Professional Documents

Culture Documents

The Absolute Return Letter 0215

The Absolute Return Letter 0215

Uploaded by

Jimmy ChowCopyright:

Available Formats

You might also like

- Porter Stansberry - End of AmericaDocument40 pagesPorter Stansberry - End of AmericaRama Raju100% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- OakTree Real EstateDocument13 pagesOakTree Real EstateCanadianValue100% (1)

- Einhorn Consol PresentationDocument107 pagesEinhorn Consol PresentationCanadianValueNo ratings yet

- Beanstream API Integration OriginalDocument92 pagesBeanstream API Integration Originalsoleone9378No ratings yet

- How Do I Hate Thee?Document12 pagesHow Do I Hate Thee?richardck61No ratings yet

- The Absolute Return Letter 1113 PDFDocument11 pagesThe Absolute Return Letter 1113 PDFCanadianValueNo ratings yet

- Going GlobalDocument17 pagesGoing Globalrichardck61No ratings yet

- Financial Wanderings: Why'd It Do What It Did?Document4 pagesFinancial Wanderings: Why'd It Do What It Did?bblackburn76No ratings yet

- The Absolute Return Letter March 2015Document7 pagesThe Absolute Return Letter March 2015CanadianValueNo ratings yet

- Fat Tail Insurance Scenarios - SocGenDocument7 pagesFat Tail Insurance Scenarios - SocGenfcamargoeNo ratings yet

- Absolute Return Oct 2015Document9 pagesAbsolute Return Oct 2015CanadianValue0% (1)

- Ten Quick Topics To Ruin Your SummerDocument16 pagesTen Quick Topics To Ruin Your SummerbasilclickNo ratings yet

- Some Thoughts On DeflationDocument9 pagesSome Thoughts On Deflationrichardck30No ratings yet

- The Economic Singularity: by John MauldinDocument10 pagesThe Economic Singularity: by John Mauldinrichardck61No ratings yet

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDocument36 pagesStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaNo ratings yet

- Mauldin January 12Document12 pagesMauldin January 12richardck61No ratings yet

- Europe Takes The QE BatonDocument16 pagesEurope Takes The QE Batonrichardck61No ratings yet

- Review of Global EconomyDocument31 pagesReview of Global EconomyAnanthNo ratings yet

- Half A Bubble Off Dead CenterDocument14 pagesHalf A Bubble Off Dead Centerrichardck61No ratings yet

- Needed at The Fed: An Inverse Volcker: Detroit, Toronto, NYC?, and Coconut GroveDocument16 pagesNeeded at The Fed: An Inverse Volcker: Detroit, Toronto, NYC?, and Coconut Groverichardck61No ratings yet

- Mauldin February 5Document16 pagesMauldin February 5richardck61No ratings yet

- Oil - Islamorada November Newsletter ExtractDocument53 pagesOil - Islamorada November Newsletter ExtractDeepak SharmaNo ratings yet

- Guru Focus Interview With Arnold VandenbergDocument16 pagesGuru Focus Interview With Arnold VandenbergVu Latticework Poet100% (2)

- Air Phase1 0Document13 pagesAir Phase1 0drkwng100% (1)

- The Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellDocument15 pagesThe Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellGoldfish2021No ratings yet

- The Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellDocument15 pagesThe Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellGoldfish2021No ratings yet

- Incrementum Advisory Board October 2015Document32 pagesIncrementum Advisory Board October 2015Gold Silver WorldsNo ratings yet

- John Mauldin: European Banks On The BrinkDocument7 pagesJohn Mauldin: European Banks On The BrinkTREND_7425No ratings yet

- The Pensford Letter - 8.13.12Document5 pagesThe Pensford Letter - 8.13.12Pensford FinancialNo ratings yet

- George Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFDocument88 pagesGeorge Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFJoao Alves Monteiro NetoNo ratings yet

- Economists Are (Still) CluelessDocument13 pagesEconomists Are (Still) Cluelessrichardck61No ratings yet

- Crisis Control For 2000 and Beyond: Boom or Bust?: Seven Key Principles to Surviving the Coming Economic UpheavalFrom EverandCrisis Control For 2000 and Beyond: Boom or Bust?: Seven Key Principles to Surviving the Coming Economic UpheavalNo ratings yet

- 11/4/14 Global-Macro Trading SimulationDocument20 pages11/4/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- End of AmericaDocument39 pagesEnd of AmericaAnonymous MdbmF7s5No ratings yet

- Mauldin March 6Document10 pagesMauldin March 6richardck61No ratings yet

- The Global Economy Is Slowing: in This Month's Issue..Document52 pagesThe Global Economy Is Slowing: in This Month's Issue..Nicolae ChisoceanuNo ratings yet

- 11/6/14 Global-Macro Trading SimulationDocument18 pages11/6/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- China's Secret Plan To Take Over The World's Gold Market: Investment AdvisoryDocument12 pagesChina's Secret Plan To Take Over The World's Gold Market: Investment Advisorymtnrunner7No ratings yet

- Peak Oil DissertationDocument8 pagesPeak Oil DissertationWhoCanWriteMyPaperHartford100% (1)

- The Center Cannot Hold: LA, NYC, Hong Kong, and SingaporeDocument12 pagesThe Center Cannot Hold: LA, NYC, Hong Kong, and Singaporerichardck61No ratings yet

- Never Smile at A Crocodile: Debt and (Not Much) DeleveragingDocument9 pagesNever Smile at A Crocodile: Debt and (Not Much) Deleveragingrichardck61No ratings yet

- The Greater Depression or - How I Learned To Stop Worrying and Love The Bear 2011.10.15Document153 pagesThe Greater Depression or - How I Learned To Stop Worrying and Love The Bear 2011.10.15nicknyseNo ratings yet

- 2012-04-Echo From The AlpsDocument15 pages2012-04-Echo From The AlpsluikesNo ratings yet

- !!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentDocument6 pages!!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentGeneration GenerationNo ratings yet

- Are We Reaching "Limits To Growth"?Document7 pagesAre We Reaching "Limits To Growth"?George AdcockNo ratings yet

- The Pensford Letter - 10.24.11Document7 pagesThe Pensford Letter - 10.24.11Pensford FinancialNo ratings yet

- Aef No Business Like Bond Business StillDocument5 pagesAef No Business Like Bond Business StillNew AustrianeconomicsNo ratings yet

