Professional Documents

Culture Documents

Rev. Regs. 1-79

Rev. Regs. 1-79

Uploaded by

Arby LaconicoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rev. Regs. 1-79

Rev. Regs. 1-79

Uploaded by

Arby LaconicoCopyright:

Available Formats

Revenue Regulations 1-79 (Jan.

8, 1979) (Section 2)

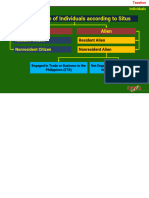

SECTION 2. Who are considered as nonresident citizens.

The term "non-resident citizen" means one who establishes to the

satisfaction of the Commissioner of Internal Revenue the fact of his

physical presence abroad with the definite intention to reside therein

and shall include any Filipino who leaves the country during the

taxable year as:

(a) Immigrant one who leaves the Philippines to reside abroad as

an immigrant for which a foreign visa as such has been secured.

(b) Permanent employee one who leaves the Philippines to reside

abroad for employment on a more or less permanent basis.

(c) Contract worker one who leaves the Philippines on account of a

contract of employment which is renewed from time to time within

or during the taxable year under such circumstances as to require

him to be physically present abroad most of the time during the

taxable year. To be considered physically present abroad most of the

time during the taxable year, a contract worker must have been

outside the Philippines for not less than 183 days during such

taxable year.

Any such Filipino shall be considered a non-resident citizen for such

taxable year with respect to the income he derived from foreign

sources from the date he actually departed from the Philippines.

A Filipino citizen who has been previously considered as a nonresident citizen and who arrives in the Philippines at any time during

the taxable year to reside therein permanently shall also be

considered a non-resident citizen for the taxable year in which he

arrived in the Philippines with respect to his income derived from

sources abroad until the date of his arrival.

You might also like

- Incomes Which Do Not Form Part of Total Income - ItDocument33 pagesIncomes Which Do Not Form Part of Total Income - ItVijayendra RaoNo ratings yet

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesNo ratings yet

- Tax-Review-Handouts-INDV FWT CGT FBT EST PDFDocument34 pagesTax-Review-Handouts-INDV FWT CGT FBT EST PDFMarinella Oppa100% (1)

- Individual ItDocument12 pagesIndividual ItlouellasoleilgpNo ratings yet

- Tax-RegulationsDocument12 pagesTax-RegulationsMichelle Jude TinioNo ratings yet

- RR 1-79Document2 pagesRR 1-79Derly ObtialNo ratings yet

- RR 1-79Document2 pagesRR 1-79Edione CueNo ratings yet

- IBAÑEZ Present Income Tax SystemDocument74 pagesIBAÑEZ Present Income Tax SystemJasmine Montero-GaribayNo ratings yet

- Handout TaxationDocument2 pagesHandout TaxationJohn Oicemen RocaNo ratings yet

- Income Tax ConDocument2 pagesIncome Tax ConMaricon EstradaNo ratings yet

- Tax601 Individual Itx Lecture Notes 122Document12 pagesTax601 Individual Itx Lecture Notes 122Justine JaymaNo ratings yet

- Tax 601Document11 pagesTax 601C.J. Clarisse FranciscoNo ratings yet

- Tax Reviewer by MoiDocument4 pagesTax Reviewer by MoiKenny BesarioNo ratings yet

- In Re RR 1-79Document2 pagesIn Re RR 1-79RayBradleyEduardoNo ratings yet

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S ADocument12 pagesTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoNo ratings yet

- Income Tax On IndividualsDocument7 pagesIncome Tax On IndividualsThe man with a Square stacheNo ratings yet

- Taxation Reviewer-Group 2Document24 pagesTaxation Reviewer-Group 2Angelica ManzanoNo ratings yet

- Present Income Tax SystemDocument57 pagesPresent Income Tax SystemCharm Ferrer100% (1)

- Types of Income Tax PayersDocument3 pagesTypes of Income Tax PayersAce Fati-igNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Module 2 - Individuals Estates and Trusts Without Answer-2Document12 pagesModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesNo ratings yet

- Chapter 2 - Individual TaxpayersDocument2 pagesChapter 2 - Individual TaxpayersAlyza AlmoniaNo ratings yet

