Professional Documents

Culture Documents

Chapter 4

Chapter 4

Uploaded by

Sameer BhoirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 4

Chapter 4

Uploaded by

Sameer BhoirCopyright:

Available Formats

[Type the document title]

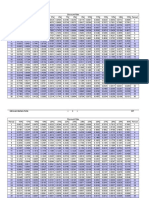

TABLE NO:4.1.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF AXIS BANK 2012.

Axis Bank

Month

Open

Jan

162

Close

Open

215.0

8009.8

1

235.5

Feb

214.9

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Close

9919.45

0.2384

0.3272

10385.

X2

4

221.3

2

10186.

9

194.1

8

10282.

225.2

10414.2

0.0475

10212.7

0.0961

7

9434.4

5

208.8

5

10366.

0.0166

5

10347.

8

10030.

208.05

199.63

3

0.000

0.0169

-

1

0.006

227.2

0.0819

0.1231

0.0961

0.0474

9

11462.

2

263.9

1

11266.

0.0017

0.0224

0.0345

0.0466

0.1422

0.1381

0.0001

0.0101

0.0151

0.0046

0.0022

0.0000

0.0005

0.0016

0.0022

0.0196

0.0191

0

0.001

2

0.020

-

0.0792

0.0017

3

0.006

0.1157

0.0007

0.0092

0.0134

0.0009

0.0010

0.1281

0.1725

3

0.000

12474.2

262.8

1

6

Summation Total

0.0006

0.0410

0.0169

12158.9

5

12126.

0.0004

7

0.009

2

0.000

11268.8

236.6

0.0092

2

0.000

11456.8

236.5

0.0046

0.0003

9990.5

227.2

[Type text]

0.0245

-

10340.6

10384.1

3

198.3

0.1071

0.0088

-

193.96

204.25

0.0780

3

0.000

9441

9

203.1

Y2

8

0.002

10276.8

221.44

X*Y

0.056

235

8

271.3

Dec

Returns

5

9941.9

5

229.2

Mar

Bank Nifty

0.0287

0.0324

5

0.4927

Page 1

0.6093

8

0.104

[Type the document title]

2

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.2287

n XY ( X ) (Y )

r=

( n X ( X ) ) (n Y ( Y ) )

[Type text]

= 0.9462

Page 2

[Type the document title]

GRAPH NO:4.1.1

GRAPH SHOWING RETURNS OF AXIS BANK 2012.

0.4

0.3

R

E

T

U

R

N

S

0.2

0.1

Returns X

0

jan feb mar apr may jun

Returns Y

jul aug sep oct nov dec

-0.1

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 3

[Type the document title]

TABLE NO:4.1.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF AXIS BANK 2013.

Axis Bank

Month

Open

Close

Bank Nifty

Open

Returns

Close

12708.6

0.0126

0.0989

0.0968

-

0.1046

-

X*Y

0.0002

0.0013

0.0098

0.0094

0.0101

0.0109

0.0002

0.0005

0.0011

0.0101

0.0148

0.0216

0.0000

0.0002

0.0013

0.0045

0.0047

0.0048

0.0186

0.0298

0.0478

0.0114

0.0216

0.0409

0.0031

0.0341

0.0106

0.0371

0.0368

0.0405

12549.9

Jan

273.94

301.03

5

12718.5

Feb

300.22

268.83

11487.35

5

Mar

269

260.14

11533.05 11361.85

0.0148

0.0329

0.1004

0.1471

12561.5

Apr

260.25

298.54

11414.95

5

12475.6

May

297.02

286.11

12554.7

5

Jun

284.8

265.04

12453.4

264.8

206.91

208.8

166.59

10130.1

169.14

203.58

201.57

244.54

9112.8

9685.15

9617.8

11473.15

Nov

244.99

231.19

11472.2

11153.95

231.96

259.91

0.0694

-

11180.3

0.1364

-

0.2186

-

0.1067

0.0554

0.1846

-

0.2022

0.1917

0.2012

-

0.0008

0.0016

0.0032

0.0277

0.0183

-

0.0563

0.1205

0.0003

0.0022

0.0145

0.0387

0.0926

0.1345

0.2332

9049.2

Sep

Oct

Dec

0.0671

-

11597.45

5

Aug

0.0367

-

11617.25

10015.7

Jul

0.0063

-

11385.25

Summation Total

0.0845

n XY ( X )(Y )

2

[n X 2( X ) ]

[Type text]

= 1.4638

Page 4

[Type the document title]

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9199

GRAPH NO:4.1.2

GRAPH SHOWING RETURNS OF AXIS BANK 2013.

0.25

0.2

0.15

R

0.1

E

0.05

T

0

U

R -0.05jan feb mar apr may jun jul aug sep oct nov dec

N

S -0.1

-0.15

-0.2

-0.25

MONTHS

Analysis and interpretation

[Type text]

Page 5

Returns X

Returns Y

[Type the document title]

TABLE NO:4.1.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF AXIS BANK 2014.

Axis bank

Month

Jan

Open

260.3

Close

224.59

Bank nifty

Open

Returns

2

0.0107

0.0142

0.0188

0.1393

0.0030

0.0076

0.0194

0.1902

0.1591

0.0362

0.0303

0.0253

0.0039

0.0321

0.0000

0.0001

0.0010

14793.4

0.1450

0.2038

0.0210

0.0295

0.0415

15241.9

0.0308

0.0473

0.0009

0.0015

0.0022

0.0157

0.0000

0.0000

0.0002

0.0014

0.0398

-

0.0238

-

0.0016

0.0009

0.0006

0.0006

0.0013

0.0028

0.0252

0.0533

0.1089

0.1699

0.0119

0.0185

0.0289

0.0835

0.0887

0.0070

0.0074

0.0079

0.0081

0.0372

0.0001

0.0003

0.0014

0.5349

0.7264

0.0930

0.1117

0.1501

10237.7

0.1034

0.1372

10764.7

0.0548

11418.9

X*Y

Close

10205.4

Feb

222.42

253.41

5

10705.4

Mar

252

Apr

May

12742.0

292.1

294

5

12806.1

5

12855.8

5

12920.3

303.44

305.07

367.23

5

14786.4

Jun

366.45

383.77

5

Jul

385.6

391.65

15288.8

15267.6

Aug

388

397.25

15137.6

15790.2

15740.4

15392.2

Sep

398.95

377.7

5

5

17045.0

Oct

375.6

439.4

15370.7

5

18513.1

Nov

442

481.2

17087

18586.9

Dec

484.4

502.4

5

Summation Total

[Type text]

5

18736.6

5

Page 6

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.1470

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9259

GRAPH NO:4.1.3

GRAPH SHOWING RETURNS OF AXIS BANK 2014.

0.25

0.2

0.15

R

0.1

E

T 0.05

U

0

R

N -0.05jan feb mar apr may jun jul aug sep oct nov dec

S

-0.1

-0.15

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 7

Returns X

Returns Y

[Type the document title]

TABLE NO:4.2.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF BANK OF INDIA

2012.

Bank of India

Bank Nifty

Returns

Mont

Open

Close

267.25

344.65

Open

Close

9919.45

0.2384

0.2896

X2

X*Y

Y2

0.0690

0.0839

0.0038

0.0062

h

8009.8

Jan

0.056

5

Feb

345

372.25

9941.9

10385.

Mar

360

389.7

10414.2

0.0475

10212.7

353.5

353.5

0.0166

10276.8

340.85

329

348.95

296.3

255.1

312

297.9

277

255.3

282

311.2

11456.8

276.5

0.0086

0.0358

0.0961

0.0549

280.65

12158.9

0.0013

2

0.000

0.0053

0.0030

0.0017

0.0214

0.1463

-

0

0.001

0.0345

0.1384

2

0.020

0.1422

0.2199

0.0169

0.1138

0.0792

0.0132

0.0002

0.0048

0.0191

0.0313

0.0484

0.0019

0.0129

0.0010

0.0002

0.0062

0.0468

2

0.000

3

0.006

3

0.000

12474.2

343

0.0029

7

0.009

11268.8

0.0287

6

[Type text]

0.0008

9990.5

5

12126.

