Professional Documents

Culture Documents

Nasir Energy Saving Lamp Industries Limited: Statement of Financial Position

Nasir Energy Saving Lamp Industries Limited: Statement of Financial Position

Uploaded by

PratikBhowmickOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nasir Energy Saving Lamp Industries Limited: Statement of Financial Position

Nasir Energy Saving Lamp Industries Limited: Statement of Financial Position

Uploaded by

PratikBhowmickCopyright:

Available Formats

Nasir Energy Saving Lamp Industries

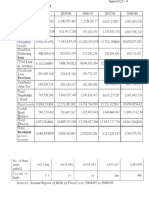

Statement of Financial Position

Description

Non Current Assets:

Property, Plant & Equipment

Capital Work-in-progress

30.06.2014

379,570,147

379,570,147

-

30.06.2013

405,081,766

405,081,766

-

Current Assets:

Advances, Deposits and Prepayment

Inventories

Cash & Cash equivalents

199,209,138

13,021,470

186,115,484

72,184

235,899,740

13,528,258

222,044,329

327,153

Total Assets

578,779,285

640,981,506

Shareholders Equity

Share Capital

Retained Earnings

68,204,145

2,500,000

65,704,145

(48,782,933)

2,500,000

(51,282,933)

Current Liabilities

Short term loan

Security Deposit from Supplier

Sundry Creditors

Inter Company payable

510,575,140

1,000,220,652

1,883,034

(491,528,546)

689,764,439

502,154,098

3,276,264

2,134,913

182,199,164

Total Shareholders Equity and Liabilities

578,779,285

640,981,506

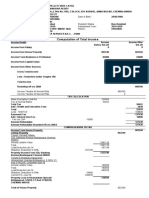

Nasir Energy Saving Lamp Industries

Statement of Comprihensive Income

Description

30.06.2014

Revenue

Cost of Goods Sold

Gross Profit

404,553,441

(148,496,067)

256,057,374

Operating Expense:

General & Administrative Expense

Selling and Distribution Expense

(20,390,875)

(12,398,303)

(7,992,572)

30.06.2013

63%

201,802,669

(111,668,244)

90,134,425

3%

2%

(18,959,671)

(13,493,233)

(5,466,438)

Operating profit

235,666,499

71,174,754

Finance Cost

Contribution to WPPF

Other Income-weaving charge

Profit before income tax

(118,679,421)

116,987,078

(93,629,610)

(22,454,856)

Provision for income tax

Current tax

Deferred tax

Tax holiday reserve

Net profit for the year

Earning Per Share (EPS)

116,987,078

(22,454,856)

4,679.48

(898.19)

Cost of Goods Sold

Opening Raw Materials

Add: Purchase during the year

Less: Closing stock of raw material

Raw Material Consumption

Factory Overhead (Note-15.01)

Cost of Goods Manufacture

Add: Opening Stock of Finished Goods

Less: Closing Stock of Finished Goods

Cost of Goods Sold

188,729,061

56,496,313

154,937,519

90,287,855

56,876,600

147,164,455

31,313,743

178,478,198

29,982,131

148,496,067

0

61%

39%

155,625,687

81,808,298

188,729,061

48,704,924

53,753,586

102,458,510

40,523,477

142,981,987

31,313,743

111,668,244

(0)

Industries Limited

al Position

30.06.2012

416,533,134

416,533,134

-

30.06.2011

224,700,375

208,081,018

10,021,680

198,009,703

49,635

99,222,662

624,614,152

323,923,037

23,372,820

201,327,555

21,534,996

77,543,068

144,598

(26,328,077)

2,500,000

(28,828,077)

(4,039,407)

2,500,000

(6,539,407)

650,942,229

568,591,198

3,276,264

243,476

78,831,291

327,962,444

5,320,512

31,070

322,610,862

624,614,152

323,923,037

Industries Limited

rihensive Income

30.06.2012

45%

30,283,334

(12,876,030)

