Professional Documents

Culture Documents

Derivations: - Computational

Derivations: - Computational

Uploaded by

Andrin LlemosCopyright:

Available Formats

You might also like

- 기초전기전자공학 Floyd 8판 솔루션Document194 pages기초전기전자공학 Floyd 8판 솔루션박범규No ratings yet

- Derivations: - ComputationalDocument5 pagesDerivations: - ComputationalAndrin LlemosNo ratings yet

- Derivations: - ComputationalDocument3 pagesDerivations: - ComputationalEdiane QuilezaNo ratings yet

- Derivations: - ComputationalDocument4 pagesDerivations: - ComputationalHAKUNA MATATANo ratings yet

- Null 1Document2 pagesNull 1Mazen SalahNo ratings yet

- Additonal - Chapter 5Document19 pagesAdditonal - Chapter 5Gega XachidENo ratings yet

- Homework 1Document5 pagesHomework 1zelihasekmen1453No ratings yet

- Krm8 Ism Ch11Document34 pagesKrm8 Ism Ch11Saif Ullah Qureshi100% (2)

- 312 Relcost Soln3 PDFDocument1 page312 Relcost Soln3 PDFMissInertia07No ratings yet

- Tutorial 1 SolutionDocument3 pagesTutorial 1 Solutionsissy.he.7No ratings yet

- Tutorial 4 SolutionDocument3 pagesTutorial 4 Solutionsissy.he.7No ratings yet

- Approximations Quiz 35Document6 pagesApproximations Quiz 35queensmiling495No ratings yet

- Chapter 1 - Standard FormDocument9 pagesChapter 1 - Standard FormNasir RahmanNo ratings yet

- Topic 3 Extra Questions Suggested AnswersDocument4 pagesTopic 3 Extra Questions Suggested AnswersThirusha balamuraliNo ratings yet

- UAS Struktur Beton Lanjutan VI B KBGDocument5 pagesUAS Struktur Beton Lanjutan VI B KBGCliv Fabo SolossaNo ratings yet

- D E+ D X RD+ E D+ E X : Return Richard ExpectDocument5 pagesD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanNo ratings yet

- Multiple Choice AnswersDocument3 pagesMultiple Choice AnswersrenNo ratings yet

- Exercises2 - SolutionsDocument1 pageExercises2 - SolutionsGiorgi TediashviliNo ratings yet

- Electronics Fundamentals Circuits Devices and ApplicationsDocument194 pagesElectronics Fundamentals Circuits Devices and ApplicationsRenz Justine VillegasNo ratings yet

- Solution To CVP ProblemsDocument8 pagesSolution To CVP ProblemsGizachew NadewNo ratings yet

- CVP ANALYSIS (Solutions)Document24 pagesCVP ANALYSIS (Solutions)Mohammad UmairNo ratings yet

- Solutions To Sample Variable Absorption and Job Order CostingDocument7 pagesSolutions To Sample Variable Absorption and Job Order CostingWinter's ClandestineNo ratings yet

- Homework 1Document8 pagesHomework 1Shawn HarringtonNo ratings yet

- Cara Hitung AnalitisDocument11 pagesCara Hitung AnalitisZatalini Gaje Mushi-damaNo ratings yet

- Problems Involving Money L2 AnswersDocument7 pagesProblems Involving Money L2 AnswersDanyNo ratings yet

- Equivalant UnitDocument1 pageEquivalant UnitAva DasNo ratings yet

- Multiple Choice Answers: - ConceptualDocument1 pageMultiple Choice Answers: - ConceptualDing CostaNo ratings yet

- 1.4 IQM Suggested AnswersDocument10 pages1.4 IQM Suggested AnswersCollen MahamboNo ratings yet

- 1281College Mathematics 9th Edition Cleaves Solutions Manual download pdf full chapterDocument35 pages1281College Mathematics 9th Edition Cleaves Solutions Manual download pdf full chapterjhaninkeyson100% (4)

- Business Math Long Test 1Document1 pageBusiness Math Long Test 1gianenekarlamarteNo ratings yet

- Sol-Manual (9-Chap's) Thomas - L.floyd - Principles of Electric Circuits (2013)Document98 pagesSol-Manual (9-Chap's) Thomas - L.floyd - Principles of Electric Circuits (2013)Sarmad AsadNo ratings yet

- Textbook Solutions Chapter 9Document76 pagesTextbook Solutions Chapter 9api-371867039No ratings yet

