Professional Documents

Culture Documents

Case 11

Case 11

Uploaded by

HealthyYOUOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 11

Case 11

Uploaded by

HealthyYOUCopyright:

Available Formats

Case 11: Risk Analysis

Magnate, Inc., is a Texas-based manufacturer and distributor of

components and replacement parts for the auto, machinery, farm, and

construction equipment industries. The company is presently funding a

program of capital investment that is necessary to reduce production costs,

and thereby meet an onslaught of competition from low-cost suppliers

located in Mexico and throughout Latin America. Magnate has a limited

amount of capital available, and must carefully weigh both the risk and

potential rewards associated with alternative investments. In particular, the

company seeks to weigh the advantages and disadvantages of a new

investment project, Project X, in light of two other recently adopted

investment projects, Project Y and Project Z:

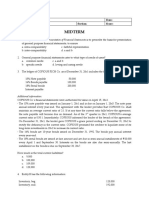

Expected Cash Flows After Tax (CFAT) per year

Proje X Project Y

Year ($) ($) Project Z ($)

1996 10,000 20,000 -

1997 10,000 18,000 2,500

1998 10,000 16,000 5,000

1999 10,000 14,000 7,500

2000 10,000 12,000 10,000

2001 10,000 10,000 12,500

2002 10,000 8,000 15,000

2003 10,000 6,000 17,500

2004 10,000 4,000 20,000

2005 10,000 2,000 22,500

PV of Cash Flow @ 5% $91,131 $79,130

Investment Outlay in

1995: $60,000 $60,000 $50,000

A. Using a 5% risk-free rate, calculate the present value of expected cash

flows after tax (CFAT) for the ten-year life of Project X.

B. Calculate the minimum certainty equivalent adjustment factor for each

project’s CFAT that would justify investment in each project.

C. Assume that the management of Magnate is risk averse and uses the

certainty equivalent method in decision making. Is Project X as attractive

or more attractive than Projects Y and Z?

D. If the company would not have been willing to invest more than $60,000

in Project Y nor more than $50,000 in Project Z, should Project X be

undertaken?

You might also like

- Soalan Webex 3Document2 pagesSoalan Webex 3lenakaNo ratings yet

- Managerial Economics Final ExamDocument1 pageManagerial Economics Final ExamHealthyYOU100% (5)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- 26-06-2020 Financial Management Suggested AnswersDocument3 pages26-06-2020 Financial Management Suggested AnswersJEANNo ratings yet

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- Assignement No 4Document5 pagesAssignement No 4Elina aliNo ratings yet

- Assignement No 4Document5 pagesAssignement No 4Elina aliNo ratings yet

- BF2 AssignmentDocument5 pagesBF2 AssignmentIbaad KhanNo ratings yet

- Financial Management 1 CatDocument9 pagesFinancial Management 1 CatcyrusNo ratings yet

- Assignment - 1 (Capital Budgeting)Document3 pagesAssignment - 1 (Capital Budgeting)AnusreeNo ratings yet

- 3 Annual Worth MethodDocument29 pages3 Annual Worth MethodAngel NaldoNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- Applied Value Knowledge Opportunistic MA in Times of CrisisDocument12 pagesApplied Value Knowledge Opportunistic MA in Times of CrisisfabrlafontNo ratings yet

- Finance Management-Week 8Document12 pagesFinance Management-Week 8arwa_mukadam03No ratings yet

- 10.2 BASTRCSX Learning Activity 9 and 10 - StudentsDocument4 pages10.2 BASTRCSX Learning Activity 9 and 10 - Studentssam imperialNo ratings yet

- Corporate FinanceDocument4 pagesCorporate Financegianluigi de rubertisNo ratings yet

- Cap Budg QuestionsDocument6 pagesCap Budg QuestionsSikandar AsifNo ratings yet

- TutDocument2 pagesTutElzubair EljaaliNo ratings yet

- End of Chapter 11 SolutionDocument19 pagesEnd of Chapter 11 SolutionsaniyahNo ratings yet