- The Pensford Letter - Leadpipe Locks 2015 Edition 12.31.14Document4 pagesThe Pensford Letter - Leadpipe Locks 2015 Edition 12.31.14Pensford FinancialNo ratings yet

- Mauldin December 7Document13 pagesMauldin December 7richardck61No ratings yet

- Gmo Quarterly LetterDocument16 pagesGmo Quarterly LetterAnonymous Ht0MIJ100% (2)

- How We FailedDocument6 pagesHow We FailedAndy HongNo ratings yet

- The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real MoneyFrom EverandThe Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real MoneyNo ratings yet

- The Bigger 'Bigger Picture'Document6 pagesThe Bigger 'Bigger Picture'tanase.octavian2561No ratings yet

- Mauldin September 27Document13 pagesMauldin September 27richardck61No ratings yet

- Dow Dive Shocks Investors: Dave's Daily: There's No TwoDocument9 pagesDow Dive Shocks Investors: Dave's Daily: There's No TwoAlbert L. PeiaNo ratings yet

- White Paper: We Re in A Financial Recession by Larson Gunness, July 2012Document3 pagesWhite Paper: We Re in A Financial Recession by Larson Gunness, July 2012E. Larson GunnessNo ratings yet

- Bill GrosBill GrossDocument4 pagesBill GrosBill GrossJuan HervadaNo ratings yet

- TL-Bill Gross Investment Outlook - June 2015 - Exp 6.30.16 - FINALv4Document4 pagesTL-Bill Gross Investment Outlook - June 2015 - Exp 6.30.16 - FINALv4dpbasicNo ratings yet

- Protect Yourself and ProfitDocument28 pagesProtect Yourself and ProfitMike AdemolaNo ratings yet

- Aftershock: Protect Yourself and Profit in the Next Global Financial MeltdownFrom EverandAftershock: Protect Yourself and Profit in the Next Global Financial MeltdownRating: 2.5 out of 5 stars2.5/5 (2)

- Is My Wife Cheating On Me?Document2 pagesIs My Wife Cheating On Me?Christian WehbeNo ratings yet

- INFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockDocument24 pagesINFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockVas RaNo ratings yet

- Charlie Munger 2016 Daily Journal Annual Meeting Transcript 2 10 16 PDFDocument18 pagesCharlie Munger 2016 Daily Journal Annual Meeting Transcript 2 10 16 PDFaakashshah85No ratings yet

- Stan Druckenmiller The Endgame SohnDocument10 pagesStan Druckenmiller The Endgame SohnCanadianValueNo ratings yet

- Greenlight UnlockedDocument7 pagesGreenlight UnlockedZerohedgeNo ratings yet

- Stan Druckenmiller Sohn TranscriptDocument8 pagesStan Druckenmiller Sohn Transcriptmarketfolly.com100% (1)

- Hussman Funds Semi-Annual ReportDocument84 pagesHussman Funds Semi-Annual ReportCanadianValueNo ratings yet

- KaseFundannualletter 2015Document20 pagesKaseFundannualletter 2015CanadianValueNo ratings yet

- Munger-Daily Journal Annual Mtg-Adam Blum Notes-2!10!16Document12 pagesMunger-Daily Journal Annual Mtg-Adam Blum Notes-2!10!16CanadianValueNo ratings yet

- The Stock Market As Monetary Policy Junkie Quantifying The Fed's Impact On The S P 500Document6 pagesThe Stock Market As Monetary Policy Junkie Quantifying The Fed's Impact On The S P 500dpbasicNo ratings yet

- Market Macro Myths Debts Deficits and DelusionsDocument13 pagesMarket Macro Myths Debts Deficits and DelusionsCanadianValueNo ratings yet

- Whitney Tilson Favorite Long and Short IdeasDocument103 pagesWhitney Tilson Favorite Long and Short IdeasCanadianValueNo ratings yet

- Absolute Return Oct 2015Document9 pagesAbsolute Return Oct 2015CanadianValue0% (1)

- Investor Call Re Valeant PharmaceuticalsDocument39 pagesInvestor Call Re Valeant PharmaceuticalsCanadianValueNo ratings yet

- Einhorn Q4 2015Document7 pagesEinhorn Q4 2015CanadianValueNo ratings yet

- Letter To Clients and ShareholdersDocument3 pagesLetter To Clients and ShareholdersJulia Reynolds La RocheNo ratings yet

- Starboard Value LP AAP Presentation 09.30.15Document23 pagesStarboard Value LP AAP Presentation 09.30.15marketfolly.com100% (1)

- List PDFDocument9 pagesList PDFLulu LuthfiyahNo ratings yet

- Universal Banking Is A Combination of Commercial BankingDocument8 pagesUniversal Banking Is A Combination of Commercial Bankingsonika7No ratings yet

- State Bank of IndiaDocument3 pagesState Bank of IndiaImran HassanNo ratings yet

- Credit AppraisalDocument14 pagesCredit AppraisalRishabh Jain0% (1)

- Dr. Carlos S. Lanting CollegeDocument21 pagesDr. Carlos S. Lanting CollegeGalen Lei JaveñarNo ratings yet

- CleanDocument6 pagesCleanKadeen RobinsonNo ratings yet

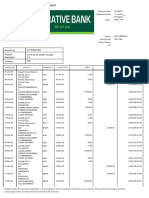

- Sammy Gicheha - Bank StatementDocument6 pagesSammy Gicheha - Bank StatementJason MoutiNo ratings yet

- 13) Gregorio Araneta, Inc., V. Tuason de Paterno and Vidal, 91phil 786 (1952)Document14 pages13) Gregorio Araneta, Inc., V. Tuason de Paterno and Vidal, 91phil 786 (1952)Christian AnresNo ratings yet

- A Brief Report EnglishDocument10 pagesA Brief Report EnglishJohn BernalNo ratings yet

- Im en 2009 1 MylonakisDocument11 pagesIm en 2009 1 MylonakisFerdous AlaminNo ratings yet

- ELEMENTS of The Law of Bills, Notes, and Cheques and The English B of E ActDocument368 pagesELEMENTS of The Law of Bills, Notes, and Cheques and The English B of E ActDanny Clarke100% (1)

- New BizChannel@CIMB Campaign Form - Final (061115)Document3 pagesNew BizChannel@CIMB Campaign Form - Final (061115)AzuanNo ratings yet

- Your RBC Personal Banking Account StatementDocument4 pagesYour RBC Personal Banking Account StatementmarktunguaqNo ratings yet

