Professional Documents

Culture Documents

Lambdastar Infrastructure Partners LLC

Lambdastar Infrastructure Partners LLC

Uploaded by

JayCopyright:

Available Formats

You might also like

- Setoff BondDocument1 pageSetoff BondMichael Kovach95% (42)

- Bank Guarantee Swift Mt760 Sample 2Document1 pageBank Guarantee Swift Mt760 Sample 2Божидар Денев100% (1)

- De Lage Landen Financial Services vs. Frydman - CompanyDocument11 pagesDe Lage Landen Financial Services vs. Frydman - CompanyJayNo ratings yet

- Jack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanDocument129 pagesJack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanJayNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument11 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityCJNo ratings yet

- Torren Colcord's "Promissary Note"Document6 pagesTorren Colcord's "Promissary Note"RickyRescueNo ratings yet

- Fake Whistleblower Robert MacLean - Clean Up America of California - Recorded Los Angeles County Tax LienDocument1 pageFake Whistleblower Robert MacLean - Clean Up America of California - Recorded Los Angeles County Tax LienThe Truth ChroniclesNo ratings yet

- Litton Loan Short SaleDocument3 pagesLitton Loan Short SaleGreg ZajdelNo ratings yet

- Proof of Claim by First Community BankDocument31 pagesProof of Claim by First Community BankbdcoryellNo ratings yet

- United States v. Erie R. Co., 106 U.S. 327 (1882)Document11 pagesUnited States v. Erie R. Co., 106 U.S. 327 (1882)Scribd Government DocsNo ratings yet

- Tax 6th Set Case Digest Part 2Document21 pagesTax 6th Set Case Digest Part 2jesserazonrnNo ratings yet

- Metrobank V CIRDocument2 pagesMetrobank V CIRReena MaNo ratings yet

- 10000001667Document79 pages10000001667Chapter 11 DocketsNo ratings yet

- Ontario Statement of Claim EXAMPLE 1Document8 pagesOntario Statement of Claim EXAMPLE 1Jonathan AlphonsoNo ratings yet

- MBTC v. CIRDocument3 pagesMBTC v. CIRAngelique Padilla UgayNo ratings yet

- Standard Roofing & Material Co. v. United States, 199 F.2d 607, 10th Cir. (1952)Document4 pagesStandard Roofing & Material Co. v. United States, 199 F.2d 607, 10th Cir. (1952)Scribd Government DocsNo ratings yet

- Osorio Tax Refund Case DigestsDocument5 pagesOsorio Tax Refund Case DigestsErwin April MidsapakNo ratings yet

- Debtors.) : in Re:) Chapter 11Document25 pagesDebtors.) : in Re:) Chapter 11Chapter 11 DocketsNo ratings yet

- 12-12553-jmp Doc 12Document3 pages12-12553-jmp Doc 12oldhillbillyNo ratings yet

- 103 Metropolitan Bank V CIRDocument3 pages103 Metropolitan Bank V CIRAJ QuimNo ratings yet

- NJ Ins. Co. v. Div. of Tax Appeals, 338 U.S. 665 (1950)Document11 pagesNJ Ins. Co. v. Div. of Tax Appeals, 338 U.S. 665 (1950)Scribd Government DocsNo ratings yet

- NDC v. CIRDocument2 pagesNDC v. CIRalexis_bea100% (1)

- United States Bankruptcy Court Southern District of New YorkDocument7 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayDocument15 pagesDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayChapter 11 DocketsNo ratings yet

- Mindanao Shopping Destination Corp. vs. Davao City, CTA AC No. 62, Jan. 21, 2011Document8 pagesMindanao Shopping Destination Corp. vs. Davao City, CTA AC No. 62, Jan. 21, 2011Jade Palace TribezNo ratings yet

- Garcia POC Including Note 1 - No EndorsementDocument31 pagesGarcia POC Including Note 1 - No EndorsementAC FieldNo ratings yet

- PreliminaryReport 10 Audrey LNDocument18 pagesPreliminaryReport 10 Audrey LNtraderash1020No ratings yet