- ConsultaDocument17 pagesConsultaDQNIELNo ratings yet

- Tugas Individu I MKB Capital BudgetingDocument4 pagesTugas Individu I MKB Capital BudgetingAndryo RachmatNo ratings yet

- LAB 4 Capital Budgeting 2024Document3 pagesLAB 4 Capital Budgeting 2024asthapatel.akpNo ratings yet

- Investment Appraisal CasesDocument4 pagesInvestment Appraisal CasesmatheussNo ratings yet

- Assignment #3 V4Document4 pagesAssignment #3 V4SumitGaikwadNo ratings yet

- Gaurav Solanki Section E 447 Assingment 3Document10 pagesGaurav Solanki Section E 447 Assingment 3Praveen Singh ChauhanNo ratings yet

- Binder 1Document105 pagesBinder 1prineetu143No ratings yet

- Ch#7 Practice Problem SolutionDocument4 pagesCh#7 Practice Problem SolutionF0x123100% (1)

- Tutorial Sheet For Engineering EconomicsDocument12 pagesTutorial Sheet For Engineering EconomicsTinashe ChikariNo ratings yet

- Exercises Chap3Document3 pagesExercises Chap3Nguyễn Phương Nhi 12C2No ratings yet

- BenefitsDocument3 pagesBenefitsPeninahNo ratings yet

- Chapter 8Document31 pagesChapter 8laurenbondy44No ratings yet

- BU6009 Assessment 4Document3 pagesBU6009 Assessment 4Sana MohdNo ratings yet

- Capital Budgeting Simulated ExamDocument11 pagesCapital Budgeting Simulated ExamSarah BalisacanNo ratings yet

- W10 Case Study Capital BudgetingDocument2 pagesW10 Case Study Capital BudgetingJuanNo ratings yet

- 620669c280570504de6f585f Office DocumentDocument3 pages620669c280570504de6f585f Office DocumentParas RastogiNo ratings yet

- MIDTERM EXAM FDocument14 pagesMIDTERM EXAM FJoyce LunaNo ratings yet

- Kuis - Financial Lab ModelingDocument2 pagesKuis - Financial Lab Modelingalexandersur9No ratings yet

- Solution Assignment 6 2Document16 pagesSolution Assignment 6 2irinasarjveladze19No ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementVratish AryagNo ratings yet

- MAS Part II Illustrative Examples (Capital Budgeting)Document2 pagesMAS Part II Illustrative Examples (Capital Budgeting)Princess SalvadorNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- Intermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreDocument19 pagesIntermediate Accounting 3 Final Examination: Name: Date: Professor: Section: ScoreMay Ramos100% (2)

- Financial Reporting Week 1 Class 1 Important!Document18 pagesFinancial Reporting Week 1 Class 1 Important!Lin SongNo ratings yet

- Finance Questions 3Document2 pagesFinance Questions 3asma raeesNo ratings yet

- 1 - 9 QuestionDocument1 page1 - 9 QuestionBùi Thị Thu HoàiNo ratings yet

- Ch. 11 - 13ed CF EstimationDocument69 pagesCh. 11 - 13ed CF EstimationFarahditaNo ratings yet

- Ca Inter FM Icai Past Year Q Ca Namir AroraDocument193 pagesCa Inter FM Icai Past Year Q Ca Namir AroraPankaj MeenaNo ratings yet

- Engineering Economy Alday Ric Harold MDocument6 pagesEngineering Economy Alday Ric Harold MHarold AldayNo ratings yet

- CH 13b BASICS OF CAPITAL BUDGETINGDocument2 pagesCH 13b BASICS OF CAPITAL BUDGETINGSadia YasmeenNo ratings yet

- Com 203 (FM) - Capital Budgeting TechniquesDocument10 pagesCom 203 (FM) - Capital Budgeting TechniquesYash GangwaniNo ratings yet