- Conference Details SunflowerDocument16 pagesConference Details SunflowerSahil VoraNo ratings yet

- Sample Paper-05 (2016-17) Economics Class - XII Time Allowed: 3 Hours Maximum Marks: 100 AnswersDocument6 pagesSample Paper-05 (2016-17) Economics Class - XII Time Allowed: 3 Hours Maximum Marks: 100 AnswerspariteotiaNo ratings yet

- Reforms in Capital MarketDocument2 pagesReforms in Capital MarketApurv SuryaNo ratings yet

- Credit Digitization For Credit Management Presentation 23jul19Document21 pagesCredit Digitization For Credit Management Presentation 23jul19Chidozie Farsight100% (1)

- Loan EMI CalculatorDocument13 pagesLoan EMI CalculatorSameer ThakkarNo ratings yet

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNo ratings yet

- A Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Document120 pagesA Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Vaibhav ShuklaNo ratings yet

- Banking For The Poor, NigeriaDocument18 pagesBanking For The Poor, NigeriaRight MagejoNo ratings yet

- Account Statement For The Account: 1926010003332: Branch DetailsDocument7 pagesAccount Statement For The Account: 1926010003332: Branch DetailsOp MassNo ratings yet

- Project Titles VBDocument2 pagesProject Titles VBgovindarajnNo ratings yet

- Islamic Infrastructure Project FinanceDocument97 pagesIslamic Infrastructure Project FinancePakistan ZindabadNo ratings yet

- PA Language DetailsDocument460 pagesPA Language Detailssaad essalmaniNo ratings yet

- BLW/INV38/04/2020: Note: This Invoice Is Not Valid Whitout Our Official StampDocument2 pagesBLW/INV38/04/2020: Note: This Invoice Is Not Valid Whitout Our Official StampAnisa YosivaNo ratings yet

- Rights of Unpaid Seller: Submitted By: Name: Ananya Shukla Roll Number: 1914Document21 pagesRights of Unpaid Seller: Submitted By: Name: Ananya Shukla Roll Number: 1914Ananya ShuklaNo ratings yet

- EDW at HDFCDocument26 pagesEDW at HDFCYogesh YadavNo ratings yet

- Law On Nego Sundiang NotesDocument33 pagesLaw On Nego Sundiang NotesAudrey100% (1)

The Absolute Return Letter 0215

The Absolute Return Letter 0215

Uploaded by

Jimmy ChowCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Absolute Return Letter 0215

The Absolute Return Letter 0215

Uploaded by

Jimmy ChowCopyright:

Available Formats

The Absolute

Return Letter

February 2015

The End Game

Pessimism sells. For reasons I have never understood, people

like to hear that the world is going to hell, and become huffy

and scornful when some idiotic optimist intrudes on their

pleasure.

Professor Deirdre McCloskey

The end of cheap oil

In large parts of the financial community there is a strongly held belief that the

problems which caused the credit crisis back in 2008-09 have never been properly

addressed, causing many to suspect that it is only a matter of time before the end

game is upon us the credit crisis Mk. II so to speak. I will in the following pages

look at various ways the end game might unfold but, before I do so, I shall return to

one of the subjects I discussed in the January letter the end of cheap oil which

caused a flurry of comments and questions.

So lets begin with an update on oil. If you dont really care to hear more about it,

you can go straight to page 3, where my thoughts on a possible end game begin.

Let me start with a quote from last months Absolute Return Letter, which you can

find here. I wrote:

All I know is that the price of oil wont stay below the production

cost for a long period of time (as in years). Hence I think we will see

the oil price at $100 again, and it wont take many years, but it could

be an extraordinarily bumpy ride.

Based on the number of comments I received, that statement requires some

explanation. First the number itself. I obviously dont know if the price of oil will rise

to $100, a little bit more or a little bit less, or over what time period. I am, however,

a self-confessed numbers junkie, and want to put numbers on absolutely

everything. Please do not take numbers like that too literally. Up it will go, though (I

think).

Anatole Kaletsky, who is a brilliant thinker and writer, wrote an interesting piece in

mid-January which you can find here. Anatoles key argument is (and I agree) that,

in a truly competitive market, the price should equal the marginal cost of

production, which leads him to conclude that the current oil price of around $50 per

The Absolute Return Letter

January 2015

barrel is a ceiling not a floor. I happen to disagree with Anatole that the world is

capable of delivering meaningful amounts of oil around $50.

Let me elaborate. When it comes to drilling, there are two types of costs. There is

the cash cost, i.e. the cost it takes to extract oil from an already existing well, and

there is the all-in production cost, which would include the cost of establishing the

well, depreciations, etc. The difference can be significant to put it mildly, and

longer-term strategic decisions, such as opening new wells, will, in the vast majority

of cases, be a function of the oil price relative to the all-in marginal production cost.

That is certainly higher than $50, but thats a story for another day.

It is not the easiest thing to calculate the exact size of these costs, as oil producing

countries are not the most informative I have come across; however, Morgan

Stanley has recently made a valiant effort (chart 1). As you can see, none of the

newer techniques, such as horizontal drilling, Arctic drilling, Canadian tar sands and

shale are cheap. And, as far as shale is concerned, the all-in production cost is

particularly important, because fracking will cause the well to deplete very quickly,

often within a couple of years.

It is therefore relatively safe to assume that, at current oil prices, the shale boom

will fizzle out fairly quickly. The other possible outcome, which I subscribe to, is that

the price of oil will rise until the true all-in marginal cost of production has been

reached. What is not safe to assume is anything at all to do with technological

improvements particularly under times of stress which can be very

unpredictable, as time has shown. Fracking itself is probably the greatest example

of this.

Chart 1: Crude all-in production costs by region

Source: Morgan Stanley, Rystad Energy, Slate.com

If I am ultimately proven wrong on the oil price, it could very well be because

fracking (or a new technology we havent even heard of yet) has effectively put a

lid on the oil price, although I think the lid will prove to be a fair bit higher than the

$50 suggested by Anatole Kaletsky. Should OPEC misbehave and drive up prices

to ridiculous levels, shale producers will simply increase production. This is likely to

create a price range that is narrower, and less volatile, than the one we have

experienced since the two oil crises in the 1970s, which again will be good for

economic activity as it eliminates an important risk factor.

The one additional dynamic to consider is the large fiscal deficits in most oil

producing countries which is only made worse the further the price of oil drops.