Dec

1

0.006

10384.1

1

11266.

Nov

0.0929

-

0.0819

9

11462.

Oct

0.0001

-

8

10030.

Sep

3

0.000

10340.6

5

10347.

Aug

0.0088

-

347.05

5

10366.

Jul

0.0001

9441

7

9434.4

Jun

3

0.000

0.0074

8

10282.

May

0.0790

362.65

2

10186.

Apr

8

0.002

0.2163

8

Page 8

[Type the document title]

0.104

Summation Total

0.4927

0.3531

0.1250

0.2519

2

n XY ( X )(Y )

= [n X 2( X )2]

= 1.3167

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.7762

GRAPH NO:4.2.1

GRAPH SHOWING RETURNS OF BANK OF INDIA 2012.

0.4

0.3

R

E

T

U

R

N

S

0.2

0.1

Returns X

0

jan feb mar apr may jun

Returns Y

jul aug sep oct nov dec

-0.1

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 9

[Type the document title]

[Type text]

Page 10

[Type the document title]

TABLE NO:4.2.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF BANK OF INDIA

2013.

Bank of India

Month

Open

Close

Jan

345.35

353

Bank Nifty

Open

Returns

Close

X2

X*Y

Y2

12708.6

0.0126

0.0222

0.0002

0.0003

0.0005

0.0094

0.0098

0.0103

0.0968

-

0.1017

0.0002

0.0008

0.0026

0.0101

0.0073

0.0052

0.0000

0.0008

0.0154

0.0045

0.0131

0.0378

0.0186

0.0282

0.0428

0.0114

0.0253

0.0562

0.2370

0.0969

0.3260

0.0031

0.0341

0.0054

0.0602

0.0094

0.1063

0.0195

0.0008

-0.0005

0.0004

0.0277

0.0183

-

0.0845

-

0.0003

0.0015

0.0071

0.0926

0.1520

0.2940

0.0845

0.2937

12549.9

5

12718.5

Feb

354

318

11487.35

5

Mar

319.05

302.85

11533.05 11361.85

0.0148

0.0508

0.1004

0.0722

0.0063

-

0.1240

-

0.0671

-

0.1945

-

0.1364

-

0.2070

-

12561.5

Apr

305.9

328

11414.95

5

12475.6

May

328.5

287.75

12554.7

5

Jun

288.5

232.4

12453.4

11617.25

10015.7

Jul

232.9

184.7

11597.45

5

Aug

186.5

142.3

10130.1

9049.2

Sep

Oct

144

158.3

157.95

209.9

9112.8

9685.15

9617.8

11473.15

Nov

213

217.15

11472.2

11153.95

Dec

219.4

237.95

11180.3

11385.25

0.1067

0.0554

0.1846

-

Summation Total

[Type text]

Page 11

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.6295

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9231

GRAPH NO:4.2.2

GRAPH SHOWING RETURNS OF BANK OF INDIA 2013.

0.4

0.3

R 0.2

E

T 0.1

U

0

R

jan feb mar apr may jun jul aug sep oct nov dec

N

-0.1

S

-0.2

-0.3

MONTHS

Analysis and interpretation

[Type text]

Page 12

Returns X

Returns Y

[Type the document title]

TABLE NO:4.2.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF BANK OF INDIA

2014.

Bank of India

Bank Nifty

Month

Open

Close

Open

Jan

239

191.7

11418.9

Returns

Close

10237.7

0.1034

10205.4

Feb

191.5

171.35

10764.7

5

10705.4

Mar

169.7

Apr

231

May

311.1

5

12806.1

5

12855.8

5

12920.3

5

14793.4

301.55

303.6

274.5

Aug

270

277.45

Sep

278.7

232

15137.6

15790.2

5

Oct

230

285.35

0.0392

0.0030

0.0111

0.0058

0.3465

0.0362

0.0659

0.1201

0.0039

0.0136

0.0000

0.0001

0.0002

0.1450

0.3049

0.0210

0.0442

0.0929

15241.9

15288.8

0.0205

0.1902

0.0308

5

Jul

0.0107

0.1979

-

0.0548

5

14786.4

Jun

Y2

12742.0

228.5

309.25

X*Y

0.1052

234.15

237

X2

0.0009

0.0307

-

0.0014

0.0398

-

0.0958

0.0276

-

15267.6

15740.4

15392.2

5

17045.0

15370.7

0.0009

0.0009

0.0000

0.0001

0.0092

0.0016

0.0011

0.0008

0.0006

0.0042

0.0281

0.0252

0.1676

0.1089

0.2407

0.0119

0.0262

0.0579

0.0835

0.0030

0.0070

0.0002

0.0000

0.0081

0.0441

0.0001

0.0004

0.0019

0.5349

0.3830

0.0930

0.1562

0.3623

5

18513.1

Nov

287.95

288.8

17087

18586.9

Dec

289.05

301.8

5

Summation Total

[Type text]

5

18736.6

5

Page 13

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 2.0119

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8942

GRAPH NO:4.2.3

GRAPH SHOWING RETURNS OF BANK OF INDIA 2014.

0.4

0.3

R 0.2

E

T 0.1

U

0

R

jan feb mar apr may jun jul aug sep oct nov dec

N

-0.1

S

-0.2

-0.3

MONTHS

Analysis and interpretation

[Type text]

Page 14

Returns X

Returns Y

[Type the document title]

TABLE NO:4.3.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF BANK OF

BARODA 2012.

Bank of

Bank Nifty

Returns

Baroda

Mont

Open

Close

134.02

150.75

Open

Close

9919.45

0.2384

0.1248

X2

X*Y

Y2

0.0298

0.0156

0.0038

0.0065

0.0002

0.0001

h

8009.8

Jan

0.056

5

Feb

Mar

Apr

148.88

160.89

158

160.88

8

0.002

9941.9

10414.2

0.0475

0.0806

10385.

10212.7

3

0.000

2

10186.

0.0166

0.0103

-

3

0.000

10276.8

0.0088

159.23

153.98

8

10282.

May

153.06

137.75

Jun

137.2

147.4

131.98

131.22

10384.1

126.37

127.05

159.8

159.56

11456.8

145.13

Dec

144.21

152.66

[Type text]

152.52

173.29

0.1000

7

0.009

0.0961

0.0684

-

2

0.000

0.1098

-

0

0.001

12474.2

0.0082

0.0100

0.0066

0.0047

0.0120

0.0345

0.0425

0.1422

0.2559

12158.9

5

12126.

0.0002

0.0017

0.0169

0.0918

0.0792

0.0576

0.0287

Page 15

0.1351

0.0002

0.0015

0.0018

0.0364

0.0655

0.0015

0.0084

0.0046

0.0033

0.0039

0.0183

2

0.020

2

0.000

11268.8

1

11266.

Nov

0.0819

9

11462.

Oct

1

0.006

9990.5

8

10030.

Sep

0.0254

-

5

10347.

Aug

10340.6

146.58

5

10366.

Jul

0.0006

9441

7

9434.4

3

0.006

3

0.000

[Type the document title]

6

8

0.104

Summation Total

0.4927

0.3426

0.0959

0.1469

2

n XY ( X )(Y )

= [n X 2( X )2]

= 0.9754

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.7633

GRAPH NO:4.3.1

GRAPH SHOWING RETURNS OF BANK OF BARODA 2012.

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

0

jan feb mar apr may jun

-0.05

Returns Y

jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 16

[Type the document title]

[Type text]

Page 17

[Type the document title]

TABLE NO:4.3.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF BANK OF

BARODA 2013.