- United States Bankruptcy Court District of DelawareDocument76 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- Ericsson Vs City of PasigDocument3 pagesEricsson Vs City of PasigRaymond RoqueNo ratings yet

- NJ Debt Collection LawsDocument10 pagesNJ Debt Collection LawsfdarteeNo ratings yet

- Commissioner vs. PalancaDocument6 pagesCommissioner vs. Palancacmv mendozaNo ratings yet

- Wisconsin Gas Co. v. United States, 322 U.S. 526 (1944)Document6 pagesWisconsin Gas Co. v. United States, 322 U.S. 526 (1944)Scribd Government DocsNo ratings yet

- Documentary Stamp TaxDocument24 pagesDocumentary Stamp TaxBlack PantherNo ratings yet

- Louisiana v. Jumel, 107 U.S. 711 (1883)Document46 pagesLouisiana v. Jumel, 107 U.S. 711 (1883)Scribd Government DocsNo ratings yet

- Victorias Milling Vs PPA (G.R. No. 73705 Aug 27, 1987)Document19 pagesVictorias Milling Vs PPA (G.R. No. 73705 Aug 27, 1987)NingClaudioNo ratings yet

- Winthrop Couchot Professional Corporation: Filed & EnteredDocument6 pagesWinthrop Couchot Professional Corporation: Filed & EnteredChapter 11 DocketsNo ratings yet

- Ordered:: Case 12-20253-KAO Doc 15 Filed 10/10/12 Ent. 10/10/12 16:31:02 Pg. 1 of 2Document2 pagesOrdered:: Case 12-20253-KAO Doc 15 Filed 10/10/12 Ent. 10/10/12 16:31:02 Pg. 1 of 2Chapter 11 DocketsNo ratings yet

- Filipinas Synthetic Fiber Corp. Vs CA, CTA and CIRDocument3 pagesFilipinas Synthetic Fiber Corp. Vs CA, CTA and CIRNathalie YapNo ratings yet

- RCBCDocument2 pagesRCBCLisa BautistaNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDocument3 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNo ratings yet

- United States Court of Appeals, Third CircuitDocument15 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- United States Bankruptcy Court Central District Santa Ana DivisionDocument6 pagesUnited States Bankruptcy Court Central District Santa Ana DivisionChapter 11 DocketsNo ratings yet

- Leyte Bank of CommerceDocument5 pagesLeyte Bank of CommerceDennis Aran Tupaz AbrilNo ratings yet

- Cir vs. Pascor-DigestDocument3 pagesCir vs. Pascor-DigestLeigh Anne MercadoNo ratings yet

- QuizDocument14 pagesQuizJepoy Nisperos ReyesNo ratings yet

- Deed of Trust CATAYLODocument15 pagesDeed of Trust CATAYLOEL Filibusterisimo Paul CatayloNo ratings yet

- Payment AgreementDocument4 pagesPayment AgreementRocketLawyer100% (3)

- Interest or Mutuum - Part 2Document3 pagesInterest or Mutuum - Part 2Maria Anny YanongNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Lgu ProceduresDocument6 pagesLgu ProceduresAli IsaacNo ratings yet

- I. Company Contact InformationDocument3 pagesI. Company Contact InformationRoland SaderNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- 136 CIR vs. Vda de PrietoDocument2 pages136 CIR vs. Vda de PrietoMiw Cortes100% (1)

- United States Bankruptcy Court Southern District of New YorkDocument3 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Origii (Al: of Opposttton (A) To (Il)Document17 pagesOrigii (Al: of Opposttton (A) To (Il)Chapter 11 DocketsNo ratings yet

- STAGES ASPECTS WPS OfficeDocument20 pagesSTAGES ASPECTS WPS OfficesimpatheticoNo ratings yet

- Documents PDFDocument6 pagesDocuments PDFAngela NortonNo ratings yet

- Attorneys For Midland Loan Services, IncDocument41 pagesAttorneys For Midland Loan Services, IncChapter 11 DocketsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- APF Fire Protection Inc and Aleander Francese Against Ledgerock LLC & The American Arbitration AssDocument2 pagesAPF Fire Protection Inc and Aleander Francese Against Ledgerock LLC & The American Arbitration AssJayNo ratings yet