Clearly the biggest risk factor in this context is Russia which needs an oil price of

The Absolute Return Letter

January 2015

around $105 to balance its budget this year (chart 2). One can only guess if this will

in any way add to geo-political instability, but it is a fact that virtually none of the

worlds leading oil producing countries have as easy access to bond markets as we

are used to in this part of the world.

Chart 2: Fiscal break-even oil price (Brent oil in USD)

200.0

150.0

100.0

50.0

0.0

2006

2010

2015E

Source: Deutsche Bank, Slate.com

The end game

And now to the main topic of this months Absolute Return Letter the end game.

Large parts of the financial community have been on tenterhooks ever since 2008.

Somehow, many feel that we have never really left the crisis environment. Central

banks have, with QE, managed to lower the temperature; however, the patient is

still sick, or so the argument goes.

I can understand, and have some sympathy for, that view. Having said that, in my

eyes, crisis is a temporary condition but, after a period of time, if the condition

persists, it is no longer a crisis but becomes the norm. What do I mean by that?

Since the outbreak of the credit crisis, it has been customary to blame pretty much

every problem on central bankers who have become the bogeymen of modern

times, at least in some peoples eyes. Having said that, the critics have conveniently

ignored a very important question. Could it be that the low economic growth most

western countries are suffering from is due to something entirely different and has

little to do with the credit crisis and/or the policies currently being pursued?

My answer to that question is a qualified yes, and long term readers of the

Absolute Return Letter will already know what I suspect is the main reason

demographics. They have really turned against us in the last few years and wont

turn favourable until the mid-2020s at the earliest, so wed better accept that low

growth is going to be with us for another 10 years or so.

Adding to that, todays central bankers have inherited a system that is to a large

degree unmanageable. Europe was nowhere near ready for a currency union (at

least not with that many participants), as the difference between north and south

was, and still is, too great. What is an entirely appropriate policy for one part of

Europe may be destructive for another part, but the diehards, who continue to

blame central bankers for all misfortunes, should point their canons in a different

direction.

The slightly more positive conclusion to draw from this observation is that the crisis

many investors are waiting for may actually never happen. We are possibly already

over the vast majority of the hurdles. We just havent figured it out yet.

The Absolute Return Letter

January 2015

Incidents a la carte

It is not that the world is currently short of problems. Some of those can escalate

and possibly turn into crisis material, but I suppose you can almost always make

that observation. If you absolutely want to be negative, nothing is easier. I am

sometimes accused of being overly negative in these letters, but it is part of my job

to identify risks, hence the negative tilt. I have always been a believer in managing

downside risk well, as the upside usually takes care of itself.

Having said that, I just dont see a repeat of 2008 on the horizon. Returns, as I have

said repeatedly over the last few months, are likely to be uninspiring over the next

5-10 years but, on average, still positive. However, if the worlds financial markets

decide to take another tumble, here are the incidents I have identified as the most

likely to kick it off:

Possible end games:

1.

2.

3.

4.

5.

Deflation followed by inflation

Another sovereign crisis

Outright currency wars

Real-time testing of the new financial system

Equity melt-up

Deflation followed by inflation

Deflation in the Eurozone is no longer a risk but a fact. But deflation followed by

inflation is not, and it is not entirely inconceivable that central bankers in both

Europe and the U.S. could fall behind the curve, at least temporarily. The fear of a

repeat of the Japanese disease is so deep that almost anything will be tried to get

inflation going again, and it doesnt take a lot of imagination to picture an ECB or a

Fed sitting on its hands (some say they already do which I dont agree with) at a

time where the appropriate action would be a rate hike. I dont rate this as the most

likely outcome, but neither is it the least likely to happen.

The last time a major central bank found itself falling significantly behind the curve

was the Fed in 1994, and the year turned out to be an unpleasant one for fixed

income and equity investors alike. You would have thought that a lesson or two

would have been learned from that experience, but the real question is whether

central bankers rate falling behind the deflation curve as potentially more

dangerous than falling behind the inflation curve? I suspect that is the case.

Remember, when debt levels are high, deflation can do a lot more damage than

inflation.

Such an outcome would obviously not be very constructive for financial assets

bonds or equities - but 1994 was hardly a disaster for equity investors with the S&P

500 falling 1.5%. Even if the drop in equity values would be somewhat bigger this

time around (it probably would, as there would be no support from being in the

biggest bull market of all times as in 1994), a repeat of 2008-09 on these grounds

is unlikely.

Another sovereign crisis

I can see a sovereign crisis developing along three different lines. The first one is

Greece. Greece has just held parliamentary elections, and the left-wing party Syriza

became, as predicted by many, the largest party. However it didnt quite get the

38% it required to gain absolute majority (38%? Only in Greece!), but wasted no

time in allying itself with a small right-wing party to ensure a majority in parliament.

Apart from the fact that the two parties in the alliance are about as far from each

other as possible (the only policy in common is the opposition to austerity), which

in itself is bound to create frictions down the road, the Greek hand in the

The Absolute Return Letter

January 2015

negotiations with its creditors is very weak, and much weaker than acknowledged

in public by Syriza.

If serious concessions are made by the creditors, who do you think will be the first

to knock on the German door tomorrow morning? Portugal, Spain or Italy?

Secondly, it was no coincidence that Mrs. Merkel made a complete U-turn a few

weeks ago when she said that a Greek exit would now be manageable. The Germans

have prepared for this for years and are now ready (which is effectively what Mrs.

Merkel said).

The most likely outcome is still a Greek recognition that the debts have to be

honoured probably with some bells and whistles attached. However, that implies

that Syriza party leader Alexis Tsipras will have to eat the biggest humble pie that

anyone has ever put in front of him. However, the alternative (exclusion) is so bad

for Greece, that he may have no choice, even if his supporters will feel betrayed.

If the Greeks decide to renege on debts to the international community, it could

create a bit of a wobble in European equity markets later this year, possibly quite

soon. At stake here is the $240 billion bail-out programme which the EU, the ECB

and the IMF put together for Greece. In return the lenders demanded strict austerity

which has become very unpopular and is the main reason Syriza won the recent

elections.

From an investors point of view, the good news is that about 80% of all Greek

government bonds are now held by the public sector, meaning that any Greek

default is unlikely to do serious damage to the investment community.

Even worse than a Greek default is the rhetoric coming from Mr. Tsipras. He has said

on more than one occasion that the Syriza party will take back what the rich have

stolen from the poor for many years. The last time Greece made a serious attempt

to confiscate large fortunes from the seriously wealthy (in the mid-1960s), it

resulted in a military coup.