Bank of Baroda

Month

Open

Close

Jan

174.4

173.55

Bank Nifty

Open

Returns

Close

12708.6

0.0126

5

12718.5

11487.3

0.0049

-

5

11533.0

5

11361.8

0.0968

-

0.1983

-

12549.9

Feb

Mar

Apr

May

Jun

Jul

Aug

173.55

139.2

135.97

139.02

132.5

115.09

114.73

135.08

5

11414.9

5

12561.5

0.0148

0.0296

5

12475.6

0.1004

0.0281

5

11617.2

0.0063

-

0.0625

-

11597.4

5

10015.7

0.0671

-

0.1334

-

0.1364

-

0.0241

-

10130.1

9049.2

139.79

130.33

114.83

12554.7

12453.4

112.32

92.16

92.42

98.71

9112.8

Oct

98.6

128.58

9685.15

9617.8

11473.1

5

11153.9

127.24

128.92

129.4

129.11

Y2

0.0002

-0.0001

0.0000

0.0094

0.0192

0.0393

0.0002

0.0004

0.0009

0.0101

0.0028

0.0008

0.0000

0.0004

0.0039

0.0045

0.0090

0.0178

0.0186

0.0033

0.0006

0.0114

0.0210

0.0387

0.1967

0.0681

0.0031

0.0038

0.0046

0.1846

0.3041

0.0341

0.0561

0.0925

0.0132

0.0008

-0.0004

0.0002

0.0003

0.0000

0.0000

0.0926

0.1155

0.1993

11180.3

0.0277

0.0183

5

-

0.0022

-

Summation Total

0.0845

[Type text]

X*Y

0.1067

0.0554

11472.2

5

11385.2

Dec

X2

139.13

Sep

Nov

Page 18

0.2383

[Type the document title]

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.2369

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8508

GRAPH NO:4.3.2

GRAPH SHOWING RETURNS OF BANK OF BARODA 2013.

0.4

0.3

R 0.2

E

T 0.1

U

0

R

jan feb mar apr may jun jul aug sep oct nov dec

N

-0.1

S

-0.2

-0.3

MONTHS

Analysis and interpretation

[Type text]

Page 19

Returns X

Returns Y

[Type the document title]

TABLE NO:4.3.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF BANK OF

BARODA 2014.

Bank of Baroda

Month

Jan

Open

129.46

Close

109.68

Bank Nifty

Open

Returns

Close

10237.7

0.1034

0.1528

10764.7

0.0548

11418.9

X* Y

0.0107

0.0158

0.0233

0.0050

0.0030

0.0003

0.0000

0.1902

0.3088

0.0362

0.0587

0.0954

0.0039

0.1191

0.0000

0.0005

0.0142

14793.4

0.1450

0.0264

0.0210

0.0038

0.0007

15241.9

0.0308

0.0335

0.0009

0.0010

0.0011

0.0000

0.0000

0.0001

0.0113

0.0091

0.0016

0.0004

-

0.0001

0.0308

0.0006

10205.4

Feb

Mar

109.68

110.14

Apr

146

110.23

5

10705.4

12742.0

5

12806.1

5

12855.8

144.15

163.39

5

12920.3

May

164.2

168.53

5

14786.4

Jun

169.6

175.29

5

Jul

176.37

174.37

Aug

172.72

174.3

Sep

175.06

180.46

[Type text]

15288.8

15267.6

15137.6

15790.2

15740.4

15392.2

0.0014

0.0398

-

0.0252

Page 20

0.0010

0.0008

[Type the document title]

17045.0

Oct

179.32

185.9

15370.7

0.1089

0.0367

0.0119

0.0040

0.0013

0.0835

0.1690

0.0070

0.0141

0.0286

5

18513.1

Nov

186

217.44

17087

18586.9

Dec

218.2

5

18736.6

216.78

5

Summation Total

n XY ( X )(Y )

= [n X 2( X )2]

0.0081

5

0.5349

0.0001

0.0065

0.5679

0.0930

0.0000

0.0001

0.0978

= 1.0482

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.7394

GRAPH NO:4.3.3

GRAPH SHOWING RETURNS OF BANK OF BARODA 2014.

0.4

0.3

R

E

T

U

R

N

S

0.2

0.1

Returns X

0

jan feb mar apr may jun

Returns Y

jul aug sep oct nov dec

-0.1

-0.2

MONTHS

[Type text]

Page 21

0.1659

[Type the document title]

Analysis and interpretation

[Type text]

Page 22

[Type the document title]

TABLE NO:4.4.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF CANARA BANK

2012.

Canara bank

Bank nifty

Returns

Mont

Open

Close

366

470.1

Open

Close

9919.45

0.2384

0.2844

X2

X*Y

Y2

0.0678

0.0809

0.0035

0.0054

0.0009

0.0031

h

8009.8

Jan

0.056

5

Feb

476

510.9

9941.9

10385.

Mar

504

477

10414.2

10212.7

436.6

436

10276.8

402.1

400.65

412

368

323.1

366.2

433

318.1

403.9

431.45

11456.8

400.9

464.55

12158.9

466

0.0778

0.0961

0.0300

0.0007

0.0064

0.0060

0.0029

0.0009

7

0.009

2

0.000

0.0017

0.0124

0.1112

-

0

0.001

0.0345

0.1356

2

0.020

0.1422

0.3353

0.0169

0.0741

0.0792

0.1502

0.0002

0.0047

0.0184

0.0477

0.1125

0.0013

0.0055

0.0119

0.0225

0.0019

0.0044

2

0.000

3

0.006

3

0.000

0.0287

6

[Type text]

0.0819

12474.2

496.9

0.0072

11268.8

5

12126.

Dec

1

0.006

9990.5

1

11266.

Nov

0.0847

-

10384.1

9

11462.

Oct

3

0.000

8

10030.

Sep

0.0560

-

10340.6

5

10347.

Aug

3

0.000

0.0088

-

412.65

5

10366.

Jul

0.0733

9441

7

9434.4

Jun

0.0166

8

10282.

May

0.0475

475.8

2

10186.

Apr

8

0.002

0.0663

8

Page 23

[Type the document title]

0.104

Summation Total

0.4927

0.4002

0.1479

0.2792

2

n XY ( X )(Y )

= [n X 2( X )2]

= 1.5667

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8803

GRAPH NO:4.4.1

GRAPH SHOWING RETURNS OF CANARA BANK 2012.

0.4

0.3

R

E

T

U

R

N

S

0.2

0.1

Returns X

0

jan feb mar apr may jun

Returns Y

jul aug sep oct nov dec

-0.1

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 24

[Type the document title]

TABLE NO:4.4.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF CANARA BANK

2013.

Canara Bank

Month

Open

Close

Jan

499.9

481.1

Bank Nifty

Open

Returns

Close

12708.6

0.0126

12549.9

483.9

415.6

419.05

384.05

X*Y

Y2

0.0002

-0.0005

0.0014

0.0094

0.0137

0.0199

0.0002

0.0012

0.0070

0.0101

0.0078

0.0060

0.0000

0.0000

0.0000

0.0045

0.0080

0.0141

0.0186

0.0326

0.0572

0.0114

0.0285

0.0713

0.0031

0.0341

0.0046

0.0291

0.0069

0.0249

0.0008

0.0012

0.0020

0.0003

0.0024

0.0166

0.0926

0.1286

0.2273

0.0376

11487.35

5

Mar

X2

5

12718.5

Feb

-0.1411

0.0968

-

11533.05 11361.85

0.0148

0.0835

0.1004

0.0776

0.0063

-

0.0024

12561.5

Apr

384.9

414.75

11414.95

5

12475.6

May

413

412

12554.7

5

Jun

409.2

360.6

12453.4

11617.25

10015.7

Jul

360

273.9

276.7

202.8

10130.1

204.5

223.05

221.45

258.25

9112.8

9685.15

9617.8

11473.15

Nov

260

248.4

11472.2

11153.95

250.05

282.25

0.1364

-

0.2392

-

9049.2

Sep

Oct

Dec

11597.45

5

Aug

-0.1188

0.0671

-

11180.3

11385.25

0.1067

0.0554

0.1846

-

0.2671

0.0829

0.1578

-

0.0277

0.0183

-

0.0446

0.1288

-

0.0845

0.4873

Summation Total

[Type text]

Page 25

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.3605

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8146

GRAPH NO:4.4.2

GRAPH SHOWING RETURNS OF CANARA BANK 2013.

