Professional Documents

Culture Documents

Chap 008

Chap 008

Uploaded by

Wensen ChuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 008

Chap 008

Uploaded by

Wensen ChuCopyright:

Available Formats

08

Pure Competition in the Short Run

McGraw-Hill/Irwin

Copyright 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Four Market Models

Pure competition

Pure monopoly

Monopolistic competition

Oligopoly

Pure

Competition

Monopolistic

Competition

Oligopoly

Pure

Monopoly

Market Structure Continuum

LO1

8-2

Four Market Models

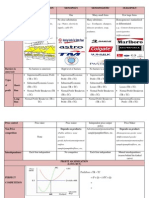

Characteristics of the Four Basic Market Models

Pure

Characteristic Competition

Monopolistic

Competition

Oligopoly

Monopoly

Number of firms

A very large

number

Many

Few

One

Type of product

Standardized

Differentiated

Standardized or

differentiated

Unique; no

close subs.

Control over

price

None

Some, but within rather

narrow limits

Limited by mutual

inter-dependence;

considerable with

collusion

Considerable

Conditions of

entry

Very easy, no

obstacles

Relatively easy

Significant

obstacles

Blocked

Nonprice

Competition

None

Considerable emphasis

on advertising, brand

names, trademarks

Typically a great

deal, particularly

with product

differentiation

Mostly public

relation

advertising

Examples

Agriculture

Retail trade, dresses,

shoes

Steel, auto, farm

implements

Local utilities

LO1

8-3

Pure Competition: Characteristics

Very large numbers of sellers

Standardized product

Price takers

Easy entry and exit

Perfectly elastic demand

Firm produces as much or little as

they want at the price

Demand graphs as horizontal line

LO2

8-4

Average, Total, and Marginal Revenue

Average Revenue

Revenue per unit

AR = TR/Q = P

Total Revenue

TR = P X Q

Marginal Revenue

Extra revenue from 1 more unit

MR = TR/Q

LO3

8-5

Average, Total, and Marginal Revenue

Firms

Demand

Schedule

(Average

Revenue)

QD

Firms

Revenue

Data

TR

MR

0 $131

$0

] $131

1 131 131

] 131

2 131 262

] 131

3 131 393

] 131

4 131 524

] 131

5 131 655

] 131

6 131 786

] 131

7 131 917

] 131

8 131 1048

] 131

9 131 1179

131

10 131 1310 ]

LO3

TR

D = MR = AR

8-6

Profit Maximization: TRTC Approach

Three questions:

Should the firm produce?

If so, what amount?

What economic profit (loss) will be

realized?

LO3

8-7

Profit Maximization: TRTC Approach

The Profit-Maximizing Output for a Purely Competitive Firm: Total Revenue

Total Cost Approach (Price = $131)

(1)

Total Product

(Output) (Q)

(2)

Total Fixed Cost

(TFC)

(3)

Total Variable

Costs (TVC)

(4)

Total Cost

(TC)

(5)

Total Revenue

(TR)

(6)

Profit (+)

or Loss (-)

$100

$0

$100

$0

$-100

100

90

190

131

-59

100

170

270

262

-8

100

240

340

393

+53

100

300

400

524

+124

100

370

470

655

+185

100

450

550

786

+236

100

540

640

917

+277

100

650

750

1048

+298

100

780

880

1179

+299

10

100

930

1030

1310

+280

LO3

8-8

Profit Maximization: TRTC Approach

Total Economic

Profit

Total Revenue and Total Cost

$1800

1700

1600

1500

1400

1300

1200

1100

1000

900

800

700

600

500

400

300

200

100

LO3

Break-Even Point

(Normal Profit)

Total Revenue, (TR)

Maximum

Economic

Profit

$299

Total Cost,

(TC)

P=$131

Break-Even Point

(Normal Profit)

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14

Quantity Demanded (Sold)

$500

400

300

200

100

Total Economic

Profit

$299

0 1 2 3 4 5 6 7 8 9 10 11 12 13 14

Quantity Demanded (Sold)