Germany next. Germany is obviously in a very different situation from Greece, and

I am not at all predicting a Greek-like crisis unfolding in Germany. However, the fact

that ECB president Mario Draghi appears willing to fall out with the Germans to get

inflation going again across the Eurozone is worth spending a minute or two on.

To put it bluntly, only gold bugs and a few German professors seem unable to

distinguish between QE and money thrown from helicopters. Central bankers in

Europe and the U.S. have NEVER done what the Weimar Republic or Zimbabwe were

guilty of, and neither are they about to.

Apart from the fact that some European countries could do with money thrown

from helicopters right now, it is probably fair to say that German resentment

towards QE is such that Draghis strategy has moved Germany an inch or two closer

to the exit door. The ultimate result? Most likely nothing, but it could be a very

colourful next few months.

The third possible way a sovereign crisis could unfold over the next several months

is if the U.S. dollar continues to strengthen. So much borrowing in USD has taken

place in emerging markets over the past few years that somebody somewhere is

likely to get into trouble.

On that note, I wouldnt be surprised to see the U.S. dollar taking a near term break

from its relentless rise (but the USD rise isnt over yet). Recent macroeconomic data

coming out of the U.S. have not been as strong as expected, and the Fed must begin

to have second thoughts about raising rates as early as this summer, as they have

previously said they would.

The Absolute Return Letter

January 2015

The key will be the guidance to be provided by Mrs. Yellen in the March Fed meeting,

and dont be surprised if she delays the widely anticipated cycle of rate hikes. This

could result in significant, but temporary, USD profit taking.

Going back to each of the three possible outcomes again, a German Eurozone exit

would unquestionably be perceived as very bad news, and would therefore have a

very negative impact on financial asset prices, at least in Europe, but it is very

unlikely to happen. Mrs. Merkel is far too pragmatic for that ever likely to happen

with her at the helm.

A Greek exit is far more plausible and would probably (after a bit of a wobble initially)

be considered a positive for European equities and perhaps even for Greek equities

in particular if the exit is combined with some sort of debt forgiveness.

Why? Because a Eurozone where the members are largely on an equal footing will

be considered a major positive. A critical reader or two may argue that Europe will

still suffer from large (insurmountable?) problems between north and south, but the

political leadership in Portugal, Spain and Italy will (a) have learned from the

mistakes made by Greece, and (b) are blessed with a willingness to make the

necessary changes which simply doesnt seem to exist in Greece.

A sovereign crisis in some emerging market country will probably be considered

largely irrelevant for financial asset prices in our part of the world, unless it were to

happen to a very large country like Brazil or Russia. The key there could very well be

Petrobras and Gazprom respectively. Both corporations are large USD borrowers

with earnings linked to the oil (and gas) price, so recent developments are not

pleasant ones for either of them. Given the size and importance of both companies

to the local economy, my guess is that what appears to be private debt is in fact

public debt. We shall see.

Outright currency wars

The Swiss Franc was a wonderful currency. Stable and predictable, at least until a

couple of weeks ago, when the Swiss woke up to a currency that was suddenly 30%

more expensive. Even if some of those gains were given up later in the day,

CHF/EUR still ended up about 15% on the day. A simple decision by the Swiss

National Bank to untie CHF from EUR, which was fast becoming a prohibitively

expensive policy, was behind the big move.

With CHF out of the way, currency speculators have turned their attention to

which currency to attack next, and the favourite seems to be DKK. The Danes have

kept DKK within a very narrow range against EUR for a number of years, and have

had to lower short-term rates in Denmark three times since the CHF incident to keep

the Danish currency sufficiently unattractive to speculators.

It is not unreasonable to expect DKK to strengthen meaningfully, should the tie be

loosened. The Danish media has been full of reports on how unlikely it is for the

Danes to drop the link, as there is absolutely no political desire to do so and, while

that is probably true, the real world works a little differently, as the Swiss found out.

In other words, a more coordinated attack on DKK at some stage is quite likely.

Whether the Danes will throw in the towel like the Swiss did remains to be seen, but

it is nevertheless too small a currency to have the sort of impact a stronger CHF will

have going forward. (I am Danish and like to think of Denmark as the centre of the

Universe but, in reality, it is not).

Whatever is going to happen, there is a much bigger story here. The Eurozone at

first, and then the policies pursued to address the credit crisis (mainly QE), have

largely eliminated interest rates as the key policy tool for monetary authorities. In

their place, exchange rates have taken over not as dictated by the powers that be

but by financial markets, at least so far.

The Absolute Return Letter

January 2015

Going into a period of relatively low economic growth, and with further interest rate

cuts likely to be largely futile, it doesnt take a lot of imagination to picture the

currency market becoming a playground for political leaders around the World

(more than it already is). I dont know yet who will play this game the best, but

expect plenty of exchange rate moves in the months and years to come.

Real-time testing of the new financial system

Very much linked to the currency story above is the risk that financial markets will

sooner or later test the resilience of the new financial system as refurbished by

central bankers around the globe in recent years, and those changes will prove to

be hopelessly inadequate. The attack on CHF was in reality one such test and the

strong dollar, which may still cause big problems in some borrowing nations, is

another one.

Obviously, the reaction to any such test will depend on how resilient markets are.

In that respect, a 30% move in CHF in less than one trading day could have created

much bigger problems than it apparently did, although I have been told that we

havent heard everything yet. So, unless there are still major skeletons to come out

of the cupboards, it is fair to say that the system passed this test with flying colours.

Equity melt-up

While many investors sit and wait for the next equity meltdown to unfold, exactly

the opposite could happen, and I am not even joking. It is not as crazy an idea as

you may first think. Some of the largest pension funds in the world have recently

decided to exit alternative investments almost entirely (think CalPERS and PMT).

Hence the vast majority of their capital will have to be invested in either bonds or

equities. With bond yields in many countries at historically low levels, the only

realistic (attractive) alternative to these investors will be equities.

If you add to that the fact that more and more capital is steered towards passive

investments, you potentially have an explosive cocktail, because the trend towards

passive investing is likely to push valuations of the largest companies to ever higher

levels. It is actually bizarre that the more expensively valued a company is, the

bigger its weight in various indices will be, and the more shares investors will buy

a fact that one shouldnt ignore.

This has two implications. Firstly, as more and more capital goes passive, growth

stocks will likely continue to outperform value ones (but beware; investors will wake

up one day). Secondly, as the move towards passive investing drives P/E ratios of

the most successful companies ever higher, we could in effect see a repeat of 1999,

when valuations of certain companies were almost grotesque.