0.3

0.2

R

E 0.1

T

0

U

jan feb mar apr may jun jul aug sep oct nov dec

R

N -0.1

S

-0.2

-0.3

MONTHS

Analysis and interpretation

[Type text]

Page 26

Returns X

Returns Y

[Type the document title]

TABLE NO:4.4.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF CANARA BANK

2014.

Canara Bank

Month

Jan

Open

283.7

Close

221.15

Bank Nifty

Open

Returns

Close

10237.7

0.1034

0.2205

-

10764.7

0.0548

11418.9

10205.4

Feb

219

Mar

Apr

May

214

266.4

287.5

216.1

5

10705.4

12742.0

5

12806.1

5

12855.8

5

12920.3

X*Y

Y2

0.0107

0.0228

0.0486

0.0030

0.0132

264.35

0.0002

0.0007

0.1902

0.2353

0.0362

0.0448

0.0554

0.0039

0.0723

0.0000

0.0003

0.0052

14793.4

0.1450

0.4426

0.0210

0.0642

0.1959

15241.9

0.0308

0.1067

0.0009

0.0033

0.0114

0.0000

0.0002

0.0197

285.65

414.75

X2

5

14786.4

Jun

417.8

462.4

5

Jul

465

399.7

15288.8

15267.6

0.0014

Aug

Sep

395.7

381.25

[Type text]

378.15

350.9

15137.6

15790.2

15740.4

15392.2

Page 27

0.1404

-

0.0398

-

0.0016

0.0444

-

0.0006

0.0020

0.0018

0.0020

0.0063

[Type the document title]

5

Oct

349.05

402.25

5

17045.0

15370.7

0.0252

0.0796

0.1089

0.1524

0.0119

0.0166

0.0232

0.0835

0.0160

0.0070

0.0013

0.0003

0.0081

0.0828

0.0001

0.0007

0.0069

0.5349

0.6100

0.0930

0.1536

0.3750

5

18513.1

Nov

405.8

412.3

17087

18586.9

Dec

414.4

448.7

5

Summation Total

5

18736.6

n XY ( X )(Y )

2

2

[n X ( X ) ]

= 1.8283

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8197

GRAPH NO:4.4.3

GRAPH SHOWING RETURNS OF CANARA BANK 2014.

[Type text]

Page 28

[Type the document title]

0.5

0.4

0.3

R

E 0.2

T

U 0.1

R

0

N

S -0.1jan feb mar apr may jun jul aug sep oct nov dec

-0.2

-0.3

MONTHS

Analysis and interpretation

[Type text]

Page 29

Returns X

Returns Y

[Type the document title]

TABLE NO:4.5.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF FEDERAL BANK

2012.

Federal Bank

Bank Nifty

Returns

Mont

Open

Close

67.8

79.78

Open

Close

9919.45

0.2384

0.1767

X2

X*Y

Y2

0.0421

0.0312

0.0007

0.0002

h

8009.8

Jan

0.056

5

Feb

79.97

81.11

9941.9

10385.

Mar

77.6

85.4

10414.2

10212.7

84

83.99

84.08

84.08

89.83

83.17

0.0819

0.0961

82.86

81.29

81.38

89.29

96.85

89.39

11456.8

96.92

95.8

96.36

0.0064

2

0.000

0.0776

-

0

0.001

0.0345

0.0226

2

0.020

0.1422

0.0984

0.0001

0.0008

0.0005

0.0140

0.0097

2

0.000

3

0.006

0.0014

-

3

0.000

0.0004

0.0073

0.0792

0.0000

0.0051

12474.2

0.0287

5

0.1236

0.0035

8

Page 30

0.0045

0.0855

0.0169

107.64

0.0001

0.0060

12158.9

6

[Type text]

0.0000

0.0017

11268.8

5

12126.

Dec

0.0001

-

9990.5

1

11266.

Nov

1

0.006

0.0670

-

9

11462.

Oct

0.0016

-

7

0.009

5

10384.1

3

0.000

0.0010

10340.6

89.71

0.0098

0.0003

8

10030.

Sep

0.0088

0.0165

5

10347.

Aug

9441

5

10366.

Jul

3

0.000

0.0166

10276.8

7

9434.4

Jun

0.0143

0.0992

8

10282.

May

0.0475

85.3

2

10186.

Apr

8

0.002

0.0153

[Type the document title]

0.104

Summation Total

0.4927

0.5438

0.0637

0.0848

2

n XY ( X )(Y )

= [n X 2( X )2]

= 0.4930

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.5821

GRAPH NO:4.5.1

GRAPH SHOWING RETURNS OF FEDERAL BANK 2012.

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

Returns Y

0

jan feb mar apr may jun

-0.05

jul aug sep oct nov dec

-0.1

MONTHS

Analysis and interpretation

[Type text]

Page 31

[Type the document title]

TABLE NO:4.5.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF FEDERAL BANK

2013.

Month

Federal Bank

Open

Close

Jan

107.69

101.11

Feb

101.49

98.65

Mar

98.18

Apr

May

Jun

96.8

Bank Nifty

Open

Close

12549.9

12708.6

5

12718.5 11487.3

Returns

X

Y

0.0126

0.0611

-

5

11533.0

0.0968

-

5

11414.9

5

12561.5

5

12475.6

91.29

91.29

90.02

90.07

81.85

81.81

Aug

70

12554.7

5

11617.2

0.0063

-

0.0134

-

5

10015.7

0.0671

-

0.0908

-

12453.4

10130.1

9049.2

51.54

56.92

9112.8

Oct

56.28

82.1

9685.15

9617.8

11473.1

5

11153.9

78.85

Dec

79.05

84.05

11180.3

-0.0008

0.0037

0.0094

0.0027

0.0008

0.0002

0.0003

0.0004

0.0101

-0.0057

0.0032

0.0000

0.0001

0.0002

0.0045

0.0061

0.0082

0.0186

0.0198

0.0211

0.1364

-

0.1452

0.0114

0.0286

0.0719

0.1067

0.0554

0.2681

0.1044

0.0031

0.0058

0.0109

0.1846

0.4588

0.0341

0.0847

0.2105

0.0008

0.0012

0.0018

0.0277

0.0419

0.0183

0.0633

0.0003

0.0012

0.0040

0.0926

0.1439

0.3367

11472.2

5

11385.2

0.0002

0.0569

-

69.93

51.23

82.3

Y^2

0.0209

-

0.1004

Sep

Nov

0.0148

X*y

0.0280

-

96.13

11597.4

Jul

5

11361.8

X^2

5

Summation Total

0.0845

[Type text]

Page 32

0.0999

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.5561

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8146

GRAPH NO:4.5.2

GRAPH SHOWING RETURNS OF FEDERAL BANK 2013.

0.6

0.5

0.4

R 0.3

E

0.2

T

U 0.1

R

0

N

jan feb mar apr may jun jul aug sep oct nov dec

S -0.1

-0.2

-0.3

-0.4

MONTHS

Analysis and interpretation

[Type text]

Page 33

Returns X

Returns Y

[Type the document title]

TABLE NO:4.5.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF FEDERAL BANK

2014.