- Engineering Economy Solution of HW2: Exercise 1Document5 pagesEngineering Economy Solution of HW2: Exercise 1Moe ShNo ratings yet

- Business Data Analysis 12 Assignment 11Document9 pagesBusiness Data Analysis 12 Assignment 11Fungai MajuriraNo ratings yet

- Akuntansi Manajemen CPVDocument13 pagesAkuntansi Manajemen CPVVanni LimNo ratings yet

- Solution Assignment 4 Chapter 7Document9 pagesSolution Assignment 4 Chapter 7Huynh Ng Quynh NhuNo ratings yet

- A2.Docx BST 10104Document7 pagesA2.Docx BST 10104veha nathanNo ratings yet

- Tugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42Document3 pagesTugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42WisnualdiwibowoNo ratings yet

- Decesion MakingDocument11 pagesDecesion MakingShoaib NaeemNo ratings yet

- Part One Solutions To End-of-Chapter ProblemsDocument194 pagesPart One Solutions To End-of-Chapter ProblemsMuhammad OsamaNo ratings yet

- Electronics Fundamentals: Circuits, Devices, and ApplicationsDocument381 pagesElectronics Fundamentals: Circuits, Devices, and ApplicationsHarold AmbidNo ratings yet

- Class - VI Mathematics (Ex. 2.1) QuestionsDocument7 pagesClass - VI Mathematics (Ex. 2.1) QuestionsAnanya KarmakarNo ratings yet

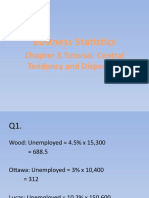

- Business Statistics: Chapter 3 Tutorial: Central Tendency and DispersionDocument27 pagesBusiness Statistics: Chapter 3 Tutorial: Central Tendency and DispersionAnnie LimNo ratings yet

- KeedaapproximationDocument24 pagesKeedaapproximationAshwini SNo ratings yet

- Approximation PDF Set 1Document23 pagesApproximation PDF Set 1sharmasuhani944No ratings yet

- Approximation PDF Set 1Document23 pagesApproximation PDF Set 1sanju kumariNo ratings yet

- Mathematical Studies IB Worked SolutionsDocument38 pagesMathematical Studies IB Worked SolutionsJuanita DomínguezNo ratings yet

- Chapter 1&2 AnswerDocument2 pagesChapter 1&2 AnswerSwee Yi LeeNo ratings yet

- Fiche - Le ComplémentaireDocument1 pageFiche - Le Complémentairepeyre.pamelaNo ratings yet

- Chapter-12-Worked-Solutions Year 11 Standard Maths Cambridge NSWDocument13 pagesChapter-12-Worked-Solutions Year 11 Standard Maths Cambridge NSWallthehalls666No ratings yet

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensNo ratings yet

- College Mathematics 9th Edition Cleaves Solutions ManualDocument11 pagesCollege Mathematics 9th Edition Cleaves Solutions ManualBrian Craig100% (40)

- Inventory Workshop Operations Research II Presented By: Silvia Santamaria & Yesica Taboada Problem 1Document5 pagesInventory Workshop Operations Research II Presented By: Silvia Santamaria & Yesica Taboada Problem 1Silvia SantamariaNo ratings yet

- Jawapan PPT Math Ting 3 (Modul 2)Document6 pagesJawapan PPT Math Ting 3 (Modul 2)Yan WahabNo ratings yet

- WFWEDocument30 pagesWFWEEstiven Gier50% (4)

- 100 Soalan Cepat KiraDocument8 pages100 Soalan Cepat KiraRukmani NadarajahNo ratings yet

- Calculus Group5Document27 pagesCalculus Group5VictoriaReyes_No ratings yet

- Jawapan PPT Math Ting 3 2023Document6 pagesJawapan PPT Math Ting 3 2023Yan WahabNo ratings yet

- HomeworkDocument4 pagesHomeworkBrianna MossNo ratings yet

- Analytic Geometry: Graphic Solutions Using Matlab LanguageFrom EverandAnalytic Geometry: Graphic Solutions Using Matlab LanguageNo ratings yet

- Conceptual Framework.: ThoroughlyDocument2 pagesConceptual Framework.: ThoroughlyAndrin LlemosNo ratings yet

- 123Document18 pages123Andrin LlemosNo ratings yet

- Plate Group Assignments Plan: Complete The FollowingDocument2 pagesPlate Group Assignments Plan: Complete The FollowingAndrin LlemosNo ratings yet