- CapbdgtDocument25 pagesCapbdgtmajidNo ratings yet

- Exercise On CVP - CB PDFDocument3 pagesExercise On CVP - CB PDFqwertNo ratings yet

- QA&DM Assignment Fanta1Document12 pagesQA&DM Assignment Fanta1Getu WeyessaNo ratings yet

- Risk and Uncertainity in Capital BudgetingDocument3 pagesRisk and Uncertainity in Capital Budgeting9909922996No ratings yet

- FIN5FMA Tutorial 4 SolutionsDocument5 pagesFIN5FMA Tutorial 4 SolutionsMaruko ChanNo ratings yet

- Soalan FinanceDocument27 pagesSoalan FinanceNur Ain SyazwaniNo ratings yet

- Ise 307Document56 pagesIse 307Hussain Ali Al-HarthiNo ratings yet

- Prospers.: If You Have Diabetes, Mineral Supplementation Is More Than Important, It Is Vital!Document2 pagesProspers.: If You Have Diabetes, Mineral Supplementation Is More Than Important, It Is Vital!HealthyYOUNo ratings yet

- CholesterolDocument2 pagesCholesterolHealthyYOUNo ratings yet

- HCI CMD Free ReportDocument9 pagesHCI CMD Free ReportHealthyYOUNo ratings yet

- HCI Biz Rally Aug2013Document1 pageHCI Biz Rally Aug2013HealthyYOUNo ratings yet

- HCI CMD Free ReportDocument10 pagesHCI CMD Free ReportHealthyYOUNo ratings yet

- HCIBiz Opportunity RallyDocument1 pageHCIBiz Opportunity RallyHealthyYOUNo ratings yet

- CholesterolDocument2 pagesCholesterolHealthyYOUNo ratings yet

- Newsletter Dec 2010Document2 pagesNewsletter Dec 2010HealthyYOUNo ratings yet

- TeamHealthyYOU! Free Report HCI BizDocument10 pagesTeamHealthyYOU! Free Report HCI BizHealthyYOUNo ratings yet

- Who Else Wants To Be Healthy With Less Pain, Sickness and Disease?Document12 pagesWho Else Wants To Be Healthy With Less Pain, Sickness and Disease?HealthyYOUNo ratings yet

- HealthyYOU! Enewsletter February 2012 IssueDocument1 pageHealthyYOU! Enewsletter February 2012 IssueHealthyYOUNo ratings yet

- Final Exam 7Document4 pagesFinal Exam 7HealthyYOUNo ratings yet

- Final Exam 3Document4 pagesFinal Exam 3HealthyYOU50% (2)

- Final Exam 7Document4 pagesFinal Exam 7HealthyYOUNo ratings yet

- Final Exam 6Document4 pagesFinal Exam 6HealthyYOUNo ratings yet

- Final Exam 7Document4 pagesFinal Exam 7HealthyYOUNo ratings yet

- Final Exam 4Document4 pagesFinal Exam 4HealthyYOU100% (1)

- Final Exam 2Document4 pagesFinal Exam 2HealthyYOU0% (1)

- Final Exam 1Document4 pagesFinal Exam 1HealthyYOU50% (2)

- Final Exam 6Document4 pagesFinal Exam 6HealthyYOUNo ratings yet

- Final Exam 5Document3 pagesFinal Exam 5HealthyYOUNo ratings yet

- Final Exam 4Document4 pagesFinal Exam 4HealthyYOU100% (1)

- Take Home Quiz 1Document4 pagesTake Home Quiz 1HealthyYOUNo ratings yet

- Final Exam 2Document4 pagesFinal Exam 2HealthyYOU0% (1)

- Final Exam 3Document4 pagesFinal Exam 3HealthyYOU50% (2)

- Final Exam 1Document4 pagesFinal Exam 1HealthyYOU50% (2)