8-9

Profit Maximization: MR-MC Approach

The Profit-Maximizing Output for a Purely Competitive Firm: Marginal

Revenue Marginal Cost Approach (Price = $131)

(1)

Total

Product

(Output)

(2)

Average

Fixed Cost

(AFC)

(3)

Average

Variable

Costs (AVC)

(4)

Average

Total Cost

(ATC)

(5)

Marginal

Cost

(MC)

(5)

Price =

Marginal

Revenue

(MR)

LO3

(6)

Total

Economic

Profit (+)

or Loss (-)

$-100

$100.00

$90.00

$190

$90

$131

-59

50.00

85.00

135

80

131

-8

33.33

80.00

113.33

70

131

+53

25.00

75.00

100.00

60

131

+124

20.00

74.00

94.00

70

131

+185

16.67

75.00

91.67

80

131

+236

14.29

77.14

91.43

90

131

+277

12.50

81.25

93.75

110

131

+298

11.11

86.67

97.78

130

131

+299

10

10.00

93.00

103.00

150

131

+280

8-10

Profit Maximization: MR-MC Approach

Cost and Revenue

$200

MR = MC

150

MC

P=$131

MR = P

ATC

Economic Profit

100

AVC

A=$97.78

50

10

Output

LO3

8-11

Loss-Minimizing Case

Loss minimization

Still produce because P > minAVC

Losses at a minimum where

MR=MC

LO3

8-12

Loss-Minimizing Case

Cost and Revenue

$200

MC

150

Loss

A=$91.67

ATC

AVC

100

P=$81

50

MR = P

V = $75

10

Output

LO3

8-13

Shutdown Case

Cost and Revenue

$200

MC

150

ATC

V = $74

100

AVC

MR = P

P=$71

Short-Run Shut Down Point

P < Minimum AVC

$71 < $74

50

10

Output

LO3

8-14

Three Production Questions

Output Determination in Pure Competition in the Short Run

LO3

Question

Answer

Should this firm produce?

Yes, if price is equal to, or greater than,

minimum average variable cost. This

means that the firm is profitable or that

its losses are less than its fixed cost.

What quantity should this firm produce?

Produce where MR (=P) = MC; there,

profit is maximized (TR exceeds TC by

a maximum amount) or loss is

minimized.

Will production result in economic

profit?

Yes, if price exceeds average total cost

(TR will exceed TC). No, if average

total cost exceeds price (TC will exceed

TR).

8-15

Firm and Industry: Equilibrium

Firm and Market Supply and the Market Demand

LO4

(1)

Quantity

Supplied,

Single

Firm

(2)

Total

Quantity

Supplied,

1000 Firms

(3)

Product

Price

(4)

Total

Quantity

Demanded

10

10,000

$151

4,000

9,000

131

6,000

8,000

111

8,000

7,000

91

9,000

6,000

81

11,000

71

13,000

61

16,000

8-16

Firm and Industry: Equilibrium

S = MCs

s = MC

Economic

Profit

ATC

d

$111

$111

AVC

LO4

8000

8-17

You might also like

- ArnisDocument14 pagesArnisJosiah Rodolfo Santiago93% (44)

- Market Structure ComparisonDocument5 pagesMarket Structure ComparisonMell's KingdomNo ratings yet

- Market Structure - Pure CompetitionDocument59 pagesMarket Structure - Pure CompetitionPickboy Xlxlx100% (1)

- Colander Ch12 MonopolyDocument65 pagesColander Ch12 Monopolymadhumitha_vaniNo ratings yet

- Pure Competition in The Short Run: Mcgraw-Hill/IrwinDocument17 pagesPure Competition in The Short Run: Mcgraw-Hill/IrwinPowerpoint XtremeNo ratings yet

- Chap 008Document15 pagesChap 008Wendors WendorsNo ratings yet

- Principles of Microeconomics: Monopoly and Antitrust PolicyDocument24 pagesPrinciples of Microeconomics: Monopoly and Antitrust PolicynyawieNo ratings yet