- Obligations AND ContractsDocument1 pageObligations AND ContractsAndrin LlemosNo ratings yet

- Derivations: - ComputationalDocument5 pagesDerivations: - ComputationalAndrin LlemosNo ratings yet

- Audit EvidenceDocument2 pagesAudit EvidenceAndrin LlemosNo ratings yet

- Chapter 9Document4 pagesChapter 9Andrin LlemosNo ratings yet

- PSA NotesDocument3 pagesPSA NotesAndrin Llemos100% (2)

Derivations: - Computational

Derivations: - Computational

Uploaded by

Andrin LlemosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivations: - Computational

Derivations: - Computational

Uploaded by

Andrin LlemosCopyright:

Available Formats

DERIVATIONS Computational

No.

Answer

Derivation

84.

$27,000 + $59,000 + $72,000 = $158,000.

85.

$27,000 + $59,000 + $92,000 = $178,000.

86.

[($10,000 $1,000) .02] = $180.

87.

[($30,000 $3,000) .02] = $540.

88.

$650,000 + $50,000 + $75,000 = $775,000.

89.

$475,000 + $25,000 = $500,000.

90.

$1,200,000 and ($135,000 + $10,000) = $145,000.

($1,600,000 + $10,000) and ($85,000 $23,000 + $10,000) =

92.

$3,000 + $2,000 = $5,000.

93.

$6,000 ($3,000 + $2,000) = $1,000.

94.

The effect of the errors in ending inventories reverse themselves in

the following year.

95.

$260,000 + (4 $150,000) = $860,000.

96.

$1,200 ($1,200 .02) = $1,176.

97.

($16,000 $1,200) .02 = $296.

91.

$72,000.

98.

b

$10.237/unit

($29,310 + $20,600 + $28,917) (3,000 + 2,000 + 2,700) =

$10.237 1,200 = $12,284.

99.

Avg. on 1/6 $49,910 5,000 = $9.982/unit

1/26 $53,872 5,200 = $10.36/unit

$10.36 1,200 = $12,432.

100.

(100 $4.20) + (30 $4.40) = $552.

No.

Answer

101.

100 + 350 + 70 130 = 390 units

(100 $4.20) + (290 $4.40) = $1,696.

102.

($60,000 $40,000) = $20,000.

103.

Available (purchases) = 6,500 units

Sales = 5,200 units

EI = 6,500 5,200 = 1,300 units

(800 $3.20) + (500 $3.10) = $4,110.

104.

(200 $3.2) + (400 $3.1) + (400 $3.4) + (300 $3.5) = $4,290.

Date

6/1

6/2

6/3

Derivation

Purchase

(800 @ 3.2)

2,560

(2,200 @ 3.1)

(1,200 @ 3.3)

(600 @ 3.2)

1,920

(1,600 @ 3.1)

4,960

6,820

6/6

6/7

Sold

3,960

6/9

(1,000 @ 3.3)

6/10

(200 @ 3.3)

(200 @ 3.1)

6/15

(1,800 @ 3.4)

1,280

6,120

6/18

6/22

6/25

3,300

(1,400 @ 3.4) 4,760

(500 @ 3.5)

1,750

(200 @ 3.5)

700

Balance

(800 @ 3.2)

(200 @ 3.2)

(200 @ 3.2)

(2,200 @ 3.1)

(200 @ 3.2)

(600 @ 3.1)

(200 @ 3.2)

(600 @ 3.1)

(1,200 @ 3.3)

(200 @ 3.2)

(600 @ 3.1)

(200 @ 3.3)

(200 @ 3.2)

(400 @ 3.1)

(200 @ 3.2)

(400 @ 3.1)

(1,800 @ 3.4)

(200 @ 3.2)

(400 @ 3.1)

(400 @ 3.4)

(500 @ 3.5)

(200 @ 3.2)

(400 @ 3.1)

(400 @ 3.4)

(300 @ 3.5)

105.

(500 $3.5) + (800 $3.4) = $4,470.

106.

$21,210 6,500 units = $3.26

$3.26 1,300 = $4,238.

107.

(400 $10) $1,600 = $2,400 COGS

[(500 $4) + $2,800] $2,400 = $2,400 E.I.

($4,800 800) 400 units = $2,400 E.I. under weighted avg.

2,560

640

7,460

2,500

6,460

3,160

1,880

8,000

3,240

4,990

4,290

No.

Answer

Derivation

108.

