Professional Documents

Culture Documents

Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based Costing

Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based Costing

Uploaded by

analsluttyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based Costing

Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based Costing

Uploaded by

analsluttyCopyright:

Available Formats

N12405 MAD II

Seminar 3

Activity-Based Costing

Indicative Answers:

1

2

3

4

5

D

A

C

C

D

6

7

8

9

10

B

B

B

D

B

11

12

13

14

15

D

C

D

B

D

16

17

A

A

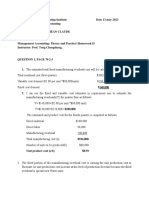

18(a)

i. The more traditional, Plant-Wide Application Rate for Conversion Costs using Direct

Labor Hours as the Cost Driver would be calculated as follows:

Estimated Overhead $5,324,400

Estimated DLHs = 54,600

Application rate = $97.52 (rounded)

ii. The predetermined allocation rates for each activities are calculated as follows:

Activity

Material Handling

Calculation

$258,400 /

[(30 x10,000)+(50 x 5,000)+(120 x 800)]

Application Rate

40 / part

Prod. Scheduling

$114,000 / [300 + 70 + 200]

$200 / prod order

Setups

$160,000 / [100 + 50 + 50]

$800 / prod setup

Machinery

$3,510,000 /

[(7 x 10,000) + (7 x 5,000) + 15(800)]

$30 / mach hour

Finishing

$1,092,000 /

[(2 x 10,000)+(5 x 5,000) + (12 x 800)]

$20 / DLH

Packing & Shipping

$190,000 / [1,000+2,000+800]

$50 /order shipped

(b)

Allocation of conversion costs

i. Traditional plant-wide allocation rate:

Quality

Superior

Plant-Wide

(2 x $97.52) $195.04

(5 x $97.52) $487.60

Superb

(12 x $97.52) $1,170.24

ii. The ABC rate

(Note: since activities can represent batch costs (costs incurred in the production of products in

groups) and product costs (cost incurred at the product line level) as opposed to unit-level costs,

it may be best to calculate the total Conversion Cost for the entire product line and then divide

that total by the budgeted production level in order to get a Conversion Cost per unit).

Activity

Mat Hand

Prod Sch

Setups

Machinery

Finishing

Pck & Shp

Ttl Conv.

Conv./Unit

Quality

Superior

Superb

((30x10,000)x.40) $120,000

(300x$200) 60,000

(100x$800) 80,000

((7x10,000)x$30) 2,100,000

((2x10,000)x$20) 400,000

(1,000x$50) 50,000

$2,810,000

($2,810,000/10,000) $281.00

(50x5,000)x$.40) $100,000

(70x$200) 14,000

(50x$800) 40,000

((7x5,000)x$30) 1,050,000

((5x5,000)x$20) 500,000

(2,000x$50) 100,000

$1,804,000

($1,804,000/5,000) $360.80

((120x800)x$.40) $38,400

(200x$200) 40,000

(50x$800) 40,000

((15x800)x$30) 360,000

((12x800)x$20) 192,000

(800x$50) 40,000

$710,400

($710,400/800) $888.00

N12405 MAD II

Seminar 3

Activity-Based Costing

Comparisons of Conversion Cost applied to each unit using ABC versus the Plant-Wide rate:

Plant-Wide

ABC

Difference

Quality

$195.04

$281.00

-$85.96

Superior

$487.60

$360.80

$126.80

Superb

$1,170.24

$ 888.00

$ 282.24

(c) Assuming that ABC presents a more accurate Conversion Cost for each product, under the

traditional, Plant-Wide Application Rate, the Quality units are under-costed and the Superior and

Superb units are over-costed.

(d) Production decisions criteria: minimum c/s ratio of 40%.