As equity prices go ever higher, investors will be happy and will conveniently ignore

the fact that prices will eventually go into nosebleed territory, as most chose to do

in 1999. And the more capital that goes passive, the more likely this is to happen,

and the more likely it all is to end in tears.

Concluding remarks

The above mentioned scenarios are in no way mutually exclusive. It is quite possible

that more than one end game will unfold in the months and years to come. For

example, the recent parliamentary elections in Greece could quite feasibly end with

a Greek Eurozone exit.

Simultaneously, we could have a crisis unfolding across emerging markets, as the

strong U.S. dollar begins to do damage to borrowers in those countries, of which

there are many. Quite how it will all pan out with both negative and positive effects

is very difficult to predict.

The Absolute Return Letter

January 2015

I should also point out that nothing dramatic may happen at all. If I were a betting

man, my money would be on the permanent condition becoming the generally

accepted view of the future economic environment. By implication that means a

proper end game is never very likely to unfold. One growth-slowing incident (the

ageing of people in western society) has simply replaced another (the credit crisis)

without too many noticing.

The implication of that is that investors will slowly come around to the fact that

economic growth will stay relatively low for an extended period of time. One thing

is not likely to change anytime soon, though. I expect central bankers to continue

to take the blame for pretty much all miseries in this world.

Just one note to wrap up this months Absolute Return Letter, and it is a very sad

one. Ruggero Carraro, who has worked with us in Italy for several years, and who

has been a great friend of the firm, has died unexpectedly at the age of only 53. The

vast majority of our readership would not know Ruggero, but those who do will

probably agree with me that they rarely come better than him; extremely well tuned

into financial affairs and a great friend. He will be sadly missed. Ciao Ruggero.

Niels C. Jensen

2 February 2015

Absolute Return Partners LLP 2015. Registered in England No. OC303480. Authorised and

Regulated by the Financial Conduct Authority. Registered Office: 16 Water Lane, Richmond, Surrey,

TW9 1TJ, UK.

The Absolute Return Letter

January 2015

Important Notice

This material has been prepared by Absolute Return Partners LLP (ARP). ARP is

authorised and regulated by the Financial Conduct Authority in the United

Kingdom. It is provided for information purposes, is intended for your use only

and does not constitute an invitation or offer to subscribe for or purchase any of

the products or services mentioned. The information provided is not intended to

provide a sufficient basis on which to make an investment decision. Information

and opinions presented in this material have been obtained or derived from

sources believed by ARP to be reliable, but ARP makes no representation as to

their accuracy or completeness. ARP accepts no liability for any loss arising from

the use of this material. The results referred to in this document are not a guide

to the future performance of ARP. The value of investments can go down as well

as up and the implementation of the approach described does not guarantee

positive performance. Any reference to potential asset allocation and potential

returns do not represent and should not be interpreted as projections.

Absolute Return Partners

Absolute Return Partners LLP is a London based client-driven, alternative

investment boutique. We provide independent asset management and

investment advisory services globally to institutional investors.

We are a company with a simple mission delivering superior risk-adjusted

returns to our clients. We believe that we can achieve this through a disciplined

risk management approach and an investment process based on our open

architecture platform.

Our focus is strictly on absolute returns and our thinking, product development,

asset allocation and portfolio construction are all driven by a series of long-term

macro themes, some of which we express in the Absolute Return Letter.

We have eliminated all conflicts of interest with our transparent business model

and we offer flexible solutions, tailored to match specific needs.

We are authorised and regulated by the Financial Conduct Authority in the UK.

Visit www.arpinvestments.com to learn more about us.

Absolute Return Letter contributors:

Niels C. Jensen

nj@arpinvestments.com

Tel +44 20 8939 2901

Gerard Ifill-Williams

giw@arpinvestments.com

Tel +44 20 8939 2902

Nick Rees

nr@arpinvestments.com

Tel +44 20 8939 2903

Tricia Ward

tw@arpinvestments.com

Tel +44 20 8939 2906

You might also like

- Porter Stansberry - End of AmericaDocument40 pagesPorter Stansberry - End of AmericaRama Raju100% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- OakTree Real EstateDocument13 pagesOakTree Real EstateCanadianValue100% (1)

- Einhorn Consol PresentationDocument107 pagesEinhorn Consol PresentationCanadianValueNo ratings yet

- Beanstream API Integration OriginalDocument92 pagesBeanstream API Integration Originalsoleone9378No ratings yet

- How Do I Hate Thee?Document12 pagesHow Do I Hate Thee?richardck61No ratings yet

- The Absolute Return Letter 1113 PDFDocument11 pagesThe Absolute Return Letter 1113 PDFCanadianValueNo ratings yet

- Going GlobalDocument17 pagesGoing Globalrichardck61No ratings yet

- Financial Wanderings: Why'd It Do What It Did?Document4 pagesFinancial Wanderings: Why'd It Do What It Did?bblackburn76No ratings yet

- The Absolute Return Letter March 2015Document7 pagesThe Absolute Return Letter March 2015CanadianValueNo ratings yet

- Fat Tail Insurance Scenarios - SocGenDocument7 pagesFat Tail Insurance Scenarios - SocGenfcamargoeNo ratings yet

- Absolute Return Oct 2015Document9 pagesAbsolute Return Oct 2015CanadianValue0% (1)

- Ten Quick Topics To Ruin Your SummerDocument16 pagesTen Quick Topics To Ruin Your SummerbasilclickNo ratings yet

- Some Thoughts On DeflationDocument9 pagesSome Thoughts On Deflationrichardck30No ratings yet

- The Economic Singularity: by John MauldinDocument10 pagesThe Economic Singularity: by John Mauldinrichardck61No ratings yet

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDocument36 pagesStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaNo ratings yet

- Mauldin January 12Document12 pagesMauldin January 12richardck61No ratings yet

- Europe Takes The QE BatonDocument16 pagesEurope Takes The QE Batonrichardck61No ratings yet

- Review of Global EconomyDocument31 pagesReview of Global EconomyAnanthNo ratings yet

- Half A Bubble Off Dead CenterDocument14 pagesHalf A Bubble Off Dead Centerrichardck61No ratings yet

- Needed at The Fed: An Inverse Volcker: Detroit, Toronto, NYC?, and Coconut GroveDocument16 pagesNeeded at The Fed: An Inverse Volcker: Detroit, Toronto, NYC?, and Coconut Groverichardck61No ratings yet