(600 $10) $2,100 = $3,900 COGS

[(500 $5) + $2,400] $3,900 = $1,000 E.I.

200 $5 = $1,000 E.I. under LIFO.

109.

10 + 60 45 = 25 units.

110.

45 $20/unit = $900.

111.

2,000) =

[(1,200 $12) + (500 $13) + (2,000 $13.50] (1,200 + 500 +

$12.95; $12.95 2,150 = $27,843.

112.

$67.54;

[(200 $65) + (300 $68) + (150 $70)] (200 + 300 + 150) =

$67.54 (650 500) = $10,131.

113.

(1,200 + 500 + 2,000) 2,150 = 1,550; 1,550 $13.50 = $20,925.

114.

(200 $65) + [(500 200) $68] = $33,400.

115.

(1,200 + 500 + 2,000) 2,150 = 1,550;

(1,200 $12) + [(1,550 1,200) $13] = $18,950.

116.

(150 $70) + (300 $68) + (50 $65) = $34,150.

117.

$450,000 + ($90,000 $60,000) = $480,000.

118.

$600,000 + ($120,000 $80,000) = $640,000.

119.

[(700 600) ($6 $4)] = $200.

120.

[(700 600) ($9 $6)] = $300.

121.

$143,360 1.12 = $128,000 $100,000 = $28,000.

$100,000 + ($28,000 1.12) = $131,360.

122.

$100,000 + $600,000 $131,360 = $568,640 COGS

$1,000,000 $568,640 = $431,360.

123.

$126,500 1.10 = $115,000 $100,000 = $15,000.

$100,000 + ($15,000 1.10) = $116,500.

124.

$100,000 + $600,000 $116,500 = $583,500 COGS

$1,000,000 $583,500 = $416,500.

125.

$256,800 1.07 = $240,000

$220,000 + [(240,000 $220,000) 1.07] = $241,400.

126.

$290,000 1.25 = $232,000

($220,000 1) + ($12,000 1.07) = $232,840.

No.

Answer

127.

Derivation

$325,000 1.30 = $250,000

($220,000 1) + ($12,000 1.07) + ($18,000 1.3) = $256,240.

128.

[(2,000 $6) + (10,000 $5.75) + (7,000 $17)] [(12,000 $5) +

(7,000 $16)] = 1.0959 = 109.59%.

129.

$345,000 1.10 = $313,636; $313,636 $250,000 = $63,636;

$250,000 + ($63,636 1.10) = $320,000.

130.

$47,000;

$215,000 1.25 = $172,000; $172,000 ($150,000 1.20) =

$100,000 + [($150,000 1.20) $100,000) 1.2] = $130,000

$130,000 + ($47,000 1.25) = $188,750.

131.

$65,000 1.00 = $65,000.

132.

$126,000 1.05 = $120,000; $120,000 $65,000 = $55,000.

$65,000 + ($55,000 1.05) = $122,750.

133.

$135,000 1.10 = $122,727; $122,727 ($126,000 1.05) = $2,727;

$126,000 1.05 = $120,000; $120,000 $65,000 = $55,000;

$65,000 + ($55,000 1.05) + ($2,727 1.10) = $125,750.

DERIVATIONS CPA Adapted

No.

Answer

Derivation

134.

Conceptual.

135.

$300,000 + $8,000 $2,000 = $306,000.

136.

$130,000 + $14,000 + $575,000 + $70,000 + $10,000 + $5,000

$145,000 $20,000 = $639,000.

137.

$800,000 + $350,000 + $147,000 = $1,297,000.

138.

$700,000 + $40,000 + $30,000 = $770,000.

139.

$1,500,000 + $70,000 + $50,000 = $1,620,000.

140.

$50,000 .8 .9 = $36,000.

141.

$20,000 .7 .8 = $11,200

($11,200 .98) + 400 = $11,376.

142.

[(1,600 $8.00) + (4,000 $9.40)] 5,600 = $9.00.

143.

Conceptual.

No.

Answer

Derivation

144.

Conceptual.

145.

(450 $42) + (150 $44) = $25,500.

146.

Conceptual.

147.

$440,000 1.1 = $400,000

$320,000 + ($80,000 1.1) = $408,000.