- Micro Strategies Inc Vs White Ace Equities LLCDocument4 pagesMicro Strategies Inc Vs White Ace Equities LLCJayNo ratings yet

- Atlantic Concrete Foundation Against White Acre Equities LLC Lederock LLC J Frydman Monica FrydmanDocument3 pagesAtlantic Concrete Foundation Against White Acre Equities LLC Lederock LLC J Frydman Monica FrydmanJayNo ratings yet

- Capital One vs. Surrey Equities, Senergy Et AlDocument32 pagesCapital One vs. Surrey Equities, Senergy Et AlJayNo ratings yet

- Fidelity and Deposit Co of Maryland Against Jacob FrydmanDocument2 pagesFidelity and Deposit Co of Maryland Against Jacob FrydmanJayNo ratings yet

- Andrew Sutton and Lambdastar Infrastructure Partners LLCDocument2 pagesAndrew Sutton and Lambdastar Infrastructure Partners LLCJayNo ratings yet

- Andrew Sutton vs. Lambdastar Infrastructure Partners JUDGEMENT, Et AlDocument41 pagesAndrew Sutton vs. Lambdastar Infrastructure Partners JUDGEMENT, Et AlJayNo ratings yet

- Barnes - Thornburg LLP vs. Jacob A. FrydmanDocument11 pagesBarnes - Thornburg LLP vs. Jacob A. FrydmanJayNo ratings yet

- Brett Heath and Debra Heath vs. Gemstone BuildersDocument2 pagesBrett Heath and Debra Heath vs. Gemstone BuildersJayNo ratings yet

- Coca-Cola Refreshments vs. Bull BuddhaDocument17 pagesCoca-Cola Refreshments vs. Bull BuddhaJayNo ratings yet

- Capital One, National Association vs. Jacob FrydmanDocument20 pagesCapital One, National Association vs. Jacob FrydmanJay100% (1)

- Scott Diamond vs. Tunnel Associates, Et AlDocument88 pagesScott Diamond vs. Tunnel Associates, Et AlJayNo ratings yet

- Home Design Services vs. Lake Diamond Assoc, Et Al - Frydman FraudDocument9 pagesHome Design Services vs. Lake Diamond Assoc, Et Al - Frydman FraudJayNo ratings yet

- Tunnel Associates, Et Al vs. Warren Diamond, Et AlDocument9 pagesTunnel Associates, Et Al vs. Warren Diamond, Et AlJayNo ratings yet

Lambdastar Infrastructure Partners LLC

Lambdastar Infrastructure Partners LLC

Uploaded by

JayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lambdastar Infrastructure Partners LLC

Lambdastar Infrastructure Partners LLC

Uploaded by

JayCopyright:

Available Formats

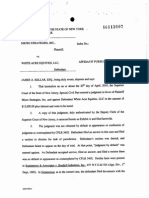

New Yoric State DopaiSMSiM'

Taxation and Finance

'Civil Enforcement-CO-ATC

W A Harriman Campus

Albany NY 12227-0001

Judgment

Commissioner of Taxation and Finance

Creditor

against

Judgment

LAMBDASTAR INFRASTRUCTURE PARTNERS, LLC

Warrant ID:

Debtor

E-035773343-W001-6

505 PARK AVE STE 1700

NEWYORK, NY 10022-9313

Last Known

Address

County of Judgment:

NEW YORK

Article of Tax Law:

22/30

The people of the state of New York to: J M JONES

an officer or employee of the Department of Taxation and Finance: Whereas, a tax has been found due to the

Commissioner of Taxation and Finance of the state of New York imposed by the above noted Article of Tax

Law from the debtor named, the nature and amount of which, together with the interest and penalties thereon,

are as follows:

Assessment

ID

Ending

L-0357733A3-5

06/30/10

Period

Assessment

Penalty

Tax

Interest

5,500.00

546.50

Total amount due

Total

6,046.50

6,046.50

And whereas, said tax, interest and penalties now remain wholly unpaid;

Now therefore, we command you to file a copy of this warrant within five days after its receipt by you in the

office of the clerk of the county named above, for entry by him in the judgment docket, pursuant to the provisions

of the Tax Law.

