Professional Documents

Culture Documents

(A) Prepared A Journey Entry To Record The Allocation On 1 January 2014 and The Actual Collection of Revenues and Payment of Expenditures Based On Date Given

(A) Prepared A Journey Entry To Record The Allocation On 1 January 2014 and The Actual Collection of Revenues and Payment of Expenditures Based On Date Given

Uploaded by

kctOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(A) Prepared A Journey Entry To Record The Allocation On 1 January 2014 and The Actual Collection of Revenues and Payment of Expenditures Based On Date Given

(A) Prepared A Journey Entry To Record The Allocation On 1 January 2014 and The Actual Collection of Revenues and Payment of Expenditures Based On Date Given

Uploaded by

kctCopyright:

Available Formats

TEOH KHAR CHUAN 219924

1. (a) Prepared a journey entry to record the allocation on 1 st January 2014 and the

actual collection of revenues and payment of expenditures based on date given.

Dr.

Estimated Revenue

RM 14,531.74

Fund Balance

RM 8,906.23

Cr. Estimated Expenditure

RM 23,437.97

Dr.

Cash

RM 500

Cr. Fund Balance

RM 500

Dr.

Cash (0.25 x 7,441.896)

RM 1,860.47

Cr. Tax Revenue (Direct Tax)

RM 1,860.47

Dr.

Cash [(0.85 x 12,166.5) 1,860.47] RM 8,481.06

Cr. Tax Revenue

RM 8,481.06

Dr.

Cash

RM 1,500

Cr. Tax Revenue

RM 1,500

Dr.

Cash

RM 2,000

Cr. Tax Revenue

RM 2,000

Dr.

Cash

RM 500

Cr. Tax Revenue

RM 500

Dr.

Cash (33.4 + 85)

RM 118.4

Cr. Non Tax Revenue

RM 118.4

Dr.

Cash (161 + 241)

RM 402

Cr. Non Tax Revenue

RM 402

Dr.

Cash (1,300 118.4 402)

RM 779.6

Cr. Non Tax Revenue

RM 779.6

Dr.

Cash (0.9 x 483.14)

RM 434.83

Cr. Non-Revenue Receipts

RM 434.83

Dr.

Emolument

RM 5,156

Services & Supplies

RM 1,300

Asset

RM 2,000

Fixed charges

RM 3,500

Other Expenditure

RM 150

Cr. Cash

RM 12,106

st

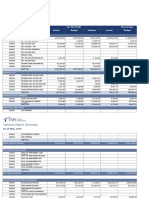

(b) Prepared a trial balance at 31 December 2014

Malaysian Federal Government

Trial Balance

As at 31 December 2014

Dr. (RM)

Cr. (RM)

Cash

4, 470.36

Tax Revenue

14, 341.53

Non Tax Revenue

1,300

Non-Revenue Receipts

434.83

Emolument

5, 156

Services & Supplies

1, 300

Asset

2, 000

Fixed Charges

3, 500

1

TEOH KHAR CHUAN 219924

Other Expenditure

Fund Balance

150

16,576.36

500

16576.36

You might also like

- D Web OPResume Upload 10178 Project 30551 File 50130 Accountingweek4HWyouSKQODocument6 pagesD Web OPResume Upload 10178 Project 30551 File 50130 Accountingweek4HWyouSKQOChristy Wu100% (1)

- Clinic Revenue Audit 2020Document4 pagesClinic Revenue Audit 2020Ukeje ChikaNo ratings yet

- Office of Councilor John Marvin Yul Servo Nieto: Caccomplishment Report Month of February 2014Document2 pagesOffice of Councilor John Marvin Yul Servo Nieto: Caccomplishment Report Month of February 2014Peng GuintoNo ratings yet

- Spjfung Rpt-Dinkes1 PDFDocument154 pagesSpjfung Rpt-Dinkes1 PDFHartono WafaNo ratings yet

- (BA 123) Answer Audit of LiabilitiesDocument14 pages(BA 123) Answer Audit of LiabilitiesJuvy DimaanoNo ratings yet

- Variance Report SummaryDocument10 pagesVariance Report SummaryMark Domingo MendozaNo ratings yet

- SAOB AS OF December 31 2011Document5 pagesSAOB AS OF December 31 2011bacsecNo ratings yet

- Solutions To Multiple Choice Questions, Exercises and ProblemsDocument41 pagesSolutions To Multiple Choice Questions, Exercises and ProblemsJan SpantonNo ratings yet

- P2 2BDocument6 pagesP2 2BStella Tralalatrilili0% (2)

- Analisis Penyajian Laporan Operasional Berbasis Akrual Pada Satuan Kerja Perangkat Daerah (SKPD) Provinsi Sulawesi TengahDocument12 pagesAnalisis Penyajian Laporan Operasional Berbasis Akrual Pada Satuan Kerja Perangkat Daerah (SKPD) Provinsi Sulawesi TengahNurul Isda FahridaNo ratings yet

- Lampiran 1 SSK Kab - Karawang 2017Document20 pagesLampiran 1 SSK Kab - Karawang 2017Daron DaronoNo ratings yet

- EMB 834 Test - Aliyu ObabiOlorunkosi GafaarDocument7 pagesEMB 834 Test - Aliyu ObabiOlorunkosi GafaarAliyu GafaarNo ratings yet

- Buku Jurnal PPKD: Uraian Debet Kredit No. TanggalDocument22 pagesBuku Jurnal PPKD: Uraian Debet Kredit No. TanggalSabrina BellaNo ratings yet

- Stom TP Group 1Document12 pagesStom TP Group 1Meryll Jhoy TejamNo ratings yet

- Pleasure HuntDocument13 pagesPleasure HuntSachin RaikarNo ratings yet

- Kidanu HinkosaDocument3 pagesKidanu Hinkosakidanu enkosaNo ratings yet

- Shoe Store - Financial 4 MonthsDocument2 pagesShoe Store - Financial 4 MonthsGytzel AranzelyNo ratings yet

- Irpf 14 SabecoDocument1 pageIrpf 14 SabecoMaite GonzálezdelaNavaNo ratings yet

- Bond Price 100,000Document22 pagesBond Price 100,000HAMMADHRNo ratings yet

- Tugas Bab 5 AbcDocument4 pagesTugas Bab 5 AbcAshari PsiNo ratings yet

- Operational Guideline 2019-20 - IdspDocument34 pagesOperational Guideline 2019-20 - Idspkrishna bptNo ratings yet

- Feasibility Study of ProjectDocument15 pagesFeasibility Study of ProjectMauliddha RachmiNo ratings yet

- Exercise Chapter 3: Adjusting The AccountsDocument9 pagesExercise Chapter 3: Adjusting The AccountsSeany Sukmawati100% (3)

- 2023 GaaDocument60 pages2023 GaaManuel EscasuraNo ratings yet

- Managerial Accounting: SectionDocument17 pagesManagerial Accounting: SectionNostecNo ratings yet

- June 2003Document29 pagesJune 2003johnny458No ratings yet

- Reviewer For FinalsDocument18 pagesReviewer For FinalsjhannashantiNo ratings yet

- CFS FinalDocument4 pagesCFS FinalRajesh VemareddyNo ratings yet

- CMNN SZ BSDocument2 pagesCMNN SZ BSkaushalNo ratings yet

- Las Nieves Executive Summary 2015Document7 pagesLas Nieves Executive Summary 2015Henry AunzoNo ratings yet

- Executive Summary A.Introduction: Comparative Presentation of Total Assets, Liabilities, Equity, Income and ExpensesDocument8 pagesExecutive Summary A.Introduction: Comparative Presentation of Total Assets, Liabilities, Equity, Income and ExpensesArchAngel Grace Moreno BayangNo ratings yet

- Data PenelitianDocument4 pagesData PenelitianJohan SuryaNo ratings yet

- Acid Slurry (ALKYL Benzene Sulphonate) : Ntroduction Arket OtentialDocument5 pagesAcid Slurry (ALKYL Benzene Sulphonate) : Ntroduction Arket OtentialRajul GargNo ratings yet

- Exercise Cash FlowDocument5 pagesExercise Cash FlowSiti AishahNo ratings yet

- Dpsaf 1 NotesDocument7 pagesDpsaf 1 NotesshadrackteklaNo ratings yet

- Expense Report AnnelieDocument9 pagesExpense Report Annelieapi-255370969No ratings yet

- The Hospital: Fast FactsDocument40 pagesThe Hospital: Fast Factsmeshuaib100% (1)

- Dolphin Sea Food Restaurant: Gulistan E Jauhar KarachiDocument19 pagesDolphin Sea Food Restaurant: Gulistan E Jauhar KarachitariqNo ratings yet

- Rka Bok 2018 Final Update 1 - 2Document233 pagesRka Bok 2018 Final Update 1 - 2asmiyatunNo ratings yet

- I) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedDocument12 pagesI) .Oeurnent Lsibiiaiin Aftidaviiisuppleiuciit Reqcl1Ud 1) O (I:Ments Form No. Attached. Attached AutichedChapter 11 DocketsNo ratings yet

- BudgetDocument1 pageBudgetAnil Krishna ReddyNo ratings yet

- Pemerintah Kabupaten Semarang UPTD Puskesmas Bergas: Uraian 2022 2021 Kenaikan / PenurunanDocument5 pagesPemerintah Kabupaten Semarang UPTD Puskesmas Bergas: Uraian 2022 2021 Kenaikan / PenurunanbokpkmsimpangulimNo ratings yet

- Null O4mf44azdcfh646x.1Document15 pagesNull O4mf44azdcfh646x.1Clipsal ClipsalNo ratings yet

- Project 2 Workbook AB 1 Wendell PayneDocument11 pagesProject 2 Workbook AB 1 Wendell PayneshirazasadNo ratings yet

- HUL Annual Report 2011-12 For Sessions-17-19Document164 pagesHUL Annual Report 2011-12 For Sessions-17-19Sakshi YadavNo ratings yet

- (OhfwurvwdwlfvDocument16 pages(Ohfwurvwdwlfvminhhuan0101No ratings yet

- Tura Polytechnic, Tura: Department of Food Processing and PreservationDocument20 pagesTura Polytechnic, Tura: Department of Food Processing and PreservationNehbor MadurNo ratings yet

- Profile of Fisheries: Uttar PradeshDocument3 pagesProfile of Fisheries: Uttar PradeshArun AbNo ratings yet

- I.M.S. Vessel: Date Particulars RsDocument2 pagesI.M.S. Vessel: Date Particulars RsAshokz RockzzNo ratings yet

- Insaf Pharmaceu-Wps OfficeDocument23 pagesInsaf Pharmaceu-Wps OfficeHasnain KhanNo ratings yet

- Enclosures For Tms Cycle Meeting - 1st Qtr. 2015-16Document5 pagesEnclosures For Tms Cycle Meeting - 1st Qtr. 2015-16abhi.206bNo ratings yet

- Start-Up Funding: Financial PlanDocument3 pagesStart-Up Funding: Financial Planamar_cool_adityaNo ratings yet

- Dolores Executive Summary 2013Document6 pagesDolores Executive Summary 2013Lyrics DistrictNo ratings yet

- Costing Ans 2Document16 pagesCosting Ans 2Shikha SinghNo ratings yet

- Business PlanDocument4 pagesBusiness PlanDanaNo ratings yet

- A Project On Mushroom CultivationDocument24 pagesA Project On Mushroom CultivationsunitatevatiyaNo ratings yet

- 2016 IRA For Barangays - QuezonDocument79 pages2016 IRA For Barangays - QuezonDBM CALABARZONNo ratings yet

- Year End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Document58 pagesYear End Adjustments - Accruals & Prepayments: Woods, Chapter 28 Thomas, Chapter 13Hendry Heng Wei XiangNo ratings yet

- Skema BM 2 2 KelantanDocument17 pagesSkema BM 2 2 KelantankctNo ratings yet

- bm-1-2 KelantanDocument3 pagesbm-1-2 KelantankctNo ratings yet

- MDocument1 pageMkctNo ratings yet

- New Doc 2018-11-15 17.49.26 PDFDocument2 pagesNew Doc 2018-11-15 17.49.26 PDFkctNo ratings yet

- bm-2-3 KelantanDocument10 pagesbm-2-3 KelantankctNo ratings yet

- New Doc 2018-11-22 22.05.32Document5 pagesNew Doc 2018-11-22 22.05.32kctNo ratings yet

- Exercise: Management Control SystemDocument2 pagesExercise: Management Control SystemkctNo ratings yet

- 1 - Introduction To Accounting and BusinessDocument48 pages1 - Introduction To Accounting and BusinesskctNo ratings yet

- STPM Trials 2009 Perakaunan Paper 1 (KL)Document13 pagesSTPM Trials 2009 Perakaunan Paper 1 (KL)kctNo ratings yet

- Third Edition: John J. WildDocument41 pagesThird Edition: John J. WildkctNo ratings yet

- The Influence of Knowledge Management and Leveraging of Intellectual Capital On The Organization Performance: A Case Study of Telekom MalaysiaDocument6 pagesThe Influence of Knowledge Management and Leveraging of Intellectual Capital On The Organization Performance: A Case Study of Telekom MalaysiakctNo ratings yet

- Accounting Counts: Why Take High School Accounting?Document14 pagesAccounting Counts: Why Take High School Accounting?kctNo ratings yet

- SJK (C) Pei Hwa Ear 2 English Language Assessment 3: A.M.Chong/Bahasa Inggeris/Tahun 2/Ogos/Muka Surat 1Document6 pagesSJK (C) Pei Hwa Ear 2 English Language Assessment 3: A.M.Chong/Bahasa Inggeris/Tahun 2/Ogos/Muka Surat 1kctNo ratings yet

- Toolkit Removing Board MembersDocument2 pagesToolkit Removing Board MemberskctNo ratings yet

- SJK (C) Pei Hwa Ear 2 English Language Assessment (4) : Yeap Choo Bin / English Language / October / Year 2 / Page 1Document6 pagesSJK (C) Pei Hwa Ear 2 English Language Assessment (4) : Yeap Choo Bin / English Language / October / Year 2 / Page 1kctNo ratings yet

- Bkal 3023Document5 pagesBkal 3023kctNo ratings yet

- JWP A142 Final 7apr15Document96 pagesJWP A142 Final 7apr15kctNo ratings yet