- Mauldin February 5Document16 pagesMauldin February 5richardck61No ratings yet

- Oil - Islamorada November Newsletter ExtractDocument53 pagesOil - Islamorada November Newsletter ExtractDeepak SharmaNo ratings yet

- Guru Focus Interview With Arnold VandenbergDocument16 pagesGuru Focus Interview With Arnold VandenbergVu Latticework Poet100% (2)

- Air Phase1 0Document13 pagesAir Phase1 0drkwng100% (1)

- The Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellDocument15 pagesThe Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellGoldfish2021No ratings yet

- The Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellDocument15 pagesThe Costs Are Up Up Up Were Seeing Substantial Inflation Admits A Surprised Warren Buffett As PowellGoldfish2021No ratings yet

- Incrementum Advisory Board October 2015Document32 pagesIncrementum Advisory Board October 2015Gold Silver WorldsNo ratings yet

- John Mauldin: European Banks On The BrinkDocument7 pagesJohn Mauldin: European Banks On The BrinkTREND_7425No ratings yet

- The Pensford Letter - 8.13.12Document5 pagesThe Pensford Letter - 8.13.12Pensford FinancialNo ratings yet

- George Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFDocument88 pagesGeorge Soros - Reflections On The Crash of 2008 and What It Means - An Ebook Update To The New Paradigm For Financial Markets PDFJoao Alves Monteiro NetoNo ratings yet

- Economists Are (Still) CluelessDocument13 pagesEconomists Are (Still) Cluelessrichardck61No ratings yet

- Crisis Control For 2000 and Beyond: Boom or Bust?: Seven Key Principles to Surviving the Coming Economic UpheavalFrom EverandCrisis Control For 2000 and Beyond: Boom or Bust?: Seven Key Principles to Surviving the Coming Economic UpheavalNo ratings yet

- 11/4/14 Global-Macro Trading SimulationDocument20 pages11/4/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- End of AmericaDocument39 pagesEnd of AmericaAnonymous MdbmF7s5No ratings yet

- Mauldin March 6Document10 pagesMauldin March 6richardck61No ratings yet

- The Global Economy Is Slowing: in This Month's Issue..Document52 pagesThe Global Economy Is Slowing: in This Month's Issue..Nicolae ChisoceanuNo ratings yet

- 11/6/14 Global-Macro Trading SimulationDocument18 pages11/6/14 Global-Macro Trading SimulationPaul KimNo ratings yet

- China's Secret Plan To Take Over The World's Gold Market: Investment AdvisoryDocument12 pagesChina's Secret Plan To Take Over The World's Gold Market: Investment Advisorymtnrunner7No ratings yet

- Peak Oil DissertationDocument8 pagesPeak Oil DissertationWhoCanWriteMyPaperHartford100% (1)

- The Center Cannot Hold: LA, NYC, Hong Kong, and SingaporeDocument12 pagesThe Center Cannot Hold: LA, NYC, Hong Kong, and Singaporerichardck61No ratings yet

- Never Smile at A Crocodile: Debt and (Not Much) DeleveragingDocument9 pagesNever Smile at A Crocodile: Debt and (Not Much) Deleveragingrichardck61No ratings yet

- The Greater Depression or - How I Learned To Stop Worrying and Love The Bear 2011.10.15Document153 pagesThe Greater Depression or - How I Learned To Stop Worrying and Love The Bear 2011.10.15nicknyseNo ratings yet

- 2012-04-Echo From The AlpsDocument15 pages2012-04-Echo From The AlpsluikesNo ratings yet

- !!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentDocument6 pages!!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentGeneration GenerationNo ratings yet

- Are We Reaching "Limits To Growth"?Document7 pagesAre We Reaching "Limits To Growth"?George AdcockNo ratings yet

- The Pensford Letter - 10.24.11Document7 pagesThe Pensford Letter - 10.24.11Pensford FinancialNo ratings yet

- Aef No Business Like Bond Business StillDocument5 pagesAef No Business Like Bond Business StillNew AustrianeconomicsNo ratings yet

- The Pensford Letter - Leadpipe Locks 2015 Edition 12.31.14Document4 pagesThe Pensford Letter - Leadpipe Locks 2015 Edition 12.31.14Pensford FinancialNo ratings yet

- Mauldin December 7Document13 pagesMauldin December 7richardck61No ratings yet

- Gmo Quarterly LetterDocument16 pagesGmo Quarterly LetterAnonymous Ht0MIJ100% (2)

- How We FailedDocument6 pagesHow We FailedAndy HongNo ratings yet

- The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real MoneyFrom EverandThe Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real MoneyNo ratings yet

- The Bigger 'Bigger Picture'Document6 pagesThe Bigger 'Bigger Picture'tanase.octavian2561No ratings yet

- Mauldin September 27Document13 pagesMauldin September 27richardck61No ratings yet

- Dow Dive Shocks Investors: Dave's Daily: There's No TwoDocument9 pagesDow Dive Shocks Investors: Dave's Daily: There's No TwoAlbert L. PeiaNo ratings yet

- White Paper: We Re in A Financial Recession by Larson Gunness, July 2012Document3 pagesWhite Paper: We Re in A Financial Recession by Larson Gunness, July 2012E. Larson GunnessNo ratings yet

- Bill GrosBill GrossDocument4 pagesBill GrosBill GrossJuan HervadaNo ratings yet

- TL-Bill Gross Investment Outlook - June 2015 - Exp 6.30.16 - FINALv4Document4 pagesTL-Bill Gross Investment Outlook - June 2015 - Exp 6.30.16 - FINALv4dpbasicNo ratings yet

- Protect Yourself and ProfitDocument28 pagesProtect Yourself and ProfitMike AdemolaNo ratings yet

- Aftershock: Protect Yourself and Profit in the Next Global Financial MeltdownFrom EverandAftershock: Protect Yourself and Profit in the Next Global Financial MeltdownRating: 2.5 out of 5 stars2.5/5 (2)

- Is My Wife Cheating On Me?Document2 pagesIs My Wife Cheating On Me?Christian WehbeNo ratings yet

- INFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockDocument24 pagesINFLATION and DEFLATION - What Truly Causes Each What Lies Ahead and Why Woody BrockVas RaNo ratings yet

- Charlie Munger 2016 Daily Journal Annual Meeting Transcript 2 10 16 PDFDocument18 pagesCharlie Munger 2016 Daily Journal Annual Meeting Transcript 2 10 16 PDFaakashshah85No ratings yet