And we further command you, that you satisfy said claim of said Commissioner of Taxation and Finance for said

tax with penalties and interest out of the real and personal property in said county belonging to said debtor and

the debts due to him at the time when said copy of this warrant is so docketed in the office of the clerk of such

county or at any time thereafter; and that only the property in which said debtor who is not deceased has an

interest or the debts owed to him shall be levied upon or sold hereunder; and return this warrant and pay the

money collected, to the Commissioner of Taxation and Finance of the state of New York.

Levy and collect total amount due shown above plus accrued interest and any additional penalties provided by law.

Current interest rate 7.50 % per year on $

6,046.50 from JULY

The interest rate may vary according to the Tax Law.

Warrant received at 9 o'clock A.M. on JULY

28,2012.

30, 2012.

Issued

DTF-977 (7/95)

By.

Deputy Tax Commissioner

for the Commissioner

of Taxation and Finance

You might also like

- Setoff BondDocument1 pageSetoff BondMichael Kovach95% (42)

- Bank Guarantee Swift Mt760 Sample 2Document1 pageBank Guarantee Swift Mt760 Sample 2Божидар Денев100% (1)

- De Lage Landen Financial Services vs. Frydman - CompanyDocument11 pagesDe Lage Landen Financial Services vs. Frydman - CompanyJayNo ratings yet

- Jack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanDocument129 pagesJack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanJayNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon CityDocument11 pagesRepublic of The Philippines Court of Tax Appeals Quezon CityCJNo ratings yet

- Torren Colcord's "Promissary Note"Document6 pagesTorren Colcord's "Promissary Note"RickyRescueNo ratings yet

- Fake Whistleblower Robert MacLean - Clean Up America of California - Recorded Los Angeles County Tax LienDocument1 pageFake Whistleblower Robert MacLean - Clean Up America of California - Recorded Los Angeles County Tax LienThe Truth ChroniclesNo ratings yet

- Litton Loan Short SaleDocument3 pagesLitton Loan Short SaleGreg ZajdelNo ratings yet

- Proof of Claim by First Community BankDocument31 pagesProof of Claim by First Community BankbdcoryellNo ratings yet

- United States v. Erie R. Co., 106 U.S. 327 (1882)Document11 pagesUnited States v. Erie R. Co., 106 U.S. 327 (1882)Scribd Government DocsNo ratings yet

- Tax 6th Set Case Digest Part 2Document21 pagesTax 6th Set Case Digest Part 2jesserazonrnNo ratings yet

- Metrobank V CIRDocument2 pagesMetrobank V CIRReena MaNo ratings yet

- 10000001667Document79 pages10000001667Chapter 11 DocketsNo ratings yet

- Ontario Statement of Claim EXAMPLE 1Document8 pagesOntario Statement of Claim EXAMPLE 1Jonathan AlphonsoNo ratings yet

- MBTC v. CIRDocument3 pagesMBTC v. CIRAngelique Padilla UgayNo ratings yet

- Standard Roofing & Material Co. v. United States, 199 F.2d 607, 10th Cir. (1952)Document4 pagesStandard Roofing & Material Co. v. United States, 199 F.2d 607, 10th Cir. (1952)Scribd Government DocsNo ratings yet

- Osorio Tax Refund Case DigestsDocument5 pagesOsorio Tax Refund Case DigestsErwin April MidsapakNo ratings yet

- Debtors.) : in Re:) Chapter 11Document25 pagesDebtors.) : in Re:) Chapter 11Chapter 11 DocketsNo ratings yet

- 12-12553-jmp Doc 12Document3 pages12-12553-jmp Doc 12oldhillbillyNo ratings yet

- 103 Metropolitan Bank V CIRDocument3 pages103 Metropolitan Bank V CIRAJ QuimNo ratings yet