- Income Tax On Individuals - REVISED 2022Document141 pagesIncome Tax On Individuals - REVISED 2022rav dano100% (2)

- Ast TX 501 Individual, Estate and Trust Taxation (Batch 22)Document7 pagesAst TX 501 Individual, Estate and Trust Taxation (Batch 22)Herald Gangcuangco100% (1)

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Document8 pagesTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaNo ratings yet

- 2 Classification of Individual TaxpayersDocument2 pages2 Classification of Individual TaxpayersDiana SheineNo ratings yet

- TAX - 601 - Individuals - Abapo, Mary Jhudiel G.Document53 pagesTAX - 601 - Individuals - Abapo, Mary Jhudiel G.Mohammad100% (1)

- Tax ReviewerDocument103 pagesTax ReviewerOscar Ryan SantillanNo ratings yet

- CH09B Income and Business TaxationDocument20 pagesCH09B Income and Business TaxationArt MelancholiaNo ratings yet

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Document5 pagesHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoNo ratings yet

- 03 Individuals. Study Notes. LectureDocument54 pages03 Individuals. Study Notes. Lecturemarvin.cpa.cmaNo ratings yet

- BIR Ruling No. 052 10Document2 pagesBIR Ruling No. 052 10MrDigesterNo ratings yet

- Summary Lesson 4Document6 pagesSummary Lesson 4Janien MedestomasNo ratings yet

- Tax 1 Unit 1. Chapter 3Document5 pagesTax 1 Unit 1. Chapter 3angelika dijamcoNo ratings yet

- TAX-5.0 - Individual Income TaxDocument65 pagesTAX-5.0 - Individual Income TaxCharmaine RosalesNo ratings yet

- Assignment 2Document2 pagesAssignment 2Caroline Dy DimakilingNo ratings yet

- BAC103A-02a Income Tax For IndividualsDocument8 pagesBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Quickie PreFi Tax PDFDocument12 pagesQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- PreFi Tax PDFDocument21 pagesPreFi Tax PDFJoesil Dianne SempronNo ratings yet

- Income Taxes: 1. Persons Subject To The Individual Income TaxDocument5 pagesIncome Taxes: 1. Persons Subject To The Individual Income TaxJerome Eziekel Posada PanaliganNo ratings yet

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErvin Ray FernandezNo ratings yet

- Template Taxation Unit IIDocument29 pagesTemplate Taxation Unit IINacion, Jaime G.No ratings yet

- RR 1-79Document9 pagesRR 1-79matinikkiNo ratings yet

- Intro. To Income Tax FTDocument52 pagesIntro. To Income Tax FTJOANA GRACE ALLORINNo ratings yet

- Assignment No. 4Document7 pagesAssignment No. 4HannahPauleneDimaanoNo ratings yet

- Individual Taxpayers Handouts and ProblemsDocument15 pagesIndividual Taxpayers Handouts and ProblemsLovely De CastroNo ratings yet

- Produced The Income)Document4 pagesProduced The Income)bluesNo ratings yet

- Classification of Individual TaxpayerDocument4 pagesClassification of Individual TaxpayerJj helterbrandNo ratings yet

- Basergo, Lovers Mae B. General Classification of Individual TaxpayersDocument2 pagesBasergo, Lovers Mae B. General Classification of Individual Taxpayerslavender kayeNo ratings yet

- Taxation One CompleteDocument90 pagesTaxation One CompleteCiena MaeNo ratings yet

- Tax Code: Partnerships' Are Partnerships Formed by Persons For TheDocument10 pagesTax Code: Partnerships' Are Partnerships Formed by Persons For Thegabriel omliNo ratings yet

- Module TX003 Types On Income TaxpayersDocument3 pagesModule TX003 Types On Income TaxpayersErwin TorresNo ratings yet

- Individual TaxationDocument4 pagesIndividual TaxationRyan xdNo ratings yet

- SEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenDocument11 pagesSEC. 23. General Principles of Income Taxation in The Philippines. - Except WhenMiguel BerguNo ratings yet

- Income Taxation PDFDocument4 pagesIncome Taxation PDFRyon TagabanNo ratings yet

- Income Tax of IndividualsDocument23 pagesIncome Tax of Individualspeter banjaoNo ratings yet