- Market StructureDocument40 pagesMarket StructureSreerama MurthyNo ratings yet

- Market Structures: Chapter 5-6 Acec 30Document90 pagesMarket Structures: Chapter 5-6 Acec 30Zulaikha MHNo ratings yet

- BB107 PPT Microecon CH07Document21 pagesBB107 PPT Microecon CH07Pump AestheticsNo ratings yet

- Market Structures: 1.perfect Competition 2. Monopoly 3. Oligopoly 4. Monopolistic CompetitionDocument13 pagesMarket Structures: 1.perfect Competition 2. Monopoly 3. Oligopoly 4. Monopolistic CompetitionAbhishek DeshpandeNo ratings yet

- Market StructureDocument35 pagesMarket StructureShashwat ChuriwalaNo ratings yet

- Firms in Perfectly Competitive Markets: Name of InstitutionDocument31 pagesFirms in Perfectly Competitive Markets: Name of InstitutionSanket KhuranaNo ratings yet

- Perfect Competition MarketDocument17 pagesPerfect Competition MarketMaide HamasesNo ratings yet

- Market TypesDocument32 pagesMarket TypesJintu Moni BarmanNo ratings yet

- Chap 009Document31 pagesChap 009api-264755370No ratings yet

- Microeconomics - 7Document19 pagesMicroeconomics - 7Linh Trinh NgNo ratings yet

- Chap 15Document23 pagesChap 15Harshad ItaliyaNo ratings yet

- Chap 009Document17 pagesChap 009Wendors WendorsNo ratings yet

- Forms of Markets Forms of MarketsDocument55 pagesForms of Markets Forms of MarketsAkhil NeyyattinkaraNo ratings yet

- McConnell 21e Ch10 AccessibleDocument24 pagesMcConnell 21e Ch10 AccessibleAsayelNo ratings yet

- Colander Ch11 Perfect CompetitionDocument84 pagesColander Ch11 Perfect CompetitionVishal JoshiNo ratings yet

- Market Structures Recap Lecture (FLT) 2Document72 pagesMarket Structures Recap Lecture (FLT) 2Cheng KysonNo ratings yet

- Unit V I - MarketDocument29 pagesUnit V I - MarketManjit BhusalNo ratings yet

- Principles of Microeconomics - Overview Market StructuresDocument28 pagesPrinciples of Microeconomics - Overview Market StructuresKatherine SauerNo ratings yet

- Group Report. Perfect CompetitionDocument31 pagesGroup Report. Perfect CompetitionMary Ann Manalo PanopioNo ratings yet

- MarkrtDocument94 pagesMarkrtDev Nandan DasNo ratings yet

- Perfect Competition Profit MacDocument51 pagesPerfect Competition Profit MacSmurf AccountNo ratings yet

- LectureDocument15 pagesLectureVivek MishraNo ratings yet

- Econ202 ch21Document37 pagesEcon202 ch21Kenny LohNo ratings yet

- Unit 8 - Perfect CompetitionDocument20 pagesUnit 8 - Perfect CompetitionRax-Nguajandja KapuireNo ratings yet

- Chap 008Document26 pagesChap 008Citra Dewi WulansariNo ratings yet

- Clase 7 Capitulo 6 Sloman Competencia Perfecta y MonopolioDocument63 pagesClase 7 Capitulo 6 Sloman Competencia Perfecta y MonopolioFelix Xndres Contreras GonzalezNo ratings yet

- ME Ch8 WosabiDocument16 pagesME Ch8 WosabiAbdulrahman Alotaibi100% (1)

- Perfect Competition: To Determine Structure of Any Particular Market, We Begin by AskingDocument26 pagesPerfect Competition: To Determine Structure of Any Particular Market, We Begin by AskingRavi SharmaNo ratings yet

- Business Economics Session 2 - Market StructuresDocument24 pagesBusiness Economics Session 2 - Market StructuresNeha GuptaNo ratings yet

- ECON 300 PPT CH - 05Document45 pagesECON 300 PPT CH - 05sam lissenNo ratings yet

