Professional Documents

Culture Documents

Publish To Web Q4 12

Publish To Web Q4 12

Uploaded by

leadyourlifeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Publish To Web Q4 12

Publish To Web Q4 12

Uploaded by

leadyourlifeCopyright:

Available Formats

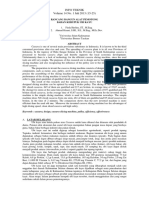

SALES BREAKDOWN BY SEGMENT

Q4 MO PERFORMANCE

Per Segment

2012

2011

OEM

4,210

50.9%

3,703

50.3%

REM

3,347

40.4%

2,930

39.8%

721

8.7%

730

9.9%

8,277

100.0%

7,364

100.0%

Export

Total

2012

2011

OEM

REM

Export

8.7%

40.4%

9.9%

50.3%

50.9%

39.8%

PT ASTRA OTOPARTS Tbk CONSOLIDATED

FINANCIAL HIGHLIGHTS (audited) in IDR million for 12 month period

(Except income from operation per share, earnings per share and percentages)

in million Rupiah, unless stated otherwise

31 Dec 2012

31 Dec 2011

Consolidated Income Statement

Net Revenue

Gross Profit

Operating Profit

Profit Attributable to Owners of the Parent (AOP)

Income from Operation per Share

Earnings per Share *

8,277,485

1,356,275

475,534

1,053,246

123

273

7,363,659

1,237,601

519,548

1,006,716

135

261

Balance Sheet

Total Assets

Total Current Assets

Investment in Share of Stock

Property, Plant and Equipment - net

Total Current Liabilities

Total Liabilities **

Net Working Capital ***

Total Equity (Exclude Non-controlling Interests)

Non-controlling Interests

8,881,642

3,205,631

3,079,213

2,084,184

2,751,766

3,396,543

1,403,267

5,132,113

352,986

6,964,227

2,509,443

2,485,324

1,547,831

1,892,818

2,241,333

1,183,940

4,423,554

299,340

Ratio Analysis and Other Information

Gross Profit Margin

Operating Margin

Net Asset value per Share (Rp)

Return on Assets (annualized)

Return on Equity (annualized)

Current Ratio

Debt to Equity Ratio

Debt to Assets Ratio

Issued Shares (in millions)****

16.4%

5.7%

1,331

11.9%

20.5%

1.16

32.1%

18.5%

3,855.79

16.8%

7.1%

1,147

14.5%

22.8%

1.33

20.2%

12.8%

3,855.79

Notes:

*

**

***

****

Earning per share is computed by dividing net income with the weighted average number of shares outstanding

during the year.

Total Current Liabilities + Total Non Current Liabilities

Trade Receivable+Inventory- Current Trade Payables

After effect of stock split

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Publish To Web Q4 13Document2 pagesPublish To Web Q4 13leadyourlifeNo ratings yet

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasNo ratings yet

- Analysis of Financial StatementDocument4 pagesAnalysis of Financial StatementArpitha RajashekarNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Financial Highlights: in This Annual Report $ Denotes US$Document2 pagesFinancial Highlights: in This Annual Report $ Denotes US$Harish PotnuriNo ratings yet

- Historia Financiera 2011 - 2013Document1 pageHistoria Financiera 2011 - 2013Diego MoralesNo ratings yet

- Faysal Bank Spread Accounts 2012Document133 pagesFaysal Bank Spread Accounts 2012waqas_haider_1No ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Analisis Laporan Keuangan PT XL AXIATA TBKDocument9 pagesAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- Bull 2012arDocument197 pagesBull 2012arMayawidiNo ratings yet

- Merk v2Document19 pagesMerk v2Ardian WidiNo ratings yet

- Hero Honda Motors LTD.: Results ReviewDocument7 pagesHero Honda Motors LTD.: Results ReviewVidhan KediaNo ratings yet

- AR2011Document144 pagesAR2011Seharum MyoriNo ratings yet

- Balance Sheet of John Limited As OnDocument19 pagesBalance Sheet of John Limited As OnAravind MaitreyaNo ratings yet

- EBBM SEM 1, 2012/2013: Fin 4150 - Financial Statement AnalysisDocument4 pagesEBBM SEM 1, 2012/2013: Fin 4150 - Financial Statement AnalysismmdinarNo ratings yet

- First Quarter Ended March 31 2012Document24 pagesFirst Quarter Ended March 31 2012Wai HOngNo ratings yet

- Aftab Automobiles Limited: 27,2009, We Are Pleased To Forward Herewith The Un-Audited Statement of ComprehensiveDocument4 pagesAftab Automobiles Limited: 27,2009, We Are Pleased To Forward Herewith The Un-Audited Statement of ComprehensiveNur Md Al HossainNo ratings yet

- Ings BHD RR 3Q FY2012Document6 pagesIngs BHD RR 3Q FY2012Lionel TanNo ratings yet

- 155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportDocument14 pages155.ASX IAW Aug 16 2012 16.33 Preliminary Final ReportASX:ILH (ILH Group)No ratings yet