- Stan Druckenmiller The Endgame SohnDocument10 pagesStan Druckenmiller The Endgame SohnCanadianValueNo ratings yet

- Greenlight UnlockedDocument7 pagesGreenlight UnlockedZerohedgeNo ratings yet

- Stan Druckenmiller Sohn TranscriptDocument8 pagesStan Druckenmiller Sohn Transcriptmarketfolly.com100% (1)

- Hussman Funds Semi-Annual ReportDocument84 pagesHussman Funds Semi-Annual ReportCanadianValueNo ratings yet

- KaseFundannualletter 2015Document20 pagesKaseFundannualletter 2015CanadianValueNo ratings yet

- Munger-Daily Journal Annual Mtg-Adam Blum Notes-2!10!16Document12 pagesMunger-Daily Journal Annual Mtg-Adam Blum Notes-2!10!16CanadianValueNo ratings yet

- The Stock Market As Monetary Policy Junkie Quantifying The Fed's Impact On The S P 500Document6 pagesThe Stock Market As Monetary Policy Junkie Quantifying The Fed's Impact On The S P 500dpbasicNo ratings yet

- Market Macro Myths Debts Deficits and DelusionsDocument13 pagesMarket Macro Myths Debts Deficits and DelusionsCanadianValueNo ratings yet

- Whitney Tilson Favorite Long and Short IdeasDocument103 pagesWhitney Tilson Favorite Long and Short IdeasCanadianValueNo ratings yet

- Absolute Return Oct 2015Document9 pagesAbsolute Return Oct 2015CanadianValue0% (1)

- Investor Call Re Valeant PharmaceuticalsDocument39 pagesInvestor Call Re Valeant PharmaceuticalsCanadianValueNo ratings yet

- Einhorn Q4 2015Document7 pagesEinhorn Q4 2015CanadianValueNo ratings yet

- Letter To Clients and ShareholdersDocument3 pagesLetter To Clients and ShareholdersJulia Reynolds La RocheNo ratings yet

- Starboard Value LP AAP Presentation 09.30.15Document23 pagesStarboard Value LP AAP Presentation 09.30.15marketfolly.com100% (1)

- List PDFDocument9 pagesList PDFLulu LuthfiyahNo ratings yet

- Universal Banking Is A Combination of Commercial BankingDocument8 pagesUniversal Banking Is A Combination of Commercial Bankingsonika7No ratings yet

- State Bank of IndiaDocument3 pagesState Bank of IndiaImran HassanNo ratings yet

- Credit AppraisalDocument14 pagesCredit AppraisalRishabh Jain0% (1)

- Dr. Carlos S. Lanting CollegeDocument21 pagesDr. Carlos S. Lanting CollegeGalen Lei JaveñarNo ratings yet

- CleanDocument6 pagesCleanKadeen RobinsonNo ratings yet

- Sammy Gicheha - Bank StatementDocument6 pagesSammy Gicheha - Bank StatementJason MoutiNo ratings yet

- 13) Gregorio Araneta, Inc., V. Tuason de Paterno and Vidal, 91phil 786 (1952)Document14 pages13) Gregorio Araneta, Inc., V. Tuason de Paterno and Vidal, 91phil 786 (1952)Christian AnresNo ratings yet

- A Brief Report EnglishDocument10 pagesA Brief Report EnglishJohn BernalNo ratings yet

- Im en 2009 1 MylonakisDocument11 pagesIm en 2009 1 MylonakisFerdous AlaminNo ratings yet

- ELEMENTS of The Law of Bills, Notes, and Cheques and The English B of E ActDocument368 pagesELEMENTS of The Law of Bills, Notes, and Cheques and The English B of E ActDanny Clarke100% (1)

- New BizChannel@CIMB Campaign Form - Final (061115)Document3 pagesNew BizChannel@CIMB Campaign Form - Final (061115)AzuanNo ratings yet

- Your RBC Personal Banking Account StatementDocument4 pagesYour RBC Personal Banking Account StatementmarktunguaqNo ratings yet

- Conference Details SunflowerDocument16 pagesConference Details SunflowerSahil VoraNo ratings yet

- Sample Paper-05 (2016-17) Economics Class - XII Time Allowed: 3 Hours Maximum Marks: 100 AnswersDocument6 pagesSample Paper-05 (2016-17) Economics Class - XII Time Allowed: 3 Hours Maximum Marks: 100 AnswerspariteotiaNo ratings yet

- Reforms in Capital MarketDocument2 pagesReforms in Capital MarketApurv SuryaNo ratings yet

- Credit Digitization For Credit Management Presentation 23jul19Document21 pagesCredit Digitization For Credit Management Presentation 23jul19Chidozie Farsight100% (1)

- Loan EMI CalculatorDocument13 pagesLoan EMI CalculatorSameer ThakkarNo ratings yet

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNo ratings yet

- A Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Document120 pagesA Project Report ON: "Comparative Study of Current Account and Saving Account of HDFC Bank With Other Private Banks"Vaibhav ShuklaNo ratings yet

- Banking For The Poor, NigeriaDocument18 pagesBanking For The Poor, NigeriaRight MagejoNo ratings yet

- Account Statement For The Account: 1926010003332: Branch DetailsDocument7 pagesAccount Statement For The Account: 1926010003332: Branch DetailsOp MassNo ratings yet

- Project Titles VBDocument2 pagesProject Titles VBgovindarajnNo ratings yet

- Islamic Infrastructure Project FinanceDocument97 pagesIslamic Infrastructure Project FinancePakistan ZindabadNo ratings yet

- PA Language DetailsDocument460 pagesPA Language Detailssaad essalmaniNo ratings yet

- BLW/INV38/04/2020: Note: This Invoice Is Not Valid Whitout Our Official StampDocument2 pagesBLW/INV38/04/2020: Note: This Invoice Is Not Valid Whitout Our Official StampAnisa YosivaNo ratings yet

- Rights of Unpaid Seller: Submitted By: Name: Ananya Shukla Roll Number: 1914Document21 pagesRights of Unpaid Seller: Submitted By: Name: Ananya Shukla Roll Number: 1914Ananya ShuklaNo ratings yet

- EDW at HDFCDocument26 pagesEDW at HDFCYogesh YadavNo ratings yet

- Law On Nego Sundiang NotesDocument33 pagesLaw On Nego Sundiang NotesAudrey100% (1)