17,407,304

7%

3%

(5,034,295)

(3,627,976)

(1,406,319)

30.06.2011

57%

(3,637,650)

(3,637,650)

12%

5%

(1,605,513)

(1,580,357)

(25,156)

12,373,009

(5,243,163)

(34,661,679)

(22,288,670)

(900,573)

(6,143,736)

48%

52%

(22,288,670)

(6,143,736)

(891.55)

(245.75)

77,543,069

113,785,461

155,625,687

35,702,843

17,696,664

53,399,507

53,399,507

40,523,477

12,876,030

(0)

67%

33%

You might also like

- Notes and Loans Receivable c8 ValixDocument6 pagesNotes and Loans Receivable c8 ValixJames Patrick Antonio75% (12)

- User Training DSE FlexTP DT 20141022Document66 pagesUser Training DSE FlexTP DT 20141022PratikBhowmick40% (5)

- Accelerator Program - Draft Equity AgreementDocument7 pagesAccelerator Program - Draft Equity AgreementmihidaseNo ratings yet

- Financial Analysis of Hotel Investments TEMARIODocument31 pagesFinancial Analysis of Hotel Investments TEMARIOAdrian Villalobos100% (1)

- CCS - Pension - Rules, 1972Document26 pagesCCS - Pension - Rules, 1972Krishnamurthy Raviprakash92% (13)

- Profit & Loss Statement: O' Lites RestaurantDocument7 pagesProfit & Loss Statement: O' Lites RestaurantNoorulain Adnan100% (1)

- Balance SheetDocument90 pagesBalance SheetRashedNo ratings yet

- Executive Summary: Financial Analysis of Square PharmaceuticalsDocument50 pagesExecutive Summary: Financial Analysis of Square PharmaceuticalsPratikBhowmickNo ratings yet

- API Standard 521 Guide For Pressure Relieving and Depressuring Systems PDFDocument1 pageAPI Standard 521 Guide For Pressure Relieving and Depressuring Systems PDFSanket YewaleNo ratings yet

- Beximco Hy2014Document2 pagesBeximco Hy2014Md Saiful Islam KhanNo ratings yet

- Ashok LeylandDocument124 pagesAshok LeylandananndNo ratings yet

- Annual Financial Statements 2007Document0 pagesAnnual Financial Statements 2007hyjulioNo ratings yet

- Desco Final Account AnalysisDocument26 pagesDesco Final Account AnalysiskmsakibNo ratings yet

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- Enterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToDocument35 pagesEnterprise Valuation of BEACON Pharmaceuticals Limited: Submitted ToMD.Thariqul Islam 1411347630No ratings yet

- Consolidated AccountDocument44 pagesConsolidated Accountnaveed153331No ratings yet

- Bs 2009 BergerDocument1 pageBs 2009 BergerSanoj NairNo ratings yet

- FIN501 Term Paper (Group 5)Document20 pagesFIN501 Term Paper (Group 5)sayedxon48No ratings yet

- Balance SheetDocument1 pageBalance SheetNahida AfrinNo ratings yet

- Balance Sheet - LifeDocument110 pagesBalance Sheet - LifeYisehak NibereNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- Penilaian Saham PT. Ultra Jaya Milk IndustryDocument12 pagesPenilaian Saham PT. Ultra Jaya Milk IndustryPricillia Aura100% (1)

- New ExcelDocument25 pagesNew Excelred8blue8No ratings yet

- Income Statement, Balance Sheet Economic Earnings of 3 CompaniesDocument28 pagesIncome Statement, Balance Sheet Economic Earnings of 3 CompaniesLamia MazedNo ratings yet

- Annual of City BankDocument13 pagesAnnual of City BankAnonymous yu9A5ShBNo ratings yet

- My Project Yunzelah Nauman (060) (BBA)Document42 pagesMy Project Yunzelah Nauman (060) (BBA)Ayman ayNo ratings yet

- 2Q10 ITR Free Translation FIBRIADocument74 pages2Q10 ITR Free Translation FIBRIAFibriaRINo ratings yet

- United Bank Limited: Consolidated Condensed Interim Financial StatementsDocument19 pagesUnited Bank Limited: Consolidated Condensed Interim Financial StatementsMuhammad HassanNo ratings yet

- Balance Sheet: Equity and LiabilitiesDocument17 pagesBalance Sheet: Equity and LiabilitiesAbdullah JawadNo ratings yet

- Gov1. SecuritvDocument2 pagesGov1. SecuritvrahulNo ratings yet

- 01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012Document25 pages01 SKDM Draft - Recasted Balance - Sheet - 21.11.2012saifulcrislNo ratings yet

- Wa 2Document2 pagesWa 2Areeba QureshiNo ratings yet

- 16 Fin 03487Document23 pages16 Fin 03487যুবরাজ মহিউদ্দিনNo ratings yet

- Berger Paints: Statement of Financial PositionDocument6 pagesBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNo ratings yet

- Reports 6Document18 pagesReports 6Asad ZamanNo ratings yet

- Balance Sheet: AssetsDocument19 pagesBalance Sheet: Assetssumeer shafiqNo ratings yet

- Sources of FundsDocument1 pageSources of FundsRavishankar RemoNo ratings yet

- BCU - BS SD 0618 ESDocument1 pageBCU - BS SD 0618 ESNaufal Anggarda AdhitamaNo ratings yet

- GP MIS ReportDocument16 pagesGP MIS ReportFarah MarjanNo ratings yet

- KPJ Financial Comparison 1Document15 pagesKPJ Financial Comparison 1MaryamKhalilahNo ratings yet

- Mughal SteelDocument81 pagesMughal SteelFahad MughalNo ratings yet

- Financial Statements Year-End Results 2012Document2 pagesFinancial Statements Year-End Results 2012Bernews AdmnNo ratings yet

- Itr - 1Q13Document75 pagesItr - 1Q13Usiminas_RINo ratings yet

- University of The Punjab, Jhelum CampusDocument24 pagesUniversity of The Punjab, Jhelum CampusMa AnNo ratings yet

- Result 2Document1 pageResult 2ronit brahmaNo ratings yet

- Statement of Allotment, Obligation and Balances 2012Document12 pagesStatement of Allotment, Obligation and Balances 2012visayasstateuNo ratings yet

- Analisis Fundamental (Kbri)Document125 pagesAnalisis Fundamental (Kbri)triaNo ratings yet

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocument17 pages2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlNo ratings yet

- Appliances LTD January WORKING FILEDocument27 pagesAppliances LTD January WORKING FILEWaqarNo ratings yet

- Balance Sheet, K USD, Asia: AssetsDocument1 pageBalance Sheet, K USD, Asia: Assetsronit brahmaNo ratings yet

- Answer To The Question NoDocument12 pagesAnswer To The Question NoSk. Alifur RahmanNo ratings yet

- Balance Sheet 30 June 2007: 2007 2006 Equity and Liabilities Amount in 000 Share Capital and ReservesDocument2 pagesBalance Sheet 30 June 2007: 2007 2006 Equity and Liabilities Amount in 000 Share Capital and ReservesSubash KumarNo ratings yet

- 1.accounts 2012 AcnabinDocument66 pages1.accounts 2012 AcnabinArman Hossain WarsiNo ratings yet

- Investment ExcelDocument78 pagesInvestment ExcelByezid LimonNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- Financial Statment of Chenab LimitedDocument13 pagesFinancial Statment of Chenab LimitedShakeel AhmadNo ratings yet

- Navana CNG Limited (AutoRecovered)Document18 pagesNavana CNG Limited (AutoRecovered)HridoyNo ratings yet