- PT Ever Shine Tex TBK.: Summary of Financial StatementDocument2 pagesPT Ever Shine Tex TBK.: Summary of Financial StatementIshidaUryuuNo ratings yet

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNo ratings yet

- 9 ICBP 2014 Fiancial HighlightsDocument1 page9 ICBP 2014 Fiancial HighlightsyansenbarusNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Financial Highlights 2010Document2 pagesFinancial Highlights 2010adityahrcNo ratings yet

- 5 Years Financial ReportDocument1 page5 Years Financial ReportJJ Firdaus AliNo ratings yet

- Key RatiosDocument2 pagesKey RatiosKhalid MahmoodNo ratings yet

- 2011 Results Presentation SlidesDocument56 pages2011 Results Presentation SlidesTarun GuptaNo ratings yet

- Samsung C&T 2Q11 EarningsDocument18 pagesSamsung C&T 2Q11 EarningsSam_Ha_No ratings yet

- Alok Result 30 Sept 2011Document24 pagesAlok Result 30 Sept 2011Mohnish KatreNo ratings yet

- MSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012Document4 pagesMSSL Unaudited Financial Results For The Quarter Nine Months Ended 31dec 2012kpatil.kp3750No ratings yet

- Pevc Q1Document8 pagesPevc Q1Ankit JohariNo ratings yet

- Qian Hu - 2012 4Q - PresDocument8 pagesQian Hu - 2012 4Q - PreskilaalaaNo ratings yet

- EV CalcDocument11 pagesEV CalcDeepak KapoorNo ratings yet

- 2011 24 Cash Flow StatementDocument1 page2011 24 Cash Flow StatementM Ali JahanNo ratings yet

- Asok 06 08Document1 pageAsok 06 08rahulbalujaNo ratings yet

- Profit and Loss StatementDocument2 pagesProfit and Loss StatementSaleh RehmanNo ratings yet

- Third Quarter Ended 31 December 2011Document19 pagesThird Quarter Ended 31 December 2011Norliza YusofNo ratings yet

- Selected Financial Summary (U.S. GAAP) : For The YearDocument82 pagesSelected Financial Summary (U.S. GAAP) : For The YearshanzarapunzleNo ratings yet

- Income Statement: Assets Non-Current AssetsDocument213 pagesIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- TSL Audited Results For FY Ended 31 Oct 13Document2 pagesTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNo ratings yet

- CSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial StatementsDocument13 pagesCSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial StatementsLBTodayNo ratings yet

- Annual Report PT Dharma Satya Nusantara TBK 2013Document185 pagesAnnual Report PT Dharma Satya Nusantara TBK 2013Rudy Sebayang100% (1)

- Trading Information 2011 2010 2009 2008Document10 pagesTrading Information 2011 2010 2009 2008Fadi MashharawiNo ratings yet

- Advanced Financial Accounting & Reporting AnswerDocument13 pagesAdvanced Financial Accounting & Reporting AnswerMyat Zar GyiNo ratings yet

- EAHDocument83 pagesEAHJames WarrenNo ratings yet

- Vodafone Vs AirtelDocument13 pagesVodafone Vs AirtelMuhammad Irfan ZafarNo ratings yet

- Progress Report June 2011Document21 pagesProgress Report June 2011Lasantha DadallageNo ratings yet

- Bakrie Sumatra Plantations 2012 Annual ReportDocument330 pagesBakrie Sumatra Plantations 2012 Annual ReportAntEsillorNo ratings yet

- Padaeng FS Dec2011Document35 pagesPadaeng FS Dec2011reine1987No ratings yet

- Performance Highlights: NeutralDocument10 pagesPerformance Highlights: NeutralAngel BrokingNo ratings yet

- HCL Technologies LTD 170112Document3 pagesHCL Technologies LTD 170112Raji_r30No ratings yet

- Mahindra Satyam Result UpdatedDocument11 pagesMahindra Satyam Result UpdatedAngel BrokingNo ratings yet

- HUL MQ 12 Results Statement - tcm114-286728Document3 pagesHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNo ratings yet

- Blue Star Result UpdatedDocument10 pagesBlue Star Result UpdatedAngel BrokingNo ratings yet

- Consolidated Accounts June-2011Document17 pagesConsolidated Accounts June-2011Syed Aoun MuhammadNo ratings yet

- Rallis India Result UpdatedDocument9 pagesRallis India Result UpdatedAngel BrokingNo ratings yet

- SpiceJet Result UpdatedDocument9 pagesSpiceJet Result UpdatedAngel BrokingNo ratings yet

- ID Rancang Bangun Alat Pemotong Bahan KerupDocument11 pagesID Rancang Bangun Alat Pemotong Bahan KerupleadyourlifeNo ratings yet

- ISO/TS 16949:2009 Checklist - QWBT Issue: Ref. Question CommentsDocument40 pagesISO/TS 16949:2009 Checklist - QWBT Issue: Ref. Question CommentsleadyourlifeNo ratings yet

- Publish To Web Q4 13Document2 pagesPublish To Web Q4 13leadyourlifeNo ratings yet

- AutoDocument3 pagesAutoleadyourlifeNo ratings yet