Professional Documents

Culture Documents

Information Required As Per New Tax Return Forms

Information Required As Per New Tax Return Forms

Uploaded by

AnilCopyright:

Available Formats

You might also like

- Tally ERP 9 (Power Of Simplicity): Software for business & accountsFrom EverandTally ERP 9 (Power Of Simplicity): Software for business & accountsRating: 5 out of 5 stars5/5 (3)

- Entry of Journal VouchersDocument25 pagesEntry of Journal Vouchersirfanahmed.dba@gmail.com100% (2)

- Financial Details Modification Form PDFDocument1 pageFinancial Details Modification Form PDFbvdasNo ratings yet

- E Filing Project MaterialDocument4 pagesE Filing Project MaterialMRPRITHWISH NATH.No ratings yet

- 2013 Tax OrgDocument18 pages2013 Tax OrgShashikant TripathiNo ratings yet

- Income Tax Consideration While Filing Itr For Ay 2015 2016Document2 pagesIncome Tax Consideration While Filing Itr For Ay 2015 2016JimitNo ratings yet

- ToDocument1 pageToGiriTelecomNo ratings yet

- Professional Abridgement Previous Organizational Highlights: Jindal Naturecure Institute, Bangalore, IndiaDocument3 pagesProfessional Abridgement Previous Organizational Highlights: Jindal Naturecure Institute, Bangalore, IndiaAdditya ChauhanNo ratings yet

- Ref: JJS/SR/05/2015/ Date - 19/05/2015 To, The Manager State Bank of IndiaDocument2 pagesRef: JJS/SR/05/2015/ Date - 19/05/2015 To, The Manager State Bank of IndiaDepesh JoshiNo ratings yet

- Unit 3Document41 pagesUnit 3bhagyashripande321No ratings yet

- Amith - PayrollDocument2 pagesAmith - PayrollAmith VishwanathNo ratings yet

- Non GSTDocument1 pageNon GSTchamundaxerox88No ratings yet

- Itr AssignmentDocument10 pagesItr AssignmentMohal gargNo ratings yet

- Setting Up Unit 4Document27 pagesSetting Up Unit 4BARATHRAJ D commerceNo ratings yet

- Statement of Account 85749-JAN14-0011SDocument4 pagesStatement of Account 85749-JAN14-0011SAmit JajuNo ratings yet

- Wa0000.Document2 pagesWa0000.www.taxontrackNo ratings yet

- CV-Lelin Roul - EcommerceDocument2 pagesCV-Lelin Roul - Ecommercewww.taxontrackNo ratings yet

- JagguDocument3 pagesJagguAnonymous 5p2dyVEpNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Curriculum Vitae: Hemant RawatDocument3 pagesCurriculum Vitae: Hemant RawatBrijesh KumarNo ratings yet

- Panther SurveillanceDocument1 pagePanther SurveillanceHardik PatelNo ratings yet

- Chandan KumarDocument2 pagesChandan Kumarhrcloudologykitchen07No ratings yet

- FAQ's Income TaxDocument8 pagesFAQ's Income TaxRobin SharmaNo ratings yet

- Application For Employment Form English - UPDATEDocument5 pagesApplication For Employment Form English - UPDATEMulyadi ZenNo ratings yet

- Know The Do's and Don'Ts of Forms 15G and 15H - MoneycontrolDocument3 pagesKnow The Do's and Don'Ts of Forms 15G and 15H - MoneycontrolSushant GargNo ratings yet

- Guidelines UAN BasedDocument2 pagesGuidelines UAN BasedDhamu DharanNo ratings yet

- Service TaxDocument4 pagesService TaxMadan DahiyaNo ratings yet

- Show Detailed Resume - CV: Summary of Skills and ExperienceDocument1 pageShow Detailed Resume - CV: Summary of Skills and ExperienceAamir Shahzad AfridiNo ratings yet

- Summary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012Document3 pagesSummary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012skbansal1976No ratings yet

- E TDS - Common ErrorsDocument2 pagesE TDS - Common ErrorsBimalKrishnaNo ratings yet

- 1.sanish Resume Latest - FinalDocument4 pages1.sanish Resume Latest - FinalBos BosNo ratings yet

