Professional Documents

Culture Documents

Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

Anonymous glyBR9Copyright:

Available Formats

You might also like

- Form 16 2020-2021Document2 pagesForm 16 2020-2021Parth BeriNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- HeheDocument1 pageHeheMuhammad Ahmad JavedNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSUDHEESH KUMARNo ratings yet

- PDF 233526110140623Document1 pagePDF 233526110140623p. r ravichandraNo ratings yet

- Itr 2022-23Document1 pageItr 2022-23digitalworldnangalNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- Form 16 (2022-23) Assessment Year 2023-24Document6 pagesForm 16 (2022-23) Assessment Year 2023-24Hidden future techNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- UnknownDocument1 pageUnknownsaravananbsnlslm3866No ratings yet

- PDF 139527500310723Document1 pagePDF 139527500310723NithinNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- ACK253273911130923Document1 pageACK253273911130923Satyanarayana BalusaNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- PDF 115914800310723Document1 pagePDF 115914800310723jayanto chowdhuryNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022shanmuganathan716No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Lavanya MittaNo ratings yet

- PDF 812625500111121 PDFDocument1 pagePDF 812625500111121 PDFPranav NegiNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- ACK544968000190723Document1 pageACK544968000190723hp agencyNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- ACK833415090290723Document1 pageACK833415090290723prashanth.financialpanditNo ratings yet

- ACK660988680240723Document1 pageACK660988680240723Harsh JainNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Itr2019 2022Document3 pagesItr2019 2022CHANDANNo ratings yet

- PDF 750277940261022Document1 pagePDF 750277940261022Ayush AgrawalNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearShivi ChaurasiaNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- PDF 979868730130323Document1 pagePDF 979868730130323Abhilash Bhavan SasiNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- Form 16A NewDocument2 pagesForm 16A NewKovidh GoyalNo ratings yet

Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

Anonymous glyBR9Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source

Uploaded by

Anonymous glyBR9Copyright:

Available Formats

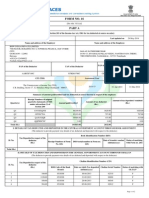

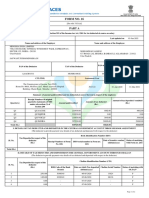

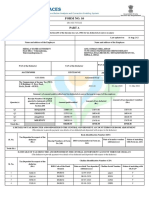

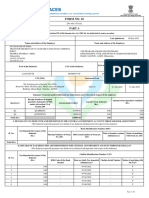

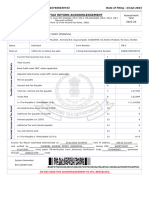

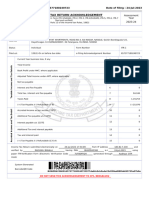

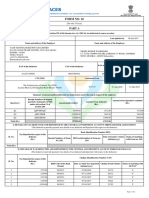

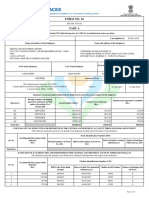

FORM NO.

16A

[See rule 31(1)(b)]

Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source

Certificate No.

Name and address of the Deductor

PAN of the Deductor

Last updated on

Name and address of the Deductee

TAN of the Deductor

CIT(TDS)

PAN of the Deductee

Assessment Year

Period

Address

From

City

To

Pin code

Summary of payment

Amount paid/credited

Nature of payment

Date of payment/credit

Summary of tax deducted at source in respect of deductee

Quarter

Receipt Numbers of original

quarterly statements of TDS under

sub-section (3) of section 200.

Amount of tax deducted

in respect of the

deductee

Amount of tax

deposited/remitted in

respect of the deductee

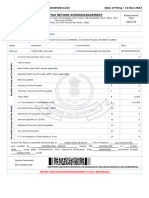

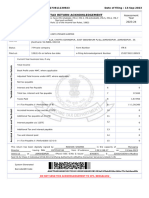

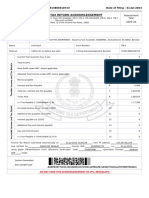

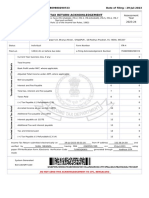

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK

ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Total ( Rs. )

Tax Deposited in respect

of the deductee

( Rs. )

Book Identification Number (BIN)