- NJ Ins. Co. v. Div. of Tax Appeals, 338 U.S. 665 (1950)Document11 pagesNJ Ins. Co. v. Div. of Tax Appeals, 338 U.S. 665 (1950)Scribd Government DocsNo ratings yet

- NDC v. CIRDocument2 pagesNDC v. CIRalexis_bea100% (1)

- United States Bankruptcy Court Southern District of New YorkDocument7 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayDocument15 pagesDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day Relief (The "First DayChapter 11 DocketsNo ratings yet

- Mindanao Shopping Destination Corp. vs. Davao City, CTA AC No. 62, Jan. 21, 2011Document8 pagesMindanao Shopping Destination Corp. vs. Davao City, CTA AC No. 62, Jan. 21, 2011Jade Palace TribezNo ratings yet

- Garcia POC Including Note 1 - No EndorsementDocument31 pagesGarcia POC Including Note 1 - No EndorsementAC FieldNo ratings yet

- PreliminaryReport 10 Audrey LNDocument18 pagesPreliminaryReport 10 Audrey LNtraderash1020No ratings yet

- United States Bankruptcy Court District of DelawareDocument76 pagesUnited States Bankruptcy Court District of DelawareChapter 11 DocketsNo ratings yet

- Ericsson Vs City of PasigDocument3 pagesEricsson Vs City of PasigRaymond RoqueNo ratings yet

- NJ Debt Collection LawsDocument10 pagesNJ Debt Collection LawsfdarteeNo ratings yet

- Commissioner vs. PalancaDocument6 pagesCommissioner vs. Palancacmv mendozaNo ratings yet

- Wisconsin Gas Co. v. United States, 322 U.S. 526 (1944)Document6 pagesWisconsin Gas Co. v. United States, 322 U.S. 526 (1944)Scribd Government DocsNo ratings yet

- Documentary Stamp TaxDocument24 pagesDocumentary Stamp TaxBlack PantherNo ratings yet

- Louisiana v. Jumel, 107 U.S. 711 (1883)Document46 pagesLouisiana v. Jumel, 107 U.S. 711 (1883)Scribd Government DocsNo ratings yet

- Victorias Milling Vs PPA (G.R. No. 73705 Aug 27, 1987)Document19 pagesVictorias Milling Vs PPA (G.R. No. 73705 Aug 27, 1987)NingClaudioNo ratings yet

- Winthrop Couchot Professional Corporation: Filed & EnteredDocument6 pagesWinthrop Couchot Professional Corporation: Filed & EnteredChapter 11 DocketsNo ratings yet

- Ordered:: Case 12-20253-KAO Doc 15 Filed 10/10/12 Ent. 10/10/12 16:31:02 Pg. 1 of 2Document2 pagesOrdered:: Case 12-20253-KAO Doc 15 Filed 10/10/12 Ent. 10/10/12 16:31:02 Pg. 1 of 2Chapter 11 DocketsNo ratings yet

- Filipinas Synthetic Fiber Corp. Vs CA, CTA and CIRDocument3 pagesFilipinas Synthetic Fiber Corp. Vs CA, CTA and CIRNathalie YapNo ratings yet

- RCBCDocument2 pagesRCBCLisa BautistaNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDocument3 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNo ratings yet

- United States Court of Appeals, Third CircuitDocument15 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- DST-CTA-gr 221655 2021Document5 pagesDST-CTA-gr 221655 2021Teresita TibayanNo ratings yet

- United States Bankruptcy Court Central District Santa Ana DivisionDocument6 pagesUnited States Bankruptcy Court Central District Santa Ana DivisionChapter 11 DocketsNo ratings yet

- Leyte Bank of CommerceDocument5 pagesLeyte Bank of CommerceDennis Aran Tupaz AbrilNo ratings yet

- Cir vs. Pascor-DigestDocument3 pagesCir vs. Pascor-DigestLeigh Anne MercadoNo ratings yet

- QuizDocument14 pagesQuizJepoy Nisperos ReyesNo ratings yet

- Deed of Trust CATAYLODocument15 pagesDeed of Trust CATAYLOEL Filibusterisimo Paul CatayloNo ratings yet