Federal Bank

Bank Nifty

Month

Open

Close

Open

Jan

84.45

79.25

11418.9

Returns

Close

10237.7

0.1034

10205.4

Feb

78.95

76.8

10764.7

5

10705.4

Mar

Apr

May

76.1

0.0107

0.0064

0.0038

0.0616

-

0.0548

0.1902

5

12806.1

5

12855.8

5

12920.3

0.0030

0.2582

0.0007

0.0015

0.0362

0.0039

116.3

Y2

12742.0

90.45

91.35

X*Y

0.0272

95.75

95.75

X2

0.0491

0.0667

0.0000

0.0554

0.0031

0.0002

14793.4

0.1450

0.2731

0.0210

0.0396

0.0746

15241.9

0.0308

0.1340

0.0009

0.0041

0.0180

0.0000

0.0002

0.0119

0.0014

0.0398

-

0.1092

0.0233

0.0016

0.0009

-

0.0005

0.0358

0.0006

5

14786.4

Jun

117.9

133.7

5

Jul

134.65

119.95

Aug

118

120.75

Sep

121.5

125.85

15288.8

15137.6

15790.2

5

Oct

125.25

142.05

15267.6

15740.4

15392.2

5

17045.0

15370.7

0.0252

0.0013

0.0009

0.1089

0.1341

0.0119

0.0146

0.0180

0.0835

0.0473

0.0070

0.0039

0.0022

0.0081

0.0013

0.0001

0.0000

0.0000

0.5349

0.6538

0.0930

0.1162

0.2008

5

18513.1

Nov

144.95

151.8

17087

18586.9

Dec

151.5

151.7

5

Summation Total

[Type text]

5

18736.6

5

Page 34

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.2597

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8150

GRAPH NO:4.5.3

GRAPH SHOWING RETURNS OF FEDERAL BANK 2014.

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

0

jan feb mar apr may jun

-0.05

Returns Y

jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 35

[Type the document title]

TABLE NO:4.6.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF HDFC BANK

2012.

HDFC Bank

Bank Nifty

Returns

Mont

Open

Close

428.9

492.1

Open

Close

9919.45

0.2384

0.1474

X2

X*Y

Y2

0.0351

0.0217

0.0022

0.0021

h

8009.8

Jan

0.056

5

Feb

494.5

517.1

9941.9

10385.

Mar

517

518

10414.2

10212.7

540.7

542.5

506.2

504

564

0.0166

10276.8

0.0088

-

585.55

597.55

629

587.75

10384.1

595.35

632.75

700

629.15

0.0961

0.1182

0.0017

634.2

0.0052

0.0041

0.0113

0.0140

0.0001

0.0018

7

0.009

0

0.001

0.1422

0.0529

0.0006

0.0075

2

0.000

0.0792

12474.2

0.0001

3

0.006

0.1125

-

0.0001

0.0089

3

0.000

0.0009

0.0306

Page 36

0.0127

0.0287

5

0.0028

0.0083

0.0169

12158.9

0.0003

2

0.020

678.6

0.0022

0.0167

11268.8

703.95

0.0004

1

0.006

0.0421

0.0345

11456.8

6

[Type text]

0.0638

9990.5

5

12126.

Dec

0.0819

1

11266.

Nov

0.0001

2

0.000

9

11462.

Oct

0.0473

8

10030.

Sep

0.0000

3

0.000

10340.6

5

10347.

Aug

563.55

5

10366.

Jul

3

0.000

9441

7

9434.4

Jun

0.0457

0.0055

8

10282.

May

0.0475

519.85

2

10186.

Apr

8

0.002

0.0009

[Type the document title]

0.104

Summation Total

0.4927

0.5022

0.0691

0.0626

2

n XY ( X )(Y )

= [n X 2( X )2]

= 0.5777

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8206

GRAPH NO:4.6.1

GRAPH SHOWING RETURNS OF HDFC BANK 2012.

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

Returns Y

0

jan feb mar apr may jun

-0.05

jul aug sep oct nov dec

-0.1

MONTHS

Analysis and interpretation

[Type text]

Page 37

[Type the document title]

TABLE NO:4.6.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF HDFC BANK

2013.

Month

HDFC Bank

Open

Close

Jan

682.1

643.05

Feb

644.8

625.35

Mar

Apr

May

625

Returns

X

Y

0.0126

0.0572

-

5

11533.0

0.0968

-

684.4

698

5

11414.9

5

12561.5

5

12475.6

682.3

700.5

669.5

Aug

669

X*y

Y^2

0.0002

-0.0007

0.0033

0.0094

0.0029

0.0009

0.0006

0.0002

0.0000

0.0000

0.0923

0.0101

0.0093

0.0085

0.0235

0.0000

-0.0001

0.0006

0.0045

0.0027

0.0017

0.0186

0.0121

0.0078

0.0114

0.0035

0.0011

0.0031

-0.0005

0.0001

0.0341

0.0253

0.0188

0.0008

0.0008

0.0009

0.0302

12554.7

5

11617.2

0.0063

-

5

10015.7

0.0671

-

0.0408

-

12453.4

609.75

613.9

Sep

X^2

0.0148

0.1004

11597.4

Jul

5

11361.8

625.35

624.65

Jun

Bank Nifty

Open

Close

12549.9

12708.6

5

12718.5 11487.3

598

594

593.05

10130.1

9049.2

9112.8

9617.8

0.1364

-

0.0886

-

0.1067

0.0324

-

0.0554

0.0083

11473.1

Oct

598.8

680.8

9685.15

5

11153.9

Nov

681.6

661.3

662

665.85

0.1369

11472.2

5

11385.2

Dec

0.1846

11180.3

0.0277

0.0298

0.0183

0.0058

0.0003

0.0001

0.0000

0.0926

0.0553

0.0436

5

Summation Total

[Type text]

Page 38

[Type the document title]

0.0845

n XY ( X )(Y )

2

[n X 2( X ) ]

0.0282

= 0.5992

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8716

GRAPH NO:4.6.2

GRAPH SHOWING RETURNS OF HDFC BANK 2013.

0.25

0.2

0.15

R

0.1

E

T 0.05

U

0

R

N -0.05jan feb mar apr may jun jul aug sep oct nov dec

S

-0.1

-0.15

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 39

Returns X

Returns Y

[Type the document title]

TABLE NO:4.6.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF HDFC BANK

2014.

HDFC bank

Bank Nifty

Month

Open

Close

Open

Jan

668

628.5

11418.9

Returns

Close

10237.7

X2

X*Y

Y2

0.0107

0.0061

0.0035

0.1034

0.0591

10764.7

0.0548

0.0629

0.0030

0.0034

0.0040

0.1902

0.1257

0.0362

0.0239

0.0158

10205.4

Feb

629.95

669.6

5

10705.4

Mar

Apr

May

665.2

751.5

723.5

12742.0

748.8

5

12806.1

5

12855.8

5

12920.3

721.3

0.0039

792.75

0.0000

0.0402

0.0016

0.0002

14793.4

0.1450

0.0957

0.0210

0.0139

0.0092

15241.9

0.0308

0.0353

0.0009

0.0011

0.0012

0.0134

0.0000

0.0000

0.0002

0.0212

0.0016

0.0008

-

0.0004

0.0316

0.0006

5

14786.4

Jun

793.5

821.55

5

Jul

823

834

Aug

826.05

843.55

Sep

845.9

872.65

15288.8

15137.6

15790.2

5

Oct

866

911.85

15267.6

15740.4

15392.2

5

17045.0

15370.7

0.0014

0.0398

0.0252

0.0010

0.0008

0.1089

0.0529

0.0119

0.0058

0.0028

0.0835

0.0458

0.0070

0.0038

0.0021

5

18513.1

Nov

915.2

957.15

17087

18586.9

Dec

958.3

951.6

5

Summation Total

[Type text]

5

18736.6

0.0081

5

0.5349

Page 40

0.0001

0.0070

0.3783

0.0930

0.0000

0.0001

0.0578

0.0419

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 0.5927

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9008

GRAPH NO:4.6.3

GRAPH SHOWING RETURNS OF HDFC BANK 2014.

0.25

0.2

0.15

R

E

0.1

T

U 0.05

R

0

N

S -0.05jan feb mar apr may jun jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 41

Returns X

Returns Y

[Type the document title]

TABLE NO:4.7.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF ICICI BANK 2012.