- Non Face To Face Account Opening FormDocument10 pagesNon Face To Face Account Opening FormAlvin Samuel PandianNo ratings yet

- 2014 Business Year End Checklist: AuthorisationDocument4 pages2014 Business Year End Checklist: AuthorisationjeyaNo ratings yet

- Input Data For Incometax Fillling FY 2014-15 AY 2015-16Document3 pagesInput Data For Incometax Fillling FY 2014-15 AY 2015-16satishktNo ratings yet

- IT Proof Submission Format 2011-12Document18 pagesIT Proof Submission Format 2011-12Manu PanickerNo ratings yet

- Curriculum Vitae: Manish KaranDocument3 pagesCurriculum Vitae: Manish KaranAvinash SharmaNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Tally Project 2Document24 pagesTally Project 2shubhanginikhushiNo ratings yet

- Resume Riya SarkarDocument2 pagesResume Riya SarkarSanghamitra GhoshNo ratings yet

- Declaration of GST Non EnrollmentDocument1 pageDeclaration of GST Non Enrollmentrsteca100% (1)

- Declaration of GST Non EnrollmentDocument1 pageDeclaration of GST Non EnrollmentOcean ImpaxNo ratings yet

- Accounts Receivable Confirmation Letter: March 2014 Agrees With YourDocument10 pagesAccounts Receivable Confirmation Letter: March 2014 Agrees With Yourmj192No ratings yet

- Registration AcknowDocument1 pageRegistration AcknowcachandhiranNo ratings yet

- DCB NRE Account OpeningDocument8 pagesDCB NRE Account OpeningAbhay AgrawalNo ratings yet

- Summer Training Report ON "Marketing Management at All India Itr"Document65 pagesSummer Training Report ON "Marketing Management at All India Itr"Latest SongsNo ratings yet

- Resume Miraj DahalDocument3 pagesResume Miraj DahalMirage DahalNo ratings yet

- Request For Confirmation of BalanceDocument2 pagesRequest For Confirmation of BalanceGreenweiz Projects LtdNo ratings yet

- How To Fill The Foreign Inward Remittance FormDocument3 pagesHow To Fill The Foreign Inward Remittance FormSubrata DasNo ratings yet

- Wa0003.Document24 pagesWa0003.arunisealNo ratings yet

- Academic Qualification:-: Sap & Erp Implementation (Finsys)Document5 pagesAcademic Qualification:-: Sap & Erp Implementation (Finsys)Vikas BhardwajNo ratings yet

- ICICI Salary Account Opening DetailsDocument1 pageICICI Salary Account Opening Detailsdeepanmtm001No ratings yet

- Nitesh JhaDocument16 pagesNitesh JhaSoleman DewanNo ratings yet

- First-Time LoginDocument7 pagesFirst-Time Loginpratikraval102No ratings yet

- Ranjan JhaDocument3 pagesRanjan Jhahrcloudologykitchen07No ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

Information Required As Per New Tax Return Forms

Information Required As Per New Tax Return Forms

Uploaded by

AnilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Information Required As Per New Tax Return Forms

Information Required As Per New Tax Return Forms

Uploaded by

AnilCopyright:

Available Formats

Dear Assignee,

We refer to your India tax return for the tax year 2014-15.

In this connection, we would like to inform you that as per the new India tax return forms

as notified by the revenue authorities for the tax year 2014-15, there is additional

information required to be furnished in the India tax return as mentioned below:

Aadhaar Number:

The new India tax return form requires disclosing the details of Aadhaar number.

Do you have Aadhaar Number? (Yes/No)

:

If Yes, kindly provide the 12 digit Aadhaar Number

Indian Bank Accounts closed during the tax year 2014-15:

As per the new disclosure requirements in the new tax return forms it is required to

furnish the details of the savings and current bank accounts held any time during the

tax year 2014-15 including the accounts closed during the tax year. If the account is

not operational for more than 3 years (i.e., dormant account) the details of the same are

not required.