- Cash Flow Statement: For The Year Ended 30 June 2013Document1 pageCash Flow Statement: For The Year Ended 30 June 2013Shoaib AkhtarNo ratings yet

- Financial Statements June 2012 Paper Ad 3rd ProofDocument1 pageFinancial Statements June 2012 Paper Ad 3rd ProofArman Hossain WarsiNo ratings yet

- 3Q14 CIMB Group Financial Statements PDFDocument50 pages3Q14 CIMB Group Financial Statements PDFleong2007No ratings yet

- Vertical and Horizontal Analysis of PidiliteDocument12 pagesVertical and Horizontal Analysis of PidiliteAnuj AgarwalNo ratings yet

- ITR - Free Translation Fibria 3t10Document85 pagesITR - Free Translation Fibria 3t10FibriaRINo ratings yet

- Term Paper Excel Calculations-Premier Cement Mills Ltd.Document40 pagesTerm Paper Excel Calculations-Premier Cement Mills Ltd.Jannatul TrishiNo ratings yet

- BALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityDocument20 pagesBALANCE SHEET AS AT JUNE 2006,2007,2008.: Liabilities & EquityAitzaz AliNo ratings yet

- AREONAR Business PlanDocument57 pagesAREONAR Business Planmahendrakadam2No ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Principles of The WTO Trading System: Most Favored Nation RuleDocument6 pagesPrinciples of The WTO Trading System: Most Favored Nation RulePratikBhowmickNo ratings yet

- Transfer of TrainingDocument7 pagesTransfer of TrainingPratikBhowmickNo ratings yet

- BBA Viva Final Year PDFDocument70 pagesBBA Viva Final Year PDFPratikBhowmickNo ratings yet

- Timeline Project Planning: 12 MonthsDocument15 pagesTimeline Project Planning: 12 MonthsPratikBhowmickNo ratings yet

- Jagannath University, Dhaka: Department of MathematicsDocument6 pagesJagannath University, Dhaka: Department of MathematicsPratikBhowmickNo ratings yet

- Analysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedDocument68 pagesAnalysis of Employee's Satisfaction and Customer Service Management of Mercantile Bank LimitedPratikBhowmickNo ratings yet

- Financial Ratio Analysis of Square Pharmaceuticals LTD .: Prepared ForDocument2 pagesFinancial Ratio Analysis of Square Pharmaceuticals LTD .: Prepared ForPratikBhowmickNo ratings yet

- Comparative Financial StatementsDocument6 pagesComparative Financial StatementsPratikBhowmickNo ratings yet

- Table of ContentsDocument2 pagesTable of ContentsPratikBhowmickNo ratings yet

- Pharmaceutical Industry of BangladeshDocument32 pagesPharmaceutical Industry of BangladeshPratikBhowmick100% (1)

- Power and Energy Sector of BangladeshDocument42 pagesPower and Energy Sector of BangladeshPratikBhowmickNo ratings yet

- Presentation Title: Your Company InformationDocument2 pagesPresentation Title: Your Company InformationPratikBhowmickNo ratings yet

- Content Master Plan 2012 2022Document3 pagesContent Master Plan 2012 2022PratikBhowmickNo ratings yet

- Report On Pharmaceutical Industry of BangladeshDocument27 pagesReport On Pharmaceutical Industry of BangladeshPratikBhowmick0% (1)

- Detail Masterplan 2012 2022Document27 pagesDetail Masterplan 2012 2022PratikBhowmickNo ratings yet

- Underwriter Letter of BSRMDocument16 pagesUnderwriter Letter of BSRMPratikBhowmickNo ratings yet

- Bkash 140717075321 Phpapp01Document69 pagesBkash 140717075321 Phpapp01Achilees HeelNo ratings yet

- Member List of DSEDocument36 pagesMember List of DSEPratikBhowmick0% (1)

- New Subjects of ICMAB SyllabusDocument3 pagesNew Subjects of ICMAB SyllabusPratikBhowmick100% (3)