ICICI Baank

Bank Nifty

Returns

Mont

Open

Close

Open

Close

X*Y

h

690.1

Jan

8009.8

902.15

5

Feb

Mar

Apr

0.056

9919.45

0.2384

908

906.3

902.5

887.8

885.8

0.0019

-

3

0.000

0.0136

-

3

0.000

0.0061

-

1

0.006

0.0819

0.1158

7

0.009

0.0961

0.1473

9941.9

10414.2

0.0475

10385.

10212.7

2

10186.

0.0166

10276.8

0.0088

890.2

784

882.35

783.25

9441

901

961.4

5

10384.1

952

902.15

1,058.8

Sep

Oct

Nov

905.2

11456.8

0

1,050.2

9

11462.

0

1,099.8

1

11266.

1060

0.0017

0.0670

1052

12158.9

Dec

5

12126.

0.0345

0.0524

5

6

Summation Total

[Type text]

0

0.013

4

0.021

0.1422

0.1697

0.0169

0.0092

0.0792

0.0455

7

0.004

0

0.001

5

0.002

0.0018

2

0.020

7

0.028

0.0241

2

0.000

8

0.000

0.0002

3

0.006

1

0.002

0.0036

3

0.000

12474.2

1095

0.0001

2

0.000

0.0001

11268.8

5

1,138.2

0

0.000

0.0142

9990.5

8

10030.

2

0.000

5

10347.

Aug

0.0001

0.0095

10340.6

899.5

5

10366.

Jul

4

0.000

0.0002

7

9434.4

Jun

0.0732

8

0.002

8

10282.

May

0.3072

0.094

0.0287

0.0395

5

0.4927

Page 42

0.5772

1

0.001

0.0011

8

0.104

0.1279

6

0.169

[Type the document title]

2

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.2413

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9554

GRAPH NO:4.7.1

GRAPH SHOWING RETURNS OF ICICI BANK 2012.

0.35

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

Returns Y

0

jan feb mar apr may jun

-0.05

jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 43

[Type the document title]

TABLE NO:4.7.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF ICICI BANK 2013.

ICICI Bank

Month

Jan

Feb

Mar

Apr

Open

Close

Open

1,191.1

12549.9

5

1,040.4

5

12718.5

1146.4

Close

X2

X*Y

Y2

12708.6

0.0126

0.0390

0.0002

0.0005

0.0015

11487.3

0.0094

0.0125

0.0165

0.0002

0.0001

0.0001

0.0101

0.0101

0.0102

0.0000

0.0000

0.0000

0.0045

0.0046

0.0047

0.0186

0.0197

0.0209

0.0114

0.0142

0.0177

0

1,045.2

5

11533.0

5

11361.8

0.0968

-

0.1286

-

0

1,163.6

5

11414.9

5

12561.5

0.0148

0.0098

0.1004

0.1009

5

12475.6

5

11617.2

0.0063

-

0.0050

-

1055.5

1057

1160.2

5

12554.7

5

1,070.7

Jun

1150

12453.4

5

1062.6

Jul

11597.4

5

10015.7

0.0671

-

0.0689

-

0.1364

-

0.1445

-

909.05

5

Aug

927

803.75

10130.1

9049.2

Sep

814.1

883.65

1,120.9

9112.8

9617.8

11473.1

Oct

889.95

9685.15

5

1,068.6

Nov

1119.8

5

11153.9

0.1067

0.0554

0.1330

0.0854

0.0031

0.0047

0.0073

0.1846

0.2596

0.0341

0.0479

0.0674

0.0008

0.0013

0.0021

0.0277

0.0457

0.0183

0.0265

0.0003

0.0005

0.0007

0.0926

0.1162

0.1492

0.0845

0.0240

11472.2

5

1,098.7

Dec

Returns

1194

5

1,154.4

May

Bank Nifty

1070.4

5

11385.2

11180.3

Summation Total

[Type text]

Page 44

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.2606

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9904

GRAPH NO:4.7.2

GRAPH SHOWING RETURNS OF ICICI BANK 2013.

0.3

0.25

0.2

R 0.15

E

0.1

T

U 0.05

R

0

N

jan feb mar apr may jun jul aug sep oct nov dec

S -0.05

-0.1

-0.15

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 45

Returns X

Returns Y

[Type the document title]

TABLE NO:4.7.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF ICICI BANK 2014.

ICICI Bank

Month

Jan

Open

1100.9

Feb

Mar

Apr

May

Close

987.7

Bank Nifty

Open

1,043.8

10205.4

5

1,245.0

5

10705.4

0.0035

0.0041

0.2004

0.0362

0.0381

0.0402

0.0000

0.0000

0.0001

0.1034

0.1028

10764.7

0.0548

0.1902

12742.0

0

1,418.0

5

12920.3

0.0039

1411.2

5

1,418.1

5

14786.4

5

1420.5

5

1,471.2

14793.4

0.1450

0.1344

0.0210

0.0195

0.0181

15241.9

0.0308

0.0049

0.0009

0.0002

0.0000

0.0357

0.0000

0.0000

0.0013

0.0016

0.0026

0.0042

0.0006

0.0020

0.0064

15267.6

5

1,556.8

1462.3

0.0071

15288.8

0.0014

15137.6

15740.4

0.0398

0.0646

15790.2

15392.2

1558

1443

1626

17087

18586.9

0.0799

0.1089

0.1273

0.0119

0.0139

0.0162

0.0835

0.0790

0.0070

0.0066

0.0062

0.0001

0.0000

0.0000

0.0930

0.0969

0.1072

5

18736.6

1765.5

5

Summation Total

[Type text]

0.0252

5

18513.1

0

1766

5

17045.0

15370.7

5

1,754.4

Dec

0.0030

1252.3

5

1,626.6

Nov

0.0641

5

12855.8

0

1,433.5

Oct

0.0106

5

12806.1

Jul

Sep

0.0106

10237.7

5

1,243.4

Jun

Aug

0.0107

1037.2

1250

X*Y

Close

11418.9

981

Returns

0.0081

5

0.5349

Page 46

0.0003

0.5202

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.0656

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9628

GRAPH NO:4.7.3

GRAPH SHOWING RETURNS OF ICICI BANK 2014.

0.25

0.2

0.15

R

E

0.1

T

U 0.05

R

0

N

S -0.05jan feb mar apr may jun jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 47

Returns X

Returns Y

[Type the document title]

TABLE NO:4.8.1

TABLE SHOWING RISK AND RETURN ANALYSIS OFINDUSIND BANK

2012.

Indusind Bank

Bank Nifty

Returns

Mont

Open

Close

225.5

291.9

Open

Close

9919.45

0.2384

0.2945

X^2

X*y

Y^2

0.0702

0.0867

0.0040

0.0070

h

8009.8

Jan

0.056

5

Feb

288.2

312.25

9941.9

10385.

Mar

314.9

322.2

10414.2

10212.7

332.9

331.7

298.4

299.85

342.15

0.0166

10276.8

0.0088

-

334.95

317.45

334.15

358.85

316.55

363.8

355.3

11456.8

364.1

406.1

416.75

0.0961

0.1347

0.0009

0.0085

0.0107

0.0129

0.0182

0.0000

0.0005

0.0019

0.0030

0.0169

0.0142

2

0.000

0.0234

-

0

0.001

0.0345

0.0549

2

0.020

0.1422

0.1192

2

0.000

0.0146

0.0169

0.0792

0.0002

3

0.006

0.1455

0.0002

0.0115

0.0212

0.0008

0.0007

3

0.000

12474.2

417.05

0.0003

7

0.009

0.0017

12158.9

0.0287

6

[Type text]

0.1036

11268.8

5

12126.

Dec

0.0819

0.0004

1

0.006

9990.5

1

11266.

Nov

10384.1

9

11462.

Oct

0.0295

8

10030.

Sep

0.0005

3

0.000

10340.6

5

10347.

Aug

340.25

5

10366.

Jul

3

0.000

9441

7

9434.4

Jun

0.0834

0.0214

8

10282.