Do you have details of any savings and current bank accounts held any time in

India including the accounts closed during the tax year 2014-15 : (Yes / No)

If Yes; Did you provide the details of all such accounts in the India Global

Organiser 2014-15 : (Yes/No)

If No; we request you to kindly provide the details of the same in the given

below format

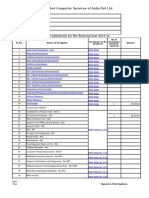

Sl.

No.

1

2

3

IFSC Code

Name of the Bank

Account

Number

Savings /

Current

If you have any queries, please feel free to reach us at ibm.india@in.ey.com /

Prashanth.ks@in.ey.com / Ramya.kinthali@in.ey.com

Best regards

Prashanth KS | Tax Consultant | Tax

Ernst n Young LLP

Prestige Emerald 1st Floor, No. 4, Madras Bank Road Lavelle road Junction,, Bangalore, Karnataka

560001, India

Office: +91 80 6727 5000, Office: +91 80 6727 5875| Prashanth.ks@in.ey.com

Website: http://www.ey.com

Instructions to Respond to the Information Request in myEYOnline

When you log in to myEYOnline, select the Documents & Consents tab from the

top navigation bar

Select the Information Request option from the tab

Select Respond hyperlink from the left side of the view to provide response.

Click on the Browse to Upload any document and then Submit

You might also like

- Tally ERP 9 (Power Of Simplicity): Software for business & accountsFrom EverandTally ERP 9 (Power Of Simplicity): Software for business & accountsRating: 5 out of 5 stars5/5 (3)

- Entry of Journal VouchersDocument25 pagesEntry of Journal Vouchersirfanahmed.dba@gmail.com100% (2)

- Financial Details Modification Form PDFDocument1 pageFinancial Details Modification Form PDFbvdasNo ratings yet

- E Filing Project MaterialDocument4 pagesE Filing Project MaterialMRPRITHWISH NATH.No ratings yet

- 2013 Tax OrgDocument18 pages2013 Tax OrgShashikant TripathiNo ratings yet

- Income Tax Consideration While Filing Itr For Ay 2015 2016Document2 pagesIncome Tax Consideration While Filing Itr For Ay 2015 2016JimitNo ratings yet

- ToDocument1 pageToGiriTelecomNo ratings yet

- Professional Abridgement Previous Organizational Highlights: Jindal Naturecure Institute, Bangalore, IndiaDocument3 pagesProfessional Abridgement Previous Organizational Highlights: Jindal Naturecure Institute, Bangalore, IndiaAdditya ChauhanNo ratings yet

- Ref: JJS/SR/05/2015/ Date - 19/05/2015 To, The Manager State Bank of IndiaDocument2 pagesRef: JJS/SR/05/2015/ Date - 19/05/2015 To, The Manager State Bank of IndiaDepesh JoshiNo ratings yet

- Unit 3Document41 pagesUnit 3bhagyashripande321No ratings yet

- Amith - PayrollDocument2 pagesAmith - PayrollAmith VishwanathNo ratings yet

- Non GSTDocument1 pageNon GSTchamundaxerox88No ratings yet

- Itr AssignmentDocument10 pagesItr AssignmentMohal gargNo ratings yet

- Setting Up Unit 4Document27 pagesSetting Up Unit 4BARATHRAJ D commerceNo ratings yet

- Statement of Account 85749-JAN14-0011SDocument4 pagesStatement of Account 85749-JAN14-0011SAmit JajuNo ratings yet

- Wa0000.Document2 pagesWa0000.www.taxontrackNo ratings yet

- CV-Lelin Roul - EcommerceDocument2 pagesCV-Lelin Roul - Ecommercewww.taxontrackNo ratings yet

- JagguDocument3 pagesJagguAnonymous 5p2dyVEpNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Curriculum Vitae: Hemant RawatDocument3 pagesCurriculum Vitae: Hemant RawatBrijesh KumarNo ratings yet

- Panther SurveillanceDocument1 pagePanther SurveillanceHardik PatelNo ratings yet

- Chandan KumarDocument2 pagesChandan Kumarhrcloudologykitchen07No ratings yet

- FAQ's Income TaxDocument8 pagesFAQ's Income TaxRobin SharmaNo ratings yet

- Application For Employment Form English - UPDATEDocument5 pagesApplication For Employment Form English - UPDATEMulyadi ZenNo ratings yet