- Chapter Two: Demand and SupplyDocument71 pagesChapter Two: Demand and Supplykasech mogesNo ratings yet

- At Monocomp Mono OligopolyDocument23 pagesAt Monocomp Mono OligopolyNIKNISHNo ratings yet

- Market StructuresDocument5 pagesMarket StructuresProfessor Tarun DasNo ratings yet

- 9-Perfect CompetitionDocument30 pages9-Perfect CompetitionSaiRamNo ratings yet

- Chapter 9 - Market Structure - 1 - 2020Document31 pagesChapter 9 - Market Structure - 1 - 2020abcNo ratings yet

- Economic 5Document12 pagesEconomic 5peter banjaoNo ratings yet

- Market Structure and Pricing: By: Dr. Ali FallahchayDocument38 pagesMarket Structure and Pricing: By: Dr. Ali FallahchayJacq RYPNo ratings yet

- 1 MonopolyDocument23 pages1 MonopolyNikhil SharmaNo ratings yet

- Market StructureDocument33 pagesMarket StructurejeevanandamcNo ratings yet

- Monopoly: © 2003 South-Western/Thomson LearningDocument45 pagesMonopoly: © 2003 South-Western/Thomson Learningshephard007No ratings yet

- Economics 1110: Topic 6Document62 pagesEconomics 1110: Topic 6mahesh kumaraNo ratings yet

- Economic Market ModelsDocument8 pagesEconomic Market Modelssweet ecstacyNo ratings yet

- Chapter 7 Market StructureDocument14 pagesChapter 7 Market StructureMissDang100% (1)

- Managerial Economics and Business Strategy, 8E Baye Chap. 8Document49 pagesManagerial Economics and Business Strategy, 8E Baye Chap. 8love100% (2)

- Monopoly PDFDocument12 pagesMonopoly PDFzofuNo ratings yet

- Pricing, Competition and Market Structure BUSI 7130 / 7136Document41 pagesPricing, Competition and Market Structure BUSI 7130 / 7136palashdon6No ratings yet

- 5 MarketsDocument79 pages5 Marketsbilal12941100% (1)

- Competition & Pure MonopolyDocument36 pagesCompetition & Pure MonopolyChadi AboukrrroumNo ratings yet

- Chap011 MKT Structure Perfect CompetitionDocument75 pagesChap011 MKT Structure Perfect CompetitionM Yaseen ButtNo ratings yet

- Beating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsFrom EverandBeating Low Cost Competition: How Premium Brands can respond to Cut-Price RivalsNo ratings yet

- How to Write Bids That Win Business: A guide to improving your bidding success rate and winning more tendersFrom EverandHow to Write Bids That Win Business: A guide to improving your bidding success rate and winning more tendersNo ratings yet

- Nonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryFrom EverandNonmetallic Coated Abrasive Products, Buffing & Polishing Wheels & Laps World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Discount Business Strategy: How the New Market Leaders are Redefining Business StrategyFrom EverandDiscount Business Strategy: How the New Market Leaders are Redefining Business StrategyNo ratings yet

- Type of Business: Company NameDocument2 pagesType of Business: Company NameJosiah Rodolfo SantiagoNo ratings yet

- Untitled Map: Untitled Layer Untitled LayerDocument1 pageUntitled Map: Untitled Layer Untitled LayerJosiah Rodolfo SantiagoNo ratings yet

- Counter P1 P2: Parking AreaDocument6 pagesCounter P1 P2: Parking AreaJosiah Rodolfo SantiagoNo ratings yet

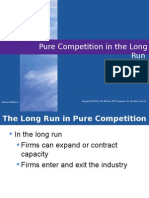

- Pure Competition in The Long Run: Mcgraw-Hill/IrwinDocument17 pagesPure Competition in The Long Run: Mcgraw-Hill/IrwinJosiah Rodolfo SantiagoNo ratings yet

- DIVORCEDocument5 pagesDIVORCEJosiah Rodolfo SantiagoNo ratings yet

- Negotiable InstrumentDocument316 pagesNegotiable InstrumentJosiah Rodolfo Santiago100% (1)