May

0.0475

321.65

2

10186.

Apr

8

0.002

0.0270

8

Page 48

[Type the document title]

0.104

Summation Total

0.4927

0.6880

0.1264

0.1638

2

n XY ( X )(Y )

= [n X 2( X )2]

= 1.1689

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9603

GRAPH NO:4.8.1

GRAPH SHOWING RETURNS OF INDUSIND BANK 2012.

0.35

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

Returns Y

0

jan feb mar apr may jun

-0.05

jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 49

[Type the document title]

[Type text]

Page 50

[Type the document title]

TABLE NO:4.8.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF INDUSIND

BANK 2013.

Indusind Bank

Month

Open

Close

Jan

419.95

435.8

Bank Nifty

Returns

Close

X2

X*Y

Y2

12708.6

0.0126

0.0377

0.0002

0.0005

0.0014

5

12718.5

11487.3

0.0094

0.0051

0.0027

5

11533.0

5

11361.8

0.0968

-

0.0524

0.0002

0.0003

0.0003

Open

12549.9

Feb

Mar

Apr

434.8

412.1

407.5

May

467

Jun

Jul

Aug

412

404.7

467.45

466.5

391.95

5

12561.5

5

12475.6

5

11617.2

0.0063

-

11597.4

5

10015.7

0.0671

-

0.1011

-

0.1364

-

0.1695

-

10130.1

9049.2

467.75

517.3

520

5

11414.9

356.75

9112.8

Oct

371

445.6

9685.15

9617.8

11473.1

5

11153.9

422.2

0.0101

0.0149

0.0219

0.1077

0.0000

-0.0007

0.0116

0.0045

0.0068

0.0102

0.0186

0.0231

0.0287

0.0114

0.0096

0.0081

420.7

0.1067

0.0554

0.0898

0.0302

0.0031

0.0017

0.0009

0.1846

0.2011

0.0341

0.0371

0.0404

0.0008

0.0013

0.0022

0.0003

-0.0002

0.0001

0.0926

0.0994

0.1286

11472.2

5

11385.2

425.4

0.1479

387.45

368.75

Dec

0.1004

12453.4

357.95

443

0.0180

12554.7

Sep

Nov

0.0148

11180.3

0.0277

0.0470

-

0.0183

5

0.0110

-

Summation Total

0.0358

0.0845

[Type text]

Page 51

[Type the document title]

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.0823

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.9160

GRAPH NO:4.8.2

GRAPH SHOWING RETURNS OF INDUSIND BANK 2013.

0.25

0.2

0.15

R

0.1

E

T 0.05

U

0

R

N -0.05jan feb mar apr may jun jul aug sep oct nov dec

S

-0.1

-0.15

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 52

Returns X

Returns Y

[Type the document title]

TABLE NO:4.8.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF INDUSIND

BANK 2014.

Indusind Bank

Bank Nifty

Month

Open

Close

Open

Jan

422.6

383.8

11418.9

Returns

Close

10237.7

X2

X*Y

Y2

0.0107

0.0095

0.0084

0.1034

0.0918

10764.7

0.0548

0.0448

0.0030

0.0025

0.0020

0.1902

0.2641

0.0362

0.0502

0.0698

10205.4

Feb

380.45

397.5

5

10705.4

Mar

Apr

May

397

12742.0

501.85

502.95

480.6

5

12806.1

5

12855.8

5

12920.3

478.35

0.0039

533.95

0.0000

0.0489

0.0024

0.0002

14793.4

0.1450

0.1110

0.0210

0.0161

0.0123

15241.9

0.0308

0.0744

0.0009

0.0023

0.0055

0.0000

0.0000

0.0007

0.0014

0.0398

-

0.0255

0.0530

0.0016

0.0021

-

0.0028

0.0597

0.0006

5

14786.4

Jun

532.1

571.7

5

Jul

574.15

559.5

Aug

556

585.45

Sep

586.55

621.55

15288.8

15137.6

15790.2

5

Oct

621.5

720.1

15267.6

15740.4

15392.2

5

17045.0

15370.7

0.0252

0.0036

0.0015

0.1089

0.1586

0.0119

0.0173

0.0252

0.0835

0.0352

0.0070

0.0029

0.0012

0.0081

0.0672

0.0001

0.0005

0.0045

0.5349

0.7018

0.0930

0.1018

0.1384

5

18513.1

Nov

724.9

750.45

17087

18586.9

Dec

751.95

802.45

5

Summation Total

[Type text]

5

18736.6

5

Page 53

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 1.0197

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8595

GRAPH NO:4.8.3

GRAPH SHOWING RETURNS OF INDUSIND BANK 2014.

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

0

jan feb mar apr may jun

-0.05

Returns Y

jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 54

[Type the document title]

TABLE NO:4.9.1

TABLE SHOWING RISK AND RETURN ANALYSIS OF KOTAK

MAHINDRA BANK 2012.

Kotak

Bank Nifty

Returns

Mahindra

Mont

Open

Close

Open

Close

X2

X*Y

Y2

h

0.056

Jan

432.9

498.35

8009.85

9919.45

0.2384

0.1512

0.022

0.0360

8

0.002

Feb

498

547.75

9941.9

10414.2

0.0475

10212.7

Mar

Apr

543

546.25

545.35

582.8

583.55

563.5

10282.7

0.0166

10276.8

0.0088

3

0.000

0.0669

-

563.5

592.3

9434.45

0.0819

0.0344

0.0961

0.0511

-

593.25

535.75

10366.5

10384.1

0.0969

537.5

574.1

10347.8

9990.5

Oct

577.25

648.5

648.75

603.75

10030.9

11462.1

11456.8

0.1422

0.1239

7

0.009

2

0.002

0.0049

2

0.000

6

0.009

0

0.001

0.0002

-

4

0.004

2

0.020

0.0024

6

0.015

0.0169

0.0690

0.0176

2

0.000

11268.8

3

0.004

0.0012

Nov

603.75

670.45

11266.5

12158.9

0.0792

0.1105

Dec

670

650.05

12126.6

12474.2

0.0287

[Type text]

5

0.001

0.0681

0.0345

Sep

0.0006

0.0017

-

Aug

0

0.004

0.0028

5

Jul

0.0001

1

0.006

9441

10340.6

Jun

0

0.000

0.0043

May

0.0047

3

0.000

10385.2

10186.8

0.0999

9

0.010

Page 55

3

0.006

8

0.012

0.0088

3

0.000

2

0.000

[Type the document title]

5

0.0298

Summation Total

0.4927

8

0.104

0.4458

0.0009

9

0.088

0.0732

2

n XY ( X )(Y )

= [n X 2( X )2]

= 0.6539

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.7070

GRAPH NO:4.9.1

GRAPH SHOWING RETURNS OF KOTAK MAHINDRA BANK 2012.

0.3

0.25

R

E

T

U

R

N

S

0.2

0.15

0.1

Returns X

0.05

0

jan feb mar apr may jun

-0.05

Returns Y

jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 56

[Type the document title]

[Type text]

Page 57

[Type the document title]

TABLE NO:4.9.2

TABLE SHOWING RISK AND RETURN ANALYSIS OF KOTAK

MAHINDRA BANK 2012.