- Know The Do's and Don'Ts of Forms 15G and 15H - MoneycontrolDocument3 pagesKnow The Do's and Don'Ts of Forms 15G and 15H - MoneycontrolSushant GargNo ratings yet

- Guidelines UAN BasedDocument2 pagesGuidelines UAN BasedDhamu DharanNo ratings yet

- Service TaxDocument4 pagesService TaxMadan DahiyaNo ratings yet

- Show Detailed Resume - CV: Summary of Skills and ExperienceDocument1 pageShow Detailed Resume - CV: Summary of Skills and ExperienceAamir Shahzad AfridiNo ratings yet

- Summary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012Document3 pagesSummary of Accounts Held Under Customer Id: 523327962 As On 31-10-2012skbansal1976No ratings yet

- E TDS - Common ErrorsDocument2 pagesE TDS - Common ErrorsBimalKrishnaNo ratings yet

- 1.sanish Resume Latest - FinalDocument4 pages1.sanish Resume Latest - FinalBos BosNo ratings yet

- Non Face To Face Account Opening FormDocument10 pagesNon Face To Face Account Opening FormAlvin Samuel PandianNo ratings yet

- 2014 Business Year End Checklist: AuthorisationDocument4 pages2014 Business Year End Checklist: AuthorisationjeyaNo ratings yet

- Input Data For Incometax Fillling FY 2014-15 AY 2015-16Document3 pagesInput Data For Incometax Fillling FY 2014-15 AY 2015-16satishktNo ratings yet

- IT Proof Submission Format 2011-12Document18 pagesIT Proof Submission Format 2011-12Manu PanickerNo ratings yet

- Curriculum Vitae: Manish KaranDocument3 pagesCurriculum Vitae: Manish KaranAvinash SharmaNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Harish Kumar Kandoi: Contact: +91 9874472220/9830714467Document3 pagesHarish Kumar Kandoi: Contact: +91 9874472220/9830714467Sabuj SarkarNo ratings yet

- Tally Project 2Document24 pagesTally Project 2shubhanginikhushiNo ratings yet

- Resume Riya SarkarDocument2 pagesResume Riya SarkarSanghamitra GhoshNo ratings yet

- Declaration of GST Non EnrollmentDocument1 pageDeclaration of GST Non Enrollmentrsteca100% (1)

- Declaration of GST Non EnrollmentDocument1 pageDeclaration of GST Non EnrollmentOcean ImpaxNo ratings yet

- Accounts Receivable Confirmation Letter: March 2014 Agrees With YourDocument10 pagesAccounts Receivable Confirmation Letter: March 2014 Agrees With Yourmj192No ratings yet

- Registration AcknowDocument1 pageRegistration AcknowcachandhiranNo ratings yet

- DCB NRE Account OpeningDocument8 pagesDCB NRE Account OpeningAbhay AgrawalNo ratings yet

- Summer Training Report ON "Marketing Management at All India Itr"Document65 pagesSummer Training Report ON "Marketing Management at All India Itr"Latest SongsNo ratings yet

- Resume Miraj DahalDocument3 pagesResume Miraj DahalMirage DahalNo ratings yet

- Request For Confirmation of BalanceDocument2 pagesRequest For Confirmation of BalanceGreenweiz Projects LtdNo ratings yet

- How To Fill The Foreign Inward Remittance FormDocument3 pagesHow To Fill The Foreign Inward Remittance FormSubrata DasNo ratings yet

- Wa0003.Document24 pagesWa0003.arunisealNo ratings yet

- Academic Qualification:-: Sap & Erp Implementation (Finsys)Document5 pagesAcademic Qualification:-: Sap & Erp Implementation (Finsys)Vikas BhardwajNo ratings yet

- ICICI Salary Account Opening DetailsDocument1 pageICICI Salary Account Opening Detailsdeepanmtm001No ratings yet

- Nitesh JhaDocument16 pagesNitesh JhaSoleman DewanNo ratings yet

- First-Time LoginDocument7 pagesFirst-Time Loginpratikraval102No ratings yet

- Ranjan JhaDocument3 pagesRanjan Jhahrcloudologykitchen07No ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet