April 2012Document1 pageComviva Technologies Limited: Pay Slip For The Month of April 2012Prabhakar KumarNo ratings yet

- Pay Slip For May 2013: Empno Gaurav Kumar 155281 NameDocument1 pagePay Slip For May 2013: Empno Gaurav Kumar 155281 NameashukundanNo ratings yet

- Fuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 DaysDocument1 pageFuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 Daysanup_nairNo ratings yet

- Salary SlipsDocument6 pagesSalary SlipsIMSaMiNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Model SlipDocument1 pageModel SlipNithiyanantham BcomcaNo ratings yet

- SalarySlipwithTaxDetails JUNEDocument2 pagesSalarySlipwithTaxDetails JUNEParveen SainiNo ratings yet

- February 2023 Salary Slip E000052897Document1 pageFebruary 2023 Salary Slip E000052897rajvNo ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- Udipta Energy & Equipment Pvt. LTDDocument3 pagesUdipta Energy & Equipment Pvt. LTDParesh NayakNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- Anuja Tejinkar3Document1 pageAnuja Tejinkar3javed9890No ratings yet

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- Payslip MarDocument1 pagePayslip MarMaheshKandguleNo ratings yet

- PayslipSalary Slips - 9-2020 PDFDocument1 pagePayslipSalary Slips - 9-2020 PDFSukant ChampatiNo ratings yet

- Pay SlipDocument1 pagePay SlipVISHESH JAISWALNo ratings yet

- Recoveries Earnings: Amount AmountDocument3 pagesRecoveries Earnings: Amount AmountVadamalai AdhimoolamNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- Schneider Electric India Pvt. LTDDocument1 pageSchneider Electric India Pvt. LTDArasu RajaNo ratings yet

- M/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00Document1 pageM/S Vrvs India Private Limited: Total 17124.54 Total Deductions 1434.54 Payable Amount Rs. 15690.00AnilNo ratings yet

- Kelly PayslipDocument1 pageKelly PayslipadtyshkhrNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Oct 08Document1 pageOct 08api-19460822No ratings yet

- Salary SlipDocument1 pageSalary Slipkiran pawarNo ratings yet

- Payslip Jul 2023Document1 pagePayslip Jul 2023Kartika RaguvanshiNo ratings yet

- Salary Slip SepDocument1 pageSalary Slip SepKhwaja ShaikhNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- Yogesh August PayslipDocument1 pageYogesh August Payslipशिवभक्त बाळासाहेब मोरेNo ratings yet

- Payslip SepDocument1 pagePayslip SepBrajesh PandeyNo ratings yet

- Salary SlipDocument3 pagesSalary Slipsagerofgyan0% (1)

- Salma Saifi May SlipDocument2 pagesSalma Saifi May Slipsalma saifiNo ratings yet

- November 2016Document1 pageNovember 2016vasssssssSNo ratings yet

- Tata Projects Limited: Salary Slip For The Month of June - 2021Document1 pageTata Projects Limited: Salary Slip For The Month of June - 2021prishaprajapati01No ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- March 2022Document1 pageMarch 2022Urmila UjgareNo ratings yet

- India Payslip May 2021Document1 pageIndia Payslip May 2021Talla KaseeswarNo ratings yet

- QUA06708 SalarySlipwithTaxDetailsDocument1 pageQUA06708 SalarySlipwithTaxDetailssonu mackNo ratings yet

- QUA06708 SalarySlipwithTaxDetails FebDocument1 pageQUA06708 SalarySlipwithTaxDetails Febsonu mackNo ratings yet

- QUA06673 Feb-2015Document1 pageQUA06673 Feb-2015AmitNo ratings yet

- QUA06708 SalarySlipwithTaxDetails AprilDocument1 pageQUA06708 SalarySlipwithTaxDetails Aprilsonu mackNo ratings yet

- Use Case - Practice ExampleDocument2 pagesUse Case - Practice ExampleArafat Rahman Talukder100% (2)

- Labor Relations Process 11Th Edition Holley Test Bank Full Chapter PDFDocument35 pagesLabor Relations Process 11Th Edition Holley Test Bank Full Chapter PDFNancyWardDDSrods100% (12)

- Chap 12-Pages-16-24,29-47Document28 pagesChap 12-Pages-16-24,29-47RITZ BROWNNo ratings yet

- 01.09.22 - 66130005113501R - Home Depot - CarwashDocument2 pages01.09.22 - 66130005113501R - Home Depot - CarwashjleonardomendozaNo ratings yet