- Payment AgreementDocument4 pagesPayment AgreementRocketLawyer100% (3)

- Interest or Mutuum - Part 2Document3 pagesInterest or Mutuum - Part 2Maria Anny YanongNo ratings yet

- RMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesDocument1 pageRMC No. 13-2020 Annex A - 1600-VT 2018 GuidelinesGodfrey Tejada100% (1)

- Lgu ProceduresDocument6 pagesLgu ProceduresAli IsaacNo ratings yet

- I. Company Contact InformationDocument3 pagesI. Company Contact InformationRoland SaderNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- 136 CIR vs. Vda de PrietoDocument2 pages136 CIR vs. Vda de PrietoMiw Cortes100% (1)

- United States Bankruptcy Court Southern District of New YorkDocument3 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Origii (Al: of Opposttton (A) To (Il)Document17 pagesOrigii (Al: of Opposttton (A) To (Il)Chapter 11 DocketsNo ratings yet

- STAGES ASPECTS WPS OfficeDocument20 pagesSTAGES ASPECTS WPS OfficesimpatheticoNo ratings yet

- Documents PDFDocument6 pagesDocuments PDFAngela NortonNo ratings yet

- Attorneys For Midland Loan Services, IncDocument41 pagesAttorneys For Midland Loan Services, IncChapter 11 DocketsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- APF Fire Protection Inc and Aleander Francese Against Ledgerock LLC & The American Arbitration AssDocument2 pagesAPF Fire Protection Inc and Aleander Francese Against Ledgerock LLC & The American Arbitration AssJayNo ratings yet

- Micro Strategies Inc Vs White Ace Equities LLCDocument4 pagesMicro Strategies Inc Vs White Ace Equities LLCJayNo ratings yet

- Atlantic Concrete Foundation Against White Acre Equities LLC Lederock LLC J Frydman Monica FrydmanDocument3 pagesAtlantic Concrete Foundation Against White Acre Equities LLC Lederock LLC J Frydman Monica FrydmanJayNo ratings yet

- Capital One vs. Surrey Equities, Senergy Et AlDocument32 pagesCapital One vs. Surrey Equities, Senergy Et AlJayNo ratings yet

- Fidelity and Deposit Co of Maryland Against Jacob FrydmanDocument2 pagesFidelity and Deposit Co of Maryland Against Jacob FrydmanJayNo ratings yet

- Andrew Sutton and Lambdastar Infrastructure Partners LLCDocument2 pagesAndrew Sutton and Lambdastar Infrastructure Partners LLCJayNo ratings yet

- Andrew Sutton vs. Lambdastar Infrastructure Partners JUDGEMENT, Et AlDocument41 pagesAndrew Sutton vs. Lambdastar Infrastructure Partners JUDGEMENT, Et AlJayNo ratings yet

- Barnes - Thornburg LLP vs. Jacob A. FrydmanDocument11 pagesBarnes - Thornburg LLP vs. Jacob A. FrydmanJayNo ratings yet

- Brett Heath and Debra Heath vs. Gemstone BuildersDocument2 pagesBrett Heath and Debra Heath vs. Gemstone BuildersJayNo ratings yet

- Coca-Cola Refreshments vs. Bull BuddhaDocument17 pagesCoca-Cola Refreshments vs. Bull BuddhaJayNo ratings yet

- Capital One, National Association vs. Jacob FrydmanDocument20 pagesCapital One, National Association vs. Jacob FrydmanJay100% (1)

- Scott Diamond vs. Tunnel Associates, Et AlDocument88 pagesScott Diamond vs. Tunnel Associates, Et AlJayNo ratings yet

- Home Design Services vs. Lake Diamond Assoc, Et Al - Frydman FraudDocument9 pagesHome Design Services vs. Lake Diamond Assoc, Et Al - Frydman FraudJayNo ratings yet

- Tunnel Associates, Et Al vs. Warren Diamond, Et AlDocument9 pagesTunnel Associates, Et Al vs. Warren Diamond, Et AlJayNo ratings yet