Month

Kotak Mahindra

Open

Close

Jan

652.95

680.35

Feb

680.45

659.6

Returns

Open

Close

12549.9

12708.6

5

12718.5 11487.3

5

11533.0

Mar

654.55

Apr

655

May

Jun

782.95

781.25

5

11414.9

5

12561.5

5

12475.6

Aug

722.2

0.0968

-

0.0306

-

659.6

654.9

678.1

9112.8

Oct

678.4

752.45

9685.15

753

756.8

756.25

728.25

11180.3

0.0030

0.0009

0.0002

0.0000

0.0000

0.1121

0.0000

-0.0007

0.0126

0.0045

0.0051

0.0057

0.0186

0.0133

0.0095

0.1364

-

0.0977

0.0067

0.0114

-0.0007

0.0000

0.1067

0.0554

0.0354

0.0031

0.0020

0.0013

0.1846

0.1092

0.0341

0.0202

0.0119

0.0050

0.0008

-0.0001

0.0000

0.0003

-0.0007

0.0014

0.0926

0.0498

0.0515

11472.2

5

11385.2

0.0094

0.0063

0.0756

-

5

11153.9

0.0018

0.0080

0.0671

-

9617.8

11473.1

0.0005

0.0101

5

10015.7

9049.2

0.0002

0.0795

10130.1

Y^2

0.1004

0.0063

-

X*y

0.0024

5

11617.2

X^2

0.0148

12453.4

Sep

Dec

652.35

655.2

Nov

0.0420

12554.7

11597.4

723

0.0126

653

707.1

704

Jul

5

11361.8

Returns

X

Y

0.0277

0.0183

0.0370

-

Summation Total

0.1467

0.0845

[Type text]

Page 58

[Type the document title]

=

n XY ( X )(Y )

2

[n X 2( X ) ]

= 0.5523

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.7516

GRAPH NO:4.9.2

GRAPH SHOWING RETURNS OF KOTAK MAHINDRA BANK 2013.

0.25

0.2

0.15

R

0.1

E

T 0.05

U

0

R

N -0.05jan feb mar apr may jun jul aug sep oct nov dec

S

-0.1

-0.15

-0.2

MONTHS

Analysis and interpretation

[Type text]

Page 59

Returns X

Returns Y

[Type the document title]

TABLE NO:4.9.3

TABLE SHOWING RISK AND RETURN ANALYSIS OF KOTAK

MAHINDRA BANK 2014.

Kotakmahindra

Month

Open

Jan

732

Close

657.05

Bank Nifty

Open

Returns

2

0.0107

0.0106

0.0105

0.0510

0.0030

0.0028

0.0026

0.1902

0.1452

0.0362

0.0276

0.0211

0.0039

0.0270

0.0000

0.0001

0.0007

14793.4

0.1450

0.0810

0.0210

0.0117

0.0066

15241.9

0.0308

0.0203

0.0009

0.0006

0.0004

0.0769

0.0000

10237.7

0.1034

0.1024

10764.7

0.0548

11418.9

X*Y

Close

10205.4

Feb

651.3

684.5

5

10705.4

Mar

Apr

May

682

12742.0

781.05

781.5

803.55

5

12806.1

5

12855.8

5

12920.3

802.6

868.65

5

14786.4

Jun

866

883.55

5

Jul

885.6

953.7

15288.8

15267.6

0.0014

0.0059

0.0001

1037.5

Aug

948

15137.6

15740.4

0.0398

0.0945

15790.2

15392.2

0.0016

0.0038

0.0089

0.0006

0.0007

0.0008

5

Sep

1042.5

1013.1

5

1118.2

Oct

1008.5

15370.7

5

1202.5

5

1205.1

Dec

[Type text]

17087

18586.9

0.0282

0.1089

0.1088

0.0119

0.0119

0.0118

0.0835

0.0744

0.0070

0.0062

0.0055

0.0081

0.0487

0.0001

0.0004

0.0024

0.5349

0.5972

0.0930

0.0763

0.0773

5

18736.6

1263.9

5

0.0252

5

18513.1

1119.2

Nov

5

17045.0

5

Summation Total

Page 60

[Type the document title]

n XY ( X )(Y )

= [n X 2( X )2]

= 0.7186

n XY ( X ) ( Y )

r=

( n X ( X ) ) (n Y ( Y ) )

2

= 0.8666

GRAPH NO:4.9.3

GRAPH SHOWING RETURNS OF KOTAK MAHINDRA BANK 2014.

0.25

0.2

0.15

R

E

0.1

T

U 0.05

R

0

N

S -0.05jan feb mar apr may jun jul aug sep oct nov dec

-0.1

-0.15

MONTHS

Analysis and interpretation

[Type text]

Page 61

Returns X

Returns Y

You might also like

- Supply Chain Game Round 2Document5 pagesSupply Chain Game Round 2douding41163.com100% (1)

- SG12 Team 4 Strategic Audit - BreadTalkDocument32 pagesSG12 Team 4 Strategic Audit - BreadTalkMahalim Fivebuckets100% (1)

- Assig BetaDocument9 pagesAssig BetaGan Huey Ling100% (1)

- HWChap003 ANSDocument68 pagesHWChap003 ANShelloocean100% (1)

- Kenya Revised Code of Regulation 2006Document230 pagesKenya Revised Code of Regulation 2006sise193% (14)

- Advanced Human Resource Management: Presentation On Strategic HRM at Mercia Systems'Document10 pagesAdvanced Human Resource Management: Presentation On Strategic HRM at Mercia Systems'Ashutosh Sharma100% (1)

- UHS Past Pupil Database October 2010Document39 pagesUHS Past Pupil Database October 2010traceNo ratings yet

- Beginners Guide To Contact Center ManagementDocument64 pagesBeginners Guide To Contact Center ManagementBilly Willɪam100% (1)

- Review Questions: Cost Concepts and ClassificationsDocument6 pagesReview Questions: Cost Concepts and ClassificationsArah Opalec64% (11)

- Acceleration Without G 2021-09-14 21-34-30Document38 pagesAcceleration Without G 2021-09-14 21-34-30Nuri NurfauziahNo ratings yet

- Tabel Probstat - Montgomery (Part 1)Document19 pagesTabel Probstat - Montgomery (Part 1)IQbalTriWidiantoNo ratings yet

- Tablas EstadisticasDocument5 pagesTablas EstadisticasCsar Calla MendozaNo ratings yet

- Đầu Tư Tài Chính Index and Full Covariance.Document19 pagesĐầu Tư Tài Chính Index and Full Covariance.thuynkn21404aNo ratings yet

- Z Two TailsDocument1 pageZ Two TailsRoby ZulkarnainNo ratings yet

- Grafik Karakteristik Antara H Dengan P: Nama: Muhammad Hammaaduun NIM: 141944910549 Jurusan: Teknik Elektro I HDocument3 pagesGrafik Karakteristik Antara H Dengan P: Nama: Muhammad Hammaaduun NIM: 141944910549 Jurusan: Teknik Elektro I HMuhammadHammaaduunNo ratings yet

- Analysis of Beta: Banking IndustryDocument14 pagesAnalysis of Beta: Banking IndustryShweta SharmaNo ratings yet

- Targets&Outputsof IEEE30 BusDocument18 pagesTargets&Outputsof IEEE30 Busswaroop paulNo ratings yet

- Binomial Tables 1Document7 pagesBinomial Tables 1Sananda GhoshNo ratings yet

- Binomial, Poisson, Noramal Distribution TablesDocument21 pagesBinomial, Poisson, Noramal Distribution TablesJulian Brix De VeraNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementfiiimpactNo ratings yet

- Discount Factor TableDocument2 pagesDiscount Factor Tablesenthilr7879% (24)

- Tablo 1Document6 pagesTablo 1Salih Alzein alshehabiNo ratings yet

- AyDocument3,635 pagesAyJerson Manuel VCNo ratings yet

- Tables For Standard Normal CDF and Loss FunctionsDocument3 pagesTables For Standard Normal CDF and Loss FunctionsНастя БорзуноваNo ratings yet

- Zemin Tablolar 1Document6 pagesZemin Tablolar 1Hayati KalabalıkNo ratings yet

- PBG GempakuDocument897 pagesPBG Gempakumrakha adiwNo ratings yet

- 74843bos60509 AppendixDocument7 pages74843bos60509 AppendixNeha JainNo ratings yet

- UntitledDocument11 pagesUntitledseptianimulyantoNo ratings yet

- 2 Modul2Document13 pages2 Modul2Loh Chee WeiNo ratings yet

- Tabel Binomial IndividualDocument4 pagesTabel Binomial IndividualFerdiawan Hadi SusantoNo ratings yet