Receipt numbers of

Form No. 24G

DDO serial number in

Form No. 24G

Date of transfer

voucher

(dd/mm/yyyy)

Status of matching

with Form No.24G

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Finotax

Tax Deposited in respect

of the deductee

( Rs. )

Challan Identification Number (CIN)

BSR Code of the

Bank Branch

Date on which tax

deposited (dd/mm/yyyy)

Challan Serial

Number

Status of matching

with OLTAS

1 of 2

Total ( Rs. )

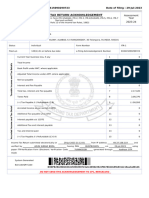

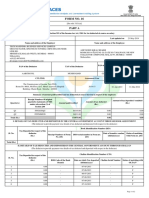

Verification

I,

, son/daughter of

working in the capacity of

(designation) do hereby certify that a sum of Rs.

#VALUE!

0

(in words)]

has been deducted and deposited to the credit of the Central Government. I further certify that the information given above is

true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other

available records.

Place

Date

Designation:

Finotax

10/24/2015

Signature of the person responsible for deduction of tax

Full Name:

2 of 2

You might also like

- Form 16 2020-2021Document2 pagesForm 16 2020-2021Parth BeriNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- HeheDocument1 pageHeheMuhammad Ahmad JavedNo ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- 2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFDocument1 page2019 08 28 15 18 21 048 - 1566985701048 - XXXPL5235X - Acknowledgement PDFmaxNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDipak Ranjan RathNo ratings yet

- PDFReportsDocument6 pagesPDFReportsDeeptimayee SahooNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentSatyam MaramNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSUDHEESH KUMARNo ratings yet

- PDF 233526110140623Document1 pagePDF 233526110140623p. r ravichandraNo ratings yet

- Itr 2022-23Document1 pageItr 2022-23digitalworldnangalNo ratings yet

- FSRID11020Document8 pagesFSRID11020SaleemNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- Form 16 (2022-23) Assessment Year 2023-24Document6 pagesForm 16 (2022-23) Assessment Year 2023-24Hidden future techNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Ack 367661020050723Document1 pageAck 367661020050723Sivaram PopuriNo ratings yet

- UnknownDocument1 pageUnknownsaravananbsnlslm3866No ratings yet

- PDF 139527500310723Document1 pagePDF 139527500310723NithinNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedRishabh PareekNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- RK 1Document1 pageRK 1Sharada ShankarNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruAdarsh KeshariNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Itr-V FKTPM7864L 2023-24 756976760270723Document1 pageItr-V FKTPM7864L 2023-24 756976760270723Samrat AseshNo ratings yet

- ACK253273911130923Document1 pageACK253273911130923Satyanarayana BalusaNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- PDF 115914800310723Document1 pagePDF 115914800310723jayanto chowdhuryNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Ack 657377180240723Document1 pageAck 657377180240723SRIYA GADAGOJUNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022shanmuganathan716No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Lavanya MittaNo ratings yet

- PDF 812625500111121 PDFDocument1 pagePDF 812625500111121 PDFPranav NegiNo ratings yet

- PDF 236811830140623Document1 pagePDF 236811830140623Akeybo 340No ratings yet

- ACK544968000190723Document1 pageACK544968000190723hp agencyNo ratings yet

- Sunil MewadaDocument1 pageSunil MewadaSteve BurnsNo ratings yet

- ACK833415090290723Document1 pageACK833415090290723prashanth.financialpanditNo ratings yet

- ACK660988680240723Document1 pageACK660988680240723Harsh JainNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRavi KumarNo ratings yet

- Abfpw1788f 2017-18 PDFDocument2 pagesAbfpw1788f 2017-18 PDFNikhil121314No ratings yet

- Itr2019 2022Document3 pagesItr2019 2022CHANDANNo ratings yet

- PDF 750277940261022Document1 pagePDF 750277940261022Ayush AgrawalNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearShivi ChaurasiaNo ratings yet

- Itr 23-24Document1 pageItr 23-24addy01.0001No ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023arun poojariNo ratings yet

- PDF 979868730130323Document1 pagePDF 979868730130323Abhilash Bhavan SasiNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- 1 1000 Form16Document5 pages1 1000 Form16Rakshit SharmaNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- Form 16A NewDocument2 pagesForm 16A NewKovidh GoyalNo ratings yet