Selling price

Conversion cost (PW)

Contribution (PW)

Decision

Quality

$350

195.04

44%

/

Superior

$610

487.60

20%

X

Superb

$2,340

1,170.24

50%

/

Conversion cost (ABC)

Contribution (ABC)

Decision

281.00

20%

X

360.80

41%

/

888.00

62%

/

You might also like

- Assignment - Service Cost AllocationDocument4 pagesAssignment - Service Cost AllocationRoselyn LumbaoNo ratings yet

- Economics - FE Review Problems and Solutions 2012Document154 pagesEconomics - FE Review Problems and Solutions 2012Blake Reeves50% (2)

- Activity Based Costing and Activity Based Management - ProblemDocument3 pagesActivity Based Costing and Activity Based Management - Problemkiara kiesh FosterNo ratings yet

- ECON STUDIES SAMPLE PROBDocument5 pagesECON STUDIES SAMPLE PROBDarius MegamindNo ratings yet

- m80221012-Kanyabwira Jean Claude - 基因 - Ass2Document10 pagesm80221012-Kanyabwira Jean Claude - 基因 - Ass2UKURI TV7No ratings yet

- Activity Based CostingDocument52 pagesActivity Based CostingraviktatiNo ratings yet

- COSMAN ASSIGNMENT 21 32 Answers CheggDocument8 pagesCOSMAN ASSIGNMENT 21 32 Answers CheggwalsondevNo ratings yet

- ABC - Practice Set Answer and SolutionDocument4 pagesABC - Practice Set Answer and SolutionYvone Ehnnery BumosaoNo ratings yet

- Ch.2 - Job CostingDocument26 pagesCh.2 - Job Costingahmedgalalabdalbaath2003No ratings yet

- Chapter 5 - ExercisesDocument6 pagesChapter 5 - Exercisesotaku25488No ratings yet

- Decesion MakingDocument11 pagesDecesion MakingShoaib NaeemNo ratings yet

- ABC SystemDocument11 pagesABC SystemSyarifatuz Zuhriyah UmarNo ratings yet

- f5 Worksheet BPPDocument19 pagesf5 Worksheet BPPYashna SohawonNo ratings yet

- ACCT3500 (Fall 20) Answers To Tutorial 3Document7 pagesACCT3500 (Fall 20) Answers To Tutorial 3Mohammad ShabirNo ratings yet

- AccountingDocument4 pagesAccountingFerrNo ratings yet

- Chapter 2Document18 pagesChapter 2FakeMe12No ratings yet

- CM121. COA (IL-I) Solution CMA January-2023 Exam.Document7 pagesCM121. COA (IL-I) Solution CMA January-2023 Exam.Shawn MehdiNo ratings yet

- Management and Financial Accounting Assessment-2Document6 pagesManagement and Financial Accounting Assessment-2saranyaNo ratings yet

- Assignment 5Document6 pagesAssignment 5Ruby TaylorNo ratings yet

- Question 4Document8 pagesQuestion 4Jeremiah NcubeNo ratings yet

- Charles AKMENDocument11 pagesCharles AKMENCharles GohNo ratings yet

- F5 Asignment 1Document5 pagesF5 Asignment 1Minhaj AlbeezNo ratings yet

- Chapter 7 Solutions-2Document9 pagesChapter 7 Solutions-2mackkshellNo ratings yet

- Activity Based CostingDocument10 pagesActivity Based CostingEdi Kristanta PelawiNo ratings yet

- Solutions Ch. 7 ABCDocument11 pagesSolutions Ch. 7 ABCThanawat PHURISIRUNGROJNo ratings yet

- Catedra 8 - LayoutDocument64 pagesCatedra 8 - LayoutCamilo Collao GómezNo ratings yet

- Chapter 4 Examples 9-13Document5 pagesChapter 4 Examples 9-13deniz turkbayragiNo ratings yet

- Solution Cost and Management Nov 2010Document7 pagesSolution Cost and Management Nov 2010Samuel DwumfourNo ratings yet

- Tugas-Kasus - 4.12Document3 pagesTugas-Kasus - 4.12niti dsNo ratings yet

- Target Costing: Ludwigsburg VMDocument11 pagesTarget Costing: Ludwigsburg VMkashi3027No ratings yet

- Chapter 8 Homework MADocument13 pagesChapter 8 Homework MAErvin Jello Rosete RagonotNo ratings yet

- Mobin Kanjiani: Assignment#3Document3 pagesMobin Kanjiani: Assignment#3MKMikeNo ratings yet

- Daellenbach CH6 SolutionsDocument10 pagesDaellenbach CH6 SolutionsTantowi Jauhari83% (6)

- Homework Chapter 5: Requirement 1: Manufacturing Cost Per Unit - TraditionalDocument2 pagesHomework Chapter 5: Requirement 1: Manufacturing Cost Per Unit - TraditionalMalene Mandrup TherkelsenNo ratings yet