- Underwriter of OTOBI Ltd.Document3 pagesUnderwriter of OTOBI Ltd.PratikBhowmickNo ratings yet

- Ejab Group. (Comparative)Document12 pagesEjab Group. (Comparative)PratikBhowmickNo ratings yet

- Cost Accounting CycleDocument4 pagesCost Accounting CycleM Ali Mustafa100% (1)

- Case 21: Maynard Company (A) : Our Objective Is To Look at The Concept of Balance SheetDocument6 pagesCase 21: Maynard Company (A) : Our Objective Is To Look at The Concept of Balance SheetAranhav SinghNo ratings yet

- Finance AssigmentDocument7 pagesFinance AssigmentwawanNo ratings yet

- Functions of RbiDocument4 pagesFunctions of RbiMunish PathaniaNo ratings yet

- Sps. Andal v. PNBDocument2 pagesSps. Andal v. PNBBenjie Pangosfian100% (2)

- Credit Default Swaps: Chapter SummaryDocument23 pagesCredit Default Swaps: Chapter SummaryasdasdNo ratings yet

- Credit Digest Alcantara v. AlineaDocument2 pagesCredit Digest Alcantara v. Alineacclacsina100% (1)

- CIR Vs Goodyear PhilippinesDocument2 pagesCIR Vs Goodyear Philippinesmaikadjim100% (1)

- What Is The Accounting Cycle?: Financial Statements BookkeeperDocument4 pagesWhat Is The Accounting Cycle?: Financial Statements Bookkeepermarissa casareno almueteNo ratings yet

- Income Tax Pan Services Unit: (Managed by National Securities Depository Limited)Document2 pagesIncome Tax Pan Services Unit: (Managed by National Securities Depository Limited)MalliMurthyNo ratings yet

- 12 Lustan vs. CA DIGESTDocument3 pages12 Lustan vs. CA DIGESTcassandra leeNo ratings yet

- Chapter 8Document31 pagesChapter 8Shirah CoolNo ratings yet

- Repayment Agreement FormDocument1 pageRepayment Agreement FormbryanastollNo ratings yet

- Appendix C Part 1 Functional Requirements Required in Core Sap ErpDocument62 pagesAppendix C Part 1 Functional Requirements Required in Core Sap ErpMaheen AhmedNo ratings yet

- MPNDocument10 pagesMPNSergio BianchiNo ratings yet

- China Banking Corporation vs. Qbro Fishing Enterprises, Inc. G.R. No. 184556, February 22, 2012Document2 pagesChina Banking Corporation vs. Qbro Fishing Enterprises, Inc. G.R. No. 184556, February 22, 2012Rey Almon Tolentino AlibuyogNo ratings yet

- DBP V Arcilla JRDocument11 pagesDBP V Arcilla JRChanel GarciaNo ratings yet

- Rating Rationale - Hero Steel Oct 2019Document4 pagesRating Rationale - Hero Steel Oct 2019Puneet367No ratings yet

- Tasia NT ResumeDocument1 pageTasia NT Resumeapi-274131880No ratings yet

- Mrs - Pelleti Sri LathaDocument2 pagesMrs - Pelleti Sri LathaKarthi KNo ratings yet

- Financial Management ReviewerDocument57 pagesFinancial Management ReviewerMadelle Q. PradasNo ratings yet

- Compoun Interest New - 412310955Document21 pagesCompoun Interest New - 412310955Kathryn Santos50% (2)

- Philippine Budget ProcessDocument44 pagesPhilippine Budget Processfrancis ralph valdezNo ratings yet

- 21 HR Manual For Union Bank Officers Min PDFDocument217 pages21 HR Manual For Union Bank Officers Min PDFeswar414No ratings yet

- 7 Steps To 7 Figures TranscriptDocument15 pages7 Steps To 7 Figures TranscriptZachary MillerNo ratings yet