You might also like

- 기초전기전자공학 Floyd 8판 솔루션Document194 pages기초전기전자공학 Floyd 8판 솔루션박범규No ratings yet

- Derivations: - ComputationalDocument5 pagesDerivations: - ComputationalAndrin LlemosNo ratings yet

- Derivations: - ComputationalDocument3 pagesDerivations: - ComputationalEdiane QuilezaNo ratings yet

- Derivations: - ComputationalDocument4 pagesDerivations: - ComputationalHAKUNA MATATANo ratings yet

- Null 1Document2 pagesNull 1Mazen SalahNo ratings yet

- Additonal - Chapter 5Document19 pagesAdditonal - Chapter 5Gega XachidENo ratings yet

- Homework 1Document5 pagesHomework 1zelihasekmen1453No ratings yet

- Krm8 Ism Ch11Document34 pagesKrm8 Ism Ch11Saif Ullah Qureshi100% (2)

- 312 Relcost Soln3 PDFDocument1 page312 Relcost Soln3 PDFMissInertia07No ratings yet

- Tutorial 1 SolutionDocument3 pagesTutorial 1 Solutionsissy.he.7No ratings yet

- Tutorial 4 SolutionDocument3 pagesTutorial 4 Solutionsissy.he.7No ratings yet

- Approximations Quiz 35Document6 pagesApproximations Quiz 35queensmiling495No ratings yet

- Chapter 1 - Standard FormDocument9 pagesChapter 1 - Standard FormNasir RahmanNo ratings yet

- Topic 3 Extra Questions Suggested AnswersDocument4 pagesTopic 3 Extra Questions Suggested AnswersThirusha balamuraliNo ratings yet

- UAS Struktur Beton Lanjutan VI B KBGDocument5 pagesUAS Struktur Beton Lanjutan VI B KBGCliv Fabo SolossaNo ratings yet

- D E+ D X RD+ E D+ E X : Return Richard ExpectDocument5 pagesD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanNo ratings yet

- Multiple Choice AnswersDocument3 pagesMultiple Choice AnswersrenNo ratings yet

- Exercises2 - SolutionsDocument1 pageExercises2 - SolutionsGiorgi TediashviliNo ratings yet

- Electronics Fundamentals Circuits Devices and ApplicationsDocument194 pagesElectronics Fundamentals Circuits Devices and ApplicationsRenz Justine VillegasNo ratings yet

- Solution To CVP ProblemsDocument8 pagesSolution To CVP ProblemsGizachew NadewNo ratings yet

- CVP ANALYSIS (Solutions)Document24 pagesCVP ANALYSIS (Solutions)Mohammad UmairNo ratings yet

- Solutions To Sample Variable Absorption and Job Order CostingDocument7 pagesSolutions To Sample Variable Absorption and Job Order CostingWinter's ClandestineNo ratings yet

- Homework 1Document8 pagesHomework 1Shawn HarringtonNo ratings yet

- Cara Hitung AnalitisDocument11 pagesCara Hitung AnalitisZatalini Gaje Mushi-damaNo ratings yet

- Problems Involving Money L2 AnswersDocument7 pagesProblems Involving Money L2 AnswersDanyNo ratings yet

- Equivalant UnitDocument1 pageEquivalant UnitAva DasNo ratings yet

- Multiple Choice Answers: - ConceptualDocument1 pageMultiple Choice Answers: - ConceptualDing CostaNo ratings yet

- 1.4 IQM Suggested AnswersDocument10 pages1.4 IQM Suggested AnswersCollen MahamboNo ratings yet

- 1281College Mathematics 9th Edition Cleaves Solutions Manual download pdf full chapterDocument35 pages1281College Mathematics 9th Edition Cleaves Solutions Manual download pdf full chapterjhaninkeyson100% (4)

- Business Math Long Test 1Document1 pageBusiness Math Long Test 1gianenekarlamarteNo ratings yet

- Sol-Manual (9-Chap's) Thomas - L.floyd - Principles of Electric Circuits (2013)Document98 pagesSol-Manual (9-Chap's) Thomas - L.floyd - Principles of Electric Circuits (2013)Sarmad AsadNo ratings yet

- Textbook Solutions Chapter 9Document76 pagesTextbook Solutions Chapter 9api-371867039No ratings yet

- Engineering Economy Solution of HW2: Exercise 1Document5 pagesEngineering Economy Solution of HW2: Exercise 1Moe ShNo ratings yet

- Business Data Analysis 12 Assignment 11Document9 pagesBusiness Data Analysis 12 Assignment 11Fungai MajuriraNo ratings yet

- Akuntansi Manajemen CPVDocument13 pagesAkuntansi Manajemen CPVVanni LimNo ratings yet