- MERC 113 Guide (Answer) To Problem Solving Ex and Formative TestDocument15 pagesMERC 113 Guide (Answer) To Problem Solving Ex and Formative TestqemsabaterNo ratings yet

- Market TrendsDocument13 pagesMarket TrendsChinmay ThoratNo ratings yet

- Life Certificate LICIDocument2 pagesLife Certificate LICIChatterjee KushalNo ratings yet

- President's Budget Nominee Withdraws Amid Opposition: Biden Limited by Judges Leery of Rule by RegulationDocument34 pagesPresident's Budget Nominee Withdraws Amid Opposition: Biden Limited by Judges Leery of Rule by RegulationyurijapNo ratings yet

- Flux Charger Sales Pitch, FAQ PDFDocument4 pagesFlux Charger Sales Pitch, FAQ PDFAmy Bersalona-DimapilisNo ratings yet

- Your Paddle - Com Order #43570095Document2 pagesYour Paddle - Com Order #43570095Bénedicte Shabani ZeïtunaNo ratings yet

- Carbon Markets Pathways To Promote Sustainable AgricultureDocument33 pagesCarbon Markets Pathways To Promote Sustainable AgricultureKaustav SoodNo ratings yet

- Entrep Task Performance MidtermDocument3 pagesEntrep Task Performance MidtermCyra GarciaNo ratings yet

- Senior Audit Associate: Isla Lipana & Co., The Philippine Member Firm of The PWC Global NetworkDocument5 pagesSenior Audit Associate: Isla Lipana & Co., The Philippine Member Firm of The PWC Global NetworkJerome MontoyaNo ratings yet

- ALD - BECSA - HSE - 002 Contractor Engagement - V1.2Document38 pagesALD - BECSA - HSE - 002 Contractor Engagement - V1.2JoachimNo ratings yet

- AMCTender DocumentDocument135 pagesAMCTender DocumentsdattaNo ratings yet

- Cloud Resource Management and SchedulingDocument39 pagesCloud Resource Management and SchedulingSubhadip Das SarmaNo ratings yet

- FAR MODULE 3 The Accounting EquationDocument3 pagesFAR MODULE 3 The Accounting EquationKatherine MagpantayNo ratings yet

- Gap Analysis Model AssignmentDocument10 pagesGap Analysis Model Assignmentsamia suktaNo ratings yet

- Xii Acc WS 3Document4 pagesXii Acc WS 3Gaytri ThaparNo ratings yet

- List of Mines in Bhubaneswar Region.Document241 pagesList of Mines in Bhubaneswar Region.Harekrishna Nag100% (1)

- Niken Hervina (C1C019009) - PEREKONOMIAN INDONESIA - JURNAL 2Document200 pagesNiken Hervina (C1C019009) - PEREKONOMIAN INDONESIA - JURNAL 2Niken HervinaNo ratings yet

- 90 Day Year BlueprintDocument15 pages90 Day Year BlueprintKen maz100% (1)

- Brand Identity and Strategies of Couverture & The GarbstoreDocument6 pagesBrand Identity and Strategies of Couverture & The GarbstorefakhrulNo ratings yet

- Facebook Groups: Guide To Effectively Using FB Groups For Fast ResultsDocument9 pagesFacebook Groups: Guide To Effectively Using FB Groups For Fast ResultsinGrill MediaNo ratings yet

- Tugas Inggris M Edi SuryaDocument9 pagesTugas Inggris M Edi SuryaAstaghfirullahNo ratings yet

- WELD-Electrical Characteristics of An Arc (With Diagram) - MetallurgyDocument4 pagesWELD-Electrical Characteristics of An Arc (With Diagram) - MetallurgypeterNo ratings yet

- Myanmar Health Assistant Association Vacancy Announcement (VA - 103/2021 MHAA-HR)Document3 pagesMyanmar Health Assistant Association Vacancy Announcement (VA - 103/2021 MHAA-HR)Win Moe KyawNo ratings yet

- Storage Facility Closure Plan (Template)Document2 pagesStorage Facility Closure Plan (Template)paolo sangalangNo ratings yet

- TYPES OF ADVERTISING CLassification of AdvertisingDocument127 pagesTYPES OF ADVERTISING CLassification of AdvertisingTejaswi PundhirNo ratings yet

- Warranties Liabilities Patents Bids and InsuranceDocument39 pagesWarranties Liabilities Patents Bids and InsuranceIVAN JOHN BITONNo ratings yet