Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsNotes Inclass 2

Notes Inclass 2

Uploaded by

Benjamin NeldnerFinance

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tall VowelsDocument3 pagesTall VowelsBenjamin NeldnerNo ratings yet

- Aussie English Sentence ERxamplesDocument4 pagesAussie English Sentence ERxamplesBenjamin NeldnerNo ratings yet

- Cube OutlineDocument1 pageCube OutlineBenjamin NeldnerNo ratings yet

- Grubfinder: PrrroDocument5 pagesGrubfinder: PrrroBenjamin NeldnerNo ratings yet

- Bens Japanese Travel PlansDocument2 pagesBens Japanese Travel PlansBenjamin NeldnerNo ratings yet

- Arranged by Wheelhouse Transcribed by Matthew Stringer Song by Irving BerlinDocument1 pageArranged by Wheelhouse Transcribed by Matthew Stringer Song by Irving BerlinBenjamin NeldnerNo ratings yet

- Bens Japanese Travel PlansDocument15 pagesBens Japanese Travel PlansBenjamin NeldnerNo ratings yet

- Hello!: NotesDocument3 pagesHello!: NotesBenjamin NeldnerNo ratings yet

- 3/02 Can Have Hybrid Between Replaceable Rules and or Constitution How Its Different From A Common Law Contract Don't Have ConcensusDocument1 page3/02 Can Have Hybrid Between Replaceable Rules and or Constitution How Its Different From A Common Law Contract Don't Have ConcensusBenjamin NeldnerNo ratings yet

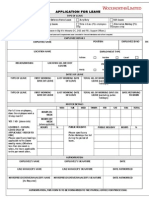

- Application For Leave: (PEL Employees Only) PEL Employees Only)Document1 pageApplication For Leave: (PEL Employees Only) PEL Employees Only)Benjamin NeldnerNo ratings yet

- Imogen HeapDocument11 pagesImogen HeapBenjamin NeldnerNo ratings yet

- 480 12 Tone TechniqueDocument4 pages480 12 Tone TechniqueBenjamin NeldnerNo ratings yet

- MeloDocument1 pageMeloBenjamin NeldnerNo ratings yet

Notes Inclass 2

Notes Inclass 2

Uploaded by

Benjamin Neldner0 ratings0% found this document useful (0 votes)

10 views2 pagesFinance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinance

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views2 pagesNotes Inclass 2

Notes Inclass 2

Uploaded by

Benjamin NeldnerFinance

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Equity can be represented in many forms (which ways we can describe)

Respresents portion of ownership in an entity

Focus on company structure in this module/ course shares issued by a company

evidences equity ownership

Networth=equity

Goodwill- asset

Intangible goods

Share script.

When comparing appropriate business structures for investors (particularly

where investors are not involved in the direct management of the business

relevant factors to assess include

Ordinary shares

Pereferance shares

Types

Company shares may be listed (publically registered on a securities exchange

for trading purposes) or unlisted (traded privately).

Also known as the stock market

The role of the stockmarket is to act as an exchange- in an orderly and liquid

context.

ASX- a well informed and transparent market for the trading in a range of

financial securities on the asx this is achieved electronically via the itsintergrated transaction system

A system allowing for the clearing and settlement of securities on the asx this

is the chess system requiring settlement on the terms T+3

Weights may be determined either by market capitalisation (number of issued

shares x current price.) note these indivies are based solely on share price

changes

Accumulation indicies includes both shares price changes and reinvestment of

dividends

Dowjones-30

Where supply > demand on average prices will fall

Where supply <demand on average prices will rise

Dividend yield: dps/share price

Earnings yield: eps/share price

Required rate = 10% K= 10% buy because that is what we want

Fundamental analysis-process u are using based on TVM context

Or technical analysis- trends in prices as a precursor, share prices follow a

random walk

Investors are rational

Managed fund

20-30 to diversify to get rid of risk

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tall VowelsDocument3 pagesTall VowelsBenjamin NeldnerNo ratings yet

- Aussie English Sentence ERxamplesDocument4 pagesAussie English Sentence ERxamplesBenjamin NeldnerNo ratings yet

- Cube OutlineDocument1 pageCube OutlineBenjamin NeldnerNo ratings yet

- Grubfinder: PrrroDocument5 pagesGrubfinder: PrrroBenjamin NeldnerNo ratings yet

- Bens Japanese Travel PlansDocument2 pagesBens Japanese Travel PlansBenjamin NeldnerNo ratings yet

- Arranged by Wheelhouse Transcribed by Matthew Stringer Song by Irving BerlinDocument1 pageArranged by Wheelhouse Transcribed by Matthew Stringer Song by Irving BerlinBenjamin NeldnerNo ratings yet

- Bens Japanese Travel PlansDocument15 pagesBens Japanese Travel PlansBenjamin NeldnerNo ratings yet

- Hello!: NotesDocument3 pagesHello!: NotesBenjamin NeldnerNo ratings yet

- 3/02 Can Have Hybrid Between Replaceable Rules and or Constitution How Its Different From A Common Law Contract Don't Have ConcensusDocument1 page3/02 Can Have Hybrid Between Replaceable Rules and or Constitution How Its Different From A Common Law Contract Don't Have ConcensusBenjamin NeldnerNo ratings yet

- Application For Leave: (PEL Employees Only) PEL Employees Only)Document1 pageApplication For Leave: (PEL Employees Only) PEL Employees Only)Benjamin NeldnerNo ratings yet

- Imogen HeapDocument11 pagesImogen HeapBenjamin NeldnerNo ratings yet

- 480 12 Tone TechniqueDocument4 pages480 12 Tone TechniqueBenjamin NeldnerNo ratings yet

- MeloDocument1 pageMeloBenjamin NeldnerNo ratings yet