- Solution Assignment 4 Chapter 7Document9 pagesSolution Assignment 4 Chapter 7Huynh Ng Quynh NhuNo ratings yet

- A2.Docx BST 10104Document7 pagesA2.Docx BST 10104veha nathanNo ratings yet

- Tugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42Document3 pagesTugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42WisnualdiwibowoNo ratings yet

- Decesion MakingDocument11 pagesDecesion MakingShoaib NaeemNo ratings yet

- Part One Solutions To End-of-Chapter ProblemsDocument194 pagesPart One Solutions To End-of-Chapter ProblemsMuhammad OsamaNo ratings yet

- Electronics Fundamentals: Circuits, Devices, and ApplicationsDocument381 pagesElectronics Fundamentals: Circuits, Devices, and ApplicationsHarold AmbidNo ratings yet

- Class - VI Mathematics (Ex. 2.1) QuestionsDocument7 pagesClass - VI Mathematics (Ex. 2.1) QuestionsAnanya KarmakarNo ratings yet

- Business Statistics: Chapter 3 Tutorial: Central Tendency and DispersionDocument27 pagesBusiness Statistics: Chapter 3 Tutorial: Central Tendency and DispersionAnnie LimNo ratings yet

- KeedaapproximationDocument24 pagesKeedaapproximationAshwini SNo ratings yet

- Approximation PDF Set 1Document23 pagesApproximation PDF Set 1sharmasuhani944No ratings yet

- Approximation PDF Set 1Document23 pagesApproximation PDF Set 1sanju kumariNo ratings yet

- Mathematical Studies IB Worked SolutionsDocument38 pagesMathematical Studies IB Worked SolutionsJuanita DomínguezNo ratings yet

- Chapter 1&2 AnswerDocument2 pagesChapter 1&2 AnswerSwee Yi LeeNo ratings yet

- Fiche - Le ComplémentaireDocument1 pageFiche - Le Complémentairepeyre.pamelaNo ratings yet

- Chapter-12-Worked-Solutions Year 11 Standard Maths Cambridge NSWDocument13 pagesChapter-12-Worked-Solutions Year 11 Standard Maths Cambridge NSWallthehalls666No ratings yet

- Sol. Man. - Chapter 15 EpsDocument12 pagesSol. Man. - Chapter 15 Epsfinn mertensNo ratings yet

- College Mathematics 9th Edition Cleaves Solutions ManualDocument11 pagesCollege Mathematics 9th Edition Cleaves Solutions ManualBrian Craig100% (40)

- Inventory Workshop Operations Research II Presented By: Silvia Santamaria & Yesica Taboada Problem 1Document5 pagesInventory Workshop Operations Research II Presented By: Silvia Santamaria & Yesica Taboada Problem 1Silvia SantamariaNo ratings yet

- Jawapan PPT Math Ting 3 (Modul 2)Document6 pagesJawapan PPT Math Ting 3 (Modul 2)Yan WahabNo ratings yet

- WFWEDocument30 pagesWFWEEstiven Gier50% (4)

- 100 Soalan Cepat KiraDocument8 pages100 Soalan Cepat KiraRukmani NadarajahNo ratings yet

- Calculus Group5Document27 pagesCalculus Group5VictoriaReyes_No ratings yet

- Jawapan PPT Math Ting 3 2023Document6 pagesJawapan PPT Math Ting 3 2023Yan WahabNo ratings yet

- HomeworkDocument4 pagesHomeworkBrianna MossNo ratings yet

- Analytic Geometry: Graphic Solutions Using Matlab LanguageFrom EverandAnalytic Geometry: Graphic Solutions Using Matlab LanguageNo ratings yet

- Conceptual Framework.: ThoroughlyDocument2 pagesConceptual Framework.: ThoroughlyAndrin LlemosNo ratings yet

- 123Document18 pages123Andrin LlemosNo ratings yet

- Plate Group Assignments Plan: Complete The FollowingDocument2 pagesPlate Group Assignments Plan: Complete The FollowingAndrin LlemosNo ratings yet

- Obligations AND ContractsDocument1 pageObligations AND ContractsAndrin LlemosNo ratings yet

- Derivations: - ComputationalDocument5 pagesDerivations: - ComputationalAndrin LlemosNo ratings yet

- Audit EvidenceDocument2 pagesAudit EvidenceAndrin LlemosNo ratings yet

- Chapter 9Document4 pagesChapter 9Andrin LlemosNo ratings yet

- PSA NotesDocument3 pagesPSA NotesAndrin Llemos100% (2)