- AMA Tutorial 2 (A)Document8 pagesAMA Tutorial 2 (A)Chia Pei JunNo ratings yet

- 7-28 7-29 The Direct MethodDocument5 pages7-28 7-29 The Direct MethodJohn Carlo AquinoNo ratings yet

- Review QuestionsDocument22 pagesReview QuestionsJustus MusilaNo ratings yet

- ABCDocument18 pagesABCRohit VarmaNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- Answers Toa Extra Questions Management AnDocument77 pagesAnswers Toa Extra Questions Management AnNhan ThaiNo ratings yet

- Abc ProblemDocument2 pagesAbc ProblemBrian TorresNo ratings yet

- ABC MethodDocument6 pagesABC MethodPrincess RapisuraNo ratings yet

- Lecture 14 POADocument7 pagesLecture 14 POALau Chun GuiNo ratings yet

- Chapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument13 pagesChapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- Longman F21 (Key)Document18 pagesLongman F21 (Key)Yan Pak KiuNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- Tugas Kasus Akuntansi Manajemen ABCDocument3 pagesTugas Kasus Akuntansi Manajemen ABCutari yani dewiNo ratings yet

- Practice Sheet 6 - CH7 Solution (1)Document8 pagesPractice Sheet 6 - CH7 Solution (1)musfat016No ratings yet

- Final Managerial 2013 SolutionDocument6 pagesFinal Managerial 2013 SolutionRanim HfaidhiaNo ratings yet

- ABC NotesDocument6 pagesABC NotesVictoria MasawiNo ratings yet

- Activity Based CostingDocument20 pagesActivity Based CostingArpit SahaiNo ratings yet

- Cash Flow Estimation Models: Estimating Relationships and ProblemsDocument30 pagesCash Flow Estimation Models: Estimating Relationships and ProblemsSenthil RNo ratings yet

- PR Cost Chapter 13Document12 pagesPR Cost Chapter 13LarasAANo ratings yet

- Suggested Answers Final Examination - Winter 2011: Working S Rs. in 000Document6 pagesSuggested Answers Final Examination - Winter 2011: Working S Rs. in 000HaseebNo ratings yet

- Solution AMA Tutorial 10 (SOLUTIONS)Document5 pagesSolution AMA Tutorial 10 (SOLUTIONS)Chia Pei JunNo ratings yet

- Production Cost Variances: Changes From Tenth EditionDocument15 pagesProduction Cost Variances: Changes From Tenth EditionAlka NarayanNo ratings yet

- AnswersDocument9 pagesAnswersĐào Thị Thu ThủyNo ratings yet

- Tutorial 4 SolutionDocument3 pagesTutorial 4 Solutionsissy.he.7No ratings yet

- Problem 14-4 Shauton Company Product Costs From Traditional Costing SystemDocument4 pagesProblem 14-4 Shauton Company Product Costs From Traditional Costing SystemLarasAANo ratings yet

- Active Listening ExercisesDocument13 pagesActive Listening Exercisesanalslutty0% (1)

- C82COU Introduction To Counselling: Cognitive-Behavioral Approach To CounselingDocument21 pagesC82COU Introduction To Counselling: Cognitive-Behavioral Approach To CounselinganalsluttyNo ratings yet

- Seminar 2 - Part 2 AnsDocument2 pagesSeminar 2 - Part 2 AnsanalsluttyNo ratings yet

- Sep 2014 N12M01 - Workshop 1Document3 pagesSep 2014 N12M01 - Workshop 1analsluttyNo ratings yet

- Rodrigue DisDocument252 pagesRodrigue DisanalsluttyNo ratings yet

- Seminar 3 - QDocument3 pagesSeminar 3 - QanalsluttyNo ratings yet

- Seminar 2 - Part 1 AnsDocument1 pageSeminar 2 - Part 1 AnsanalsluttyNo ratings yet

- Seminar 1 - Part 2 AnsDocument1 pageSeminar 1 - Part 2 AnsanalsluttyNo ratings yet

- Economics of Business Decisions: RevisionDocument14 pagesEconomics of Business Decisions: RevisionanalsluttyNo ratings yet

- Seminar 1 - Part 2 QDocument2 pagesSeminar 1 - Part 2 QanalsluttyNo ratings yet